Free Real Estate Purchase Agreement Form for California

Entering into a real estate transaction in California marks a significant milestone, whether you're buying your first home, investing in property, or selling a cherished family residence. At the heart of these transactions lies the California Real Estate Purchase Agreement form, a critically important document that outlines the terms and conditions agreed upon by both the buyer and seller. This comprehensive form serves not only as a record of the sale but also as a roadmap through the intricate landscape of real estate transactions within the state. It covers a wide range of essential details, including the purchase price, property description, closing and possession dates, contingencies, and disclosures that both parties must adhere to. As such, understanding each element of the form is imperative for anyone looking to navigate the complexities of buying or selling property in California. The form's inherent detail ensures that both parties are well-informed and protected throughout the transaction process, thereby minimizing potential disputes and fostering a smoother transition of property ownership.

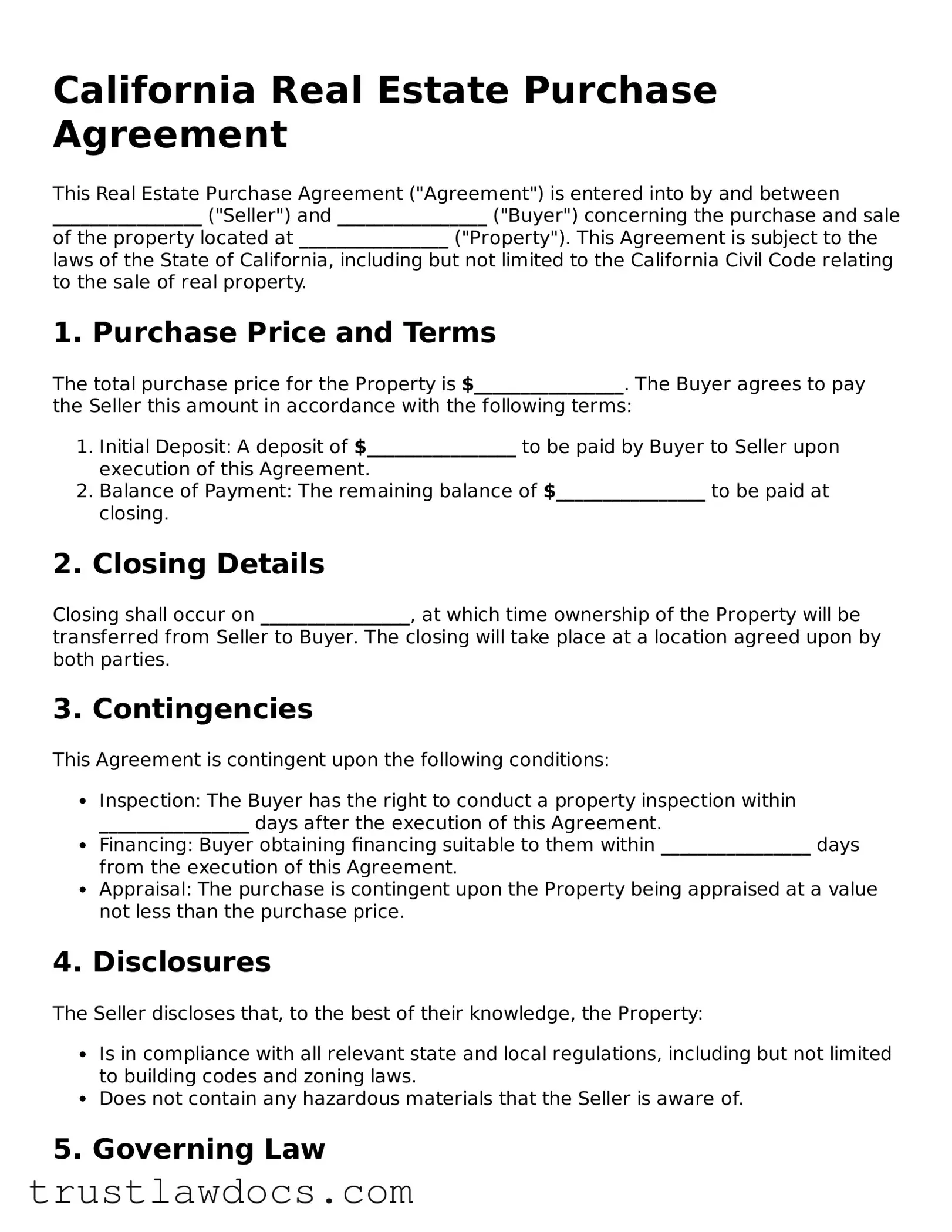

Form Example

California Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between ________________ ("Seller") and ________________ ("Buyer") concerning the purchase and sale of the property located at ________________ ("Property"). This Agreement is subject to the laws of the State of California, including but not limited to the California Civil Code relating to the sale of real property.

1. Purchase Price and Terms

The total purchase price for the Property is $________________. The Buyer agrees to pay the Seller this amount in accordance with the following terms:

- Initial Deposit: A deposit of $________________ to be paid by Buyer to Seller upon execution of this Agreement.

- Balance of Payment: The remaining balance of $________________ to be paid at closing.

2. Closing Details

Closing shall occur on ________________, at which time ownership of the Property will be transferred from Seller to Buyer. The closing will take place at a location agreed upon by both parties.

3. Contingencies

This Agreement is contingent upon the following conditions:

- Inspection: The Buyer has the right to conduct a property inspection within ________________ days after the execution of this Agreement.

- Financing: Buyer obtaining financing suitable to them within ________________ days from the execution of this Agreement.

- Appraisal: The purchase is contingent upon the Property being appraised at a value not less than the purchase price.

4. Disclosures

The Seller discloses that, to the best of their knowledge, the Property:

- Is in compliance with all relevant state and local regulations, including but not limited to building codes and zoning laws.

- Does not contain any hazardous materials that the Seller is aware of.

5. Governing Law

This Agreement shall be governed by and interpreted in accordance with the laws of the State of California. Any disputes arising from this Agreement shall be resolved in the courts of the State of California.

6. Signatures

By signing below, both Seller and Buyer indicate their agreement to all terms and conditions outlined in this Real Estate Purchase Agreement.

Seller's Signature: ________________ Date: ________________

Buyer's Signature: ________________ Date: ________________

PDF Form Details

| Fact Name | Detail |

|---|---|

| Governing Law | The California Real Estate Purchase Agreement is governed by California's general real estate laws, but more specifically, the provisions set out in the California Civil Code. |

| Required Disclosures | In California, sellers are required to provide specific disclosures about the property's condition, including any environmental hazards, structural problems, or other material defects. |

| Use of Form | This form is used exclusively for real estate transactions within the state of California and is tailored to meet its specific regulatory requirements. |

| Contingencies | The agreement allows for various contingencies, including financing, inspection, and appraisal, which must be met before the sale can proceed. |

| Closing Process | In California, the closing process involves the transfer of property title from the seller to the buyer, the disbursement of funds, and the recording of the deed, typically facilitated by a neutral third party or escrow company. |

How to Write California Real Estate Purchase Agreement

Once an agreement is reached between a buyer and seller on the purchase of real estate in California, it's essential to document the transaction with a California Real Estate Purchase Agreement form. This legal document outlines the terms and conditions of the sale, ensuring both parties understand their obligations. Filling out this form accurately is crucial for the legality of the agreement and to prevent future disputes. The steps listed below will guide you through the process of completing the form correctly.

- Start by entering the full names and contact information of both the buyer and seller at the top of the form.

- Describe the property being sold, including its address, legal description, and any personal property included in the sale.

- Fill in the purchase price agreed upon by both parties in the designated section.

- Detail the terms of the payment, including any deposit amount, financing details, and closing costs responsibilities.

- Specify any contingencies that must be met before the sale can proceed, such as inspections, approvals, or the sale of another property.

- Outline the timeline for the sale, including the offer date, acceptance date, and expected closing date.

- Include any additional terms or conditions that are part of the agreement, such as seller concessions or fixtures and appliances included in the sale.

- Review the entire form for accuracy and completeness. Make sure both parties understand their obligations under the agreement.

- Have both the buyer and seller sign and date the form in the presence of a notary public to validate the agreement.

- Retain a copy of the signed agreement for both the buyer's and seller's records and proceed with fulfilling any contingencies and preparing for the closing date.

Completing the California Real Estate Purchase Agreement form accurately is a critical step in the home buying process. This document serves as the legal foundation of the sale, detailing every aspect of the transaction. It ensures clarity and understanding for both parties involved, paving the way for a smooth transition of property ownership. Once filled out and signed, it's important to adhere to the terms set forth and work towards closing the sale as outlined in the agreement.

Get Answers on California Real Estate Purchase Agreement

What is a California Real Estate Purchase Agreement form?

A California Real Estate Purchase Agreement form is a legally-binding document used when someone is buying or selling property in California. This form outlines the terms of the deal, including the sale price, closing date, and any conditions that need to be met before the deal is finalized.

Who needs to sign the California Real Estate Purchase Agreement?

The buyer(s) and the seller(s) of the property must sign the California Real Estate Purchase Agreement. If either party has agents representing them, the agents might also sign the agreement, acknowledging their participation in the transaction.

Are there any specific disclosures that need to be attached to the Purchase Agreement in California?

Yes, California law requires certain disclosures to be made during the sale of residential property. These can include the Natural Hazard Disclosure Statement, Lead-Based Paint Disclosure, and others relevant to the specific property being sold. These disclosures provide important information to the buyer and are a mandatory part of the real estate transaction process.

What happens if either the buyer or seller backs out of the agreement?

If the buyer or seller backs out of the agreement without a justified reason outlined in the contract (such as not meeting a contingency), they could face legal and financial consequences. The specifics depend on the terms of the agreement, including any penalties or the forfeiture of the deposit.

How is the purchase price determined in the agreement?

The purchase price is usually determined through negotiations between the buyer and the seller prior to finalizing the California Real Estate Purchase Agreement. The agreed-upon amount is then clearly stated in the contract.

Is it necessary to have a real estate lawyer review the California Real Estate Purchase Agreement?

While it's not legally required to have a lawyer review your California Real Estate Purchase Agreement, it's highly recommended. A real estate lawyer can provide valuable insights, ensure the agreement complies with all state laws, and help navigate any complex legal issues that may arise.

What are the consequences of not fulfilling the terms of the Purchase Agreement?

Not fulfilling the terms of the Purchase Agreement can lead to a breach of contract, resulting in legal action. The offending party may be required to pay damages, complete the terms of the sale, or face other penalties as determined by a court.

Common mistakes

When engaging in the process of buying or selling property in California, filling out the Real Estate Purchase Agreement form is a critical step. Mistakes made during this key phase can lead to unnecessary delays, legal complications, or even the deal falling through. One common error is neglecting to thoroughly review all the details. Ensuring that names, addresses, and other basic information are accurate is fundamental but often overlooked. Such seemingly minor oversights can cause significant hindrances down the line.

Another frequent mistake involves misunderstanding legal terms and conditions. The language used in real estate contracts can be complex, making it easy for individuals without legal expertise to misinterpret the obligations and rights assigned to them by the agreement. This misunderstanding can lead to disputes and dissatisfaction with the terms of the deal, sometimes after it is too late to make changes.

Many also fail to specify contingencies clearly. Contingencies such as financing, home inspections, and the sale of a current home can all affect the progression of a sale. If these conditions are not clearly outlined and agreed upon by all parties in the agreement, it can lead to confusion and conflict, potentially derailing the sale entirely.

Forgetting to include all necessary addenda and disclosures is another common pitfall. California law requires the disclosure of specific information about the property's condition and other factors that could influence the buyer's decision. Failure to include these disclosures can lead to legal consequences and the buyer might have grounds to cancel the sale.

Being vague about the closing date and possession terms is another oversight that often occurs. The agreement should specify a clear timeline for the closing process and detail when the buyer can take possession of the property. Vagueness in this area can cause scheduling conflicts and unnecessary stress for both parties.

Incorrectly handling the earnest money deposit can also create issues. This deposit demonstrates the buyer's good faith and interest in proceeding with the purchase. The agreement should outline how this deposit is handled, including the conditions under which it is refundable or can be retained by the seller. Lack of clarity here can lead to disputes over the deposit should the sale not proceed as planned.

Overlooking the need for professional advice is a misstep that can result in these and other mistakes. While it's possible to fill out the Real Estate Purchase Agreement on one's own, consulting with a real estate professional or legal advisor can help prevent errors and ensure that the agreement accurately reflects the wishes and intentions of the parties involved.

Finally, procrastinating on the submission or review of the agreement can be a critical error. Timely action is often essential in real estate transactions. Delays in completing, reviewing, or submitting the agreement can cause missed opportunities or give the other party the impression of disinterest or unreliability.

In conclusion, while filling out the Real Estate Purchase Agreement in California might seem straightforward, attention to detail and an understanding of the document's legal implications are crucial. Avoiding these common mistakes can help ensure a smoother transaction for all parties involved.

Documents used along the form

Buying or selling a home in California is a process that includes a number of forms and documents in addition to the Real Estate Purchase Agreement. This essential document lays the foundation for the transaction, outlining the terms, price, and contingencies related to the purchase. However, to ensure that all aspects of the property's condition, the buyer's financing, and legal compliance are addressed, several other documents are commonly required. Here are four key forms that often accompany the Real Estate Purchase Agreement in California.

- Disclosures: Sellers must provide buyers with various disclosures about the property's condition, known defects, and any material facts that could affect the property's value or desirability. These can include natural hazards, the presence of lead-based paint, and any deaths on the property within the last three years.

- Contingency Removal Form: This document is used by the buyer to remove contingencies from the agreement, signifying they are satisfied with the condition of the property, the financing has been secured, and any other conditions outlined in the purchase agreement have been met.

- Title Report: A title report provides detailed information about the property's title, including ownership history, any liens or encumbrances on the property, and any easements or restrictions. It's crucial for ensuring the buyer is receiving a clear title.

- Loan Documents: If the purchase is being financed, the buyer will need to complete several loan documents as part of the process. These include the loan application, a loan estimate detailing the terms and costs of the borrower's loan, and eventually the final closing disclosure.

In addition to the Real Estate Purchase Agreement, these documents collectively ensure both parties are well-informed, protected, and legally compliant throughout the transaction. Whether you're buying or selling, understanding the purpose and requirements of each document can help streamline the process, ensuring a smoother path to closing. Remember, reviewing these documents with a real estate professional or legal advisor can provide valuable insight and ensure that your interests are fully protected.

Similar forms

The Residential Lease Agreement shares similarities with the California Real Estate Purchase Agreement, essentially also being a legally binding contract between two parties. However, instead of outlining terms for buying and selling property, it details the agreements between a landlord and tenant for the rental of residential property. Both documents are designed to clarify the rights and responsibilities of each party involved, such as payment schedules, maintenance obligations, and other terms specific to the occupancy or ownership of the property.

A Bill of Sale is another document that bears resemblance to the California Real Estate Purchase Agreement, primarily because it serves as a record of a transaction between a buyer and a seller. While a Bill of Sale typically pertains to personal property, such as vehicles or equipment, and the Real Estate Purchase Agreement deals with real property, both documents function to establish the terms of the sale, identify the parties involved, document the transfer of ownership, and outline any warranties or representations.

The Loan Agreement has commonalities with the California Real Estate Purchase Agreement in that it involves terms agreed upon by two parties regarding a large financial transaction. A Loan Agreement specifies the conditions under which one party lends money to another, including repayment schedule, interest rates, and collateral, if any. This is akin to the Real Estate Purchase Agreement specifying the purchase price, financing terms, and contingencies that must be met before the sale of property is finalized. Both are crucial in ensuring that each party understands their commitments and the consequences of failing to meet them.

Lastly, the Property Management Agreement is related to the California Real Estate Purchase Agreement through their focus on real property transactions. However, the Property Management Agreement is contracted between a property owner and a company or individual hired to manage that property on the owner's behalf. It outlines responsibilities concerning the upkeep, leasing, and tenant interactions of a property, ensuring it remains valuable and compliant with housing regulations. While the Real Estate Purchase Agreement facilitates the change of ownership, the Property Management Agreement ensures the property is well-cared for post-acquisition. Both agreements are essential for the maintenance of property value and legal compliance.

Dos and Don'ts

When you're filling out the California Real Estate Purchase Agreement form, it's essential to pay attention to detail and approach the task with care. This document is a legally binding contract regarding the sale of real estate, so both accuracy and completeness are vital. To help you navigate through, here are five do's and don'ts to keep in mind.

Do:Ensure all information is accurate: Double-check dates, names, property details, and figures. Mistakes can lead to delays or legal issues.

Use clear and concise language: Avoid ambiguity to ensure that all parties have the same understanding of the agreement's terms.

Include all relevant parties: Make sure that anyone with a legal interest in the property is named in the agreement.

Review the contingencies carefully: Understand the conditions that must be met for the transaction to proceed, such as inspections, financing, and appraisals.

Seek legal advice if needed: Don't hesitate to consult with a real estate attorney to clarify any portion of the agreement or to ensure it meets all legal requirements.

Leave any sections blank: If a section does not apply, mark it as N/A. Empty fields can cause confusion or misunderstandings.

Sign without reading: Take the time to read every part of the agreement before you sign to ensure it accurately reflects your understanding and agreement.

Forget to specify fixtures and fittings: Clearly define what will be included with the sale of the property (e.g., appliances, lighting fixtures).

Rush the process: Allow yourself and the other party ample time to review the document. Rushing can lead to oversights.

Ignore amendments: If changes are made, ensure they are documented and initialed by all parties. Verbal agreements should be formalized in writing.

Misconceptions

When it comes to buying or selling property in California, the Real Estate Purchase Agreement (REPA) is a crucial document. However, there are several misconceptions about its content and purpose. Let's clarify some of these misconceptions to ensure buyers and sellers are well-informed.

It's just a formality: Many people mistakenly believe that the REPA is a simple formality, resembling more of a checkbox process rather than a binding agreement. In truth, the REPA is a legally binding contract that outlines the terms and conditions of the property sale, including obligations, rights, and remedies of both parties involved. Understanding every component is essential before signing.

It's standard and non-negotiable: Another misconception is that the REPA form is standard and leaves no room for negotiation. Contrary to this belief, many aspects of the agreement, such as price, closing dates, contingencies, and more, can be negotiated by the parties involved. Both buyers and sellers have the opportunity to propose adjustments until a mutual agreement is reached.

It only concerns the price: While the price of the property is a significant aspect, the REPA covers much more. It includes terms related to financing, inspections, disclosures, and other contingencies that protect both parties. Overlooking these elements can lead to unforeseen complications later in the transaction process.

All REPA forms are the same: Some individuals believe all REPAs in California are identical. However, the specifics of the agreement can vary significantly depending on the property type, location, and other factors. It's critical to work with a real estate professional who understands these subtleties and can tailor the REPA to fit the specific transaction.

Cancellation is simple and without consequence: Lastly, there's a misconception that either party can easily cancel the agreement without facing any repercussions. In reality, the REPA includes specific provisions related to cancellation, earnest money deposits, and potential legal actions. Cancelling an agreement without a legitimate reason outlined in the contingencies can be costly for the party initiating the cancellation.

Understanding the importance and complexity of the California Real Estate Purchase Agreement is crucial for anyone involved in buying or selling property. By dispelling these misconceptions, parties can approach real estate transactions with more confidence and clarity.

Key takeaways

Filling out the California Real Estate Purchase Agreement form is a critical step in buying or selling property in the state. This document outlines the terms and conditions of the sale, making it legally binding once signed by both parties. Understanding the nuances of this form can help ensure a smooth transaction. Here are key takeaways to keep in mind:

- Accuracy Is Crucial: Make sure all the information provided in the form is accurate. Errors or omissions can delay the process or lead to disputes.

- Legal Names Must Be Used: All parties involved need to use their full legal names to avoid any confusion or legal issues down the line.

- Understand the Terms: Familiarize yourself with the terms of the agreement, such as sale price, closing date, and contingencies. This understanding can prevent misunderstandings.

- Contingencies Matter: Pay special attention to the contingencies listed, such as home inspections, financing, and appraisals. These conditions protect both the buyer and seller and outline circumstances under which the contract can be terminated.

- Review Disclosure Requirements: The state of California has specific disclosure requirements that sellers must meet. Ensure these are clearly outlined and understood by both parties.

- Signatures Are Binding: Once all parties have signed the agreement, it becomes a legally binding document. Ensure that you are fully willing and able to meet the terms before signing.

- Seek Legal Advice If Needed: Considering the complexity and importance of the agreement, consulting with a legal professional before finalizing the document can provide valuable peace of mind.

- Follow Through With Obligations: After the agreement is signed, both buyer and seller must fulfill their respective obligations (such as making deposits, completing inspections, and securing financing) to move forward with the sale.

Understanding and correctly filling out the California Real Estate Purchase Agreement form is fundamental for a successful real estate transaction. Keeping these key points in mind can help navigate the process smoothly and efficiently.

Popular Real Estate Purchase Agreement State Forms

For Sale by Owner Purchase Agreement Pdf Michigan - Such an agreement serves as a roadmap for the transaction, guiding both parties from the initial offer to the final closing.

House for Sale Contract - By providing a legal basis for the transaction, this document facilitates a smooth transfer of property and helps avoid legal disputes.

Purchasing Agreements - It also spells out the earnest money deposit amount and the conditions under which it may be retained or refunded.

Home Purchase Contract - It functions as a record of the transaction, providing a historical document that can be referenced for future needs, such as tax purposes or legal review.