Free Promissory Note Form for Florida

In Florida, the Promissory Note form serves as a crucial document for borrowers and lenders, setting the groundwork for a clear, legally binding agreement regarding the loan of money. This form, tailored specifically to meet the legal requirements within the state, outlines the necessary details both parties must adhere to, such as the amount borrowed, interest rate, repayment schedule, and conditions under which the loan must be repaid. Additionally, it addresses the actions to be taken if the borrower defaults on the loan, providing a level of security and predictability for the lender. The form's customization to Florida laws makes it an indispensable tool for private loans, ensuring that both lender and borrower are protected under state guidelines. Its comprehensive nature captures the essence of the agreement, enabling a smoother transaction and helping to prevent future disputes between the involved parties.

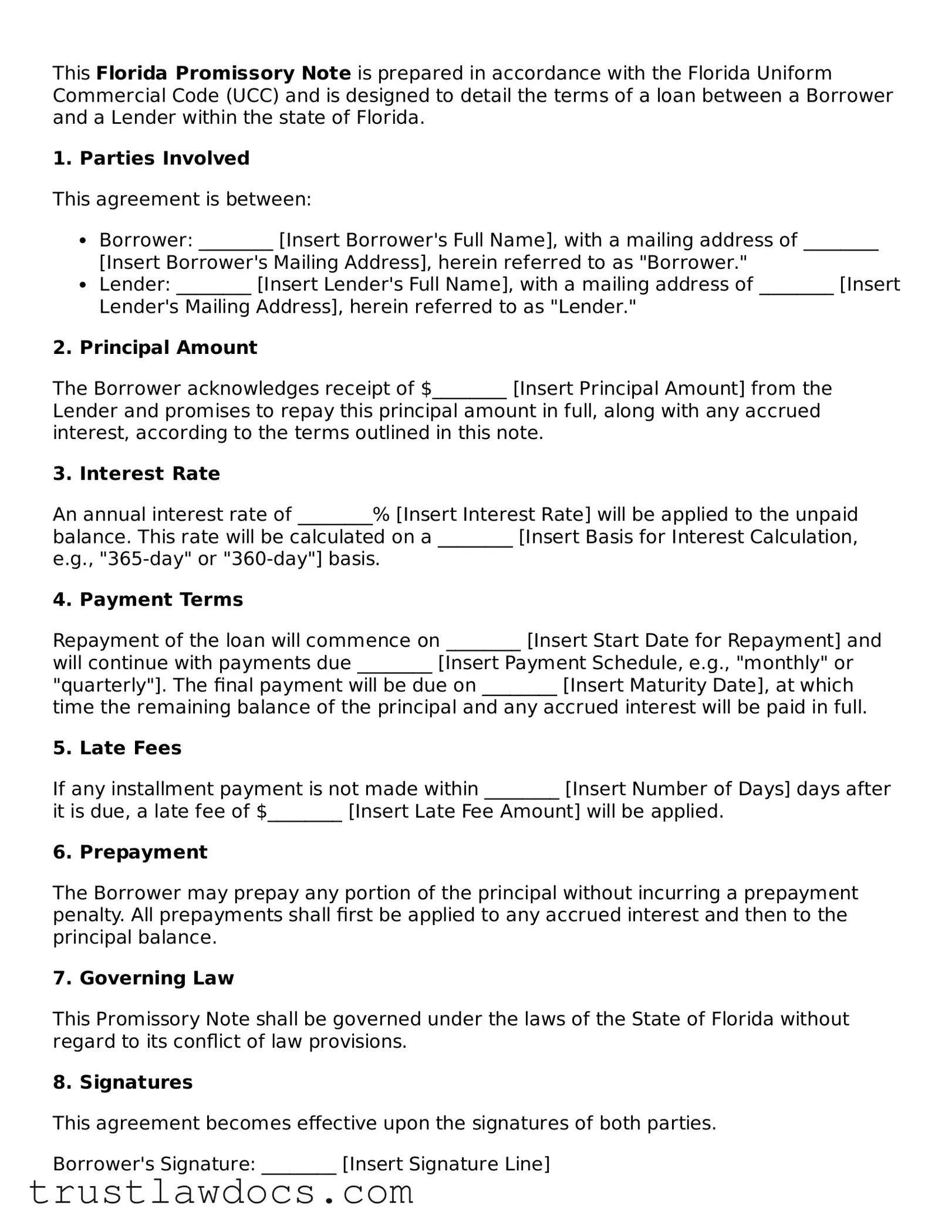

Form Example

This Florida Promissory Note is prepared in accordance with the Florida Uniform Commercial Code (UCC) and is designed to detail the terms of a loan between a Borrower and a Lender within the state of Florida.

1. Parties Involved

This agreement is between:

- Borrower: ________ [Insert Borrower's Full Name], with a mailing address of ________ [Insert Borrower's Mailing Address], herein referred to as "Borrower."

- Lender: ________ [Insert Lender's Full Name], with a mailing address of ________ [Insert Lender's Mailing Address], herein referred to as "Lender."

2. Principal Amount

The Borrower acknowledges receipt of $________ [Insert Principal Amount] from the Lender and promises to repay this principal amount in full, along with any accrued interest, according to the terms outlined in this note.

3. Interest Rate

An annual interest rate of ________% [Insert Interest Rate] will be applied to the unpaid balance. This rate will be calculated on a ________ [Insert Basis for Interest Calculation, e.g., "365-day" or "360-day"] basis.

4. Payment Terms

Repayment of the loan will commence on ________ [Insert Start Date for Repayment] and will continue with payments due ________ [Insert Payment Schedule, e.g., "monthly" or "quarterly"]. The final payment will be due on ________ [Insert Maturity Date], at which time the remaining balance of the principal and any accrued interest will be paid in full.

5. Late Fees

If any installment payment is not made within ________ [Insert Number of Days] days after it is due, a late fee of $________ [Insert Late Fee Amount] will be applied.

6. Prepayment

The Borrower may prepay any portion of the principal without incurring a prepayment penalty. All prepayments shall first be applied to any accrued interest and then to the principal balance.

7. Governing Law

This Promissory Note shall be governed under the laws of the State of Florida without regard to its conflict of law provisions.

8. Signatures

This agreement becomes effective upon the signatures of both parties.

Borrower's Signature: ________ [Insert Signature Line]

Date: ________ [Insert Date Line]

Lender's Signature: ________ [Insert Signature Line]

Date: ________ [Insert Date Line]

PDF Form Details

| Fact Name | Detail |

|---|---|

| Governing Law | Florida promissory notes are governed by the state laws of Florida. |

| Types Available | Two main types: secured and unsecured. Secured notes require collateral, while unsecured do not. |

| Usury Rate Application | Interest rates must comply with Florida’s usury laws to avoid being deemed excessively high. |

| Signature Requirement | Both secured and unsecured promissory notes must be signed by the borrower and, in some cases, a witness or notary public. |

| Prepayment Penalties | Florida law allows for prepayment penalties, but they must be clearly stated in the promissory note. |

How to Write Florida Promissory Note

Filling out the Florida Promissory Note form is an important step for individuals who are entering into a loan agreement. This document serves as a legally binding agreement between the borrower and the lender, outlining the loan amount, interest rate, repayment schedule, and other essential terms. It is crucial for both parties to clearly understand and accurately fill out the form to avoid any potential misunderstandings or legal disputes down the line. Following a detailed, step-by-step guide can help ensure that the form is completed correctly and thoroughly.

Steps to Fill Out the Florida Promissory Note Form:

- Begin by entering the date on which the promissory note is being created at the top of the form.

- Write the full legal name of the borrower and their complete address, including the city, state, and ZIP code.

- Insert the full legal name of the lender along with their complete address, following the same format used for the borrower.

- Specify the principal amount of the loan in U.S. dollars without the inclusion of the interest rate.

- Determine and insert the annual interest rate percentage that will be applied to the principal loan amount.

- Choose the repayment schedule (e.g., monthly, quarterly, annually) and detail the payment start date and the conditions for the repayment structure.

- If applicable, describe any collateral that the borrower is using to secure the loan, ensuring to include a detailed description of the property or asset.

- Include terms regarding late fees, specifying the amount and the conditions under which a late fee will be charged.

- Outline the conditions under which the loan may be prepaid, if applicable, including whether prepayment penalties will apply.

- List any additional terms or conditions that are relevant to the loan agreement and have been agreed upon by both parties.

- Review the entire form to ensure all information is accurate and complete. Make any necessary corrections or additions.

- Both the borrower and the lender should sign and date the promissory note. It is recommended to have the signatures witnessed or notarized for added legal validity.

Once the Florida Promissory Note form is filled out, both the lender and the borrower should keep a copy of the document for their records. This promissory note will serve as a crucial reference in the event of any questions or disputes regarding the loan agreement. Proper completion and preservation of this document can significantly contribute to a smooth and transparent lending process.

Get Answers on Florida Promissory Note

What is a Florida Promissory Note?

A Florida Promissory Note is a legal document that outlines the terms under which money is borrowed and to be repaid. This includes the amount borrowed, interest rate, repayment schedule, and any collateral securing the loan. It serves as a binding agreement between a lender and a borrower in the state of Florida.

Is a written Promissory Note required in Florida?

While oral agreements can be enforceable, a written Promissory Note is highly recommended in Florida. A written document helps prevent any misunderstandings about the loan terms and can be necessary evidence in court if there is a dispute.

Are there different types of Promissory Notes in Florida?

Yes, there are mainly two types of Promissory Notes in Florida: secured and unsecured. A secured Promissory Note requires the borrower to pledge collateral, which the lender can claim if the loan isn't repaid. An unsecured Promissory Note does not require collateral, making it a higher risk for the lender.

How is the interest rate determined in a Florida Promissory Note?

The interest rate on a Florida Promissory Note is agreed upon by the lender and the borrower. However, it must comply with Florida's usury laws, which cap the maximum interest rate allowed. The current legal rates can change, so it's important to check the latest regulations.

What happens if a borrower defaults on a Promissory Note in Florida?

If a borrower defaults on a Promissory Note in Florida, the lender has the right to take legal action to recover the outstanding debt. If the note is secured, the lender may also seize the collateral. The specific course of action depends on the terms outlined in the Promissory Note.

Can a Florida Promissory Note be modified?

Yes, a Florida Promissory Note can be modified if both the lender and the borrower agree to the changes. The modifications should be made in writing and both parties should sign the updated agreement to ensure the changes are legally binding.

How is a Promissory Note legally enforced in Florida?

To legally enforce a Promissory Note in Florida, the lender must file a lawsuit in the appropriate court. The court will review the note, the circumstances of the default, and the attempts made to resolve the payment issue. If the court finds in favor of the lender, it may award a judgment that can include the outstanding debt, interest, and legal fees.

Does signing a Florida Promissory Note affect the borrower’s credit score?

Signing a Promissory Note itself does not affect a borrower's credit score. However, if the borrower fails to meet the repayment terms and the lender reports the default to credit bureaus, it can negatively impact the borrower's credit score.

Where can someone obtain a Florida Promissory Note form?

A Florida Promissory Note form can be obtained from legal document websites, attorneys specializing in financial agreements, or financial institutions. It's important to ensure the form complies with Florida law and accurately reflects the agreement between the lender and the borrower.

Common mistakes

Filling out the Florida Promissory Note form requires attention to detail, but many individuals often overlook key components, which can lead to significant problems. One common mistake is not specifying the interest rate. The interest rate needs to be clearly stated to avoid any ambiguity and potential disputes over the amount of interest being charged. This oversight can complicate repayment schedules and the total amount due.

Another area frequently mishandled is failing to include a clear repayment schedule. The note should detail when payments are due, such as monthly or at the completion of a project, and the amount of each payment. Without this critical information, misunderstandings about the timing and amount of payments are likely to occur, complicating the borrower-lender relationship.

Misidentifying the parties involved is also a common error. Both the borrower and lender's full legal names should be included to clearly establish who is responsible for borrowing and repaying the money. Using nicknames or incomplete names can lead to confusion and legal challenges if disputes arise.

The omission of collateral details, when applicable, is another considerable mistake. If the promissory note is secured by collateral, the document should describe the collateral in detail. This omission could weaken the lender’s position if the borrower defaults, making it more difficult to recover the lent amount.

Many individuals neglect to spell out the consequences of a default. It's crucial to define what constitutes a default and the actions the lender can take if the borrower fails to meet the terms of the note. Without this, enforcing the note or taking legal action becomes complicated.

Last but not least, skipping the requirement for witness or notary signatures when filling out the form can be a grave mistake. These signatures lend credibility to the document and may be required to enforce the note legally. Failing to have the promissory note properly witnessed or notarized could impact its enforceability in a court of law.

Documents used along the form

When a Florida Promissory Note form is drafted, it becomes an essential document in formalizing a promise to repay a loan. However, this form rarely exists in isolation. Several other documents complement its effectiveness, enhancing clarity and legal compliance for both the borrower and lender. These auxiliary documents range from securing the loan to detailing repayment schedules. Understanding each document's role can significantly contribute to a seamless borrowing and lending process.

- Mortgage Agreement or Deed of Trust: For loans secured by real estate, this document places a lien on the property as collateral. It outlines the lender's rights to foreclose on the property if the borrower defaults on the loan.

- Security Agreement: Similar to a Mortgage Agreement, but for personal property. It grants the lender a security interest in a specific asset or property that is not real estate, serving as collateral for the loan.

- Guaranty: A guaranty is a promise by a third party, known as the guarantor, to repay the loan if the primary borrower fails to do so. This additional security measure is often required when the borrower’s creditworthiness is in question.

- Loan Amortization Schedule: This detailed document outlines the repayment plan for the loan, including the breakdown between principal and interest for each payment, payment dates, and the loan's maturity date.

- UCC-1 Financing Statement: Used for loans involving secured transactions under the Uniform Commercial Code. This document is filed to perfect a security interest in collateral, alerting other creditors about the lender's claim.

- Loan Modification Agreement: If both the borrower and lender agree to alter the terms of the original loan, this document formalizes those changes. Modifications can include adjustments to the interest rate, payment schedule, or loan principal.

In preparing and reviewing these documents, both parties gain a clearer understanding of their rights, responsibilities, and the specific details of the loan agreement. Careful attention to each document used alongside the Florida Promissory Note can safeguard interests and foster a healthy financial agreement. Thus, it is crucial for borrowers and lenders alike to be familiar with these documents, ensuring a well-structured and legally sound loan transaction.

Similar forms

One similar document to the Florida Promissory Note form is the Loan Agreement. Both outline the specifics of a loan between two parties, including the amount borrowed, the repayment schedule, and the interest rate. However, a Loan Agreement tends to be more detailed, often including clauses on default, borrower’s representations, and covenants, providing a comprehensive framework for the financial transaction.

The Mortgage Agreement shares a resemblance with the Promissory Note, especially when it comes to secured loans involving real estate. The Promissory Note establishes the borrower's promise to pay back the debt, while the Mortgage Agreement puts a lien on the property as collateral for the loan. This ensures that if the borrower defaults, the lender has the right to foreclose on the property to recover their money.

The IOU (I Owe You) document is less formal than a Promissory Note but serves a similar purpose. It acknowledges that a debt exists and specifies the amount owed. Unlike the Promissory Note, an IOU typically does not detail repayment terms, interest rates, or consequences of non-payment, making it a simpler acknowledgment of debt without the binding legal terms.

Indenture Agreements, commonly used in bond issuance, share foundational elements with Promissory Notes. Both specify terms of a loan, including repayment obligations and interest rates. However, an Indenture Agreement is often more complex, involving multiple parties including the borrower, a trustee representing bondholders, and the bondholders themselves, and contains detailed terms regarding the bond issue.

The Line of Credit Agreement, similar to a Promissory Note, outlines the terms between a borrower and a lender, allowing the borrower to draw funds up to a specified limit. The key difference is that a Line of Credit Agreement offers ongoing access to funds, unlike the lump-sum nature of a Promissory Note. Repayment terms and interest rates are specified, adapting to the variable nature of the borrowed amount.

Personal Loan Agreements are closely aligned with Promissory Notes, as both are used between individuals to lend and borrow money. The specifics regarding the loan amount, interest rate, and repayment schedule are outlined in both documents. However, Personal Loan Agreements might include more detailed clauses about the relationship between the parties and any collateral secured against the loan.

The Debt Settlement Agreement, while serving a different purpose, is conceptually akin to a Promissory Note. It is typically used when renegotiating an existing debt, outlining new terms for repayment that both creditor and debtor agree upon. It may reference the original Promissory Note to signify an adjustment to the loan’s terms rather than setting the terms anew.

The Guaranty is another document that shares similarities with the Promissory Note, focusing on the promise to repay a debt. However, the Guaranty is specifically a pledge by a third party (the guarantor) to repay the loan if the original borrower fails to do so, adding an extra layer of security for the lender.

The Security Agreement complements the Promissory Note in secured loans, detailing the collateral that guarantees the loan. While the Promissory Note signifies the borrower's commitment to repay the borrowed amount, the Security Agreement specifies what assets are pledged as security. This legal document is crucial for lenders as it outlines the process for seizing the collateral if the borrower defaults on the loan.

Dos and Don'ts

When filling out a Florida Promissory Note form, it's important to pay attention to specific details to ensure the document is legally binding and clear to all parties involved. Adhering to these guidelines can help avoid common mistakes and potential disputes in the future.

Do:

- Ensure all parties involved have their full legal names and addresses accurately listed to establish clear identification.

- Specify the loan amount in words and numbers to avoid any confusion regarding the total amount being borrowed.

- Clearly state the interest rate, ensuring it is in compliance with Florida's applicable usury laws, to prevent any legal issues regarding excessive interest.

- Outline a clear repayment schedule, including dates and amounts for each installment, to set expectations and avoid misunderstandings about payment obligations.

- Include a clause about the legal actions that can be taken if the borrower fails to repay the loan as agreed, offering protection to the lender.

Don't:

- Leave any fields blank, as incomplete information can lead to disputes over the terms of the loan or even question the document's enforceability.

- Sign the document without witnesses or a notary public present, if required, as their presence helps validate the authenticity of the promissory note.

- Agree to a loan term or repayment plan that is unrealistic for the borrower's financial situation, which could lead to default and additional stress on the relationship.

- Forget to keep a copy of the fully executed promissory note for both the lender and the borrower's records, ensuring both parties have proof of the agreement.

- Ignore state-specific requirements or provisions that may apply to the creation and enforcement of promissory notes in Florida, as these can have significant legal implications.

Misconceptions

When dealing with the Florida Promissory Note form, several misconceptions can lead to confusion and, potentially, financial or legal missteps. It is vital to dispel these myths to ensure both parties enter into this financial agreement with full understanding and clarity.

- All promissory notes are the same. Contrary to this belief, the Florida Promissory Note form is subject to specific state laws that can affect the terms and enforcement of the note. Understanding the legal requirements in Florida is crucial for drafting a valid and enforceable document.

- Verbal agreements are as binding as written ones. While some verbal agreements can be legally binding, a written promissory note is essential in Florida to ensure clear terms and conditions are established, especially concerning repayment schedules, interest rates, and the consequences of non-payment.

- No legal advice is needed to create a Promissory Note. Although individuals can draft a Promissory Note without legal assistance, consulting with a legal professional is advisable to ensure the note complies with Florida law and adequately protects both parties' interests.

- Interest rates can be set arbitrarily. In Florida, interest rates on promissory notes are subject to usury laws. These laws cap the amount of interest that can be charged to prevent unfair or predatory lending practices.

- The borrower is the only party that needs to sign the note. Although the borrower's signature is critical to bind them to the repayment obligation, having the lender or witnesses sign the document can provide additional legal safeguards and validity to the agreement in Florida.

- A Promissory Note automatically includes collateral. The terms of security—whether personal property, real estate, or other assets—are not inherently included in a Promissory Note. These terms need to be explicitly stated in a separate security agreement or clearly defined within the note itself, particularly in Florida, where specific types of collateral may be subject to additional legal requirements.

Key takeaways

Filling out and using the Florida Promissory Note form is a crucial step in documenting a loan between two parties. It serves as a legal agreement that outlines the borrower's promise to repay a specific sum of money to the lender under agreed-upon terms. The following key takeaways can help ensure this process is managed effectively and legally.

- Understand the Legal Requirements: The Florida Promissory Note must comply with state laws, including the usury laws which dictate the maximum interest rate that can be charged. This understanding is critical to ensure that the promissory note is enforceable in court if necessary.

- Clearly Define Payment Terms: The document should specify the loan amount, interest rate, repayment schedule, and any late fees. Clear definitions prevent misunderstandings and provide a solid basis for legal recourse if the terms are not met.

- Include Both Parties' Information: Full names and addresses of both the borrower and lender should be accurately included. This identifies the parties involved and makes the document legally binding upon them.

- Secured vs. Unsecured Loans: Determine whether the loan will be secured by collateral or unsecured. This decision impacts the lender's recourse in the event the borrower defaults on the loan. A secured promissory note requires a description of the collateral.

- Signing Requirements: For a Florida Promissory Note to be legally binding, it must be signed by the borrower and, depending on the circumstances, the lender. Witnesses or a notarization may also be required to further authenticate the document.

Adherence to these key points ensures that the promissory note fulfills its role as a protective legal document for both parties involved in the loan transaction. It is strongly advised to consult legal counsel when drafting or signing such documents to avoid potential legal pitfalls and ensure the agreement is legally sound and enforceable in the state of Florida.

Popular Promissory Note State Forms

Free Loan Agreement Template Texas - It helps in clearly specifying the obligations of the borrower and protects the rights of the lender in case of default.

Promissory Note Friendly Loan Agreement Format - The clarity provided by the Promissory Note can prevent misunderstandings and potential conflicts during the loan's life.

Promissory Note Template New York - It is a critical document in student loans, outlining the terms under which students agree to pay back their educational loans.

Promissory Note Form California - It offers a straightforward way for lenders to secure repayment and for borrowers to demonstrate their commitment to fulfilling the loan terms.