Free Real Estate Purchase Agreement Form for Texas

Embarking on the journey of buying or selling property in Texas marks a significant milestone in anyone’s life, paving the way for new beginnings and opportunities. At the heart of this process is the Texas Real Estate Purchase Agreement, a crucial document that lays the foundation for a legally binding relationship between the buyer and seller. This form meticulously outlines the terms and conditions of the sale, including the purchase price, property description, financing details, and any contingencies that must be met before the transaction can be finalized. It acts as a roadmap, guiding all parties through the complexities of the real estate transaction with clarity and precision. Whether you are stepping into the real estate market for the first time or are a seasoned investor, understanding the components and significance of this agreement is essential for a smooth and successful exchange, ensuring that all legal requirements are satisfied and the interests of both buyer and seller are protected.

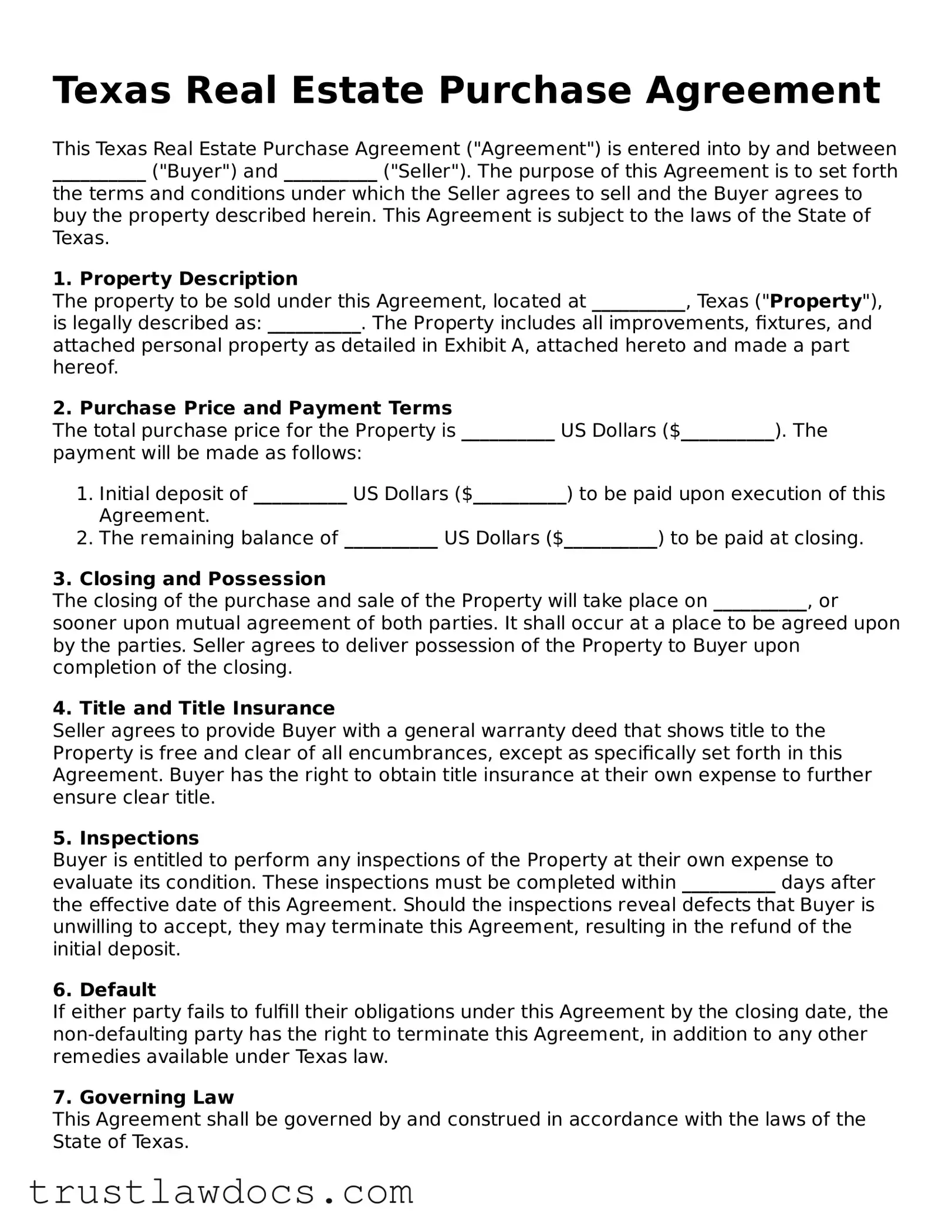

Form Example

Texas Real Estate Purchase Agreement

This Texas Real Estate Purchase Agreement ("Agreement") is entered into by and between __________ ("Buyer") and __________ ("Seller"). The purpose of this Agreement is to set forth the terms and conditions under which the Seller agrees to sell and the Buyer agrees to buy the property described herein. This Agreement is subject to the laws of the State of Texas.

1. Property Description

The property to be sold under this Agreement, located at __________, Texas ("Property"), is legally described as: __________. The Property includes all improvements, fixtures, and attached personal property as detailed in Exhibit A, attached hereto and made a part hereof.

2. Purchase Price and Payment Terms

The total purchase price for the Property is __________ US Dollars ($__________). The payment will be made as follows:

- Initial deposit of __________ US Dollars ($__________) to be paid upon execution of this Agreement.

- The remaining balance of __________ US Dollars ($__________) to be paid at closing.

3. Closing and Possession

The closing of the purchase and sale of the Property will take place on __________, or sooner upon mutual agreement of both parties. It shall occur at a place to be agreed upon by the parties. Seller agrees to deliver possession of the Property to Buyer upon completion of the closing.

4. Title and Title Insurance

Seller agrees to provide Buyer with a general warranty deed that shows title to the Property is free and clear of all encumbrances, except as specifically set forth in this Agreement. Buyer has the right to obtain title insurance at their own expense to further ensure clear title.

5. Inspections

Buyer is entitled to perform any inspections of the Property at their own expense to evaluate its condition. These inspections must be completed within __________ days after the effective date of this Agreement. Should the inspections reveal defects that Buyer is unwilling to accept, they may terminate this Agreement, resulting in the refund of the initial deposit.

6. Default

If either party fails to fulfill their obligations under this Agreement by the closing date, the non-defaulting party has the right to terminate this Agreement, in addition to any other remedies available under Texas law.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Texas.

8. Amendments

Any amendments or modifications to this Agreement must be made in writing and signed by both Buyer and Seller.

9. Entire Agreement

This Agreement contains the entire understanding between Buyer and Seller regarding the purchase and sale of the Property and supersedes all prior and contemporaneous negotiations and agreements, whether oral or written.

Please fill in the blanks and sign below to indicate your agreement with the terms outlined in this Texas Real Estate Purchase Agreement.

Buyer's Name: __________

Buyer's Signature: __________

Date: __________

Seller's Name: __________

Seller's Signature: __________

Date: __________

PDF Form Details

| Fact | Description |

|---|---|

| Governing Law | The Texas Real Estate Purchase Agreement is governed by Texas law, specifically the Texas Property Code. |

| Essential Elements | This form includes critical elements such as property details, purchase price, financing, closing details, disclosures, and contingency clauses. |

| Use for Residential Properties | It is primarily used for the sale and purchase of residential real estate. |

| Customization | Although standardized, it allows for certain customizations to match the specifics of the transaction. |

| Necessity for Legal Description | A legal description of the property, distinct from the address, is required to identify the property accurately. |

How to Write Texas Real Estate Purchase Agreement

For individuals navigating the process of purchasing real estate in Texas, understanding how to properly complete the Texas Real Estate Purchase Agreement is crucial. This document is a legally binding contract that outlines the terms and conditions of the real estate transaction. To ensure a smooth transaction, both the buyer and the seller must accurately fill out this form, adhering to all required steps. Following a step-by-step guide will assist in understanding and completing the form correctly, thereby minimizing potential legal issues and expediting the purchase process.

- Identify the Parties: Begin by entering the full legal names of both the buyer(s) and seller(s) as well as their current addresses. Ensure that the names are spelled correctly to avoid any discrepancies or legal issues later.

- Description of Property: Include a detailed description of the property being sold. This should encompass the legal description as found in the public records, the street address, and any additional identifying information. If applicable, provisions related to fixtures, exclusions, or related personal property should also be included.

- Agreement of Purchase Price: Clearly state the purchase price agreed upon by both parties. This section should also specify the form of payment, whether it's cash, through financing, or other agreed-upon methods.

- Deposits: Detail any deposit amount that the buyer is required to pay upfront. Include instructions for whom the deposit should be paid to, and the conditions under which the deposit is refundable.

- Closing and Possession Dates: Specify the expected closing date of the transaction and the date when the buyer will officially take possession of the property. It is important to have clear agreements to avoid confusion or disputes.

- Disclosures: If there are any legal disclosures such as lead-based paint disclosures, flood zone status, or others mandated by Texas law, they must be acknowledged and included in this section. Both parties should be clear on the property’s conditions and any potential hazards.

- Contingencies: Clearly note any conditions that must be met for the transaction to proceed, such as the buyer obtaining financing, the sale of another property, or satisfactory inspection results.

- Signatures: Once all other sections are completed, both the buyer(s) and seller(s) must sign and date the agreement. These signatures legally bind the parties to the terms of the agreement. Witness or notary signatures may also be required, depending on local regulations.

After the Texas Real Estate Purchase Agreement is fully executed, it's pivotal to adhere to the outlined steps and meet all contingencies within the specified timelines. The following steps typically involve conducting inspections, securing financing, and preparing for the closing. Each party should work closely with their respective legal and real estate professionals to ensure that all aspects of the transaction proceed smoothly and legally. Proper completion and understanding of the Purchase Agreement is the foundational step toward achieving a successful real estate transaction in Texas.

Get Answers on Texas Real Estate Purchase Agreement

What is a Texas Real Estate Purchase Agreement?

A Texas Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a property in Texas will be sold and purchased. It includes details such as the purchase price, property description, financing conditions, closing and possession dates, and any contingencies (like inspections or financing) that must be met before the sale is finalized. This agreement serves as a roadmap for the transaction, ensuring both buyer and seller understand their rights and obligations.

Do I need a lawyer to prepare a Texas Real Estate Purchase Agreement?

While it's not a legal requirement to have a lawyer prepare a Texas Real Estate Purchase Agreement, it is highly recommended. Real estate transactions involve significant financial investments and complex legal terms. An experienced lawyer can ensure the agreement complies with Texas laws, address any specific concerns you may have, and help prevent costly mistakes or misunderstandings. A lawyer can also provide valuable negotiation leverage and peace of mind.

Can I back out of a Texas Real Estate Purchase Agreement once it's signed?

Backing out of a Texas Real Estate Purchase Agreement after it's been signed is possible but can be complicated and may have legal or financial consequences. The agreement typically includes specific conditions under which either party can legally terminate the contract (contingencies) without penalty, such as a failed home inspection or inability to secure financing. However, if you wish to back out without a contingency basis, you may be at risk of losing your earnest money deposit or facing legal action from the seller. It's important to review the agreement thoroughly and understand your rights and obligations before signing.

How does financing affect the Texas Real Estate Purchase Agreement?

Financing plays a crucial role in the Texas Real Estate Purchase Agreement. The agreement often includes a financing contingency clause, which makes the purchase conditional upon the buyer securing a mortgage loan within a certain timeframe. If the buyer cannot obtain financing, they can typically withdraw from the agreement without penalty, and their earnest money is returned. It's crucial for buyers to apply for financing early in the process and keep the seller informed of their loan application status to maintain the trust and confidence of all involved parties.

What happens if either party breaches the Texas Real Estate Purchase Agreement?

If either party breaches the Texas Real Estate Purchase Agreement, the non-breaching party has several legal remedies available. These can include seeking specific performance, which is a court order requiring the breaching party to fulfill their contractual obligations, or pursuing damages for financial losses incurred due to the breach. The agreement itself may also outline agreed-upon penalties or steps for resolution in the event of a breach. It's important for both buyers and sellers to fully understand their rights and obligations under the agreement to avoid potential disputes.

Common mistakes

Filling out the Texas Real Estate Purchase Agreement form requires attention to detail and an understanding of what is legally required. A common mistake made is not thoroughly reviewing the property description. This critical detail encompasses more than just the address; it includes legal descriptions that ensure the exact boundaries and specifications of the property are accurately documented. Failing to ensure this information is precise can lead to disputes regarding the property's boundaries or the inclusion of certain parcels of land.

Another oversight involves neglecting to specify fixtures and non-fixtures within the agreement. Fixtures are items permanently attached to the property, such as lighting fixtures or built-in appliances, which are typically included in the sale. Non-fixtures, items that are not permanently attached and can be removed, should be explicitly stated if they are to remain or go. Without this clarity, both parties could have differing expectations, potentially derailing the transaction.

Incorrectly filling out the financial details is yet another error frequently encountered. This includes the purchase price, deposit amounts, and any other financial terms associated with the sale. Accurate financial information is paramount to ensure all parties have a clear understanding of the transaction's terms and to prevent any future disputes over finances.

Often, the allocation of closing costs between buyer and seller is misunderstood or miscommunicated. Both parties need to agree on who is responsible for these costs, and this agreement should be clearly outlined in the document. Misunderstandings here can lead to unexpected expenses or delays in the closing process.

Not specifying the closing date or allowing an unrealistic timeframe for closing can lead to complications. This date is crucial for planning the transfer of ownership and ensuring that financial and legal preparations are made. An unrealistic closing date may not allow sufficient time for inspections, loan approvals, and other necessary steps, potentially causing delays or the deal to fall through.

The contingency clauses are also a critical component that is often mishandled. These clauses protect the buyer and seller under certain conditions, such as the buyer needing to sell their current home before purchasing the new one, or the need for the property to pass certain inspections. Failing to include necessary contingencies or not fully understanding their implications can lead to legal and financial consequences.

Last but not least, neglecting to obtain professional advice or review before submitting the agreement is a significant oversight. Understanding every aspect of a real estate purchase agreement can be complex, and overlooking or misunderstanding a single detail can have substantial impacts on the transaction. Seeking the advice of a real estate professional or legal counsel can help avoid these common mistakes and ensure a smooth property transfer process.

Documents used along the form

When parties enter into a real estate transaction in Texas, the Real Estate Purchase Agreement is a critical document that outlines the terms of the sale. However, to ensure a smooth and legally sound transaction, several other forms and documents often accompany this agreement. These additional documents play crucial roles in providing clarity, ensuring compliance with legal requirements, and protecting the interests of both buyers and sellers.

- Seller's Disclosure Notice: This document requires the seller to disclose known defects and conditions of the property. It serves as a declaration of the property's condition, offering transparency to the buyer and helping them make an informed decision.

- Lead-Based Paint Addendum: For homes built before 1978, this addendum is necessary due to federal laws requiring disclosure of lead-based paint presence. It provides buyers with information on the dangers of lead paint and records any known presence in the property.

- Loan Estimate and Closing Disclosure: Required by lenders for home purchases that involve a mortgage. The Loan Estimate provides details on the expected costs involved in the mortgage process, while the Closing Disclosure offers a final review of loan terms and closing costs, allowing buyers to understand their financial obligations fully.

- Title Report: This document outlines the history of property ownership and details any liens, easements, or other encumbrances that may affect the buyer's use and ownership of the property. It helps ensure that the buyer receives clear title to the property.

- Homeowners Association (HOA) Documents: For properties within an HOA, these documents provide critical information on the rules, regulations, and fees associated with the community. They are essential for buyers to understand any restrictions or obligations they are agreeing to by purchasing the property.

Each of these documents complements the Real Estate Purchase Agreement by addressing specific aspects of the property and sale process, ensuring both parties are well-informed and legally protected throughout the transaction. While the Real Estate Purchase Agreement lays the foundation for the sale, these additional documents ensure a comprehensive approach to real estate transactions in Texas.

Similar forms

The Texas Real Estate Purchase Agreement shares similarities with the Residential Lease Agreement, as both detail the terms under which a property transaction occurs. While the purchase agreement outlines the conditions of selling and buying real estate, the lease agreement focuses on the conditions under which one party rents property from another. Key similarities include the identification of the parties, the property in question, the financial terms, and the duration for which the agreement is valid, though in the context of ownership versus rental.

Comparable to the Bill of Sale, the Real Estate Purchase Agreement documents the transfer of property from one party to another. However, while the bill of sale is often used for personal property like cars and boats, the purchase agreement is specific to real estate transactions. Both serve as legally binding documents that record the details of the transaction, including the parties involved, the description of the property sold, and the agreed-upon price, ensuring a clear transfer of ownership.

The Agreement for Deed, much like the Texas Real Estate Purchase Agreement, is used in financing real estate transactions but in a slightly different manner. The Agreement for Deed, or land contract, implies that the buyer makes payments to the seller until the full price is paid, after which the seller transfers the property title to the buyer. Both documents establish the sale price, payment schedule, and obligations of each party but differ in when the actual transfer of property ownership occurs.

Similarly, the Loan Agreement has parallels with the Real Estate Purchase Agreement because it stipulates the terms under which money is borrowed and should be repaid. In real estate transactions, a Loan Agreement might be used in conjunction with a purchase agreement to finance the sale of the property. Both outline the payment schedule, interest rate, and other financial obligations. The primary difference lies in the Loan Agreement focusing on the terms of borrowing money, whereas the purchase agreement deals with the specifics of transferring real estate ownership.

The Option Agreement also bears resemblance to the Texas Real Estate Purchase Agreement as it grants the buyer the right, but not the obligation, to purchase real estate under specific conditions. Both agreements define critical terms such as price and the period during which the transaction may occur. However, the Option Agreement is unique in providing the buyer a certain timeframe to decide to proceed with the purchase, offering a form of flexibility not typically found in the outright purchase agreements that commit both parties to the transaction from the outset.

Dos and Don'ts

When navigating the purchase of a property in Texas, the Real Estate Purchase Agreement is a critical document that outlines the terms of the sale. To ensure a smooth transaction, there are essential steps one must follow, as well as common pitfalls to avoid. Below are five key do's and don'ts when filling out this form:

Do's:

- Review all sections carefully: Ensure every part of the form is completed accurately, including buyer and seller information, property details, and the sale price.

- Confirm accuracy of legal descriptions: The legal description of the property must match public records exactly. This includes lot numbers, subdivision names, and any other identifying details.

- Clearly outline terms: Be specific about the terms of the sale, including payment plans, closing costs, and any contingencies, such as financing or inspection requirements.

- Include necessary addenda: Attach any additional documents that are part of the agreement, such as disclosures about the property's condition or lead-based paint disclosures for older homes.

- Sign and date the document: Ensure that all parties involved sign and date the agreement, officially documenting the transaction's terms and the date of agreement.

Don'ts:

- Leave blank spaces: Avoid leaving any sections incomplete. If a section does not apply, mark it as "N/A" (not applicable) instead of leaving it blank.

- Rush through the process: Take your time to understand every clause and condition. Rushing can lead to oversights that might complicate the transaction later.

- Forget to specify fixtures and exclusions: Clearly state which fixtures and fittings are included in the sale and which are excluded to avoid any misunderstandings.

- Ignore legal requirements: Be aware of Texas-specific legal requirements related to real estate transactions to ensure compliance and to protect both buyer and seller interests.

- Rely solely on verbal agreements: Make sure all agreements between the parties are reflected in writing within the purchase agreement. Verbal agreements are difficult to enforce and can lead to disputes.

Misconceptions

When it comes to buying or selling property in Texas, the Real Estate Purchase Agreement form is a critical document that outlines the terms and conditions of the transaction. However, there are several misconceptions about this form that can create confusion. Let’s address some of these misunderstandings.

It's just a standard form. One common misconception is that the Texas Real Estate Purchase Agreement is a "one size fits all" document. In reality, while it does follow a standardized format, it's designed to be modified and adjusted to fit the specific needs of each transaction. The terms can greatly vary depending on the negotiation between the buyer and seller.

Anyone can prepare it. While it's true that individuals can complete the form on their own, it's advisable to work with a professional. Real estate agents or attorneys understand the legal requirements and complexities involved, ensuring that the agreement complies with Texas law and accurately reflects the agreement between the parties.

Verbal agreements are just as binding. In Texas, verbal agreements relating to real estate transactions are not legally binding. The law requires real estate purchase agreements to be in writing and signed by both parties to be enforceable.

The form covers everything. Another misconception is that once the Real Estate Purchase Agreement is signed, all aspects of the transaction are set in stone. However, aspects such as financing, inspections, and appraisals can still affect the transaction and may require additional negotiation and documentation.

It's only about the price. While the purchase price is a critical element of the Real Estate Purchase Agreement, the form includes much more. It covers terms such as the closing date, contingencies, title clearance, and other conditions that are crucial to the transaction.

Signing the agreement means you're immediately bound to buy or sell. Although signing the agreement is a significant step, the completion of the sale is often contingent upon fulfilling certain conditions listed in the agreement, such as securing financing or passing inspections. Until these conditions are met, the parties are not legally bound to complete the transaction.

Modifications are not allowed after signing. It is a common belief that once the Real Estate Purchase Agreement is signed, the terms cannot be modified. In reality, the parties can agree to modify the terms at any time, as long as both parties agree to the changes in writing.

It guarantees the condition of the property. Lastly, some believe that the Real Estate Purchase Agreement guarantees the condition of the property being sold. However, this is not the case. The agreement may include terms that allow the buyer to inspect the property and negotiate repairs, but it does not in itself guarantee the property's condition. Buyers are encouraged to conduct thorough inspections to understand the property's state before purchasing.

Understanding these misconceptions about the Texas Real Estate Purchase Agreement can help buyers and sellers navigate their real estate transactions more effectively. When in doubt, seeking professional advice is always a wise decision to ensure that all legal requirements are met and interests are protected.

Key takeaways

The Texas Real Estate Purchase Agreement form is a vital document in the process of buying or selling property within the state. It lays out the terms and conditions of a real estate transaction and is legally binding once signed by both the buyer and the seller. Understanding the key components and implications of this agreement ensures a smoother transaction for all parties involved. Below are ten key takeaways about filling out and using the Texas Real Estate Purchase Agreement form.

- Accuracy Is Crucial: Every detail entered into the form must be accurate and thoroughly verified by both parties. Incorrect information can lead to delays or legal complications down the line.

- Legal Description of the Property: The form requires a precise legal description of the property being sold, including its address, boundaries, and any applicable legal identifiers. This ensures there is no ambiguity about what is being purchased.

- Agreement of Sale Price: The agreed-upon sale price of the property should be clearly stated in the agreement. This figure is central to the contract and affects financial calculations for both parties.

- Terms of Payment: Details about the payment terms, including any deposit required, the balance amount, and the due date for the final payment, need to be explicitly mentioned.

- Contingencies: The agreement can include various contingencies that must be met before the sale concludes, such as inspections, financing, and the sale of the buyer’s current home.

- Closing Costs: The document should detail which party is responsible for covering closing costs and any other expenses related to the sale.

- Closing Date and Possession: It’s important to agree upon a closing date by which all transactions should be completed. The agreement should also specify when the buyer will take possession of the property.

- Disclosure of Material Facts: Sellers are required to disclose known material facts about the property’s condition. Failing to do so can lead to legal action post-sale.

- Warranties and Representations: Any warranties or representations about the property or the agreement should be thoroughly documented, including what will happen in the event of a breach.

- Signature Requirement: The agreement is not legally binding until it has been signed by both the buyer and the seller. Digital signatures are typically accepted, but this can vary.

Before filling out the Texas Real Estate Purchase Agreement form, it’s advisable for both buyers and sellers to consult with real estate professionals or legal advisors. This ensures that the agreement accurately reflects the intentions of the parties and complies with Texas state laws. Understanding and adhering to the guidelines above can help facilitate a successful real estate transaction in Texas.

Popular Real Estate Purchase Agreement State Forms

How to Write a Purchase and Sale Agreement - Important dates, such as the offer acceptance deadline and the proposed closing date, are clearly stated in the agreement.

House for Sale Contract - The document outlines responsibilities regarding property assessments, repairs, and other pre-sale requirements.

Real Estate Sales Agreement - Any breach of the terms stipulated in the agreement can lead to legal consequences, emphasizing the importance of fulfilling agreed conditions.