Official Promissory Note Document

At the heart of many financial transactions, the Promissory Note form serves as a critical document, facilitating the flow of money between parties in a structured and legally binding manner. This instrument not only specifies the amount of money borrowed and the interest rate, if any, but also outlines the repayment schedule in clear terms. Integral to a variety of settings, from personal loans between family members to more complex dealings in the business world, its versatility cannot be overstated. With clear terms and conditions, the promissory note ensures that both the borrower and the lender have a mutual understanding of their obligations, potentially avoiding disputes down the line. Additionally, it provides a legal framework that can be crucial in the enforcement of the agreement, underlining its importance in the financial landscape. As such, obtaining a thorough grasp of how the Promissory Note form functions can serve to protect the interests of all parties involved.

Promissory Note Document Types

Form Example

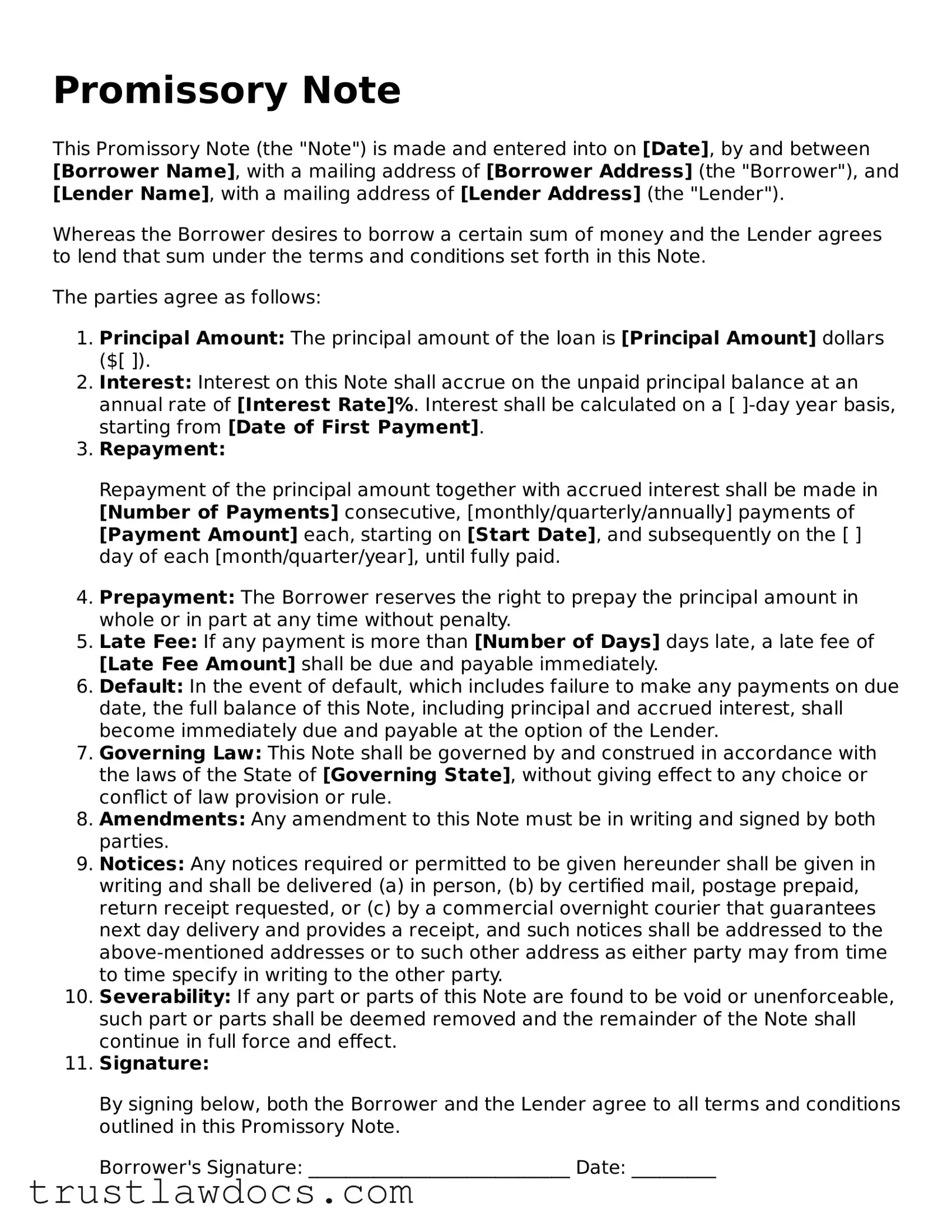

Promissory Note

This Promissory Note (the "Note") is made and entered into on [Date], by and between [Borrower Name], with a mailing address of [Borrower Address] (the "Borrower"), and [Lender Name], with a mailing address of [Lender Address] (the "Lender").

Whereas the Borrower desires to borrow a certain sum of money and the Lender agrees to lend that sum under the terms and conditions set forth in this Note.

The parties agree as follows:

- Principal Amount: The principal amount of the loan is [Principal Amount] dollars ($[ ]).

- Interest: Interest on this Note shall accrue on the unpaid principal balance at an annual rate of [Interest Rate]%. Interest shall be calculated on a [ ]-day year basis, starting from [Date of First Payment].

- Repayment:

Repayment of the principal amount together with accrued interest shall be made in [Number of Payments] consecutive, [monthly/quarterly/annually] payments of [Payment Amount] each, starting on [Start Date], and subsequently on the [ ] day of each [month/quarter/year], until fully paid.

- Prepayment: The Borrower reserves the right to prepay the principal amount in whole or in part at any time without penalty.

- Late Fee: If any payment is more than [Number of Days] days late, a late fee of [Late Fee Amount] shall be due and payable immediately.

- Default: In the event of default, which includes failure to make any payments on due date, the full balance of this Note, including principal and accrued interest, shall become immediately due and payable at the option of the Lender.

- Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of [Governing State], without giving effect to any choice or conflict of law provision or rule.

- Amendments: Any amendment to this Note must be in writing and signed by both parties.

- Notices: Any notices required or permitted to be given hereunder shall be given in writing and shall be delivered (a) in person, (b) by certified mail, postage prepaid, return receipt requested, or (c) by a commercial overnight courier that guarantees next day delivery and provides a receipt, and such notices shall be addressed to the above-mentioned addresses or to such other address as either party may from time to time specify in writing to the other party.

- Severability: If any part or parts of this Note are found to be void or unenforceable, such part or parts shall be deemed removed and the remainder of the Note shall continue in full force and effect.

- Signature:

By signing below, both the Borrower and the Lender agree to all terms and conditions outlined in this Promissory Note.

Borrower's Signature: ____________________________ Date: _________

Lender's Signature: ______________________________ Date: _________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | A Promissory Note is a financial document in which one party promises to pay a certain amount of money to another party under specified conditions. |

| Legally Binding | This document creates a legal obligation for the borrower to repay the loan as agreed. |

| Key Elements | Essential elements include the amount borrowed, interest rate, repayment schedule, and any collateral. |

| Types | There are secured and unsecured Promissory Notes, distinguished by whether collateral backs the loan. |

| Interest Rate | The interest rate can be fixed or variable, as specified within the agreement. |

| State Specific | Laws and requirements can vary by state; it is crucial to ensure the note is compliant with local regulations. |

| Governing Law | The Note should indicate the governing law under which it is interpreted, generally the law of the state where the document is executed. |

How to Write Promissory Note

Filling out a promissory note is a crucial step in formalizing the details of a loan between two parties. It outlines the repayment plan, interest rate, and the consequences of non-payment, serving as a legally binding agreement. To ensure clarity and avoid potential disputes, it’s important to complete this form accurately and thoroughly. The following steps guide you through the essential information required to fill out a promissory note effectively.

- Identify the parties involved: Write the full legal names of the lender and the borrower at the beginning of the document to clearly establish who is involved in the agreement.

- Specify the loan amount: Clearly state the amount of money being borrowed. This should be the exact figure agreed upon by both parties.

- Determine the interest rate: Agree upon an interest rate, and ensure it is clearly noted. This rate affects how much the borrower will pay back in addition to the original loan amount.

- Set the repayment schedule: Detail how the loan will be repaid. This could include the frequency of payments (e.g., monthly), the amount of each payment, and the duration over which payments will be made.

- Outline the terms of late payments: Specify any fees or penalties for late payments within the promissory note. Clear guidelines will help manage expectations and prevent disputes.

- Include a maturity date: State the date by which the loan should be fully repaid. This is critical to ensure both parties are clear on the timeline for the financial obligation.

- Define the collateral, if applicable: If the loan is secured with collateral, describe the asset being used as security for the loan. This section is only necessary if the loan is not unsecured.

- Add a co-signer section, if necessary: If someone is co-signing the promissory note, include their name and details. A co-signer agrees to take on the responsibility of the loan if the initial borrower fails to make payments.

- Sign and date the form: Both the borrower and the lender must sign and date the promissory note. These signatures legally bind the parties to the terms of the note.

Once the promissory note is filled out and signed, it’s important to keep a copy for both parties’ records. This document will serve as a reference in case of any discrepancies or disputes about the loan terms. Regular communication and adherence to the agreed-upon terms can help prevent issues and ensure a smooth repayment process.

Get Answers on Promissory Note

What is a Promissory Note?

A Promissory Note is a legal document between two parties, where one party (the borrower) promises to repay a loan to the other party (the lender) under specified terms and conditions. It includes the amount of loan, interest rate, repayment schedule, and consequences of default.

Who should use a Promissory Note?

Anyone lending or borrowing money can use a Promissory Note. It is commonly used for personal loans between friends and family, loans to employees by businesses, or real estate transactions. It provides a clear and enforceable agreement for repayment.

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding document when it contains the signature of the borrower and adheres to the legal requirements of the jurisdiction in which it is used. It can be used in a court of law to enforce repayment if the borrower fails to meet the terms of the agreement.

What information is needed to create a Promissory Note?

To create a Promissory Note, the following information is necessary: the names and addresses of the borrower and lender, the loan amount, interest rate, repayment schedule, collateral (if any), and any other specific terms both parties agree upon.

Can the terms of a Promissory Note be changed?

Yes, the terms of a Promissory Note can be changed if both the borrower and the lender agree to the modifications. The changes should be documented in writing, and both parties should sign any amendment to the original agreement to ensure that it remains legally binding.

What happens if the borrower does not repay the loan as agreed?

If the borrower fails to repay the loan according to the terms of the Promissory Note, the lender may have legal recourse, which includes suing for the remaining balance, taking possession of any collateral specified in the note, or reporting the default to credit bureaus, depending on the agreed-upon terms.

Do I need a lawyer to create a Promissory Note?

While it is not mandatory to have a lawyer create a Promissory Note, it is advisable to consult with one to ensure that the document complies with local laws and adequately protects the interests of both parties. A lawyer can also advise on specific terms to include based on the circumstances of the loan.

Common mistakes

One of the most common mistakes people make when filling out a Promissory Note form is neglecting to clearly define the terms of repayment. This should include the repayment schedule, whether in installments or a lump sum, as well as the due date. Without specifying these details, the agreement can become a subject of dispute, potentially leading to legal complications. It's critical to outline whether payments will be made on a weekly, monthly, or annual basis, and if there are any grace periods for late payments.

Another frequent oversight is failing to include the interest rate, if any, applicable to the loan. This omission can lead to misunderstandings about the total amount owed. Interest rates should be stated clearly, specifying whether the rate is fixed or variable. Including the method for calculating the interest—whether it's simple or compounded—can also prevent potential disagreements between the parties involved.

Forgetting to detail the consequences of a default is also a significant error. It's essential to outline what constitutes a default under the terms of the Promissory Note, such as failing to make payments on time or violating other stipulations of the agreement. Equally important is specifying the legal recourse for the lender, including late fees, acceleration of the debt, and legal action. This not only ensures the lender is protected but also informs the borrower of the repercussions of non-compliance.

Many individuals neglect to include a clause on security or collateral. In secured loans, specifying what assets serve as collateral offers protection to the lender, ensuring there is recourse to recover the loaned amounts if the borrower defaults. Without this, the promissory note may be considered unsecured, potentially placing the lender at a higher risk of loss. It’s crucial for both parties to clearly understand and document what, if any, assets are being used as collateral.

Another common mistake is not properly identifying the parties involved, by failing to use their full legal names and addresses. This ambiguity can lead to confusion about the parties' identities, particularly in the case of common names or if either party is a business entity. Proper identification establishes the legitimacy of the parties and can aid in enforcement of the note.

Lastly, omitting signatures and dates at the conclusion of the document is a critical error. A Promissory Note, like any contract, requires the signatures of all parties involved to be legally binding. Additionally, dating the document establishes the timeline for the agreement, which is essential for interpreting the terms of repayment and enforceability of the note. Ensuring all parties sign and date the note is fundamental to its validity.

Documents used along the form

A Promissory Note is a crucial document for formalizing the terms of a loan between two parties. It clarifies the amount borrowed, the repayment schedule, and the consequences of not repaying the loan. There are several other documents that are often used alongside a Promissory Note to ensure a comprehensive and enforceable agreement. These documents complement the Promissory Note by providing additional legal protections and clarifications for both the borrower and lender.

- Loan Agreement: This document outlines the broader terms of the loan beyond the basic repayment plan found in a Promissory Note. It includes clauses related to borrower representations, warranties, covenants, and conditions of the loan. The Loan Agreement is comprehensive and provides a detailed framework for the relationship between the borrower and lender.

- Security Agreement: If the loan is secured against collateral, a Security Agreement is necessary. This document identifies the collateral that is to be used to secure the loan, ensuring the lender can take possession of the collateral if the borrower defaults on the loan. It details the rights of the lender over the secured property.

- Guaranty: A Guaranty is required when there’s a third party guaranteeing the loan. This document makes a third party (the guarantor) responsible for the debt if the original borrower fails to repay. It's a form of assurance for the lender that the loan will be repaid, either by the borrower or the guarantor.

- Amendment Agreement: Over the life of the loan, the terms agreed upon in the Promissory Note and related documents may need to be revised or extended. An Amendment Agreement allows both parties to make changes to the terms without drafting a new Promissory Note. This could include changes to the repayment schedule, interest rates, or other key terms.

Together, these documents form a robust legal framework that supports the lending process. They safeguard the interests of both parties, ensure clarity in terms of expectations and responsibilities, and provide mechanisms for dealing with disputes or defaults. For anyone entering into a loan agreement, understanding these documents and how they interact with a Promissory Note is essential.

Similar forms

A promissory note, often used in transactions to document a loan between two parties, shares common characteristics with several other financial and legal documents. One similar document is a Loan Agreement. While a promissory note is a straightforward acknowledgment of a debt and a promise to repay, a Loan Agreement typically includes additional details such as repayment schedule, interest rates, and collateral. Both serve to provide a legal foundation for lending transactions but the Loan Agreement offers a more detailed framework governing the terms of the loan.

Mortgage agreements are another type of document closely related to promissory notes but are specifically tied to real estate transactions. In essence, a mortgage agreement is a promissory note secured with the collateral of real property. The borrower promises to repay the lender over time, typically in the form of monthly payments, with the property itself serving as security for the loan. Should the borrower fail to meet the repayment terms, the lender has the right to foreclose on the property to recover the owed amount.

IOU documents also share similarities with promissory notes, as they both signify an acknowledgment of debt. However, IOUs are often less formal and typically do not include detailed terms of repayment like interest rates or payment schedules. An IOU simply states that one party owes another a specified amount of money, making it more of an informal acknowledgment of debt compared to the binding legal commitment represented by a promissory note.

Bonds issued by corporations or governments can be likened to promissory notes in that they are formal agreements to repay borrowed funds. A bond details the terms under which a borrower (in this case, a corporation or government entity) agrees to pay back the face value of the bond to the investor, plus any agreed-upon interest, over a set period. While promissory notes are commonly used in private lending between individuals or businesses, bonds are used to raise capital from multiple investors in the public market.

Dos and Don'ts

When completing a Promissory Note form, it's essential to tread carefully to ensure all the terms are clear, binding, and accurately represent the agreement between the lender and borrower. Here are some pivotal dos and don'ts that can help guide you through the process:

Things You Should Do:

Read through the entire form thoroughly before filling it out to ensure you understand all the provisions and how they apply to your agreement.

Include clear, detailed personal information for both the lender and the borrower, such as full names, addresses, and contact information, to avoid any confusion about the parties involved.

Specify the loan amount in words and numbers to prevent any ambiguity regarding the total amount being borrowed.

Clearly outline the repayment schedule, including due dates and amounts for each installment, if applicable, to ensure there is a mutual understanding of the expectations for repayment.

State the interest rate clearly, if any, and whether it is fixed or variable, to avoid any surprises or disagreements down the line.

Include any relevant legal information, such as the state laws governing the promissory note, to ensure the document's enforceability.

Have both parties sign and date the promissory note to make it a legally binding document.

Things You Shouldn't Do:

Don't leave any fields blank. If a section doesn't apply, write "N/A" (not applicable) to show that you didn't overlook it.

Avoid using vague terms that can be misinterpreted. Be as specific as possible to prevent misunderstandings.

Don't forget to specify any collateral securing the loan, if applicable, to protect the lender's interests.

Avoid setting unrealistic repayment terms that could be difficult for the borrower to meet, as this might lead to unnecessary conflict or even default.

Don't ignore the necessity to notarize the document if required by the state law where your agreement is executed, to add an extra layer of legal protection.

Avoid omitting a clause that allows for modifications to the agreement, acknowledging that unforeseen circumstances can necessitate changes to the original terms.

Don't neglect to keep copies of the signed promissory note for both the lender's and borrower's records.

Misconceptions

When it comes to managing money matters, especially loans between two parties, a promissory note is a critical document. However, several misconceptions surround its usage and legal standing. Here’s a look at some of the most common misunderstandings.

All promissory notes are the same. This is a common misconception. Various types of promissory notes exist, such as secured, unsecured, demand, and installment notes, each serving different purposes and consisting of specific terms and conditions tailored to the agreement between the parties involved.

Promissory notes are legally binding, even without a witness or notarization. While it’s true that promissory notes are legal documents, the requirement for a witness or notarization depends on state laws. In some states, having the note witnessed or notarized can add an extra layer of legal protection.

Promissory notes are only for personal loans between family and friends. This is not accurate. Promissory notes can be utilized for a wide range of lending scenarios, including business loans, mortgages, and car loans, beyond just personal borrowings.

If the borrower does not pay, there's nothing much one can do. On the contrary, if a borrower fails to make payments as outlined in the promissory note, the lender has the right to pursue legal action to enforce the agreement and seek repayment, which may include taking possession of collateral if the note is secured.

A verbal agreement is as good as a written promissory note. While verbal agreements may be enforceable under certain conditions, a written promissory note is far more straightforward to enforce legally. It clearly outlines the details of the loan, including repayment terms, interest rate, and what happens if the borrower defaults.

There’s no need to report interest from a promissory note on taxes. Interest earned from a promissory note is taxable income and must be reported to the IRS. Failure to do so could result in penalties and interest on the unpaid tax.

You can’t modify a promissory note once it’s signed. Adjustments can be made to a promissory note if both the lender and borrower agree to the changes. Any modifications should be documented in writing and signed by both parties to maintain the note's enforceability.

Understanding the intricacies of promissory notes can demystify their use and ensure that you are better prepared to navigate financial agreements accurately and effectively.

Key takeaways

A promissory note is a formal financial document that outlines an agreement for one party to pay a specific sum of money to another party under defined conditions. Understanding the key aspects of filling out and using a promissory note form is essential for ensuring that the obligations and rights of all parties involved are clearly defined and legally enforceable. Here are several critical takeaways to consider:

- Accurate Information: Ensure that all personal information, including names, addresses, and identification numbers of both the borrower and the lender, are accurately documented to prevent any disputes or legal complications.

- Loan Details: Clearly specify the loan amount, interest rate (if applicable), and the method used to calculate the interest to avoid any ambiguity regarding the financial obligations.

- Repayment Schedule: Detail the repayment plan, including the frequency of payments (e.g., monthly, quarterly), the amount of each payment, and the due date for the final payment. This clarifies the expectations for both parties and aids in financial planning.

- Collateral: If the loan is secured, describe the collateral that will guarantee the loan. It's important to be precise about which assets are being pledged and the conditions under which they can be seized in case of default.

- Default Terms: Define what constitutes a default on the loan, the notification process for a default, and any grace period that the borrower may have to rectify the situation before further action is taken.

- Legal Jurisdiction: Specify the state laws under which the promissory note will be governed. This is crucial in determining how disputes will be resolved should they arise.

- Signature: Both parties must sign the promissory note for it to be considered valid and enforceable. In some cases, it may also be beneficial to have the signatures notarized to confirm the identity of the signatories.

- Record Keeping: Both the borrower and the lender should keep a copy of the signed promissory note. This ensures that both parties have access to the agreed-upon terms for reference or if proof of the agreement is needed in the future.

By thoughtfully preparing and executing a promissory note, both lenders and borrowers can protect their interests and establish a clear, structured, and enforceable financial agreement.

Other Templates:

Intent to Purchase Letter - An engaging agreement that presents a buyer's proposition to a seller, specifying the products, terms, and price points under consideration for sale.

Basic Short Rental Agreement - Landlords may require this form to be signed to ensure that tenants understand and agree to the conditions under which they are renting the property.

Real Estate Termination Agreement - Designed to clear all obligations and allow parties to part ways without completing the real estate transaction.