Free Real Estate Purchase Agreement Form for New York

In the bustling world of New York real estate, the purchase agreement form serves as the cornerstone of property transactions, embodying the mutual consent between buyer and seller regarding the terms of sale. This critical document delineates the specifics of the transaction, including but not limited to the sale price, property description, payment arrangements, contingencies, and closing details. Its comprehensive nature ensures that all parties are clear on their obligations, rights, and expectations, laying a solid foundation for a smooth transition of ownership. The form not only functions as a legally binding contract that secures the agreement between the involved parties but also acts as a detailed record of the sale, pivotal for both financial and legal record-keeping. Understanding the nuances of this form is essential for anyone looking to navigate the complexities of buying or selling property in New York, as it directly influences the outcome and legality of the real estate transaction.

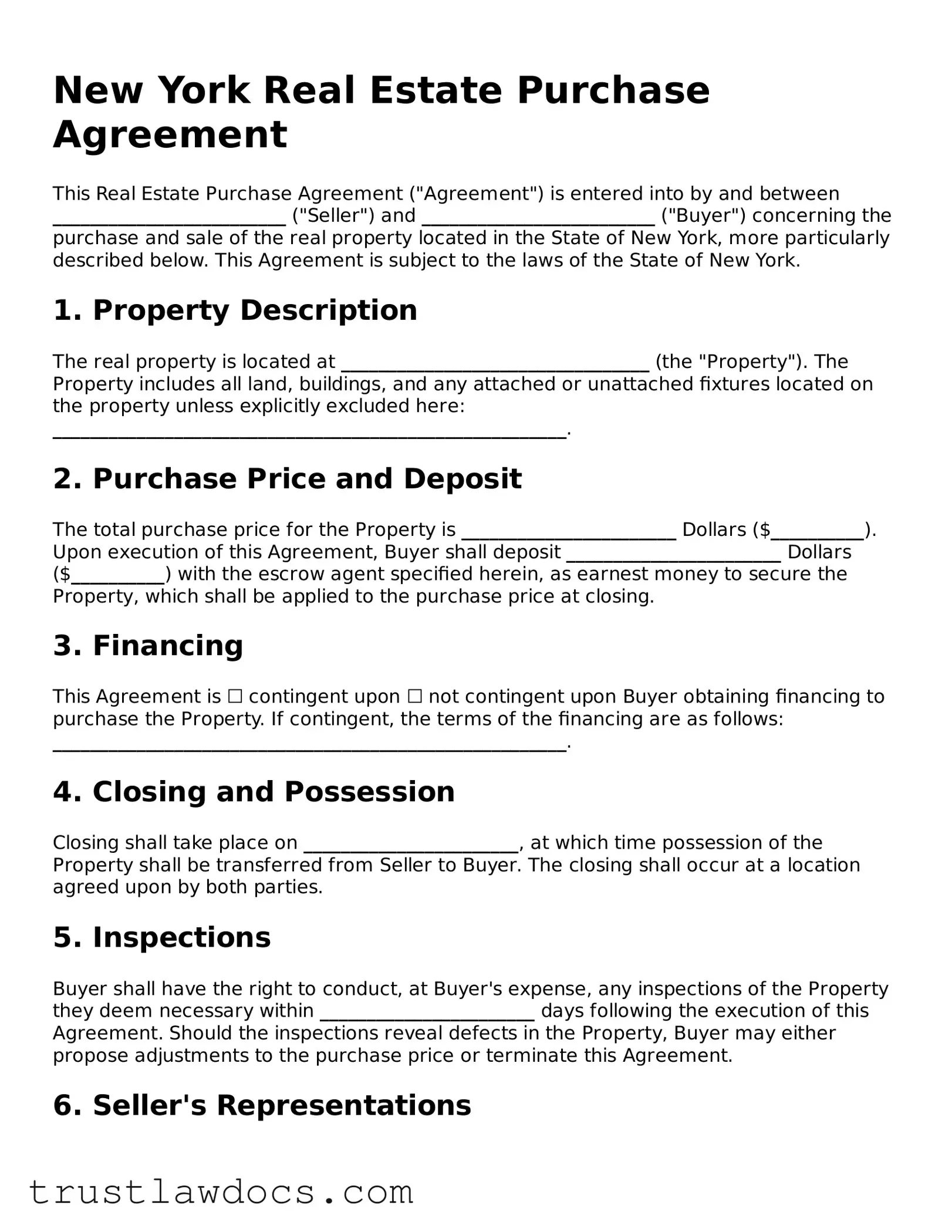

Form Example

New York Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between _________________________ ("Seller") and _________________________ ("Buyer") concerning the purchase and sale of the real property located in the State of New York, more particularly described below. This Agreement is subject to the laws of the State of New York.

1. Property Description

The real property is located at _________________________________ (the "Property"). The Property includes all land, buildings, and any attached or unattached fixtures located on the property unless explicitly excluded here: _______________________________________________________.

2. Purchase Price and Deposit

The total purchase price for the Property is _______________________ Dollars ($__________). Upon execution of this Agreement, Buyer shall deposit _______________________ Dollars ($__________) with the escrow agent specified herein, as earnest money to secure the Property, which shall be applied to the purchase price at closing.

3. Financing

This Agreement is ☐ contingent upon ☐ not contingent upon Buyer obtaining financing to purchase the Property. If contingent, the terms of the financing are as follows: _______________________________________________________.

4. Closing and Possession

Closing shall take place on _______________________, at which time possession of the Property shall be transferred from Seller to Buyer. The closing shall occur at a location agreed upon by both parties.

5. Inspections

Buyer shall have the right to conduct, at Buyer's expense, any inspections of the Property they deem necessary within _______________________ days following the execution of this Agreement. Should the inspections reveal defects in the Property, Buyer may either propose adjustments to the purchase price or terminate this Agreement.

6. Seller's Representations

Seller represents that as of the closing date, the Property will be free of liens and encumbrances, except as specifically noted in this Agreement, and that the physical condition of the Property will be substantially the same as at the time of the Buyer's inspection.

7. Closing Costs

Closing costs, including but not limited to attorneys' fees, title insurance, and recording fees, shall be paid as follows:

- Buyer's costs: _________________________________________________.

- Seller's costs: _________________________________________________.

8. Notices

All notices under this Agreement must be in writing and delivered by mail, email, or in person to the addresses specified herein:

Seller: _________________________________________________.

Buyer: _________________________________________________.

9. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

10. Signature

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

Seller's Signature: _______________________ Date: __________

Buyer's Signature: _______________________ Date: __________

PDF Form Details

| Fact | Detail |

|---|---|

| Definition | A New York Real Estate Purchase Agreement is a legally binding contract where a seller agrees to sell and a buyer agrees to buy real estate under specified terms and conditions. |

| Governing Law | New York Consolidated Laws, Real Property Law - RPP. |

| Required Disclosures | Property sellers in New York must provide buyers with a property condition disclosure statement or credit the buyer $500 at closing. |

| Signing Requirements | All parties involved (buyers and sellers) must sign the agreement for it to be legally binding. Witnessed signatures are recommended but not required. |

| Consideration | The buyer must provide some form of consideration (usually a monetary deposit) to the seller as part of the agreement to indicate that the intention to buy the property is serious. |

| Closing Process | The agreement outlines the steps and timeline from agreement to closing, including financing conditions, inspections, and any other contingencies that must be satisfied before the deal is finalized. |

How to Write New York Real Estate Purchase Agreement

Filling out the New York Real Estate Purchase Agreement form is a significant step in the process of buying or selling property in New York. This document lays out the terms and conditions of the sale, including the purchase price, property details, and the rights and responsibilities of both the buyer and the seller. Ensuring that this form is completed accurately is essential for a smooth and legally sound transaction. The following steps have been outlined to assist in the process, ensuring clarity and compliance with New York state laws.

- Start by entering the date of the agreement at the top of the form. This marks the official beginning of the purchase agreement between the buyer and seller.

- Fill in the buyer's full legal name and current address in the designated section. If there are co-buyers, include their information as well.

- Proceed to enter the seller's full legal name and current address. For multiple sellers, ensure that all names and addresses are listed.

- Describe the property being sold, including its complete address, legal description, and any additional identifying details. This ensures there are no misunderstandings about what is being sold.

- State the purchase price in the agreed-upon section. Also, detail the form of payment, whether it be cash, financing, or another method agreed upon by both parties.

- Outline any contingencies that must be met before the sale can proceed, such as home inspections, financing details, or the sale of the buyer's current home.

- Specify the closing date and location where the final sale will be concluded and the property officially changes hands.

- Include any additional terms or conditions that have been agreed upon, such as items to be included or excluded from the sale, home warranty information, or any allowances for repairs.

- Have both the buyer and seller sign and date the agreement. Witness signatures may also be required, depending on local laws and regulations.

Once the New York Real Estate Purchase Agreement form has been filled out completely and signed, the next steps involve ensuring all contingencies are met, and preparing for the closing date. This typically includes final inspections, securing financing, and obtaining title insurance. Both parties should work closely with their real estate agents and legal advisors to ensure all necessary steps are completed before the sale is finalized. Remember, clear communication and thoroughness in completing this form can significantly contribute to a successful real estate transaction.

Get Answers on New York Real Estate Purchase Agreement

What is a New York Real Estate Purchase Agreement?

A New York Real Estate Purchase Agreement is a legally binding document used in real estate transactions that outlines the terms and conditions of the sale of a property between a buyer and a seller. This contract specifies details such as the purchase price, property description, financing terms, closing conditions, and any contingencies that must be met before the transaction can be completed.

Who needs to sign the New York Real Estate Purchase Agreement?

The New York Real Estate Purchase Agreement needs to be signed by both the buyer(s) and the seller(s) of the property. If there are multiple buyers or sellers, all parties must sign the agreement to ensure that it is legally binding. In some cases, witnesses or a notary public may also need to sign, depending on local laws and regulations.

Is a lawyer required for preparing or reviewing the New York Real Estate Purchase Agreement?

While it is not legally required to have a lawyer prepare or review the New York Real Estate Purchase Agreement, it is highly recommended. Real estate transactions can be complex, and a lawyer can help ensure that all legal requirements are met and that the agreement protects your rights and interests.

Can the New York Real Estate Purchase Agreement be modified after it's been signed?

Yes, the New York Real Estate Purchase Agreement can be modified after it has been signed, but any changes must be agreed upon by all parties involved. Modifications to the agreement should be made in writing, and a new document or amendment should be signed by both the buyer and the seller.

What happens if a party breaches the New York Real Estate Purchase Agreement?

If a party breaches the New York Real Estate Purchase Agreement, various legal remedies may be available. The non-breaching party can seek specific performance, asking a court to enforce the terms of the agreement, or they can seek damages for any financial loss incurred. The specific consequences will depend on the terms of the agreement and the nature of the breach.

Are there any contingencies that should be included in a New York Real Estate Purchase Agreement?

Common contingencies in a New York Real Estate Purchase Agreement include financing, inspection, and title contingencies. A financing contingency allows the buyer to cancel the contract if they are unable to secure a mortgage. An inspection contingency permits the buyer to renegotiate or withdraw based on the results of a property inspection. A title contingency ensures the buyer receives a clean title. Including such contingencies can provide important protections for both the buyer and seller.

What are the consequences of withdrawing from a New York Real Estate Purchase Agreement?

Withdrawing from a New York Real Estate Purchase Agreement can have serious consequences, including the loss of earnest money deposit or being sued for breach of contract. The exact consequences depend on the terms of the agreement and the reasons for withdrawal. It's crucial to understand your rights and obligations under the agreement before making any decision to withdraw.

Common mistakes

Filling out a New York Real Estate Purchase Agreement form is a critical step in the process of buying or selling property. However, mistakes can happen, which might lead to delays or legal complications. It's important to approach this task with attention to detail and full awareness of the common pitfalls.

One major mistake is not reviewing the property details thoroughly. This includes the legal description of the property, which is more specific than just the address. It should match exactly what's on record with the county to avoid disputes about what is being bought or sold.

Another area where errors often occur is in the financial terms section. People sometimes enter incorrect figures for the purchase price or down payment. This could cause confusion or disputes later on, especially if the seller or buyer remembers the numbers differently.

Often, individuals neglect to specify contingencies clearly. Contingencies protect the parties if certain conditions aren't met, like securing a mortgage or the results of a home inspection. Failing to detail these conditions can lead to a buyer being stuck in a contract without a way out, or a seller facing an unexpected obligation to make repairs.

A common oversight is not verifying the closing date. This date is crucial for both the buyer and seller to make necessary preparations. If it’s incorrect or unrealistic, it could result in financial penalties or the deal falling through.

Some people fail to include all necessary signatures. A Real Estate Purchase Agreement is legally binding only if it is signed by all parties involved. Missing signatures can invalidate the entire agreement, potentially leading to serious legal issues.

Another frequent error is failing to acknowledge the earnest money deposit properly. This part of the agreement details the amount, the party holding it, and conditions for its return or forfeiture. Incorrect information here can lead to disagreements and loss of trust between the parties.

A subtle yet critical mistake is using vague language. Ambiguous terms or unclear clauses can be interpreted in multiple ways, leading to disputes. Precise, clear language ensures everyone understands their rights and obligations, helping to avoid conflicts down the line.

Last but not least, not seeking professional advice is a significant misstep. Real estate transactions can be complex and have substantial legal implications. Professional guidance from a legal expert or a realtor can help prevent mistakes and ensure the agreement accurately reflects the intent of all parties involved.

Documents used along the form

In the complex process of purchasing real estate in New York, a variety of forms and documents complement the Real Estate Purchase Agreement to ensure thoroughness and compliance with state law. These documents are essential for both parties to understand their rights, responsibilities, and the specifics of the property transaction. Let's explore some of the key forms and documents often used alongside the Real Estate Purchase Agreement.

- Residential Property Disclosure Form: Sellers use this form to disclose the condition of the property, including any known issues or defects. It's a critical document that informs buyers about the property’s current state.

- Title Search Document: This document provides a history of the property, including previous ownership, any liens on the property, and easements. It ensures that the title is clear and transferable.

- Mortgage Pre-Approval Letter: Often submitted with the purchase offer, this letter from a lender states the amount the buyer is pre-approved to borrow. It demonstrates the buyer's financial capability to complete the purchase.

- Home Inspection Report: This report is prepared by a professional inspector after thoroughly examining the property for structural, electrical, and plumbing issues among others. The findings can affect negotiations on the purchase price or terms of the sale.

- Appraisal Report: An appraisal report provides an estimate of the property’s market value. Lenders require this document to ensure the property is worth the loan amount.

- Flood Zone Statement: This document identifies if the property is in a flood zone, which affects insurance requirements and costs for the buyer.

- Pest Inspection Report: This document details the presence of any pest infestations, such as termites or rodents, which is critical for the maintenance and integrity of the property.

- Lead-Based Paint Disclosure: For homes built before 1978, this disclosure is required by federal law. It informs buyers about the presence of lead-based paint in the property, which poses health risks.

- Closing Disclosure: This form outlines the final closing costs and the details of the mortgage loan. It is provided to the buyer at least three days before closing for review.

To successfully navigate a real estate transaction in New York, both buyers and sellers must be diligent in preparing and reviewing these documents. Not only do they safeguard the interests of both parties, but they also ensure adherence to legal requirements and smooth facilitation of the property transfer. Understanding each document’s purpose and ensuring its accuracy is paramount in achieving a successful real estate transaction.

Similar forms

The New York Real Estate Purchase Agreement shares similarities with a Bill of Sale. Both documents are pivotal in the transfer of ownership from one party to another. A Bill of Sale is used for various types of personal property such as vehicles, boats, or even smaller items like furniture, while the Real Estate Purchase Agreement is specific to transactions involving property such as land or buildings. Despite their focus on different types of property, both documents serve as legal evidence of a transaction and outline the terms and conditions agreed upon by both parties, including the sale price and description of the property being sold.

Similar to a Lease Agreement, the New York Real Estate Purchase Agreement outlines terms related to property but does so in the context of a sale rather than a rental arrangement. While a Lease Agreement details the terms under which one party agrees to rent property from another party, such as the duration of the lease term, monthly rent, and rules regarding the use of the property, the Real Estate Purchase Agreement focuses on the terms of sale. This includes the purchase price, closing details, and any contingencies that must be met before the sale is finalized. Both documents are crucial for specifying the rights and responsibilities of each party involved in the transaction.

The New York Real Estate Purchase Agreement also bears resemblance to a Mortgage Agreement. In a Mortgage Agreement, a borrower agrees to pledge real estate as security for a loan, essentially detailing the borrower's promise to repay the borrowed amount under specified terms, including interest rates and payment schedules. While the Mortgage Agreement facilitates the financial aspect of acquiring property through a loan, the Real Estate Purchase Agreement governs the transaction of buying the property itself, including how and when payment will be made, often involving financing obtained via a mortgage. Both agreements work in tandem for financed property purchases, delineating both the transfer of property ownership and the financing terms.

Lastly, the New York Real Estate Purchase Agreement is akin to a Title Insurance Policy in that it deals with aspects of property ownership and potential disputes. A Title Insurance Policy offers protection to both buyers and lenders against losses resulting from disputes over the title of a property. While the Title Insurance Policy serves as a safeguard against future claims or discovered defects related to the property’s title, the Real Estate Purchase Agreement encompasses the immediate terms of the property’s sale, including any warranties or representations concerning the title. Both documents are integral to ensuring that the transfer and financing of real estate proceed with clear expectations and protections for the involved parties.

Dos and Don'ts

When filling out the New York Real Estate Purchase Agreement, it is crucial to ensure accuracy and completeness to avoid potential legal issues and financial losses. Here are essential dos and don'ts to consider:

Do:- Verify all the details: Double-check names, addresses, and other key information for accuracy. Mistakes can lead to significant delays or legal complications.

- Understand every term: Make sure you fully comprehend the terms and conditions before signing. Seek clarification on any point that is not clear.

- Disclose all material facts: Be transparent about any issues with the property that could affect its value or the buyer's decision.

- Use professional help when needed: Consider consulting with a real estate attorney or a licensed real estate professional to ensure all aspects of the agreement comply with state laws.

- Review financial terms: Carefully examine the purchase price, down payment amount, and any contingencies related to financing.

- Check zoning and use restrictions: Confirm that the property's intended use is permissible under local zoning laws.

- Be mindful of deadlines: Note all important dates, such as closing and possession dates, and ensure you can meet them.

- Rush the process: Take the time needed to review all parts of the agreement. Making decisions in haste can lead to oversight.

- Omit relevant details: Leaving out essential information can invalidate the agreement or lead to future disputes.

- Assume standard provisions apply: Real estate laws vary by state, and standard provisions in one state may not be applicable in New York.

- Sign without understanding: Never sign the agreement if there are clauses or terms you do not fully understand.

- Ignore contingencies: Failing to properly address contingencies regarding financing, inspections, and other key aspects can jeopardize the transaction.

- Forget to include all parties: Ensure that everyone with a legal interest in the property is part of the agreement.

- Underestimate the importance of accuracy: Every detail, no matter how small, must be accurate to ensure the legality of the agreement.

Misconceptions

The New York Real Estate Purchase Agreement form is a crucial document in the buying and selling of property within New York, but there are several misconceptions that can cloud the understanding of its purpose and content. Let's clarify some of these common misunderstandings:

It's standard and non-negotiable: Many believe that the form is set in stone and cannot be altered. However, terms in the agreement can often be negotiated to suit both the buyer and seller's interests. It's about finding a mutually agreeable ground.

It only covers the sale price: Far from just detailing the sale price, the agreement encompasses numerous other important terms including contingencies, closing dates, and specific conditions that both parties must fulfill.

Signing it immediately binds you to the purchase: While the agreement is indeed a legally binding document, there are typically contingencies (such as inspection or financing) that allow parties a legal way to withdraw without breaching the agreement.

The buyer is the only one who needs to review it thoroughly: Both the buyer and the seller should thoroughly review and understand the agreement. It contains obligations and rights for both parties, making it equally important for sellers to scrutinize the document.

Once signed, the terms are final: If both parties agree, amendments can be made to the agreement even after signing. This requires mutual consent and usually in writing to be legally binding.

It doesn't impact the closing process: The agreement sets the foundation for the closing process by outlining deadlines, responsibilities, and procedures that both parties must follow. It's a road map that guides the transaction to closing.

Legal representation is not necessary: Although not a legal requirement, having a lawyer review the agreement can provide valuable insights, ensuring that your rights are protected and that you fully understand your obligations.

Key takeaways

The New York Real Estate Purchase Agreement form is a crucial document for anyone buying or selling property in the state. It outlines the terms of the sale and protects both parties involved. Here are five key takeaways to ensure its effective use:

- Accuracy is paramount: Every detail entered in the form must be accurate. This includes personal information, property details, and financial terms. Mistakes can lead to delays or legal issues.

- Legal advice is advised: Before signing the agreement, both the buyer and seller should consider consulting with a legal professional. This step ensures that the interests of both parties are protected and that they understand their rights and obligations.

- Contingencies matter: The agreement allows for contingencies, which are conditions that must be met for the sale to proceed. Common examples include home inspections, financing, and appraisals. These should be clearly outlined in the agreement.

- Signatures make it binding: Once all parties sign the agreement, it becomes legally binding. Everyone should review the document thoroughly before signing to make sure they agree with all the terms.

- Deadlines are critical: The agreement specifies deadlines for various stages of the sale process, such as inspections and securing financing. Adhering to these deadlines is necessary to maintain the validity of the contract and keep the sale moving forward.

Popular Real Estate Purchase Agreement State Forms

Home Purchase Contract - It serves as a binding contract that delineates the responsibilities and obligations of each party involved in the transaction, promoting a smooth transfer of ownership.

For Sale by Owner Purchase Agreement Pdf Michigan - A Real Estate Purchase Agreement is a legally binding document between a buyer and a seller for the purchase of property.

Real Estate Sales Agreement - Provisions for the termination of the agreement and the consequences for such an action are included.