Official Mortgage Lien Release Document

When homeowners successfully pay off their mortgage, a crucial step in truly owning their property outright involves securing a Mortgage Lien Release form. This document serves as official proof that the homeowner has fulfilled their financial obligation to the lender, ensuring that the lien placed on the property's title for securing the mortgage loan is officially removed. The process and specific requirements for obtaining this form can vary by state and lender, but generally, the lender is responsible for preparing and recording it with the local government. The form not only signifies the end of a homeowner's mortgage payments but also plays a vital role in protecting the homeowner's rights. Without it, selling the property or obtaining new financing could become significantly more complicated. By comprehensively understanding the Mortgage Lien Release form and ensuring its proper execution, homeowners can fully embrace the financial freedom and security that comes with property ownership.

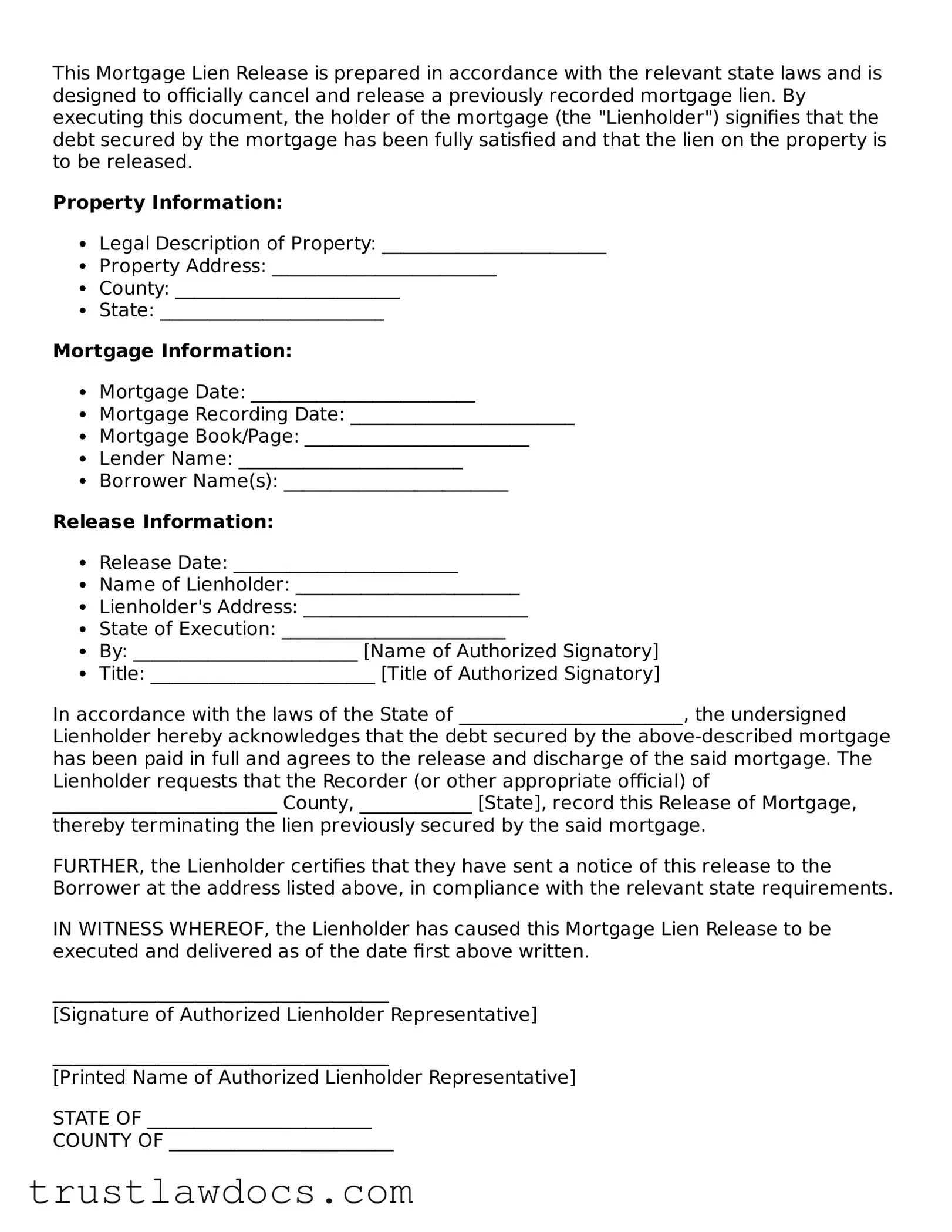

Form Example

This Mortgage Lien Release is prepared in accordance with the relevant state laws and is designed to officially cancel and release a previously recorded mortgage lien. By executing this document, the holder of the mortgage (the "Lienholder") signifies that the debt secured by the mortgage has been fully satisfied and that the lien on the property is to be released.

Property Information:

- Legal Description of Property: ________________________

- Property Address: ________________________

- County: ________________________

- State: ________________________

Mortgage Information:

- Mortgage Date: ________________________

- Mortgage Recording Date: ________________________

- Mortgage Book/Page: ________________________

- Lender Name: ________________________

- Borrower Name(s): ________________________

Release Information:

- Release Date: ________________________

- Name of Lienholder: ________________________

- Lienholder's Address: ________________________

- State of Execution: ________________________

- By: ________________________ [Name of Authorized Signatory]

- Title: ________________________ [Title of Authorized Signatory]

In accordance with the laws of the State of ________________________, the undersigned Lienholder hereby acknowledges that the debt secured by the above-described mortgage has been paid in full and agrees to the release and discharge of the said mortgage. The Lienholder requests that the Recorder (or other appropriate official) of ________________________ County, ____________ [State], record this Release of Mortgage, thereby terminating the lien previously secured by the said mortgage.

FURTHER, the Lienholder certifies that they have sent a notice of this release to the Borrower at the address listed above, in compliance with the relevant state requirements.

IN WITNESS WHEREOF, the Lienholder has caused this Mortgage Lien Release to be executed and delivered as of the date first above written.

____________________________________

[Signature of Authorized Lienholder Representative]

____________________________________

[Printed Name of Authorized Lienholder Representative]

STATE OF ________________________

COUNTY OF ________________________

On ________________________, before me, ________________________ [Name of Notary Public], personally appeared ________________________ [Name of Signatory], who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to in the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

WITNESS my hand and official seal.

____________________________________

[Notary Public Signature]

My commission expires: ________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose of Mortgage Lien Release | The form is used to officially release a borrower from the mortgage lien once the mortgage loan has been fully paid off. |

| Key Document | It must be filed with the county recorder's office or similar local government authority to remove the lien from public records. |

| State-Specific Forms | Forms and requirements can vary by state, adhering to specific state laws governing real estate transactions and records. |

| Document Preparer | Typically, the lender or an authorized agent prepares the Mortgage Lien Release form. |

| Signatories | The document needs to be signed by the lender, confirming that the debt has been satisfied. |

| Notarization | In most cases, the form requires notarization to validate the lender's signature. |

| Recording | After notarization, the form should be filed with the appropriate county office to be recorded. |

| Importance | Filing the form is crucial as it impacts the borrower's credit and property rights, ensuring that the mortgage no longer encumbers the borrower's property. |

How to Write Mortgage Lien Release

Once a mortgage is paid in full, the lien on the property should be released to clear the title and give the homeowner full ownership. The Mortgage Lien Release form is crucial in this process. It's a document submitted to the relevant local or state office, indicating that the borrower has fulfilled the loan terms, and the lien can officially be removed. Preparing this document accurately is essential to ensure the process is completed without delay. Following are the steps to fill out the Mortgage Lien Release form properly.

- Begin by entering the date of the document in the top right corner. This should be the date you are filling out the form.

- Write the full legal name of the person or entity that is releasing the lien in the space provided for the lienholder's information.

- Include the name of the borrower whose mortgage was paid off. Make sure to use the legal name as it appears on the mortgage documents.

- Enter the full address of the property without abbreviations. This detail helps in identifying the property involved.

- Provide the original mortgage date and the recording information, including the book and page number or the document number, depending on the system used by the local recording office.

- Some forms require details about the mortgage loan, such as the loan amount and the mortgage account number. Fill in these details accurately.

- For forms that include a notary section, leave this area blank until you meet with a notary. The notary will witness the signing and complete this portion.

- Review the document thoroughly for any mistakes or omissions. Such errors can delay the process of releasing the lien.

- Sign the document in the presence of a notary, if required. Ensure that all parties required by law to sign the Mortgage Lien Release form do so before submitting it.

- Finally, submit the completed form to the appropriate local or state office. This might involve a recording fee, so verify the amount and include it with your submission.

After these steps are followed, the office handling real estate documents will process the Mortgage Lien Release form. The time it takes to remove the lien from public records can vary, depending on the jurisdiction's workload and procedures. Once processed, the homeowner will receive confirmation, and the property title will be clear of the mortgage lien. Through precise completion and submission of this form, homeowners can successfully navigate this final step in mortgage fulfillment.

Get Answers on Mortgage Lien Release

What is a Mortgage Lien Release form?

A Mortgage Lien Release form is a legal document showing that the borrower has paid off the mortgage in full and the lender no longer has a lien on the property. This document is vital for the homeowner to prove that they own the property free and clear of any mortgages.

When is a Mortgage Lien Release form needed?

This form is needed once a mortgage has been fully paid off. It's used to update public records, showing that the lien on the property has been released, and the borrower now holds clear title to the property.

Who prepares the Mortgage Lien Release form?

Typically, the lender prepares the Mortgage Lien Release form. Once the final mortgage payment is made, it's the lender's responsibility to complete and sign this form, acknowledging that the debt has been paid in full.

How is a Mortgage Lien Release form filed?

After the lender prepares and signs the Mortgage Lien Release form, it must be filed with the local county recorder's office or land registry office. This step officially removes the lien from the property record, ensuring that the public records reflect the property's current status.

What happens if you don't receive a Mortgage Lien Release form after paying off your mortgage?

If you don't receive a Mortgage Lien Release form after paying off your mortgage, you should contact your lender to request it. If the lender does not provide the form, you may need to seek legal assistance to ensure that the lien is removed from the public record and your property rights are protected.

Is there a fee to file a Mortgage Lien Release form?

Yes, there typically is a fee to file a Mortgage Lien Release form. This fee varies by jurisdiction and is paid to the county recorder's or land registry office. It covers the cost of updating the property's record to show that the mortgage lien has been released.

How long does it take for a Mortgage Lien Release to be processed?

The processing time for a Mortgage Lien Release can vary widely depending on the jurisdiction. It can take anywhere from a few days to several weeks for the document to be recorded and for the public records to be updated.

Can a homeowner prepare and file a Mortgage Lien Release form themselves?

While it is possible for a homeowner to prepare a Mortgage Lien Release form, it's uncommon. This form must be prepared and signed by the lender since it is a legal statement verifying that the mortgage has been fully paid. However, the homeowner is responsible for ensuring that it is filed correctly if the lender does not take this step.

Common mistakes

Filling out a Mortgage Lien Release form is a critical step for homeowners seeking to confirm they have paid off their mortgage. Yet, mistakes in this process are common and can lead to delays or complications. One frequent error is not checking for completeness; every section of the form needs to be filled out. Leaving out information, especially identification details like the loan number, can cause significant setbacks.

Another mistake lies in not verifying the accuracy of all filled information. Small errors, such as misspelled names or incorrect property descriptions, can render the document invalid. This attention to detail is paramount since even minor discrepancies can question the document's legitimacy.

Additionally, individuals often overlook the requirement for notarization. Most states require that a Mortgage Lien Release form be notarized to validate the identity of the signer. Failing to have the document notarized can mean it won't be recognized by the county recorder, preventing the lien from being officially released.

Timing is another element frequently mishandled. Submitting the form too early or too late can both be problematic. There's often a specific window after the final mortgage payment in which the document should be submitted to ensure timely processing. Ignoring this timeline might lead to unnecessary delays.

Some people incorrectly assume that a generic form can be used in any state. However, mortgage laws and requirements can vary significantly from one state to another. Using a form not specific to the state where the property is located might mean it does not meet all legal requirements, potentially invalidating the document.

The failure to include all necessary signatures is a common oversight. Depending on the state and the original mortgage agreement, there might be a need for signatures from multiple parties, not just the homeowner. Missing any required signature can void the process, requiring it to start over.

People sometimes neglect to check whether their form needs witness signatures in addition to notarization. Some jurisdictions require witness signatures for the form to be legally binding, and without these, the process cannot move forward successfully.

Choosing the wrong delivery method or address for sending the completed form to the county recorder's office or other relevant authority is another error that can lead to delays. It's crucial to confirm the correct address and whether the office accepts mailed forms, requires in-person delivery, or allows electronic submission.

Lastly, a significant mistake is not retaining a copy of the submitted Mortgage Lien Release form and any related correspondence. Should there be any question or issue down the line, having a record of the documents submitted and communications received is invaluable for verifying that the lien has been properly released.

A careful approach to filling out and submitting the Mortgage Lien Release form can streamline the process, ensuring that homeowners can officially release the lien on their property without unnecessary complications.

Documents used along the form

Completing a Mortgage Lien Release form is an important event, as it signifies that a mortgage loan has been fully paid off and the lien the lender held on the property is released. This document is critical in the process of clearing the title of the property, ensuring that it is free from claims by the lender. Alongside the Mortgage Lien Release form, several other documents are frequently used to ensure a comprehensive and legally sound transaction. The preparation and submission of these documents require meticulous attention to detail.

- Promissory Note: This is the borrower's promise to repay the amount borrowed. It includes information about the loan amount, interest rate, repayment schedule, and what happens in case of default. The release of the mortgage lien usually coincides with the fulfillment of the promissory note's terms.

- Deed of Trust: In some states, instead of a mortgage, a deed of trust is used. This document involves a third party, called a trustee, who holds the property's title until the loan is paid off. The release of a deed of trust serves a similar purpose to the mortgage lien release, indicating the loan has been paid in full.

- Loan Amortization Schedule: This document outlines each payment on the loan from start to finish. It shows how each payment is split into principal and interest and demonstrates the loan balance after each payment. It's useful for the borrower to track progress toward loan repayment.

- Final Truth in Lending Statement: This document provides a summary of the mortgage terms, including the annual percentage rate (APR), the total amount paid over the life of the loan, and other closing costs. It's usually provided at the beginning of the loan process and then updated upon payoff.

- Release of Promissory Note: Upon the loan's payoff, a release of the promissory note is issued, indicating that the borrower has fulfilled their repayment obligation and there is no outstanding debt against the note.

- HUD-1 Settlement Statement: This document is used for real estate transactions that involve a mortgage. It itemizes all charges and credits to the buyer and seller in a transaction. When the mortgage is paid off, the HUD-1 shows that there are no further charges or liens on the property related to the mortgage.

When the Mortgage Lien Release form and these related documents are properly completed, they collectively provide a clear, indisputable record that the homeowner has successfully repaid their mortgage. This process is crucial for homeowners to regain full ownership of their property, free from claims by lenders or other entities. It is essential for all parties involved to carefully review and accurately complete each of these documents to ensure the legal transfer of property rights occurs without issue.

Similar forms

The Satisfaction of Mortgage form closely mirrors the Mortgage Lien Release form in its ultimate purpose: to indicate that a borrower has fully repaid their mortgage loan, thereby removing the lender's claim or lien on the property. This document is a critical piece for homeowners, officially signifying that they no longer owe any mortgage debt and that the property is entirely theirs, free of claims from the lender. Like the Mortgage Lien Release, it serves as legal proof that the borrower has fulfilled their financial obligations under the mortgage agreement.

Similarly, the Deed of Reconveyance is used in states that utilize deeds of trust instead of mortgages. This document accomplishes the same objective as the Mortgage Lien Release, which is to clear the title of the property and transfer full ownership back to the borrower once the loan is paid off. The trustee (who holds the title for the property as security for the loan) reconveys, or transfers, the property title back to the borrower, signifying that there are no longer any outstanding debts against the property.

The Release of Lien is another document which parallels the Mortgage Lien Release but is broader in its application. It is used to signify the payment and satisfaction of any type of debt that results in a lien, not just those related to mortgages. This could include mechanics' liens, judgment liens, or tax liens. Once the underlying debt is paid, the lienholder signs the Release of Lien, effectively clearing the claim against the property or asset, similarly marking the resolution of the debt as the Mortgage Lien Release does for mortgages.

The Warranty Deed, while primarily a tool for transferring property, also resembles the Mortgage Lien Release when it includes a clause that guarantees the property is free of any encumbrances, including mortgages. This document not only changes property ownership but certifies that the seller has the legal right to sell the property, and that it comes to the buyer without any liens or outstanding debts. This sort of assurance is akin to the confirmation a Mortgage Lien Release provides, ensuring that there are no financial obligations pending against the property's title.

Similarly, a Quit Claim Deed, albeit less formal than a Warranty Deed, can serve a similar function to the Mortgage Lien Release in specific scenarios. It is used to transfer any ownership interest the grantor might have in a property, without promising that the property is free of claims. However, when used between family members or to clear up a title, it can effectively remove potential claims by transferring interests that could include those involved in resolving financial liens against the property.

The UCC-3 Amendment form also shares similarities with the Mortgage Lien Release, particularly regarding personal property rather than real estate. The UCC-3 is used to amend a UCC-1 financing statement, which could include indicating the termination or release of the statement, thus signaling that the secured debt has been satisfied. Like a Mortgage Lien Release, it is a critical document for clarifying the status of ownership and ensuring that the asset is free from claims related to the security interest noted in the UCC-1.

Dos and Don'ts

When completing the Mortgage Lien Release form, it's crucial to follow certain guidelines to ensure the process goes smoothly and correctly. Knowing what to do and what to avoid can greatly impact the outcome.

What to Do:

- Verify all information before submission: Double-check property descriptions, names on the mortgage, and all dates for accuracy.

- Keep a copy for your records: Before sending the form, make sure you have a duplicate for personal records.

- Use blue or black ink: If completing the form by hand, use blue or black ink to ensure legibility and formality.

- Consult with a professional: If there's any confusion, seeking advice from a legal expert or financial advisor can prevent mistakes.

- Follow up: After submission, follow up with the relevant parties to confirm that the lien release has been processed.

What Not to Do:

- Ignore discrepancies: Don't overlook any discrepancies in the information on the form; resolve them before submission.

- Rush through the process: Take your time to fill out the form correctly to avoid delays and errors.

- Use pencil: Never fill out the form in pencil as it can be easily altered and may not be accepted.

- Forget to check state requirements: Each state may have different requirements or additional forms, so ensure you're in compliance.

- Skip legalese: Avoid ignoring the legal terms or instructions provided with the form; understanding these can be crucial for correct completion.

Misconceptions

When it comes to understanding the Mortgage Lien Release form, several misconceptions can complicate the process for homeowners and buyers alike. Clearing these up is essential for smooth real estate transactions.

It happens automatically: Many believe that once they pay off their mortgage, the lien release will automatically be filed. However, the borrower or their agent typically needs to request this release from the lender, who then files it with the local government office.

It's the lender's sole responsibility: While lenders are responsible for providing the necessary documentation for a lien release, the borrower often must ensure that this document gets filed correctly with the county recorder's office. Overlooking this step can result in the lien remaining on the record.

No cost involved: There's a common misconception that releasing a mortgage lien is free. Depending on the state or county, there may be filing fees associated with recording the lien release. These costs are usually the borrower's responsibility.

Immediate removal from credit reports: Some people expect that once a mortgage lien is released, it will instantly improve their credit score or be removed from their credit report. In reality, it can take some time for the release to be processed and reflected in credit history. The credit report will update to reflect the mortgage as paid, but the improvement in credit score can be gradual.

Only one form is needed: The specific requirements for a mortgage lien release can vary significantly by jurisdiction. More than one form or document may be necessary to complete the process legally and thoroughly.

It's the same as a deed release: A deed and a lien are not the same, and thus, their release forms serve different purposes. A mortgage lien release does not transfer property ownership; it merely removes the lender's claim on the property as security for the mortgage loan. A deed release, on the other hand, would be used to transfer property ownership rights.

Understanding these misconceptions and preparing accordingly can help property owners navigate the complexities of real estate transactions more smoothly.

Key takeaways

When dealing with the Mortgage Lien Release form, it's crucial to approach the process with diligence and awareness of its significance. This document serves as legal evidence that the mortgage on a property has been fully paid off, and the lien tied to the mortgage is released, freeing the property from the hold of the lender. Below are key takeaways for filling out and using the Mortgage Lien Release form properly:

- Ensure Accuracy: Double-check all information you include on the form to prevent errors. Incorrect details can delay the lien release process.

- Know the Requirements: Understand the specific requirements for a Mortgage Lien Release in your state as they can vary. Some states may require additional documentation.

- Complete All Sections: Fill out every required section of the form. Leaving parts blank can invalidate the document or cause processing delays.

- Legal Description of Property: Provide a precise legal description of the property. This is usually more detailed than just an address and may require consulting your original mortgage documents or a professional.

- Signatures Are Key: Ensure that all required parties, especially the lienholder, sign the form. Without these signatures, the document won't be legally binding.

- Notarization: Some states require the Mortgage Lien Release form to be notarized. Check if this applies to your case and, if so, ensure proper notarization.

- Keep Copies: After completing the form, make copies for your records. Having backups can be crucial for future reference or in case of disputes.

- Submit to the Proper Authority: Submit the completed form to the county recorder's office or another appropriate local government entity to officially record the lien release.

- Follow Up: After submission, follow up to ensure the form has been recorded and the lien release is reflected in the property’s official records. This can prevent future legal or financial complications.

By adhering to these steps, property owners can navigate the Mortgage Lien Release process more smoothly, ensuring their property is legally free and clear of the associated mortgage lien.

Consider More Types of Mortgage Lien Release Forms

Partial Waiver of Lien Form - An effective tool in managing real estate assets and liabilities, especially in complex ownership situations.

Car Accident Settlement Agreement - Geared towards expediently resolving financial matters post-accident, this form signifies the end of damage claims related to the incident.