Official Owner Financing Contract Document

Embarking on the journey of purchasing a home through owner financing is akin to navigating a river with its unique twists and turns. This alternative route to homeownership, provided outside the traditional bank mortgage framework, brings with it various facets encapsulated in the Owner Financing Contract form. This quintessential document plays a pivotal role in the process, acting as the bedrock upon which the terms of the sale are established, ensuring clarity and security for both the buyer and the seller. Detailing the sales price, interest rates, payment schedule, and other critical elements, this contract form delineates the responsibilities and protections afforded to both parties. Additionally, it touches upon the legal implications, including foreclosure processes should the buyer default on payments, thereby bearing the hallmark of a comprehensive agreement designed to navigate the complexities of a financing arrangement directly between the purchaser and the property owner. Emphasizing the importance of due diligence and clear communication, this form serves as a testament to the unique opportunities and challenges presented by owner-financed transactions.

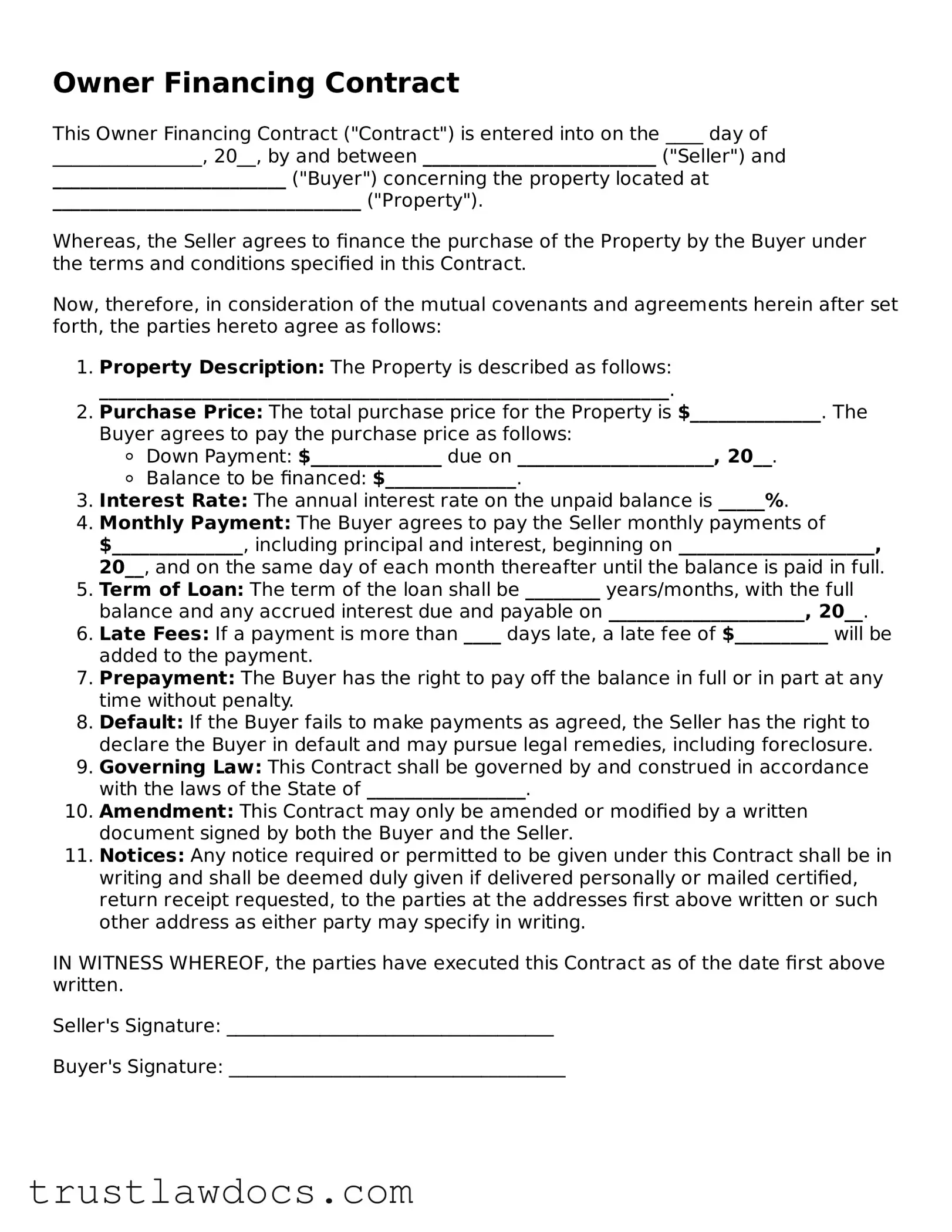

Form Example

Owner Financing Contract

This Owner Financing Contract ("Contract") is entered into on the ____ day of ________________, 20__, by and between _________________________ ("Seller") and _________________________ ("Buyer") concerning the property located at _________________________________ ("Property").

Whereas, the Seller agrees to finance the purchase of the Property by the Buyer under the terms and conditions specified in this Contract.

Now, therefore, in consideration of the mutual covenants and agreements herein after set forth, the parties hereto agree as follows:

- Property Description: The Property is described as follows: _____________________________________________________________.

- Purchase Price: The total purchase price for the Property is $______________. The Buyer agrees to pay the purchase price as follows:

- Down Payment: $______________ due on _____________________, 20__.

- Balance to be financed: $______________.

- Interest Rate: The annual interest rate on the unpaid balance is _____%.

- Monthly Payment: The Buyer agrees to pay the Seller monthly payments of $______________, including principal and interest, beginning on _____________________, 20__, and on the same day of each month thereafter until the balance is paid in full.

- Term of Loan: The term of the loan shall be ________ years/months, with the full balance and any accrued interest due and payable on _____________________, 20__.

- Late Fees: If a payment is more than ____ days late, a late fee of $__________ will be added to the payment.

- Prepayment: The Buyer has the right to pay off the balance in full or in part at any time without penalty.

- Default: If the Buyer fails to make payments as agreed, the Seller has the right to declare the Buyer in default and may pursue legal remedies, including foreclosure.

- Governing Law: This Contract shall be governed by and construed in accordance with the laws of the State of _________________.

- Amendment: This Contract may only be amended or modified by a written document signed by both the Buyer and the Seller.

- Notices: Any notice required or permitted to be given under this Contract shall be in writing and shall be deemed duly given if delivered personally or mailed certified, return receipt requested, to the parties at the addresses first above written or such other address as either party may specify in writing.

IN WITNESS WHEREOF, the parties have executed this Contract as of the date first above written.

Seller's Signature: ___________________________________

Buyer's Signature: ____________________________________

PDF Form Details

| Fact | Detail |

|---|---|

| Definition | A contract where the seller of a property provides the financing to the buyer directly. |

| Components | Typically includes terms like purchase price, interest rate, payment schedule, and consequences of default. |

| Benefit to Buyer | May allow purchase without traditional financing from a bank or financial institution. |

| Benefit to Seller | Can potentially sell the property faster and earn interest on the loan provided to the buyer. |

| Risk to Buyer | Higher interest rates and possible loss of the property if unable to comply with the terms. |

| Risk to Seller | Potential for buyer default, requiring action to reclaim the property. |

| State Specificity | Terms and legality can vary by state, requiring adherence to local laws and regulations. |

| Governing Laws | Usually governed by state laws related to real estate transactions and financing. |

| Importance of Legal Advice | Both parties are advised to seek legal counsel to ensure understanding and compliance with the contract terms. |

| Recording Requirement | The contract or a memorandum of it is often required to be recorded with the local county to ensure enforceability. |

How to Write Owner Financing Contract

Filling out an Owner Financing Contract is a significant step in securing a real estate transaction where the seller provides the financing to the buyer, instead of a bank or another traditional lender. This process involves detailing the terms of the loan provided by the seller to facilitate the purchase of the property. A properly filled out contract safeguards both parties' interests, outlining the loan repayment schedule, interest rate, and what happens in case of default. Here are the steps to accurately complete the Owner Financing Contract form:

- Start by entering the date on which the agreement is being made at the top of the form.

- Fill in the full legal names of both the seller and the buyer as they appear on official IDs.

- Provide a detailed description of the property being financed, including the physical address, legal description, and any identifying parcel numbers.

- List the purchase price of the property in words and figures.

- Specify the down payment amount, including how and when it is to be paid.

- Detail the financing terms, including the loan amount (purchase price less the down payment), annual interest rate, repayment schedule (monthly payments, balloon payments, etc.), and the loan term (number of years).

- Indicate any prepayment penalties or the absence thereof.

- Outline the legal ramifications in case of default on the loan, specifying any grace period and actions the seller can take.

- Include maintenance and insurance responsibilities, stating who will maintain the property and carry homeowner's insurance.

- Specify any additional terms and conditions that are agreed upon, such as property tax obligations, modifications to the property, or transfer restrictions.

- Both parties should review the entire document to ensure all the information is accurate and reflects their agreement.

- Have the buyer and seller sign and date the form in the presence of a notary public or witnesses, as required by state laws. Include printed names below signatures.

- Finally, ensure the contract is notarized, if necessary, and distribute copies to both the buyer and the seller for their records.

Once the Owner Financing Contract form is fully executed, it represents a legally binding agreement that outlines the terms of the property purchase financed by the seller. Both parties should adhere to the terms set forth to ensure a smooth transition of property ownership and repayment of the financed amount. Future steps may include recording the contract with the local government office to formalize the transaction and protect both parties' interests.

Get Answers on Owner Financing Contract

What is an Owner Financing Contract?

An Owner Financing Contract is a legal agreement where the seller of a property provides the financing to the buyer directly, without involving traditional lenders like banks. This means the buyer pays the seller in installments, based on terms agreed upon in the contract, until the full purchase price is paid off. This type of financing can be beneficial for buyers who may not qualify for a mortgage through conventional means and for sellers looking to move a property quickly.

Are there any risks involved with Owner Financing for both the buyer and the seller?

Yes, there are risks for both parties. For the seller, there's the risk that the buyer may default on their payments. This could lead to the need for foreclosure, which is a legal process to force the sale of the property to recover the owed amount. For the buyer, the biggest risk is that the contract might come with higher interest rates compared to conventional loans. Additionally, if the seller still has a mortgage on the property, there's a risk that the seller's lender could accelerate the loan upon discovering the property has been sold, potentially leading to foreclosure if the seller cannot pay off the balance immediately.

What are the key components that should be included in an Owner Financing Contract?

An Owner Financing Contract should clearly outline all terms of the agreement, including the purchase price, down payment, interest rate, payment schedule (amount and frequency of payments), term of the loan (how long the buyer has to pay off the full amount), any provisions for late payments, and consequences of default. It should also detail the legal description of the property being sold, and both the buyer's and seller's responsibilities regarding property taxes, insurance, and maintenance. A clause that addresses what happens in the event of the seller’s death before the loan is paid in full should also be considered.

Can an Owner Financing Contract be modified after it's been signed?

Yes, an Owner Financing Contract can be modified after it's been signed, but any modifications must be agreed upon by both the buyer and the seller. It's crucial that any changes to the contract are recorded in writing and legally documented to avoid future disputes. Both parties may also benefit from consulting with a real estate attorney to ensure that the modified agreement adheres to state laws and protects both their interests.

Common mistakes

When diving into the process of owner financing, it's not uncommon for parties to stumble over the complexities of the contract form. A notable misstep involves inaccurately listing the property details. This can range from an incorrect address to a muddled description of the property boundaries. Ensuring precision in this area is crucial, as it sets the foundation for the entire agreement.

Another area often overlooked is the terms of the loan. Many people either underestimate or overestimate their financial capacity, leading to terms that are either too ambitious or too conservative. This makes selecting the right interest rate, down payment, and repayment schedule more critical than it might seem at first glance. The goal should be to create a balanced agreement that benefits both the buyer and the seller, without placing undue financial strain on either party.

Payment terms are yet another hurdle. A clear outline of when payments are due, acceptable payment methods, and the consequences of late payments must be established. Without this clarity, misunderstandings are bound to arise, potentially leading to conflict or even the derailing of the agreement. It’s imperative for both parties to have a mutual understanding and agreement on these terms.

Not specifying who is responsible for property taxes, insurance, and maintenance can lead to serious disagreements down the line. These details should never be assumed or verbalized outside the contract; they need to be clearly written out in the agreement. A mutual understanding of these obligations will help prevent potential disputes between the buyer and the seller.

A common mistake is neglecting to detail the recourse should any party default on the agreement. This includes outlining the steps for remedying defaults and the rights of each party in such scenarios. Protecting both parties' interests, especially in unforeseen circumstances, is a vital aspect of drafting a solid owner financing contract.

Many individuals also fail to include a clause that addresses the potential for prepayment. Buyers might decide to pay off the mortgage earlier than anticipated, and without a clear prepayment clause, this situation can become unnecessarily complicated. A well-defined clause can guide both parties on how to proceed with prepayment, ensuring there are no surprises.

Failing to legally bind the contract with the right kind of signatures and notarization is a critical mistake. This formalization process is what transforms the agreement from a mere proposal into a legally enforceable document. Without it, the enforceability of the contract is in jeopardy.

Lastly, overlooking the need for a professional review is a common pitfall. Seeking the guidance of a legal professional or a real estate expert to review the contract before finalizing it can save individuals from future legal and financial troubles. This step ensures all bases are covered, and both parties' interests are adequately protected.

Documents used along the form

When entering into a transaction that involves owner financing, several other documents and forms typically accompany the Owner Financing Contract. These documents play critical roles in ensuring the agreement is clear, binding, and compliant with legal requirements. They cover various aspects of the transaction, from detailing the property to ensuring the buyer's capability to afford the purchase. Below is a list of some of these essential documents, making the complex process of owner financing more manageable and secure for both parties involved.

- Promissory Note: This document outlines the buyer's promise to repay the loan under the terms agreed upon. It includes the interest rate, repayment schedule, and the repercussions of failing to make payments on time.

- Mortgage or Deed of Trust: This secures the promissory note and essentially ties the loan to the property being purchased. It grants the lender the right to foreclose on the property if the buyer defaults on the loan.

- Title Report: Before finalizing the sale, a title report is necessary to ensure the property is free of legal encumbrances or liens that could affect the transaction or the buyer’s ownership.

- Property Appraisal: This document provides an objective valuation of the property, ensuring the buyer and seller agree on a price that reflects the market value.

- Insurance Documents: Buyers are often required to obtain property insurance, which protects the investment of both the buyer and seller in the event of damage to the property.

- Home Inspection Report: A thorough inspection of the property by a qualified professional can reveal issues that may need to be addressed before completing the sale. This report provides a detailed account of the property’s condition.

- Disclosure Statements: Sellers are typically required to provide these statements, disclosing known defects or issues with the property. This document ensures transparency and protects the buyer from unforeseen problems.

Integrating these documents with the Owner Financing Contract forms the backbone of a secure and transparent transaction. They collectively work to protect the interests of both the buyer and the seller, ensuring that everyone enters the agreement with a clear understanding of the terms, conditions, and the state of the property in question. By taking the time to compile and review these documents, parties can navigate the complexities of owner financing with confidence and peace of mind.

Similar forms

An Owner Financing Contract is a pivotal document in real estate transactions where the seller finances the purchase for the buyer, essentially taking the role of the lender. This type of arrangement opens doors to buyers who might not qualify for traditional financing methods, and it gives sellers a way to move their property more quickly. While unique, there are several documents that share similarities with an Owner Financing Contract, each playing a distinct role in the real estate or financial world.

A Mortgage Agreement is perhaps the closest relative to an Owner Financing Contract. Both serve as binding agreements where a property is used as collateral for a loan. The critical difference lies in who provides the financing – in a Mortgage Agreement, it's usually a bank or financial institution, whereas, in an Owner Financing Contract, the seller takes on this role. However, both documents ensure legal recourse if the borrower defaults on their payments.

The Promissory Note is another document that echoes the Owner Financing Contract, especially since it often accompanies it. This document outlines the borrower's promise to repay the amount owed, detailing the loan amount, interest rate, repayment schedule, and consequences of default. While a Promissory Note can exist independently for any loan agreement, within the realm of owner financing, it complements the contract by specifying the financial obligations.

Land Contracts share a kinship with Owner Financing Contracts with their focus on real estate transactions involving seller financing. However, a Land Contract typically transfers possession of the property to the buyer immediately, but the title remains with the seller until the debt is fully paid. This contrasts with some owner financing setups where the title can transfer to the buyer upfront, with the seller holding a lien as security.

A Deed of Trust is often used interchangeably with a Mortgage Agreement in states that prefer this method of securing a loan with real estate. Like an Owner Financing Contract, it involves three parties: the borrower, the lender, and a trustee. The trustee holds the property's title until the borrower pays off the loan. This document serves a similar protective function for the seller/lender in an owner-financed transaction.

The Real Estate Purchase Agreement is a foundational document that precedes and outlines the terms for a real estate transaction, including price and conditions, but does not detail the financing aspects. However, when an Owner Financing Contract is used, elements of the Real Estate Purchase Agreement will integrate into the financing contract, ensuring that the sale conditions are clear and part of the financial arrangement.

A Lease Agreement with an Option to Buy is a unique document that, like an Owner Financing Contract, provides an alternative path to homeownership. It combines elements of a standard lease with the exclusive right for the lessee to purchase the property under specific conditions during or after the lease term. While it doesn't provide immediate ownership like owner financing, it's another creative financing solution.

The Loan Agreement is a broad document covering any agreement to borrow money and repay it with interest. Its similarity to an Owner Financing Contract lies in the structuring of the loan details, such as payment schedules, interest, and terms of repayment. However, Loan Agreements cover a wider range of purposes beyond real estate, making them more versatile but less specialized.

Finally, the Sale-Leaseback Agreement offers an interesting comparison. In this arrangement, a property owner sells their property and immediately leases it back from the buyer. This way, they gain liquidity while retaining the use of the property. While significantly different in structure and purpose, both the Sale-Leaseback Agreement and an Owner Financing Contract provide creative financial strategies outside traditional lending.

Each of these documents, while serving distinctive purposes, intersects with an Owner Financing Contract in the broader context of financial arrangements, real estate transactions, and asset management. Understanding their differences and similarities helps parties navigate their options in achieving their real estate and financial goals.

Dos and Don'ts

When filling out an Owner Financing Contract form, it's essential to approach the task with care and attention to detail to ensure the agreement is binding and reflects the agreement between the buyer and seller accurately. Here are some dos and don'ts that can guide you through the process:

Dos:- Read the contract thoroughly before filling it out to understand all the terms and conditions.

- Ensure all parties' information is accurate and complete, including names, addresses, and contact details.

- Specify the financial terms clearly, such as the purchase price, down payment, interest rate, installment amounts, and duration of the loan.

- Include a clear description of the property being sold, including its address, legal description, and any other identifying details.

- Detail the responsibilities of each party, such as insurance, taxes, and maintenance of the property.

- Outline the consequences of default for both buyer and seller, ensuring both understand the implications of failing to uphold the contract.

- Have a lawyer review the contract to ensure it's legally sound and binding.

- Sign and date the contract in the presence of a notary public to add an extra layer of legal protection and authentication.

- Keep copies of the contract in a safe place, ensuring both the buyer and seller have a copy for their records.

- Include a clause regarding dispute resolution, specifying how any disputes related to the contract will be handled.

- Don't leave any blanks unfilled; if a section doesn't apply, mark it as N/A (not applicable) instead of leaving it blank.

- Avoid using vague language; be as specific as possible to prevent misunderstandings.

- Don't skip the legal review step, even if it seems straightforward or an attorney's review seems like an unnecessary expense.

- Don't forget to include all agreements in writing within the contract; oral agreements should be documented and included.

- Avoid entering into an owner financing agreement without a thorough background check on the other party, especially concerning their credit history and financial stability.

- Don't rush through the process; take your time to ensure that all information is accurate and comprehensive.

- Avoid making changes to the contract without the consent of both parties; any modifications should be made in writing and signed by both parties.

- Don't underestimate the importance of specifying who is responsible for paying closing costs and other transactional fees.

- Avoid proceeding without a clear exit strategy in case the financing doesn't go as planned for either party.

- Don't neglect to include a provision for an early payoff, specifying any penalties or procedures for early termination of the contract.

Misconceptions

When it comes to buying or selling a property, owner financing can seem like an attractive alternative to traditional mortgage financing. This method involves a buyer making payments directly to the seller instead of securing a mortgage through a bank. However, there are several misconceptions about Owner Financing Contract forms that need clarification:

- It's only for buyers with bad credit. While owner financing can be a boon for buyers who might struggle to secure traditional financing, it’s not solely for those with poor credit. Many buyers choose owner financing for its flexibility in terms and rates, or to avoid the rigorous process of bank financing.

- The contract form is standard and non-negotiable. Contrary to this belief, owner financing agreements can vary greatly and are highly negotiable. Factors such as interest rate, payment schedule, and term length are all open for discussion to suit both the buyer's and seller's needs.

- Owner financing doesn’t require a down payment. Many people mistakenly assume that owner financing means you can skip the down payment. In reality, sellers often require a down payment to protect their financial interests and ensure the buyer has a stake in the property.

- You don't need a lawyer to prepare the contract. Given the complexity and legal implications of an owner-financed sale, having a legal professional draft or review your contract is crucial. This helps protect both parties from future disputes and ensures the agreement complies with state laws.

- Owner financing is risk-free for sellers. While offering financing can attract more potential buyers, it comes with its risks, such as the buyer defaulting on payments. Sellers should conduct thorough due diligence on buyers, similar to traditional lenders.

- Interest rates are always lower than bank rates. Interest rates in owner-financed deals are negotiable and can vary widely. Sometimes, sellers may charge higher rates than banks to compensate for the increased risk they are taking on.

- It's a quicker process than traditional financing. While avoiding the lengthy bank mortgage application process might seem quicker, owner financing deals involve considerable negotiation and legal work. The overall timeframe can be similar to or longer than bank-financed purchases.

- No title company is needed. Involving a title company in an owner-financed transaction is advisable to ensure the title is clear and to manage the closing process efficiently. This step is vital for protecting both parties' interests.

Understanding these misconceptions about Owner Financing Contract forms is essential for anyone considering this route for buying or selling property. It can offer great opportunities when managed carefully and with proper legal guidance.

Key takeaways

Owner Financing Contracts represent a unique agreement between the buyer and seller of a property, where the seller extends credit to the buyer for the purchase. Understanding the nuances of filling out and using the Owner Financing Contract form effectively ensures that both parties can enter into the agreement with clarity and confidence.

- Before detailing terms, both parties should be fully identified, including their full legal names and contact information, to avoid any potential disputes regarding the contract's stakeholders.

- Accurately describe the property being sold, including its full address and any legal identifiers such as the parcel number. This specificity ensures the contract is enforceable and pertains only to the clearly defined asset.

- The agreed purchase price should be clearly outlined in the contract, alongside the down payment and interest rate, to set forth the financial terms transparently.

- Determine the payment schedule, including the frequency of payments, the amount of each installment, and when the loan is to be paid in full. Preciseness in these details avoids any ambiguity regarding financial obligations.

- Delve into the consequences of default by the buyer. The contract should include a clear definition of what constitutes a default and the steps to be taken if this unfortunate situation arises, protecting both parties' interests.

- The contract must specify who holds the title to the property during the financing period. Whether the title is immediately transferred to the buyer or held until the full purchase price is paid can significantly impact the agreement's dynamics.

- Address responsibilities for property taxes, insurance, and maintenance. Clearly stated responsibilities ensure that the property remains protected and in good condition throughout the financing term.

- Include clauses regarding the allowance or prohibition of prepayment. Some sellers may require a minimum interest amount before allowing prepayment, while others may offer the buyer the flexibility to pay off the balance early without penalty.

- Both parties should consult legal and financial advisors before finalizing the contract. Professional advice ensures that the agreement complies with all relevant laws and adequately protects each party's interests.

Conclusively, when filling out and using the Owner Financing Contract form, attention to detail and a mutual understanding of the agreement's terms are critical. By thoroughly addressing each of these key areas, buyers and sellers can create a solid foundation for their owner-financed transaction, leading to successful outcomes for both parties.

Consider More Types of Owner Financing Contract Forms

Can You Negotiate After Appraisal - It acts as a crucial checkpoint in your home buying process, offering you a way to back out if the property doesn't appraise at or above the sale price.