Official Partial Release of Lien Document

When navigating the complexities of property improvement projects, homeowners and contractors alike may encounter the Partial Release of Lien form, a crucial document in the realm of real estate and construction law. This form plays a significant role in protecting the financial interests of all parties involved. By officially documenting the partial satisfaction of a debt related to property work, it ensures transparency and security in transactions. The process of obtaining a Partial Release of Lien involves understanding specific legal requirements, which can vary by jurisdiction. It serves as a testament to the partial completion of contractually agreed-upon services or improvements, allowing for a clear progression towards the total fulfillment of financial obligations. For individuals looking to sell or refinance property under lien, this form acts as a bridge, enabling these processes to move forward by releasing a portion of the property from the lien, while still protecting the rights of the lienholder for the remaining balance. The Partial Release of Lien form, therefore, stands as an essential document for mitigating risks and fostering trust between property owners, contractors, and financiers.

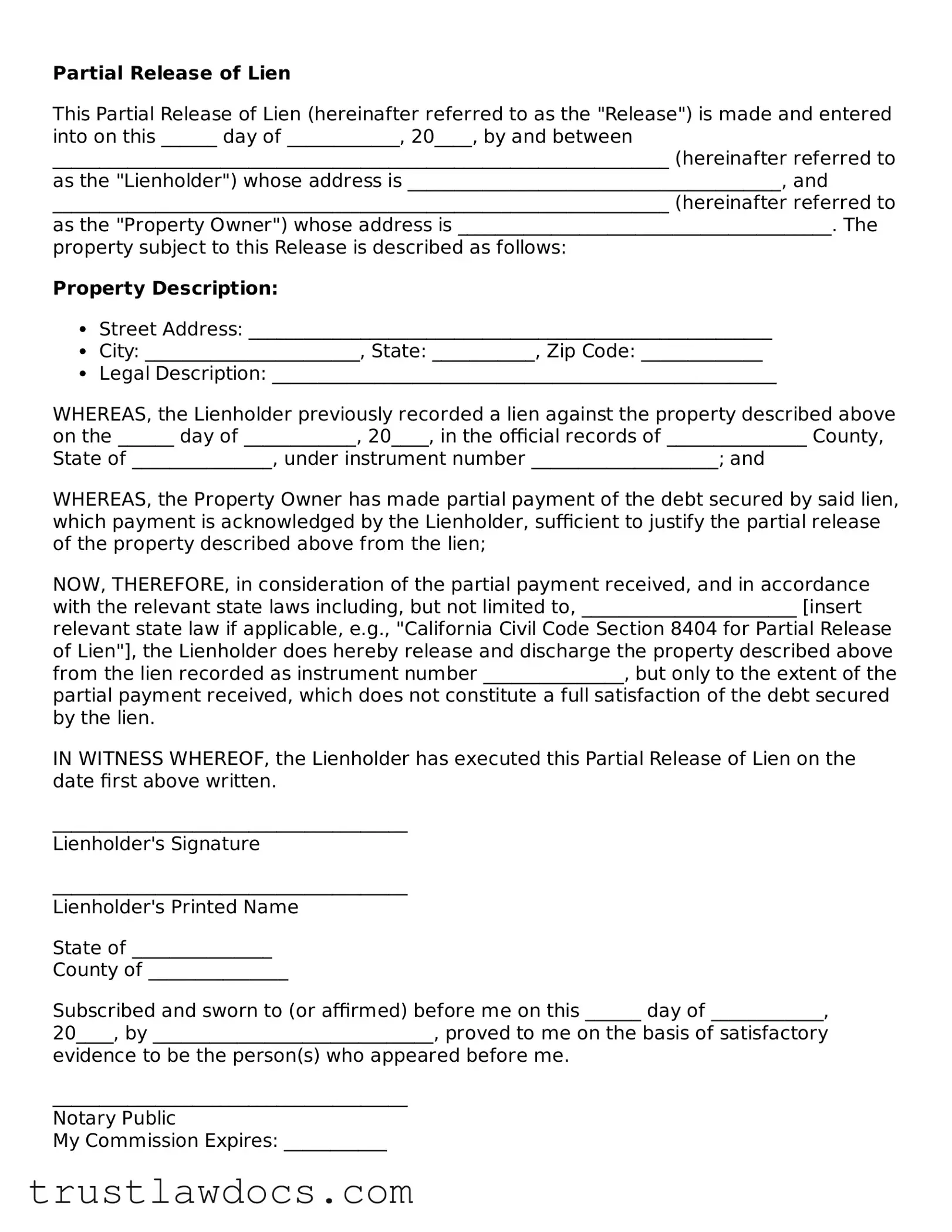

Form Example

Partial Release of Lien

This Partial Release of Lien (hereinafter referred to as the "Release") is made and entered into on this ______ day of ____________, 20____, by and between __________________________________________________________________ (hereinafter referred to as the "Lienholder") whose address is ________________________________________, and __________________________________________________________________ (hereinafter referred to as the "Property Owner") whose address is ________________________________________. The property subject to this Release is described as follows:

Property Description:

- Street Address: ________________________________________________________

- City: _______________________, State: ___________, Zip Code: _____________

- Legal Description: ______________________________________________________

WHEREAS, the Lienholder previously recorded a lien against the property described above on the ______ day of ____________, 20____, in the official records of _______________ County, State of _______________, under instrument number ____________________; and

WHEREAS, the Property Owner has made partial payment of the debt secured by said lien, which payment is acknowledged by the Lienholder, sufficient to justify the partial release of the property described above from the lien;

NOW, THEREFORE, in consideration of the partial payment received, and in accordance with the relevant state laws including, but not limited to, _______________________ [insert relevant state law if applicable, e.g., "California Civil Code Section 8404 for Partial Release of Lien"], the Lienholder does hereby release and discharge the property described above from the lien recorded as instrument number _______________, but only to the extent of the partial payment received, which does not constitute a full satisfaction of the debt secured by the lien.

IN WITNESS WHEREOF, the Lienholder has executed this Partial Release of Lien on the date first above written.

______________________________________

Lienholder's Signature

______________________________________

Lienholder's Printed Name

State of _______________

County of _______________

Subscribed and sworn to (or affirmed) before me on this ______ day of ____________, 20____, by ______________________________, proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

______________________________________

Notary Public

My Commission Expires: ___________

PDF Form Details

| Fact Number | Detail |

|---|---|

| 1 | A Partial Release of Lien form is used when a portion of the debt secured by a lien has been paid and the lienholder agrees to release part of the property from the lien. |

| 2 | This form is particularly common in construction, where it allows progress payments to be made for work completed without fully releasing the entire original lien. |

| 3 | The use and requirements of a Partial Release of Lien can vary significantly from one state to another, depending on local laws. |

| 4 | In Florida, for example, the law requires lien releases to be recorded with the county to be enforceable. |

| 5 | Before being recognized, many states require the form to be notarized, signifying that the lienholder's signature is genuine and voluntary. |

| 6 | A lien, including one partially released, can affect the sale or refinancing of property, as it appears in title searches. |

| 7 | It’s crucial for property owners to request and secure a Partial Release of Lien when making payments on a debt that is secured by their property. |

| 8 | Without a proper release, lien rights remain in effect, which can hinder transactions involving the property. |

| 9 | After filing a Partial Release of Lien, it’s important to keep a copy on file as proof of the reduced encumbrance on the property. |

| 10 | Lien laws are designed to protect both the property owner and those providing services or materials, balancing interests by allowing partial releases during ongoing projects. |

How to Write Partial Release of Lien

When navigating the process of real estate transactions or construction projects, a Partial Release of Lien form plays a crucial role. This document is often used to acknowledge that a portion of the lien has been paid off, allowing for a partial release of the claim against the property. Completing this form accurately is essential in ensuring that the property title becomes clear for further transactions or refinancing. The steps provided below will guide you through filling out the Partial Release of Lien form to ensure that the process is handled correctly and efficiently.

- Start by identifying the original lien document connected to the property in question. You will need information from this document, such as the lien recording date and the amount secured by the lien, to accurately complete the Partial Release of Lien form.

- Enter the date at the top of the form. This should be the current date on which you are filling out the form.

- Write the name of the lienholder (the person or entity releasing the lien) in the designated space. Ensure the name is spelled correctly and matches the name on the original lien document.

- Fill in the name of the property owner whose property is partially released from the lien. Again, verify that the spelling matches the original documents related to the lien and property.

- Describe the property in question, including its legal description and address. This information must be accurate and match the details on the original lien document and current property records.

- Input the amount that has been paid, leading to this partial release. Be precise with the figures to avoid any discrepancies.

- List the remaining amount owed under the lien after this partial release. This will clarify the outstanding balance that still affects the property.

- Sign and date the form. The lienholder must sign the Partial Release of Lien form to validate its authenticity and effectiveness. A witness or notary may also be required, depending on state laws or the preferences of the involved parties.

- Finally, file the completed form with the same county or city records office where the original lien was recorded. This step is crucial to officially update the property records, reflecting the partial release of the lien.

After properly filling out and submitting the Partial Release of Lien form, the property’s lien record will be updated to reflect the partial release, inching closer to a lien-free status. It's an essential step forward in the property transaction or construction project. This process not only represents a significant milestone but also reinforces the importance of keeping accurate and timely records throughout the duration of any property-related endeavor.

Get Answers on Partial Release of Lien

What is a Partial Release of Lien form?

A Partial Release of Lien form is a legal document used when a lienholder agrees to release a portion of the property from a lien, but not the entirety. This can happen when a payment has been made that satisfies part of the debt, hence, part of the property is released from the lien, but the remainder is still subject to it.

When should a Partial Release of Lien form be used?

This form should be used when a debtor has made a significant payment towards the outstanding debt that doesn’t fully settle the amount but is substantial enough to warrant the partial release of the property from the lien. It ensures that the property or part of it is no longer held as collateral for that portion of the debt which has been paid.

Who can file a Partial Release of Lien?

The lienholder, who is the person or entity holding the lien rights to the property due to an outstanding debt, is typically the one who files the Partial Release of Lien. This action acknowledges that a part of the debt has been paid and releases a portion of the property as a result.

Does a Partial Release of Lien remove the lien from the property entirely?

No, a Partial Release of Lien does not remove the lien from the property entirely. It only releases a specific part of the property from the lien, indicating that the debt associated with that particular portion has been satisfied. The rest of the property remains under lien until the full debt is paid off.

What information is needed to fill out a Partial Release of Lien form?

Filling out a Partial Release of Lien requires specific information, including the legal description of the property, the amount of debt being satisfied with the partial release, the portion of the property being released, details of the lienholder, and the remaining debt after the partial release. Ensuring accuracy in this information is crucial.

Can a Partial Release of Lien form be filed electronically?

Whether a Partial Release of Lien can be filed electronically depends on the jurisdiction's regulations. Some areas allow electronic filing of such documents, while others may require physical filing at a local government office or registry. It’s important to check the specific requirements of the local jurisdiction.

How does a Partial Release of Lien affect the property’s title?

A Partial Release of Lien positively impacts the property’s title by clearing it of the lien partially, which can make the property more attractive to potential buyers or financiers. It signifies that a portion of the debt has been resolved, thereby reducing the encumbrances on the title.

Is it necessary to get a Partial Release of Lien notarized?

Yes, typically, it is necessary to get a Partial Release of Lien notarized. Notarization helps verify the authenticity of the document, reducing the likelihood of disputes regarding the release of the property from the lien. The requirement for notarization can vary, so it is advisable to check local laws.

What happens if a lienholder refuses to provide a Partial Release of Lien?

If a lienholder refuses to provide a Partial Release of Lien, despite partial payment of the debt, the debtor may need to seek legal advice. Legal action might be necessary to enforce the partial release, especially when there's evidence that part of the debt has indeed been paid according to the terms initially agreed upon.

Can a Partial Release of Lien be reversed?

Reversing a Partial Release of Lien is uncommon and complex as it involves legal processes. It may be possible if there was a mistake or fraud involved in obtaining the release. Both parties may need to agree to reverse it, or a court order may be required, emphasizing the need for precise handling of the Partial Release of Lien.

Common mistakes

Filling out a Partial Release of Lien form can often seem straightforward, but pitfalls await those not paying close attention. One common mistake is the failure to include all relevant legal descriptions of the property. This description is not merely the address; it includes the legal terminology used in the property's deed. Without this precise description, the release may not effectively remove the lien from the property in question.

Another error involves incorrect or incomplete information about the lienholder. It's vital to use the exact name and contact details as they appear on the original lien document. Discrepancies here can lead to questions about the release's validity, potentially leaving the lien active on the public record. This oversight adds unnecessary hurdles, especially when attempting to sell or refinance the property.

Failing to specify the amount being released is a less obvious but significant error. On a Partial Release of Lien, it's crucial to clearly identify what portion of the lien is being satisfied. Without specifying this amount, the intent of the parties becomes unclear, and the document could be interpreted in ways that leave the lien partially in place, contrary to the parties' intentions.

Lastly, not obtaining or incorrectly executing the notarization can render the entire document void. Notarization is a critical step in verifying the identity of the parties signing the document and affirming the document's validity. A document that is not properly notarized may not be accepted by the county recorder, leading to a failure in the attempt to partially release the lien. The effort to correct this oversight can be time-consuming and costly.

Documents used along the form

When navigating through the process of managing a Partial Release of Lien, it's crucial to recognize that this form does not exist in isolation. Accompanying documents often play a pivotal role in ensuring that the lien release process is comprehensive, legal, and effectively communicates the updated status of the property or asset in question. These forms and documents not only provide a structured framework for such transactions but also offer legal protection and clarity for all parties involved. Understanding these documents can significantly streamline real estate or construction-related dealings.

- Notice of Commencement: Prior to the start of any construction project, this document is usually filed. It formally notifies all parties involved about the beginning of the project. By doing so, it helps in delineating the scope of work and the identities of the parties involved, thus laying down a foundational reference that can be critical for lien-related matters.

- Waiver and Release of Lien upon Progress Payment: This form is often used during the construction process, upon the completion of certain phases or upon making progress payments. It serves to release partially the claim of lien on the property, in exchange for payments received. This document is crucial for maintaining a clear record of payments and corresponding lien releases throughout the project.

- Final Waiver and Release of Lien: Upon the completion of a project and the final payment, this document is executed to release any remaining claims of liens by the contractors, subcontractors, or suppliers. This is an essential document for ensuring the property is free of liens and can be particularly significant in the sale or refinancing of the property.

- Claim of Lien: This document is filed by a contractor, subcontractor, or supplier who has not been paid for services provided. It is a legal claim against the property for the amount owed. Understanding the Claim of Lien is crucial as it precedes the partial or full release of liens, and its resolution is fundamental for the clear transfer of property titles.

Together, these documents form a network of legal safeguards and procedural steps that protect the rights and interests of all parties involved in a project. When handled with the proper attention to detail and legal adherence, they facilitate the smooth transition of property rights, the release of liens, and ensure that all financial obligations are met. Understanding these forms and how they interconnect enhances one's ability to navigate the complexities of lien management and real estate transactions more broadly.

Similar forms

A Partial Release of Lien is closely related to a Full Release of Lien. The key difference lies in the scope: while a Partial Release of Lien removes the claim over a specific part of the property or for a portion of the owed amount, a Full Release of Lien clears the property of any debt obligations in their entirety. This allows property owners to resolve claims piece by piece or in one full swoop, depending on the progress of payments or negotiations.

The Mechanic’s Lien, another document in the same family, gives contractors and laborers assurance that they will be compensated for their work. By placing a lien on the property they've worked on, they essentially mark their financial interest. A Partial Release of Lien, conversely, indicates that a portion of their work has been satisfactorily compensated for, reducing their claim on the property to reflect the outstanding balance.

Satisfaction of Mortgage documents are akin to a Partial Release of Lien in their finality, but they apply specifically to mortgages. Once a mortgage is paid off, the lender issues this document to remove their interest from the property, signifying the homeowner's complete ownership. Whereas, a Partial Release may be issued during the mortgage term to reflect payments made or modifications to the loan.

Conditional Waiver and Release on Progress Payment forms are commonly used in construction, like Partial Release of Lien forms, to note the settlement of due payments up to a certain point without fully clearing the property of claims. These waivers are pivotal during ongoing projects, ensuring that both parties acknowledge the payment for phases of work completed, without fully relinquishing the right to future claims for remaining work.

Unconditional Waiver and Release on Final Payment documents finalize the transaction, confirming that all work has been completed and paid for, lifting any liens placed on the property. In contrast, a Partial Release of Lien serves more as an incremental step towards this final release, acknowledging partial payment or completion.

The Notice of Intent to Lien is a preliminary step before an actual lien is placed, serving as a warning to property owners that legal action is imminent unless payment disputes are resolved. This document’s issuance often precedes the need for a Partial Release of Lien, which would later indicate that the issues flagged in the notice have been partially addressed.

Lastly, the Claim of Lien form is an official filing that secures a contractor’s, laborer's, or supplier's legal claim against a property until they receive payment for services or materials provided. The linkage to a Partial Release of Lien is direct - as payments are made towards satisfying the claim established by a Claim of Lien, a Partial Release may be issued to reduce the encumbrance on the property accordingly.

Dos and Don'ts

Filling out a Partial Release of Lien form is an important step in the process of managing liens on property. It's a legal document that requires attention to detail and accuracy. To ensure you complete this form correctly and efficiently, consider the following dos and don'ts.

Do:

- Verify the property description: Ensure that the description of the property matches the one listed in the lien. Discrepancies can lead to confusion and potentially invalidate the form.

- Check the lien information: Confirm that the lien details, including the lienholder's name and the amount being released, are accurate.

- Sign in the presence of a notary: Signing the Partial Release of Lien form in front of a notary public is typically required to verify the authenticity of the signature.

- Retain a copy for your records: Keep a copy of the completed and signed form for your personal records. This can be crucial for future reference.

- Review state requirements: Each state may have specific laws and requirements for lien releases. Make sure to comply with these legal obligations.

Don't:

- Rush the process: Take your time while filling out the form to avoid errors that could delay the release of the lien.

- Omit any requested information: Incomplete forms may not be processed. Make sure every required field is filled out.

- Alter the form without authorization: Do not make unapproved modifications to the form, as this could lead to legal complications.

- Ignore filing deadlines: Be aware of any deadlines by which the form must be submitted to ensure the lien release is processed in a timely manner.

Misconceptions

The Partial Release of Lien form is crucial in real estate transactions, particularly in construction, yet misunderstandings about its purpose and implications abound. Let’s dismantle some of these misconceptions to foster a better comprehension of its significance.

It completely clears the property of any liens: A common misconception is that once a Partial Release of Lien is granted, the property is entirely clear of any liens. In reality, this form only releases a portion of the property or reduces the lien amount. Other liens or portions thereof may still affect the property.

It is only necessary when selling the property: Many believe the need for a Partial Release of Lien arises exclusively at the time of sale. However, this documentation can be critical at various stages of property ownership, especially during refinancing or any restructuring of finance associated with the property.

Any contractor can issue a Partial Release of Lien: It's often thought that any contractor involved can issue these forms. However, only those who have a legal claim or lien against the property can execute a Partial Release of Lien, typically after receiving partial payment for their work.

Partial Release of Lien is an informal agreement: Contrary to this belief, the process is formal and requires the release to be filed with the county recorder or similar local government entity to be effective. It must comply with state laws, and in many cases, notarization is required.

It affects the entire property: This misunderstanding stems from the notion that a lien or its release applies universally to the whole property. In reality, a Partial Release of Lien may pertain only to a specific part of the property, such as a parcel of land, or to a particular amount of the original lien, leaving the rest under the lien’s shadow.

All parties involved must sign the Partial Release of Lien: While it might seem logical, not all parties in the original lien need to sign the Partial Release of Lien. Generally, only the lienholder and the property owner, or their legal representatives, are required to execute this document for it to be valid.

Demystifying these misconceptions underscores the importance of understanding the legal nuances associated with Partial Release of Lien forms. Property owners, contractors, and legal professionals should navigate these processes with a clear comprehension of their implications to safeguard interests and ensure proper legal standing of properties involved.

Key takeaways

A Partial Release of Lien form plays a crucial role for property owners and contractors, ensuring clarity and protection during construction or renovation projects. Here are key takeaways to understand its importance and proper use:

- Understand the Purpose: A Partial Release of Lien signifies that a contractor, subcontractor, or materials supplier releases a portion of their lien rights against a property, usually after receiving partial payment.

- Gather Accurate Information: Before filling out the form, collect all necessary details such as property description, owner's name, contractor's information, and the amount paid that prompts this partial release.

- Clear Description of Property: The form must include a clear and precise description of the property, ensuring there are no ambiguities about the land or buildings concerned.

- Specify the Scope of Release: It should explicitly state which lien rights are being released and under what conditions, without nullifying the contractor’s right to claim a lien for the remaining balance.

- Notarization is Vital: To ensure legality and authenticity, the Partial Release of Lien form often requires notarization. This process officially verifies the signatories’ identities and their acknowledgment of the document.

- Keep Records: Retain a copy of the completed and signed form for your records. This documentation can serve as proof of the partial release should any disputes arise in the future.

- Communicate with All Parties: Inform all stakeholders about the issuance of a Partial Release of Lien. Clear communication prevents misunderstandings and ensures everyone involved is aware of the progress and status of payments.

- Legal Consultation: Seek legal advice if you have questions or uncertainties about filling out the form or its implications. A professional can ensure that the document complies with state laws and effectively protects your interests.

Properly utilizing a Partial Release of Lien forms a vital link in maintaining trust and transparency between property owners and construction professionals. It is an essential step in managing financial transactions and obligations throughout the course of a project.

Consider More Types of Partial Release of Lien Forms

Personal Training Waiver - It is typically presented before starting any training regimen, ensuring that clients are aware of and accept the risks associated with physical exercise.