Free Real Estate Purchase Agreement Form for Michigan

Embarking on the journey of buying or selling property in Michigan presents a unique set of opportunities and challenges, pivotal among them being the Michigan Real Estate Purchase Agreement form—a crucial document that both parties should closely familiarize themselves with. This form serves not only as a formal contract specifying the terms and conditions of the property transaction but also as a binding record of the agreement between the buyer and the seller. It covers essentials such as the offered price, the down payment details, financing conditions, inspection rights, and any contingencies that either party wishes to include, ensuring everyone's rights and responsibilities are clearly outlined. The Michigan Real Estate Purchase Agreement is designed to standardize the sale process, mitigating potential misunderstandings and disputes by providing a comprehensive framework that customarily addresses legal requirements, property descriptions, and the closing terms. Given the legal and financial implications, understanding each section of this agreement is indispensable for a smooth and successful real estate transaction in Michigan.

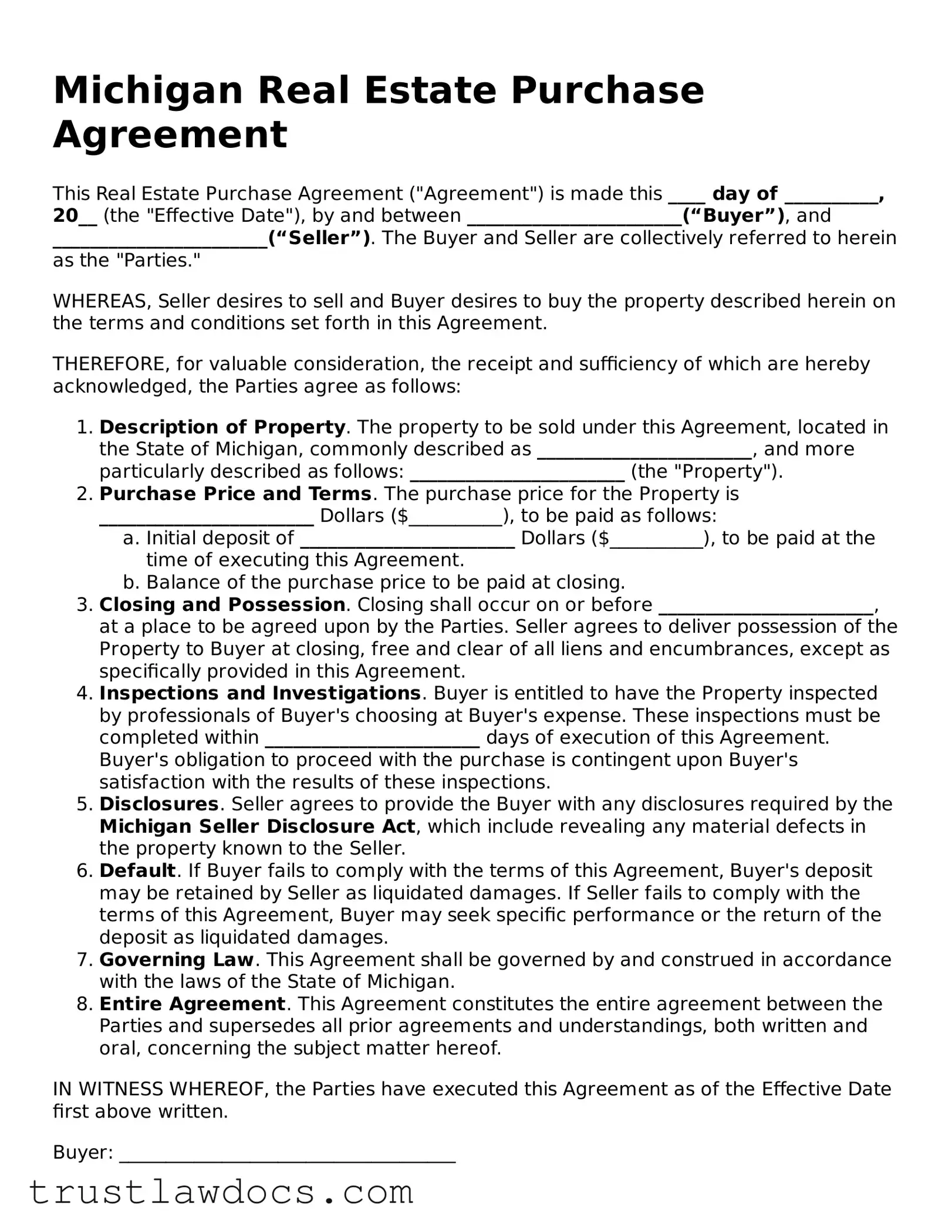

Form Example

Michigan Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made this ____ day of __________, 20__ (the "Effective Date"), by and between _______________________(“Buyer”), and _______________________(“Seller”). The Buyer and Seller are collectively referred to herein as the "Parties."

WHEREAS, Seller desires to sell and Buyer desires to buy the property described herein on the terms and conditions set forth in this Agreement.

THEREFORE, for valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

- Description of Property. The property to be sold under this Agreement, located in the State of Michigan, commonly described as _______________________, and more particularly described as follows: _______________________ (the "Property").

- Purchase Price and Terms. The purchase price for the Property is _______________________ Dollars ($__________), to be paid as follows:

- Initial deposit of _______________________ Dollars ($__________), to be paid at the time of executing this Agreement.

- Balance of the purchase price to be paid at closing.

- Closing and Possession. Closing shall occur on or before _______________________, at a place to be agreed upon by the Parties. Seller agrees to deliver possession of the Property to Buyer at closing, free and clear of all liens and encumbrances, except as specifically provided in this Agreement.

- Inspections and Investigations. Buyer is entitled to have the Property inspected by professionals of Buyer's choosing at Buyer's expense. These inspections must be completed within _______________________ days of execution of this Agreement. Buyer's obligation to proceed with the purchase is contingent upon Buyer's satisfaction with the results of these inspections.

- Disclosures. Seller agrees to provide the Buyer with any disclosures required by the Michigan Seller Disclosure Act, which include revealing any material defects in the property known to the Seller.

- Default. If Buyer fails to comply with the terms of this Agreement, Buyer's deposit may be retained by Seller as liquidated damages. If Seller fails to comply with the terms of this Agreement, Buyer may seek specific performance or the return of the deposit as liquidated damages.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Michigan.

- Entire Agreement. This Agreement constitutes the entire agreement between the Parties and supersedes all prior agreements and understandings, both written and oral, concerning the subject matter hereof.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the Effective Date first above written.

Buyer: ____________________________________

Seller: ___________________________________

PDF Form Details

| Fact Number | Detail |

|---|---|

| 1 | The Michigan Real Estate Purchase Agreement is a binding contract between a seller and buyer for the transfer of real estate. |

| 2 | This agreement outlines the terms and conditions of the sale, including the purchase price, financing conditions, and property description. |

| 3 | The agreement must be in writing to be enforceable under Michigan law. |

| 4 | Governing laws for these agreements in Michigan include the Michigan Compiled Laws (MCL) 565.3 which require real estate purchase agreements to be in writing. |

| 5 | It specifically identifies both the buyer and seller and their agreements regarding the property transaction. |

| 6 | The agreement includes provisions for a deposit or earnest money to secure the transaction, which is typically held in a trust or escrow account. |

| 7 | Closing dates and possession details are clearly laid out to prevent misunderstandings. |

| 8 | It may contain contingencies that must be fulfilled before the sale can be completed, such as obtaining a satisfactory home inspection or the buyer securing financing. |

| 9 | Amendments or additions to the agreement, known as addenda, can be made if both parties agree to the changes in writing. |

| 10 | Upon closing, the seller is responsible for delivering a clear title to the buyer, ensuring there are no legal impediments to the transfer of ownership. |

How to Write Michigan Real Estate Purchase Agreement

When you decide to buy or sell real estate in Michigan, the process begins with completing a Real Estate Purchase Agreement. This document is crucial as it outlines the terms and conditions of the sale, including the price, closing date, and any contingencies. Filling out this form correctly is essential to protect your interests, whether you're a buyer or a seller. The following steps will guide you through the process of filling out the Michigan Real Estate Purchase Agreement form, ensuring that all necessary information is accurately recorded.

- Gather all necessary information about the property, including its legal description, address, and any applicable parcel identification number (PIN).

- Identify the buyer and seller by their full names and contact information. This includes mailing addresses, phone numbers, and email addresses.

- Specify the purchase price agreed upon by the buyer and seller.

- Outline the terms of the payment, including any deposits, financing arrangements, and whether any part of the purchase price will be paid in cash.

- Document any personal property that will be included or excluded from the sale. Personal property can include appliances, furniture, or other items not affixed to the property.

- Detail any contingencies that the sale is subject to. Common contingencies include the buyer securing financing, the sale of the buyer’s current home, and satisfactory inspection results.

- Specify the closing date and location where the transaction will be finalized.

- Identify who will be responsible for paying closing costs and any other expenses associated with the sale, such as inspections or repairs.

- Include any additional terms or conditions that the buyer and seller have agreed upon.

- Both parties should review the completed form carefully. Make sure all information is accurate and that all agreed-upon terms are clearly documented.

- After reviewing, both the buyer and the seller must sign and date the form in the presence of a notary public. Ensure that a notary witnesses these signatures to make the agreement legally binding.

Completing the Michigan Real Estate Purchase Agreement form is a significant step in the process of purchasing or selling property. It serves as the foundation for a successful transaction, providing a clear framework for what is expected from both parties. After the form is filled out, signed, and notarized, the next steps typically involve fulfilling any contingencies, securing financing, and preparing for the closing day. By thoroughly completing this form and following the steps outlined above, you can proceed with confidence, knowing that the agreement reflects your understanding and protects your rights.

Get Answers on Michigan Real Estate Purchase Agreement

What is a Michigan Real Estate Purchase Agreement?

A Michigan Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of the sale and purchase of real estate property in the state of Michigan. This form covers details such as the purchase price, property description, financing terms, and any contingencies (like inspections or obtaining a mortgage) that must be met before the sale can be finalized.

Who needs to sign the Michigan Real Estate Purchase Agreement?

The Michigan Real Estate Purchase Agreement must be signed by both the buyer(s) and the seller(s) to be considered valid. If the property is owned jointly or is being bought by more than one person, all parties must sign the agreement to ensure that everyone is legally committed to the transaction under the outlined terms.

Are there any contingencies that should be included in the agreement?

Yes, including contingencies in the agreement is crucial for both the buyer and the seller. Common contingencies include home inspections, financing, and the sale of the buyer's existing home. These conditions protect the buyer by allowing them to back out of the sale without penalty if certain conditions aren't met. Sellers can also include contingencies, such as one that makes the sale dependent on finding a new home.

What happens if either party wants to back out of the agreement?

If either party wants to back out of a Michigan Real Estate Purchase Agreement, the consequences will depend on the terms specified within the agreement and whether any contingencies allow for the cancellation. If the buyer backs out without a contingency-based reason, they may lose their earnest money deposit. Conversely, sellers may face legal action or be required to return the deposit and possibly pay additional damages.

Is a Michigan Real Estate Purchase Agreement legally binding once signed?

Yes, once it is signed by all the required parties, the Michigan Real Estate Purchase Agreement becomes a legally binding document. Both parties are then obligated to fulfill their respective responsibilities as outlined in the agreement. If one party fails to comply with the terms, they can be held legally accountable, potentially through court action.

Common mistakes

When filling out the Michigan Real Estate Purchase Agreement form, people often overlook important details that can cause significant issues later. One common mistake is not double-checking the legal description of the property. This description is more than just an address; it includes specific details that define the property’s boundaries. Any inaccuracies here could lead to disputes about what land is actually being bought or sold.

Another error is failing to specify the fixtures and personal property included in the sale. People might assume that certain appliances or fixtures come with the property, only to find out they were not included in the agreement. Clearly listing what is and isn’t part of the sale can prevent misunderstandings down the line.

Incomplete or incorrect buyer and seller information is yet another frequent mistake. The full legal names of all parties should be accurately recorded to ensure there are no questions about who is involved in the transaction. Mistakes in this area can affect the validity of the agreement.

The closing date and possession date are often confused or incorrectly documented. The closing date is when the paperwork is finalized, and the sale is legally completed. The possession date is when the buyer can move in. Misunderstandings about these dates can lead to conflicts between the buyer and seller about when the property should be vacated.

Skipping over the financial details, such as the purchase price, earnest money deposit amount, and terms of the selling arrangement, is a mistake that can lead to big problems. These terms should be clearly understood and agreed upon by both parties to avoid any future disputes.

A failure to understand the contingencies outlined in the agreement is a common error. These are conditions that must be met for the sale to go through, such as a successful home inspection or the buyer securing financing. Not clearly understanding or fulfilling these contingencies can cause the deal to fall through at the last minute.

Not specifying who pays for what closing costs can lead to unexpected expenses. The agreement should clarify whether the buyer or seller (or both) will cover costs such as title insurance, examination fees, and transfer taxes. Without clear terms, the financial burden can become a point of contention.

Ignoring the need for a clear inspection clause is a misstep. This clause allows the buyer to have the property inspected for any potential issues. Without this clause, the buyer has fewer recourses if they discover problems after closing.

Not considering the implications of zoning laws or restrictions is a mistake that can limit how the property is used. Buyers should ensure that their intended use for the property complies with local laws and regulations, or they might find themselves unable to renovate or use the property as planned.

Lastly, failing to seek professional guidance when filling out the form is an oversight many regret. The complexities of real estate transactions mean that advice from an experienced real estate agent or attorney can be invaluable in avoiding mistakes that could delay or derail the sale.

Documents used along the form

When buying or selling property in Michigan, the Real Estate Purchase Agreement form plays a crucial role. However, it's just one piece of the puzzle. To ensure a smooth transaction, several other forms and documents are often used in conjunction with this agreement. Each document serves a specific purpose, contributing to the completeness and security of the real estate transaction. Let’s explore seven key forms and documents commonly utilized alongside the Michigan Real Estate Purchase Agreement.

- Seller’s Disclosure Statement: This document provides the buyer with important information about the property’s condition. Sellers are required to disclose any known defects and the status of various property systems.

- Lead-Based Paint Disclosure: For homes built before 1978, this disclosure is mandatory. It informs buyers about the presence of lead-based paint, a potential health hazard, in the property.

- Title Insurance Commitment: This document offers a preliminary view of the title's status, outlining any existing liens, encumbrances, or easements that may affect the property. It serves as a commitment to issue a title insurance policy after closing.

- Home Inspection Report: A comprehensive evaluation of the property’s condition by a licensed inspector, this report covers structural, electrical, plumbing, and other critical aspects. It helps buyers make informed decisions.

- Property Appraisal Report: A professional appraiser assesses the property’s market value based on its characteristics and comparable sales. This report is often required by lenders to ensure the loan does not exceed the property’s value.

- Deed: Upon closing, the deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be recorded with the local government to be effective.

- Closing Disclosure: This form outlines the final closing costs and the detailed financial transactions involved in the real estate deal. Buyers and sellers receive this document at least three days before closing for review.

Understanding and correctly preparing these documents can be daunting but is essential for a successful real estate transaction. Whether you're buying or selling property in Michigan, paying close attention to these key forms and documents will help safeguard your interests and ensure a smooth process from the initial agreement to the final closing.

Similar forms

The Residential Lease Agreement shares similarities with the Michigan Real Estate Purchase Agreement as both outline the terms between two parties involving property use. While the purchase agreement finalizes the sale and transfer of real property ownership, the lease agreement specifies the conditions under which a tenant is allowed to use or occupy a property for a certain period. Both documents are crucial in defining the rights and responsibilities of each party involved, including payment terms, property condition, and termination procedures.

Another document bearing resemblance to the Michigan Real Estate Purchase Agreement is the Bill of Sale. This document is often used to transfer ownership of personal property, such as vehicles or machinery. Like the real estate agreement, it serves as a legal record of the transaction, detailing the items sold, the sale price, and the parties involved. Both documents formalize the agreement between buyer and seller and provide proof of ownership transfer.

The Mortgage Agreement is also closely related to the Michigan Real Estate Purchase Agreement. It outlines the terms under which the lender provides the borrower with the funds needed to purchase property, which is secured against the property itself. Both documents are integral to the process of buying a home, with the purchase agreement detailing the sale conditions and the mortgage agreement detailing the repayment conditions.

An Option to Purchase Agreement has notable similarities to the real estate purchase agreement. It grants the holder the right, but not the obligation, to buy a property at a predetermined price within a specific period. While it does not finalize the sale like the purchase agreement, it sets the stage for a potential future transaction under agreed conditions, making it a preliminary step towards property acquisition.

The Land Contract resembles the Michigan Real Estate Purchase Agreement in its goal to transfer ownership of property. However, it allows the buyer to pay the purchase price in installments directly to the seller, who retains legal title until fully paid. The real estate purchase agreement, on the other hand, typically involves immediate full payment and transfer of ownership, often with the involvement of a mortgage lender.

Quitclaim Deeds are somewhat similar to real estate purchase agreements in that they are used to transfer interest in real property. However, a quitclaim deed transfers whatever interest the grantor has in the property without any warranties or guarantees regarding the grantor’s ownership or title. The real estate purchase agreement, in contrast, provides a detailed account of the property being sold and guarantees its title status.

The Warranty Deed also focuses on the transfer of property ownership but offers more protection to the buyer than a quitclaim deed. It guarantees that the seller holds a clear title to the property and has the right to sell it, similar to the assurances provided in a real estate purchase agreement. The key difference is that the warranty deed is used to actually transfer property ownership and guarantees title against past claims, while the purchase agreement outlines the terms under which such a transfer takes place.

The Assignment of Contract is an agreement that allows one party to transfer its rights and obligations under a contract to another party. This concept is similar to parts of the real estate purchase agreement that may allow for assignment clauses, meaning the buyer could potentially transfer their rights to buy the property to another party before closing. While serving different purposes, both documents deal with the assignment of rights and obligations.

The Power of Attorney form grants someone the authority to act on behalf of another in legal or financial matters and can encompass the authority to buy or sell real estate. Similar to the real estate purchase agreement, it can involve significant legal transactions concerning property. While the power of attorney may grant broad or specific powers for various transactions, the purchase agreement is exclusively focused on the conditions for buying or selling property.

Finally, the Title Insurance Policy is indirectly related to the Michigan Real Estate Purchase Agreement. It protects buyers and lenders against loss or damage resulting from liens, encumbrances, or defects in the title to the property. While the insurance policy itself comes after the purchase agreement and does not detail the sale terms, it is a critical component of the real estate transaction process, ensuring that the buyers receive clear title in accordance with the terms of the purchase agreement.

Dos and Don'ts

When filling out the Michigan Real Estate Purchase Agreement, it's crucial to ensure accuracy and completeness to facilitate a smooth transaction. Below, find a list of actions to follow and to avoid, aiming for a successful agreement process.

Do:

Thoroughly read the entire document before you start filling it out, ensuring you understand each section and its requirements.

Use black ink or type the information to ensure clarity and legibility for all parties involved.

Verify all property details, including the legal description of the property, to ensure they are accurate and match public records.

Include all agreed-upon terms and conditions specific to your sale, such as fixtures to remain with the property and any contingencies like financing or home inspection.

Ensure both the buyer and the seller sign and date the agreement, as it's not legally binding until it is signed by both parties.

Keep a copy of the signed agreement for your records and provide a copy to the other party.

Don't:

Skip sections or leave blanks; if a section is not applicable, write “N/A” to indicate this.

Make assumptions about what is included in the sale; if uncertain, seek clarification before finalizing the agreement.

Forget to specify who will pay for certain costs, such as closing costs, inspections, and repairs, as these can lead to disputes later on.

Sign the agreement without ensuring that all negotiated terms have been accurately included.

Overlook local and state disclosure requirements which can vary widely and may impact the agreement's terms.

Ignore the need for professional advice if you’re unsure about the implications of the agreement's terms; consulting with a real estate agent or attorney can provide valuable insights.

Misconceptions

When it comes to buying or selling property in Michigan, the Real Estate Purchase Agreement (REPA) is a crucial document. It outlines the terms and conditions of the sale, making it a cornerstone in property transactions. However, there are several misconceptions about the Michigan REPA that need to be cleared up to ensure both parties enter into agreements with a clear understanding.

- Misconception 1: A verbal agreement is just as good as a written one. In reality, Michigan law requires a written Real Estate Purchase Agreement to enforce the sale of real estate. This formalizes the agreement and protects both parties.

- Misconception 2: Once the agreement is signed, you cannot back out. Actually, the REPA often includes contingencies that allow either party to legally withdraw under specific conditions, such as failed inspections or inability to secure financing.

- Misconception 3: The asking price is non-negotiable. The REPA is a starting point for negotiations, and the final sale price is often the result of a dialogue between the buyer and the seller, facilitated by their agents.

- Misconception 4: The seller always pays for repairs after an inspection. Though it's common, it's not a rule. The agreement may allocate responsibility for repairs differently, or the buyer may accept the property "as is".

- Misconception 5: The REPA is a standard form that cannot be customized. While there is a standard form, clauses can be modified, added, or removed to suit the specifics of the transaction, as agreed upon by both parties.

- Misconception 6: You don’t need a lawyer to review the REPA. While not mandatory, having a lawyer review the agreement can prevent misunderstandings and protect your interests, especially in more complex deals.

- Misconception 7: A down payment is not necessary to make the REPA valid. In many cases, the agreement includes a provision for earnest money, which demonstrates the buyer's commitment. The absence of this component can significantly affect the transaction's credibility.

- Misconception 8: All forms of the Michigan REPA are the same. Depending on the property type and the sale's specifics, different versions of the REPA might be used. Ensure the correct form is utilized for the transaction at hand.

Understanding these misconceptions can alleviate much of the stress associated with real estate transactions in Michigan. Remember, a well-informed seller or buyer is in a much better position to navigate the complexities of property transactions smoothly and efficiently.

Key takeaways

When filling out and using the Michigan Real Estate Purchase Agreement form, there are several key takeaways to ensure the process is conducted smoothly and legally. This agreement is a legally binding document that outlines the terms and conditions of the sale and purchase of real estate in Michigan. Understanding its components and implications is crucial for all parties involved.

- Accuracy is Critical: Every detail entered into the Michigan Real Estate Purchase Agreement must be accurate and fully descriptive. This includes correct legal descriptions of the property, the agreed-upon sale price, and any contingencies (such as financing or inspections) that are part of the agreement. Inaccuracy can lead to disputes, legal complications, or voiding of the agreement.

- Understand Contingencies: The form allows for contingencies that must be carefully considered and clearly outlined. These might include financing approval, the outcome of home inspections, or the sale of another property. Once agreed upon, these contingencies are legally binding and must be fulfilled for the transaction to proceed. Failure to meet these conditions can result in the termination of the agreement.

- Disclosure Requirements: Sellers in Michigan are required to provide certain disclosures about the condition and history of the property, such as the presence of lead-based paint or other known hazards. The Michigan Real Estate Purchase Agreement should reference these disclosures and confirm that the buyer has received them. It's important for both parties to understand what disclosures are required and to ensure they are properly documented in the agreement.

- Legal Advice is Beneficial: Given the complexities and legal implications of real estate transactions, consulting with a real estate attorney can be highly beneficial. An attorney can provide guidance on the completion of the Michigan Real Estate Purchase Agreement, ensure legal requirements are met, and help in negotiating terms that protect the client’s interests. While not mandatory, legal counsel can provide peace of mind and safeguard against potential legal issues.

Popular Real Estate Purchase Agreement State Forms

Real Estate Sales Agreement - The document specifies any items or fixtures excluded from the sale, ensuring clarity for both buyer and seller.

House for Sale Contract - Provisions related to environmental concerns or liabilities can also be included, protecting the buyer's investment.

Purchasing Agreements - Environmental and zoning disclosures included in the agreement inform the buyer of potential limitations on property use.

Home Purchase Contract - Real Estate Purchase Agreements play a crucial role in real estate transactions across the U.S., adhering to state-specific legal requirements to be valid and binding.