Official Real Estate Purchase Agreement Document

Embarking on the journey of buying or selling a property, individuals find themselves navigating through an intricate process that can often appear daunting. Central to this venture is the Real Estate Purchase Agreement form, a crucial document that outlines the terms and conditions of the transaction. This form serves as a binding contract between the buyer and seller, detailing everything from the purchase price to the closing date, including any contingencies that must be met before the deal is finalized. Not only does it specify the rights and responsibilities of each party, but it also acts as a roadmap, guiding both through the complex landscape of real estate transactions. With its importance lying not just in its function but in the protection it offers, understanding the Real Estate Purchase Agreement is fundamental for anyone looking to navigate the property market successfully.

Real Estate Purchase Agreement Document Types

Form Example

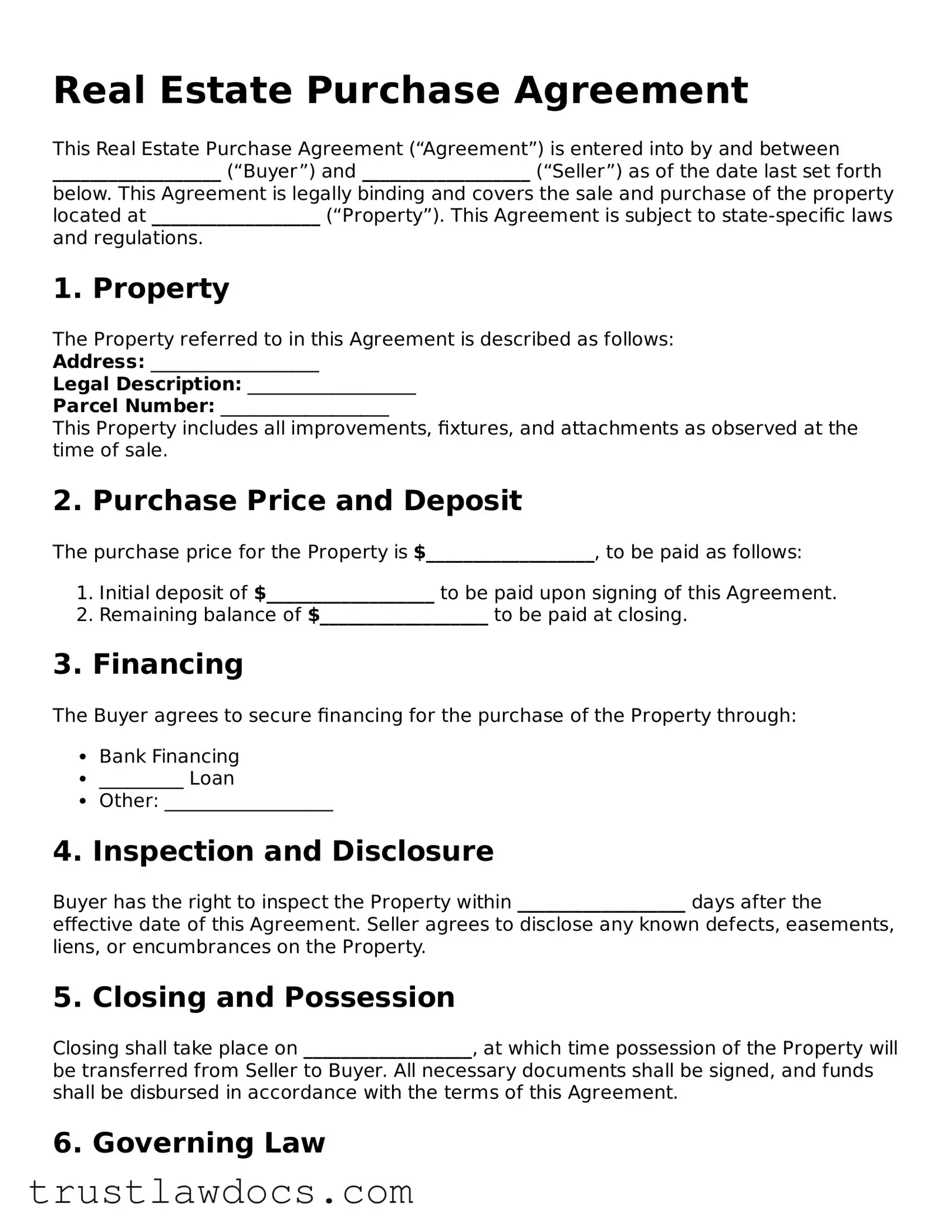

Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is entered into by and between __________________ (“Buyer”) and __________________ (“Seller”) as of the date last set forth below. This Agreement is legally binding and covers the sale and purchase of the property located at __________________ (“Property”). This Agreement is subject to state-specific laws and regulations.

1. Property

The Property referred to in this Agreement is described as follows:

Address: __________________

Legal Description: __________________

Parcel Number: __________________

This Property includes all improvements, fixtures, and attachments as observed at the time of sale.

2. Purchase Price and Deposit

The purchase price for the Property is $__________________, to be paid as follows:

- Initial deposit of $__________________ to be paid upon signing of this Agreement.

- Remaining balance of $__________________ to be paid at closing.

3. Financing

The Buyer agrees to secure financing for the purchase of the Property through:

- Bank Financing

- _________ Loan

- Other: __________________

4. Inspection and Disclosure

Buyer has the right to inspect the Property within __________________ days after the effective date of this Agreement. Seller agrees to disclose any known defects, easements, liens, or encumbrances on the Property.

5. Closing and Possession

Closing shall take place on __________________, at which time possession of the Property will be transferred from Seller to Buyer. All necessary documents shall be signed, and funds shall be disbursed in accordance with the terms of this Agreement.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of __________. Both parties agree to submit to the jurisdiction of this state and comply with all state-specific requirements.

7. Signatures

This Agreement is executed by the parties hereto as of the date set forth below:

Buyer: __________________

Date: __________________

Seller: __________________

Date: __________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | The Real Estate Purchase Agreement form is used to outline the terms and conditions under which a property will be sold and purchased. It details the agreement between the buyer and seller, specifying price, closing conditions, and any contingencies. |

| Key Components | Typically, the form includes information on the parties involved, the description of the property, the purchase price, earnest money deposits, financing, closing conditions, disclosures, and any contingencies such as the inspection or financing contingencies. |

| State-Specific Variations | Real Estate Purchase Agreement forms can vary significantly from state to state, as they are subject to the specific real estate laws and regulations of each state. These laws govern aspects like disclosure requirements, earnest money provisions, and the use of standard forms. |

| Governing Law | The agreement is governed by the state laws where the property is located. This includes general contract principles and specific real estate transfer regulations, with each state having its own set of laws that dictate the format and enforceability of a Real Estate Purchase Agreement. |

How to Write Real Estate Purchase Agreement

Filling out a Real Estate Purchase Agreement form is a critical step in the journey of buying or selling a property. This legally binding document outlines the terms and conditions of the real estate transaction, including the purchase price, closing date, and any contingencies that must be met before the sale can finalize. Completing this form accurately is crucial as it serves as the foundation for the transaction, ensuring that both the buyer and seller are clear on the obligations and the timeline. The process may seem daunting at first, but with a step-by-step approach, it can be tackled efficiently and effectively.

- Gather Necessary Information: Before you start filling out the form, collect all necessary details such as legal names of the parties involved, property address, and legal description of the property.

- Fill in the Parties' Details: Enter the full legal names and contact information of both the buyer(s) and seller(s) at the beginning of the form.

- Describe the Property: Clearly write the complete address of the property being sold, including the legal description which might be found in prior deed documents.

- Agree on the Purchase Price: Document the agreed upon purchase price of the property in the designated spot on the form.

- Outline Financing Terms: If the purchase will be financed, detail the terms including down payment, loan amount, interest rate, and the type of financing being used.

- Include Earnest Money Deposit Details: Specify the amount of earnest money deposit and the party holding this deposit until closing.

- Detail Contingencies: Clearly list any contingencies that must be met for the sale to proceed, such as the buyer obtaining financing or the sale of their current home.

- Set the Closing Date and Possession Date: State the expected closing date and when the buyer will take possession of the property.

- List Included and Excluded Items: Itemize any personal property that will be included in or excluded from the sale.

- Signatures: Ensure both the buyer(s) and seller(s) sign and date the form. Witnesses or a notary public may also be required, depending on state law.

Once the Real Estate Purchase Agreement form is fully completed and signed, the next steps involve fulfilling any contingencies outlined in the agreement, such as securing financing or completing a home inspection. Both parties should work closely with their real estate agents, attorneys, and other professionals to complete these steps and move towards a successful closing. Remember, this form is a critical part of the property transaction process, serving as a roadmap to transfer ownership from the seller to the buyer under the agreed-upon terms.

Get Answers on Real Estate Purchase Agreement

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legally binding document between a buyer and seller concerning the sale and purchase of real estate property. It outlines the terms and conditions of the sale, including price, property description, and closing details, ensuring both parties are clear on their obligations.

When should I use a Real Estate Purchase Agreement?

This agreement should be used whenever you are buying or selling real estate. It’s an essential step in the property transaction process that formally captures the agreed-upon terms between both parties, offering legal protection and clarity from the time of agreement through to the closing.

What information needs to be included in this agreement?

Specifics such as the names of the buyer and seller, a detailed description of the property being sold, the purchase price, the earnest money deposit amount, financing details, closing and possession dates, and any contingencies that might affect the sale (like the requirement for a satisfactory home inspection) should be included. Additionally, any included or excluded items, like appliances, should be clearly listed.

Are there standard contingencies found in most agreements?

Yes, common contingencies include the buyer's ability to obtain financing, the results of the home inspection, the sale being subject to the buyer selling their current home, and the requirement for a clear title. These conditions protect both parties – for instance, they ensure the buyer can withdraw without penalty under certain circumstances.

How is the purchase price decided?

The purchase price is typically a matter of negotiation between the buyer and the seller. It’s influenced by various factors including the property's market value, its condition, and current market conditions. The agreed-upon amount is then documented in the Real Estate Purchase Agreement.

What is an earnest money deposit?

An earnest money deposit is a portion of the purchase price that the buyer pays to the seller as a sign of good faith when the agreement is signed. This deposit is usually held in an escrow account and applied towards the purchase price at closing. It assures the seller of the buyer’s commitment and helps protect the seller if the buyer breaches the agreement.

Can either party back out of a Real Estate Purchase Agreement?

Backing out of the agreement can have legal repercussions. However, the agreement may contain contingencies that allow either party to terminate the contract under specific conditions, such as failure to secure financing or unsatisfactory inspection results. Without such contingencies, backing out could result in the forfeit of the earnest money deposit or other penalties.

What happens if there are disputes over the agreement?

If disputes over the agreement arise, the parties should first refer to the terms within the agreement for resolution methods. Mediation or arbitration can be pursued as alternate dispute resolution methods. Litigation is also an option, though it can be time-consuming and expensive.

Is a Real Estate Purchase Agreement legally binding once signed?

Yes, once both the buyer and seller have signed the Real Estate Purchase Agreement, it becomes a legally binding document. Each party is then obligated to fulfill their respective roles as outlined, under the protection and regulation of the agreement’s terms.

Common mistakes

Filling out a Real Estate Purchase Agreement is a critical step in the process of buying or selling property. However, many individuals make mistakes that can lead to disputes or even nullify the agreement. One common error is failing to specify all parties involved in the transaction accurately. It's crucial to include the full legal names of all buyers and sellers to ensure the contract is legally binding.

Another area where errors frequently occur is in the description of the property. Often, people provide insufficient details or inaccurately describe the property's boundaries and features. This mistake can lead to misunderstandings or legal challenges down the road. It's essential to include a comprehensive and accurate description, ideally referencing a professional survey.

Financial details are also a common source of errors. This includes incorrectly stating the purchase price or the terms of the payment. Such inaccuracies can significantly affect the agreement's validity and may lead to financial losses. Ensuring that all figures are double-checked and clearly stated is imperative for a smooth transaction.

Failure to disclose material facts about the property is another significant mistake. Sellers must disclose known issues that could affect the property's value or the buyer's decision to purchase. Neglecting to provide this information can lead to legal action against the seller after the transaction has been completed.

Ignoring contingency clauses is a mistake that both buyers and sellers often make. These clauses allow parties to back out of the agreement under specific conditions, such as the buyer's inability to secure financing or unsatisfactory inspection results. Not clearly defining or understanding these contingencies can lead to disputes and financial losses.

Date and signature errors can also undermine a Real Estate Purchase Agreement. It's essential to ensure that all parties sign the document and that the dates reflect when the agreement was actually made. Unsigned or improperly dated contracts may not be legally enforceable.

Overlooking the need for a witness or notary can also be a critical error, depending on the jurisdiction's requirements. In some cases, a witness or notarization is necessary for the document to be legally binding. Failing to comply with these requirements can invalidate the entire agreement.

Misunderstanding the legal requirements or failing to include required legal disclosures can also cause problems. Each jurisdiction may have specific requirements regarding the sale of real property, and failing to adhere to these can result in legal complications or void the contract.

Additionally, parties sometimes make the mistake of not adequately specifying the closing date and possession date. Confusion over these dates can lead to conflicts, especially if the buyer expects to move in immediately after closing, but the seller has not vacated the property.

Lastly, neglecting to review the agreement thoroughly before signing it is a widespread mistake. Parties often overlook errors, omissions, or terms they don't fully understand. Reading the document carefully and consulting with a legal professional if necessary can prevent misunderstandings and ensure the transaction proceeds as expected.

Documents used along the form

When engaging in a real estate transaction, a Real Estate Purchase Agreement is a critical document. However, this agreement often works in conjunction with several other important forms and documents to ensure a smooth and legally sound transaction process. These additional documents cover a range of purposes, from financial verification to property condition assessment, enhancing the clarity and security of the real estate purchase. Here is an overview of other commonly used forms and documents that accompany a Real Estate Purchase Agreement.

- Loan Application Form: Required for buyers securing financing, this form initiates the mortgage process by documenting the buyer's financial status, including employment, credit history, and current debt.

- Title Search: This document outlines the history of property ownership and verifies that the seller has the legal right to sell the property. It also checks for any liens or encumbrances that may affect the sale.

- Home Inspection Report: Generated after a professional inspector evaluates the property, this report details the condition of the home, including any necessary repairs or potential issues.

- Appraisal Report: This report provides an expert opinion on the value of the property, ensuring the buyer is paying a fair price and the lender is not providing more funds than the property's worth.

- Property Disclosure Statement: The seller provides this statement, disclosing known issues with the property. This could include past repairs, defects, or other material facts that could affect the property’s value.

- Closing Disclosure: Prepared by the lender for financed purchases, this form outlines the final transaction costs, loan terms, and other closing expenses, allowing for review before finalizing the deal.

- Contingency Clauses: Often part of or attached to the purchase agreement, these clauses specify conditions that must be met for the transaction to proceed, such as satisfactory inspection results or financing approval.

- Lead-Based Paint Disclosure: For homes built before 1978, this form is required by federal law to disclose the presence of any known lead-based paint, providing buyers with information on potential health risks.

Incorporating these documents with a Real Estate Purchase Agreement creates a comprehensive foundation for real estate transactions. Each plays a distinct role in ensuring transparency, legal compliance, and protection for all parties involved. Buyers and sellers are advised to understand these forms thoroughly to navigate the complexities of real estate purchases successfully.

Similar forms

The Bill of Sale and Real Estate Purchase Agreement share notable similarities, primarily in their role of transferring ownership of assets from a seller to a buyer. While the Real Estate Purchase Agreement specifically addresses the transaction of property, a Bill of Sale can apply to various types of personal property like vehicles and electronics. Both documents serve as legal proof of the transfer, detailing the agreement terms, including the price and conditions of the sale, ensuring that both parties understand and agree to their obligations.

The Deed of Trust is related to a Real Estate Purchase Agreement in that it also pertains to transactions involving property. The Deed of Trust involves three parties – the borrower, the lender, and the trustee – and serves as a security for a loan tied to real estate. While the Real Estate Purchase Agreement outlines the terms under which property is sold from one party to another, the Deed of Trust comes into play when the property is used as collateral for a loan, highlighting the rights and responsibilities related to the loan's security.

Lease Agreements share similarities with a Real Estate Purchase Agreement as they both deal with the use of real estate. However, while a Purchase Agreement culminates in the transfer of ownership, a Lease Agreement grants a tenant the right to use a property for a set term without transferring ownership. Both documents outline terms such as payment amounts, due dates, and other conditions, ensuring that the parties have a clear understanding of their rights and responsibilities.

A Quitclaim Deed, like a Real Estate Purchase Agreement, is used in the context of property transactions but serves a different purpose. It transfers any ownership interest a person might have in a property to another without guaranteeing that the property is free of liens or other encumbrances. Real Estate Purchase Agreements, conversely, often come with warranties or guarantees regarding the property's status. Quitclaim Deeds are typically used between family members or to clear title issues, simplifying property transfers without the detailed warranties found in Purchase Agreements.

The Option Agreement is akin to the Real Estate Purchase Agreement in its focus on property transactions, allowing a potential buyer the option to purchase a property at a predetermined price within a certain timeframe. Unlike a Purchase Agreement, which sets forth the immediate terms for sale, an Option Agreement secures the buyer's right to make the purchase in the future, often requiring the payment of a fee for this right. This document is beneficial in real estate markets where property values are expected to rise.

Mortgage Agreements and Real Estate Purchase Agreements both play critical roles in property transactions, particularly when financing is involved. A Mortgage Agreement outlines the terms under which a lender provides a loan to a borrower to purchase property, securing the loan by using the property as collateral. In contrast, a Real Estate Purchase Agreement details the sale agreement between buyer and seller. Together, they ensure both the transfer of property and the arrangement of financing are clearly defined.

The Escrow Agreement, related to a Real Estate Purchase Agreement, involves a neutral third party holding assets—often money or property—on behalf of the others until certain conditions are met. Particularly in real estate transactions, the Escrow Agreement ensures that funds are only transferred once all terms of the Purchase Agreement are fulfilled, acting as a safeguard for both parties. It underlines the commitment to proceed with the transaction in a manner that is secure and agreed upon by all parties.

Letters of Intent can resemble Real Estate Purchase Agreements in their early stages of a property transaction by outlining the intentions of both buyer and seller to enter into a sale. Though typically not binding in the same way as a Purchase Agreement, Letters of Intent mark a preliminary agreement on the terms of the sale, setting the stage for the formal, detailed contract to follow. They are crucial in aligning both parties' expectations before the detailed negotiations and commitments of a Purchase Agreement.

Finally, the Warranty Deed is similar to a Real Estate Purchase Agreement as both concern the transfer of property rights. However, a Warranty Deed goes further by guaranteeing that the seller holds clear title to the property and has the right to sell it, offering protection to the buyer against future claims to the property. This strong assurance of clear title makes a Warranty Deed an important complement to a Real Estate Purchase Agreement, solidifying the buyer’s confidence in the legitimacy of the transaction.

Dos and Don'ts

When filling out a Real Estate Purchase Agreement form, certain practices should be followed to ensure a smooth and legally sound transaction. It's essential to approach this document with meticulous attention to detail and a clear understanding of the transaction's terms. Here's a guide on what to do and what not to do during this process.

What You Should Do

- Review All Sections Carefully: Before signing your name, scrutinize every section of the form to ensure accuracy and completeness. Any overlooked detail can lead to legal complications later.

- Confirm Property Details: Make sure all information regarding the property, such as address, legal description, and any included fixtures, is stated accurately to prevent disputes.

- Understand Contingencies: Clearly understand any contingencies included in the agreement, such as those related to financing, inspections, and the sale of another property. These clauses can significantly impact your rights within the transaction.

- Consult Professionals: Seek advice from a real estate attorney or a qualified professional to review the agreement before finalizing. Their expertise can help identify potential issues and ensure the agreement meets your needs.

What You Shouldn't Do

- Skip Reading Any Part: Every section of the agreement is crucial. Skipping even a single line might leave you unaware of significant terms and obligations.

- Ignore Deadlines: Failing to respect the timelines set forth in the agreement, such as those for inspections or mortgage applications, can lead to the loss of rights or financial penalties.

- Assume Standard Terms Apply: Real Estate Purchase Agreements can vary greatly. Assuming that standard or typical terms apply to your agreement without verifying can lead to misunderstandings and legal issues.

- Sign Under Pressure: Never sign the agreement if you feel rushed or pressured. Taking the necessary time to understand and agree with the terms is critical for a legally binding contract that aligns with your interests.

Misconceptions

When navigating the complexities of real estate transactions, many people encounter misconceptions about the Real Estate Purchase Agreement form. Understanding these misconceptions is crucial for both buyers and sellers to ensure a smooth transaction. Here are nine common misunderstandings:

It's just standard paperwork. Many believe the Real Estate Purchase Agreement is a routine document that doesn't need much attention. However, it's a legally binding contract outlining the terms, conditions, and responsibilities of both parties. Each clause and stipulation carries significant legal weight and consequences.

Any real estate agent can prepare it accurately. While real estate agents are integral to the buying and selling process, they might not have the legal expertise to address every detail and potential issue in the agreement. It's essential to have a legal professional review or prepare the document to ensure it fully protects one's interests.

All agreements are essentially the same. There's a common thought that these agreements are a "one size fits all." In reality, every property transaction is unique, and the agreement should reflect that uniqueness, addressing specific concerns and conditions related to the property, the buyer, and the seller.

Verbal agreements are just as good. Some assume that verbal agreements between buyers and sellers can stand in place of or serve as binding agreements. However, for a real estate transaction to be legally enforceable, it must be in writing and signed by both parties.

The purchase price is non-negotiable once the agreement is signed. The initial signing of the agreement doesn't always mark the end of negotiations. Inspection contingencies, financing issues, or appraisals can reopen discussions about the purchase price or terms of the sale.

It only covers the sale price and financing details. Many overlook that the Real Estate Purchase Agreement covers a broad range of essential details beyond just the price and financing. This includes deadlines, contingencies, disclosures about the property, and specifics about the transfer of ownership.

Signing the agreement means the deal is done. Simply signing the agreement does not complete the transaction. Fulfillment of contingencies, successful closing, and transfer of ownership are necessary steps after the agreement is signed for the deal to be officially done.

The buyer always prepares the agreement. There's a misconception that the buyer is responsible for drafting the Real Estate Purchase Agreement. In reality, either the buyer or the seller's agent can prepare the document, depending on the negotiations and proceedings of the transaction.

It's not necessary to read the entire agreement. With the excitement and stress of buying or selling property, some may skim or entirely skip reading the full agreement. This oversight can lead to unexpected obligations or issues down the line. It's crucial for all parties to thoroughly review and understand the agreement before signing.

By clarifying these misconceptions, buyers and sellers can navigate real estate transactions more effectively, making informed decisions that protect their interests and promote a satisfactory outcome for all parties involved.

Key takeaways

The Real Estate Purchase Agreement form is a legally binding document between a buyer and seller for the purchase of real estate property. Its proper use is crucial for a smooth transaction and to protect the interests of both parties involved. Below are five key takeaways to ensure that filling out and using this form is done correctly and effectively.

- Ensure all parties fully understand the terms: Before signing, it's imperative that both the buyer and seller thoroughly review the document, ensuring that they fully understand every condition, clause, and obligation listed. Misunderstandings can lead to disputes, delays, and costly legal battles down the line.

- Complete every section carefully: Skipping sections or leaving blank spaces can cause confusion or misinterpretation of the agreement intentions. If a section doesn’t apply, it’s prudent to mark it as 'N/A' (not applicable) rather than leaving it empty.

- Use clear and precise language: Ambiguities in a contract can lead to different interpretations, potentially resulting in disagreements. It's crucial to use clear and unambiguous terms when describing the conditions of the sale, such as the property boundaries, included fixtures, and any contingencies.

- Include all relevant attachments: Often, additional documents need to be attached to the Real Estate Purchase Agreement to provide further detail or specify conditions (e.g., home inspection reports, title insurance policies). All attachments should be listed and included at the time of signing to ensure they are legally binding.

- Remember the importance of timing: Many real estate agreements include strict deadlines for various stages of the process, such as inspections, mortgage applications, and closing dates. It’s crucial to adhere to these timelines to avoid breaching the agreement, which could result in financial penalties or the termination of the agreement.

In conclusion, when preparing and executing a Real Estate Purchase Agreement, attention to detail, clear communication, and a full understanding of all terms and conditions are essential. This not only ensures a smooth real estate transaction but also minimizes the risk of future conflicts.

Other Templates:

Poa Document - Key for individuals who need assistance managing their affairs due to health, travel, or other personal reasons.

Immigration Letter of Good Moral Character - A Character Reference Letter for Immigration is invaluable, often being a pivotal piece of evidence in favor of the applicant's character and intentions.

Does California Have a Transfer on Death Deed - A key advantage of this document is its simplicity, allowing property owners to avoid complex legal procedures upon their death.