Free Real Estate Purchase Agreement Form for Florida

Navigating the intricacies of buying or selling real estate in Florida can be a daunting endeavor without a solid understanding of the contractual foundation that underpins such transactions. At the heart of this process lies the Florida Real Estate Purchase Agreement form, a critical document that outlines the terms and conditions of the sale between a buyer and a seller. This form serves not only as a blueprint for the transaction but also as a binding legal contract that ensures both parties adhere to their commitments. Key aspects covered within the agreement include the identity of the parties involved, the description of the property being sold, the purchase price, contingencies that may affect the final sale, and the closure date, among other essential details. Understanding this form is imperative for anyone looking to engage in real estate transactions within the state, as it not only provides a structured outline for negotiations but also safeguards the interests of all parties involved. Recognizing its complexity and the important role it plays can help in making informed decisions, ultimately leading to a smoother and more secure real estate transaction.

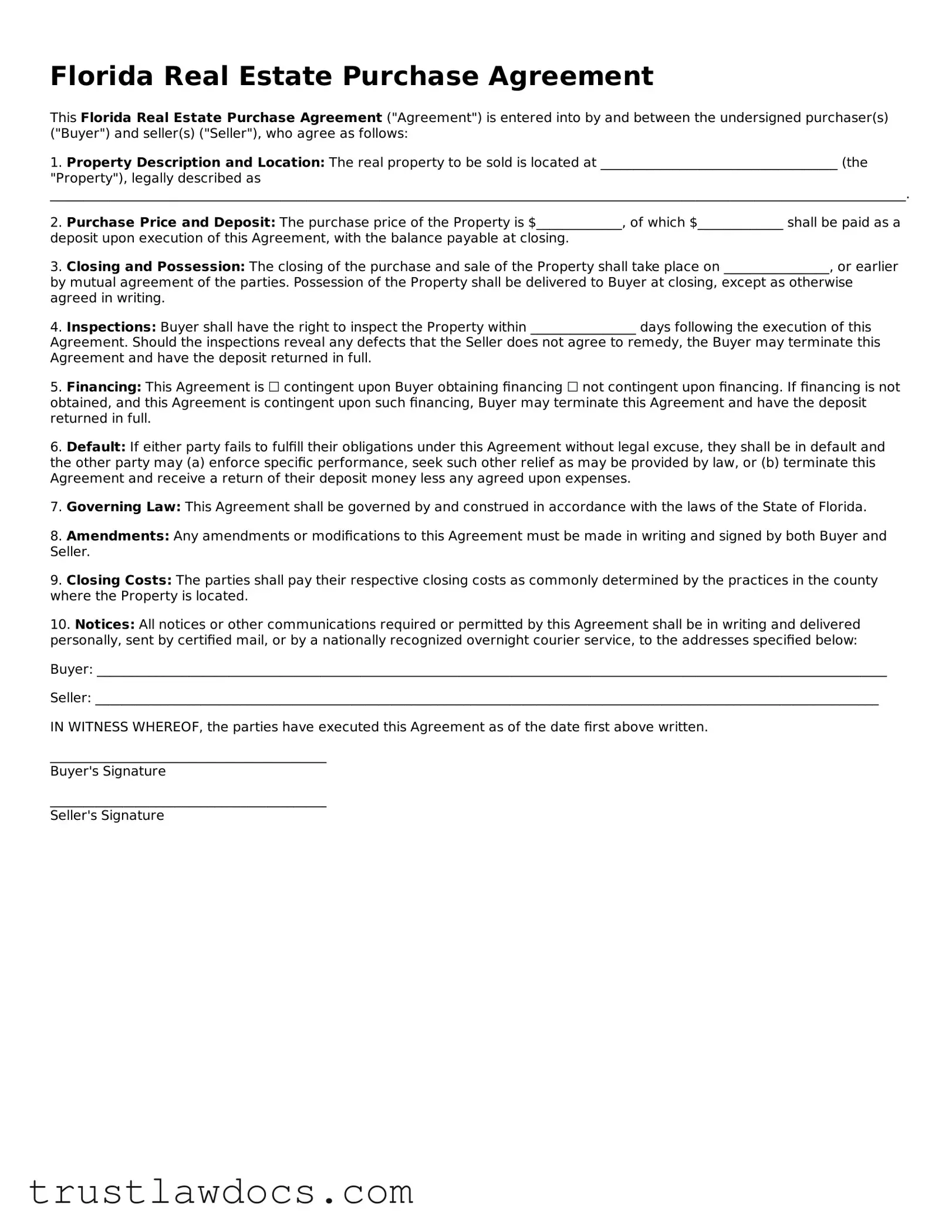

Form Example

Florida Real Estate Purchase Agreement

This Florida Real Estate Purchase Agreement ("Agreement") is entered into by and between the undersigned purchaser(s) ("Buyer") and seller(s) ("Seller"), who agree as follows:

1. Property Description and Location: The real property to be sold is located at ____________________________________ (the "Property"), legally described as __________________________________________________________________________________________________________________________________.

2. Purchase Price and Deposit: The purchase price of the Property is $_____________, of which $_____________ shall be paid as a deposit upon execution of this Agreement, with the balance payable at closing.

3. Closing and Possession: The closing of the purchase and sale of the Property shall take place on ________________, or earlier by mutual agreement of the parties. Possession of the Property shall be delivered to Buyer at closing, except as otherwise agreed in writing.

4. Inspections: Buyer shall have the right to inspect the Property within ________________ days following the execution of this Agreement. Should the inspections reveal any defects that the Seller does not agree to remedy, the Buyer may terminate this Agreement and have the deposit returned in full.

5. Financing: This Agreement is ☐ contingent upon Buyer obtaining financing ☐ not contingent upon financing. If financing is not obtained, and this Agreement is contingent upon such financing, Buyer may terminate this Agreement and have the deposit returned in full.

6. Default: If either party fails to fulfill their obligations under this Agreement without legal excuse, they shall be in default and the other party may (a) enforce specific performance, seek such other relief as may be provided by law, or (b) terminate this Agreement and receive a return of their deposit money less any agreed upon expenses.

7. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

8. Amendments: Any amendments or modifications to this Agreement must be made in writing and signed by both Buyer and Seller.

9. Closing Costs: The parties shall pay their respective closing costs as commonly determined by the practices in the county where the Property is located.

10. Notices: All notices or other communications required or permitted by this Agreement shall be in writing and delivered personally, sent by certified mail, or by a nationally recognized overnight courier service, to the addresses specified below:

Buyer: ________________________________________________________________________________________________________________________

Seller: _______________________________________________________________________________________________________________________

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

__________________________________________

Buyer's Signature

__________________________________________

Seller's Signature

PDF Form Details

| Fact Name | Description |

|---|---|

| Governing Law | Florida real estate transactions are governed by Florida state laws. |

| Form Requirement | A Florida Real Estate Purchase Agreement form is required to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Components of the Agreement | The form typically includes details like purchase price, property description, closing date, and contingencies. |

| Disclosure Requirements | Sellers are required to provide certain disclosures about the property's condition, such as the presence of lead-based paint or any known defects. |

| Contingencies | Common contingencies may include financing, inspection, and appraisal, allowing either party to back out under specific conditions. |

| Closing Date | The closing date is specified in the agreement, indicating when the title and keys will be transferred to the buyer. |

| Binding Agreement | Once signed by both parties, the agreement is legally binding, requiring both to comply with its terms. |

| Modification | Any changes to the agreement must be made in writing and signed by both parties to be effective. |

How to Write Florida Real Estate Purchase Agreement

Filling out a Florida Real Estate Purchase Agreement is an important step in the process of buying or selling a property in Florida. This form outlines the terms and conditions agreed upon by both parties. It's essential to provide accurate and thorough information to avoid any potential issues down the line. Below, you will find a step-by-step guide to help you complete this form properly.

- Start by entering the date of the agreement at the top of the form.

- Fill in the buyer's full name and current address in the designated section.

- Input the seller's full name and current address in the corresponding section.

- Describe the property being sold, including its legal description, address, and any additional details that identify the property uniquely.

- Enter the purchase price agreed upon by both the buyer and the seller.

- Specify the terms of the deposit, including the amount and the institution holding the deposit.

- Detail the financing arrangements, if applicable, including the type of loan, the amount, and the terms.

- List any contingencies that must be met before the sale can proceed, such as home inspections, financing approval, and the sale of the buyer's current home.

- Specify the closing date and location where the sale will be finalized.

- Outline any included or excluded personal property in the sale (e.g., appliances, light fixtures).

- State the allocations of closing costs between buyer and seller.

- Include any additional terms or agreements made between the buyer and the seller.

- Have both the buyer and seller sign and date the form to make it legally binding.

- If applicable, have a witness sign and date the form as well.

Once the Florida Real Estate Purchase Agreement is completed and signed by both parties, it will guide the next steps towards closing the transaction. Proper execution ensures that both the buyer and seller are clear on the terms of the sale, laying a solid foundation for a smooth transfer of property ownership. Remember, this is a legally binding document, and consulting a real estate attorney can provide further insight and assurance throughout the process.

Get Answers on Florida Real Estate Purchase Agreement

What is a Florida Real Estate Purchase Agreement?

A Florida Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of the purchase and sale of real estate property located within the state of Florida. This agreement is binding and details the rights and responsibilities of both the buyer and the seller, including the purchase price, property description, and closing details.

Who needs to sign the Florida Real Estate Purchase Agreement?

Both the buyer and the seller are required to sign the Florida Real Estate Purchase Agreement. Their signatures indicate that they understand and agree to the terms laid out in the document. It is not uncommon for real estate agents or attorneys representing each party to also sign the agreement, acknowledging their roles in the transaction.

What information is required in the Florida Real Estate Purchase Agreement?

Key information needed includes the legal description of the property, the purchase price, the names of the buyer and seller, the closing date, and any contingencies that must be met before the transaction can be completed. It should also detail any personal property that will be included or excluded in the sale.

Are there any contingencies that can be included in the agreement?

Yes, common contingencies include a satisfactory home inspection, the buyer securing financing, and the sale of the buyer's current home. Contingencies protect both the buyer and seller and provide a means to back out of the agreement under specific circumstances without facing legal consequences.

How is the closing date decided?

The closing date is mutually agreed upon by both the buyer and the seller and is specified in the Florida Real Estate Purchase Agreement. This is the date when the final transaction is completed, the title is transferred from the seller to the buyer, and the buyer typically takes possession of the property.

What happens if either the buyer or the seller breaches the agreement?

If either party fails to fulfill their obligations as outlined in the agreement, they may be considered in breach of the contract. Depending on the terms of the agreement and state laws, the injured party may seek remedies such as damages, specific performance (forcing the completion of the sale), or cancellation of the agreement.

Can amendments be made to the agreement after it has been signed?

Yes, if both the buyer and the seller agree to the changes. Any amendments to the agreement should be made in writing and signed by both parties, ensuring that they are legally binding.

Is a real estate agent required to complete the Florida Real Estate Purchase Agreement?

No, parties can enter into an agreement without the help of a real estate agent. However, considering the complexity of real estate transactions and the importance of ensuring that the agreement complies with all state laws, many choose to work with professionals.

Where can someone get a Florida Real Estate Purchase Agreement?

Florida Real Estate Purchase Agreements can be obtained from a real estate attorney, a licensed real estate agent, or through online legal document services. Ensure that any form used complies with Florida law and is up-to-date with current regulations.

Common mistakes

Filling out a Florida Real Estate Purchase Agreement form is a critical step in buying or selling property, but it's easy to slip up during this detail-oriented process. One common mistake is overlooking the full legal names of parties involved. Buyers and sellers sometimes use nicknames or incomplete names, which can lead to legal ambiguities and issues down the line. Ensuring that all parties' full legal names are accurately documented is essential for a clear and enforceable contract.

Another area where errors frequently occur is in the description of the property. This section requires meticulous attention to detail. A failure to include the complete and exact legal description of the property can create significant complications. It's not enough to list an address; the legal description from current property records must be used to avoid disputes about the property's boundaries or size.

Financial aspects also present a hotbed for mistakes. Many people inaccurately input the purchase price or fail to clearly outline the terms of the deposit, including how much will be deposited and when. Moreover, misunderstanding the allocation of closing costs between buyer and seller is a pervasive issue. Each party needs to know exactly what financial obligations they are responsible for to prevent unexpected expenses at closing.

Contingency clauses are yet another section ripe for errors. These clauses allow parties to back out of the contract under specific conditions, such as failing to secure financing or unsatisfactory home inspections. Often, individuals forget to include these crucial clauses or fail to specify the conditions clearly, putting themselves at risk of being locked into a purchase or sale without a clear exit strategy.

Incorrect dates and timelines are also a common source of mistakes. Deadlines for performing inspections, securing financing, and closing the deal need to be realistic and clearly defined. Ambiguities or unrealistic timelines can lead to missed deadlines, which could, in turn, jeopardize the transaction or result in financial penalties.

It's not uncommon for people to leave out necessary addenda and disclosures that accompany a real estate transaction. These documents provide important information about the property's condition and history, such as past repairs, existing damage, or issues with the title. Omitting these can lead to legal liabilities or disputes after the sale.

Signature issues also arise, where parties do not sign in the required places or fail to have the contract notarized if necessary. This oversight can invalidate the entire agreement, stalling the property transaction indefinitely.

Last but not least, skipping professional review is a mistake that can have far-reaching consequences. Professional legal advice ensures that the agreement is comprehensive, legally binding, and in the best interest of the party. Without this review, individuals may overlook or misinterpret terms, leading to avoidable legal challenges.

Documents used along the form

When navigating the process of buying or selling property in Florida, various documents are utilized in conjunction with the Florida Real Estate Purchase Agreement to ensure a smooth and legally compliant transaction. These forms and documents are critical in addressing specific aspects of the real estate transaction, from initial interest to the closing table. Each plays a pivotal role in protecting the interests of all parties involved, clarifying terms, and meeting state requirements.

- Residential Property Disclosure Form: This document provides buyers with vital information about the property's condition, including any known defects or problems that could affect the property’s value or desirability. It serves to inform the buyer and reduce the seller's liability for nondisclosure.

- Title Insurance Commitment: A title insurance commitment offers details on the property’s title status, revealing any encumbrances, liens, or issues that need resolution before transferring ownership. It guarantees clear title to the buyer.

- Loan Estimate and Closing Disclosure: Required for most real estate transactions involving a mortgage, these documents outline the loan terms, estimated payments, closing costs, and other financial details associated with the mortgage loan.

- Home Inspection Report: Completed by a professional home inspector, this report outlines the condition of the property, including the structural aspects and systems (e.g., HVAC, plumbing, electrical), and identifies any repairs or maintenance that may be necessary.

- Survey: A property survey delineates the boundaries, dimensions, and location of a property, highlighting any easements, encroachments, or other issues that could impact ownership rights or use of the property.

- Flood Zone Determination: This document specifies whether the property is located in a flood zone, impacting insurance requirements and potential risk factors for flooding.

- Closing Disclosure: This form provides a detailed account of all financial aspects of the transaction, including the final closing costs, and confirms the loan terms. Prepared by the lender for the buyer, it's critical for ensuring the accuracy of the transaction's financial details.

Together, these documents form a comprehensive framework supporting the Florida Real Estate Purchase Agreement, ensuring both buyers and sellers are well-informed and protected throughout the transaction. Each document facilitates a particular aspect of the transaction, from financial arrangements and property details to legal compliance and risk management. Understanding their significance and role in the context of a real estate transaction is essential for a successful property transfer.

Similar forms

A Residential Lease Agreement shares similarities with the Florida Real Estate Purchase Agreement as both set forth conditions under which property is to be occupied. The primary difference lies in the nature of the occupation: the purchase agreement culminates in transferring ownership from the seller to the buyer, while a lease agreement grants the lessee the right to occupy the property for a specified rental period without transferring ownership. Both documents detail legal descriptions of the property, parties' information, and obligations like payment terms, but their ultimate purposes diverge significantly.

The Bill of Sale is akin to the Real Estate Purchase Agreement in that they are both involved in the transfer of ownership, but they cater to different types of property. A Real Estate Purchase Agreement is concerned specifically with the transaction of real property, meaning land and anything permanently attached to it. Conversely, a Bill of Sale is used for moving property, like vehicles and appliances, specifying the item being sold, the sale price, and the parties to the transaction. Despite these differences, both serve as pivotal legal evidence of a transfer in ownership.

Loan Agreements and the Florida Real Estate Purchase Agreement share the fundamental principle of documenting the terms of a financial arrangement. In a Real Estate Purchase Agreement, part of the terms often includes financing details if the buyer is not paying the full price upfront. Similarly, a Loan Agreement outlines the loan amount, interest rate, repayment schedule, and security/collateral involved, which, in many real estate transactions, is the property itself. Both documents are crucial for ensuring the terms are clear, preventing disputes over misunderstandings of financial responsibilities.

Easement Agreements bear resemblance to Real Estate Purchase Agreements because they both deal with rights to use property. However, an Easement Agreement grants a non-owning party the right to use the property of another for a specific purpose, such as laying utility lines or accessing a road, without transferring any portion of the ownership title. In contrast, a Real Estate Purchase Agreement transfers the property's title from seller to buyer. Both documents must clearly define the property in question and the rights or interests being transferred or granted.

Property Deeds and Real Estate Purchase Agreements are closely related in their involvement with the transfer of real estate ownership. The purchase agreement outlines the terms and conditions under which the sale will occur, while the deed is the actual legal document that conveys the property from the seller to the buyer. Deeds contain descriptions of the property and must be formally executed and recorded to be effective. Though functioning at different stages of the transaction, both documents are essential to the legal transfer of property.

Home Inspection Reports, while not contractual agreements like a Real Estate Purchase Agreement, play a critical role in the real estate transaction process. These reports provide a detailed account of a property's condition, identifying any issues that might impact the sale or purchase price. This information can lead to renegotiations of the terms outlined in the Real Estate Purchase Agreement, such as adjustments to the purchase price or specific conditions to be met before finalizing the sale. Both documents are indispensable for an informed decision-making process on the part of the buyer and seller.

Finally, Homeowners Association (HOA) Agreements might resemble aspects of a Real Estate Purchase Agreement when purchasing property within an HOA-governed community. These agreements outline the covenants, conditions, and restrictions (CC&Rs) of living in such communities, including fees and assessments, use restrictions, and maintenance obligations that will affect the new owner. While the Real Estate Purchase Agreement facilitates the transfer of ownership between buyer and seller, the HOA Agreement introduces another layer of conditions related to property use and community living that the new owner must agree to.

Dos and Don'ts

Filling out a Florida Real Estate Purchase Agreement form is a crucial step in the process of buying or selling property. To ensure everything goes smoothly, it's important to pay attention to detail and avoid common errors. Here's a list of dos and don'ts that can help guide you through the process:

- Do review the entire form before filling it out to ensure you understand all the requirements and sections.

- Do fill out the form accurately, providing detailed information where required to avoid any misunderstandings.

- Do double-check the legal description of the property, including the lot and block number, to ensure it matches the title and other legal documents.

- Do include all relevant addenda or disclosures that are necessary for the property in question, such as lead-based paint disclosures for older homes.

- Do not leave any fields blank; if a section does not apply, indicate this with "N/A" (not applicable) to show that you didn't overlook the section.

- Do not guess on any information. If you're unsure about specific details, such as the exact square footage of the home, verify the information before entering it.

- Do not sign the form without reviewing it thoroughly. Mistakes or omissions can lead to disputes or complications down the line.

- Do not forget to keep a copy of the completed form for your records and provide a copy to the other party involved in the transaction.

By following these guidelines, you can help ensure the real estate transaction proceeds more smoothly and reduce the potential for legal issues or misunderstandings. Remember, the Florida Real Estate Purchase Agreement is a legally binding document, so it's critical to handle it with care and precision.

Misconceptions

When navigating the complexities of purchasing real estate in Florida, people often come across a number of misconceptions about the Real Estate Purchase Agreement form. Understanding the truth behind these misconceptions is crucial for both buyers and sellers to make informed decisions and ensure a smooth transaction. Here are six common misunderstandings:

It's Just a Standard Form: Many believe the Florida Real Estate Purchase Agreement is a simple, one-size-fits-all document. In reality, while it does follow a standard format, it's highly customizable. Parties can negotiate terms and include specific provisions that cater to the unique aspects of the transaction.

Attorney Review Isn't Necessary: Some think that completing the form doesn't require a legal professional's review, given its standardized nature. However, having an attorney review the document ensures that rights are protected, obligations are clearly defined, and any local legal requirements are met.

Verbal Agreements Suffice: A common misconception is that verbal agreements made during the negotiation process are enforceable. However, for real estate transactions in Florida, the statute of frauds requires that all agreements pertaining to the sale of real property be in writing and signed by both parties to be legally binding.

The Form Covers Everything: People often believe that the Florida Real Estate Purchase Agreement covers every aspect of the sale, including detailed arrangements about property inspections and financing. While it provides a comprehensive framework, certain specifics may need to be outlined in supplemental documents or addendums.

It Determines Closing Costs: Another misconception is that the agreement dictates who is responsible for closing costs. Although the form can specify who covers these costs, the actual distribution of expenses is typically a matter of negotiation between the buyer and seller and can vary greatly from one transaction to another.

Modifications After Signing Are Not Allowed: Many are under the impression that once the Florida Real Estate Purchase Agreement is signed, no changes can be made. In fact, parties can modify the agreement at any point prior to closing, provided both parties agree to the changes in writing.

Understanding the intricacies of the Florida Real Estate Purchase Agreement is essential. Misconceptions can lead to unexpected outcomes. Buyers and sellers are encouraged to conduct thorough due diligence and seek professional advice when navigating this crucial step of the real estate transaction process.

Key takeaways

When embarking on the exciting journey of buying or selling property in Florida, the Real Estate Purchase Agreement form plays a pivotal role. This important document outlines the terms and conditions of the sale, ensuring both parties are clear on the agreement. To navigate this process with confidence, here are nine key takeaways you need to know:

- Understanding the form is paramount. The Florida Real Estate Purchase Agreement is a legally binding contract between the buyer and seller. It includes specifics about the purchase price, closing date, and other crucial transaction details.

- Accuracy is key. When filling out the form, make sure all the information is correct and complete. Mistakes or omissions could delay the process or, worse, jeopardize the sale.

- Legal descriptions are important. The form requires a detailed legal description of the property, not just the address. This often includes lot numbers, subdivision names, and measurements, which can usually be found on the property deed.

- Funding the purchase. The agreement should specify how the purchase will be financed. Whether it's through a mortgage, cash, or another method, outlining the financing confirms that the buyer has the means to complete the transaction.

- Inspection contingencies matter. Buyers often include inspection contingencies in their offer. This gives them the right to have the property inspected within a certain period. If significant issues are found, the buyer can renegotiate or back out of the sale.

- Closing costs and who pays them. The agreement should outline which closing costs are the responsibility of the buyer and which are the responsibility of the seller. This can include things like title searches, taxes, and agent commissions.

- Disclosures are a must. Sellers are required to disclose any known defects about the property. These disclosures should be attached to the agreement and acknowledged by both parties.

- Deadlines are critical. Every step of the buying and selling process is time-sensitive. The agreement will specify deadlines for everything from inspections to loan approvals and closing. Adhering to these timelines ensures a smoother transaction.

- The closing date. This is the day the transaction is officially completed, the title is transferred from the seller to the buyer, and the buyer takes possession of the property. Both parties should agree on a closing date that is realistic considering the financing and inspection contingencies.

Adhering to these key takeaways when filling out and using the Florida Real Estate Purchase Agreement will help streamline the buying or selling process, making it as smooth and stress-free as possible. Remember, this form is not just a procedural step but a critical component that protects both parties throughout the transaction. Seeking advice from a real estate professional or legal advisor is always a wise move to ensure everything is in order.

Popular Real Estate Purchase Agreement State Forms

Home Purchase Contract - The inclusion of a jurisdiction clause determines which state's laws will govern the interpretation and enforcement of the agreement, adding an extra layer of legal clarity.

Real Estate Sales Agreement - A Real Estate Purchase Agreement is a legally binding contract between a buyer and seller outlining the sale of property.

For Sale by Owner Purchase Agreement Pdf Michigan - It also addresses the transfer of title, ensuring the seller has the right to sell the property, and specifies how the title will be conveyed.

Purchasing Agreements - Proper execution of this agreement streamlines the closing process, making it easier for both parties to fulfill their obligations.