Official Release of Promissory Note Document

Embarking on the journey of lending or borrowing funds often culminates in the creation of a promissory note, a pivotal document outlining the borrower's promise to repay the lender under agreed-upon terms. While this legal instrument signifies the commencement of the financial relationship, the conclusion of this agreement is marked by another critical document: the Release of Promissory Note form. This essential form is not merely a procedural necessity but a legal confirmation of the debt being fully satisfied, thereby releasing the borrower from their obligations. Its significance extends beyond the mere acknowledgment of payment, encompassing the protection of both parties from future disputes regarding the loan. Comprehensive in nature, the form addresses all necessary details to ensure a clear and undeniable conclusion to the financial agreement. It effectively marks the end of one chapter and the beginning of another, often signifying the borrower's return to financial independence or the lender's recovery of their investment. As such, understanding the nuances of the Release of Promissory Note form is crucial for anyone involved in the lending process, ensuring that the closure of such agreements is handled with precision, clarity, and legal foresight.

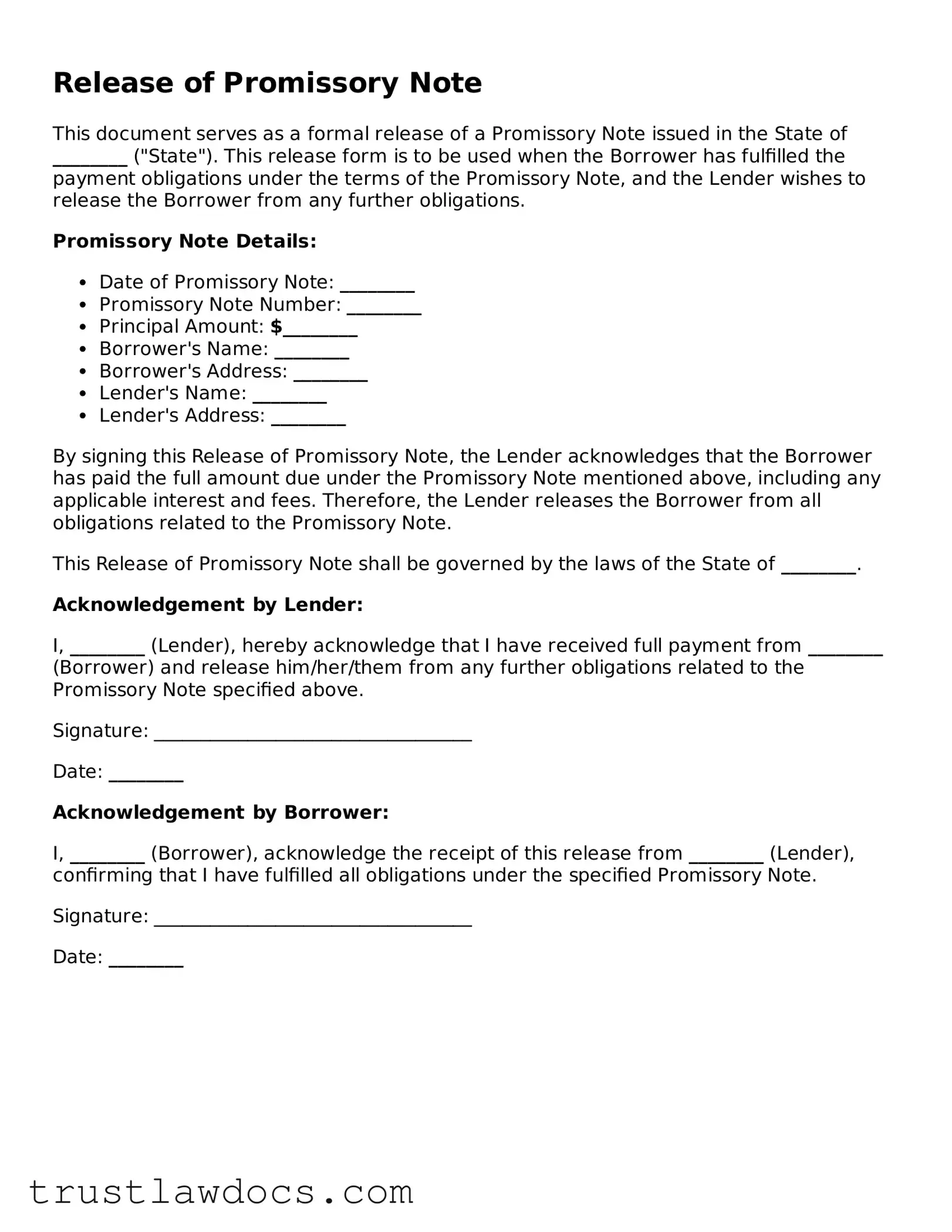

Form Example

Release of Promissory Note

This document serves as a formal release of a Promissory Note issued in the State of ________ ("State"). This release form is to be used when the Borrower has fulfilled the payment obligations under the terms of the Promissory Note, and the Lender wishes to release the Borrower from any further obligations.

Promissory Note Details:

- Date of Promissory Note: ________

- Promissory Note Number: ________

- Principal Amount: $________

- Borrower's Name: ________

- Borrower's Address: ________

- Lender's Name: ________

- Lender's Address: ________

By signing this Release of Promissory Note, the Lender acknowledges that the Borrower has paid the full amount due under the Promissory Note mentioned above, including any applicable interest and fees. Therefore, the Lender releases the Borrower from all obligations related to the Promissory Note.

This Release of Promissory Note shall be governed by the laws of the State of ________.

Acknowledgement by Lender:

I, ________ (Lender), hereby acknowledge that I have received full payment from ________ (Borrower) and release him/her/them from any further obligations related to the Promissory Note specified above.

Signature: __________________________________

Date: ________

Acknowledgement by Borrower:

I, ________ (Borrower), acknowledge the receipt of this release from ________ (Lender), confirming that I have fulfilled all obligations under the specified Promissory Note.

Signature: __________________________________

Date: ________

PDF Form Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The Release of Promissory Note form is used when a borrower has fulfilled the terms of the promissory note, completely paying off the debt owed. |

| 2 | This form serves as evidence that the borrower has no further financial obligations to the lender under the specific promissory note. |

| 3 | Execution of the release form effectively nullifies the original agreement provided that all conditions for the release are met. |

| 4 | State-specific laws may govern the requirements and enforceability of the Release of Promissory Note, necessitating a review of relevant state statutes and regulations. |

| 5 | In addition to signing the release, both parties may need to take further action to ensure that the release is recognized legally, such as filing the release with relevant state or local agencies. |

| 6 | It is highly recommended that both the lender and the borrower maintain copies of the signed Release of Promissory Note for their records. |

| 7 | Should disputes arise related to the promissory note after the release has been signed, the document serves as a key piece of evidence that the debt has been satisfied. |

How to Write Release of Promissory Note

Completing the Release of Promissory Note form is a significant step in formally acknowledging that a debt articulated in a promissory note has been fully paid and that the borrower is released from their obligations under that note. The process involves accurately filling out the form to ensure all legal requirements are met, thereby providing a clear, legal acknowledgment of the debt being settled. This step is often the final act in the lifecycle of a loan, serving as official documentation that the borrower has fulfilled their repayment obligations. Follow these straightforward steps to accurately complete the form.

- Determine the Date of Release: Enter the current date at the top of the form. This signifies when the release of the promissory note is being executed.

- Identify the Parties: Fill in the full legal names of the borrower and the lender as they appear on the original promissory note. Ensuring these match is critical for the document's legality.

- Reference the Promissory Note: Include the date of the original promissory note and any identifying number if applicable. This information ties the release directly to the original agreement.

- State the Amount: Although the debt is paid, indicate the full amount that was owed under the promissory note. This clarity supports the document's purpose in showing the debt has been cleared.

- Detail the Payment: Specify that the borrower has made full payment of the debt. If partial payments were made over time, you may note that the final payment has been received, clearing any outstanding balance.

- Sign and Date: The lender, or the lender’s authorized representative, must sign and date the form. The signature formally releases the borrower from the obligations under the promissory note.

- Notarization (If Required): Depending on state laws or the terms of the original promissory note, notarization of the release may be necessary. If so, ensure a notary public witnesses the signature and stamps the document.

Once the form is fully completed and properly signed, it provides definitive legal evidence that the debt covered by the promissory note has been settled. The borrower can then retain the release as proof of their discharge from the debt, and the lender may use it to update their records, reflecting the loan's closure. Proper filing and storage of this document by both parties is recommended, should future reference to the transaction become necessary.

Get Answers on Release of Promissory Note

What is a Release of Promissory Note form?

A Release of Promissory Note form is a document used when a borrower has fully paid off a loan to the lender. This form officially releases the borrower from any further obligations under the promissory note, which is the original agreement where they promised to pay back the borrowed money. It serves as a legal proof that the debt has been satisfied.

When should I use a Release of Promissory Note form?

This form should be used as soon as the borrower completes the payment of the loan according to the terms outlined in the promissory note. It's an important step for both parties: for borrowers, to ensure they are no longer liable for the debt, and for lenders, to formally acknowledge that they have received the full payment and closed the loan.

What information do I need to include in a Release of Promissory Note form?

Typically, the form should include the date of the promissory note, the names of both the borrower and the lender, the original amount of the loan, and the date of the final payment. It also often contains a statement that the borrower has fulfilled the obligations of the note, along with both parties' signatures.

Can I create a Release of Promissory Note form by myself?

Yes, you can create this form by yourself, but it's important to ensure that it contains all the necessary and correct information to legally release the borrower from the loan obligations. It may be beneficial to consult a legal forms expert or attorney to ensure the form adequately meets legal requirements and is properly executed.

What should I do after the Release of Promissory Note form is signed?

After the form is signed, the borrower should keep the original copy for their records, and the lender should also keep a copy. It's important to store this document safely as it serves as proof that the loan has been fully paid off. The lender might also need to take additional steps, like notifying a credit bureau, to reflect that the debt has been settled.

Is a Release of Promissory Note form legally binding?

Yes, when properly completed and signed by both the borrower and the lender, a Release of Promissory Note form is a legally binding document. It effectively releases the borrower from their obligations under the promissory note, acknowledging that the debt has been fully paid.

Can the release be revoked once it is signed?

In general, once a Release of Promissory Note form is signed and the debt is settled, the release cannot be revoked. It signifies the end of the parties' obligations related to the promissory note. Any attempt to revive the debt would likely require new agreement unless the release was obtained through fraudulent means or significant error.

Common mistakes

Filling out a Release of Promissory Note form requires attention to detail and an understanding of its implications. One common mistake people make is not correctly identifying all parties involved. The form should accurately name the borrower, lender, and any co-signers associated with the original promissory note. Misidentification or omitting a relevant party can invalidate the release or create legal ambiguities down the line.

Another oversight is failing to reference the original promissory note correctly. This includes not only the date the note was signed but also any identifying number or code associated with it. By accurately linking the release to the specific promissory note, parties ensure that there is no confusion about which debt is being released. Without this clear connection, the effectiveness of the release may be questioned, potentially leaving the lender unintentionally exposed to future claims.

A further error is neglecting to specify the conditions of the release. A Release of Promissory Note can either be full, releasing the borrower from all obligations under the note, or partial, specifying conditions such as a reduced payoff amount or other alterations to the original agreement. Failure to clearly state the nature of the release can lead to disputes over the extent of the borrower's remaining obligations.

Incorrectly dating the document is another common mistake. The date of signing the release should reflect when the agreement to release the debt was actually made. An incorrect date can create confusion regarding the timeline of the release, potentially complicating matters if the release is later contested.

Last but not least, the importance of obtaining signatures from all parties involved cannot be overstated. A Release of Promissory Note is not legally binding unless it is signed by the lender, the borrower, and any co-signers. Occasionally, individuals forget to collect all necessary signatures, undermining the legal enforceability of the document. This oversight can lead to significant legal challenges, particularly if disputes arise concerning the terms of the release.

Documents used along the form

When managing the repayment of a promissory note, several forms and documents are routinely utilized alongside the Release of Promissory Note form to ensure a smooth and legally compliant process. These documents serve various purposes, from establishing the terms of a loan agreement to officially acknowledging the satisfaction of debt. Here is a brief overview of each document.

- Promissory Note: This is a written promise made by one party (the borrower) to pay a specified sum of money to another party (the lender) under agreed-upon terms, including interest rates and repayment schedule.

- Loan Agreement: It details the obligations and expectations of both the borrower and the lender. This comprehensive document includes information on collateral, late fees, and conditions for the loan's repayment.

- Security Agreement: If the loan is secured, this document outlines the collateral that the borrower agrees to pledge to ensure repayment of the loan.

- Amortization Schedule: This is a table detailing each payment on a loan over time, breaking down the amounts going towards the principal and interest.

- Deed of Trust/Mortgage: For loans secured by real estate, this document puts a lien on the property as collateral for the loan.

- Guaranty: This is an agreement whereby a third party agrees to be responsible for the debt obligations of the borrower should they default.

- Notice of Default: This notice is sent to a borrower when they fail to make payments on time, formally warning them of defaulting on the loan.

- UCC-1 Financing Statement: For loans involving personal property as collateral, this document is filed to publicly declare the lender's right to potential interest in the borrower's property.

Collectively, these forms and documents work alongside the Release of Promissory Note form to legally bind, manage, and conclude financial transactions involving loans. They provide a structured and enforceable framework that ensures both parties' rights are protected while clearly documenting the journey from the initiation to the resolution of a loan.

Similar forms

The Release of Mortgage form shares a common purpose with the Release of Promissory Note in that it officially frees the borrower from the obligations of the mortgage upon the debt's full settlement. This document serves as proof that the borrower has fulfilled their financial responsibility to the lender, essentially clearing the lien on the property that was held as collateral. Much like how a Release of Promissory Note signifies the end of a borrower's obligation under that agreement, a Release of Mortgage confirms that the property tied to the loan is no longer encumbered by the mortgage.

A Satisfaction of Judgment document is akin to a Release of Promissory Note because it formally acknowledges that a court-ordered judgment has been settled. While the Release of Promissory Note applies to the fulfillment of a loan agreement between two parties, the Satisfaction of Judgment addresses the resolution of a legal judgment. Both documents officially recognize that an obligation—either financial in nature or as mandated by court—has been completely satisfied.

Lien Release forms are similar to Release of Promissory Note forms in that they signal the removal of a claim or hold on an asset, indicating that any debts or obligations secured by that asset have been fully paid off. The primary difference lies in the scope; a Lien Release typically pertains to tangible property like vehicles or equipment, showing that these are no longer held as collateral against a debt. Meanwhile, a Release of Promissory Note specifically deals with the conclusion of a loan agreement, releasing the signer from their promise to pay.

Loan Payoff Letters bear resemblance to Release of Promissory Note documents as they both indicate the conclusion of a financial obligation. The Loan Payoff Letter is a communication from the lender to the borrower stating that the loan has been fully repaid, including any applicable interest and fees, effectively bringing the agreement to a close. It's a preliminary step before issuing a Release of Promissory Note, which serves as the formal acknowledgment and release from the borrower's debt obligation.

Cancellation of Debt documents are in line with the Release of Promissory Note, in the sense that they formally recognize that a borrower's debt obligation has been relieved. However, the Cancellation of Debt often occurs under specific circumstances that forgive or write off the outstanding balance, such as insolvency or a settlement agreement. It signifies that the lender no longer intends to collect the debt, unlike the Release of Promissory Note, which confirms full payment of the debt.

A Deed of Reconveyance is similar to a Release of Promissory Note by its function of clearing the title to property once a loan has been fully repaid. Specifically used in trust deed states, it transfers the legal title from the trustee back to the borrower, signaling the borrower’s full repayment of the secured debt. The Release of Promissory Note also denotes the conclusion of a loan agreement but is not limited to real estate transactions.

Finally, a Payoff Statement, much like a Release of Promissory Note, is vital during the process of paying off a loan. It outlines the exact amount required to fully settle the debt by a certain date, including principal, interest, and any other fees. The Payoff Statement acts as a precursor to the Release of Promissory Note, providing the borrower with the necessary details to close out their financial obligation, leading to the issuance of the release document upon full payment.

Dos and Don'ts

Filling out a Release of Promissory Note form is an important step in formally acknowledging the fulfillment of a debt obligation. It is vital to approach this task with care and thoroughness. Here are some guidelines to ensure the process is carried out correctly:

Things You Should Do

- Verify all the details against the original promissory note, including the names of the borrower and lender, the total amount lent, and the date the loan was issued. Accuracy is key to ensure the release is legally binding.

- Ensure that all payments have been accounted for and that there are no discrepancies between the records of the borrower and the lender. This includes checking the principal amount as well as any interest or fees that were agreed upon.

- Include the date on which the final payment was made. This establishes a clear timeline and confirms that the debt has been satisfied in full.

- Have the release form signed by both parties and, if possible, notarized. This adds an extra layer of legal validation to the document, confirming that both parties acknowledge the debt has been fully repaid.

Things You Shouldn't Do

- Don’t leave any sections of the form blank. If a section does not apply to your situation, be sure to mark it as "N/A" (not applicable) rather than leaving it empty. This helps to prevent misunderstandings or the appearance of incompleteness.

- Avoid using vague language or terms. Clarity is crucial in legal documents to prevent potential disputes or challenges to the release in the future.

- Do not forget to distribute copies of the signed release to both the borrower and the lender. Both parties should have this document for their records, confirming the conclusion of their agreement.

- Refrain from destroying or discarding the original promissory note once the release has been signed. Keeping the original note with the release form as a complete record of the transaction is advisable.

Misconceptions

When it comes to the Release of Promissory Note form, there are several common misconceptions. Understanding these can help ensure that both lenders and borrowers are fully aware of their rights and obligations.

It's not necessary if the loan is paid off: Many believe that once a loan is paid off, the act of payment automatically negates the need for a Release of Promissory Note. However, this document is crucial as it serves as legal proof that the debtor has fulfilled their obligation, protecting them from any future claims.

Any format can be used: While there may be templates, it's important to ensure that the Release of Promissory Note meets specific state requirements. Using an incorrect format could invalidate the release.

Only the borrower needs a copy: It's essential for both the lender and the borrower to keep a copy of the Release of Promissory Note. This document serves as proof of the debt being paid off and protects both parties' interests.

A lawyer is not needed to draft it: While it's possible to prepare this form without legal assistance, consulting with a lawyer can ensure that the document complies with state laws and adequately protects your interests.

Signature verification is unnecessary: For the release to be legally binding, it must typically be signed in the presence of a notary or witness. This step verifies the identity of the signatory and prevents disputes.

It serves as a public record of the debt being paid: The Release of Promissory Note is a private document between the lender and borrower. While it serves as proof of payment, it is not typically filed with any government agency and doesn't serve as a public record.

It automatically transfers ownership of collateral: If collateral was used to secure the loan, a separate document may be required to release the lien on the property. The release itself does not automatically transfer ownership of collateral.

Electronic signatures are not acceptable: In today's digital age, electronic signatures are widely accepted and can be legally binding. However, the acceptability of electronic signatures on a Release of Promissory Note can vary by state law.

It can be issued before the loan is fully paid: Issuing a Release of Promissory Note before the loan is fully paid off is misleading and incorrect. The release should only be provided once the loan is fully settled.

There's no deadline for issuing it: While there may not be a strict legal deadline, it's in both parties' best interest to issue the release promptly after the loan is paid off. Delaying this process can lead to unnecessary misunderstandings or legal complications.

Key takeaways

When it comes to the Release of Promissory Note form, understanding its purpose and how to properly fill it out is crucial for both the borrower and the lender. This document officially indicates that the borrower has fulfilled the obligations under the promissory note, signifying the end of the agreement. Here are four key takeaways to keep in mind:

- Accuracy is key: Every piece of information on the form should be double-checked for accuracy. This includes names, dates, and the details of the promissory note itself. Errors can lead to confusion or disputes about whether the debt has been fully satisfied.

- Both parties should keep a copy: Once the form is filled out and signed, both the borrower and the lender should keep a copy for their records. This serves as proof of release and can be very important if there are any future questions about the debt.

- Legal requirements: The requirements for a Release of Promissory Note form can vary by state. It’s important to ensure that the form meets all legal requirements in the jurisdiction where the original agreement was made. If necessary, consulting with a legal professional can provide clarity and prevent issues down the line.

- Timing matters: The form should be filled out and signed as soon as the debt is fully satisfied. Delaying this process can result in unnecessary complications. It’s a simple step that formally concludes the agreement, providing peace of mind to all involved parties.

By paying attention to these aspects, parties can effectively use the Release of Promissory Note form to officially end a debt obligation. It's a clear and straightforward process that, when done correctly, prevents misunderstandings and legal complications, ensuring that both the borrower and the lender can move forward without any lingering obligations.

Consider More Types of Release of Promissory Note Forms

Bill of Sale With Promissory Note for Automobile - The documentation of a loan's specifics, including the repayment schedule, for a borrower who has purchased a vehicle.