Official Appraisal Contingency Addendum Document

In the journey of purchasing a home, numerous forms and agreements come into play, each significant in its own right. Among them, the Appraisal Contingency Addendum stands out as a critical document designed to protect the buyer's interests. This addendum is specifically tailored to ensure that the property's appraised value meets or exceeds the agreed-upon purchase price. If the appraised value falls short, it provides a legal framework allowing the buyer to renegotiate the price or, in some cases, withdraw from the purchase agreement without penalty. Furthermore, it outlines the time frames within which the appraisal must be completed, setting clear expectations for all parties involved. The inclusion of such a contingency is a proactive step towards securing a fair deal, safeguarding buyers from overpaying and lenders from over-lending. It is a testament to the intricate balance of interests that real estate transactions must navigate, emphasizing the importance of being informed and prepared in such significant investments.

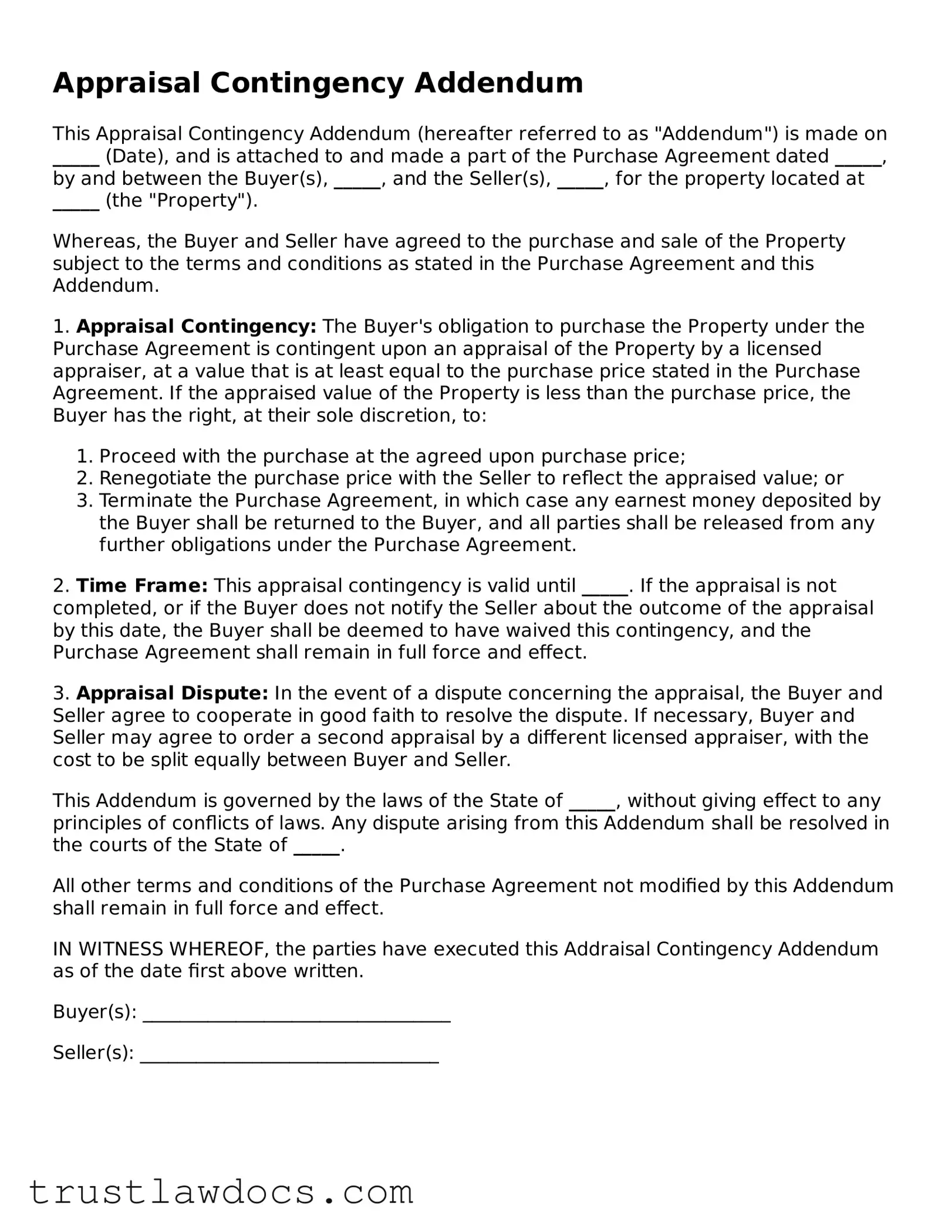

Form Example

Appraisal Contingency Addendum

This Appraisal Contingency Addendum (hereafter referred to as "Addendum") is made on _____ (Date), and is attached to and made a part of the Purchase Agreement dated _____, by and between the Buyer(s), _____, and the Seller(s), _____, for the property located at _____ (the "Property").

Whereas, the Buyer and Seller have agreed to the purchase and sale of the Property subject to the terms and conditions as stated in the Purchase Agreement and this Addendum.

1. Appraisal Contingency: The Buyer's obligation to purchase the Property under the Purchase Agreement is contingent upon an appraisal of the Property by a licensed appraiser, at a value that is at least equal to the purchase price stated in the Purchase Agreement. If the appraised value of the Property is less than the purchase price, the Buyer has the right, at their sole discretion, to:

- Proceed with the purchase at the agreed upon purchase price;

- Renegotiate the purchase price with the Seller to reflect the appraised value; or

- Terminate the Purchase Agreement, in which case any earnest money deposited by the Buyer shall be returned to the Buyer, and all parties shall be released from any further obligations under the Purchase Agreement.

2. Time Frame: This appraisal contingency is valid until _____. If the appraisal is not completed, or if the Buyer does not notify the Seller about the outcome of the appraisal by this date, the Buyer shall be deemed to have waived this contingency, and the Purchase Agreement shall remain in full force and effect.

3. Appraisal Dispute: In the event of a dispute concerning the appraisal, the Buyer and Seller agree to cooperate in good faith to resolve the dispute. If necessary, Buyer and Seller may agree to order a second appraisal by a different licensed appraiser, with the cost to be split equally between Buyer and Seller.

This Addendum is governed by the laws of the State of _____, without giving effect to any principles of conflicts of laws. Any dispute arising from this Addendum shall be resolved in the courts of the State of _____.

All other terms and conditions of the Purchase Agreement not modified by this Addendum shall remain in full force and effect.

IN WITNESS WHEREOF, the parties have executed this Addraisal Contingency Addendum as of the date first above written.

Buyer(s): _________________________________

Seller(s): ________________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | An appraisal contingency addendum is a clause in a real estate contract that makes the purchase contingent upon the results of an appraisal. |

| Purpose | It protects the buyer by ensuring the property is valued at a minimum specified amount, which usually matches or exceeds the purchase price. |

| Common Use | Typically used in real estate transactions to secure a loan from a mortgage lender. |

| Executing Parties | Entered into by the buyer and seller of a property, often as part of a broader real estate sales agreement. |

| Time Frame | The clause specifies a timeframe within which the appraisal must be conducted and reported. |

| Failure to Meet Terms | If the appraised value is less than the specified amount, the buyer may renegotiate the price or withdraw from the contract without penalty. |

| Governing Law | Varies by state, as real estate law is generally state-specific. The form could reference particular statutes or codes relevant to the jurisdiction of the property. |

| Importance of Accurate Completion | Crucial for ensuring the terms are enforceable and reflective of both parties' understanding and agreement. Errors or omissions can lead to legal disputes. |

How to Write Appraisal Contingency Addendum

Once you've found your dream home and your offer has been accepted, one of the next steps is making sure the home is valued at a price that matches what you're paying. An Appraisal Contingency Addendum can be a critical part of your real estate contract. It basically says that the purchase is contingent upon the property being appraised at the sale price or higher. This step is about protecting your investment and ensuring you're making a wise decision. While the form may seem daunting at first, filling it out is straightforward if you follow these steps.

- Start by entering the date at the top of the form. This should be the current date when you are filling out the addendum.

- Next, write the full names of the buyer(s) and seller(s) in the respective fields, making sure to include all parties involved in the purchase agreement.

- Fill in the property address, including city, state, and zip code, to specify the location of the subject property.

- Enter the agreed-upon sale price of the property in the space provided. This should match the amount in the original purchase agreement.

- Specify the deadline for the appraisal to be completed. This is typically a number of days from the effective date of the contract.

- Enter the minimum acceptable appraisal value. Usually, this is the same as the sale price but can vary based on negotiation between buyer and seller.

- Detail the steps to be taken if the appraisal comes in below the minimum acceptable value. This can include renegotiation of the sale price, additional cash payment from the buyer, or the option for the buyer to back out of the deal.

- Both the buyer and the seller must sign and date the bottom of the form, indicating their agreement to the terms specified in the addendum.

- If applicable, have the real estate agents representing both the buyer and the seller sign and date the form as well.

After you've filled out the Appraisal Contingency Addendum, it becomes a part of your purchase agreement. This document will guide the next steps in your home buying process. If the appraisal is at or above the specified value, the transaction continues as planned. If it's not, the steps outlined in the addendum will come into play. Remember, this form is here to protect you and ensure the property you're buying is worth the price. If you have any questions or uncertainties, don't hesitate to seek assistance from a real estate professional or legal advisor.

Get Answers on Appraisal Contingency Addendum

What is an Appraisal Contingency Addendum?

An Appraisal Contingency Addendum is a document added to a real estate purchase agreement. It states that the buying of the property is contingent upon the property being appraised at a minimum specified amount. This clause protects the buyer, ensuring they are not obligated to proceed with the purchase if the valuation doesn't meet the expected price, which could affect the loan amount the bank is willing to lend.

When should an Appraisal Contingency Addendum be used?

This addendum should be considered when making an offer on a property. It is especially important in markets where property values can fluctuate rapidly, or if the buyer feels there might be a risk of the property appraising for less than the offer price. Including this addendum in the purchase agreement gives the buyer a way to back out of the contract without penalty if the appraisal is not satisfactory.

How does an Appraisal Contingency work?

Once included in a real estate purchase agreement, an appraisal contingency clause requires that a licensed appraiser assess the value of the property. If the appraised value is less than the specified amount in the contingency, the buyer has the option to cancel the contract or negotiate a lower purchase price. Typically, there's a specified period in which the buyer must notify the seller of their decision.

Can a seller refuse to accept an offer with an Appraisal Contingency Addendum?

Yes, sellers can refuse an offer that includes an appraisal contingency, as they might perceive it as a potential hurdle to closing the deal. However, it's also common for sellers to accept such offers, especially in a buyer's market or if they are confident in their property's value meeting the appraisal expectations.

Is it possible to waive the Appraisal Contingency Addendum?

Yes, a buyer can waive the appraisal contingency to make their offer more appealing to the seller, especially in a competitive market. However, waiving this contingency means the buyer may have to cover the difference if the property appraises for less than the offer price, which can involve a significant amount of additional funds.

What are the risks of waiving an Appraisal Contingency?

Waiving an appraisal contingency can be risky. If the appraisal comes back lower than the purchase price, the buyer may not secure a loan for the full purchase amount. This means the buyer would need to pay the difference out of pocket or risk losing the property and any earnest money deposited. It's a decision that should not be taken lightly and usually requires careful financial planning.

What happens if the appraisal is higher than the purchase price?

If the appraisal comes in higher than the purchase price, the appraisal contingency is typically considered satisfied, and the sale proceeds as planned. The buyer will not receive any direct financial benefit from the higher appraisal, but they can gain equity in the home from the start, which is a positive outcome.

Can a buyer renegotiate the purchase price based on the appraisal?

Yes, if the appraisal comes in lower than the purchase price and there is an appraisal contingency in place, the buyer can use this as leverage to renegotiate the purchase price with the seller. However, the seller is not obligated to lower the price, and it may lead to further negotiations or the cancellation of the purchase agreement if both parties cannot agree.

What should be done if the appraisal falls short of the contingency amount?

If the appraisal falls short of the contingency amount, the buyer has several options, depending on the terms of the contract. These can include negotiating a lower purchase price with the seller, paying the difference between the appraised value and the purchase price, or exercising the right to back out of the purchase agreement if the two parties cannot reach an agreement. It's critical for the buyer to communicate their decision within the timeframe specified in the contract.

How is the minimum specified appraisal value determined?

The minimum specified appraisal value is typically determined through mutual agreement between the buyer and seller at the time of the offer and is based on factors such as recent sales of similar properties in the area, the property's condition, and current market conditions. It's a strategic figure that requires careful consideration to protect the buyer's interests while making the offer appealing to the seller.

Common mistakes

One common mistake individuals often make when filling out the Appraisal Contingency Addendum form is neglecting to precisely specify the appraisal deadline. This detail is crucial as it sets a clear timeline for when the appraisal must be completed. Failure to accurately define this timeline can lead to misunderstandings between buyer and seller, potentially derailing the transaction. It's essential that both parties have a mutual understanding of when the appraisal should be conducted to ensure the process moves forward smoothly.

Another error frequently encountered is the incorrect valuation amount being entered. The appraisal contingency is designed to protect the buyer if the property's appraised value is less than the agreed purchase price. However, if the specified appraisal value on the form is inaccurately high or low, it might either unnecessarily jeopardize the deal or inadequately shield the buyer from overpaying. Careful attention must be paid to input the correct figure that reflects the agreed-upon price or the expected appraisal value to prevent complications.

Often, individuals overlook the importance of specifying who is responsible for covering the costs associated with the appraisal. This oversight can lead to disputes over financial responsibilities, as the appraisal can be a significant expense. Ensuring that the form clearly outlines whether the buyer, seller, or both will bear the cost of the appraisal helps in avoiding last-minute disagreements and promotes a more seamless transaction process.

Another subtle yet significant mistake is failing to understand the terms and conditions related to the contingency itself. Some may not fully grasp what happens if the appraisal comes in lower than expected. The addendum should include specific steps to be taken in such situations, whether it means renegotiating the sale price, the buyer making up the difference, or the potential for the deal to be nullified. An accurate comprehension and clear documentation of these terms are paramount in protecting all parties involved.

Last but not least, an error that is easily overlooked is not duly signing or dating the form. This seemingly small oversight can invalidate the entire addendum. A signature is a binding acknowledgment, ensuring that all parties agree to the terms set forth within the document. Without a proper signature and date, the contingency lacks legal enforceability, which could lead to significant issues should a dispute arise regarding the appraisal contingency terms.

Documents used along the form

When navigating the waters of buying or selling property, the Appraisal Contingency Addendum form is a crucial document. It ensures that the property's appraised value meets or exceeds the agreed-upon sale price. However, it rarely travels alone. Several other forms and documents work in conjunction with this addendum to secure a smooth transaction. Each plays a unique role in the real estate process, offering protections and clarifications for all parties involved.

- Financing Contingency - This document acts as a safety net for the buyer, ensuring that if they cannot secure financing at or above specific terms, they can withdraw from the sale without penalty. It guards the buyer's deposit and ensures they aren't legally bound to purchase without confirmed funding.

- Title Insurance Commitment - Before the deal closes, this document proves essential. It guarantees the title's validity, ensuring there are no undisclosed heirs, liens, or legal disputes over the property. It provides peace of mind that the buyer will own the property free and clear.

- Home Inspection Report - This report, compiled by a professional home inspector, is crucial. It outlines any existing or potential issues within the property, from structural concerns to minor defects. This document helps negotiate repairs or adjust the sale price before finalizing the purchase.

- Lead-Based Paint Disclosure - For homes built before 1978, this disclosure is mandatory. It informs buyers about the presence of lead-based paint, which can pose significant health risks. This knowledge allows buyers to make informed decisions or request further testing.

- Seller’s Property Disclosure Statement - This form is filled out by the seller, detailing the condition of the property and any known issues or defects. It serves to inform the buyer about the property's state, thus reducing post-sale disputes over undisclosed problems.

- Final Closing Statement - Also known as the HUD-1 Settlement Statement, this document outlines all financial transactions between the buyer, seller, and other parties involved in the sale. It ensures transparency and accuracy in the financial aspects of the deal, showing payments, credits, and any due fees.

Together, these documents form a comprehensive package that addresses most legal, financial, and practical aspects of real estate transactions. By integrating the Appraisal Contingency Addendum with these additional forms and reports, both buyers and sellers are better protected. They provide a clearer understanding of the property and transaction, paving the way for a smoother transfer of ownership. In the landscape of real estate, being well-informed and prepared with the necessary documentation is key to a successful and stress-free conclusion.

Similar forms

The Appraisal Contingency Addendum form is similar to the Finance Contingency form in that both serve as conditions to be met for the continuation of a real estate transaction. The Finance Contingency form specifies that the purchase of a property can only proceed if the buyer secures financing by a certain date. Like the Appraisal Contingency, this places a condition on the transaction that must be fulfilled for the sale to go through, emphasizing the buyer's need for external approval — in this case, from a lender rather than an appraiser.

Another document bearing resemblance to the Appraisal Contingency Addendum is the Home Inspection Contingency form. This form conditions the sale on the property passing a professional home inspection. Similar to the appraisal contingency, which ensures the property is worth the agreed-upon sale price, the inspection contingency confirms the property's physical condition meets the buyer's expectations. Both forms allow the buyer a way out of the contract based on specific criteria not being met, thereby protecting the buyer's interests.

The Sale of Existing Home Contingency form also shares similarities with the Appraisal Contingency Addendum. This document makes the purchase contingent upon the buyer selling their current home by a specified date. It parallels the appraisal contingency by adding a condition that must be satisfied for the sale to proceed, focusing on the buyer's financial capability and situation rather than the property's value or condition.

Lastly, the Title Contingency form is akin to the Appraisal Contingency Addendum, as it places a condition related to the title's status before the sale can finalize. This document requires that the title be clear of encumbrances or defects at closing, similar to how the appraisal contingency requires the property to appraise at or above the purchase price. Both contingencies guard against unforeseen issues that could affect the buyer’s investment, focusing on ensuring a smooth and fair transaction.

Dos and Don'ts

Filling out the Appraisal Contendency Addendum form is a critical step in many real estate transactions. This document can influence the outcome and timeline of a property sale, making it imperative to approach its completion with diligence and accuracy. Below, find key dos and don'ts that will guide you through this process effectively.

Do:- Read the entire form carefully before beginning to fill it out. Understanding each section's requirements will help prevent mistakes.

- Use clear, legible handwriting if filling out the form by hand, or ensure typed responses are free from typos and formatting errors.

- Consult with a real estate professional or legal advisor if any part of the form is unclear. It's better to seek clarification than to make an incorrect assumption.

- Be precise when entering dates and numerical information, such as the appraisal value or deadlines for contingency removal. Accuracy is crucial.

- Verify all the details with your lender, if applicable, to ensure the appraisal contingency aligns with your loan approval requirements.

- Keep a copy of the completed form for your records. This can be invaluable in the event of a dispute or misunderstanding.

- Communicate openly with the seller about the appraisal process. Keeping everyone informed can help manage expectations and prevent conflicts.

- Review the form one final time before submission, checking for completeness and correctness.

- Submit the form promptly to avoid any delays in the transaction due to missing or late documentation.

- Use the form's specifications to negotiate adjustments in the purchasing agreement if the appraisal comes in lower than expected.

- Leave any sections of the form blank. If a section does not apply, indicate this with "N/A" or a similar notation.

- Guess or approximate figures; always use exact numbers provided by the appraisal report or agreed upon in the real estate transaction.

- Overlook the form's deadlines. Failing to adhere to these can jeopardize the transaction.

- Ignore discrepancies between the appraisal report and the form's figures. Address any differences immediately.

- Submit the form without double-checking that all the required parties have signed it. Missing signatures can invalidate the document.

- Assume the appraisal contingency is the only safeguard in your purchasing agreement. Be aware of other contingencies and how they interact.

- Forfeit your right to renegotiate if the appraisal uncovers issues that significantly affect the property’s value. This form can be a powerful tool in negotiations.

- Use outdated forms. Always ensure you have the most current version of the Appraisal Contigency Addendum form.

- Rush through filling out the form. Taking your time to ensure accuracy is more efficient than correcting errors later.

- Underestimate the importance of this document. It can significantly impact the financial and legal aspects of your real estate transaction.

Misconceptions

In real estate transactions, the Appraisal Contingency Addendum plays a critical role, but misunderstandings about its purpose and function are common. Clarifying these misconceptions helps both buyers and sellers navigate their transactions more effectively.

- It's only beneficial for buyers. While it's true the addendum primarily protects the buyer from overpaying, it also benefits sellers by providing a clear framework for negotiations or adjustments if the appraisal comes in lower than expected.

- The appraisal amount always matches the sale price. Market dynamics, condition of the property, and comparables within the neighborhood influence the appraised value, which does not always align with the sale price agreed upon in the contract.

- An appraisal contingency addendum drastically delays closing. In reality, the timeline for the appraisal process is generally well-defined, allowing for a timely progression towards closing. Delays can occur, but they are not a given.

- Any low appraisal can be disputed successfully. While disputing a low appraisal is an option, success is not guaranteed. The outcome depends on the presentation of relevant, new information that was not considered in the initial appraisal.

- Sellers cannot back out once an appraisal contingency is in place. Sellers have rights and options, even with such an addendum. For instance, if the parties cannot agree on a solution to an appraisal shortfall, the seller can opt to terminate the agreement, assuming the contract allows.

- Appraisal contingencies eliminate the need for a final walkthrough. Despite the property's appraised value meeting expectations, a final walkthrough remains crucial to ensure no changes or damages have occurred since the initial agreement.

- An appraisal contingency guarantees a mortgage approval. An appraisal is a significant part of the lending process, yet it's not the sole factor. Lenders also consider buyer credit, financial history, and other variables when approving a mortgage.

Understanding these key aspects of the Appraisal Contingency Addendum can significantly impact the smooth execution of real estate transactions, benefiting all parties involved by setting realistic expectations and fostering informed decision-making.

Key takeaways

Filling out and using the Appraisal Contingency Addendum can be a pivotal step in a real estate transaction. This document adds a protective layer for the buyer, ensuring the property is valued at a minimum specified amount before proceeding with the purchase. Here are key takeaways to understand:

- Accuracy Is Key: When completing the Appraisal Contingency Addendum, every detail matters. Incorrect information can lead to misunderstandings or disputes, potentially derailing the purchase. Ensure all data, including property details and contingency timelines, are accurately captured.

- Timelines Matter: The addendum specifies a period during which the appraisal must occur. Understanding and adhering to these deadlines is crucial. A missed deadline can invalidate the contingency, exposing the buyer to risks if the property appraises for less than the purchase price.

- Understand Appraisal Outcomes: If an appraisal comes in lower than the specified amount, both parties need a clear understanding of the next steps. The addendum typically allows for renegotiations or the option for the buyer to cancel the contract without penalty, safeguarding the buyer’s deposit.

- Negotiation Leverage: This addendum can serve as a significant negotiation tool. By stipulating an appraisal contingency, buyers can enter negotiations with more confidence, knowing they have a safety net if the property's value does not meet expectations.

Using the Appraisal Contingency Addendum wisely can protect all parties involved in a real estate transaction. It ensures the property is worth the agreed-upon price and provides a clear path forward should the appraisal fall short. As always, consulting with a real estate professional or legal advisor can provide further clarity and ensure that all legal and procedural requirements are met.

Consider More Types of Appraisal Contingency Addendum Forms

Owner Carryback Contract - The form encourages negotiation on terms like the interest rate, down payment, and repayment period to suit both parties’ needs.