Official Personal Guarantee Document

When individuals or businesses enter into agreements to borrow money or secure financing, they may encounter the necessity for a Personal Guarantee form. This critical document is often required by lenders as a means to ensure that the debt will be repaid. Essentially, it is a pledge made by an individual, typically a business owner or executive, to accept responsibility for repaying the loan if the original borrower fails to do so. The importance of understanding the nuances of this form cannot be overstated, as it can have significant implications for the guarantor's financial well-being. Engaging with a Personal Guarantee means evaluating one's capacity to absorb the debt under worst-case scenarios. It involves a thorough assessment of personal assets, understanding legal obligations, and considering the impact on personal credit. Additionally, awareness of the conditions under which the guaranty can be enforced by the lender is crucial. As such, navigating these forms requires care and consideration, making it essential for guarantors to thoroughly examine the terms to which they are agreeing and the potential risks involved.

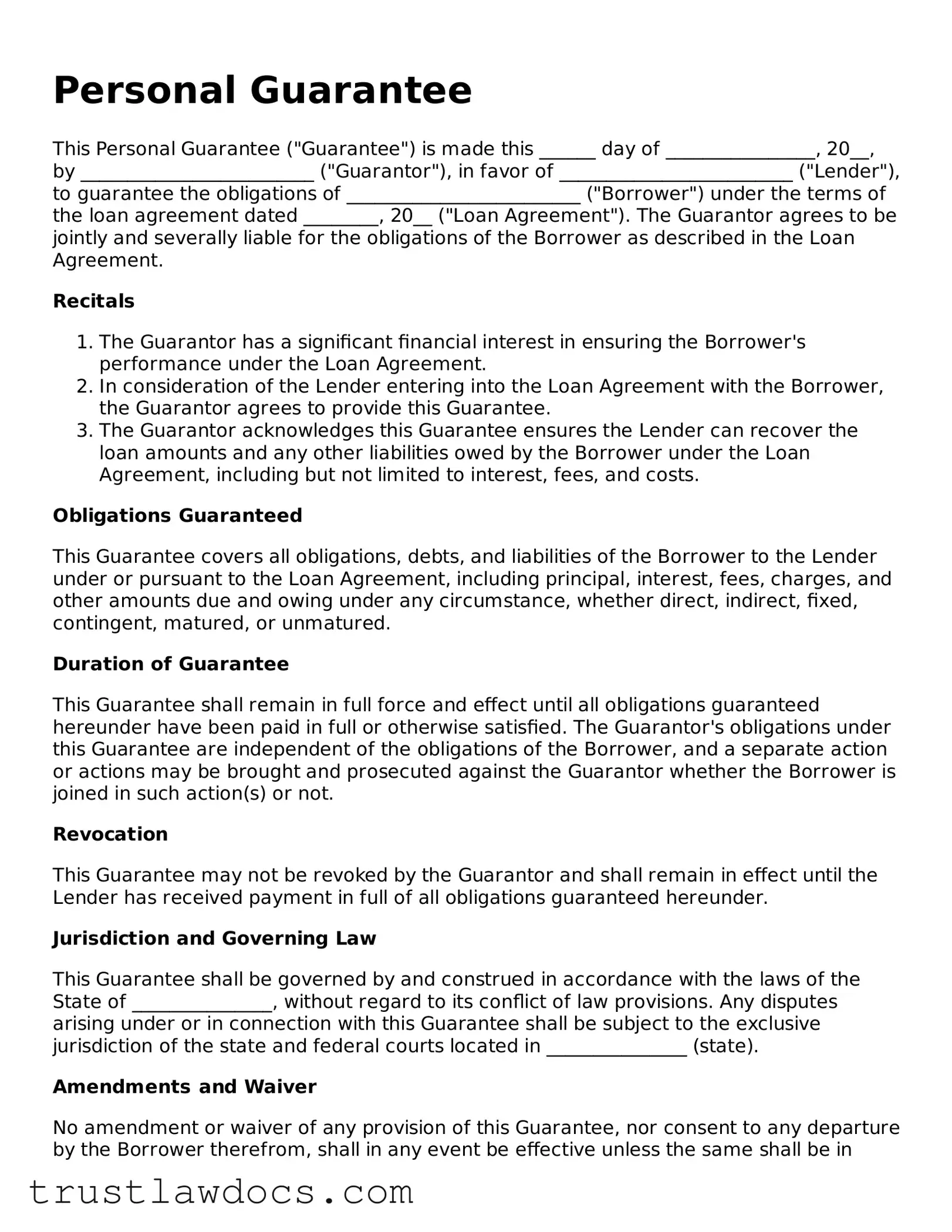

Form Example

Personal Guarantee

This Personal Guarantee ("Guarantee") is made this ______ day of ________________, 20__, by _________________________ ("Guarantor"), in favor of _________________________ ("Lender"), to guarantee the obligations of _________________________ ("Borrower") under the terms of the loan agreement dated ________, 20__ ("Loan Agreement"). The Guarantor agrees to be jointly and severally liable for the obligations of the Borrower as described in the Loan Agreement.

Recitals

- The Guarantor has a significant financial interest in ensuring the Borrower's performance under the Loan Agreement.

- In consideration of the Lender entering into the Loan Agreement with the Borrower, the Guarantor agrees to provide this Guarantee.

- The Guarantor acknowledges this Guarantee ensures the Lender can recover the loan amounts and any other liabilities owed by the Borrower under the Loan Agreement, including but not limited to interest, fees, and costs.

Obligations Guaranteed

This Guarantee covers all obligations, debts, and liabilities of the Borrower to the Lender under or pursuant to the Loan Agreement, including principal, interest, fees, charges, and other amounts due and owing under any circumstance, whether direct, indirect, fixed, contingent, matured, or unmatured.

Duration of Guarantee

This Guarantee shall remain in full force and effect until all obligations guaranteed hereunder have been paid in full or otherwise satisfied. The Guarantor's obligations under this Guarantee are independent of the obligations of the Borrower, and a separate action or actions may be brought and prosecuted against the Guarantor whether the Borrower is joined in such action(s) or not.

Revocation

This Guarantee may not be revoked by the Guarantor and shall remain in effect until the Lender has received payment in full of all obligations guaranteed hereunder.

Jurisdiction and Governing Law

This Guarantee shall be governed by and construed in accordance with the laws of the State of _______________, without regard to its conflict of law provisions. Any disputes arising under or in connection with this Guarantee shall be subject to the exclusive jurisdiction of the state and federal courts located in _______________ (state).

Amendments and Waiver

No amendment or waiver of any provision of this Guarantee, nor consent to any departure by the Borrower therefrom, shall in any event be effective unless the same shall be in writing and signed by the Lender, and then such waiver or consent shall be effective only in the specified instance and for the purpose for which given.

Successors and Assigns

This Guarantee binds and inures to the benefit of the parties and their respective successors and permitted assigns. The Guarantor may not assign this Guarantee or any rights or obligations hereunder without the prior written consent of the Lender.

IN WITNESS WHEREOF, the Guarantor has executed this Personal Guarantee as of the date first written above.

__________________________________

Guarantor's Signature

__________________________________

Guarantor's Name (Printed)

__________________________________

Address

__________________________________

Date

PDF Form Details

| Fact | Description |

|---|---|

| Definition | A Personal Guarantee form is a legal document where an individual (the guarantor) agrees to be responsible for the financial obligations of a borrower (the principal) to a lender, in the event that the borrower fails to fulfill their financial commitments. |

| Universal Application | This form can be used across various sectors such as loans, leases, and business contracts to provide security to the lender or the party owed. |

| Components | Typically, the form includes details of the guarantor, the principal, the creditor, the obligations being guaranteed, and the conditions under which the guarantee will be enforced. |

| Risk to Guarantor | The guarantor takes on significant financial risk, as they are legally obligated to fulfill the commitment if the principal party defaults. |

| State-Specific Laws | While the fundamental concept of a Personal Guarantee is consistent, the enforcement and specific requirements may vary by state due to differing local laws and statutes governing these agreements. |

| Importance of Legal Counsel | It is crucial for guarantors and principals to consult with legal counsel before entering into a Personal Guarantee, to fully understand the terms, conditions, and the extent of the obligations they are undertaking. |

How to Write Personal Guarantee

Filling out a Personal Guarantee form is a crucial step for individuals who are committing to act as a guarantor for a loan or debt, ensuring that the debt will be paid if the primary borrower fails to fulfill their obligations. This process, while straightforward, requires attention to detail to ensure all information is accurately and fully provided, thereby minimizing potential risks and misunderstandings. It involves providing personal information, understanding the extent of the guarantee, and formally agreeing to the terms set forth by the lender or creditor. Here are the steps to correctly fill out this form:

- Review the document carefully: Before filling anything out, read through the entire form to understand the obligations and conditions of the personal guarantee. This step ensures you are fully aware of what you are agreeing to.

- Gather necessary information: Collect all necessary personal information, including your legal name, address, contact details, and any required financial information. This might also include identifying details such as a driver's license number or social security number.

- Enter your personal information: Fill in the sections of the form designated for your personal information. Ensure all details are correct and match any identification documents you might be submitting alongside the form.

- Understand the terms: Pay special attention to the terms of the guarantee, including the duration, amount, and conditions under which you are responsible. This includes understanding whether the guarantee is unlimited or limited to a specific amount.

- Sign and date the form: After reviewing all the information and ensuring it is complete and accurate, sign the form in the designated area. Your signature legally binds you to the terms of the guarantee. Ensure you also fill in the date next to your signature.

- Witness or notarize if required: Depending on the requirements of the lender or creditor, you may need to have your signature witnessed or notarized. This step often adds an extra layer of legal validation to your guarantee.

- Submit the form: Follow the instructions for submitting the form to the lender or creditor. This could include mailing a hard copy or submitting the documents electronically, depending on the preference or requirements of the receiving party.

- Keep a copy: Always retain a copy of the signed form for your records. This document is important for your personal financial records and may be needed for future reference.

After submitting the Personal Guarantee form, it's advisable to remain in contact with the lender or creditor to confirm receipt and to address any follow-up questions or requirements they may have. Maintaining open lines of communication can help avoid any misunderstandings and ensure that all parties are clear on the terms of the guarantee. Additionally, being a guarantor is a significant responsibility; hence, staying informed about the primary borrower's status and any potential risks involved is prudent.

Get Answers on Personal Guarantee

What is a Personal Guarantee form?

A Personal Guarantee form is a legal document where an individual (the guarantor) agrees to be responsible for the debt or obligation of a borrower in the event that the borrower is unable to fulfill the terms. This form is often required by lenders as part of the loan process to reduce the risk of financial loss.

Who needs to sign the Personal Guarantee form?

The form must be signed by the guarantor, the individual who agrees to take on the responsibility for the debt should the borrower default. It is also recommended that a witness sign the form to validate the guarantor's signature.

Is a Personal Guarantee form legally binding?

Yes, once signed, the Personal Guarantee form becomes a legally binding agreement. The guarantor is legally obliged to fulfill the terms outlined in the document if the borrower fails to meet their obligations.

Can a Personal Guarantee be revoked?

Under most circumstances, a Personal Guarantee is irrevocable unless it contains specific terms allowing for revocation. Such terms must be clearly outlined in the agreement, and typically, the lender must consent to the revocation.

What happens if the borrower defaults on their obligations?

If the borrower defaults, the lender has the right to pursue the guarantor for the repayment of the debt. The steps involved may include demanding payment from the guarantor, initiating legal proceedings, and pursuing the guarantor’s assets.

What risks are involved for a guarantor?

A guarantor is exposed to significant financial risk, including the possibility of losing personal assets if they are unable to fulfill the borrower's obligations. Therefore, it is crucial for guarantors to fully understand the extent of their liability before signing the Personal Guarantee form.

Does the guarantor need legal advice before signing?

It is highly recommended that guarantors seek independent legal advice before signing a Personal Guarantee form. This ensures they fully understand their obligations and the potential risks involved.

Can the terms of a Personal Guarantee be negotiated?

Yes, the terms of a Personal Guarantee can often be negotiated with the lender before signing. This might include negotiating the limit of liability or the conditions under which the guarantee can be called upon.

What is required to complete a Personal Guarantee form?

To complete a Personal Guarantee form, detailed information about the guarantor and the borrower is needed, including their legal names, addresses, and the specifics of the debt or obligation. The document must be signed by the guarantor, and it is recommended to have a witness. Additionally, clear terms outlining the guarantee should be included to ensure the agreement is enforceable.

Common mistakes

Filling out a Personal Guarantee form is a crucial step when securing financing or entering into lease agreements, among other business endeavors. It binds an individual personally to pay a debt in case the business fails to do so. However, common pitfalls can lead to unnecessary complications, impacting personal financial stability.

One typical mistake is not fully understanding the scope of the guarantee. Individuals often sign these documents without recognizing the extent of their liability. This oversight can lead to a rude awakening when they are called upon to fulfill obligations they were not prepared for. It is imperative to read the fine print and seek clarification on ambiguous terms before signing.

Another error is neglecting to negotiate the terms of the guarantee. Many assume these forms are non-negotiable, which is not always the case. Negotiating the terms, like setting a limit to the liability or including clauses that offer ways to mitigate that liability, can significantly reduce personal risk.

Failure to determine the duration of the guarantee is also a common oversight. Some guarantees are in effect indefinitely, while others may expire or can be limited to certain conditions. Not clarifying this aspect can trap individuals in eternal accountability for the business’s debts.

Overlooking the impact on personal credit is another significant misstep. A personal guarantee can affect one’s credit score and borrowing capacity. If the business defaults, this could lead to serious personal financial repercussions, including difficulties in obtaining personal loans or mortgages in the future.

Not consulting with a legal professional before signing is a critical error many commit. Legal advice can provide a clearer understanding of the implications and suggest possible amendments to protect the guarantor’s interests. This oversight can lead individuals to agree to unfavorable terms out of ignorance.

Ignoring the need for a co-signer’s agreement is a frequent blunder in situations where multiple owners are involved in a business. All parties who have a stake in the company should be aware of and agree to the guarantee to prevent future disputes or misunderstandings regarding who is responsible for the debt if the business cannot pay.

Finally, failing to keep a signed copy of the guarantee can lead to challenges in recalling the exact terms agreed upon, especially if disagreements or legal issues arise later. Ensuring that all parties have a copy of the signed document safeguards everyone’s interests and provides a concrete point of reference.

Avoiding these mistakes requires careful consideration, a thorough understanding of the document, and, ideally, legal guidance. Doing so can prevent unforeseen personal financial burdens and contribute to making more informed, strategic decisions when committing to a personal guarantee.

Documents used along the form

When entering a business agreement or transaction, a Personal Guarantee form plays a crucial role, especially for small businesses and startups. This form is often not the only document required to solidify an agreement or to ensure all legal bases are covered. Various other forms and documents are typically used in conjunction with a Personal Guarantee to provide a comprehensive legal framework that protects all parties involved. Here is a list of six common documents that are usually required alongside a Personal Guarantee form.

- Loan Agreement: This document outlines the terms and conditions of a loan between two parties. It includes information such as the loan amount, interest rate, repayment schedule, and any collateral involved. The Loan Agreement serves as the primary contract that a Personal Guarantee supports.

- Security Agreement: A Security Agreement gives the lender a security interest in a specific asset or property (collateral) owned by the borrower. If the borrower defaults, the lender has the right to seize the collateral. This document is often used together with a Personal Guarantee to assure the lender of repayment.

- Business Plan: For business loans or agreements, a Business Plan might be requested to understand the business’s viability and its ability to repay the loan. Though not a legal document, it's crucial for lenders making a decision on providing financing.

- Corporate Resolution: If the entity providing the Personal Guarantee is a corporation, a Corporate Resolution may be required. This document proves that the decision to provide a Personal Guarantee has been approved by the company’s board of directors.

- Financial Statements: These documents, including balance sheets, income statements, and cash flow statements, provide a snapshot of the financial health of the business. They are often required to assess the ability of the business to uphold the Personal Guarantee.

- Collateral Documentation: If a loan or agreement involves collateral, detailed documentation of the collateral will be needed. This can include titles, registration, appraisals, or other documents that prove the value and ownership of the property used as collateral.

Understanding and preparing these documents in conjunction with a Personal Guarantee can streamline the process of securing a loan or entering into business agreements. These documents not only provide legal protection but also build trust between the parties by ensuring transparency and accountability. It’s advisable to seek professional guidance to ensure that all documentation is correctly prepared and filed.

Similar forms

A co-signer agreement is much like a personal guarantee form as it involves a third party agreeing to fulfill the financial obligations of the primary party in a transaction, should the primary party fail to do so. Both documents serve as a form of financial security for the party extending credit or a loan, providing a way to recover funds in the event of default by the primary obligor.

A promissory note has similarities to a personal guarantee because both are legally binding documents involving financial obligations. A promissory note is a written promise to pay a specific sum of money to someone at a specified time or on demand. Like a personal guarantee, it holds the signer accountable to fulfill the financial commitment outlined within the document.

Indemnity agreements also share common ground with personal guarantees. These agreements protect one party from financial loss or liability stemming from specific events or actions, often involving a third party agreeing to cover any losses. This concept aligns with personal guarantees, where an individual agrees to take responsibility for another's financial obligations, potentially covering losses incurred by the lender.

Collateral agreements are related to personal guarantees in that they both provide security to the lender. In a collateral agreement, a borrower offers an asset as security for the loan, which can be seized in case of default. Comparatively, a personal guarantee does not necessarily involve a tangible asset but rather the personal financial backing of an individual.

JV (Joint Venture) agreements can resemble personal guarantees in terms of shared financial obligations among parties entering a business venture. Each party in a JV agreement may be responsible for contributing resources, including finances, and may share liability for debts. Personal guarantees often come into play when securing financing for the JV, with partners individually guaranteeing loan repayment.

The letter of credit is somewhat akin to a personal guarantee. It functions as a guarantee from a bank that a buyer's payment to a seller will be received on time and for the correct amount. If the buyer is unable to make the payment, the bank will cover the full or remaining amount of the purchase. Similar to a personal guarantee, it provides a level of assurance to the seller or lender about receiving payment.

Finally, the mortgage agreement has parallels with a personal guarantee when a third party cosigns the mortgage. In both instances, another individual takes on the responsibility of fulfilling the debt obligation if the primary borrower defaults. While a mortgage is specifically tied to the financing of property, the principle of assuming responsibility for another's debt through a legally binding document connects it directly to the nature of a personal guarantee.

Dos and Don'ts

Filling out a Personal Guarantee form is a critical step that requires attention to detail and accuracy. Here are some essential dos and don'ts to consider:

Do:

Read the entire form carefully before beginning to fill it out. Understanding all the terms and conditions is crucial.

Ensure all information provided is accurate and current. This includes personal details, financial information, and any other required data.

Use black ink or type the information if the form allows digital input. This makes the form easier to read for processing.

Ask for clarification if any section or term is unclear. It's better to seek advice than to make an incorrect assumption.

Review the form with a professional advisor or lawyer. Their expertise can highlight any potential issues or misunderstandings.

Keep a copy of the completed form for your records. This document is important and may need to be referenced in the future.

Don't:

Rush through the form without fully understanding each section. Mistakes made can have legal implications.

Leave any sections blank. If a section does not apply, write "N/A" (not applicable) to indicate this.

Use pencil or any other erasable writing instrument. These can be altered after submission, which can create trust issues.

Sign without reading the fine print. Every clause can have significant consequences, and understanding them is essential.

Omit consulting with co-guarantors, if applicable. All parties need to be aware of the obligations and terms.

Ignore state laws that may affect the guarantee. The legal implications of personal guarantees can vary by jurisdiction.

Misconceptions

When it comes to navigating the intricacies of financial agreements, a Personal Guarantee form is a crucial document that often comes into play. However, there are many misconceptions about what this document implies for those who sign it. Here's a myth-busting list to clarify the common misunderstandings.

Signing a Personal Guarantee doesn't affect personal credit. This is a common misconception. In reality, if the debt is not repaid, it can indeed impact your personal credit score. Lenders may report defaults on personal guarantees to credit bureaus, which can affect your ability to secure personal loans in the future.

Personal Guarantees are only for businesses with bad credit. Not true. Even businesses with good credit standings may be asked to sign a Personal Guarantee, particularly for substantial loans or leases. Lenders see it as an extra layer of security.

Only business owners need to sign a Personal Guarantee. Actually, anyone with a significant stake in the business, such as major shareholders or partners, may be asked to sign a Personal Guarantee, depending on the lender's requirements.

A Personal Guarantee means you're personally liable for the entire loan amount. This can be the case, but not always. Some guarantees are limited, meaning you're only responsible for a portion of the debt.

Once signed, Personal Guarantees cannot be negotiated. This is incorrect. In some cases, it's possible to negotiate the terms of a Personal Guarantee, such as making it a limited guarantee, before signing. Communication with your lender is key.

If the business fails, the Personal Guarantee becomes void. This misconception is particularly dangerous. Even if the business goes under, the personal guarantee remains in effect, making you liable for the debt.

Marital assets are safe if one spouse signs a Personal Guarantee. This isn't always the case. Depending on your state's laws and how your assets are owned, your spouse's assets may also be at risk if you default on a loan covered by a Personal Guarantee.

You're only responsible for the debt if the business can't pay. While this is the typical scenario, there may be conditions in the guarantee that could make you responsible for the debt sooner, such as a breach of specific business performance metrics.

All personal assets are at risk with a Personal Guarantee. Though signing a Personal Guarantee does expose your personal assets to potential risk, not all guarantees are designed to put all personal assets on the line. The specifics of what is at risk will depend on the agreement's terms.

Signing a Personal Guarantee is always a bad idea. Not necessarily. While it does carry risks, providing a Personal Guarantee can be a strategic move to secure necessary funding for your business. It's crucial to weigh the risks against the potential benefits thoroughly.

Understanding the exact nature and implications of a Personal Guarantee is vital for any business owner or stakeholder contemplating entering into such an agreement. Dispelling these misconceptions can lead to more informed decisions and, ideally, a more secure financial future.

Key takeaways

Filling out and using a Personal Guarantee form is an important step when securing financing or entering into business contracts that require a personal assurance. Here are key takeaways to consider:

- Understand what a Personal Guarantee is: It's a legal commitment by an individual to repay a loan or debt if the primary borrower fails to do so. This makes the guarantor personally responsible for the debt.

- Know when a Personal Guarantee is needed: These are often required for small business loans, leases, or contracts where the business itself might not have sufficient credit history or collateral.

- Read the entire form carefully: Before signing, it’s crucial to understand every term and condition outlined in the guarantee. Paying close attention to the language can help avoid unexpected obligations.

- Be aware of your liabilities: A Personal Guarantee ties your personal assets to the debt’s repayment, including your home, car, or savings. Recognize the full extent of what you're agreeing to.

- Consider the term of the guarantee: Some guarantees are unlimited, while others have time limits. Know how long you'll be liable for the debt.

- Seek professional advice: Consulting with a financial advisor or attorney can help clarify the implications of signing a Personal Guarantee and potentially negotiate its terms.

- Understand the implications for your credit: Failure of the business to repay the loan can affect your personal credit score, since you are personally responsible for the debt.

- Explore alternatives: In some cases, it might be possible to negotiate the terms of the guarantee or propose alternative methods of securing the debt that do not involve a Personal Guarantee.

- Document everything: Keep detailed records of all communications and documents related to the Personal Guarantee. This could be invaluable in the event of a dispute or if the terms of the guarantee come into question.

Treating the Personal Guarantee with the seriousness and attention it deserves can help protect your interests and assets. It's a significant legal document that should not be entered into lightly.

Consider More Types of Personal Guarantee Forms

Can You Negotiate After Appraisal - Make your home purchase offer stronger and safer by including a clause that lets you verify the property's worth through an appraisal.

Real Estate Termination Agreement - A formal way to cancel a real estate transaction, detailing the termination conditions agreed upon by both parties.