Official Receipt Template Document

Imagine completing a transaction, whether it's buying a cup of coffee or selling a piece of furniture online, and the importance of having a tangible record of that transaction. This is where a Receipt Template form steps in, serving as a critical tool for both the buyer and seller, ensuring that the details of the transaction are documented accurately. Such a form not only offers peace of mind by providing proof of payment but also plays a vital role in managing finances, supporting returns or exchanges, and complying with legal requirements. In essence, a Receipt Template is a versatile document, adaptable to various transactions and indispensable for record-keeping and financial accountability. As we delve into the subject, understanding the major aspects of this form, from its structure to its key components and significance, becomes crucial for anyone engaged in transactions of goods or services.

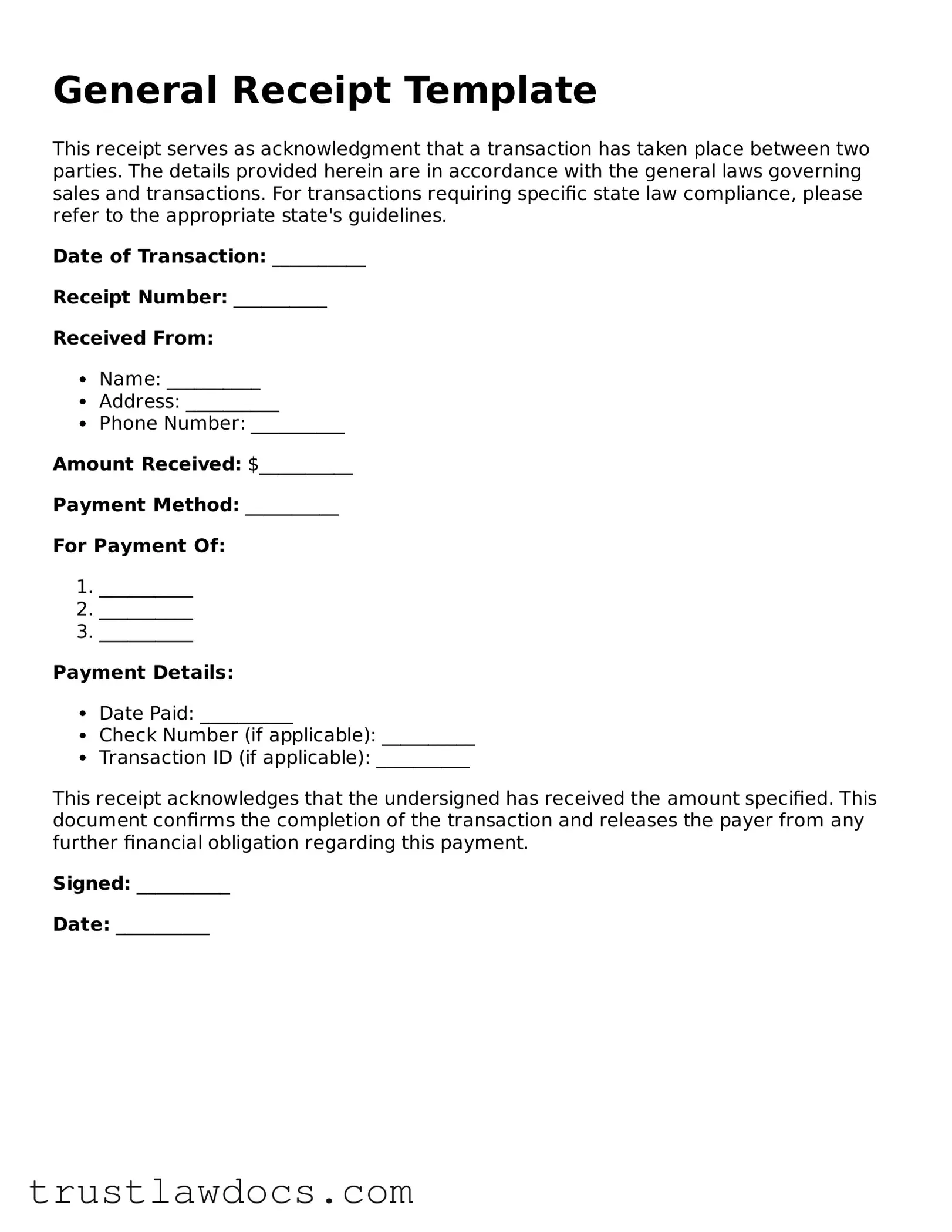

Form Example

General Receipt Template

This receipt serves as acknowledgment that a transaction has taken place between two parties. The details provided herein are in accordance with the general laws governing sales and transactions. For transactions requiring specific state law compliance, please refer to the appropriate state's guidelines.

Date of Transaction: __________

Receipt Number: __________

Received From:

- Name: __________

- Address: __________

- Phone Number: __________

Amount Received: $__________

Payment Method: __________

For Payment Of:

- __________

- __________

- __________

Payment Details:

- Date Paid: __________

- Check Number (if applicable): __________

- Transaction ID (if applicable): __________

This receipt acknowledges that the undersigned has received the amount specified. This document confirms the completion of the transaction and releases the payer from any further financial obligation regarding this payment.

Signed: __________

Date: __________

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A Receipt Template form is a standardized document used to acknowledge the receipt of goods, services, or payments from one party to another. |

| Primary Use | It serves as proof of transactions and can help in resolving disputes, maintaining records for tax purposes, or managing returns and exchanges. |

| Variability | The form can vary widely depending on the nature of the transaction, including details like date, amount, parties involved, and description of the transaction. |

| State-Specific Forms | In some cases, the law requires particular forms or details for a receipt based on the state where the transaction occurs, to comply with local sales tax laws or consumer protection statutes. |

| Governing Laws | While there is no uniform federal law that dictates the exact format of a Receipt Template, various state laws and the Uniform Commercial Code (UCC) can apply, governing the necessary elements of a receipt in commercial transactions. |

How to Write Receipt Template

The process of completing a Receipt Template form is a necessary step in ensuring the accurate documentation of transactions between two parties. It serves not just as a proof of payment or delivery but as an essential element for record-keeping and accounting. The task involves filling out various components to capture essential data such as the date of the transaction, details of the items exchanged, and the parties involved. By following a structured approach, one ensures that all necessary information is accurately recorded, which facilitates straightforward reference and reconciliation in the future.

- Begin by entering the Date of the transaction at the top of the form to establish when the exchange took place.

- Next, record the Name of the payer or the party from whom the payment is received, ensuring clarity in identification.

- In the section marked for the Recipient's Details, fill in the name and contact information of the individual or entity receiving the payment. This helps in tracking the transaction's destination.

- Proceed to describe the items or services exchanged. This involves detailing the Description of each item or service provided, including any relevant quantities or unique identifiers. This step is crucial for both parties to agree on what the payment covers.

- For each item or service listed, enter the Amount paid. If applicable, break down the amounts to show the unit price and total for quantities greater than one.

- If any taxes, shipping fees, or other charges apply to the transaction, detail these in the designated section. This ensures the receipt reflects the total amount accurately.

- Summarize the Total Amount Paid at the bottom of the form, providing a clear indication of the transaction's total financial impact.

- To conclude, the person receiving the payment should Sign the form. This act certifies that the information is accurate to the best of their knowledge and confirms the receipt of the specified payment or items.

Upon completion, this document acts as a binding acknowledgment between the parties involved, ensuring transparency and acting as a safeguard against potential disputes. It is recommended to make copies for both parties' records, further solidifying the transaction's legitimacy and agreed-upon terms.

Get Answers on Receipt Template

What is a Receipt Template form used for?

A Receipt Template form is used to create a document that proves a transaction took place. This includes the exchange of goods, services, or monetary funds between two parties. The form helps ensure that there is a written record of the details of the transaction, which can be important for financial tracking, tax purposes, or if any disputes arise.

Is the Receipt Template form legally binding?

Yes, a completed Receipt Template form, when filled out accurately and signed by both the seller and the buyer, is considered a legally binding document. It serves as evidence of the transaction and can be used in legal proceedings if necessary.

What key information should be included in a Receipt Template form?

A Receipt Template form should include the date of the transaction, names and contact information of both the seller and the buyer, a detailed description of the goods or services provided, the total amount paid, and the payment method. It may also include a signature section for both parties to acknowledge the transaction.

Can I customize the Receipt Template form to my needs?

Yes, most Receipt Template forms are designed to be customizable. Depending on your specific needs, you can add or remove details related to the transaction. However, it's crucial to ensure that all necessary information is included to maintain the document's validity and effectiveness.

How should I store completed Receipt Template forms?

Completed Receipt Template forms should be stored securely, either as a digital copy or a physical copy, in a location that is accessible for both parties involved. It is advisable to keep these records for a minimum of three years, as they might be needed for tax purposes or if any discrepancies arise regarding the transaction.

Do both parties need a copy of the completed Receipt Template form?

Yes, it is standard practice for both the seller and the buyer to have their copy of the completed Receipt Template form. This ensures that both parties have a record of the transaction details for their reference, and it aids in preventing misunderstandings or disputes in the future.

What should I do if there is a mistake on the Receipt Template form after it's been filled out?

If a mistake is identified on the completed Receipt Template form, it is best to correct the error as soon as possible. The correction should be made clearly and initialed by both parties. If the mistake is significant, it may be necessary to create a new Receipt Template form with the correct information and have both parties sign it again. Keeping accurate records is essential for the credibility of the document.

Common mistakes

One common mistake many individuals make when filling out the Receipt Template form is failing to provide complete details. In many cases, essential information such as the date of the transaction, full names, or the specific description of the service or product sold is omitted. This lack of detail can result in disputes regarding the terms of the transaction or the items involved, potentially leading to legal issues.

Another frequent oversight is neglecting to ensure that both parties receive a copy of the completed receipt. This document serves as a crucial record of the exchange, and possessing a copy is vital for both the seller and the buyer. It protects both parties in the event of disagreements or if the transaction needs to be referenced in the future.

Additionally, individuals often forget to have the Receipt Template properly signed by the relevant parties. A signature adds a layer of authenticity and acknowledgment from both the buyer and the seller, indicating that they agree with the information stated on the receipt and that the transaction has occurred. Not securing a signature can weaken the document's validity as a legal record.

Incorrect or unclear financial information is also a common mistake. This can include the wrong amount being recorded or failure to specify the currency. Such inaccuracies can lead to confusion, disputes over the transaction amount, or issues with financial records. Ensuring that the financial details are correctly listed is paramount for the transparency and accuracy of the transaction record.

Finally, a significant error made by many is treating the Receipt Template as a one-size-fits-all document without customizing it to fit the specific transaction. Each transaction is unique, and the receipt should reflect the specific details and agreements made between the involved parties. Failing to tailor the receipt to the specific sale or service can lead to misunderstandings and might not provide adequate legal protection if the details of the transaction are contested.

Documents used along the form

When managing transactions, especially in business, a receipt template is a standard document used to acknowledge payments received. However, to ensure a comprehensive approach to record-keeping and financial management, several other forms and documents are commonly used alongside the receipt template. These additional documents help in providing a detailed account of business transactions, enhancing transparency, and ensuring compliance with legal and tax obligations.

- Invoice: This document is issued prior to the receipt to request payment from the buyer. It details the products or services provided, quantities, agreed prices, and payment terms. Unlike the receipt, an invoice indicates an obligation to pay, rather than confirmation of payment received.

- Purchase Order: Often the first official document issued by a buyer to a seller, indicating types, quantities, and agreed prices for products or services. It is used to control the purchasing of products and services from external suppliers.

- Bill of Sale: A document that transfers ownership of an asset from a seller to a buyer, highlighting the sale date, parties involved, and details about the item(s) sold, including price. It serves as legal evidence of the transaction.

- Warranty or Guarantee Certificates: These documents accompany many products or services, assuring the buyer of the item's reliability and quality. They outline the conditions under which repairs or exchanges will be made should the product fail to meet specified standards.

- Delivery Note: A document accompanying the delivered goods, providing proof of delivery and specifying the details of the shipment, including the date of delivery, recipient, and a description of the goods. It helps in matching the order with the invoice.

- Payment Agreement Contract: A legally binding document that outlines the terms of payment between two parties, including the amount to be paid, payment schedule, and penalties for late payment. This contract ensures that both the payer and the recipient have clear expectations regarding the payment plan.

Together with the receipt template form, these documents create a robust framework for financial transactions, protecting the interests of all parties involved. By maintaining these records, businesses can ensure accuracy in their financial reporting, streamline their operations, and uphold accountability. The integration of these forms into a business's financial practices contributes significantly to operational efficiency and legal compliance.

Similar forms

A receipt template serves as a proof of transaction between two parties, similar to an invoice. However, while an invoice acts as a request for payment, a receipt confirms that a payment was made. Both documents contain similar information such as the date of transaction, the amount, and the involved parties, making them closely related but serving different stages of the transaction process.

Another document akin to a receipt template is a sales slip. Sales slips are often issued at the point of sale, especially in retail environments, and list the items purchased, their prices, and the total amount paid. Like receipts, they serve as evidence of a transaction, but they often provide more detailed information about the purchased items.

A bill of sale shares common ground with a receipt template, particularly in transactions involving goods or property, such as vehicles. It not only confirms that a transaction took place but also transfers ownership from the seller to the buyer. Both documents include details about the transaction and the parties involved but the bill of sale carries legal weight in proving ownership.

A delivery note is another document similar to a receipt template, primarily used in the shipping and logistics industry. It lists the items delivered to a recipient, ensuring the order has been fulfilled correctly. While a receipt confirms a payment, a delivery note confirms the receipt of goods, serving as a proof of delivery rather than a proof of purchase.

Payment confirmation emails are the digital counterparts to physical receipt templates. They acknowledge the completion of a transaction and are often used in online purchases. These emails provide transaction details such as the purchase date, amount, and payment method, fulfilling a similar role to traditional receipts but in a digital format.

A warranty card, provided at the time of purchase, shares similarities with receipt templates. It typically includes transaction details necessary for service claims, proving that the consumer purchased the item and is entitled to warranty services. Both documents are important for post-purchase service and support, although warranty cards specifically relate to service claims.

Credit card statements, while broader in scope, resemble receipts in their function of confirming transactions. They list all purchases made within a billing period, including transaction dates, amounts, and merchants, serving as a monthly aggregated receipt for all credit card purchases, though they lack the itemized detail of individual receipts.

A bank statement, much like a credit card statement, serves as a monthly summary of financial transactions conducted through a bank account, including deposits, withdrawals, and transfers. It acts as a collection of electronic receipts for those transactions, presenting a comprehensive view of an account's financial activity over a designated period.

Loan repayment schedules bear resemblance to receipt templates by documenting the exchange and repayment of borrowed funds. They detail the amount paid, remaining balance, and payment dates, serving as a receipt for each installment. While focusing on loan management, they affirm payments similar to how receipts confirm purchases.

Finally, a lease agreement, while primarily a contract, includes elements found in a receipt template, such as payment amounts, due dates, and party information. Upon payments, tenants often receive receipts or payment confirmations that mirror the terms outlined in the lease, verifying that rent obligations have been met in accordance with the agreement.

Dos and Don'ts

Filling out a receipt template form correctly is essential for ensuring that all transactions are recorded accurately. This document serves as a proof of payment, making it vital for both businesses and customers. Below are key do's and don'ts to consider when completing a receipt template form:

Do's:

Ensure all information is legible and accurate. Ambiguities or errors can cause confusion and disputes down the line.

Include a detailed description of the goods or services provided. This helps in clarifying what the payment is for, especially in cases of returns or exchanges.

Write the date of the transaction. This is critical for record-keeping and can be important for warranty or return timelines.

State the total amount paid, including a breakdown of taxes and any discounts if applicable. This transparency is key for both parties’ financial records.

Sign the receipt or provide a digital signature if the receipt is electronic. A signature validates the transaction.

Don'ts:

Don't leave any fields blank. If a section does not apply, mark it as "N/A" (not applicable) instead of leaving it empty.

Don't forget to provide contact information for both the provider and the recipient. This information is crucial in case there are any questions or issues with the transaction.

Don't use vague language. Be as specific as possible to avoid any misunderstandings.

Don't forget to check the receipt for errors before finalizing. Taking a moment to review can prevent future headaches.

Don't discard your copy of the receipt. It's important to keep your records up to date and maintain a copy for your files.

By following these guidelines, you can ensure that your receipt template forms are filled out correctly and efficiently, providing clear and concise records of transactions for all parties involved.

Misconceptions

When examining the realm of financial documents, the Receipt Template form occupies an essential role in the daily operations of businesses and transactions. However, several misconceptions surround its use and importance. Let's clarify these misunderstandings to ensure that both businesses and customers can navigate their financial interactions with confidence.

One Receipt Template Fits All: A common mistake is the belief that a single receipt template suffices for every type of transaction. In reality, different transactions—be it a sale, service, or donation—require templates that cater to their specific needs and legal requirements.

Receipts Are Only for In-Person Transactions: In the digital age, this notion is outdated. Online transactions also necessitate receipts, providing proof of purchase and delineating the terms of the exchange, regardless of the physical presence of the buyer or seller.

A Receipt Is Just a Formality: Far from being mere paperwork, receipts hold legal significance. They serve as proof of a transaction, helping to resolve disputes, facilitate returns, and ensure warranty claims. For businesses, they are critical for accounting and tax purposes.

Digital Receipts Are Less Valid than Paper Ones: With advancements in technology, digital receipts hold the same legal weight as their paper counterparts. The key factor is that they accurately reflect the transaction and are accessible for future reference.

Receipts Aren’t Necessary for Low-Value Transactions: Regardless of the amount, a receipt serves as proof of transaction. It's a misconception that minor transactions don't require documentation, especially when accounting and proof of purchase are necessary.

Handwritten Receipts Are Not Legitimate: In many circumstances, a handwritten receipt is as valid as a printed one. The critical aspect is the inclusion of the transaction details, such as date, amount, and parties involved, not the method of documentation.

Receipt Templates Are Hard to Customize: With the multitude of software and online resources available today, customizing a receipt template to fit specific transaction types or company branding is easier than ever.

All Receipt Information Is the Same: This misunderstanding ignores the nuanced needs of various industries. While certain information is universally relevant, like transaction date and amount, other details can vary significantly depending on the nature of the transaction and legal requirements.

Keeping Receipts Is Only Beneficial for Businesses: This overlooks the consumer's perspective, for whom keeping receipts can be equally critical. They enable consumers to track spending, manage returns, and claim warranties, underscoring the mutual benefit of receipt retention.

Dispelling these misconceptions enhances the understanding and efficient use of Receipt Template forms, facilitating smoother financial interactions and legal compliance for all parties involved.

Key takeaways

When you're preparing to fill out and use a Receipt Template form, understanding the essentials ensures both clarity and legality in your transactions. A well-prepared receipt serves as a proof of payment, protects against potential disputes, and keeps a clear record for both parties involved. Here are key takeaways to guide you:

- Accuracy is crucial: Ensure all information is correct and up-to-date. Mistakes in details like the date, amount, or parties' names can lead to confusion or disputes later on.

- Detail the transaction: Be specific about what the payment is for. Including a detailed description of goods or services ensures transparency and serves as a reference for both the payer and the payee.

- Include all parties’ information: Clearly state the names and contact information of both the payer and the payee. This is essential for the document's legitimacy and might be required for future reference or claims.

- Payment method: Clearly indicate the method of payment (cash, check, credit card, etc.). This can be crucial in resolving any future disputes over the payment.

- Issue a receipt number: Each receipt should have a unique identification number. This practice helps in organizing and tracking transactions efficiently.

- Signatures matter: When possible, include the signatures of both parties. A signature verifies that the transaction was acknowledged by both the payer and the payee, adding another layer of validation to the document.

- Make copies: Always keep a copy of the receipt for your records. Maintaining a physical or digital archive of all transactions can protect against future disputes or be essential for tax purposes.

Following these guidelines when filling out and using a Receipt Template form will help ensure that all financial transactions are recorded with accuracy and integrity. Proper documentation is not just about legal compliance; it also fosters trust and transparency in business relationships.

Other Templates:

Sample Employee Loan Agreement - An Employee Loan Agreement form is a document that outlines the terms under which an employee agrees to borrow money from their employer, specifying repayment schedules and interest rates.

Bill of Sale Four Wheeler - It's essential for recording the change of ownership and can be used for registration and tax purposes in many states.

Where to Sell Limited Edition Prints - An essential piece of administration for artists and art collectors alike, aiming to streamline and secure the process of art sales.