Official Promissory Note for a Car Document

When embarking on the journey of purchasing a vehicle through private sale, both buyers and sellers find themselves navigating a sea of paperwork and agreements to ensure a smooth transaction. Central to these transactions is the Promissory Note for a Car form, a critical document that serves as a binding agreement between the two parties involved. This form outlines the terms under which the buyer agrees to pay the seller for the vehicle, specifying details like payment amount, schedule, interest rates, if applicable, and the repercussions of failing to meet the agreed-upon terms. Not only does it solidify the buyer's commitment to fulfill the payment plan, but it also provides the seller with a measure of security and recourse should the agreement be breached. Given its importance, understanding the nuances of this form is pivotal for anyone involved in a private car sale, ensuring both parties can embark on their agreement with confidence and a clear understanding of their respective obligations and rights.

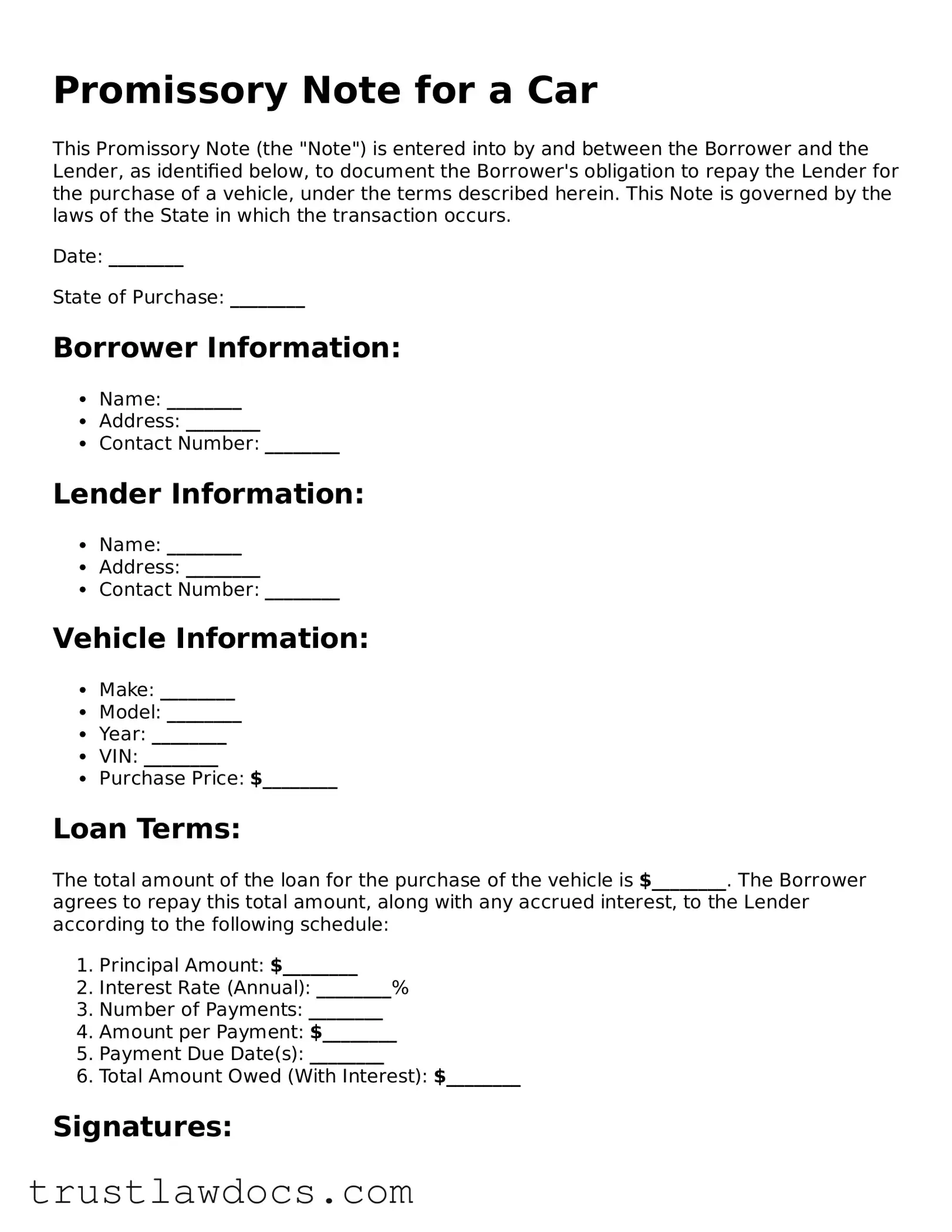

Form Example

Promissory Note for a Car

This Promissory Note (the "Note") is entered into by and between the Borrower and the Lender, as identified below, to document the Borrower's obligation to repay the Lender for the purchase of a vehicle, under the terms described herein. This Note is governed by the laws of the State in which the transaction occurs.

Date: ________

State of Purchase: ________

Borrower Information:

- Name: ________

- Address: ________

- Contact Number: ________

Lender Information:

- Name: ________

- Address: ________

- Contact Number: ________

Vehicle Information:

- Make: ________

- Model: ________

- Year: ________

- VIN: ________

- Purchase Price: $________

Loan Terms:

The total amount of the loan for the purchase of the vehicle is $________. The Borrower agrees to repay this total amount, along with any accrued interest, to the Lender according to the following schedule:

- Principal Amount: $________

- Interest Rate (Annual): ________%

- Number of Payments: ________

- Amount per Payment: $________

- Payment Due Date(s): ________

- Total Amount Owed (With Interest): $________

Signatures:

By signing below, both the Borrower and the Lender agree to the terms of this Note. Each party acknowledges receiving a completed copy of this Note at the time of signing.

Borrower's Signature: ________ Date: ________

Lender's Signature: ________ Date: ________

This Promissory Note is binding upon the Borrower and Lender, as well as their heirs, successors, and assigns.

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A Promissory Note for a Car is a written agreement wherein the borrower promises to pay back a sum of money borrowed to purchase a vehicle to the lender, typically including interest, by a certain date. |

| Key Components | Includes the amount borrowed, interest rate, repayment schedule, and signatures of both parties involved. |

| Importance of Clarity | Ensuring all terms are clear and agreed upon prevents misunderstandings and legal complications down the line. |

| Governing Laws | While all U.S. states allow the use of a Promissory Note for a Car, the specific laws and regulations governing them can vary significantly from state to state. |

| Consequences of Default | If the borrower fails to repay according to the agreed terms, the lender may have the right to take possession of the vehicle or pursue other legal remedies. |

How to Write Promissory Note for a Car

When purchasing a car, individuals might decide on a private sale where traditional financing options are not a feasible choice. In such cases, both the buyer and seller can opt for a Promissory Note. This legal document not only outlines the repayment plan for the vehicle but also sets a legal framework to protect both parties’ interests. Properly completing the Promissory Note can seem daunting, but by following a structured approach, parties can ensure clarity and legality in their transaction. Let's walk through the steps necessary to fill out this form accurately.

Steps to Fill Out the Promissory Note for a Car Form- Gather the necessary information: the full names and addresses of both the buyer and the seller, the sale price of the car, agreed upon repayment schedule, the APR (Annual Percentage Rate), and any late fees.

- Begin by entering the date on which the Promissory Note is being created at the top of the form.

- Write down the full legal names and addresses of the borrower (buyer) and the lender (seller) in the designated sections.

- Include the vehicle information: make, model, year, VIN (Vehicle Identification Number), and the odometer reading at the time of sale.

- Detail the loan amount. This is the sale price of the vehicle that the borrower agrees to repay to the lender. Ensure this amount is written clearly and accurately.

- Specify the repayment schedule. This section includes the total number of payments, the amount of each payment, the due date of the first payment, and the frequency of payments (e.g., monthly).

- Input the interest rate, referred to as the Annual Percentage Rate (APR). This percentage outlines the interest that will be paid in addition to the principal amount owed on the car.

- Clarify the late payment policy. This should include any late fees that will apply if a payment is not made by the due date.

- Both the borrower and the lender should sign and date the bottom of the form, ratifying their agreement to the terms specified in the Promissory Note. Witness signatures may also be required depending on local laws.

Once filled out, the Promissory Note acts as a binding legal agreement that delineates the responsibilities of the buyer to repay the borrowed amount under the agreed-upon terms. It is suggested that both parties keep a signed copy of the document. Completing this form not only formalizes the sale but also instills a sense of security and confidence between the buyer and the seller. Remember, a well-documented agreement is a step towards a transparent and respectful financial transaction.

Get Answers on Promissory Note for a Car

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines the details of a loan agreement specifically meant for the purchase of a vehicle. This document clearly lays out the amount borrowed, the repayment schedule, interest rate if applicable, and any other terms related to the sale and financing of the car. By signing this note, the borrower commits to repaying the loan under the agreed-upon conditions.

Who should sign the Promissory Note for a Car?

Both the lender, who could be either a financial institution or an individual providing the loan, and the borrower, the person receiving the funds to purchase the vehicle, must sign the Promissory Note. These signatures are essential as they validate the agreement, making it legally binding and enforceable. Witnesses or a notary public may also sign the document to further authenticate the agreement.

Is interest required on a Promissory Note for a Car?

Whether or not interest is required on a Promissory Note for a Car depends on the agreement between the lender and the borrower. The terms regarding interest, including the rate and how it is to be applied, should be detailed in the note. In some cases, the parties may agree on a no-interest loan; however, if interest is charged, it must not exceed the legal limit set by the state in which the agreement is made.

What happens if the borrower defaults on the Promissory Note for a Car?

In the event of a default, where the borrower fails to make the agreed-upon payments, the consequences should be specified within the Promissory Note itself. Typically, the lender has the right to take legal action to recover the outstanding debt. This could include repossessing the vehicle or suing the borrower for the amount owed. The specific recovery process often depends on the terms of the promissory note and the laws of the state.

Can the Promissory Note for a Car be modified?

Yes, modifications to the Promissory Note for a Car can be made if both the lender and the borrower agree to the changes. Any amendments should be documented in writing and signed by both parties, as verbal agreements may not be legally enforceable. It's important to clearly document any changes to ensure both parties have a clear understanding of the new terms.

Common mistakes

Filling out a Promissory Note for a Car is a straightforward process, but it's easy to make mistakes if one is not careful. These errors can range from simple oversights to more significant misunderstandings of the terms, leading to problems down the line for both the borrower and the lender. By being aware of these common pitfalls, parties can ensure a smoother transaction and protect their interests.

One common mistake is not clearly defining the terms of the loan. This includes failing to specify the loan amount, interest rate, repayment schedule, and due dates. When these key details are vague or omitted altogether, disputes can arise, making it difficult to enforce the agreement. It's crucial to spell out every term and condition explicitly to prevent misunderstandings.

Another error involves overlooking the importance of including a clause about late fees and penalties for missed payments. Without this, the lender has limited recourse if payments are made late or not at all. By clearly defining the consequences for non-payment, both parties understand the seriousness of the commitment, encouraging adherence to the agreed-upon schedule.

Not verifying the identity and the authority of the parties involved is also a mistake that can lead to significant issues. Both the borrower and the lender must have the legal capacity to enter into the agreement. Failing to confirm this can invalidate the entire note, rendering it unenforceable in a court of law.

Underestimating the importance of having a witness or notarization is another oversight. While not always legally required, having the document witnessed or notarized adds a layer of authenticity and can help prove the validity of the signatures if the agreement is ever disputed.

A further mistake is neglecting to outline the procedure for amending the note. Circumstances change, and the initial terms may no longer be feasible. Without a clear process for making amendments, modifying the agreement can become complicated, potentially damaging the relationship between the parties.

Ignoring the need to specify the governing law is also problematic. Without stating which state's laws will interpret the note, there can be confusion and conflict over which legal standards apply in the event of a dispute. This could lead to lengthy and costly legal battles that could have been easily avoided.

Finally, a critical error some make is not keeping a signed copy of the note. Each party should retain a copy for their records to ensure that there's evidence of the agreement and its terms. Losing this vital document can make it challenging to enforce its terms or prove the loan's existence in a disagreement.

Documents used along the form

When purchasing or selling a car, the Promissory Note is a critical document. However, this note often comes with other forms and documents to ensure a legally sound and smooth transaction. Here's a list of up to eight additional documents commonly used alongside the Promissory Note for a Car form.

- Bill of Sale: This document officially records the sale of the car and transfers ownership from the seller to the buyer. It typically includes the car's make, model, year, VIN, and the purchase price.

- Title Transfer Documents: To legally transfer the vehicle’s title to the new owner, these documents are required. The specific forms vary by state but usually involve signing over the car's title from the seller to the buyer.

- Odometer Disclosure Statement: Federally required for vehicles under ten years of age, this statement confirms the accuracy of the car's mileage at the time of sale.

- VIN Inspection Form: Some states require a vehicle identification number (VIN) inspection when a used vehicle is sold or registered for the first time in that state.

- As-Is Sale Agreement: If the car is sold without any warranties regarding its condition, this document clearly states that the buyer accepts the car "as is."

- Loan Agreement: When a car is purchased with a loan, this agreement outlines the terms of the loan, including interest rate and repayment schedule.

- Insurance Proof: Proof of insurance is usually required at the time of purchase to ensure the vehicle is covered under a policy.

- Registration Application: To legally drive the car, the buyer must submit a registration application to the state’s motor vehicle department.

Together, these documents create a comprehensive legal framework around the sale and purchase of a vehicle, protecting both the buyer and the seller. While the Promissory Note for a Car form establishes the promise to pay, the additional documents ensure the legitimacy of the sale, the transfer of ownership, and compliance with state and federal laws. It's important for both parties to understand and accurately complete these forms to avoid any legal or financial complications down the road.

Similar forms

A Loan Agreement is closely related to a Promissory Note for a Car form in that both outline the terms under which money is borrowed and must be repaid. Like the Promissory Note, a Loan Agreement specifies the amount of the loan, repayment schedule, interest rate, and the consequences of non-payment. However, a Loan Agreement is typically more detailed and may include clauses about the use of the loaned funds, requirements for insurance on the purchased vehicle, and guarantees or collateral.

A Bill of Sale for a Car shares similarities with a Promissory Note for a Car as both documents are used in the process of buying or selling a vehicle. The Bill of Sale serves as proof of the transaction and transfers ownership of the vehicle from the seller to the buyer. Unlike the Promissory Note, which outlines the repayment of the loan used to purchase the vehicle, the Bill of Sale confirms that the transaction has occurred and details the vehicle's purchase price, make, model, and VIN.

A Security Agreement has aspects in common with a Promissory Note for a Car, especially when a vehicle is used as collateral for a loan. This legal document provides the lender with a security interest in the asset (the car) until the borrower repays the loan in full. It outlines conditions under which the lender can repossess or sell the vehicle if the borrower defaults on the loan, akin to how a Promissory Note specifies the financial obligations of the borrower.

An IOU (I Owe You) is another document similar to a Promissory Note for a Car, as it acknowledges a debt owed by one party to another. However, an IOU is far less formal and detailed than a Promissory Note. It typically includes minimal details such as the amount owed and the parties involved, without specifying repayment schedules, interest rates, or what happens in case of default.

A Personal Guarantee is related to a Promissory Note for a Car when an individual guarantees the repayment of the loan. This legal commitment means that if the borrower fails to repay the loan according to the terms of the Promissory Note, the guarantor will be responsible for repayment. The Personal Guarantee adds a layer of security for the lender, similar to how the Promissory Note lays out the repayment terms and obligations.

An Installment Sale Agreement is akin to a Promissory Note for a Car form, particularly with purchases that are paid over time in multiple payments. This agreement details the sale of goods where payment is made in increments, and just like a Promissory Note, it outlines the payment schedule, interest rates, and the consequences of late or missed payments. The primary difference is that an Installment Sale Agreement often covers the immediate transfer of possession of the item being purchased, even if payment is not yet complete.

Lastly, a Mortgage Agreement shares similarities with a Promissory Note for a Car, with the primary difference being the asset involved. In a Mortgage Agreement, the subject is real property or real estate, whereas a Promissory Note for a Car deals with a vehicle. Both documents serve as a pledge to repay a loan under agreed-upon terms and conditions, including the payment schedule, interest rate, and the consequences of non-payment. A Mortgage Agreement, like a Promissory Note, also often involves a security interest in the item being financed to protect the lender.

Dos and Don'ts

When filling out a Promissory Note for a car, it's essential to approach the process with attention and care. The document serves as a legal agreement between the borrower and the lender, outlining the repayment of the loan used to purchase the vehicle. The following guidelines can help ensure that the Promissory Note is completed accurately and effectively.

Do:

- Verify all personal information: Ensure that the names, addresses, and contact details of both the borrower and the lender are accurate.

- Include a detailed description of the car: This should cover the make, model, year, and Vehicle Identification Number (VIN) to avoid any ambiguity.

- Be clear about the loan amount: State the total amount being borrowed and ensure that both parties agree on this figure.

- Specify the interest rate: If the loan carries interest, the rate should be clearly noted in the document.

- Detail the repayment plan: Outline how repayments will be made, including the frequency of payments and the due dates.

- Consider including a late payment policy: Clearly state any penalties or additional charges for late payments to avoid future disputes.

- Sign in the presence of a notary: Although not always required, having the document notarized can add a layer of legal validation.

Don't:

- Leave blanks in the document: All sections should be completed to prevent potential alterations or misunderstandings.

- Rush through the process: Take the time to review all sections of the note thoroughly before signing.

- Skip the specifics of the repayment plan: Vague terms can lead to confusion and disagreements down the line.

- Forget to specify the jurisdiction: Indicate the governing state laws for the agreement, as legal provisions can vary from one state to another.

- Overlook the need for witness signatures: While not mandatory in all cases, having witnesses can provide additional proof of the agreement's validity.

- Ignore the importance of keeping copies: Both the borrower and the lender should retain copies of the signed document for their records.

- Assume verbal agreements suffice: Always ensure that all terms are written down in the promissory note to provide a legal basis for the loan's terms.

Misconceptions

When dealing with the Promissory Note for a Car form, there are several misconceptions that can create confusion. It's crucial to understand what this document is and what it is not to ensure a smooth transaction and to protect both parties involved. Here are four common misconceptions:

- A Promissory Note is the same as a Car Sale Agreement. Many people confuse a Promissory Note with a Car Sale Agreement, but they serve different purposes. A Promissory Note is a promise to pay a specified amount under agreed-upon terms. In contrast, a Car Sale Agreement outlines the terms of the sale, including responsibilities and warranties.

- The Promissory Note fully secures the loan. While a Promissory Note is legally binding, it does not by itself fully secure the loan. For better security, the lender should also obtain a security interest in the car, ensuring legal measures can be taken if the borrower fails to make payments.

- Only the borrower needs to sign the Promissory Note. This misunderstanding can lead to legal challenges. Both the borrower and the lender should sign the Promissory Note. This makes the agreement legally binding and ensures that both parties understand and agree to the terms.

- Terms of the Promissory Note cannot be modified once signed. Life can be unpredictable, and financial situations change. Both parties can agree to modify the terms of the Promissory Note. Any changes should be documented in writing and signed by both the lender and the borrower to avoid future disputes.

Understanding these misconceptions allows both lenders and borrowers to better prepare and execute a Promissory Note for a Car form, ensuring clarity and fairness in the agreement.

Key takeaways

When you're filling out and using a Promissory Note for a Car, it's essential to understand what you're getting into. This financial agreement is not just any ordinary document. It is a binding contract between the borrower and the lender, outlining the details of the car loan. Below are key takeaways to ensure the process is handled correctly and both parties are protected.

- Complete All Sections Accurately: Without fail, every section of the Promissory Note must be completed with accurate information. This includes the full names and addresses of both the borrower and the lender, along with the vehicle's description (make, model, year, and VIN).

- Detail the Loan Amount Clearly: The total amount being lent for the purchase of the car should be clearly stated to avoid any confusion. This should be the amount agreed upon by both parties.

- Clarify Payment Terms: Spell out the repayment terms, including the due date for the first payment, the payment schedule (monthly, quarterly, etc.), the amount of each payment, and where payments should be sent.

- Include Interest Rate Information: If the loan includes interest, the rate should be specified in the Promissory Note. Ensure that this rate is agreed upon by both parties and is within state legal limits.

- Specify Late Fees: Clearly state any late fees applicable if payments are not made on time. This section should include how many days after a missed payment a fee will be charged and the amount of the fee.

- Address Prepayment: If the borrower wishes to repay the loan early, terms governing prepayment should be included. This section should specify if there are any penalties for early repayment.

- Include a Security Agreement: In many cases, the car itself serves as collateral for the loan. It’s imperative to include a clause that outlines the lender's right to take possession of the vehicle if the borrower fails to make payments.

- Signatures are Crucial: The Promissory Note is not legally binding until it has been signed by both the borrower and the lender. Ensure that both parties sign and date the document in front of a witness or notary, if required by law.

Properly filling out and understanding a Promissory Note for a Car can prevent future disputes and ensure that both the borrower and lender are clear on the agreement terms. By keeping these key points in mind, you can facilitate a smoother loan process for the purchase of a vehicle.

Consider More Types of Promissory Note for a Car Forms

Satisfaction and Release Form - It signifies the trustworthiness of a borrower to future lenders, seen through their commitment to fulfilling loan agreements.