Free Prenuptial Agreement Form for New York

Entering into marriage is not only a declaration of love but also a legal agreement that intertwines the lives of two people in profound ways. In the state of New York, couples who are looking forward to tying the knot have the option to prepare for the financial aspects of their marriage with the aid of a prenuptial agreement form. This document, commonly known as a "prenup," allows individuals to outline their financial rights and responsibilities during the marriage and determine how assets will be distributed should the marriage end in divorce or death. Designed to provide clarity and protect personal and joint assets, prenuptial agreements in New York must adhere to specific legal requirements to be considered valid and enforceable. From defining separate property to detailing alimony provisions, this form covers a range of financial considerations. It not only offers a layer of financial security and transparency for both parties but also seeks to minimize potential disputes by clearly setting expectations and agreements in advance. As such, understanding its intricacies is crucial for couples who wish to ensure their prenuptial agreement fully reflects their wishes and complies with New York law.

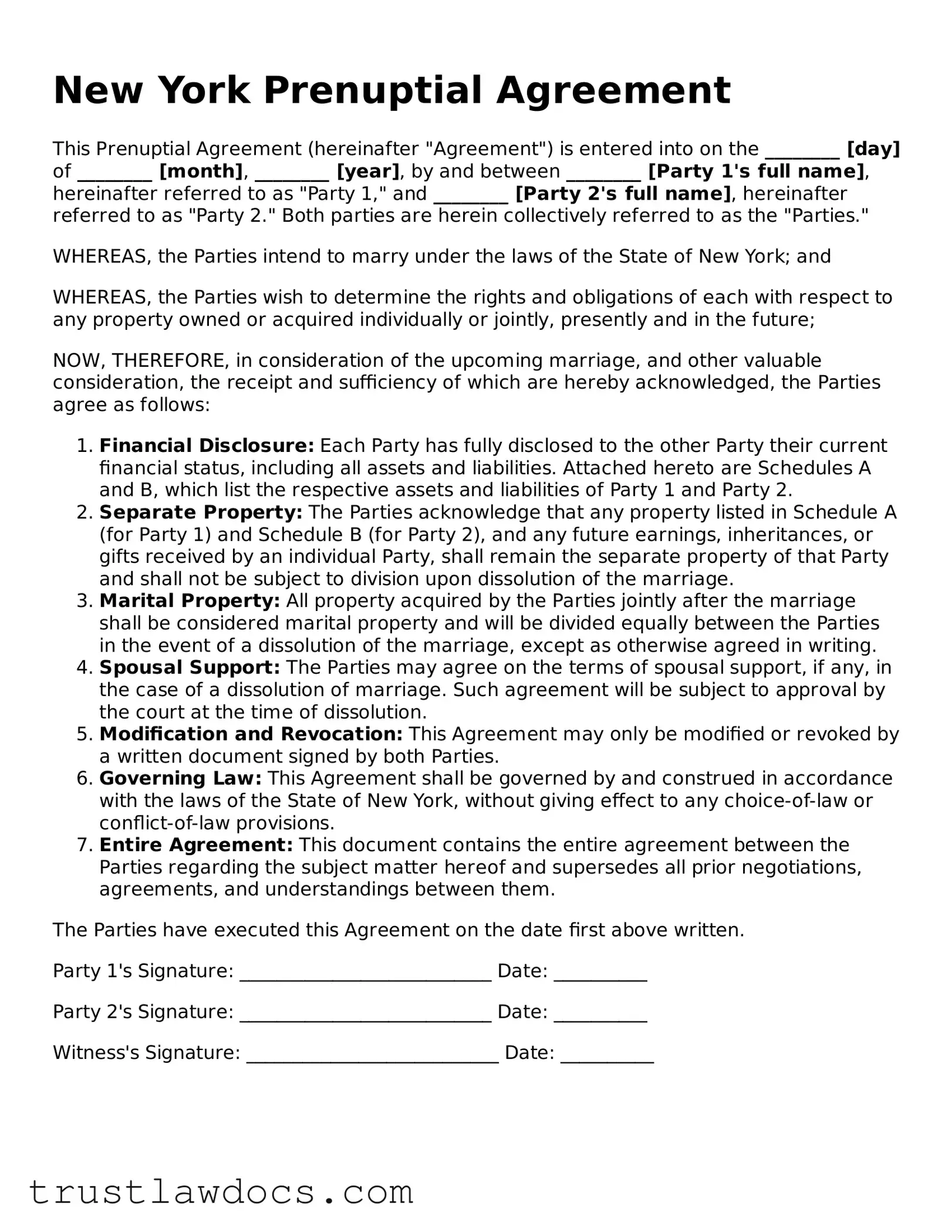

Form Example

New York Prenuptial Agreement

This Prenuptial Agreement (hereinafter "Agreement") is entered into on the ________ [day] of ________ [month], ________ [year], by and between ________ [Party 1's full name], hereinafter referred to as "Party 1," and ________ [Party 2's full name], hereinafter referred to as "Party 2." Both parties are herein collectively referred to as the "Parties."

WHEREAS, the Parties intend to marry under the laws of the State of New York; and

WHEREAS, the Parties wish to determine the rights and obligations of each with respect to any property owned or acquired individually or jointly, presently and in the future;

NOW, THEREFORE, in consideration of the upcoming marriage, and other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

- Financial Disclosure: Each Party has fully disclosed to the other Party their current financial status, including all assets and liabilities. Attached hereto are Schedules A and B, which list the respective assets and liabilities of Party 1 and Party 2.

- Separate Property: The Parties acknowledge that any property listed in Schedule A (for Party 1) and Schedule B (for Party 2), and any future earnings, inheritances, or gifts received by an individual Party, shall remain the separate property of that Party and shall not be subject to division upon dissolution of the marriage.

- Marital Property: All property acquired by the Parties jointly after the marriage shall be considered marital property and will be divided equally between the Parties in the event of a dissolution of the marriage, except as otherwise agreed in writing.

- Spousal Support: The Parties may agree on the terms of spousal support, if any, in the case of a dissolution of marriage. Such agreement will be subject to approval by the court at the time of dissolution.

- Modification and Revocation: This Agreement may only be modified or revoked by a written document signed by both Parties.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of New York, without giving effect to any choice-of-law or conflict-of-law provisions.

- Entire Agreement: This document contains the entire agreement between the Parties regarding the subject matter hereof and supersedes all prior negotiations, agreements, and understandings between them.

The Parties have executed this Agreement on the date first above written.

Party 1's Signature: ___________________________ Date: __________

Party 2's Signature: ___________________________ Date: __________

Witness's Signature: ___________________________ Date: __________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | Defines financial rights and responsibilities during marriage and in the event of divorce or death. |

| Governing Law | New York Domestic Relations Law. |

| Enforceability | Must be written, signed by both parties, and acknowledged in the manner required to entitle a deed to be recorded. |

| Financial Disclosure | Requires full and fair disclosure of the assets and liabilities of both parties. |

| Amendment | Can be modified or revoked only by a written agreement signed by both parties. |

| Scope | Covers property division, spousal support, and inheritance, but cannot dictate child custody or support. |

| Consideration | The promise to marry is sufficient consideration for the agreement. |

| Legal Representation | It is highly recommended that each party has independent legal counsel. |

| Common Misconceptions | Often thought to only benefit the wealthier spouse, but can protect both parties. |

How to Write New York Prenuptial Agreement

Before you walk down the aisle, taking the time to create a prenuptial agreement can be a vital step in planning for your future together. This legal document allows both parties to outline how they wish to divide their assets and handle other financial matters in the event of a divorce. Although discussing a prenup might not seem romantic, it's a practical way to protect both individuals. Filling out the New York Prenuptial Agreement form is not complicated. Just follow the steps below to ensure that your agreement is properly completed and legally binding.

- Gather all necessary financial documents for both parties, such as tax returns, bank statements, and lists of assets and liabilities.

- Download the latest version of the New York Prenuptial Agreement form from a reliable legal forms website.

- Begin by filling in the full legal names of both parties entering into the agreement.

- Specify the marital property and how it will be divided. Marital property includes everything that either of you earns or acquires during your marriage.

- Clearly state any separate property that each individual will retain as their own. Separate property is anything you owned before your marriage or receive as a gift or inheritance during marriage.

- Decide and document how you will handle debt, both that which is brought into the marriage and any that may be incurred together.

- Consider whether you want to include provisions for spousal support in the event of a divorce or separation, and outline those terms.

- Review all sections carefully to ensure that all the information provided is accurate and reflects your agreement.

- Both parties must sign the document in the presence of a Notary Public to make it legally binding.

- Keep a copy of the signed agreement in a safe place, and consider filing a copy with your attorney or legal advisor.

Creating a prenuptial agreement can sometimes feel overwhelming, but it's an important step in protecting your future. Ensure that all communications and decisions are made jointly and that you fully understand every aspect of the agreement before signing. If necessary, consult with a legal professional to guide you through the process and provide advice tailored to your specific situation.

Get Answers on New York Prenuptial Agreement

What is a prenuptial agreement in New York?

A prenuptial agreement in New York is a legal document created by two individuals who plan to marry. It outlines how assets and financial issues will be handled during the marriage and in the event of a divorce, separation, or the death of either spouse. This agreement aims to provide clarity and protect each party's interests.

Who should consider getting a prenuptial agreement?

Anyone entering a marriage who wishes to define the handling of their financial matters and assets should consider a prenuptial agreement. Particularly, individuals with significant assets, business owners, those with children from previous relationships, or anyone concerned about the impact of marriage on their finances may find it beneficial.

Is a prenuptial agreement legally enforceable in New York?

Yes, a prenuptial agreement is legally enforceable in New York, providing it meets all legal requirements. These include full disclosure of assets, separate legal representation for each party, and assurance that the agreement was entered into voluntarily without duress. It must also be in writing and signed by both parties.

Can a prenuptial agreement cover child support and custody in New York?

No, a prenuptial agreement cannot determine child support or custody issues in New York. These matters are decided by the court based on the child's best interests at the time of the divorce or separation, not pre-determined in a prenuptial agreement.

How can I ensure my prenuptial agreement is valid in New York?

To ensure a prenuptial agreement is valid in New York, both parties should fully disclose their assets and liabilities, seek independent legal advice to understand their rights and obligations, and ensure the terms are fair and reasonable. The agreement must be in writing, signed voluntarily, and notarized.

What happens if we don't follow the prenuptial agreement during the marriage?

If the terms of a prenuptial agreement are not followed during the marriage, it may lead to disputes or legal challenges during a divorce or separation. It's important for both parties to adhere to the agreement or formally amend it if changes are needed.

Can we modify our prenuptial agreement after getting married?

Yes, couples can modify their prenuptial agreement after marriage through a postnuptial agreement. This requires the same level of formalities as the original agreement, including full disclosure, voluntary signing, and notarization. Both parties must agree to the changes for them to be valid.

Are there any circumstances under which a prenuptial agreement would be invalidated in New York?

A prenuptial agreement may be invalidated in New York if it was signed under duress, fraud, or coercion, if there was a lack of full disclosure of assets, if one party did not have independent legal representation, or if the terms are deemed unconscionable or unfair at the time of enforcement.

What steps should I take if I want to get a prenuptial agreement in New York?

To get a prenuptial agreement in New York, start by discussing the terms with your partner. Consult with an independent attorney to understand your rights and draft the agreement. Ensure full financial disclosure, review the agreement carefully, and then both parties should sign the document in the presence of a notary. Keeping clear, open communication and legal guidance throughout the process is key to creating an effective prenuptial agreement.

Common mistakes

When couples decide to sign a New York Prenuptial Agreement, they often embark on the process with the best intentions but can easily make mistakes due to misunderstanding or misinterpreting the required information. A common error is not fully disclosing all assets and liabilities. Full transparency is crucial in these agreements, as any omission could lead to the agreement being challenged or invalidated in the future. This mistake not only threatens the legal standing of the document but can also damage the trust between partners.

Another frequent mistake involves not giving enough consideration to future changes. Many couples enter into these agreements without accounting for potential changes in finances, inheritance, or even the possibility of children. Without provisions that acknowledge these possible changes, the agreement may become unfair or irrelevant, leading to disputes or the need for costly modifications down the line. It's essential to approach a prenuptial agreement with a long-term perspective, considering how different scenarios might impact its fairness and enforceability.

Failure to obtain independent legal advice is yet another misstep. Some couples opt to use the same lawyer for the sake of convenience or to save on expenses. However, this can lead to a conflict of interest and may result in an agreement that favors one party over the other. Each partner should have their own attorney who can review the agreement and advocate for their client's best interests. This ensures that both parties fully understand the terms and implications of the agreement.

Finally, rushing through the process can be detrimental. Prenuptial agreements are complex legal documents that require careful thought and negotiation. Rushing to sign an agreement without proper review or consideration can lead to mistakes, oversights, and a lack of clarity about what the agreement entails. Taking the time to thoroughly discuss and negotiate terms, and then allowing each party adequate time to review the agreement with their attorney, can prevent misunderstandings and ensure that the agreement accurately reflects the wishes of both individuals.

Documents used along the form

When entering into a prenuptial agreement in New York, it's not uncommon for couples to encounter various other forms and documents that complement or are necessary for the process. A prenuptial agreement, designed to establish terms for division of assets and financial arrangements in the event of a divorce or death, is just the cornerstone of a comprehensive legal framework that couples might need to consider. Alongside it, several other documents often come into play to ensure that all financial and personal aspects are thoroughly covered and legally binding.

- Financial Disclosure Statements: These are detailed forms where each party discloses their individual assets, liabilities, income, and expenses. Completeness and accuracy in these statements are crucial for the fairness and enforceability of the prenuptial agreement.

- Will or Testament: Often, couples will update or create new wills to reflect the agreements and wishes laid out in the prenuptial agreement, ensuring consistency in the handling of estates and assets after death.

- Life Insurance Policies: Documents regarding life insurance policies may be reviewed or updated to align with the terms of the prenuptial agreement, particularly concerning beneficiary designations.

- Real Estate Deeds: For couples who own property together or separately, deeds and other real estate documents might need to be updated to reflect the ownership terms agreed upon in the prenuptial agreement.

- Postnuptial Agreement: Sometimes, after marrying, couples decide to make adjustments to their original prenuptial arrangement. A postnuptial agreement allows these changes to be documented and enforceable.

- Separation Agreement: In cases where couples decide to separate but not divorce, a separation agreement outlines the terms of this separation, potentially following some guidelines previously set in the prenuptial agreement.

- Business Ownership Documents: If one or both parties own a business, relevant documents may need to be reviewed or amended to reflect any prenuptial agreements related to business assets and operations.

- Debt Responsibility Agreements: Couples might choose to outline responsibilities for any joint or individual debts incurred before or during the marriage, clarifying this aspect within the broader financial planning.

- Amendments to the Prenuptial Agreement: Over time, amendments might be made to the original prenuptial agreement to reflect changes in circumstances, assets, or preferences. These amendments should be carefully documented and attached to the original agreement.

In conclusion, while the prenuptial agreement serves as a foundational document for couples looking to clarify the financial aspects of their marriage, the supporting documents listed above play a critical role in fleshing out the details and ensuring that all angles are covered. Each of these documents interacts with the prenuptial agreement in a way that solidifies the couple's intentions and agreements, providing a comprehensive legal framework that can protect both parties' interests throughout their marriage and possibly after. It's advised to consult with legal professionals to ensure all documents are properly prepared and executed.

Similar forms

A Postnuptial Agreement is closely related to a Prenuptial Agreement, serving a very similar purpose but executed after a couple marries rather than before. Both documents allow the couple to outline how their assets, debts, and finances would be handled during the marriage or in the event of a divorce. The primary difference lies in the timing of when these agreements are signed, yet they both seek to provide clarity and security for financial matters within a marriage.

A Cohabitation Agreement is another document similar to a Prenuptial Agreement, designed for couples who live together without getting married. Like a Prenuptial Agreement, it helps partners manage their financial responsibilities and the division of property should the relationship end. This document shows that while the legal recognition of the relationship may differ, the need to establish clear financial guidelines remains consistent between married and unmarried couples.

An Estate Plan or Will shares similarities with a Prenuptial Agreement in terms of managing and distributing one's assets. Both documents specify how assets should be handled, but they do so in different contexts. A Prenuptial Agreement focuses on the division of property in the event of a divorce or sometimes death, while an Estate Plan or Will addresses asset distribution upon an individual's death to their heirs or beneficiaries. This highlights the proactive steps individuals take to manage their assets in various personal and legal scenarios.

A Separation Agreement is akin to a Prenuptial Agreement in its purpose of detailing the division of assets and debts upon a dissolution of the relationship. However, a Separation Agreement is enacted when a couple decides to live apart without officially divorcing, serving as a legal arrangement for this transition period. This demonstrates that even in stages of potential reconciliation or indefinite separation, there is a need for clear financial and property arrangements.

Lastly, a Business Partnership Agreement can be paralleled with a Prenuptial Agreement, as both establish the division of assets, responsibilities, and procedures for resolving disputes. While one pertains to marriage and the other to business partnerships, each agreement functions to prevent conflicts and ensure a fair and agreed-upon procedure for any separations or dissolutions. This similarity underlines the importance of clear, legally binding agreements in any form of partnership, whether personal or professional.

Dos and Don'ts

When filling out the New York Prenuptial Agreement form, it's important to follow these guidelines to ensure the process goes smoothly and the document is valid and legally binding. Here are things you should and shouldn't do:

- Do:

- Review all sections of the form carefully to understand what information and decisions are required.

- Discuss the terms openly and honestly with your partner to ensure mutual understanding and agreement.

- Clearly list all assets, liabilities, and property each party owns, whether jointly or separately.

- Consider hiring legal counsel to ensure the agreement meets all legal requirements and fully protects your interests.

- Ensure that both parties sign the agreement in the presence of a notary to validate the signatures.

- Don't:

- Sign the agreement without fully understanding every term and condition it contains.

- Rush through the process. Take your time to consider all aspects of the agreement.

- Use vague or ambiguous language that could lead to misinterpretation or disputes in the future.

- Forget to update the agreement as circumstances change, such as acquiring new assets or changes in financial status.

Misconceptions

When couples are planning to marry, the subject of a prenuptial agreement can sometimes be a delicate matter. In New York, as in many places, there are several misconceptions surrounding prenuptial agreements that can cause unnecessary concern or confusion. Understanding these common misunderstandings can help partners approach the topic with a clearer perspective.

Only wealthy people need a prenuptial agreement. This misconception overlooks the fact that a prenuptial agreement can protect both parties, regardless of their current financial status. It can safeguard future earnings, inheritance, and assets acquired during the marriage, making it a practical consideration for many couples, not just those with substantial pre-marital assets.

A prenuptial agreement means you don’t trust each other. Trust is an essential component of any relationship, but so is practicality. A prenuptial agreement is more about preparing for all of life’s possibilities and protecting both parties rather than a sign of distrust. In many cases, discussing financial expectations and arrangements openly can strengthen trust between partners.

Prenuptial agreements are only about dividing assets. While the division of assets is a significant aspect of prenuptial agreements, they can also cover a wide range of concerns including debt liability, spousal support, and inheritance rights. This makes them a valuable planning tool beyond simply determining who gets what.

If we divorce, a prenuptial agreement is all we need. While prenuptial agreements can significantly streamline the divorce process by predetermining many financial outcomes, they are not a comprehensive solution. Issues around child custody and support, for example, cannot be predetermined in a prenuptial agreement and will need resolution at the time of divorce.

You can wait until just before the wedding to create a prenuptial agreement. While you technically can wait, this isn’t advisable. For a prenuptial agreement to be considered fair and enforceable, both parties need ample time to consider the agreement’s terms and seek independent legal advice. Last-minute agreements are more susceptible to challenges based on duress or lack of informed consent.

You don’t need separate lawyers. It's crucial for each party to have their own attorney when creating a prenuptial agreement. This ensures that both individuals fully understand the terms and that their interests are independently represented, reducing the chance of coercion and increasing the enforceability of the agreement.

My spouse’s debts are mine, regardless of a prenuptial agreement. A properly drafted prenuptial agreement can include provisions that protect one spouse from the other’s pre-existing debts or debts incurred individually during the marriage. This is particularly important in New York, a state that can otherwise see debts acquired during marriage as shared marital liabilities.

A prenuptial agreement can include personal obligations. While prenuptial agreements can cover a wide range of financial and property issues, they cannot enforce personal behavior, conditions about child rearing, or intimate aspects of the marriage. Courts will not uphold conditions that are unreasonable or violate public policy.

Once signed, a prenuptial agreement cannot be changed. Circumstances change, and so can prenuptial agreements, as long as both parties agree to the modifications. Amendments must be made in writing and signed by both parties, similar to the original agreement process.

Couples considering a prenuptial agreement should approach the topic with open minds and clear communication. By dispelling these common misconceptions, partners can make informed decisions that protect their interests and help lay a strong foundation for their future together.

Key takeaways

When approaching the task of filling out and utilizing the New York Prenuptial Agreement form, individuals are navigating a vital document that serves to protect their financial interests and set clear expectations for the marriage. Here are key takeaways to consider:

Full Disclosure is Crucial: Each party must provide a complete and honest disclosure of their assets, liabilities, and income. This transparency is not only foundational for trust but is legally necessary for the agreement to be enforceable. Without full disclosure, there's a risk that the agreement could be invalidated in the future.

Seek Independent Legal Advice: It's essential for both parties to have separate legal counsel. This ensures that each person fully understands the terms of the agreement and its implications. Lawyers can also help navigate complex legal language, ensuring the agreement is drafted correctly and in accordance with New York law.

Understand Modification and Termination Terms: The prenuptial agreement should clearly outline under what conditions it can be modified or terminated. Knowing these terms helps both parties understand how future changes in circumstances could affect the agreement.

Consider Future Changes in Circumstances: While it's impossible to predict everything the future holds, the agreement should account for potential changes in finances, such as inheritance, shifts in income, or the possibility of children. It's wise to include provisions that consider how these changes will be managed within the context of the marriage.

Properly completed and utilized, a New York Prenuptial Agreement can provide a strong foundation for marital financial planning. It encourages open communication about finances before marriage and helps ensure that both parties have a clear understanding of their rights and obligations.

Popular Prenuptial Agreement State Forms

Florida Prenup - As a preventive tool, it minimizes the likelihood of protracted legal battles over assets, making the dissolution process more manageable.

Michigan Prenup - It may further delineate the handling of potential future earnings and investments, clearly distinguishing between what is considered marital property and what remains individual.

Indiana Prenup - Assists in delineating responsibility for pre-marital debts, protecting the other spouse from financial liability.

Texas Prenup - Signing a prenuptial agreement form can provide peace of mind by ensuring both parties are entering the marriage with clear expectations.