Free Promissory Note Form for Texas

Embarking on a financial transaction, especially in the state of Texas, often involves the use of a Promissory Note, a critical document that outlines the loan's terms and conditions between the borrower and the lender. This form serves as a legally binding agreement, ensuring that the borrower promises to repay the loan to the lender, under the laid-out terms, which include the loan amount, interest rate, repayment schedule, and consequences in the event of default. Drafting a Texas Promissory Note requires careful consideration of state laws and regulations, as these dictate the legality and enforceability of the agreement. Whether it involves a large financial sum for purchasing property or a smaller loan between friends, this note acts as a safeguard, protecting both parties' interests throughout the loan’s duration. Understanding its major aspects is paramount for anyone looking to navigate their financial dealings smoothly and legally within Texas.

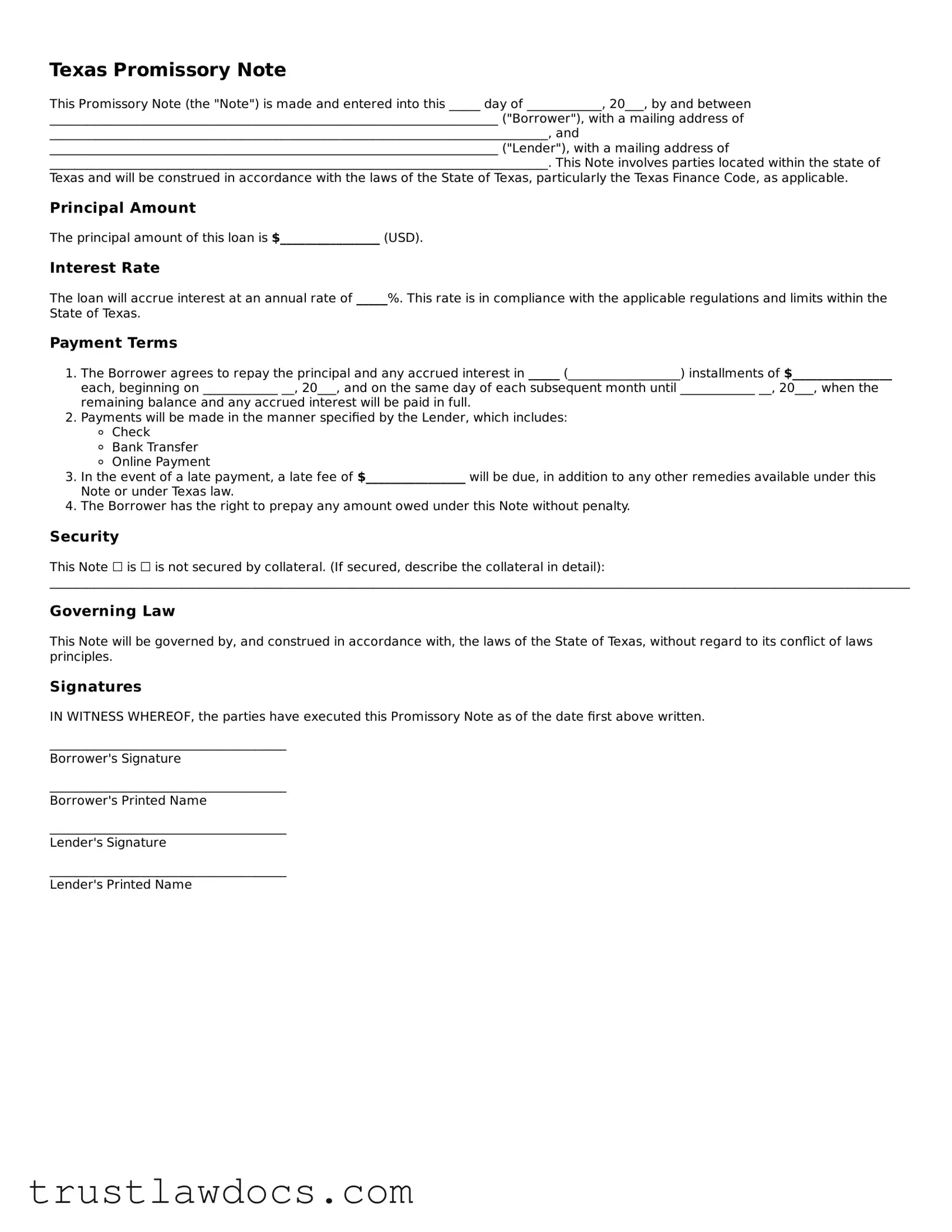

Form Example

Texas Promissory Note

This Promissory Note (the "Note") is made and entered into this _____ day of ____________, 20___, by and between ________________________________________________________________________ ("Borrower"), with a mailing address of ________________________________________________________________________________, and ________________________________________________________________________ ("Lender"), with a mailing address of ________________________________________________________________________________. This Note involves parties located within the state of Texas and will be construed in accordance with the laws of the State of Texas, particularly the Texas Finance Code, as applicable.

Principal Amount

The principal amount of this loan is $________________ (USD).

Interest Rate

The loan will accrue interest at an annual rate of _____%. This rate is in compliance with the applicable regulations and limits within the State of Texas.

Payment Terms

- The Borrower agrees to repay the principal and any accrued interest in _____ (__________________) installments of $________________ each, beginning on ____________ __, 20___, and on the same day of each subsequent month until ____________ __, 20___, when the remaining balance and any accrued interest will be paid in full.

- Payments will be made in the manner specified by the Lender, which includes:

- Check

- Bank Transfer

- Online Payment

- In the event of a late payment, a late fee of $________________ will be due, in addition to any other remedies available under this Note or under Texas law.

- The Borrower has the right to prepay any amount owed under this Note without penalty.

Security

This Note ☐ is ☐ is not secured by collateral. (If secured, describe the collateral in detail): ______________________________________________________________________________________________________________________________________________________________________________________________________________________.

Governing Law

This Note will be governed by, and construed in accordance with, the laws of the State of Texas, without regard to its conflict of laws principles.

Signatures

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the date first above written.

______________________________________

Borrower's Signature

______________________________________

Borrower's Printed Name

______________________________________

Lender's Signature

______________________________________

Lender's Printed Name

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A Texas promissory note is a legal document where one party promises to pay another party a specific sum of money in Texas. |

| Governing Law | These forms are governed by the laws of the State of Texas, including the Texas Finance Code. |

| Types | There are two main types: secured and unsecured. A secured promissory note requires collateral, while an unsecured note does not. |

| Interest Rate | The maximum interest rate is determined by Texas law, which caps the rate to avoid usury. |

| Usury Protection | Texans are protected from excessive interest rates under the state's usury laws, which are outlined in the Texas Finance Code. |

| Enforcement | In case of default, the creditor may enforce the note through the Texas court system to seek repayment or seizure of collateral. |

| Signature Requirements | For a Texas promissory note to be legally binding, it must be signed by the borrower and, in some cases, co-signed by a guarantor. |

How to Write Texas Promissory Note

After deciding to take out a loan or extend credit in Texas, it is crucial to clearly document the agreement's terms to ensure both the borrower’s and lender's rights are protected. The Texas Promissory Note form serves this purpose, providing a legal framework for the transaction. Completing this form accurately is essential for it to be legally binding and effective. The following steps will guide you through filling out the Texas Promissory Note form properly.

- Start by entering the date the promissory note is being created at the top of the form.

- Write the full legal name of the borrower and the lender, including their complete addresses.

- Specify the principal amount of the loan in U.S. dollars.

- Detail the interest rate per annum. Texas law may limit this rate, so ensure it complies with current statutes.

- Choose the type of repayment structure (e.g., interest-only, lump sum, installment) and clearly describe the repayment terms, including the schedule, number of payments, and due dates.

- If there is collateral securing the loan, describe it fully in the designated section of the form.

- Include any co-signer information, if a co-signer is part of the loan agreement, ensuring their name and address are recorded.

- Outline the conditions under which the note can be paid before the due date without penalty, if applicable.

- Document any agreed-upon fees for late payments or penalties for defaulting on the loan terms.

- Both the borrower and the lender should sign and date the form in the presence of a witness or notary public, as required.

- Keep multiple copies of the completed form—one for each party involved and another for legal records.

Following these steps meticulously will assist in creating a clear and enforceable financial agreement. This not only establishes a legal obligation for the borrower to repay the borrowed funds but also sets out a clear framework for how the repayment process will work, protecting both parties' interests. If you have any questions or concerns during this process, seeking legal advice could be beneficial.

Get Answers on Texas Promissory Note

What is a Texas Promissory Note?

A Texas Promissory Note is a legal document that outlines the terms under which one party (the borrower) promises to repay a sum of money to another party (the lender). This form is specifically tailored to comply with the legal requirements set by the state of Texas, ensuring that the agreement is enforceable under state law. It details the loan amount, interest rate, repayment schedule, and any other terms agreed upon by the parties involved.

Is a written Promissory Note required in Texas?

While verbal agreements can be legally binding, a written Promissory Note is strongly recommended in Texas. This is because a written document provides a clear, enforceable record of the loan and its terms, which can be crucial for resolving any disputes that may arise. Moreover, certain types of loans in Texas, such as those involving real estate, must be documented in writing to be enforceable.

What information needs to be included in a Texas Promissory Note?

A Texas Promissory Note should include: the names and addresses of the borrower and lender, the amount of money being borrowed, the interest rate, the repayment plan (including dates and amounts), and any collateral securing the loan. Additionally, it should detail the consequences of non-payment and any other terms relevant to the agreement. Both parties should sign and date the document, preferably in the presence of a notary public.

How is interest determined for a Promissory Note in Texas?

The interest rate for a loan documented in a Texas Promissory Note must comply with the state's usury laws to avoid being considered illegal. As of the last update, Texas sets a maximum annual interest rate that can be charged. However, the parties can agree to any interest rate as long as it does not exceed this legal maximum. It's crucial to verify the current legal limit on interest rates to ensure compliance.

Can a Texas Promissory Note include provisions for late fees and collateral?

Yes, a Texas Promissory Note can include terms for late fees and collateral. Late fees must be reasonable and designed to compensate the lender for the missed payment rather than punishing the borrower excessively. As for collateral, specifying what it is in the Promissory Note secures the loan by giving the lender a right to seize the property if the loan is not repaid according to the agreed terms.

What happens if the borrower fails to repay the loan as agreed?

If the borrower fails to meet the repayment terms outlined in the Texas Promissory Note, the lender has the legal right to pursue collection. This may involve initiating a lawsuit to recover the outstanding amount. If collateral was pledged, the lender might also have the right to seize it. The steps a lender can take depend on the terms detailed in the Promissory Note and applicable Texas laws.

Where can one obtain a Texas Promissory Note form?

A Texas Promissory Note form can be obtained from legal document providers, attorneys specializing in Texas law, or through online resources offering legal forms customized for Texas. It's important to ensure that the form complies with Texas law and includes all necessary elements. Consulting with a legal professional is recommended to ensure that the document meets legal standards and properly protects the interests of both parties.

Common mistakes

Navigating financial agreements can often feel like walking through a maze, and drafting a Texas Promissory Note is no exception. This vital document outlines the repayment terms for a loan, and while it may appear straightforward, errors can creep in. People frequently make mistakes that range from minor oversights to substantial errors that could invalidate the agreement or lead to future disputes.

One common mistake is the failure to detail the loan terms clearly. Many assume that a simple statement of the amount borrowed and a promise to repay is sufficient. However, a comprehensive promissory note should include the interest rate, repayment schedule, late fees, and what constitutes a default. Without these specifics, the enforceability of the note can be compromised, potentially leading to misunderstandings or legal challenges.

Another area often overlooked is failing to specify the collateral for a secured loan. In a secured note, the borrower offers an asset as security for the loan, which the lender can claim if the borrower defaults. Neglecting to clearly describe the collateral or failing to sign a separate security agreement can leave the lender unprotected.

Inadequately identifying the parties involved is yet another pitfall. It's crucial to use the full legal names of both the borrower and the lender and to ensure that all parties understand their obligations and rights. This clarity helps prevent future disputes about who is responsible for repayment or who is entitled to enforce the note.

Ambiguity concerning the jurisdiction and governing law can also lead to problems. Since laws vary from state to state, a Texas Promissory Note should explicitly state that it is governed by Texas law. This provision helps ensure that, in the event of a disagreement, both parties know which state's laws will be applied to interpret the note.

Finally, ignoring the need for witnesses or a notary can undermine the legal strength of the document. While Texas law may not always require a witness or notarization for a promissory note to be valid, having the document notarized or witnessed can add a layer of authenticity and deter future challenges to its validity.

Avoiding these errors when filling out a Texas Promissory Note can save all parties involved a significant amount of time, money, and stress. It turns a seemingly simple piece of paper into a robust agreement that clearly outlines every party's expectations and obligations, ultimately providing a smoother path to repayment and financial peace of mind.

Documents used along the form

When drafting or receiving a Texas Promissory Note, it's crucial to understand that this form rarely operates in isolation. Often, it is part of a broader package of documents designed to secure a loan, delineate the terms of repayment, and safeguard the interests of both the lender and the borrower. While the Promissory Note outlines the promise to pay, other documents serve to complement and reinforce its terms, offering a comprehensive framework for the transaction. Here are five additional forms and documents commonly used alongside a Texas Promissory Note to ensure clarity and legal compliance in financial transactions.

- Security Agreement: This document is pivotal when the Promissory Note is secured, meaning the borrower has promised collateral to guarantee the loan. The Security Agreement details the pledged assets and conditions under which they may be seized should the borrower default on the promise made in the Promissory Note.

- Guaranty: Often, a third party will guarantee the loan, promising to fulfill the borrower's obligations under the Promissory Note should they be unable to do so. The Guaranty is painstakingly clear about the guarantor's liabilities and the circumstances that would trigger these commitments.

- Loan Agreement: More comprehensive than a Promissory Note, the Loan Agreement covers a broader range of terms and conditions of the loan. Whereas the Promissory Note emphasizes repayment, the Loan Agreement addresses the entirety of the loan's structure, including provisions for default, dispute resolution, and prepayment.

- Mortgage or Deed of Trust: For real estate transactions requiring a Promissory Note, a Mortgage or Deed of Trust is essential. This document places a lien on the property as security for the loan, outlining the legal process for foreclosure if the borrower fails to adhere to the terms of the Promissory Note.

- Amendment Agreement: Should any terms of the Promissory Note or associated documents require modification, an Amendment Agreement is necessary. This ensures that changes are documented, agreed upon by all parties, and legally enforceable.

Using these documents in conjunction with a Texas Promissory Note creates a solid legal foundation for any loan. Each plays a specific role in detailing the agreement's terms, protecting involved parties, and providing mechanisms for enforcing obligations and resolving disputes. Knowledgeable preparation and use of these documents can significantly mitigate financial and legal risks for both lenders and borrowers.

Similar forms

A Loan Agreement is the first document similar to a Texas Promissory Note. Both outline terms under which money is borrowed and must be repaid. However, a Loan Agreement often includes more detailed clauses about the responsibilities of each party beyond repayment, including dispute resolution methods and more specific collateral arrangements if the loan is secured.

The Mortgage Agreement is another document that bears similarity, specifically when a promissory note is secured with real property. Like Promissory Notes, Mortgage Agreements detail the borrower's promise to repay the lender, but they also legally tie the loan to the property as security, explicitly outlining what happens if the borrower fails to meet their repayment obligation.

A Deed of Trust, used in some jurisdictions instead of a mortgage, also shares attributes with a Promissory Note. It includes the borrower’s promise to pay back the loan but is unique in involving a third party, the trustee, who holds the title to the property until the loan is repaid in full.

Installment Agreements resemble Promissory Notes in that both allow for repayment over time. However, Installment Agreements can involve transactions not strictly related to cash loans, such as buying goods on a payment plan. The focus is more on the schedule of payments rather than the promise to pay a sum.

An IOU is a simple acknowledgment of debt, similar to but more informal than a Promissory Note. It typically includes less detail and may not specify repayment terms, making it less enforceable than a formally executed Promissory Note, which outlines detailed terms of repayment.

A Line of Credit Agreement shares similarities with a Promissory Note by detailing borrow and repayment terms. However, it allows the borrower to draw upon funds up to a specified limit over time, making it more flexible than a promissory note’s usually fixed borrowing amount.

A Personal Guarantee is akin to a Promissory Note when it involves repayment of a loan. With this document, another individual agrees to be responsible for the debt if the original borrower fails to repay, adding a layer of security for the lender not typically found in a basic Promissory Note.

A Credit Agreement can resemble a Promissory Note as it also involves the extension of credit under specific terms. However, Credit Agreements are often more complex and may govern revolving loans, such as credit card agreements, with variable interest rates and terms.

Lastly, a Bond is somewhat similar to a Promissory Note in that it represents a loan made by an investor to a borrower, typically a corporation or government entity. Bonds include terms of repayment and interest, but they are usually traded on public markets, which differs significantly from the private nature of a Promissory Note.

Dos and Don'ts

When filling out the Texas Promissory Note form, it's crucial to ensure all information is accurate and clear. Below is a list of things you should and shouldn't do to help guide you through the process.

Do:

- Read through the entire form before you start filling it out. This helps understand the requirements and ensures that all necessary information is at hand.

- Use black ink or type the information if the form is available in a fillable PDF format. This makes the document legible and ensures that all entries are clearly visible.

- Include all requested details such as the full legal names of the borrower and lender, the loan amount, and the repayment schedule.

- Ensure the interest rate complies with Texas state laws to avoid any legal issues concerning usury.

- Review the form for errors or omissions before signing. It's important to double-check all entered information for accuracy.

- Have all parties sign the promissory note in the presence of a notary public if required, to authenticate the identities of the signatories.

Don't:

- Leave any fields blank. If a section doesn’t apply, enter "N/A" (not applicable) to show that you didn’t overlook it.

- Use pencil or colors other than black ink as they can fade over time or not be suitable for official records.

- Sign the form without ensuring that all parties fully understand the terms and conditions of the loan, including repayment expectations and any potential consequences for default.

- Rely solely on verbal agreements. The promissory note should accurately reflect all terms agreed upon by the parties involved.

- Forget to include a clause about late fees or consequences of non-payment. Clearly outlined penalties help ensure compliance with the repayment schedule.

- Overlook the importance of keeping a copy of the signed promissory note for your records. It serves as a legal document and proof of the loan agreement.

Following these guidelines will help ensure that your Texas Promissory Note is complete, accurate, and legally compliant.

Misconceptions

In the realm of financial agreements, particularly within the jurisdiction of Texas, various misconceptions orbit around the use of a Promissory Note. Below, some of these misunderstandings are addressed to clarify the nature and legal standing of these documents.

All promissory notes are the same: It's a common misconception that all promissory notes are uniform across the board. In truth, the terms and conditions can vary dramatically, reflecting the intentions and agreements of the parties involved. Texas law requires certain elements for a promissory note to be legally binding but allows flexibility in terms.

Only financial institutions can issue them: There's a belief that promissory notes are formal financial instruments only banks or lending institutions can issue. However, any individual or business entity can create a promissory note as long as it meets legal requirements set forth by Texas law.

Verbal agreements suffice: While verbal agreements may hold value in social contexts, a promissory note needs to be in writing to be enforceable in Texas. This ensures clarity in terms, repayment schedules, and interest rates, if any.

Interest rates are non-negotiable: Many believe that the interest rates on promissory notes are fixed or regulated strictly. In reality, while Texas does set a maximum allowable interest rate to prevent usury, the parties are otherwise free to negotiate a rate that suits them both.

They require notarization to be valid: A widespread misconception is that for a promissory note to be legally binding in Texas, it must be notarized. Though notarization can add a layer of formal verification, the absence of a notary seal does not invalidate a properly executed note.

There's no need for witnesses: While Texas law doesn't strictly require witnesses for a promissory note to be valid, having impartial witnesses can provide additional legal protection and credibility to the document, especially in the event of a dispute.

A promissory note is just an IOU: It's a common misunderstanding to conflate promissory notes with IOUs. Although both acknowledge debt, a promissory note is more formal and includes specific terms of repayment which an IOU may lack.

They don't expire: Some people believe promissory notes remain valid indefinitely. However, Texas has a statute of limitations for the enforcement of debts. Once this period expires, the note cannot be legally enforced, though it remains a record of debt.

Co-signers aren't responsible for the debt: Misunderstandings about the responsibility of co-signers can lead to disputes. In Texas, a co-signer on a promissory note is equally liable for the debt, provided this is outlined in the agreement.

Failure to repay isn't a big deal: There's a misconception that failing to repay a loan under a promissory note has no serious consequences. In reality, defaulting can lead to legal action in Texas courts, impacting credit scores and financial stability.

Understanding these misconceptions about promissory notes in Texas is crucial for individuals and businesses alike to navigate their financial undertakings with clarity and legal foresight.

Key takeaways

A Texas Promissory Note form is a legal document that outlines a loan's terms between two parties: the lender and the borrower. In Texas, this document helps ensure that the agreement's specifics are clear and enforceable. Below are ten key takeaways regarding filling out and using this form:

- Understand the Types: Texas recognizes both secured and unsecured promissory notes. A secured note requires collateral, while an unsecured note does not. Knowing the difference is crucial in determining the right approach for your needs.

- Include Essential Information: The promissory note must contain details such as the amount borrowed, interest rate, repayment schedule, and information about both the lender and the borrower.

- Determine the Interest Rate: Texas law caps the interest rate that can be charged. Ensure the rate agreed upon does not exceed the legal limit to avoid penalties related to usury laws.

- Specify Repayment Terms: Clearly outline how and when repayments will be made. This could include payment frequency, amounts, and the final due date for the loan's full repayment.

- Consider Adding a Co-signer: If the borrower's creditworthiness is uncertain, you might require a co-signer. This adds an extra layer of security for the lender as the co-signer becomes equally responsible for repaying the loan.

- Secured Promissory Notes: If the note is secured, describe the collateral in detail. This clarity ensures both parties understand what is at risk if the loan is not repaid.

- Document the Loan Thoroughly: Both parties should keep accurate records of all payments made under the promissory note to avoid any future disputes.

- Include Default Terms: Specify what constitutes a default on the loan, the repercussions, and any grace period that the borrower may have for late payments before they are considered in default.

- Understand the Legal Enforcement: Be aware of the legal actions that can be taken if the borrower fails to meet the terms of the note. This includes the process for securing judgments or seizing collateral in the case of secured loans.

- Signatures Are Mandatory: The promissory note must be signed by both the lender and the borrower to be legally binding. Witnesses or a notary public can provide additional legal validation.

Properly completing and understanding a Texas Promissory Note form is essential for both parties involved in a loan agreement. It not only provides a clear agreement but also ensures that the arrangement is enforceable under Texas law. Ensure all information is accurate and that both parties have a copy of the signed document for their records.

Popular Promissory Note State Forms

How to Get a Copy of Your Mortgage Note - Serves as a enforceable legal document in court, should there be a dispute or failure to repay the loan.

Promissory Note Template New York - The inclusion of an interest rate is a key feature, detailing whether the loan will accrue interest over time.

Promissory Note Friendly Loan Agreement Format - It clearly defines the obligations of the borrower, including how and when payments should be made.

Promissory Note Template Florida Pdf - Real estate transactions often utilize Promissory Notes to detail mortgage agreements, including payment schedules and interest.