Free Promissory Note Form for New York

In the bustling state of New York, amidst its towering skyscrapers and vibrant neighborhoods, the use of a promissory note form holds significant value for both lenders and borrowers navigating the complexities of financial agreements. This document, fundamental in nature, crystallizes the promise made by a borrower to pay back a specified sum of money to the lender within a set timeframe. Its framework encompasses various essential aspects such as interest rates, repayment schedules, and the consequences of default, ensuring clarity and mutual understanding between the parties involved. Tailored to adhere to New York's specific legal standards, the promissory note serves as a binding agreement that underscores the seriousness of the financial transaction, providing a sense of security and trust. By meticulously outlining the obligations and expectations, this form plays a pivotal role in facilitating smooth financial exchanges, guarding against misunderstandings, and laying the groundwork for amicable resolutions in case of disputes. Thus, it stands as a cornerstone in the realm of personal and business finance within the Empire State, embodying the principles of accountability and reliability.

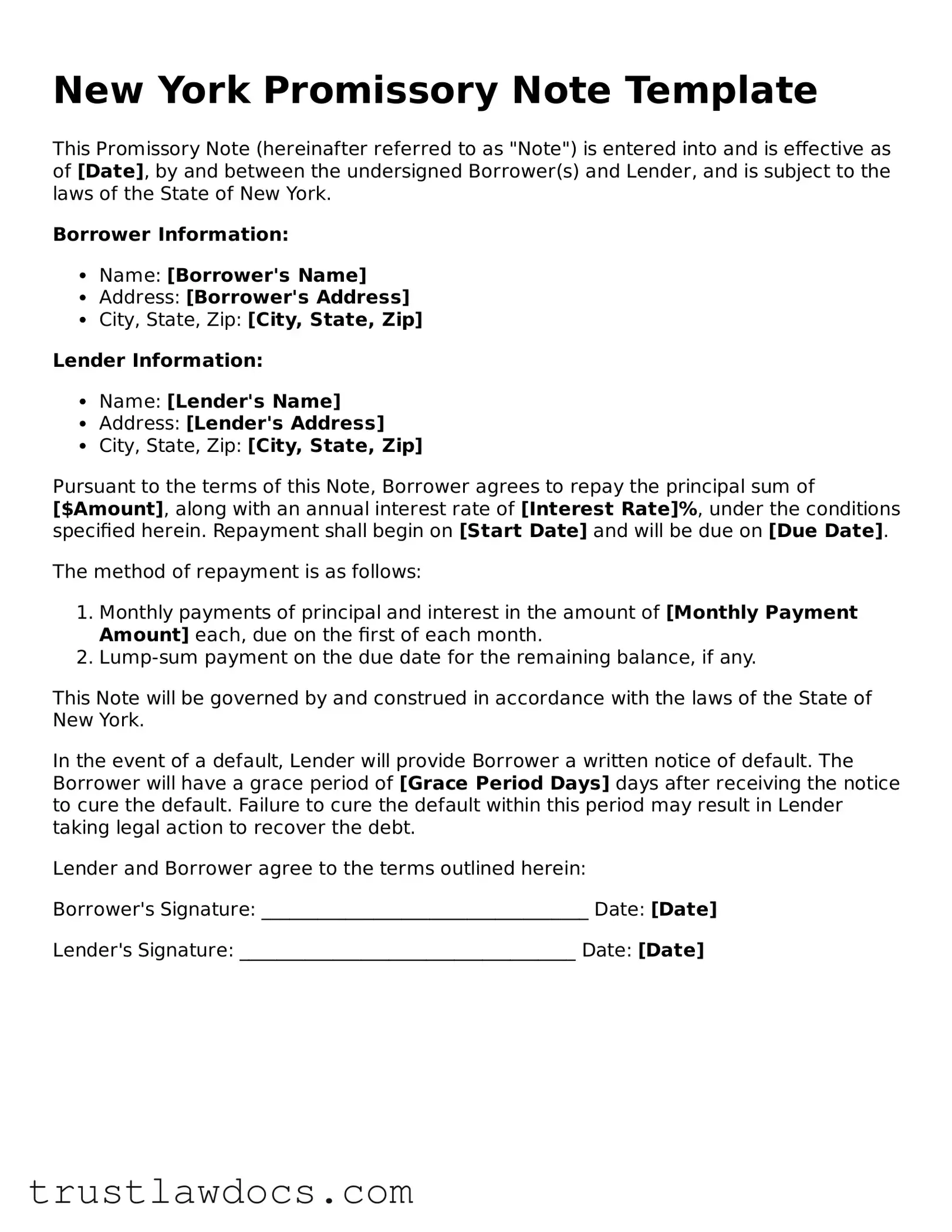

Form Example

New York Promissory Note Template

This Promissory Note (hereinafter referred to as "Note") is entered into and is effective as of [Date], by and between the undersigned Borrower(s) and Lender, and is subject to the laws of the State of New York.

Borrower Information:

- Name: [Borrower's Name]

- Address: [Borrower's Address]

- City, State, Zip: [City, State, Zip]

Lender Information:

- Name: [Lender's Name]

- Address: [Lender's Address]

- City, State, Zip: [City, State, Zip]

Pursuant to the terms of this Note, Borrower agrees to repay the principal sum of [$Amount], along with an annual interest rate of [Interest Rate]%, under the conditions specified herein. Repayment shall begin on [Start Date] and will be due on [Due Date].

The method of repayment is as follows:

- Monthly payments of principal and interest in the amount of [Monthly Payment Amount] each, due on the first of each month.

- Lump-sum payment on the due date for the remaining balance, if any.

This Note will be governed by and construed in accordance with the laws of the State of New York.

In the event of a default, Lender will provide Borrower a written notice of default. The Borrower will have a grace period of [Grace Period Days] days after receiving the notice to cure the default. Failure to cure the default within this period may result in Lender taking legal action to recover the debt.

Lender and Borrower agree to the terms outlined herein:

Borrower's Signature: ___________________________________ Date: [Date]

Lender's Signature: ____________________________________ Date: [Date]

PDF Form Details

| Fact | Description |

|---|---|

| Definition | A New York Promissory Note form is a legal document that outlines the terms under which one party promises to repay a specified sum of money to another party. |

| Types | There are two main types: Secured (backed by collateral) and Unsecured (not backed by collateral). |

| Governing Laws | The form and enforcement are governed by the laws of the State of New York, including the New York General Obligations Law. |

| Interest Rate | New York law stipulates that the interest rate should not exceed the legal limit set by the state's usury laws unless a specific exemption applies. |

| Enforcement | If a borrower fails to repay according to the agreed terms, the lender may take legal action to recover the debt, subject to New York's statutes of limitations. |

| Key Elements | Essential elements include the amount borrowed, interest rate, repayment schedule, and signatures of both parties. |

How to Write New York Promissory Note

When you're about to fill out a New York Promissory Note, it's crucial to understand that this document is a formal promise to pay a specified sum of money to someone within a defined period. The procedure isn't complicated, but attention to detail is essential to ensure all the information is accurate and complete. By following a step-by-step guide, you can fill out the form correctly and avoid any potential issues that might arise from mistakes or omissions.

- Start by entering the date at the top of the form. This should be the date on which the promissory note is being completed and signed.

- Next, fill in the full legal name of the borrower (the person who is borrowing the money) as well as their complete address including city, state, and zip code.

- In the following section, enter the full legal name of the lender (the person or entity lending the money) along with their full address.

- The principal amount of the loan must be written in both words and figures. Ensure that both representations match exactly.

- Specify the interest rate per annum. This should be a clear percentage and must comply with New York's usury laws to avoid being rendered void for excessive interest charges.

- Detail the loan repayment schedule. Choose whether the loan will be paid in a lump sum, in regular installments, or on demand, and specify the dates or conditions accordingly.

- If installments are chosen, clarify the amount of each payment and whether these payments will include both principal and interest or interest only initially.

- Include any agreed terms regarding late fees and missed payment penalties. This section provides an opportunity to specify any financial consequences for late or missed payments.

- Specify the governing state law, which in this case would be New York, to make clear which state's laws apply to the interpretation of the note.

- Both the borrower and lender must sign and print their names at the bottom of the form. If witnesses are required or if a notary public is to authenticate the signatures, ensure their signatures and seals are affixed too.

Following these steps will help you fill out a New York Promissory Note correctly. It's designed to create a legally binding agreement between the borrower and the lender, outlining the loan's terms and conditions. Careful completion of each step ensures that both parties are clear about their obligations, which can help prevent misunderstandings and disputes down the line.

Get Answers on New York Promissory Note

What is a New York Promissory Note?

A New York Promissory Note is a legal document that records a loan agreement between two parties in the state of New York. It outlines the amount borrowed, interest rate, repayment schedule, and the obligations of the borrower. This document helps protect the rights of both the lender and the borrower by clearly stating the terms of the loan.

Do I need to notarize my New York Promissory Note?

While notarization is not required for a New York Promissory Note to be legally binding, it is often recommended. Notarizing the document can help prove the authenticity of the signatures if there's ever a dispute. However, the most critical aspect is that all parties understand and agree to the terms outlined in the document.

Can I charge any interest rate on a New York Promissory Note?

In New York, the interest rate on a promissory note must comply with the state's usury laws. The legal rate of interest is 6% per year for loans that do not specify a rate. However, for loans between $250,000 and $2,500,000, lenders may charge up to 16% per year. It's important to check the most current regulations to ensure compliance.

What happens if the borrower does not repay the loan as agreed?

If the borrower fails to repay the loan according to the terms outlined in the New York Promissory Note, the lender has the right to seek repayment through legal means. The lender can file a lawsuit against the borrower for breach of contract. If successful, the lender may be able to recover the owed amount plus any legal fees incurred.

Is a verbal agreement just as valid as a written New York Promissory Note?

While verbal agreements can be legally binding, proving the terms and existence of a verbal agreement is significantly more challenging than with a written document. A written New York Promissory Note provides clear evidence of the loan terms and the parties' agreement, making it a much stronger and more enforceable agreement.

Can I modify a New York Promissory Note after it's been signed?

Yes, a New York Promissory Note can be modified after it's been signed, but any changes must be agreed upon by all parties involved. It's best to document these changes in writing and, if possible, to have the amendment signed by all parties or notarized to ensure there's no dispute about the modifications.

Does a New York Promissory Note need witnesses?

While having witnesses is not a legal requirement for a New York Promissory Note, it is a good practice. Witnesses can provide additional verification of the document's validity if the agreement is ever contested. However, the critical factor for enforceability is the signature of both parties involved in the transaction.

Common mistakes

Fulfilling a New York Promissory Note form might sound straightforward, but it's easy to trip up on some common mistakes. A promissory note is a legal agreement to repay a debt, so precision is key. Let's navigate through eight typical errors to help ensure that your documentation is both accurate and enforceable.

The first mistake often made is neglecting to specify the terms of repayment in detail. Simply stating the amount and the due date is not enough. You must clearly outline the payment schedule, whether it's in installments or a lump sum, and if interest will be applied. Without this, the agreement might be too vague to enforce.

Another common error is failing to define the interest rate properly, or setting an interest rate that exceeds the legal limit in New York. It's crucial to verify the current legal maximum before setting your rate. An illegally high interest rate can render the entire note unenforceable.

Inaccurate or incomplete identification of the parties involved is also a frequent misstep. Both the borrower and the lender must be clearly identified by their full legal names and addresses. This clarity ensures that all parties are legally acknowledged and can be held accountable.

Omitting key clauses can significantly weaken the promissory note. For instance, not including a clause on late payment penalties or what happens in the event of default might leave the lender vulnerable. These specifics protect both parties by setting clear expectations and consequences.

A particularly risky oversight is not securing the note when a large sum of money is involved. A secured promissory note requires the borrower to pledge collateral, which the lender can claim if the loan isn't repaid. Failing to secure the note in such cases could result in substantial losses for the lender.

Many individuals neglect to have the promissory note witnessed or notarized, assuming it’s not necessary. While not always a legal requirement, having an unbiased third party witness the signing can add an extra layer of protection and credibility to the document, helping to prevent disputes about its authenticity.

Another pitfall is failing to keep a copy of the signed promissory note. Both the lender and borrower should keep a signed copy. This precaution ensures that both parties have evidence of the agreement and its terms, which can be crucial in the event of a legal dispute.

Last but certainly not least, is the mistake of not adhering to New York State laws when drafting the promissory note. Every state has its own legal requirements and restrictions concerning promissory notes. Ignoring state-specific laws can result in an unenforceable agreement, so it's important to either consult with a legal professional or meticulously research New York’s laws when drafting your note.

Avoiding these common mistakes can greatly increase the enforceability and reliability of a New York Promissory Note. It's more than a piece of paper; it's a commitment. Detailed attention to its preparation can save both parties from potential future legal headaches and financial losses.

Documents used along the form

When dealing with financial agreements in New York, particularly those involving promissory notes, it's important to understand that a singular form often does not suffice. These documents are typically accompanied by additional forms and documents to secure the agreement fully, protect the interests of all parties involved, and ensure legal compliance. Let's delve into some of the other necessary forms and documents that are commonly used alongside the New York Promissory Note.

- Security Agreement: This document is crucial when the promissory note is secured with collateral. It details the collateral being used to secure the loan, the conditions under which the lender can take possession of the collateral, and the obligations of both parties regarding the care and maintenance of the collateral.

- Guaranty: A guaranty is often required when there is a need to provide additional assurance that the loan will be repaid. It is a legal commitment by a third party (the guarantor) to pay back the loan if the original borrower fails to do so.

- Loan Agreement: While a promissory note specifies the terms of repayment, a loan agreement is a more comprehensive document that includes all terms and conditions of the loan. This may cover interest rates, repayment schedules, and what happens in the event of default.

- Amortization Schedule: This document provides a detailed breakdown of each payment over the course of the loan's term. It shows how much of each payment goes towards the principal balance and how much goes towards interest, helping both lender and borrower track the progress of loan repayment.

- UCC-1 Financing Statement: If the loan is secured by personal property, a UCC-1 Financing Statement may need to be filed. This legal form is used to publicly declare the creditor's interest in the collateral, making it a matter of public record.

Together, these documents work in conjunction to provide a clear, enforceable, and comprehensive agreement between the lender and borrower. Understanding and properly executing these documents can greatly reduce risks and ensure that both parties are protected throughout the duration of the loan. Whether you're lending or borrowing, it's essential to familiarize yourself with these forms and consider their implications on your financial agreement.

Similar forms

A New York Promissory Note is similar to a Loan Agreement in that both outline the terms under which money has been borrowed and must be repaid. However, a Loan Agreement typically encompasses more detailed provisions regarding the obligations of both lender and borrower, including any collateral, repayment schedules, and remedies for default. A Promissory Note, by contrast, tends to be simpler and more straightforward, focusing on the basic agreement to repay the borrowed amount plus interest.

Similarly, an IOU (I Owe You) shares common ground with a Promissory Note, as both are written acknowledgments of debt. However, an IOU is much less formal and usually does not include specific terms for repayment like interest rates or due dates. In essence, while an IOU acknowledges that a debt exists, a Promissory Note provides a detailed road map for repayment.

A Mortgage Agreement is another document closely related to a Promissory Note, especially when real estate transactions are involved. The key difference is that a Mortgage Agreement is secured by the property being purchased, serving as collateral for the debt, whereas a Promissory Note might not necessarily be secured. The Promissory Note acts as proof of the debt itself, while the Mortgage Agreement outlines the lender's right to seize the property if the debt is not repaid.

A Personal Guarantee is often used in conjunction with a Promissory Note when the borrower's creditworthiness is uncertain. It means that if the borrower fails to repay the debt, a third party guarantees to cover the repayment. This adds an extra layer of security for the lender but doesn't detail the repayment terms between the borrower and the lender - that's the role of the Promissory Note.

The Bill of Sale document complements a Promissory Note in transactions where goods are sold on credit. While the Bill of Sale transfers ownership of the item from seller to buyer, a Promissory Note can be used to outline the buyer's commitment to pay the seller over time for those goods. The Promissory Note specifies the payment terms, interest, and schedule, which the Bill of Sale does not.

A Debt Settlement Agreement shares similarities with a Promissory Note as both involve the repayment of borrowed money. However, a Debt Settlement Agreement is typically used when the original terms of a Promissory Note or other debt instrument cannot be met. It outlines new terms for repaying the debt, often at a reduced amount, and represents a negotiation between the debtor and creditor.

An Installment Agreement is quite like a Promissory Note in that it also details the repayment of a loan in regular payments over time. However, Installment Agreements are more specific about the number of payments, the amount of each payment, and the dates on which payments must be made. They are used for more structured repayment plans, whereas Promissory Notes may offer more flexibility in repayment terms.

A Credit Agreement overlaps with a Promissory Note's function to document a loan's details but is usually associated with more complex and larger financial transactions. Credit Agreements cover the terms and conditions under which credit is extended, repayment schedules, warranties, and covenants. Promissory Notes are less comprehensive, focusing chiefly on the repayment promise.

Lastly, a Demand Letter, while not a loan document, can be related to a Promissory Note as it may be used to request payment on a debt outlined in a Promissory Note. If the borrower fails to meet the terms of the Note, the lender might send a Demand Letter asking for immediate repayment. It's a step often taken before legal action is considered to enforce the terms of the Promissory Note.

Dos and Don'ts

When filling out a New York Promissory Note form, ensuring accuracy and legal compliance is critical. Both borrowers and lenders benefit from clear, unambiguous agreements. Here are ten do's and don'ts to guide you through the process:

Do:- Read carefully before you start to fill out the form. Understanding every section can prevent mistakes.

- Use black ink or type the information for clarity unless the form specifies otherwise. This ensures the document is legible and photocopy-friendly.

- Include all relevant parties' full legal names to avoid any confusion about the contract's participants.

- Specify the loan amount clearly and ensure that both the lender and borrower agree on the figure in writing.

- Clearly state the interest rate, as required by New York law, to avoid any misunderstandings or legal issues regarding usury laws.

- Define the repayment schedule, including due dates, to provide structure and avoid any ambiguity about expectations.

- Keep a record of the original signed document, as it is crucial for both parties to have proof of the agreement and its terms.

- Detail any collateral if the promissory note is secured, describing the asset(s) pledged as security for the loan.

- Consult with a legal professional if there's any confusion or questions about the document or its implications.

- Sign and date the document in the presence of a witness or notary if required, to add an extra layer of legal protection.

- Leave blanks on the form—ensure all fields are filled out or marked as not applicable (N/A).

- Guess on terms or details—verify all information to be accurate and reflective of the agreement between the parties.

- Ignore state laws that might affect the promissory note, such as usury laws or requirements for a witness or notary.

- Forget to specify whether the note is secured or unsecured, as this significantly impacts rights and remedies in case of default.

- Use vague language when defining the terms of the loan. Specificity is key to a legally binding document.

- Skimp on details about repayment expectations, such as late fees, to prevent future disputes.

- Exclude contact information of both the borrower and the lender for future communication.

- Fail to check for required endorsements or additional signatures that may be needed for the note to be valid.

- Rush through the process without reviewing the completed document for accuracy and completeness.

- Assume that a template or form is one-size-fits-all; customization may be necessary to comply with specific circumstances or local laws.

Misconceptions

When it comes to the New York Promissory Note form, several misconceptions often lead to confusion. Understanding these inaccuracies can help clarify the nature of promissory notes in New York State. Here are six common misunderstandings:

- Only Banks Can Issue Them: A common misconception is that promissory notes can only be issued by banks or financial institutions. In truth, any individual or entity can create and issue a promissory note as long as it complies with New York's legal requirements. This document is a flexible tool for formalizing loans, not exclusive to banks.

- Legal Language Is a Must: Many believe that for a promissory note to be valid, it must be filled with legal jargon. However, clarity and simplicity are key. The essential terms—amount borrowed, interest rate, repayment schedule, and parties involved—should be clearly stated. Overcomplicating the document with legal language can lead to misunderstandings.

- One-Size-Fits-All: There's a misconception that a standard promissory note form exists that is suitable for every situation. While templates can provide a starting point, the note should be tailored to fit the specific agreement between the lender and borrower. Each party's rights and obligations need to be accurately reflected.

- Not Legally Binding: Some might mistakenly think that promissory notes are not enforceable in court. On the contrary, when properly executed, these notes are legally binding contracts. They can be used in a court of law to ensure repayment according to the agreed terms.

- No Need for Witnesses or Notarization: While not always required, having the promissory note signed in the presence of witnesses or notarized can add a layer of protection and validity. This practice is especially helpful if the agreement's validity is questioned in the future.

- Only Necessary for Large Loans: There's a belief that promissory notes are only needed for large loan amounts. Regardless of size, a promissory note is advisable for any loan to ensure that the terms are clear and enforceable. Even loans among friends or family can benefit from the formalization of a promissory note.

Dispelling these misconceptions can promote a better understanding of the New York Promissory Note form's purpose and ensure that parties involved in a loan agreement protect their interests through correct execution and use of this legal document.

Key takeaways

The New York Promissory Note Form is a legal document that outlines a loan's terms between a lender and a borrower within the state of New York. It's important to understand the key components and legal requirements when filling out and using this form to ensure that the agreement is enforceable and effectively communicates the expectations of all parties involved. The following takeaways provide essential guidance:

- Details of the Parties: Clearly identify all parties involved, including full names and addresses. For the document to hold legal weight, the identification of each party must be accurate and complete.

- Principal Amount: State the exact principal amount being loaned. It is crucial that this figure does not include interest, as interest is calculated separately and added to this base amount.

- Interest Rate: Specify the interest rate, adhering to New York's usury laws to avoid charging an illegal amount of interest. Understanding the maximum allowable interest rate is key to drafting a compliant promissory note.

- Repayment Schedule: Outline a clear repayment schedule, including due dates and whether the payments are to be made monthly, quarterly, or in a lump sum. This schedule helps both parties understand the timeline of the loan's repayment.

- Security: If the loan is secured with collateral, the promissory note should include a detailed description of the collateral. This assures the lender of a specific recourse should the borrower default on the loan.

- Governing Law: Include a statement that the promissory note is governed by New York State law. This is important for ensuring that any legal disputes will be adjudicated according to local laws.

- Signatures: Ensure that all parties sign and date the promissory note. Signatures are essential for the document to be legally binding. Both borrower and lender should have a witnessed or notarized signature to confirm the authenticity of the document.

Correctly filling out the New York Promissory Note Form is a critical step in formalizing a loan agreement. It not only establishes a legal obligation for the borrower to repay the loan but also provides the lender with a clear record and understanding of the loan terms. Always review the completed form carefully to ensure all information is accurate and complete before signatures are affixed.

Popular Promissory Note State Forms

Free Loan Agreement Template Texas - Interest rates on a Promissory Note can be fixed or variable, as agreed upon by both parties.

Promissory Note Form California - Promissory Notes are crucial in real estate transactions, often accompanying mortgages to detail the loan specifics.

Promissory Note Friendly Loan Agreement Format - This document specifies whether the loan is secured with collateral, protecting the lender's investment.

How to Get a Copy of Your Mortgage Note - An official record that facilitates lending by detailing the terms under which money is borrowed.