Free Promissory Note Form for Michigan

In the world of lending and borrowing, the Michigan Promissory Note form serves as a crucial document that outlines the terms of a loan between two parties. This form, while simple in concept, encompasses a variety of important aspects including the amount of money being borrowed, the interest rate attached to the loan, the repayment schedule, and what happens if the loan is not repaid according to the agreed terms. Designed to protect both the lender and the borrower, this legal document ensures that the agreement is clearly understood and enforceable in the state of Michigan. Whether the loan is for a significant investment, such as buying a home or starting a business, or for more personal reasons, like helping a family member in need, the Michigan Promissory Note form stands as a testament of trust and agreement between the parties involved. By signing this form, both the lender and the borrower agree to adhere to the terms laid out, making it a foundational piece of any loan agreement within the state.

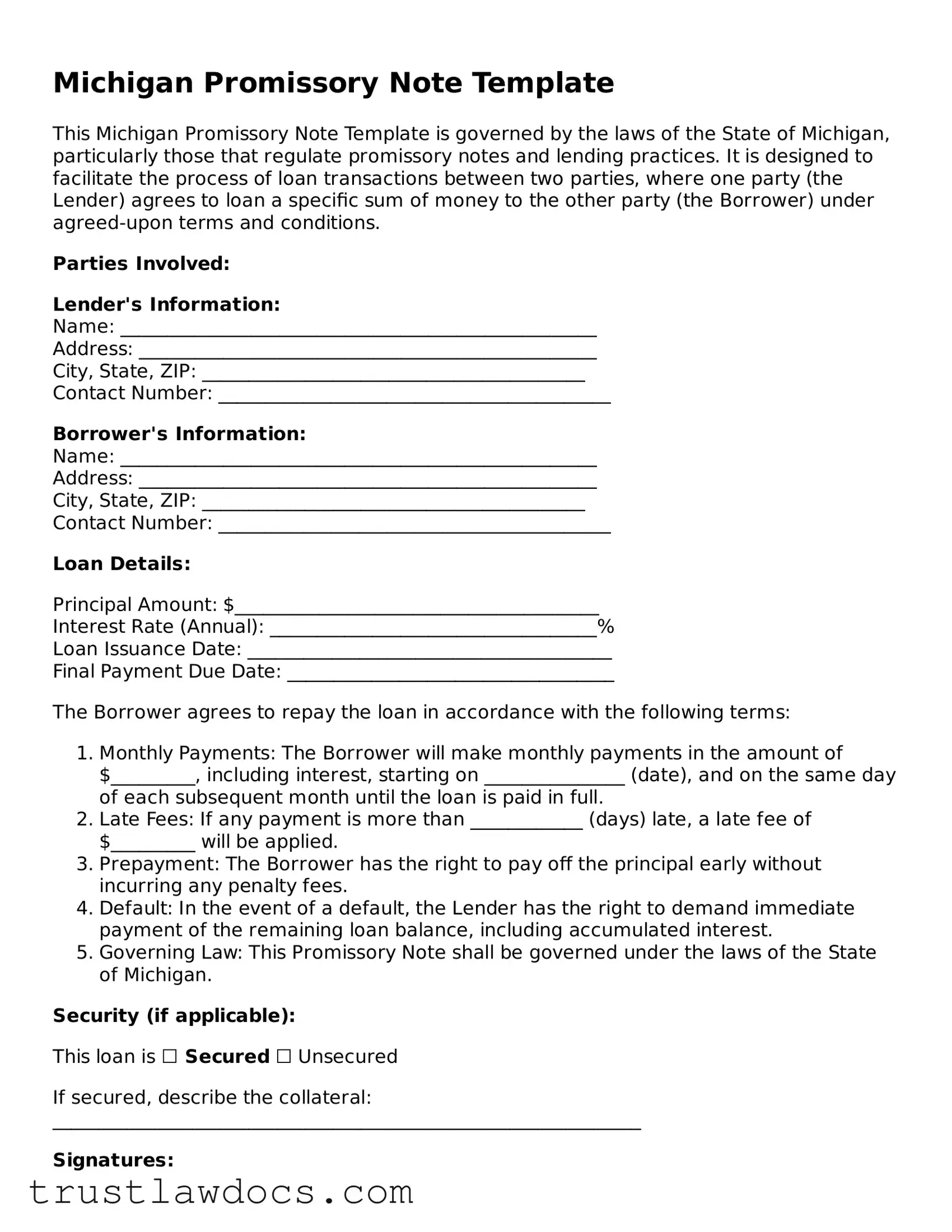

Form Example

Michigan Promissory Note Template

This Michigan Promissory Note Template is governed by the laws of the State of Michigan, particularly those that regulate promissory notes and lending practices. It is designed to facilitate the process of loan transactions between two parties, where one party (the Lender) agrees to loan a specific sum of money to the other party (the Borrower) under agreed-upon terms and conditions.

Parties Involved:

Lender's Information:

Name: ___________________________________________________

Address: _________________________________________________

City, State, ZIP: _________________________________________

Contact Number: __________________________________________

Borrower's Information:

Name: ___________________________________________________

Address: _________________________________________________

City, State, ZIP: _________________________________________

Contact Number: __________________________________________

Loan Details:

Principal Amount: $_______________________________________

Interest Rate (Annual): ___________________________________%

Loan Issuance Date: _______________________________________

Final Payment Due Date: ___________________________________

The Borrower agrees to repay the loan in accordance with the following terms:

- Monthly Payments: The Borrower will make monthly payments in the amount of $_________, including interest, starting on _______________ (date), and on the same day of each subsequent month until the loan is paid in full.

- Late Fees: If any payment is more than ____________ (days) late, a late fee of $_________ will be applied.

- Prepayment: The Borrower has the right to pay off the principal early without incurring any penalty fees.

- Default: In the event of a default, the Lender has the right to demand immediate payment of the remaining loan balance, including accumulated interest.

- Governing Law: This Promissory Note shall be governed under the laws of the State of Michigan.

Security (if applicable):

This loan is ☐ Secured ☐ Unsecured

If secured, describe the collateral: _______________________________________________________________

Signatures:

This document, valid and enforceable under the laws of the State of Michigan, signifies the agreement between the Lender and the Borrower. By signing below, both parties adhere to all terms and conditions outlined in this Promissory Note.

Lender's Signature: _______________________________ Date: _______________

Printed Name: _________________________________________________________

Borrower's Signature: ______________________________ Date: _______________

Printed Name: _________________________________________________________

Witness (Optional):

Witness's Signature: _______________________________ Date: _______________

Printed Name: _________________________________________________________

PDF Form Details

| Fact Number | Detail |

|---|---|

| 1 | The Michigan Promissory Note form is a legal document that outlines the repayment terms for a loan between two parties in the state of Michigan. |

| 2 | It must comply with Michigan’s statutes, particularly those related to usury laws, which cap the interest rate that can be charged on a loan. |

| 3 | There are two main types of promissory notes in Michigan: secured and unsecured. A secured promissory note requires collateral, whereas an unsecured promissory note does not. |

| 4 | Interest rates on a promissory note must not exceed the legal limit set by Michigan law, unless a specific exception applies that allows for a higher rate. |

| 5 | The parties involved must provide full information, including their names, addresses, and the loan amount, for the document to be considered valid and enforceable. |

| 6 | Upon default, the lender has the right to pursue legal action to collect the remaining debt, including principal, interest, and potentially other charges, as allowed by Michigan law. |

How to Write Michigan Promissory Note

Filling out a Michigan Promissory Note form is a necessary step for documenting a loan agreement between two parties in the state. This legal document helps in ensuring that the borrower agrees to pay back a specified sum of money to the lender under agreed-upon terms. The process might seem daunting at first, but by following a step-by-step guide, parties can complete the form accurately and efficiently, protecting the interests of both the borrower and the lender.

- Begin by gathering all necessary information, including the full legal names and addresses of both the lender and the borrower, the amount of the loan, and the interest rate agreed upon.

- Enter the date when the promissory note is being created at the top of the form.

- Write down the full names and addresses of the borrower and the lender in the designated spaces.

- Specify the principal amount of the loan in the section provided. This is the amount of money being lent, without including any interest.

- Detail the interest rate that has been agreed upon by both parties. Remember, this must adhere to Michigan's legal limits to avoid being considered usurious.

- Choose the repayment schedule and clearly write it on the form. Options typically include a lump-sum payment, installment payments (with or without interest), or at will of the lender under certain conditions.

- Clearly define any collateral that secures the loan, if applicable. This section is where you describe any property or assets that the borrower agrees to forfeit if they fail to pay back the loan.

- Both parties should review the completed form to ensure all the information is accurate and reflects their agreement.

- Have both the borrower and the lender sign and date the form. Depending on the amount of the loan or the parties' preference, you may also want to have the signatures notarized for additional legal validation.

- Make copies of the signed promissory note. Each party should retain a copy for their records to protect their legal rights.

After completing these steps, both parties will have a legally binding document that outlines the details of their loan agreement. It's crucial to adhere to the terms laid out in the promissory note to avoid any legal issues down the line. If circumstances change, both parties should agree to any modifications in writing to maintain the enforceability of the agreement.

Get Answers on Michigan Promissory Note

What is a Michigan Promissory Note?

A Michigan Promissory Note is a legally binding document where a borrower agrees to pay back a lender in accordance with the terms specified in the document. It includes details such as the amount borrowed, interest rate, repayment schedule, and what happens in case of default.

Who needs a Michigan Promissory Note?

Any individual or entity in Michigan lending or borrowing a sum of money may require a Promissory Note to outline the terms of the loan. It serves as a formal agreement that can be utilized by both personal lenders (like family or friends) and financial institutions.

Are Michigan Promissory Notes legally enforceable?

Yes, in Michigan, as in other states, Promissory Notes are legally enforceable contracts. For the document to be valid, it must be signed by both the borrower and the lender. If the borrower fails to meet the repayment terms, the lender has the right to pursue legal action for recovery of the debt.

What information must be included in a Michigan Promissory Note?

A standard Michigan Promissory Note should include the amount of money being lent (principal), the interest rate, repayment schedule, parties' information (lender and borrower), and provisions for default and late payments. It may also include whether the loan is secured or unsecured.

How does interest work on a Michigan Promissory Note?

The interest rate on a Michigan Promissory Note must be agreed upon by both parties and should be stated in the document. Michigan law caps the amount of interest that can be charged, and the rate should not exceed the statutory maximum. For personal loans between individuals, it's particularly important to ensure the interest rate is legally compliant.

What is the difference between a secured and unsecured Promissory Note in Michigan?

In Michigan, a secured Promissory Note is backed by collateral, meaning the borrower pledges an asset of value which the lender can seize if the loan is not repaid. An unsecured Promissory Note does not involve collateral, which generally poses a higher risk for the lender.

Can a Michigan Promissory Note be modified?

Yes, a Michigan Promissory Note can be modified, but any modifications must be agreed upon by both the lender and borrower. The changes should be documented in writing and signed by both parties, preferably with witnesses or a notary public to add validity.

What happens if the borrower defaults on a Michigan Promissory Note?

If a borrower defaults on a Promissory Note in Michigan, the lender has the right to demand immediate payment of the full balance remaining. Depending on whether the note is secured or unsecured, the lender may also have the right to seize collateral or pursue other legal remedies to recover the debt.

Do I need a lawyer to create a Michigan Promissory Note?

While it's possible to create a Promissory Note on your own, consulting with a lawyer can ensure that the note complies with Michigan law and fully protects your rights. This may be particularly important for large loans or loans involving complex terms.

How can I enforce a Michigan Promissory Note?

To enforce a Promissory Note in Michigan, the lender may need to file a lawsuit against the borrower. The court process will determine if the lender has the right to recover the debt and potentially provide various methods for debt recovery, including garnishing wages or seizing assets.

Common mistakes

One common mistake people make when filling out the Michigan Promissory Note form is neglecting to include the full legal names and addresses of both the borrower and the lender. This omission can create confusion about the parties involved and may lead to legal complications if the note is ever disputed. Including all pertinent contact information ensures clear communication and enforceability of the agreement.

Another error frequently made is failing to specify the loan amount in clear, unambiguous terms. It is crucial that the amount provided in the promissory note is accurate and written both in numeric form and spelled out in words. This dual notation method helps to prevent any misunderstandings or alterations to the agreed-upon amount, safeguarding both parties’ interests.

Not stating the interest rate or failing to adhere to Michigan’s legal maximum can also lead to problems. It's important for the promissory note to lay out the interest rate being charged on the loan clearly. This rate must comply with state regulations to prevent the contract from being deemed usurious and, therefore, void. By specifying a legal and fair interest rate, the agreement remains enforceable and protects both the borrower and lender from future disputes.

Forgetting to detail the repayment schedule is another oversight that can greatly affect the terms of the loan. Whether the loan is to be paid back in a lump sum, in regular installments, or upon demand, this agreement needs to be clearly documented. Without this information, there is no clear expectation for when the debt should be paid off, potentially leading to misunderstandings or legal actions if payments are not made as one party expects.

Lastly, omitting signatures at the end of the form is a serious mistake. The promissory note must be signed by both the borrower and the lender to be considered a valid, legally binding document. Additionally, while not always required, having the document witnessed or notarized can add an extra layer of legal protection and authenticity. Ensuring that all relevant parties sign the document finalizes the agreement and sets its terms into motion.

Documents used along the form

In financial transactions, particularly those involving loans, the Michigan Promissory Note form is often accompanied by several other documents. These documents serve various purposes, from providing security for the loan to outlining the terms of the agreement in greater detail. Each plays a vital role in ensuring that all parties involved are well-informed and protected under the agreement.

- Mortgage Agreement: This document is used when the loan is secured by real estate. It gives the lender the right to foreclose on the property if the borrower fails to meet the loan repayment terms.

- Security Agreement: Similar to a Mortgage Agreement, but for personal property instead of real estate. This agreement grants the lender a security interest in a specific asset or assets of the borrower as collateral for the loan.

- Guaranty: A guaranty is a separate agreement where a third party (the guarantor) agrees to fulfill the obligations of the borrower if the borrower cannot pay back the loan.

- Amortization Schedule: This document outlines the schedule of payments for the loan, breaking down each payment into principal and interest components and showing the remaining balance after each payment.

- Loan Agreement: A more comprehensive contract that includes the promissory note terms as well as additional details such as representations, warranties, covenants, and conditions of the loan.

- Disclosure Statement: Required by federal and state laws, this document provides the borrower with important information about the loan, including the annual percentage rate (APR), finance charges, amount financed, and total of payments.

- UCC Financing Statement: Applicable when the loan involves securing interest in personal property, a UCC Financing Statement is filed with the state to publicly declare the lender's interest in the borrower's assets as collateral.

Together with the Michigan Promissory Note form, these documents create a comprehensive framework that protects the rights and interests of both the borrower and the lender. By carefully preparing and reviewing these documents, parties can ensure that the financial transaction aligns with legal requirements and their individual needs.

Similar forms

A Michigan Promissory Note form, much like an IOU (I Owe You), functions as a written promise or acknowledgment of a debt where one party commits to pay another. However, the Promissory Note often contains more detailed information such as the interest rate, repayment schedule, and consequences of non-payment, making it more formal and legally binding than the typical IOU, which is a more casual and less detailed acknowledgment of debt.

The Loan Agreement shares similarities with a Michigan Promissory Note since both outline the terms and conditions under which money is borrowed and must be repaid. The difference primarily lies in the complexity and detail of the document. Loan agreements often include more detailed provisions regarding the obligations of both parties, such as maintenance of collateral, representations and warranties, and covenants, making them more detailed for situations that require more thorough legal documentation.

A Mortgage Agreement is another document that echoes many elements found in a Promissory Note but specifically pertains to loans secured by real estate. While a Promissory Note might outline the borrower's promise to repay the lent amount, a Mortgage Agreement adds a layer of security for the lender by providing a legal claim against the borrower's property if they fail to fulfill their repayment obligations. This distinction highlights the importance of collateral in a Mortgage Agreement.

Similar to a Michigan Promissory Note, a Deed of Trust involves a borrower, a lender, and an added third party—the trustee, who holds the property's title until the loan is repaid in full. This document is frequently used in place of a traditional mortgage in some states and outlines the terms under which the property will be managed until the debt is cleared. Its similarity to a Promissory Note is in its intention to ensure repayment of a loan, although it involves additional parties and the transfer of a property title as security.

The Bill of Sale is akin to a Promissory Note in that both are written agreements between parties. However, instead of outlining terms for repaying a loan, a Bill of Sale documents the transfer of ownership of personal property from a seller to a buyer. It serves as proof of purchase and may specify the conditions of the transfer, making it similar in function as a legal record of an agreed transaction.

Credit Agreements, like Michigan Promissory Notes, are formal agreements between a borrower and a lender. The key difference is that Credit Agreements are typically more comprehensive, detailing the revolving nature of the credit, fees, interest rates, and other terms for types of credit lines or credit extensions beyond a single loan transaction. This makes them better suited for ongoing financial relationships rather than a one-time loan.

Student Loan Agreements bear resemblance to Promissory Notes due to their nature of detailing a borrowing arrangement. Specifically, they outline the terms under which a student borrows money for education and their repayment obligations. While both documents serve to confirm and detail a loan, Student Loan Agreements often include specific conditions or provisions related to the postponement of payments and forgiveness programs, highlighting their specialized purpose.

An Employment Contract, while not a borrowing instrument, relates to a Michigan Promissory Note by virtue of being a legally binding agreement between two parties. In this case, it outlines the terms of employment, compensation, duties, and the circumstances under which the relationship can be terminated. The connection lies in the contractual commitment between parties to fulfill certain obligations, evidencing the broad applicability of contract principles across various types of agreements.

Installment Sales Contracts, similar to Promissory Notes, are agreements where payments are made in installments over a period. Often used in the sale of goods and real estate, these contracts specify the sale's terms, including payment schedules, interest rates, and the consequences of non-payment. While an Installment Sales Contract can act as a financing mechanism, like a Promissory Note, it specifically relates to the sale of items or property rather than a simple loan relationship.

Last but not least, a Lease Agreement, traditionally used for the rental of property or equipment, bears similarities to a Promissory Note in its function as an agreement that obligates one party to make payments to another. While a Lease Agreement specifies terms under which one party can use another's property, the Promissory Note focuses on the repayment of money lent. Both documents set forth the conditions under which one party provides something of value to the other in exchange for something else, delineating the expectations and obligations that govern their relationship.

Dos and Don'ts

When completing the Michigan Promissory Note form, it's important to ensure that all information is accurate and clearly stated to protect the interests of both the lender and borrower. Below are five essential dos and don'ts to consider:

Do:

- Verify all the parties' names and addresses are correct and clearly written.

- Accurately state the loan amount and the interest rate as agreed upon.

- Specify the repayment schedule, including due dates and any grace periods.

- Ensure both the borrower and lender sign the form, making it legally binding.

- Keep a copy of the signed promissory note for your records.

Don't:

- Leave any sections incomplete, as this could lead to future disputes.

- Use unclear language or legal jargon that might be misunderstood.

- Forget to include any agreed-upon collateral or security agreements.

- Sign without thoroughly reading and understanding every part of the note.

- Ignore state laws regarding lending and borrowing practices.

Misconceptions

When it comes to understanding the Michigan Promissory Note form, many individuals find themselves navigating through a sea of misconceptions. These misunderstandings can often lead to complications, affecting the validity of the agreement or the parties involved. Here, we aim to clarify some of the most common misconceptions.

- All Michigan promissory notes are the same. This statement couldn't be further from the truth. Michigan offers both secured and unsecured promissory notes, each catering to different situations. Secured notes involve collateral, protecting the lender, whereas unsecured notes do not.

- Legal language is required for the note to be valid. While it's crucial for the document to include certain terms to be enforceable, it doesn't need to be written in complex legal jargon. Clarity, completeness, and the inclusion of key elements like the amount borrowed and repayment terms matter more than sophisticated language.

- Witnesses or a notary are not important for its enforceability. Depending on the circumstances and the amount involved, having a witness or notarizing the document can enhance its enforceability. While not always a requirement, it adds a layer of security and legitimacy to the agreement.

- Promissory notes are only for vast sums of money. In reality, promissory notes can be used for loans of any size. They serve as a written promise to pay back a debt, regardless of whether it's a few hundred or several thousand dollars.

- You cannot modify a promissory note once it's signed. Amendments can be made to a promissory note if both parties agree to the changes. The modifications should be documented in writing and appended to the original note to avoid future disputes.

- A promissory note guarantees repayment. While a promissory note legally binds the borrower to repay the outlined debt, it does not ensure that the lender will be repaid. The lender may still need to take legal action to recover the funds if the borrower defaults.

- Verbal agreements are just as valid as a written promissory note in Michigan. Although verbal agreements can be binding, proving the terms and existence of such agreements can be exceedingly difficult. A written promissory note provides clear evidence of the loan's terms and conditions.

- The lender must always charge interest. While it's common to include interest rates in the terms of a promissory note, it's not a legal requirement. However, if interest is charged, it must not exceed the legal rate established by Michigan law to avoid being considered usurious.

Understanding these misconceptions about the Michigan Promissory Note form is crucial for both lenders and borrowers. It ensures transparency, legality, and fairness in the lending process, safeguarding the interests of all parties involved.

Key takeaways

When dealing with the Michigan Promissory Note form, there are several key points one should keep in mind. These notes serve as legal instruments that outline the details of a loan between two parties. Here are five essential takeaways to ensure that the promissory note serves its intended purpose and protects the interests of both the lender and the borrower.

- Complete the Form Accurately: Ensuring all parts of the Michigan Promissory Note form are filled out accurately is crucial. This includes the full names of both the lender and the borrower, the principal amount of the loan, and the interest rate. Inaccuracies or omissions can lead to disputes or legal challenges down the line.

- Understand the Legal Obligations: Both parties should thoroughly understand their obligations under the promissory note. For borrowers, this means committing to repay the loan under the agreed-upon terms. Lenders must follow state laws governing loan agreements, including any actions taken in the event of a default.

- Specify Repayment Terms: Clearly outlining how and when the loan will be repaid is essential for a smooth lending process. This includes setting a repayment schedule, whether in installments or a lump sum, and specifying due dates. Clarity in this area helps prevent misunderstandings and potential legal disputes.

- Include the Interest Rate: Michigan law allows for interest to be charged on loans, but the rate must not exceed the legal limit. The promissory note should specify the interest rate agreed upon by both parties. Failure to do so, or charging an excessive rate, can render the note unenforceable and possibly lead to legal penalties.

- Signatures Are Mandatory: For the promissory note to be legally binding in Michigan, it must be signed by both the borrower and the lender. Additionally, having the signatures notarized can add an extra layer of authenticity and legal protection, although it is not a mandatory requirement.

By paying careful attention to these key aspects, parties can ensure that the promissory note stands up as a legitimate and enforceable document, safeguarding both parties' interests throughout the duration of the loan.

Popular Promissory Note State Forms

Promissory Note Template Florida Pdf - It can be a vital part of loan modifications, allowing lenders and borrowers to adjust terms in response to changing financial situations.

Promissory Note Template New York - The precise legal language used in the note is designed to minimize ambiguity and potential legal disputes.

Promissory Note Form California - The enforceability of a Promissory Note makes it a powerful instrument for financial security and assurance.