Free Promissory Note Form for California

When diving into the financial agreements realm within the Golden State, the California Promissory Note form emerges as a pivotal document that spells out the terms under which money is loaned and the repayment is to be executed. It's a binding agreement that encapsulates the nuances of the loan details, such as the principal amount, interest rate, repayment schedule, and what happens if the borrower fails to meet their obligations. This form not only safeguards the lender by legally documenting the loan but also provides the borrower with a clear understanding of what is expected in terms of repayment. Its significance is paramount in personal and business finance transactions, ensuring clarity and commitment from both parties. Whether it's for a large sum to finance a home or a small loan between friends, mastering the contours of this document is crucial for anyone stepping into the lending or borrowing arena in California. By setting a legal foundation, it aims to prevent misunderstandings and foster a smooth financial exchange, marking an essential step in the journey of lending or borrowing money within the state.

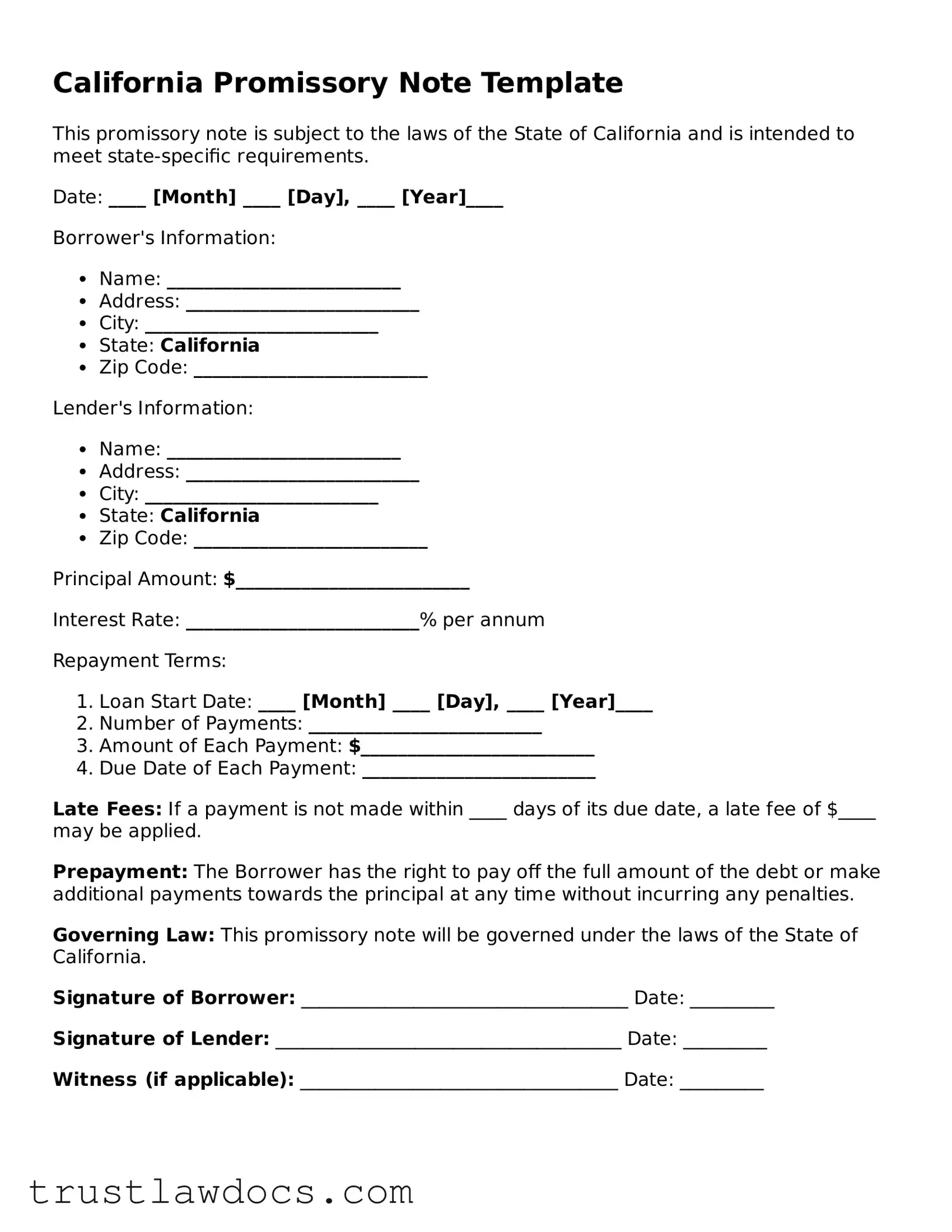

Form Example

California Promissory Note Template

This promissory note is subject to the laws of the State of California and is intended to meet state-specific requirements.

Date: ____ [Month] ____ [Day], ____ [Year]____

Borrower's Information:

- Name: _________________________

- Address: _________________________

- City: _________________________

- State: California

- Zip Code: _________________________

Lender's Information:

- Name: _________________________

- Address: _________________________

- City: _________________________

- State: California

- Zip Code: _________________________

Principal Amount: $_________________________

Interest Rate: _________________________% per annum

Repayment Terms:

- Loan Start Date: ____ [Month] ____ [Day], ____ [Year]____

- Number of Payments: _________________________

- Amount of Each Payment: $_________________________

- Due Date of Each Payment: _________________________

Late Fees: If a payment is not made within ____ days of its due date, a late fee of $____ may be applied.

Prepayment: The Borrower has the right to pay off the full amount of the debt or make additional payments towards the principal at any time without incurring any penalties.

Governing Law: This promissory note will be governed under the laws of the State of California.

Signature of Borrower: ___________________________________ Date: _________

Signature of Lender: _____________________________________ Date: _________

Witness (if applicable): __________________________________ Date: _________

PDF Form Details

| Fact | Description |

|---|---|

| Definition | A California Promissory Note is a legal document where a borrower promises to repay a loan to a lender according to agreed upon terms. |

| Governing Law | The California Civil Code governs promissory notes within the state, providing the legal framework and requirements. |

| Types | There are two main types: secured and unsecured. Secured notes are backed by collateral, while unsecured notes are not. |

| Interest Rate | Under California law, the maximum interest rate on personal loans primarily for personal, family, or household purposes is 10% per annum. |

| Enforceability | To be enforceable, the note must be in writing, signed by the borrower, and include the promise to pay a specific amount of money. |

| Default | If a borrower fails to make payments, the lender may enforce the note's terms, which could include initiating foreclosure on secured collateral or suing for the amount owed on unsecured notes. |

How to Write California Promissory Note

Filling out a promissory note in California requires careful attention to detail. This document serves as a legal agreement where one party promises to pay another a specified sum of money either on demand or at a fixed or determinable future time. Ensuring accuracy in completing this form is crucial, as it outlines the repayment schedule, interest rate, and other vital terms of the loan agreement. The steps below guide you through the process of filling out a California Promissory Note to ensure that all the necessary information is accurately captured, making the agreement legally binding and clear to all parties involved.

- Determine the type of promissory note needed—secured or unsecured. A secured note requires collateral as a security for the loan, whereas an unsecured note does not.

- Identify the parties involved. Write the full legal names and addresses of the borrower and the lender at the beginning of the document.

- Specify the loan amount. Clearly state the principal amount of money being lent.

- Detail the interest rate. Indicate the annual interest rate that will be applied to the principal balance.

- Outline the repayment schedule. Define how repayments will be made (e.g., monthly, quarterly) and specify the start date and due date for the first payment and the maturity date of the loan.

- Choose the payment method. Describe how payments will be made, such as by check, cash, or electronic transfer.

- Include terms regarding late fees and penalties. Specify any fees for late payments and under what circumstances they will be applied.

- Address the issue of prepayment. State whether the borrower is allowed to pay off the loan early and if any penalties apply for prepayment.

- Add a clause about default. Describe the action to be taken if the borrower fails to meet the terms of the agreement, including any acceleration clauses that would make the entire loan amount due immediately.

- Include governing law. State that the promissory note is governed by the laws of the State of California.

- Signatures. Both the borrower and the lender must sign and date the promissory note, making it legally binding. Witness or notary signatures may also be required, depending on the circumstances.

After the promissory note has been fully completed according to the steps outlined, it is critical to keep the document in a safe but accessible place. Both parties should have copies of the signed document for their records. This ensures that all parties have a reference to the agreed-upon terms, safeguarding their interests and making the enforcement of the agreement's terms simpler, should any disputes arise. Following the steps carefully will ensure that the promissory note is correctly filled out and legally effective, providing peace of mind to both the lender and the borrower.

Get Answers on California Promissory Note

What is a California Promissory Note?

A California Promissory Note is a legal document where one party, known as the borrower, agrees to pay back money borrowed from another party, the lender. This agreement specifies the amount of money borrowed, the interest rate, and the repayment schedule. In California, these documents are governed by local laws that outline how they must be executed and what terms need to be included.

How do I write a California Promissory Note?

To write a California Promissory Note, you must include the names and addresses of the borrower and lender, the amount of money loaned, the interest rate, and the repayment plan. Additionally, it should outline any collateral securing the loan and the actions to be taken if the borrower fails to repay the loan. Using a template specific to California can help ensure you include all necessary legal requirements.

Is a witness or notarization required for a California Promissory Note?

In California, a promissory note does not necessarily require notarization or a witness to be legally binding. However, having the document notarized or witnessed can add an extra layer of validation and may be helpful in the event of a legal dispute. It's advisable, but not legally mandatory.

Can interest be charged on a California Promissory Note, and if so, how much?

Yes, interest can be charged on a California Promissory Note. The maximum interest rate allowed is generally 10% per annum for personal, family, or household purposes. For other types of transactions, such as business loans, the rate may vary. It's crucial to adhere to the state's usury laws to avoid charging illegal interest rates.

What happens if the borrower does not repay the loan as agreed in the California Promissory Note?

If the borrower fails to repay the loan according to the agreed terms in the California Promissory Note, the lender may have the right to pursue legal action to collect the debt. This could involve suing for breach of contract or initiating foreclosure proceedings if the loan was secured by collateral. The specific remedies available would depend on the terms of the note and applicable state laws.

Do I need a lawyer to create a California Promissory Note?

While it's not a requirement to have a lawyer create a California Promissory Note, consulting with one can be very beneficial. A lawyer can provide advice on the note’s terms to ensure they comply with California laws and advise on any potential issues that might arise. This can help in creating a more solid and enforceable agreement.

Is a California Promissory Note the same as a loan agreement?

A California Promissory Note is similar to a loan agreement, as both are debt instruments stating that the borrower owes the lender a specific amount of money. However, a promissory note is usually more straightforward and less detailed than a loan agreement. A loan agreement often includes more comprehensive terms and conditions, such as representations and warranties, covenants, and event of default provisions. While both serve to document a loan, the choice between them depends on the complexity and requirements of the financial transaction.

Common mistakes

When it comes to filling out the California Promissory Note form, several common mistakes can lead to confusion, delays, and even legal issues down the road. A promissory note is a crucial document that outlines the terms under which one party promises to pay a sum of money to another. Getting it right is essential.

One common error is not specifying the payment terms clearly. This detail includes the loan's amount, interest rate, repayment schedule, and due dates. Failure to make these terms clear and concise may lead to misunderstandings between the borrower and lender, potentially resulting in disputes or default.

Another mistake is neglecting to include the full legal names and contact information of both the lender and borrower. This information is fundamental because it identifies the parties involved and makes the note enforceable. If the document only includes first names or lacks contact details, locating the parties involved or legally enforcing the agreement can become challenging.

Often, people forget to define the consequences of a late payment or non-payment. A well-prepared promissory note will clearly outline any late fees, additional interest, or actions that will be taken in the event of a default. This omission can make it difficult for the lender to take action if payments are missed, as the terms were not agreed upon in advance.

Skipping the inclusion of a security agreement is another oversight. If the loan is secured by collateral, such as property or other assets, this should be explicitly stated in the document. Without a security agreement, the lender may not be able to legally claim the collateral if the borrower fails to repay the loan.

Some individuals also make the error of not having the promissory note signed and dated. This simple step is crucial for the document to be considered legally binding. Both parties must sign and date the note, and it's even better to have the signatures notarized. This provides a level of protection and authenticity to the agreement and can be crucial if the document is ever presented in a legal setting.

Finally, failing to keep a copy of the signed promissory note is a mistake to be avoided. Both the lender and the borrower should have a copy of the agreement for their records. This ensures that both parties can refer back to the agreed terms and conditions and can be incredibly valuable in resolving any future disputes that may arise.

By addressing these common issues, individuals can create a more effective and enforceable promissory note, minimizing future misunderstandings and legal challenges while ensuring that both parties are protected.

Documents used along the form

When engaging in financial transactions in California, especially those involving personal or business loans, a Promissory Note form is instrumental. However, to fully ensure the legality and clarity of the agreement, additional documents are often used alongside it. These documents serve a variety of purposes, from detailing the collateral to stipulating the actions in case of default. Let's explore some of these essential forms and documents that complement a California Promissory Note.

- Deed of Trust: This document is used when a loan is secured by real estate. It involves three parties: the borrower (trustor), the lender (beneficiary), and a neutral third party (trustee). The Deed of Trust ensures that the property can be transferred to the lender if the borrower does not fulfill the loan obligations.

- Security Agreement: Similar to a Deed of Trust but for personal property, this agreement outlines the collateral that the borrower offers against the loan. It provides a lender the right to seize the collateral if the borrower defaults on the loan, ensuring the lender has some form of compensation.

- Guaranty: A guaranty is a promise by a third party, known as a guarantor, to pay back the loan if the borrower fails to do so. This document adds an extra layer of security for the lender by involving another responsible party.

- Loan Agreement: This comprehensive document details all the terms and conditions of the loan in a more detailed manner compared to a Promissory Note. It includes information on interest rates, repayment schedule, late fees, and the consequences of default.

- Amendment Agreement: If any terms of the original Promissory Note or related documents need to be changed or updated, an Amendment Agreement is used. This document ensures that any adjustments are legally binding and acknowledged by all parties.

Understanding and properly utilizing these documents in conjunction with a California Promissory Note can provide clarity, enforceability, and protection for all parties involved in a loan transaction. It is crucial for both lenders and borrowers to be aware of these complementary documents to ensure a smooth and legally sound lending process.

Similar forms

A California Promissory Note shares similarities with a Loan Agreement, primarily because both are legally binding documents that outline the terms for the borrowing of money. In both documents, details about the loan amount, interest rate, repayment schedule, and the consequences of non-payment are spelled out. The significant similarity lies in their primary function to define the terms of a loan between parties, ensuring there is a clear understanding of the borrower's obligation to repay the borrowed amount.

Much like a Mortgage Agreement, a California Promissory Note also establishes an understanding between a borrower and a lender regarding a loan. However, a Mortgage Agreement is specifically tied to real estate transactions and uses the purchased property as collateral. Both documents include detailed repayment terms and the interest rate, but the Mortgage Agreement also involves the legal process of placing a lien on the property, which is not typically a feature of a promissory note unless it is secured by specific collateral.

The similarities between a California Promissory Note and a Deed of Trust revolve around their use in real estate transactions, particularly in securing a loan. A Deed of Trust involves three parties—the borrower, the lender, and a trustee—and serves as an alternative to a Mortgage Agreement in some states. While it also details the loan's repayment plan, the key difference is that a Deed of Trust grants the trustee the power to sell the property without court intervention if the borrower defaults, a feature not present in standard promissory notes.

Personal Loan Agreements share a close resemblance to California Promissory Notes as both are used between individuals rather than institutions. These documents detail the loan's terms, including the repayment schedule, interest rate, and consequences for non-payment. The main distinction is that Personal Loan Agreements are generally more detailed and may include more extensive provisions regarding the responsibilities of each party, whereas promissory notes are typically more straightforward and concise.

A California Promissory Note is also similar to an IOU, but with a higher level of detail and formality. An IOU simply acknowledges that a debt exists and that one party owes another a specified sum. In contrast, a promissory note provides a comprehensive repayment schedule, including interest rates and, in some cases, the collateral securing the loan. This makes a promissory note more formal and legally binding than a simple acknowledgment of debt found in an IOU.

Compared to a Bill of Sale, a California Promissory Note provides a record of a loan rather than a completed transaction for the sale of goods or property. While a Bill of Sale signifies that ownership of an item has been transferred from one party to another and details the terms of that transfer, a promissory note records a debt obligation and outlines how that debt is to be repaid. Both serve as important legal documents that provide evidence of an agreement, but they cater to distinctly different types of agreements.

Lastly, a California Promissory Note can be paralleled with a Student Loan Agreement, specifically because both outline the terms for the repayment of a loan. A Student Loan Agreement, however, is tailored specifically for the financial assistance of a student's education and often includes specific terms regarding deferment periods and interest accrual unique to educational loans. Like promissory notes, these agreements establish a legal obligation to repay the lent amount under agreed-upon terms, highlighting their purpose of ensuring mutual understanding and agreement between borrower and lender.

Dos and Don'ts

When filling out the California Promissory Note form, it is crucial to be thorough and accurate. This legal document outlines the terms under which a loan is provided and the repayment is agreed upon. To ensure that the process goes smoothly, consider the following dos and don'ts:

- Do ensure all parties’ full legal names are included. This establishes the identities of the lender and borrower clearly.

- Do specify the loan amount in both words and figures to avoid any confusion regarding the total sum lent.

- Do clearly outline the repayment schedule, including the due dates and any grace periods, to ensure all parties are aligned on expectations.

- Do detail the interest rate, if applicable, and explain how it is calculated, ensuring it adheres to California's usury laws.

- Do mention any collateral securing the loan, if applicable, to clarify the security interests involved.

- Don't leave any sections incomplete, as this could lead to ambiguities or disputes down the line.

- Don't forget to include signatures and dates at the bottom of the form, as these are vital for the document's legality and enforceability.

- Don't ignore state-specific requirements. California may have unique provisions that need to be addressed in the Promissory Note.

- Don't hesitate to seek legal advice if any portions of the form are unclear or if you're uncertain about how to proceed. A professional can provide clarity and ensure the document complies with applicable laws.

Filling out the California Promissory Note form with care and attention to detail can prevent future complications, solidifying the agreement's foundation and ensuring that both the borrower and lender are protected under the law.

Misconceptions

Many individuals often hold misconceptions about the California Promissory Note form, which can lead to confusion or misunderstanding regarding its use and legal power. Here are five common misconceptions explained:

All Promissory Notes are the Same: People often think all promissory notes are identical, regardless of the state. However, California has specific laws that affect the content and the enforcement of a promissory note. California's regulations may necessitate specific disclosures or terms that are not required in other states.

Only Formal Loans Need a Promissory Note: Some believe that promissory notes are only for formal bank loans. In reality, any lending of money, regardless of whether it's a small personal loan between friends or family members, should ideally be documented with a promissory note to protect both parties' interests and create a legally binding understanding.

Verbal Agreements are Just as Good: While verbal agreements can be legally binding in some cases, a written promissory note is far more reliable. In California, the statute of frauds requires certain agreements to be in writing to be enforceable. This typically includes agreements that involve the borrowing of money, ensuring there is a clear record of the terms and conditions agreed upon.

No Need for a Lawyer: It's a common misconception that you don't need legal advice to create or sign a promissory note. While individuals can draft a promissory note without a lawyer, seeking legal advice can ensure that the document complies with California law and adequately protects all parties involved.

It's Only about Repayment: Many people think promissory notes are simply about the repayment of money. While repayment terms are central to the document, promissory notes in California can also include interest rates, repayment schedules, consequences of default, and collateral information, making them complex legal documents that cover various aspects of the loan agreement.

Key takeaways

The California Promissory Note form acts as a legal document that outlines the terms under which money is borrowed and must be repaid. This document holds great importance both for lenders and borrowers. The following key takeaways will help individuals navigate the complexities of filling out and using this form effectively:

- Understand the Types: Be aware that promissory notes can be either secured or unsecured. A secured note is backed by collateral, offering more security to the lender, while an unsecured note is based solely on the borrower's promise to pay.

- Include All Parties: The full legal names and addresses of both the lender and borrower should be clearly stated to avoid any confusion or ambiguity.

- Specify Loan Details: It's crucial to detail the loan amount, interest rate, and repayment schedule. These elements define the obligations of the borrower and the rights of the lender.

- Clarify the Interest Rate: The interest rate must comply with California's usury laws to avoid being deemed illegal. It's essential to verify the current legal maximum rates before setting the loan's interest rate.

- Define the Repayment Plan: Whether the loan will be repaid in a lump sum, installments, or on demand, the repayment terms should be specified clearly, including due dates and any grace periods.

- Consider Including a Co-signer: For unsecured loans, or if the borrower's creditworthiness is uncertain, adding a co-signer can provide additional security to the lender.

- Address Late Fees and Default Terms: Clearly outline any late fees and the conditions under which the note would be considered in default. This ensures both parties are aware of the consequences of a breach of the agreement.

- Keep It Legal: Ensure the note complies with all relevant state and federal laws. This includes laws regarding lending, interest rates, and debt collection.

- Signing and Witnessing: The promissory note must be signed by both the borrower and the lender. Having the signatures notarized or witnessed can add an extra layer of validity.

- Retain Copies: Both the lender and the borrower should keep signed copies of the promissory note. This ensures that a verifiable record of the agreement is always available.

By paying close attention to these key takeaways, parties involved can ensure that the promissory note serves its intended purpose without leading to future legal complications. It facilitates a clear understanding and agreement between borrower and lender, anchored in transparent and fair practices.

Popular Promissory Note State Forms

Promissory Note Template New York - Promissory Notes are integral in real estate transactions, often used in combination with mortgages.

Promissory Note Template Florida Pdf - The document can detail any agreed-upon interest-only payment periods, where the borrower pays only the interest on the loan for a certain time.