Free Prenuptial Agreement Form for Florida

Before walking down the aisle, many couples in Florida consider taking a crucial step to ensure their financial affairs and assets are clearly defined and protected, should future circumstances change. This is where the Florida Prenuptial Agreement form comes into play. A document both practical and essential, it allows both parties to openly communicate their financial expectations and agreements prior to marriage, covering a wide range of topics from asset division, debt liability, to alimony and inheritances. By setting these terms in advance, couples can avoid potential conflicts or misunderstandings that might arise during marriage or, unfortunately, in the event of a divorce. The form is tailored to comply with Florida law, requiring full financial disclosure from both parties and fairness in agreement. Its growing popularity speaks to its effectiveness in building a foundation of transparency and mutual respect in a relationship, making it a cornerstone for couples looking to enter into marriage with clear, agreed-upon terms from the start.

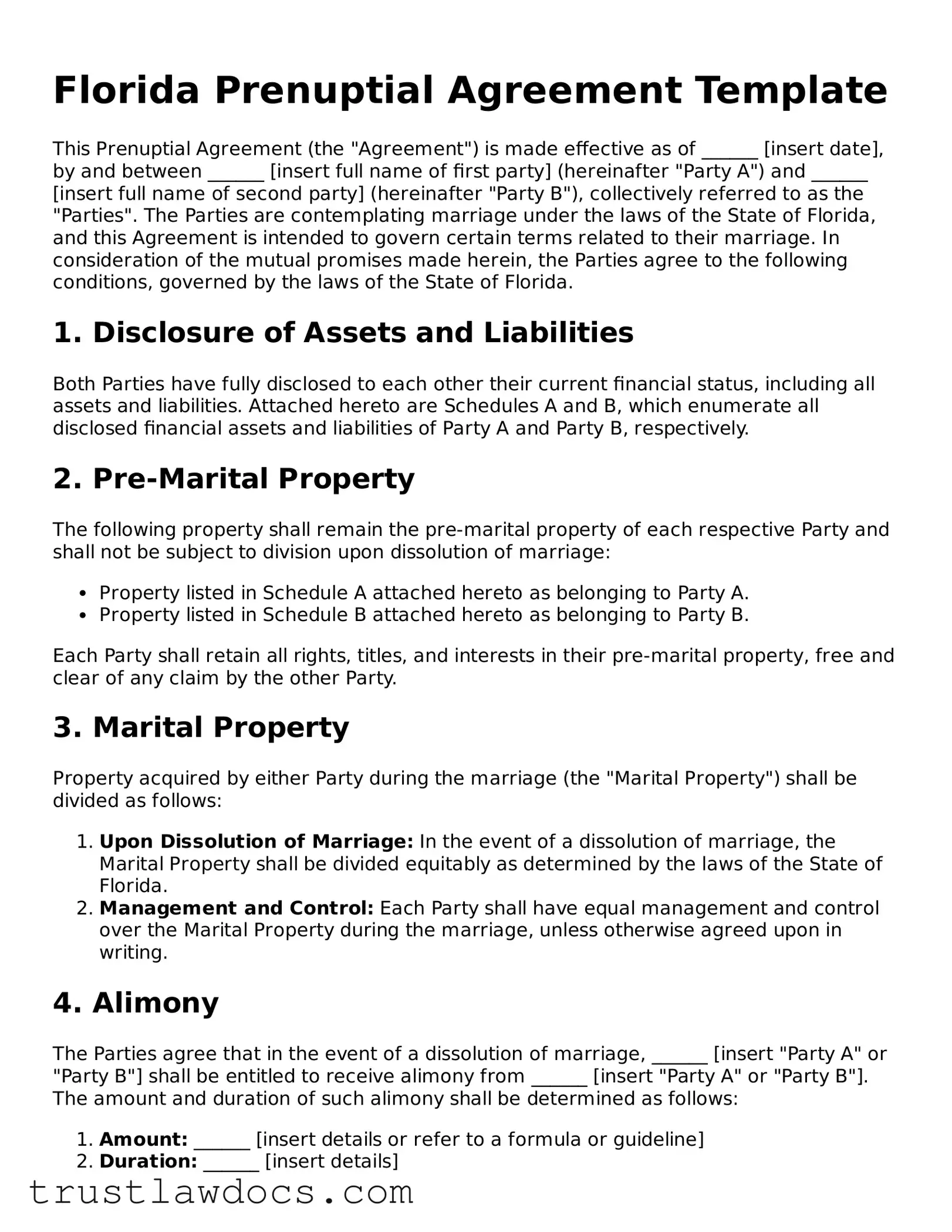

Form Example

Florida Prenuptial Agreement Template

This Prenuptial Agreement (the "Agreement") is made effective as of ______ [insert date], by and between ______ [insert full name of first party] (hereinafter "Party A") and ______ [insert full name of second party] (hereinafter "Party B"), collectively referred to as the "Parties". The Parties are contemplating marriage under the laws of the State of Florida, and this Agreement is intended to govern certain terms related to their marriage. In consideration of the mutual promises made herein, the Parties agree to the following conditions, governed by the laws of the State of Florida.

1. Disclosure of Assets and Liabilities

Both Parties have fully disclosed to each other their current financial status, including all assets and liabilities. Attached hereto are Schedules A and B, which enumerate all disclosed financial assets and liabilities of Party A and Party B, respectively.

2. Pre-Marital Property

The following property shall remain the pre-marital property of each respective Party and shall not be subject to division upon dissolution of marriage:

- Property listed in Schedule A attached hereto as belonging to Party A.

- Property listed in Schedule B attached hereto as belonging to Party B.

Each Party shall retain all rights, titles, and interests in their pre-marital property, free and clear of any claim by the other Party.

3. Marital Property

Property acquired by either Party during the marriage (the "Marital Property") shall be divided as follows:

- Upon Dissolution of Marriage: In the event of a dissolution of marriage, the Marital Property shall be divided equitably as determined by the laws of the State of Florida.

- Management and Control: Each Party shall have equal management and control over the Marital Property during the marriage, unless otherwise agreed upon in writing.

4. Alimony

The Parties agree that in the event of a dissolution of marriage, ______ [insert "Party A" or "Party B"] shall be entitled to receive alimony from ______ [insert "Party A" or "Party B"]. The amount and duration of such alimony shall be determined as follows:

- Amount: ______ [insert details or refer to a formula or guideline]

- Duration: ______ [insert details]

Alternatively:

Both Parties waive any and all rights to alimony from each other under the laws of the State of Florida.

5. Severability

If any provision of this Agreement is found to be invalid or unenforceable, the remaining provisions shall continue to be fully effective.

6. Governing Law

This Agreement shall be governed by the laws of the State of Florida, without regard to its conflict of law principles.

7. Modification and Waiver

No modification of this Agreement shall be effective unless in writing and signed by both Parties. The waiver of any breach of any provision shall not be construed as a waiver of any subsequent breach or the waiver of the provision itself.

8. Acknowledgment

Each Party acknowledges that they have had sufficient time to review the Agreement, the opportunity to consult with legal counsel of their own choosing, and that they fully understand and voluntarily enter into this Agreement.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

_____________________________ _____________________________

Signature of Party A Signature of Party B

_____________________________ _____________________________

Printed Name of Party A Printed Name of Party B

Date: ______ [insert date]

PDF Form Details

| Fact Name | Description |

|---|---|

| Governing Law | Florida prenuptial agreements are governed by the Florida Uniform Premarital Agreement Act (FUPAA), found in Chapter 61 of the Florida Statutes. |

| Form Requirements | The agreement must be in writing and signed by both parties. It is enforceable without consideration other than the marriage itself. |

| Content Scope | These agreements can include provisions for property division, spousal support, and the right to manage and control property, among other financial matters. However, matters concerning child support or custody are not governed by prenuptial agreements. |

| Amendment or Revocation | Amendment or revocation of the agreement must be done in writing and require the consent of both parties. |

| Enforcement | An agreement may not be enforceable if it was signed under duress, if it was unconscionable when executed, or if there was not fair and reasonable disclosure of the other party's financial obligations and assets. |

How to Write Florida Prenuptial Agreement

In the state of Florida, couples planning to marry might consider creating a prenuptial agreement. This legal document, often known simply as a "prenup," outlines the management of financial affairs and division of assets should the marriage come to an end, either by divorce or death. Careful preparation and understanding of this agreement are essential to ensure that it reflects the true intentions of both parties and stands up in court if ever needed. The following steps provide guidance on how to fill out a Florida Prenuptial Agreement form meticulously.

- Gather all necessary financial documents for both parties, including bank statements, investment records, property deeds, and any other assets or liabilities. This ensures accuracy in disclosure.

- Download the Florida Prenuptial Agreement form from a reliable source, ensuring it complies with the laws of the state of Florida.

- Read the entire form carefully to understand the scope and implications of the agreements being made.

- Fill in the full legal names of both parties entering the prenuptial agreement in the designated spots on the form. Make sure these are the names as they appear on official state identification to avoid any confusion or disputes later on.

- Clearly outline the terms regarding division of property, detailing what will remain separate property and what will be considered marital property, including any future earnings or purchases.

- Discuss and document any arrangements regarding spousal support, including conditions under which it might be awarded, the amount, and the duration.

- Include a comprehensive list of all financial assets and liabilities of both parties as attachments if needed. This enhances the transparency and enforceability of the agreement.

- Sign and date the agreement in the presence of a notary public. Florida law requires that prenuptial agreements be notarized to be valid.

- Ensure each party retains a copy of the signed document for their records. It's also wise to keep digital copies securely stored.

After the agreement is filled out, signed, and notarized, it becomes a binding legal document. Both parties should keep their copies in a safe place and consider reviewing the agreement periodically, especially if significant financial changes occur. This proactive approach helps ensure that the prenuptial agreement continues to serve its intended purpose and reflects the current financial situation of both parties. Remember, this process is not just about protecting assets; it's about establishing a sense of security and understanding between partners about their financial future together.

Get Answers on Florida Prenuptial Agreement

What is a Florida Prenuptial Agreement form?

A Florida Prenuptial Agreement form is a legal document signed by two people before they get married. This agreement outlines how they will divide their assets and debts if they decide to separate or if one of them passes away. It can also cover alimony and other financial responsibilities during or after the marriage. The goal is to provide clarity and protect each person's interests.

Is a Florida Prenuptial Agreement form legally binding?

Yes, in Florida, a prenuptial agreement is legally binding if it is executed properly. Both parties must enter into the agreement voluntarily, with full disclosure of their financial situation, without any fraud, duress, coercion, or undue influence. It must be in writing and signed by both parties to be enforceable.

Can you modify a Prenuptial Agreement after getting married?

Yes, a prenuptial agreement can be modified after marriage, but any modifications must be agreed upon by both parties in writing. Both parties must again sign the amendment for it to be effective, following the same principles of fairness and full disclosure.

What happens if we don't sign a Prenuptial Agreement in Florida?

If you don't sign a prenuptial agreement in Florida, the state laws governing marital property will take effect in the event of a divorce or death. Florida follows equitable distribution laws, meaning assets and debts acquired during the marriage are divided fairly, but not necessarily equally, among both parties.

Do we need a lawyer to create a Prenuptial Agreement in Florida?

While it's not mandatory to have a lawyer create a prenuptial agreement in Florida, it's highly recommended. A lawyer can ensure the agreement complies with Florida law and accurately reflects both parties' intentions. Without legal guidance, you risk creating an agreement that may not be enforceable.

What should be included in a Prenuptial Agreement?

A comprehensive prenuptial agreement should include details on asset division, debt responsibility, alimony, inheritance rights, and any other financial arrangements. It should outline what happens both during the marriage and if it ends due to divorce or death. Full disclosure of both parties' financial situations is essential for the agreement to be valid.

How does a Prenuptial Agreement protect my assets?

A prenuptial agreement protects your assets by clearly specifying how they are to be treated and divided in the event of a divorce or death. It can designate certain assets as separate property, meaning they won't be subject to division. This is particularly important for protecting inheritances, business interests, or any personal assets brought into the marriage.

Common mistakes

When couples in Florida decide to create a prenuptial agreement, their intention is often to establish clarity and security before entering into marriage. However, despite these good intentions, there are common mistakes made during the form filling process that can undermine these goals. Understanding and avoiding these errors can be crucial for ensuring the document's validity and enforceability.

One of the first mistakes is not allowing ample time for both parties to consider the agreement fully. A rushed process can lead to disputes or the document being invalidated in court. It's essential for both parties to have sufficient time to review and understand the agreement, ideally with the advice of independent legal counsel.

Another common oversight is the omission of full disclosure. In a prenuptial agreement, both parties are required to disclose their assets, liabilities, and financial circumstances fully. Failing to do so can render the agreement void. Transparency is critical to formulating a document that is fair and binding.

Many couples make the error of including invalid provisions, such as decisions regarding child custody or child support. It's important to understand that these matters cannot be predetermined in a prenuptial agreement according to Florida law. Such provisions can jeopardize the entire agreement.

Ignoring the need for separate legal representation can also be a significant misstep. When both parties use the same attorney, there is a potential conflict of interest that could result in the agreement being contested or nullified. Each party having their own lawyer ensures that both individuals' rights are fully protected.

A lack of precision and clarity in drafting the agreement is another common error. Vague terms or poorly drafted clauses can lead to interpretation disputes later on. It's crucial for the language used to be clear, specific, and unambiguous to prevent future conflicts.

Failing to comply with state legal requirements is a mistake that can completely undermine a prenuptial agreement in Florida. This includes ensuring the agreement is in writing, signed by both parties, and executed voluntarily without duress or coercion. Failure to adhere to these formalities can invalidate the document.

Some couples mistakenly believe that a prenuptial agreement can include personal duties and obligations, such as household chores or relationship expectations. These types of provisions are generally not enforceable and can detract from the legal and financial focus of the document.

Another common mistake is not updating the agreement to reflect significant changes in circumstances. Over time, changes in financial status, inheritance, or the acquisition of property can make the original terms of the prenuptial agreement obsolete or unfair. Periodic reviews and updates can ensure that the agreement remains relevant and fair.

One subtle, yet critical error is not considering the agreement in the context of estate planning. A prenuptial agreement can have significant implications for estate planning and should be coordinated with wills, trusts, and other estate planning tools to prevent conflicts.

Lastly, a common mistake is assuming that a prenuptial agreement eliminates the need for trust and communication about finances in a marriage. Rather than replacing these essential aspects, a well-constructed prenuptial agreement should serve as a foundation for open discussions about financial expectations and responsibilities.

Avoiding these mistakes requires careful consideration, thorough legal guidance, and open communication between partners. When done correctly, a prenuptial agreement can provide a strong foundation for a marriage, ensuring that both parties enter into their union with clear expectations and protections.

Documents used along the form

When couples decide to marry in Florida, they often consider drafting a prenuptial agreement to clarify financial matters in advance. However, this is just one component of a comprehensive approach to legal and financial planning before marriage. There are several other forms and documents that may be used alongside the Florida Prenuptial Agreement to ensure that all aspects of the couple's financial life and future plans are adequately protected and clearly laid out. Understanding each of these documents and their purpose can help couples make informed decisions that suit their unique circumstances.

- Financial Disclosure Form: This form provides a detailed snapshot of each party's financial situation at the time of the prenuptial agreement. It lists assets, liabilities, income, and expenses, ensuring full transparency and honesty between partners. This document is foundational for a fair and enforceable prenuptial agreement.

- Last Will and Testament: While not directly related to the prenuptial agreement, having a will ensures that assets are distributed according to each individual's wishes upon their death. It can work in concert with a prenuptial agreement to specify how assets are to be handled not just during the marriage or in the event of divorce, but also after death.

- Life Insurance Policies: Life insurance documents can be aligned with the stipulations of a prenuptial agreement, particularly in specifying beneficiaries and the division of the policy benefits. These policies can provide financial protection and peace of mind for the future.

- Postnuptial Agreement: This document is similar to a prenuptial agreement but is executed after the couple marries. Circumstances change, and a postnuptial agreement can address financial and asset management issues that arise during the marriage that were not foreseen or covered by the prenuptial agreement.

- Trust Documents: Trusts can be used for asset protection, to minimize estate taxes, and to specify how assets are distributed upon death. They can be structured to complement the objectives outlined in a prenuptial agreement, ensuring that assets are managed and protected as desired.

- Durable Power of Attorney: This legal document allows one spouse to make decisions on behalf of the other in the event of incapacitation. It's an important part of a couple's financial planning, ensuring that management of assets and decisions can continue seamlessly if one person is unable to participate in decision-making.

Each of these documents plays a distinct role in a couple's financial and legal planning. When used together with a Florida Prenuptial Agreement, they create a robust framework that protects both parties and ensures their future intentions are clearly documented. It's vital for couples to consider not only their current situation but also their long-term plans and potential scenarios. By understanding and utilizing these documents, couples can approach their union with confidence, knowing their financial wellbeing and relationship are securely protected.

Similar forms

The Florida Prenuptial Agreement form is similar to a Postnuptial Agreement, primarily in their core function which is to outline the distribution of assets and financial responsibilities in a marriage. However, the primary difference is timing. A Prenuptial Agreement is executed before marriage, while a Postnuptial Agreement is completed after a couple is legally married. Both documents allow couples to define their own financial rights and responsibilities, separate from the state’s default laws on marriage and property.

A Cohabitation Agreement closely mirrors the purpose of a Prenuptial Agreement, even though it's designed for couples who live together without getting married. It typically covers similar areas such as the division of assets and debts, but it's applied to the partnership context outside of marriage. Like a Prenuptial Agreement, it aims to protect the financial interests of both parties, delineating who owns what before the cohabitation begins.

The Will, or Last Will and Testament, is another document akin to a Florida Prenuptial Agreement in that it specifies how assets should be distributed after a person's death. While a Will takes effect after death, a Prenuptial Agreement is concerned with the division of assets upon divorce or death, operating during the lifetime of the individuals involved. Both documents provide a plan for asset distribution which can override default state laws if properly executed.

A Trust Agreement shares similarities with a Prenuptial Agreement in terms of asset management and protection. Trusts are established to manage assets during a person’s lifetime and distribute them after death. A Prenuptial Agreement might specify which assets are considered separate property and thus could be placed into a trust, safeguarding these assets for designated beneficiaries much like a trust does.

Divorce Settlement Agreements bear resemblance to Prenuptial Agreements, as they also deal with the division of assets, debts, and spousal support upon the dissolution of a marriage. The key difference is that Prenuptial Agreements are made in anticipation of marriage and possibly divorce, while Divorce Settlement Agreements are created when the marriage is being dissolved.

The Separation Agreement is akin to Prenuptial Agreements in that they both outline the financial and family arrangements upon separation. While a Prenuptial Agreement sets these terms before marriage, a Separation Agreement is tailored for couples who are considering or are in the process of separation or divorce, detailing how assets and responsibilities will be managed during this period.

The Property Settlement Agreement, often utilized in divorce proceedings, is comparable to Prenuptial Agreements because it details how marital property will be divided. Prenuptial Agreements might specify which assets remain individual property and which become marital property, influencing the content that might appear in a Property Settlement Agreement if a divorce occurs.

A Financial Affidavit, while used more broadly in legal proceedings, has elements in common with a Prenuptial Agreement because it involves the disclosure of an individual’s financial assets and liabilities. A Prenuptial Agreement often requires similar full financial disclosure to ensure all terms are fair and based on accurate information. Both documents are critical in legal matters where financial transparency is necessary.

The Partnership Agreement among business owners outlines the ownership percentages, profit and loss distribution, and managerial roles, sharing its underlying principle with a Prenuptial Agreement regarding the management of assets and liabilities. While one is for marriage, the other governs a business relationship, both establishing clear rules to avoid future disputes.

Lastly, a Buy-Sell Agreement among business partners, which stipulates what happens to a partner’s share of the business in the event of their death, divorce, or retirement, parallels a Prenuptial Agreement. It prepares for the possibility of changes in partnership due to personal circumstances, much like a Prenuptial Agreement anticipates the financial implications of changes in marital status.

Dos and Don'ts

When preparing to fill out a Florida Prenuptial Agreement form, it's crucial to approach the process with care and thoroughness. This document plays a significant role in how assets and financial matters will be handled during the marriage and in the event of a divorce or the death of one spouse. Below are key points to consider, encapsulated as things you should and shouldn't do.

Things You Should Do- Review All Financial Disclosures: Ensure that both parties have fully disclosed their assets, liabilities, incomes, and expenses. This transparency is the foundation of a fair and enforceable agreement.

- Seek Independent Legal Advice: Both parties should have their own attorneys to advise them on their rights and the implications of the agreement. This helps ensure that the agreement is fair and that both parties understand its terms.

- Consider Future Changes: Account for future changes in circumstances, such as the birth of children, potential inheritances, changes in financial situations, or shifts in state laws.

- Be Clear and Specific: Clearly define terms and conditions. Vague language can lead to disputes and potential unenforceability.

- Update the Agreement as Necessary: Amend the agreement if there are significant changes in your relationship or financial situation, ensuring it always reflects your current circumstances and intentions.

- Wait Until the Last Minute: Don't rush this process. Begin discussions and drafting well in advance of the wedding to ensure ample time for negotiation and understanding.

- Include Personal Preferences: Keep the agreement focused on financial and legal matters. Personal preferences, such as chores, relationships, or child-rearing expectations, should not be part of this legal document.

- Sign Without Understanding: Never sign the agreement without fully understanding every term and its implications. If something is unclear, ask your attorney for clarification before signing.

- Use Generic Forms Without Customization: While templates can be a starting point, the agreement should be personalized to your specific situation and comply with Florida laws.

- Ignore Emotional Impacts: Recognize and respect the emotional sensitivities involved. Approach discussions with empathy and openness to ensure the process strengthens rather than strains your relationship.

Misconceptions

Many people have misconceptions about the Florida Prenuptial Agreement form. These misunderstandings can lead to confusion and hesitation about its usefulness and implementation. Let's clear up some of these myths to better understand the reality of prenuptial agreements in Florida.

Only wealthy people need it: One common misconception is that prenuptial agreements are only for those with significant assets. However, individuals at all financial levels can benefit from a prenup, as it can clarify financial rights and responsibilities, protect against debts, and define what is considered marital or separate property.

It's planning for divorce: Another misconception is that getting a prenup is akin to planning for your marriage to fail. In reality, a prenup can strengthen a relationship by ensuring that both parties have a clear understanding of financial matters, which can reduce conflicts over finances.

It's too expensive: Some people believe that creating a prenuptial agreement is prohibitively expensive. While there are costs involved, considering the potential for saving on future legal fees and drawn-out disputes in the event of a divorce, a prenup can be a cost-effective decision.

Prenups are ironclad: While prenuptial agreements are legally binding, they are not unbreakable. Courts can and do set aside prenups that are deemed unfair, were signed under duress, or if full disclosure was not made by both parties.

They are only about protecting assets: While asset protection is a key aspect, prenups also address other important issues such as alimony, debt liability, and inheritance rights, making them multifaceted legal tools.

All assets are split 50/50 without a prenup: Without a prenup, Florida's laws of equitable distribution apply, meaning assets are divided fairly but not necessarily equally. A prenup allows couples to decide for themselves how they wish to divide their assets, should the marriage end.

You can include child support and custody arrangements: A significant misconception is that prenups can dictate child custody and support terms. In Florida, these issues are determined based on the child's best interests at the time of the divorce, not beforehand in a prenup.

It must be signed well before the wedding: While it's wise to sign a prenuptial agreement well in advance of the wedding day to avoid claims of duress, there's no specific required timeframe in Florida. However, leaving adequate time for both parties to consider the agreement fully is recommended.

Understanding these misconceptions is the first step toward recognizing the benefits and limitations of prenuptial agreements. Individuals considering a prenup should consult with a legal professional to ensure that it meets their needs and complies with Florida law.

Key takeaways

When considering the creation and use of a Florida Prenuptial Agreement form, it's crucial to understand its purpose and requirements. A prenuptial agreement, often referred to as a "prenup," is a legal document that a couple signs before getting married, which outlines the management of financial matters and distribution of assets in the event of a divorce or death. Here are key takeaways to keep in mind:

- Full Disclosure is required: Both parties must fully disclose their financial assets and liabilities. Concealing information can render the agreement invalid.

- Separate Legal Representation is advised: Each party should have their own attorney review the agreement. This helps ensure that the interests of both individuals are adequately represented and understood.

- Consideration of Future Changes: The agreement should allow for modifications. Life changes, such as the birth of children, significant changes in income, or inheritance, may necessitate adjustments to the agreement.

- Understanding State Laws: Florida law governs prenuptial agreements under the Florida Uniform Premarital Agreement Act. Familiarity with these laws can ensure that the agreement is enforceable in court.

- Voluntariness and Fairness: Both parties must enter into the agreement voluntarily, without any coercion, and the terms should not be unconscionably unfair to either party at the time of signing. An agreement viewed as coercive or grossly unfair can be challenged in court.

Properly executed, a Florida Prenuptial Agreement can offer couples peace of mind and clarity regarding their financial rights and obligations. Thoughtful consideration and professional guidance are key to developing an agreement that is fair, enforceable, and reflective of both parties' interests.

Popular Prenuptial Agreement State Forms

Texas Prenup - This legal document is especially beneficial for individuals entering their second or subsequent marriage, protecting prior obligations.

Indiana Prenup - Strengthens the relationship by ensuring both parties have realistic expectations about each other's finances.

New York Prenup - By setting clear financial boundaries and expectations, couples can avoid one of the most common sources of conflict in marriages.

California Prenup - It includes details on property division, alimony, and inheritance rights, safeguarding personal and shared interests.