Free Prenuptial Agreement Form for Indiana

The Indiana Prenuptial Agreement form is an essential tool for couples planning to marry in the state. It serves as a proactive measure, allowing individuals to outline the distribution of their assets, debts, and responsibilities, should their marriage come to an end through divorce or death. The significance of this agreement extends beyond the mere division of financial assets; it encompasses the protection of individual rights and the clarification of obligations, ensuring peace of mind for both parties involved. Furthermore, the form is designed to be compliant with Indiana's specific legal requirements, making its preparation a critical step in safeguarding couples' futures. By establishing clear financial boundaries and expectations before entering into marriage, couples can mitigate potential conflicts, fostering a stronger foundation for their partnership. This document not only reinforces the importance of financial planning and communication between partners but also reflects the practicality of preparing for various outcomes in a relationship.

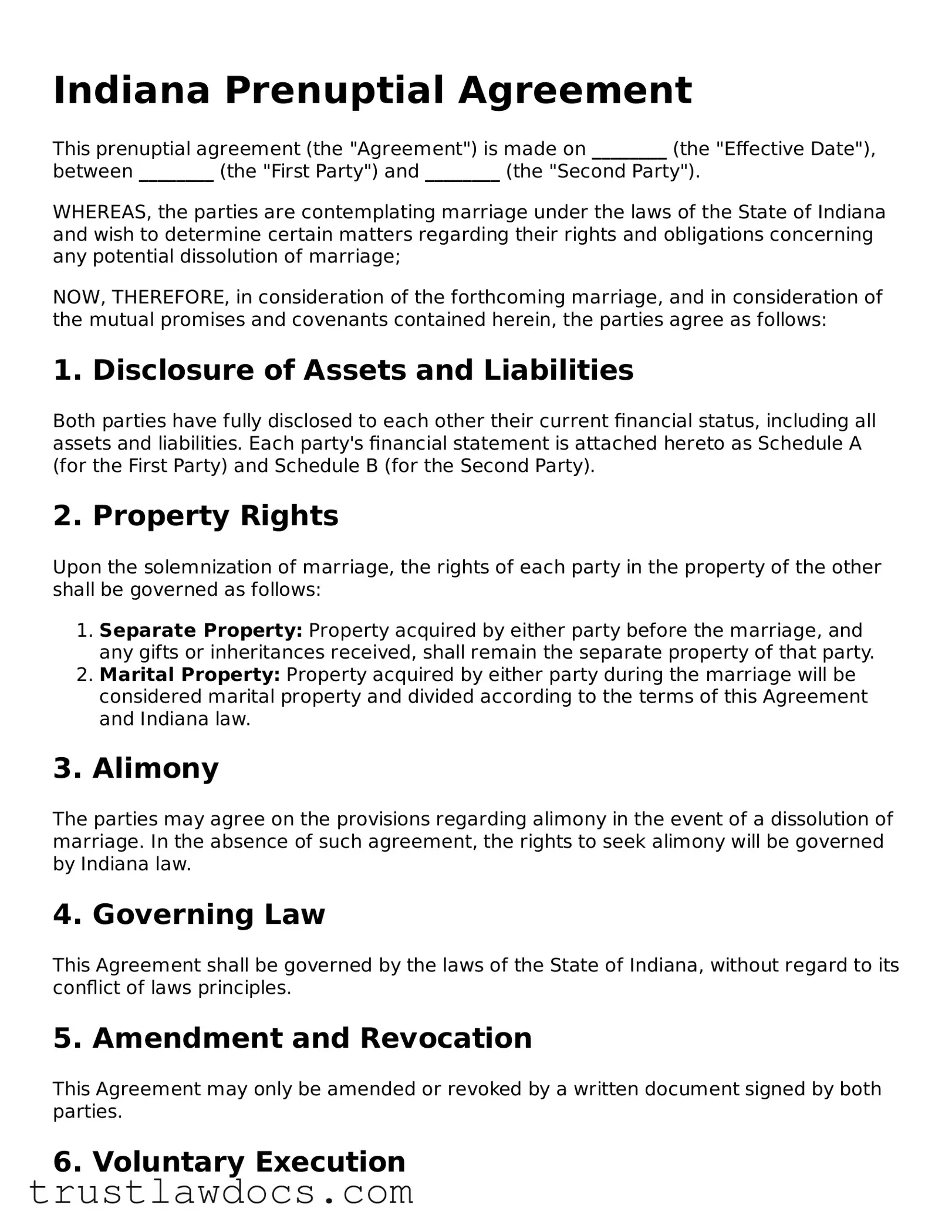

Form Example

Indiana Prenuptial Agreement

This prenuptial agreement (the "Agreement") is made on ________ (the "Effective Date"), between ________ (the "First Party") and ________ (the "Second Party").

WHEREAS, the parties are contemplating marriage under the laws of the State of Indiana and wish to determine certain matters regarding their rights and obligations concerning any potential dissolution of marriage;

NOW, THEREFORE, in consideration of the forthcoming marriage, and in consideration of the mutual promises and covenants contained herein, the parties agree as follows:

1. Disclosure of Assets and Liabilities

Both parties have fully disclosed to each other their current financial status, including all assets and liabilities. Each party's financial statement is attached hereto as Schedule A (for the First Party) and Schedule B (for the Second Party).

2. Property Rights

Upon the solemnization of marriage, the rights of each party in the property of the other shall be governed as follows:

- Separate Property: Property acquired by either party before the marriage, and any gifts or inheritances received, shall remain the separate property of that party.

- Marital Property: Property acquired by either party during the marriage will be considered marital property and divided according to the terms of this Agreement and Indiana law.

3. Alimony

The parties may agree on the provisions regarding alimony in the event of a dissolution of marriage. In the absence of such agreement, the rights to seek alimony will be governed by Indiana law.

4. Governing Law

This Agreement shall be governed by the laws of the State of Indiana, without regard to its conflict of laws principles.

5. Amendment and Revocation

This Agreement may only be amended or revoked by a written document signed by both parties.

6. Voluntary Execution

This Agreement is executed voluntarily by both parties, without any duress or undue influence. Each party acknowledges that they have had the opportunity to consult with an attorney of their choice before signing this Agreement.

Signature

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the Effective Date first above written.

First Party Signature: _________________________ Date: ________

Second Party Signature: _________________________ Date: ________

Notary Public: _________________________

My Commission Expires: _________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Governing Law | Indiana prenuptial agreements are governed by the Indiana Uniform Premarital Agreement Act (IUPAA). |

| Writing Requirement | For a prenuptial agreement to be enforceable in Indiana, it must be in writing and signed by both parties. |

| Enforceability | Prenuptial agreements in Indiana are enforceable if executed voluntarily and without coercion, and if parties fully disclose their assets. |

| Scope | The agreement can cover a variety of issues, including property division, spousal support, and inheritance rights, but cannot adversely affect child support obligations. |

How to Write Indiana Prenuptial Agreement

Filling out a prenuptial agreement in Indiana is an important step for couples looking to define the terms of their marriage, especially regarding financial matters and asset division if the marriage were to end. This document allows both parties to enter the union with clear expectations and peace of mind. The process doesn't have to be daunting. By following these steps, you can ensure that your agreement is thorough, legally binding, and reflective of both parties' wishes.

- Gather all necessary financial documents for both parties, including statements for bank accounts, retirement accounts, debts, and assets.

- Discuss and agree on the terms of the prenuptial agreement, such as how property and debts will be divided in the event of divorce or death of one of the parties.

- Download the Indiana Prenuptial Agreement form or obtain a copy from a legal form provider.

- Start by entering the full legal names of both parties who are entering the agreement.

- Detail all assets, liabilities, incomes, and expectations for property acquired during the marriage, including how they will be handled or divided.

- Include any provisions for spousal support or waiver thereof.

- If applicable, specify any agreements regarding wills, trusts, or inheritance plans to ensure they are in line with the prenuptial agreement.

- Both parties should carefully review the terms of the agreement to ensure it accurately reflects their understanding and intentions.

- Have the document reviewed by separate attorneys for each party to ensure that it is fair and in compliance with Indiana law. This step, while not mandatory, is highly recommended to protect the interests of both parties.

- Sign the document in front of a notary public to validate the agreement. Ensure both parties have valid identification at the time of notarization.

- Keep the signed agreement in a safe place, such as with a legal advisor or in a safe deposit box. Both parties should have a copy of the signed agreement.

After completing the above steps, you have successfully created a prenuptial agreement. This document lays a solid foundation for your marriage, providing clarity and protection for both parties involved. Remember, circumstances and laws can change, so consider reviewing your agreement periodically with legal counsel to ensure it continues to serve your mutual interests.

Get Answers on Indiana Prenuptial Agreement

What is a prenuptial agreement in Indiana?

In Indiana, a prenuptial agreement, also known as a premarital agreement, is a legal contract entered into by prospective spouses before marriage. This document outlines the ownership and management of certain financial aspects and assets, including property and debts, should the marriage eventually lead to divorce or address matters in the event of a spouse's death. It serves to protect individual assets and facilitate financial arrangements between parties, providing clarity and safeguarding personal and shared interests.

Who should consider getting a prenuptial agreement?

Individuals with significant assets, debts, or those entering a second marriage, should consider getting a prenuptial agreement. It's particularly advisable for those wishing to protect their financial stability, address inheritance matters for children from prior marriages, or clearly define financial responsibilities and rights. Essentially, anyone seeking to establish transparent financial expectations before marriage may benefit from a prenuptial agreement, fostering a sense of security and understanding between partners.

Are prenuptial agreements enforceable in Indiana?

Prenuptial agreements are enforceable in Indiana, provided they meet certain legal requirements. The agreement must be in writing, signed by both parties, and entered into voluntarily without any coercion, fraud, or undue influence. It should be entered into with full and fair disclosure of each party's financial situation, or there must be a waiver of that disclosure. Courts will closely scrutinize these agreements to ensure they were fair at the time of execution and are not unconscionable at the time of enforcement.

Can a prenuptial agreement include child support or custody arrangements in Indiana?

In Indiana, prenuptial agreements cannot dictate child support or custody arrangements. These matters are determined by the court based on the best interests of the child at the time of the divorce or separation. The court retains the discretion to modify child support and custody arrangements, despite any existing prenuptial agreements, to ensure that the child's needs and welfare are prioritized.

How can one create a valid prenuptial agreement in Indiana?

Creating a valid prenuptial agreement in Indiana involves several crucial steps. First, both parties should engage in a full and fair disclosure of their financial assets and liabilities. Seeking independent legal advice is highly recommended to ensure that each party fully understands the agreement's terms and its implications. The agreement must be in writing and signed by both parties, preferably well in advance of the wedding, to avoid any appearance of pressure or coercion. Additionally, it's advisable to have the signing witnessed or notarized to further substantiate the voluntary nature of the agreement. By meticulously adhering to these steps, individuals can fortify their financial future and enter into marriage with a clearer understanding of their financial arrangement.

Common mistakes

When filling out the Indiana Prenuptial Agreement form, a common mistake people make is not fully disclosing their assets and liabilities. This error can lead to misunderstandings or disputes in the event of a divorce, making the agreement void or subject to legal challenge. Complete transparency is crucial for a prenuptial agreement to be enforceable.

Another frequent oversight is failing to obtain independent legal advice before signing the agreement. Both parties should seek the counsel of separate attorneys to ensure their rights are protected, and they fully understand the terms and consequences of the agreement. This step not only ensures that both individuals are making informed decisions but also adds to the enforceability of the document.

Some individuals make the mistake of incorporating provisions about child support or custody. These matters cannot be predetermined in a prenuptial agreement in Indiana, as decisions regarding children must be based on their best interests at the time of the divorce or separation, not preemptively decided.

Timing is another factor often overlooked, with some leaving the signing of the prenuptial agreement until just before the wedding. This rush can lead to claims of coercion or undue pressure, especially if one party had significantly less time to consider the agreement. To prevent this, the agreement should be signed well in advance of the wedding date.

Additionally, not taking the agreement seriously is a pitfall for some. Treating a prenuptial agreement like a simple formality can result in a poorly drafted document that doesn’t accurately reflect the couple’s wishes or stand up in court. This document should be given the weight it deserves, considering its potential impact on both parties’ futures.

Using vague or ambiguous language is a key mistake that can render parts of the agreement difficult to enforce. It’s important to be as clear and specific as possible in outlining the terms to avoid interpretation issues later on. This clarity can prevent future disputes and legal battles over the agreement's meaning.

A considerable error is not updating the agreement to reflect significant changes in circumstances or the law. Prenuptial agreements should be reviewed periodically and possibly amended to ensure they remain fair and relevant to both parties’ current situations.

Finally, forgoing a witness or notarization is a critical oversight. While Indiana law may not expressly require these for a prenuptial agreement to be valid, having the agreement properly witnessed and notarized can add a layer of authenticity and reduce the likelihood of disputes over its validity in the future.

Documents used along the form

When preparing for marriage, couples in Indiana often consider a Prenuptial Agreement to help manage their financial future. This form is just one part of a suite of documents that can solidify personal and financial arrangements before entering into marriage. Along with a Prenuptial Agreement, there are several other forms and documents that can be equally important to ensure all aspects of a couple's life together are addressed comprehensively.

- Financial Disclosure Statements: These documents are essential for transparency between partners. Each party discloses their financial situation fully, including assets, liabilities, income, and expenses.

- Will and Testament: Creating or updating a will ensures that assets are distributed as desired in the event of one partner's death. This document can work in tandem with a prenuptial agreement to provide a comprehensive estate plan.

- Power of Attorney: This legal document allows one partner to make decisions on behalf of the other in specific situations, such as financial matters or health care decisions, if one becomes incapacitated.

- Living Will: Also known as an advance directive, this document outlines a person's wishes regarding medical treatment if they become unable to communicate those decisions themselves.

- Marriage License Application: Required to legally formalize the marriage in Indiana, the application must be filed with the county clerk's office before the ceremony.

- Property Deeds: If there is shared or individual property involved, it's vital to have proper documentation detailing the ownership and rights of each party.

- Postnuptial Agreement: Similar to a prenuptial agreement, this contract is executed after the couple has married, allowing them to make specific arrangements or changes that were not made prior to the marriage.

- Beneficiary Designations: For life insurance policies, retirement accounts, and other assets, it's crucial to designate beneficiaries to ensure that assets are distributed according to the couple’s wishes.

- Personal Property Memorandum: This document can accompany a will to specify how personal items are to be distributed, offering a more detailed approach to handling personal belongings.

While a Prenuptial Agreement forms the groundwork for financial planning before marriage, the additional documents listed above are integral in addressing all aspects of a couple's relationship and assets. By considering these forms, couples in Indiana can create a strong foundation for their marriage, ensuring clarity and comfort in their shared future.

Similar forms

The Indiana Prenuptial Agreement form shares similarities with a Postnuptial Agreement in that both documents establish the financial rights and obligations of each spouse in the event of a divorce. While a prenuptial agreement is executed before marriage, a postnuptial agreement is entered into after a couple has been married. Both agreements can include provisions for the division of property, debts, alimony, and inheritance, offering a clear financial understanding between spouses.

Similar to a Cohabitation Agreement, the Indiana Prenuptial Agreement form also outlines the financial matters between partners. However, a cohabitation agreement is designed for couples who live together without getting married. Both documents detail the handling of assets, debts, and financial responsibilities to avoid disputes, should the relationship end or undergo significant changes.

A Last Will and Testament parallels the Indiana Prenuptial Agreement form in terms of designating the distribution of assets upon one's death. While a prenuptial agreement focuses on the division of assets in the case of divorce, a will specifies asset distribution and other wishes upon death. Both documents serve as protective measures to ensure personal wishes are honored, either at the end of a marriage or life.

The Indiana Prenuptial Agreement form and a Revocable Living Trust share the common goal of asset protection and distribution, but differ in their focus and implementation. A Revocable Living Trust is an estate planning tool that allows individuals to manage their assets during their lifetime and outline distribution after death, avoiding probate. In contrast, a prenuptial agreement deals with the distribution of assets and obligations in the event of divorce or death, specifically within the context of marriage.

A Financial Power of Attorney is akin to the Indiana Prenuptial Agreement form in its allocation of financial responsibilities. This document grants an individual the authority to make financial decisions on another's behalf, typically in the event of incapacity. While a financial power of attorney operates during an individual’s lifetime under specified conditions, a prenuptial agreement sets forth financial terms and responsibilities between spouses, primarily taking effect upon divorce or death.

Similar to an Indiana Prenuptial Agreement, a Business Buy-Sell Agreement outlines the future handling of a business owner’s interest in the event of certain scenarios, such as divorce. Both documents prepare parties for a change in relationship status, detailing the division or transfer of assets to prevent future disputes and ensure smooth transitions.

A Property Agreement, much like the Indiana Prenuptial Agreement, deals with the rights over and responsibilities towards property. In the case of a Property Agreement, it typically governs the specifics of property ownership and management between non-married parties. Both agreements protect individual interests, clarify financial matters, and aim to mitigate potential conflicts over assets.

The Indiana Prenuptial Agreement aligns with a Separation Agreement in its handling of martial breakdown situations. A Separation Agreement is used when a married couple decides to live apart, outlining the division of assets, debts, and other matrimonial obligations, similar to provisions in a prenuptial agreement. Both serve to establish clear financial and personal boundaries, providing a roadmap for navigating the dissolution of a relationship.

Likewise, the Indiana Prenuptial Agreement form resembles a Debt Settlement Agreement to some extent. A Debt Settlement Agreement is negotiated between a debtor and creditor to agree on a reduced balance that is considered payment in full. While this agreement focuses on resolving outstanding debts, a prenuptial agreement can include terms for handling debts during marital separation, emphasizing financial clarity and responsibility among parties.

A Medical Power of Attorney, similar to the financial aspects of the Indiana Prenuptial Agreement, involves designating someone to make decisions on another’s behalf; in this case, regarding health care. This document comes into play when an individual becomes incapacitated and unable to make medical decisions. Both documents underscore the importance of preparing for unforeseen circumstances, highlighting proactive measures taken to protect personal interests and ensure decision-making aligns with individual wishes.

Dos and Don'ts

Understanding the steps to properly fill out an Indiana Prenuptial Agreement form can guide couples in making informed decisions about their financial agreement before marriage. Here are essential dos and don'ts in completing this legal document:

- Do ensure that both parties receive complete financial disclosures from each other. Transparency about assets, liabilities, income, and expenses is crucial for a binding agreement.

- Don't rush the process. Both parties should have ample time to review, understand, and consider the agreement's terms without pressure. A hasty decision can lead to regret or invalidation of the agreement.

- Do seek independent legal advice. Each party should enlist their own attorney to ensure their interests are adequately represented and to provide legal clarity on the agreement's provisions.

- Don't hide any assets or liabilities. Full disclosure is not only ethically mandatory but legally required for the agreement to be enforceable.

- Do ensure the agreement is in writing. Verbal agreements are not considered valid in the context of prenuptial agreements in Indiana.

- Don't include anything illegal or unfair. Provisions that violate the law or create a significant imbalance between parties can render the entire agreement invalid.

- Do make the agreement official with signatures. Both parties must sign the document for it to be legally binding. It's also wise to have witnesses or a notary public authenticate the signatures.

- Don't forget to review state laws. Prenuptial agreements are subject to state regulations, and it's crucial to understand how Indiana law affects the document's terms and enforceability.

- Do consider future changes. Life circumstances change, and it's prudent to include terms for amending or revoking the agreement within the document itself.

Misconceptions

When it comes to prenuptial agreements in Indiana, several misconceptions often cloud people's understanding of their purpose and implications. These legal documents can be crucial for both parties entering marriage, especially in terms of financial planning and asset protection. Here are four common misconceptions about Indiana Prenuptial Agreement forms:

- Prenuptial agreements are only for the wealthy. A common misconception is that prenuptial agreements are exclusively for those with substantial assets. In reality, these agreements benefit anyone who wishes to clearly define financial rights and responsibilities in a marriage, protect individual assets, or manage debt. They serve as a preventive measure to simplify financial matters should the marriage end.

- Signing a prenuptial means you expect the marriage to fail. This assumption couldn't be further from the truth. Much like insurance, a prenuptial agreement provides security and protection without the expectation of a negative outcome. It allows couples to enter into marriage with clarity about their financial future, which can actually strengthen the relationship.

- The terms of a prenuptial agreement are set in stone. Many believe that once a prenuptial agreement is signed, it cannot be altered. However, couples can update or modify their agreement as their relationship and financial situations evolve. Modifications must be agreed upon by both parties and legally documented to be effective.

- Prenuptial agreements cover child support and custody. This is a common misconception. In Indiana, prenuptial agreements cannot legally dictate child support or custody arrangements. The courts always retain the authority to make decisions based on the best interest of the children involved. Prenuptial agreements primarily focus on financial matters and property division between the spouses.

Understanding these misconceptions can help individuals and couples in Indiana approach prenuptial agreements with a clearer perspective, recognizing them as valuable tools for financial planning and protection in marriage.

Key takeaways

Filling out and using the Indiana Prenuptial Agreement form is a significant step for couples preparing for marriage. It is important to understand the key elements that ensure the process is smooth and the agreement is enforceable. Here are several takeaways to guide you through filling out and using this prenuptial agreement form.

- Understand the Purpose: First, recognize that a prenuptial agreement is designed to protect assets and define financial rights before entering into marriage. This document can safeguard individual assets, clarify financial responsibilities, and streamline financial matters in the event of divorce or death.

- Full Disclosure: Both parties must fully disclose their financial situations. This includes assets, debts, income, and potential inheritances. The validity of the agreement depends on honesty and transparency from both individuals.

- Seek Independent Legal Advice: Each party should obtain independent legal advice. Having separate attorneys ensures that each person's interests are adequately represented and understood, contributing to a fair and enforceable agreement.

- Consider Future Changes: Life brings changes, such as children, significant changes in wealth, or shifts in career paths. The agreement should include provisions on how to handle such changes, or at least a mechanism for amending the agreement in the future.

- Understand Indiana Law: Indiana law governs prenuptial agreements in the state. Familiarize yourself with local laws to ensure your agreement is drafted in compliance and addresses specific state requirements for enforceability.

- Notarization is Crucial: For a prenuptial agreement to be legally binding in Indiana, it must be notarized. Ensure that both parties sign the document in front of a notary public.

- Timing Matters: Avoid presenting or signing the prenuptial agreement too close to the wedding date. This could lead to claims of duress if the marriage does not work out. Ideally, complete this agreement well in advance of your wedding.

- Keep Copies Secure: After the agreement is signed and notarized, both parties should keep a copy in a secure place. It's also wise to have digital backups stored securely.

- Validity Check Post Marriage: It is advisable to periodically review the agreement after marriage, especially when major financial changes occur. This ensures that the agreement remains valid and reflective of the current situation.

By keeping these points in mind, couples can create a comprehensive and enforceable Indiana Prenuptial Agreement that protects both parties' interests. Remember, the goal of this agreement is not to anticipate the end of a relationship but to build a strong foundation for financial clarity and security.

Popular Prenuptial Agreement State Forms

California Prenup - Supports the management of personal and joint financial ventures, delineating the course for future financial endeavors.

Texas Prenup - It allows for flexible arrangements, accommodating changes in the couple’s financial situation over the course of the marriage.