Official Vehicle Repayment Agreement Document

Imagine you're ready to buy or sell a car, but instead of paying all at once, you and the other party decide on a payment plan. This is where a Vehicle Repayment Agreement comes into play. This crucial document outlines how much money will be paid, in what increments, and over what period. It's not just a casual promise; it serves as a legally binding contract that ensures both seller and buyer are clear on the terms of the agreement. The form protects both parties by detailing the vehicle's specifics, such as make, model, and VIN, the repayment schedule, and what happens if payments are missed. Whether you're the buyer trying to secure a deal without a lump sum payment upfront or a seller looking for assurance you'll be paid over time, understanding and utilizing this form is key to a smooth and secure transaction.

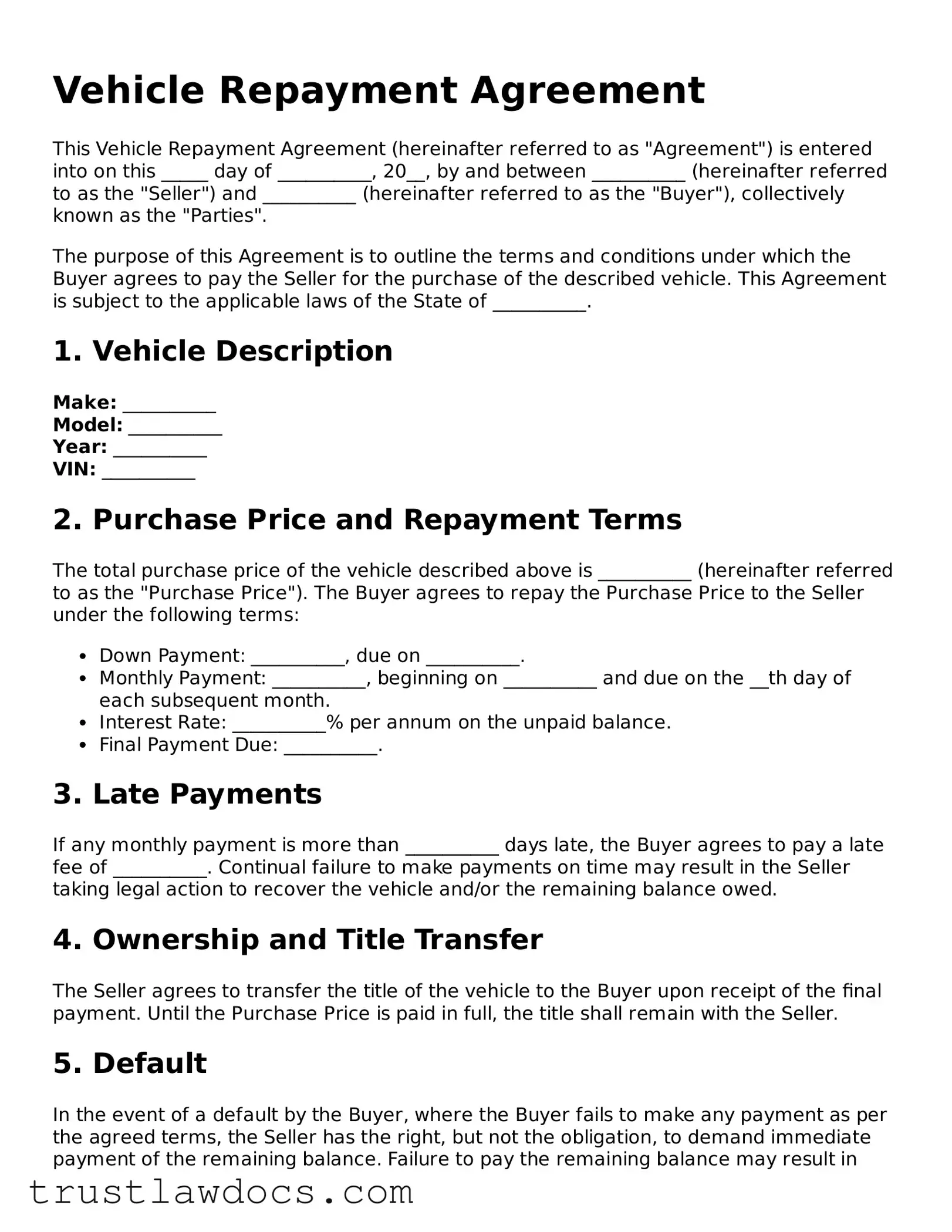

Form Example

Vehicle Repayment Agreement

This Vehicle Repayment Agreement (hereinafter referred to as "Agreement") is entered into on this _____ day of __________, 20__, by and between __________ (hereinafter referred to as the "Seller") and __________ (hereinafter referred to as the "Buyer"), collectively known as the "Parties".

The purpose of this Agreement is to outline the terms and conditions under which the Buyer agrees to pay the Seller for the purchase of the described vehicle. This Agreement is subject to the applicable laws of the State of __________.

1. Vehicle Description

Make: __________

Model: __________

Year: __________

VIN: __________

2. Purchase Price and Repayment Terms

The total purchase price of the vehicle described above is __________ (hereinafter referred to as the "Purchase Price"). The Buyer agrees to repay the Purchase Price to the Seller under the following terms:

- Down Payment: __________, due on __________.

- Monthly Payment: __________, beginning on __________ and due on the __th day of each subsequent month.

- Interest Rate: __________% per annum on the unpaid balance.

- Final Payment Due: __________.

3. Late Payments

If any monthly payment is more than __________ days late, the Buyer agrees to pay a late fee of __________. Continual failure to make payments on time may result in the Seller taking legal action to recover the vehicle and/or the remaining balance owed.

4. Ownership and Title Transfer

The Seller agrees to transfer the title of the vehicle to the Buyer upon receipt of the final payment. Until the Purchase Price is paid in full, the title shall remain with the Seller.

5. Default

In the event of a default by the Buyer, where the Buyer fails to make any payment as per the agreed terms, the Seller has the right, but not the obligation, to demand immediate payment of the remaining balance. Failure to pay the remaining balance may result in legal actions. The Seller reserves the right to repossess the vehicle in the event of the Buyer's default.

6. Governing Law

This Agreement shall be governed under the laws of the State of __________.

7. Agreement Modification

No modification of this Agreement shall be considered valid unless agreed upon in writing by both Parties.

8. Acknowledgment

Both Parties acknowledge they have read, understood, and agree to the terms and conditions stated in this Agreement.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first written above.

________________________

Seller's Signature

________________________

Buyer's Signature

________________________

Witness Signature (Optional)

PDF Form Details

| Fact | Description |

|---|---|

| 1. Purpose | The Vehicle Repayment Agreement form is used to outline the terms under which a borrower agrees to pay back the lender for a vehicle. |

| 2. Parties Involved | This agreement involves two main parties: the borrower, who is taking the loan to purchase or refinance a vehicle, and the lender, providing the loan. |

| 3. Vehicle Details | The form includes comprehensive details about the vehicle, such as make, model, year, VIN (Vehicle Identification Number), and any other identifying information. |

| 4. Loan Amount | It specifies the total loan amount that is being financed for the vehicle, including any interest rates and fees applicable. |

| 5. Repayment Terms | The agreement details the repayment schedule, including the number of payments, the amount of each payment, due dates, and the term of the loan. |

| 6. Default and Consequences | Conditions under which the borrower would be considered in default are outlined, along with the consequences, such as repossession of the vehicle. |

| 7. Governing Law | This section mentions the state laws that will govern the agreement. The applicable laws vary depending on the state where the agreement is executed. |

| 8. Signatures | The document concludes with the signatures of both the borrower and the lender, making it legally binding. |

How to Write Vehicle Repayment Agreement

Filling out a Vehicle Repayment Agreement form is a straightforward process that ensures all parties are aware of the terms concerning the repayment of a debt related to a vehicle. This document is vital for laying out the repayment plan, interest rate, and other necessary information to keep both the lender and the borrower protected. Carefully completing this form is crucial for maintaining a clear understanding and avoiding future disputes.

- Begin by entering the date on which the agreement is being made at the top of the document.

- Write down the full legal names and addresses of both the borrower and the lender in the designated sections.

- Specify the vehicle details, including make, model, year, VIN (Vehicle Identification Number), and any other identifying information to ensure there is no confusion about which vehicle the agreement covers.

- Outline the loan amount that is owed on the vehicle. This should be the principal amount being borrowed.

- Detail the repayment plan, including the size of each payment, frequency (weekly, bi-weekly, monthly), and the total number of payments to be made.

- Include the interest rate if applicable. Ensure that it is stated clearly whether the interest rate is annual or for the duration of the loan, and specify how it will be calculated.

- Define any late payment fees and the grace period before these fees apply. It's essential to be clear about the consequences of late payments.

- Insert any additional terms that both parties have agreed upon. This could include early repayment options or penalties.

- Have both parties provide their signatures and print their names below the signatures. Also, include the date the agreement is signed.

- If possible, have a witness sign the agreement to add an extra layer of validity. The witness should also print their name, address, and the date they witnessed the signing.

Following these steps will ensure the Vehicle Repayment Agreement is filled out comprehensively and accurately. This attention to detail provides a solid foundation for the financial arrangement and helps protect the interests of all parties involved. Once completed, it's recommended to make copies of the agreement for both the lender and the borrower to keep in their records.

Get Answers on Vehicle Repayment Agreement

What is a Vehicle Repayment Agreement?

A Vehicle Repayment Agreement is a legally binding contract that outlines the terms and conditions under which an individual agrees to repay a loan used to purchase a vehicle. This agreement details the loan amount, interest rate, repayment schedule, and consequences of failing to meet the agreed-upon terms. It is used by lenders and borrowers to ensure clarity and protect the interests of both parties involved.

Who needs to sign the Vehicle Repayment Agreement?

The Vehicle Repayment Agreement must be signed by both the borrower, who is taking the loan to purchase the vehicle, and the lender providing the loan. In some cases, if the borrower has a co-signer to help secure the loan, the co-signer must also sign the agreement. It's important that all parties read and understand the terms thoroughly before signing.

Can I modify a Vehicle Repayment Agreement?

Modifying a Vehicle Repayment Agreement is possible but must be agreed upon by all parties involved — the lender, borrower, and any co-signers. Modifications might include changes to the repayment schedule, interest rates, or other terms. Once an agreement on the modifications is reached, it should be documented in writing, and all parties should sign the updated agreement to ensure its legal validity.

What happens if I fail to comply with the terms of the Vehicle Repayment Agreement?

Failing to comply with the terms of a Vehicle Repayment Agreement can have serious consequences. Depending on the specifics of the contract, the lender may have the right to repossess the vehicle. Additionally, it could negatively impact the borrower's credit score and potentially lead to legal action. Borrowers facing difficulty in meeting their repayment obligations should contact their lender promptly to discuss possible solutions or modifications to their repayment plan.

Common mistakes

Filling out the Vehicle Repayment Agreement form is a crucial step in finalizing the terms of paying back a vehicle loan. However, people often make errors that can lead to misunderstandings or legal challenges down the line. One common mistake is not reading the entire agreement before signing. This oversight can result in individuals agreeing to terms they are not fully aware of, such as hidden fees or clauses that could alter the repayment schedule under certain conditions.

Another significant misstep is failing to accurately detail the loan amount and repayment schedule. The loan amount should reflect the total cost of the vehicle, including any interest rates applied throughout the loan term. The repayment schedule must be clear and feasible, outlining each payment's due date and amount. Ambiguities in these sections could lead to disputes about payment amounts or timelines.

Individuals often omit their personal information or fill it out incorrectly. This includes names, addresses, and contact information. Such inaccuracies can lead to problems in the loan's administration and might even affect the legal enforceability of the agreement. Ensuring that all personal information is correct and up-to-date is crucial for the smooth execution of the agreement.

Overlooking the need for witness signatures or notarization is another common error. Depending on the jurisdiction, some agreements must be witnessed or notarized to be considered legally binding. Neglecting this step can invalidate the agreement, leading to potential legal complications if disputes arise over the repayment of the loan.

Last but not least, many individuals fail to keep a copy of the signed agreement for their records. This document is important evidence of the terms agreed upon by both parties. Not having access to it can be problematic if there are questions or disagreements about the agreement's specifics later on. Always ensure each party has a copy of the agreement upon its completion.

Documents used along the form

When it comes to purchasing or selling a vehicle, a Vehicle Repayment Agreement is crucial. However, this form doesn't exist in isolation. Various other documents often accompany it to ensure a smooth, legal transfer of ownership and to clarify the terms of the agreement. This collection of documents provides a comprehensive framework that protects all parties involved in the transaction.

- Bill of Sale: A critical document that records the transaction between the buyer and seller, detailing the purchase price, date, and vehicle identification number (VIN).

- Promissory Note: This outlines the repayment terms, including the loan amount, interest rate, repayment schedule, and what happens in case of default.

- Loan Agreement: If the purchase involves a loan, this agreement specifies the terms, including the interest rate, collateral (if any), and repayment terms.

- Vehicle Title: The legal document that establishes the ownership of the vehicle. It must be transferred from the seller to the buyer.

- Odometer Disclosure Statement: Required by federal law to ensure the mileage of the vehicle is accurately reported at the time of sale.

- As-Is Sale Agreement: If the vehicle is being sold "as is" without any warranties regarding its condition, this agreement outlines that the buyer accepts the vehicle in its current state.

- Warranty Document: If the vehicle comes with a warranty, this document will detail the coverage and duration of the warranty.

- Insurance Proof: Proof of insurance is often required to be shown at the time of sale, indicating that the vehicle will be legally covered once it's being used by the new owner.

- Registration Documents: New owners will need to register the vehicle in their name. These documents can vary by state but are necessary for legally driving the vehicle.

In summary, when dealing with a Vehicle Repayment Agreement, it's essential to be aware of and include these complementary forms and documents. Each plays a role in ensuring the legality and clarity of the vehicle's sale and purchase, providing peace of mind to both the buyer and the seller. Handling these documents properly ensures that all aspects of the transaction are covered, making the process as smooth and straightforward as possible.

Similar forms

A Vehicle Repayment Agreement bears resemblance to a Personal Loan Agreement. Both outline the terms between two parties - the borrower and the lender - regarding the money borrowed and the repayment schedule. The critical similarity lies in the clear stipulation of the loan amount, interest rate, repayment schedule, and consequences of defaulting on the loan. The primary difference is that a Personal Loan Agreement can cover a broader range of purposes beyond purchasing a vehicle, encompassing various personal financial needs.

Similarly, the Vehicle Repayment Agreement shares common ground with a Promissory Note. A Promissory Note is a financial instrument, capturing a written promise by one party to pay a definite sum of money to another. Like Vehicle Repayment Agreements, Promissory Notes detail the loan's particulars, including the repayment terms. However, Promissory Notes are often simpler and might not include specifics like a detailed repayment schedule or security interests held in the vehicle, which are common in Vehicle Repayment Agreements.

The Vehicle Repayment Agreement also compares to a Lease Agreement, especially when the vehicle's possession is contingent on lease payments. Both documents serve to outline terms regarding the user's rights to use property (in this case, a vehicle) for a specified period while making payments. The primary distinction is that Lease Agreements usually culminate in the return of the property to the owner unless there's an option to buy, unlike Vehicle Repayment Agreements that structure towards eventual ownership transfer upon the completion of payments.

Finally, it is akin to a Bill of Sale combined with a financing arrangement. A Bill of Sale alone is a document that records the transfer of ownership from the seller to the buyer. When intertwined with elements of financing, such as in a Vehicle Repayment Agreement, it not only captures the sale but also the conditions under which the sale is financed. This combination ensures legal documentation of the ownership transfer that is contingent upon the financed repayments, specifying the amount financed, interest rate, and repayment plan.

Dos and Don'ts

Completing a Vehicle Repayment Agreement form correctly is essential for ensuring a smooth and legal agreement between a buyer and seller, or a borrower and lender. Here are some vital tips on what you should and shouldn't do during this process.

Do:Read all the sections of the form thoroughly before starting to fill it out. This ensures you understand every aspect of the agreement.

Use black or blue ink if filling out the form by hand to ensure legibility and to make the document more formal.

Provide accurate information about the vehicle, including make, model, year, VIN (Vehicle Identification Number), and current mileage.

Clearly state the loan amount, repayment schedule, interest rate (if applicable), and the final due date for the loan repayment.

Include both parties’ full legal names and contact information to avoid any confusion about the agreement's participants.

Ensure that both parties sign and date the form in the designated spaces to validate the agreement.

Keep a copy of the signed agreement for your own records. Having this document readily available can be critical if any disputes arise in the future.

Remember to notarize the document if required by your state’s law to provide an extra layer of legal validity.

Review the completed form for any mistakes or omissions before finalizing.

Consult with a legal expert if you have any doubts or questions about the agreement to ensure its compliance with your local laws.

Rush through the process without understanding all the terms and conditions laid out in the agreement.

Use pencil or non-permanent writing tools which could lead to information easily being altered.

Omit any sections or fields; incomplete forms may not be legally binding and could result in disputes.

Sign the agreement without thoroughly reviewing all the information you've provided or agreed upon.

Forget to specify who is responsible for the vehicle’s insurance and maintenance during the loan period. This can prevent future disagreements.

Assume verbal agreements will be upheld; always ensure everything is documented in writing on the form.

Leave without a copy of the agreement duly signed by both parties. It's important for documentation and conflict resolution.

Ignore the importance of witness signatures if your state requires them for this type of contract.

Postdate your signatures, as it could affect the enforceability of the agreement.

Allow any part of the agreement to be left vague or open to interpretation. It’s critical that all terms are explicitly detailed.

Misconceptions

When addressing the topic of a Vehicle Repayment Agreement form, there are several misconceptions that can lead to confusion. Understanding these misconceptions is vital for both the lender and the borrower to ensure clarity and legal compliance. Here’s a list of ten common misunderstandings and their explanations.

It's similar to a loan agreement: While both documents are related to borrowing, a Vehicle Repayment Agreement is specifically for situations where a vehicle is involved. It outlines the terms under which the borrower agrees to repay the lender for the vehicle, differing from general loan agreements in its specificity to vehicles.

Only the borrower needs to understand the agreement: It’s essential for both the lender and the borrower to fully grasp the terms. Misunderstandings can lead to disputes or legal issues down the line. Both parties should review the agreement carefully before signing.

No need for witnesses or notarization: While not always legally required, having the agreement witnessed or notarized can add a layer of protection and authenticity. This process can also help should the agreement be disputed in court.

Verbal agreements are just as valid: Although oral contracts can be legally binding, a written and signed Vehicle Repayment Agreement is far more enforceable. It clearly outlines each party's rights and obligations, reducing the chances of misunderstanding.

It only needs to include repayment details: Beyond repayment amounts and schedules, the agreement should also detail interest rates (if any), late fees, the condition of the vehicle, and any warranties or guarantees. Comprehensive agreements protect both parties.

Filling out a template is enough: While templates can be a good starting point, customization may be necessary to meet the specific needs of the parties involved. Legal advice is advisable to ensure that the agreement complies with local laws and fully covers the arrangement’s specific terms.

It’s binding as soon as it’s drafted: The agreement becomes legally binding only after both parties have agreed to the terms and signed the document. Until then, it’s a draft subject to negotiation and changes.

Any payment structure is acceptable: The payment arrangement should be realistic and sustainable for the borrower, ensuring timely repayment. It also needs to comply with any applicable laws regarding lending and borrowing.

It's unnecessary if the parties are well-acquainted: No matter the relationship between the lender and the borrower, a written agreement is crucial. It ensures that both parties are clear on the terms and provides a legal record of the agreement.

Modifications can't be made once signed: Amendments can be made if both parties agree to the changes. Any modifications should be documented and signed by both parties, ideally with legal consultation.

Understanding these misconceptions about the Vehicle Repayment Agreement form can help ensure that the agreement serves its intended purpose without unnecessary complications. It’s always recommended to seek legal advice when drafting or signing such agreements to protect the interests of all parties involved.

Key takeaways

When dealing with the intricacies of a Vehicle Repayment Agreement, understanding the nuances can greatly influence the efficacy and enforceability of the contract. Such agreements are pivotal in establishing a clear, structured path for repayment of a loan taken to purchase a vehicle, thereby helping both the lender and borrower to avoid potential misunderstandings or disputes. Below are six key takeaways that should be considered when filling out and using a Vehicle Repayment Agreement form.

- Accuracy is crucial: Every detail entered into the form must be accurate and verifiable. This includes the names and addresses of the parties involved, the vehicle identification number (VIN), make, model, and year of the vehicle, as well as the loan amount and the interest rate if applicable. Incorrect information can void the agreement or lead to legal challenges in the future.

- Payment terms should be explicit: The agreement must clearly lay out the repayment schedule, including the amount of each installment, due dates, and the total number of payments to be made. Clarity on these terms helps prevent discrepancies regarding the expectations from each party.

- Consequences of default must be defined: It is essential to specify the consequences if the borrower fails to make the payments as agreed. This may include repossession of the vehicle or other legal actions. Both parties should understand the potential outcomes of a default to mitigate risks associated with non-compliance.

- Include a clause on prepayment: The agreement should address whether the borrower is allowed to pay off the loan early and, if so, whether a prepayment penalty will apply. This gives the borrower the flexibility to manage their finances more efficiently if they choose to settle the loan ahead of schedule.

- Signatures are binding: The document must be signed by both the lender and the borrower to be enforceable. These signatures formally acknowledge that both parties have read, understood, and agreed to the terms of the contract, making it legally binding.

- Notarization adds authenticity: While not always required, having the agreement notarized can add a layer of authenticity and may help in the enforcement of the agreement, especially in jurisdictions where notarized documents are given additional legal weight.

Following these guidelines will help ensure that the Vehicle Repayment Agreement stands up to legal scrutiny while providing a structured, fair arrangement for the repayment of vehicle loans. It’s a vital step in securing the interests of both the borrower and the lender and in facilitating a smooth financial transaction for the purchase of a vehicle.

Other Templates:

Sue Letter of Intent to Take Legal Action Template - This action can serve as a wake-up call, possibly preventing further harm or breaches by the recipient.

Sample Employee Loan Agreement - Including a dispute resolution method within the agreement can help prevent legal issues, outlining steps for handling any disagreements that arise.

How to Address a Judge in Writing - This form is used for providing a personal character reference in a legal proceeding, offering insights into the individual’s behavior and ethics.