Free Promissory Note Form for Indiana

Navigating financial agreements can seem daunting, especially when they involve loans between individuals or entities within Indiana. A crucial tool in these transactions is the Indiana Promissory Note form, designed to meticulously outline the terms between the borrower and the lender. This legal document ensures clarity and accountability, specifying the loan amount, interest rate, repayment schedule, and any collateral securing the loan, if applicable. Serving as a legally binding agreement, it not only formalizes the loan process but also provides a safeguard for both parties involved. Understanding the essentials of the Indiana Promissory Note form is pivotal for anyone looking to engage in a loan transaction within the state, as it outlines the expectations and obligations in a clear and accessible manner. It acts as a testament to the commitment between the lender and the borrower, ensuring that all financial dealings are conducted with the utmost integrity and transparency.

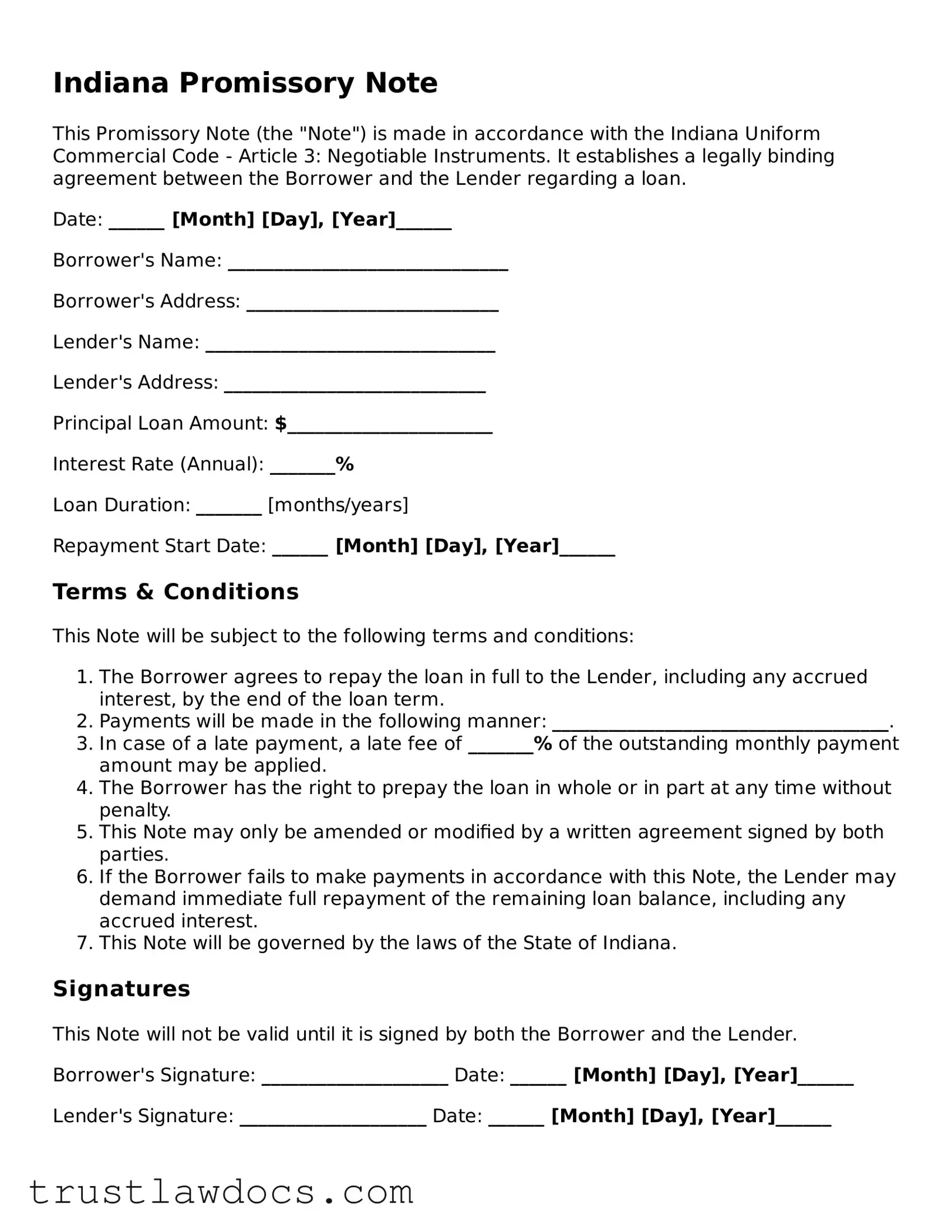

Form Example

Indiana Promissory Note

This Promissory Note (the "Note") is made in accordance with the Indiana Uniform Commercial Code - Article 3: Negotiable Instruments. It establishes a legally binding agreement between the Borrower and the Lender regarding a loan.

Date: ______ [Month] [Day], [Year]______

Borrower's Name: ______________________________

Borrower's Address: ___________________________

Lender's Name: _______________________________

Lender's Address: ____________________________

Principal Loan Amount: $______________________

Interest Rate (Annual): _______%

Loan Duration: _______ [months/years]

Repayment Start Date: ______ [Month] [Day], [Year]______

Terms & Conditions

This Note will be subject to the following terms and conditions:

- The Borrower agrees to repay the loan in full to the Lender, including any accrued interest, by the end of the loan term.

- Payments will be made in the following manner: ____________________________________.

- In case of a late payment, a late fee of _______% of the outstanding monthly payment amount may be applied.

- The Borrower has the right to prepay the loan in whole or in part at any time without penalty.

- This Note may only be amended or modified by a written agreement signed by both parties.

- If the Borrower fails to make payments in accordance with this Note, the Lender may demand immediate full repayment of the remaining loan balance, including any accrued interest.

- This Note will be governed by the laws of the State of Indiana.

Signatures

This Note will not be valid until it is signed by both the Borrower and the Lender.

Borrower's Signature: ____________________ Date: ______ [Month] [Day], [Year]______

Lender's Signature: ____________________ Date: ______ [Month] [Day], [Year]______

PDF Form Details

| Fact | Description |

|---|---|

| 1. Purpose | The Indiana Promissory Note form is used to create a legally binding agreement between a borrower and a lender, detailing the borrower's promise to repay the loan. |

| 2. Types | There are two main types: secured and unsecured. A secured promissory note requires collateral, while an unsecured note does not. |

| 3. Governing Laws | It is governed by Indiana state laws, including but not limited to the Indiana Uniform Commercial Code. |

| 4. Interest Rate | State laws dictate the maximum interest rate that can be charged. If not specified, the legal rate of interest applies. |

| 5. Co-signer | The form can include a co-signer, adding an additional layer of security for the lender. |

| 6. Repayment Schedule | The agreement must detail the repayment schedule, including amounts and due dates. |

| 7. Default Terms | Terms of default and consequences must be clearly outlined, including any late fees and acceleration clauses. |

| 8. Signature Requirement | Legally, both the borrower and lender must sign the note for it to be enforceable. |

How to Write Indiana Promissory Note

Filling out the Indiana Promissory Note form is an important step towards formalizing a loan agreement between two parties. This document outlines the terms of the loan, including repayment schedule, interest rate, and the obligations of both the borrower and lender. To ensure clarity and legal enforceability, it's crucial to complete this form accurately. Follow these steps to fill out the Indiana Promissory Note form correctly.

- Start with the date of the agreement at the top of the form. This should reflect the day when the promissory note takes effect.

- Enter the full legal names of both the borrower and the lender in the designated areas. Ensure the names are spelled correctly to avoid any confusion or legal issues down the line.

- Specify the principal amount of the loan. This is the amount of money being lent, before any interest or fees are applied.

- Detail the interest rate. Remember, the interest rate must comply with Indiana's legal guidelines to avoid being considered usurious.

- Describe the repayment schedule. This includes how often payments will be made (e.g., monthly, quarterly) and over what period (e.g., 12 months, 5 years). If there are specific dates payments should be made by, note these as well.

- Include information about late fees. Specify the amount that will be charged if a payment is late and after how many days a payment is considered late.

- Outline the consequences of defaulting on the loan. This section should detail what actions will be taken if the borrower fails to repay the loan according to the agreed-upon terms.

- If collateral is being used to secure the loan, describe the collateral in this section of the form. Be as specific as possible to avoid any ambiguity regarding what is being used as security for the loan.

- Both the borrower and the lender must sign and date the bottom of the form. Depending on state requirements, you may also need to have the document witnessed or notarized.

After completing these steps, make sure to keep a copy of the promissory note in a safe place. It's advisable for both parties to retain a copy for their records. This document serves as a legal record of the loan and can be used in court if disputes arise. Ensuring that the form is filled out correctly and completely is key to protecting the interests of both the borrower and the lender.

Get Answers on Indiana Promissory Note

What is an Indiana Promissory Note?

An Indiana Promissory Note is a legal form of agreement between two parties: the borrower and the lender. It outlines the terms by which the borrower agrees to pay back a loan to the lender. This document is crucial because it clearly states the amount borrowed, interest rates, repayment schedule, and what happens if the borrower fails to repay the loan. It serves both as a record of the loan and a legally binding contract that can be used in court, if necessary.

How do I legally execute a Promissory Note in Indiana?

To legally execute a Promissory Note in Indiana, it's important to include specific information in the document. This includes the names and addresses of the borrower and lender, the amount of money being lent, the interest rate, repayment schedule, and signatures from both parties. Both the borrower and the lender should sign the note for it to be considered valid. Additionally, having the signatures notarized can add an extra layer of legal protection, although it's not a mandatory requirement in Indiana.

Can a Promissory Note include collateral in Indiana?

Yes, a Promissory Note in Indiana can include collateral as part of the agreement. Collateral refers to assets or property that the borrower offers to secure the loan. If the borrower fails to repay the loan according to the terms of the Promissory Note, the lender has the right to take possession of the collateral as a form of repayment. Including collateral in a Promissory Note, making it a secured Promissory Note, can provide additional security for the lender and influence the terms of the loan, such as potentially lower interest rates.

What happens if there's a default on an Indiana Promissory Note?

If there's a default on an Indiana Promissory Note, the consequences for the borrower can be significant. The Promissory Note itself should outline the specific steps to be taken in the event of a default, which might include acceleration of the debt, meaning the entire balance becomes immediately due and payable. The lender may also have the right to take legal action to recover the owed amount. If collateral was included in the agreement, the lender might be entitled to seize the collateral. In any case, communication between the borrower and lender is key to resolving issues of default. Legal advice can also be a valuable tool in navigating the next steps.

Common mistakes

When filling out the Indiana Promissory Note form, it's easy to make mistakes if you're not careful. One common error is not specifying the interest rate clearly. This part of the note needs to have the annual interest rate written in a way that leaves no room for misunderstanding. If the rate isn't made explicit, there could be disputes down the line, and the lender might not be able to legally charge any interest at all.

Another mistake people often make is being vague about the repayment schedule. The form should detail when payments are due (e.g., monthly, bi-weekly), how many payments there will be, and what the amount of each payment is. Skipping these details or not being clear enough can lead to disagreements between the lender and borrower about the payment expectations.

Not correctly identifying the parties involved is a critical error as well. Both the lender and the borrower's full legal names should be used in the document. Sometimes, people use nicknames or incomplete names, which can complicate legal enforcement of the note down the road.

Forgetting to include a clause about late fees or penalties for missed payments is another oversight. This clause is essential because it incentivizes the borrower to make payments on time and provides the lender with compensation if the borrower does not adhere to the agreed-upon payment schedule.

Some individuals neglect to dictate the terms of the loan's security. If the loan is secured—that is, backed by collateral like property or other assets—those assets must be described precisely in the document. Failure to do so can make it difficult for the lender to claim the collateral if the borrower defaults on the loan.

Leaving out the governing state law is a mistake not to overlook. The promissory note should state that Indiana law governs it. Without this, there can be uncertainty about which state's laws apply in case of a dispute, especially if the parties to the note reside in or move to different states.

Omitting signatures is a surprisingly common error. Both the borrower and lender should sign the note, and it's best to have a witness or notary public sign as well to authenticate the document's validity.

Some people fail to include a co-signer when necessary. If the borrower's creditworthiness is questionable, a co-signer can be crucial for the lender's security. Not having a co-signer when one might be needed can be a risky oversight.

Not providing a copy of the promissory note to all parties involved after it's been signed is a logistical mistake. All parties need their copy for their records and to ensure that everyone has the same understanding of the loan's terms and conditions.

Last but not least, altering the promissory note after it has been signed without the agreement of all parties involved is a severe and often illegal error. Any changes to the promissory note should be documented in a written amendment that is signed by all the parties.

Documents used along the form

In Indiana, when individuals or parties enter into a loan agreement, the promissory note is a key document that outlines the borrower's promise to repay the loan. However, to fully protect all parties involved and to comply with state laws, other forms and documents are often used in conjunction with the Indiana Promissory Note. These documents help clarify the terms of the loan, secure the loan, and ensure a smooth transaction and repayment process. Here is a list of such forms and documents that are commonly used:

- Loan Agreement: This document complements the promissory note by detailing the obligations and rights of both the borrower and the lender. It includes terms about payment schedules, interest rates, and remedies for defaults.

- Security Agreement: If the loan is secured, this document outlines the collateral that the borrower offers to the lender as security. It describes the collateral and what happens if the borrower fails to repay the loan.

- Mortgage Agreement: Used specifically for real estate transactions, this document secures the loan with the property being purchased. It gives the lender the right to foreclose on the property if the borrower defaults on the loan.

- UCC Financing Statement: For loans involving personal property as collateral (excluding real estate), this document is filed to publicly disclose the secured interest of the lender in the borrower's property.

- Guaranty: This is an agreement where a third party (the guarantor) agrees to fulfill the payment obligations of the borrower if the borrower fails to do so.

- Amendment Agreement: If terms of the original promissory note or any related agreement need to be changed, this document formally records those changes.

- Release of Promissory Note: This document is a receipt that acknowledges the borrower's full repayment of the loan. It releases the borrower from further obligations under the promissory note.

- Notice of Default: If the borrower fails to meet the repayment terms, this document formally notifies the borrower of such default and the lender’s intention to enforce their rights.

- Late Payment Letter: Should the borrower miss a payment, this letter is sent as an initial reminder of the missed payment and any potential penalties as outlined in the promissory note.

- Acceleration Clause Notice: In the event of a default, this notice informs the borrower that the full amount of the loan has become due and payable immediately, as per the acceleration clause in the promissory note or loan agreement.

It's essential for both borrowers and lenders to understand the purpose and content of these additional documents, ensuring a legally sound and enforceable loan transaction. While the promissory note acts as a commitment to pay, the supplementary documents provide the structure and security to manage the loan effectively from initiation to full repayment or resolution in case of default.

Similar forms

The Indiana Promissory Note form bears a resemblance to a Loan Agreement, primarily in its function as a lending document. Both outline the terms under which money is borrowed and must be repaid, including the repayment schedule, interest rates, and the duties of all parties involved. The major difference often lies in the level of detail; loan agreements typically include more comprehensive terms about the obligations and rights of each party, making them lengthier and more complex than promissory notes, which are succinct and straightforward agreements.

Similarly, an IOU (I Owe You) document shares common ground with the Indiana Promissory Note form in that both establish an acknowledgment of debt. However, an IOU is far more simplistic and informal. It generally just states that one party owes another a certain sum of money, without specifying repayment details such as interest rates or due dates. In contrast, a promissory note is more formal and specifies a payment plan, making it a more enforceable and detailed financial instrument.

Mortgage agreements are another document type with similarities to the Indiana Promissory Note. Mortgages specifically relate to loans secured by real estate, where the borrower agrees to repay the lender over time, with the property acting as collateral. Like promissory notes, they delineate payment amounts, terms, and schedules. However, mortgage agreements go further by tying the debt to a specific piece of property and detailing what happens if the borrower fails to make payments, such as foreclosure procedures.

Last but not least, a Line of Credit Agreement shares parallels with the Indiana Promissory Note in its provision for borrowing funds. Under such agreements, a lender agrees to advance money to a borrower up to a specified limit and within a certain period. The borrower can draw from this line as needed, repaying and re-borrowing as terms allow. While promissory notes usually involve a single disbursement of funds to be repaid, lines of credit offer ongoing access to funds, making them more flexible but similarly grounded in the promise of repayment.

Dos and Don'ts

When filling out the Indiana Promissory Note form, it's important to proceed with caution and awareness of both the legal implications and the details you provide. To assist in this process, here are some essential do's and don'ts one should follow:

Do's:

- Ensure all parties' names and addresses are complete and accurately spelled. This information must reflect legal identification to prevent any misunderstandings or legal issues.

- Include the total amount of money being loaned in clear, unambiguous figures. Also, spell out the amount to prevent any discrepancies.

- Clearly state the interest rate as per Indiana state law, ensuring it is not higher than the legal maximum to avoid the loan being classified as usurious.

- Specify the repayment schedule in detail, including due dates and whether the payments are monthly or at another interval, to maintain clear expectations.

- Sign the document in the presence of a notary to ensure its legality and avoid disputes about its authenticity.

- Keep a copy of the signed document for both the lender's and borrower's records, ensuring both parties have evidence of the agreement.

Don'ts:

- Do not leave any fields blank. Incomplete forms can lead to misunderstandings or legal challenges. Fill out the form thoroughly.

- Avoid vague language. Clearly outline the loan terms, including the repayment plan and any applicable interest, to prevent ambiguity.

- Refrain from setting an interest rate above the legal limit. Doing so can render the agreement void or subject to legal penalties.

- Do not forget to specify the loan's purpose if required or agreed upon, as this can sometimes influence the terms of the loan.

- Avoid informal agreements. Even if the borrower is a close friend or family member, always document the loan in writing to protect both parties' interests.

- Do not delay updating the document if terms change. Both parties should agree in writing to any modifications to ensure the document remains valid.

Misconceptions

Many people hold misconceptions about the Indiana Promissory Note form, which can lead to confusion and potential legal issues. It's important to understand what these misconceptions are, so individuals can navigate their financial transactions with accurate information.

One size fits all: A common misconception is that a single version of the Indiana Promissory Note form is suitable for all types of loans or financial agreements. In reality, the form should be customized to reflect the specific terms of the agreement, including the interest rate, repayment schedule, and any other relevant details unique to the transaction.

Legally binding without signatures: Some believe that the Promissory Note is legally binding once it is written. However, for the note to be enforceable in Indiana, it must be signed by both the borrower and the lender. This formalizes the agreement and makes it legally binding.

No need for witnesses or notarization: While not always required, having the Promissory Note witnessed or notarized can add a layer of protection and authenticity. This is particularly relevant in disputes, as it verifies that the signatures are genuine and that the parties entered into the agreement willingly.

Interest rates can be as high as agreed: It is often mistakenly believed that parties can agree to any interest rate. However, Indiana has usury laws that cap interest rates to prevent excessive charges. It's crucial to know these limits to avoid creating an illegal contract.

Verbal agreements are sufficient: Some parties might assume that a verbal agreement or handshake is as binding as a written note. While verbal contracts can be enforceable, a written Promissory Note is crucial in providing clear evidence of the terms of the loan, making it much easier to enforce in court if necessary.

Promissory Notes are only for banks or financial institutions: This misunderstanding leads people to believe that personal loans between individuals do not require a Promissory Note. In reality, a Promissory Note can be used for any loan arrangement, providing legal protection and clarity for both parties involved, regardless of their nature.

Amendments are complicated or not allowed: Some think once a Promissory Note is signed, its terms are set in stone. This is not the case. Both parties can agree to modify the note's terms if circumstances change. It's important that any amendments are documented and signed by both parties.

Understanding these misconceptions can help individuals approach financial agreements with a clearer perspective, ensuring that both lenders and borrowers are adequately protected throughout the process.

Key takeaways

Filling out and using the Indiana Promissory Note form is a straightforward process, but it requires attention to detail to ensure that it is done correctly. Here are five key takeaways to keep in mind:

- Complete All Sections Accurately: It is critical to ensure that all sections of the promissory note are filled out accurately. This includes the names of the borrower and lender, the loan amount, the interest rate, and the repayment schedule. Accuracy in these details helps prevent misunderstandings and legal complications down the road.

- Understand State Regulations: Indiana may have specific laws and regulations regarding promissory notes. It's important to familiarize yourself with these to ensure that your note is compliant. This can affect aspects like the maximum interest rate, late fees, and the legal recourse available in case of non-payment.

- Specify the Terms Clearly: The terms of the loan should be outlined clearly in the note. This includes how and when the loan will be repaid (e.g., in installments, a lump sum, upon demand), the interest rate, and what will occur if the borrower fails to make payments as agreed. Clear terms help both parties understand their obligations and rights.

- Signature is Essential: For the promissory note to be legally binding, it must be signed by both the borrower and the lender. Ensure that these signatures are obtained and that the date of signing is noted. A witness or notarization can provide additional validity to the document, though not always required, it may be beneficial for legal enforcement.

- Keep Records: After the promissory note is fully executed, both parties should keep a copy of the document for their records. This is important for legal protection and to help either party reference the terms agreed upon in case of disputes or for record-keeping purposes.

In conclusion, when using the Indiana Promissory Note form, the focus should be on clarity, legality, and thoroughness. By paying careful attention to detail and understanding the state's requirements, parties can create a solid and legally binding agreement that suits their financial transaction.

Popular Promissory Note State Forms

Promissory Note Template Florida Pdf - For businesses, it can facilitate financing arrangements with investors or lenders, clearly laying out the repayment obligations.

Promissory Note Template New York - A Promissory Note can be transferred to another party unless explicitly stated otherwise, making the debt owed to the new holder.