Official Conditional Contractor’s Lien Release Document

In the world of construction, managing financial risks and protecting your investment are paramount, which brings the Conditional Contractor’s Lien Release form into focus. This pivotal document acts as a safeguard for property owners and lenders, essentially serving as a receipt that signifies payment for services or materials has been promised, albeit not yet finalized. The crux of its purpose lies in its ability to conditionally release a contractor or supplier's legal claim over a property, contingent upon the receipt of the agreed payment. Its significance cannot be overstated, as it prevents any unwanted liens from being placed on the property due to disputes or miscommunications about payment, providing peace of mind to all parties involved. Moreover, it ensures that the contractor or supplier will be paid, fostering a mutual trust that is necessary for the smooth progress of construction projects. Thus, understanding how to properly use and interpret this form is essential for anyone engaged in building or remodeling work, as it serves as a critical tool for financial and legal protection throughout the construction process.

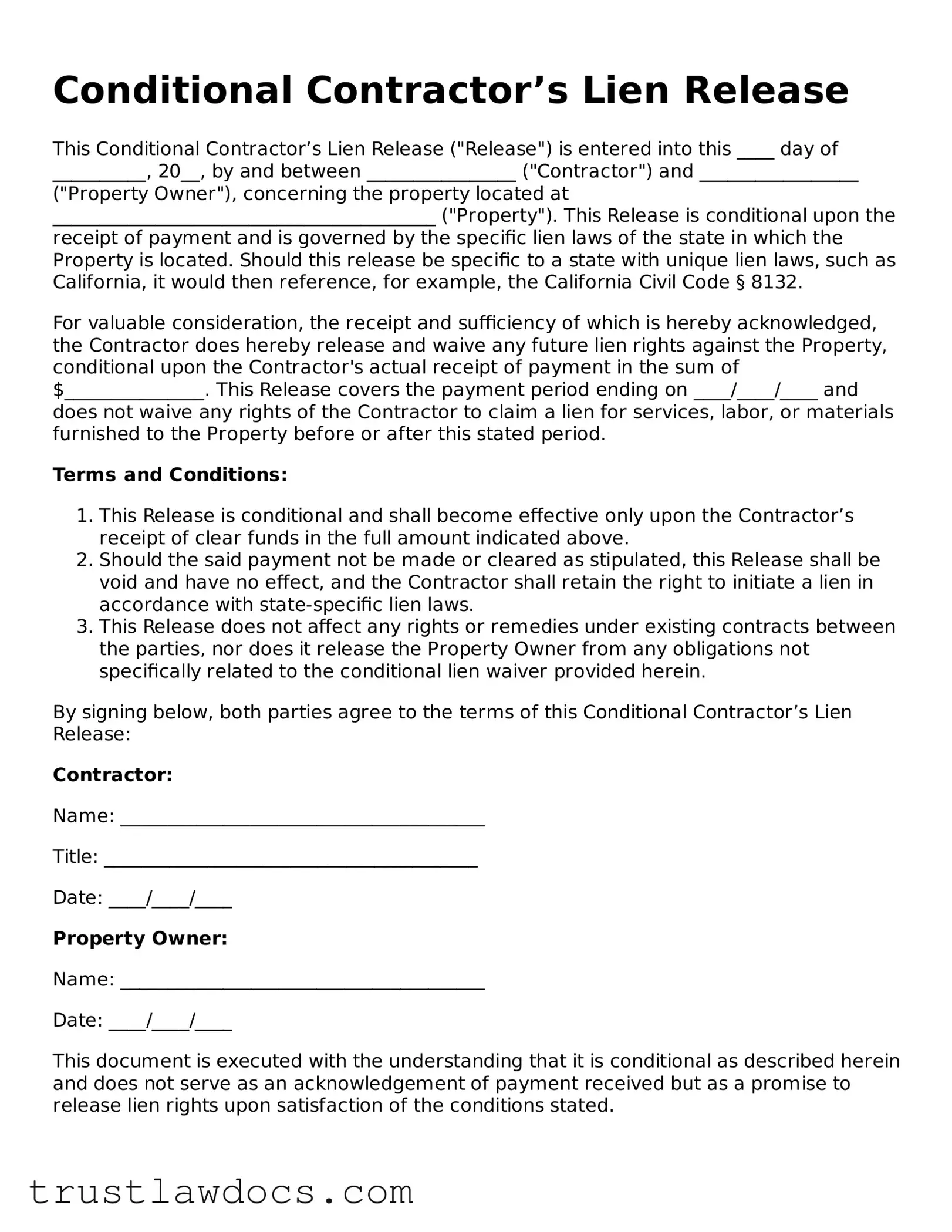

Form Example

Conditional Contractor’s Lien Release

This Conditional Contractor’s Lien Release ("Release") is entered into this ____ day of __________, 20__, by and between ________________ ("Contractor") and _________________ ("Property Owner"), concerning the property located at _________________________________________ ("Property"). This Release is conditional upon the receipt of payment and is governed by the specific lien laws of the state in which the Property is located. Should this release be specific to a state with unique lien laws, such as California, it would then reference, for example, the California Civil Code § 8132.

For valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Contractor does hereby release and waive any future lien rights against the Property, conditional upon the Contractor's actual receipt of payment in the sum of $_______________. This Release covers the payment period ending on ____/____/____ and does not waive any rights of the Contractor to claim a lien for services, labor, or materials furnished to the Property before or after this stated period.

Terms and Conditions:- This Release is conditional and shall become effective only upon the Contractor’s receipt of clear funds in the full amount indicated above.

- Should the said payment not be made or cleared as stipulated, this Release shall be void and have no effect, and the Contractor shall retain the right to initiate a lien in accordance with state-specific lien laws.

- This Release does not affect any rights or remedies under existing contracts between the parties, nor does it release the Property Owner from any obligations not specifically related to the conditional lien waiver provided herein.

By signing below, both parties agree to the terms of this Conditional Contractor’s Lien Release:

Contractor:Name: _______________________________________

Title: ________________________________________

Date: ____/____/____

Property Owner:Name: _______________________________________

Date: ____/____/____

This document is executed with the understanding that it is conditional as described herein and does not serve as an acknowledgement of payment received but as a promise to release lien rights upon satisfaction of the conditions stated.

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose of the Form | Used to release a contractor's lien rights to a property conditionally, typically upon receipt of payment. |

| Nature of the Condition | The release is effective only once certain conditions are met, usually the clearing of a payment check. |

| Governing Law | Varies by state, as lien laws are primarily determined at the state level. |

| When it is Used | Typically used during the construction process when a payment is made but not yet confirmed to have cleared by the bank. |

| Benefit to the Property Owner | Helps ensure that their property will not be subject to a lien if the agreed-upon payments are made. |

| Benefit to the Contractor | Provides assurance of payment being cleared while waiving the right to lien the property conditionally. |

| Key Information Included | Typically includes the payment amount, description of services, property information, and the specific condition triggering the release. |

| State-Specific Requirements | May require specific wording, notarization, or additional information depending on the state's lien laws. |

How to Write Conditional Contractor’s Lien Release

Once you have completed the work as specified in your contract, the next crucial step is to ensure the financial aspects of the project are also settled. This involves securing your right to payment while relinquishing potential lien claims on the property upon receipt of the agreed payment amount. The Conditional Contractor's Lien Release form plays a pivotal role in this process. This document is a formal declaration that you, as the contractor, will release your lien rights on the property in question, conditional upon receiving payment. This guide provides you with a straightforward outline on how to accurately fill out this form, ensuring that your financial interests are protected while adhering to legal standards.

Steps for Completing the Conditional Contractor’s Lien Release Form:

- Begin by entering the date on which you are filling out the form. Ensure this is located at the top right-hand corner of the document.

- Next, fill in the property owner's full name under the section titled "Property Owner." This should be the individual or entity that contracted your services.

- In the space provided, write down the full legal description of the property. This includes the address, city, county, and state where the property is located. If applicable, also include the lot or parcel number as found in property records.

- Specify the name of the claimant, which, in this case, would be your name or the name of your business entity as the contractor. Place this information in the designated field to clarify who is releasing the lien upon payment.

- Under the "Through Date," mention the last date services or materials were provided for the project. This confirms the timeframe your claim pertains to and helps in identifying the specific work or supplies included in the lien release.

- Proceed to indicate the payment amount that, when received, will activate the release of the lien. This should match the amount agreed upon in your contract for the work or materials supplied up to the mentioned through date.

- For the section marked "Exceptions," list anything that is not covered by this release. This could include charges or services provided outside of the specified through date.

- Finally, affix your signature at the bottom of the form to legally bind the declaration. If you are signing on behalf of a company, make sure to include your official title or position beside your signature.

Upon completing the Conditional Contractor’s Lien Release form, the next step involves submitting it to the relevant party, typically the property owner or their representative, along with an invoice for the payment due. This ensures both the release of lien rights conditional on payment and serves as a request for the agreed compensation. It is advisable to keep a copy of the completed form for your records, reinforcing your financial protection and supporting any necessary future references. Time and accuracy in this process safeguard your business interests and promote smooth, transparent finalization of your contractual obligations.

Get Answers on Conditional Contractor’s Lien Release

What is a Conditional Contractor’s Lien Release form?

A Conditional Contractor’s Lien Release form is a legal document used by contractors or suppliers to waive their right to a mechanic's lien against a property. This waiver is conditional upon receiving payment for services or materials provided. Essentially, it ensures that the property is free from claims once the contractor is paid.

When should I use a Conditional Contractor’s Lien Release form?

This form is typically used during the construction process when a payment is about to be made but has not yet cleared. It is a sign of good faith from the contractor or supplier that they will not pursue a lien on the property once they receive the agreed-upon payment.

Does signing this form mean I have received payment?

No, signing a Conditional Contractor’s Lien Release form does not confirm that you have received payment. It indicates your agreement to release your lien rights conditionally, pending the receipt of payment. The form usually specifies the conditions under which the lien rights are waived, which typically include the successful processing of a payment.

What information is needed to fill out the form?

To accurately fill out a Conditional Contractor’s Lien Release form, you will need the legal description of the property, the name of the property owner, the amount to be paid, details of the contractor or supplier, the date, and an understanding of the conditions under which the lien will be released.

Is a Conditional Contractor’s Lien Release form legally binding?

Yes, once it is signed by the relevant parties, the Conditional Contractor’s Lien Release form becomes a legally binding document. It obligates the contractor or supplier to relinquish their lien rights over the property, contingent upon receiving the specified payment.

What happens if I don't receive the payment after signing the form?

If you don't receive the payment as specified in the Conditional Contractor’s Lien Release form, the conditions of the release have not been met, and thus, the attempt to waive the lien rights may be considered void. In such instances, it might be necessary to consult with a legal advisor to explore your options for enforcing the lien.

Common mistakes

One common mistake is not properly identifying the parties involved. It’s crucial to use the legal names of both the contractor and the property owner, ensuring they match the names used in the contract and on the property deed. Names should be spelled correctly and completely, to avoid any ambiguity about who is releasing the lien and who benefits from the release.

Another error is failing to accurately describe the work or materials covered by the lien release. This description should match what was detailed in the original contract or agreement, and it should be as precise as possible. Vague or incomplete descriptions can lead to disagreements over whether specific work or materials have been adequately compensated and should be included or excluded from the lien release.

Incorrectly stating the dates covered by the lien release is also a frequent mistake. The form should clearly indicate the timeframe during which the work was performed or the materials were supplied. This prevents any confusion about the period the release covers, ensuring it aligns with the work completed and paid for.

Not specifying the amount that has been paid or is to be paid can lead to complications. The form should clearly reflect the exact payment amount that has triggered the release, or the conditions under which the future payment will complete the release. This clarity is key to preventing disputes over payment amounts or the timing of payments.

Overlooking the conditional nature of the release is a critical error. A conditional lien release is effective only if certain conditions are met, typically the clearance of a payment check. This condition should be spelled out clearly, including what happens if the check does not clear. Failure to do so could inadvertently create an unconditional release, regardless of whether payment is ultimately received.

Failing to include a notary public’s acknowledgment can also invalidate the lien release. Many states require this step to verify the authenticity of the signatures on the form. Skipping this process could mean the release is not legally enforceable.

Another oversight is not retaining a copy of the signed release. Both parties should keep a copy for their records to provide proof of the agreement. This can be crucial if there’s a later disagreement or if the need to prove the release’s existence arises.

Signing the form without a witness is another common mistake. While not always required, having a witness sign the form alongside the parties can add an extra layer of verification and protection against claims of forgery or coercion.

Many individuals also neglect to verify that all related parties have been informed about the lien release. In some cases, notifying the lender or other stakeholders is necessary to ensure that the lien release is fully operational and recognized by all affected parties.

Last but not least, a significant error is not understanding the legal implications of signing the form. Before filling out and signing a Conditional Contractor’s Lien Release, it's important for all parties to understand what rights are being waived and under what conditions. Consulting with a legal professional can help clarify these points and ensure that the release serves its intended purpose without unintended consequences.

Understanding these common mistakes and taking steps to avoid them can help ensure that the process of releasing a lien proceeds smoothly and effectively, avoiding future disputes and legal hassles.Documents used along the form

When engaging in construction projects or substantial property renovations, parties commonly utilize a series of documents to ensure clarity, compliance, and protection for all involved. The Conditional Contractor’s Lien Release form is a critical document that signifies a contractor's conditional agreement to waive their lien rights against a property, typically effective upon the receipt of a specified payment or fulfillment of a particular condition. Accompanying this form, several other documents play pivotal roles in the construction process, ensuring a smooth progression from start to finish.

- Notice of Commencement: This document is usually filed with the local county recorder's office before work begins on a property. It formally notifies all involved parties of the commencement of a construction project, and it often includes information such as the property description, contractor details, and project specifics. This notice is primarily for the benefit of subcontractors and material suppliers.

- Payment Bond: A Payment Bond assures that the contractor will fulfill payment obligations to subcontractors and suppliers. This bond is a safeguard for workers and suppliers, ensuring they receive payment for services rendered, even if the contractor defaults.

- Mechanic’s Lien: Unlike the Conditional Contractor’s Lien Release, a Mechanic’s Lien is a security interest in the property for the benefit of those who have supplied labor or materials that improve the property. A contractor or supplier can file this lien as a form of security if they are not paid for their services.

- Final Waiver of Lien: Upon the completion of a project and once all payments have been made, this document is issued to signify that a contractor or supplier completely waives any right to place a lien on the property, indicating full satisfaction of any potential claims.

- Partial Waiver of Lien: Throughout a project, suppliers and subcontractors may issue Partial Waivers of Lien upon receiving incremental payments. These serve to relinquish lien rights over the part of the property or project scope that corresponds to the received payment.

- Contractor’s Affidavit: This sworn statement by the contractor confirms that all subcontractors and suppliers have been paid and that there are no outstanding debts related to labor, materials, or other services for the project. It's often required before a final payment or project closeout.

In summary, the Conditional Contractor’s Lien Release form is part of a suite of documents designed to ensure all parties in a construction project are protected and comply with legal obligations. Beyond merely releasing lien rights conditionally, the incorporation of notices, bonds, waivers, and affidavits provides a structured approach to managing financial and legal risks associated with construction projects, thereby fostering a climate of trust and reliability among all parties involved.

Similar forms

The Unconditional Contractor's Lien Release form is similar to the Conditional Contractor’s Lien Release, but with a crucial difference. While the latter releases the property lien under the condition that payments are received by a certain date, the former removes the lien without any conditions once payment has been confirmed. This form provides a guarantee to the property owner that the contractor has been paid and will not make any further claims on the property, offering a final settlement.

Another related document is the Partial Waiver of Lien. This document works similarly to the Conditional Contractor's Lien Release but is used for incremental payments throughout a project. When a contractor or subcontractor receives a portion of the payment owed for work completed to date, they release a part of their claim on the property. This ensures that the property owner is protected against liens for the amount paid, while still acknowledging that further payments are due.

The Contractor’s Sworn Statement parallels the Conditional Contractor’s Lien Release by providing proof that payments are due or have been made to all subcontractors and suppliers. This document is crucial for property owners to ensure that no outstanding payments will result in liens against their property. It typically accompanies the Conditional Contractor’s Lien Release to offer a comprehensive view of the project’s financial status.

The Lien Waiver upon Final Payment document, much like the Unconditional Contractor’s Lien Release, signifies the completion of financial transactions between the contractor and the property owner. This document is used once all work is completed and all payments have been made, effectively releasing any remaining lien rights the contractor has on the property. It's an essential form for finalizing the financial aspect of a construction project, providing peace of mind to all parties involved.

Lastly, the Mechanic’s Lien is a document that establishes a contractor's, subcontractor's, or supplier's legal claim against a property when they have not received payment for services or materials provided. This document is what contractors are seeking to avoid or resolve with the issuance of a Conditional Contractor’s Lien Release form. By obtaining a Conditional Contractor’s Lien Release, the property owner can prevent a mechanic's lien from being placed on their property, contingent upon successful payment.

Dos and Don'ts

Filling out the Conditional Contractor’s Lien Release form correctly is crucial to ensuring the legal documentation reflects the agreement accurately and protects all parties involved. Here are essential do's and don'ts to help navigate the process:

Do:- Double-check the project details to ensure accuracy. This includes project name, location, and other pertinent details.

- Verify the release amount matches the payments received or expected at the time of signing the release.

- Include the correct date when the form is filled out, as this indicates when the conditions are agreed upon.

- Ensure that all parties involved in the contract are correctly identified by their full legal names.

- Review the terms and conditions associated with the release form to ensure understanding and agreement.

- Retain a copy of the filled-out form for your records. It's important for future reference or in case of disputes.

- Use clear, legible handwriting if filling out the form by hand to avoid any misunderstandings or misinterpretations.

- Consult with a legal professional if there are any uncertainties or questions regarding the form or the release process.

- Ensure that the form is notarized if required by the state law or contract terms.

- Sign and date the form in the presence of the required witnesses, if applicable, to validate its execution.

- Leave any sections blank. If a section does not apply, clearly mark it as "N/A" to indicate it was not overlooked.

- Misstate the payment status. Providing incorrect information can lead to disputes or legal issues.

- Sign the form without fully understanding the implications of the release, especially pertaining to rights and future claims.

- Forget to specify the condition under which the lien is being released to clear any ambiguity regarding the agreement.

- Omit any required attachments or supplemental documents that need to accompany the form.

- Delay submitting the completed form to the necessary parties, as this can impact project timelines and financial transactions.

- Use versions of the form that are outdated or not compliant with current state laws and regulations.

- Ignore state-specific requirements that may affect the validity of the release.

- Overlook the necessity to formally amend the document if any corrections or changes are needed after initial completion.

- Rush through the process without giving due attention to detail, as errors or omissions can compromise the document's effectiveness.

Misconceptions

Many misconceptions swirl around the Conditional Contractor's Lien Release form, often leading to confusion and mistakes in its application. This document is crucial in the construction field, serving as a contractor's promise to waive their rights for a mechanic's lien to the extent of the payment received. Understanding its nuances can significantly impact the security and smooth progression of a construction project. Here are four common misunderstandings:

- It fully clears the contractor of future claims. A widely held misconception is that once a Conditional Contractor's Lien Release form is signed, the contractor cannot make future claims against the property. However, this form only covers the period up until the payment date noted in the document. Any additional work or materials supplied after that date could potentially be subject to a new lien unless further lien releases are issued.

- It's only necessary for large projects. Another mistake is thinking this form is solely for large, commercial projects. In reality, it's just as crucial for small or residential projects. The Conditional Contractor's Lien Release form serves as a critical piece of documentation to ensure clear communication and legal clarity, irrespective of the project's size.

- It serves as an immediate release of all lien rights. This form actually represents a promise to release lien rights conditionally, depending on the receipt and clearance of the payment. It's not an instantaneous release upon signing but is contingent on financial transactions clearing properly. Therefore, it’s a conditional promise, and the actual release of lien rights is not immediate upon its execution.

- No need to verify details since it's a standard form. Many believe that because the Conditional Contractor's Lien Release form often follows a template, there's no need for a thorough review before signing. This approach can lead to significant problems. Each project has unique aspects and details—like the exact scope of work covered, the payment date, and the amounts—which must be accurately reflected in the form. Ensuring these details match the agreed-upon work and payment terms is essential to its effectiveness and enforceability.

By dispelling these misconceptions, individuals and businesses involved in construction projects can better understand the Conditional Contractor's Lien Release form's purpose and nuances. This understanding will lead to more informed decisions, bolster legal protections, and foster smoother project completions.

Key takeaways

Filling out and effectively utilizing the Conditional Contractor’s Lien Release form requires attention to detail and an understanding of its impact on construction projects. By following these key takeaways, individuals can navigate the requirements and implications of this important document.

- A Conditional Contractor’s Lien Release form is used to waive a contractor or supplier’s right to a lien against a property, but only if certain conditions, usually the payment, are met.

- The form should be filled out completely, with no sections left blank, to ensure its validity. This includes all relevant details about the contractor, the property owner, a description of the services or materials provided, and the conditions under which the lien is to be released.

- Timing is crucial when submitting this form. It is typically provided before the payment is actually made, serving as a form of guarantee that the lien will be released once the conditions are satisfied.

- Be specific about the conditions that must be met for the lien release to take effect. This often involves stating the exact amount to be paid and by when, providing clear guidelines for all parties involved.

- While the form is intended to provide security for the property owner, it also protects the rights of the contractor or supplier by specifying that the lien can only be waived if the agreed-upon conditions are fulfilled.

- Once the conditions outlined in the form have been met, it is imperative that the party responsible for filing the lien take the necessary steps to officially release the lien with the relevant local or state office, ensuring the property is clear of any claims.

Understanding and carefully managing the Conditional Contractor’s Lien Release process is essential for both property owners and construction professionals to uphold their rights and ensure smooth project completion.

Consider More Types of Conditional Contractor’s Lien Release Forms

Letter of Satisfaction Mortgage - Facilitates the removal of a mortgage from a property’s title, clearing the way for unencumbered ownership.

Artwork Release Form Pdf - Demystifies the process of music licensing, providing a clear path for your music's use in various projects.