Free Prenuptial Agreement Form for California

Before walking down the aisle in the Golden State, many couples decide to pave their path with clear financial expectations by drafting a California Prenuptial Agreement form. This critical document serves not just as a means to set the financial terms of a marriage, but also as a proactive step to prevent potential disputes in the unfortunate event of a divorce. It outlines the rights, assets, and responsibilities each party brings into the union, offering protection and peace of mind. The form demands thorough understanding and consideration, as it encompasses everything from the division of properties to the allocation of debts and outlines provisions for spousal support. Drafted with care, it stands as a testament to a couple's wish to ensure transparency and fairness, no matter what the future might hold. In embarking on this legal journey, partners are encouraged to engage openly, honestly, and with each other's best interest at heart, solidifying the foundation of their commitment with clarity and mutual respect.

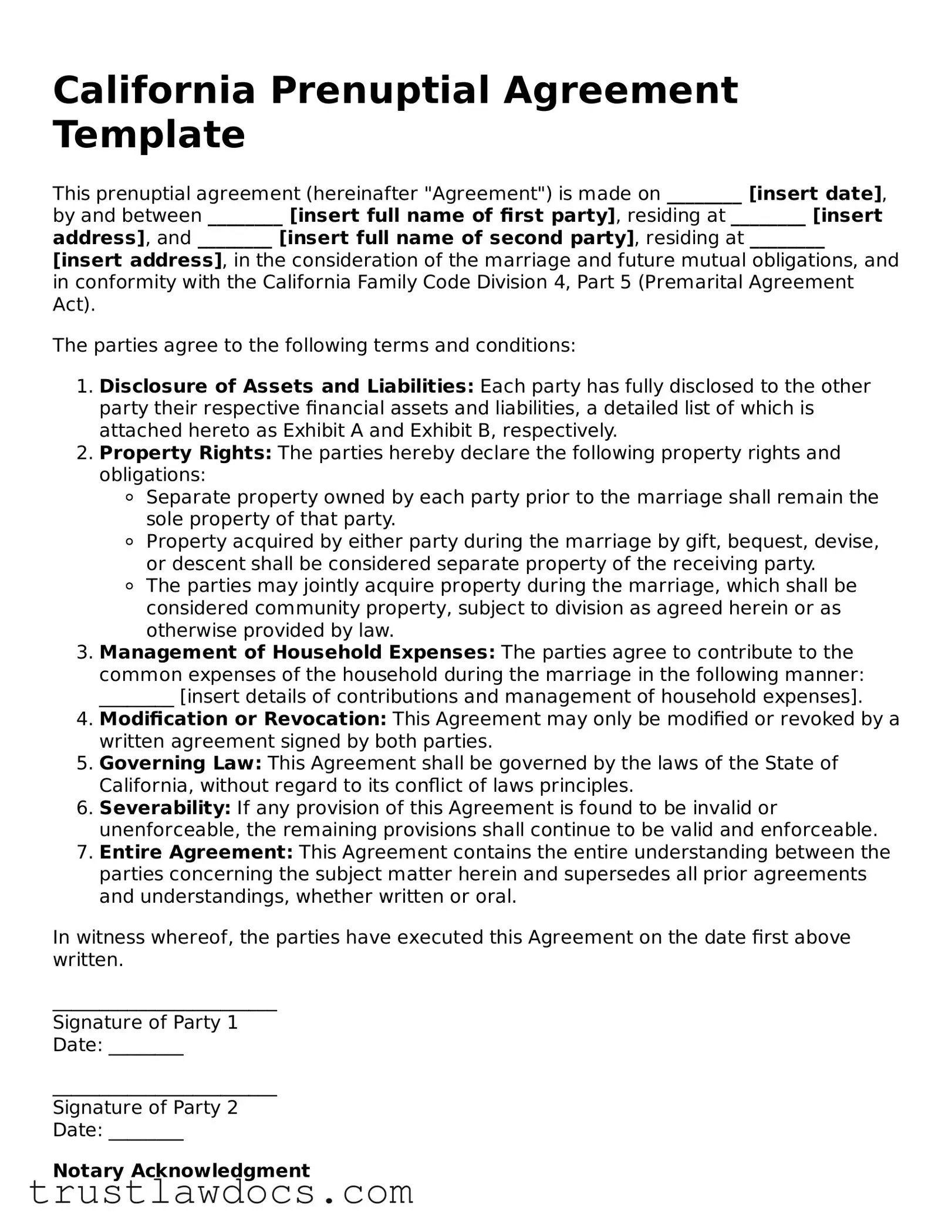

Form Example

California Prenuptial Agreement Template

This prenuptial agreement (hereinafter "Agreement") is made on ________ [insert date], by and between ________ [insert full name of first party], residing at ________ [insert address], and ________ [insert full name of second party], residing at ________ [insert address], in the consideration of the marriage and future mutual obligations, and in conformity with the California Family Code Division 4, Part 5 (Premarital Agreement Act).

The parties agree to the following terms and conditions:

- Disclosure of Assets and Liabilities: Each party has fully disclosed to the other party their respective financial assets and liabilities, a detailed list of which is attached hereto as Exhibit A and Exhibit B, respectively.

- Property Rights: The parties hereby declare the following property rights and obligations:

- Separate property owned by each party prior to the marriage shall remain the sole property of that party.

- Property acquired by either party during the marriage by gift, bequest, devise, or descent shall be considered separate property of the receiving party.

- The parties may jointly acquire property during the marriage, which shall be considered community property, subject to division as agreed herein or as otherwise provided by law.

- Management of Household Expenses: The parties agree to contribute to the common expenses of the household during the marriage in the following manner: ________ [insert details of contributions and management of household expenses].

- Modification or Revocation: This Agreement may only be modified or revoked by a written agreement signed by both parties.

- Governing Law: This Agreement shall be governed by the laws of the State of California, without regard to its conflict of laws principles.

- Severability: If any provision of this Agreement is found to be invalid or unenforceable, the remaining provisions shall continue to be valid and enforceable.

- Entire Agreement: This Agreement contains the entire understanding between the parties concerning the subject matter herein and supersedes all prior agreements and understandings, whether written or oral.

In witness whereof, the parties have executed this Agreement on the date first above written.

________________________

Signature of Party 1

Date: ________

________________________

Signature of Party 2

Date: ________

Notary Acknowledgment

State of California

County of ________

On ________ [date], before me, ________ [insert name and title of the notary], personally appeared ________ [insert names of the individuals acknowledged], known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained. In witness whereof, I hereunto set my hand and official seal.

________________________

Notary Public

My Commission Expires: ________

PDF Form Details

| Fact Number | Details |

|---|---|

| 1 | Prenuptial agreements in California are governed by the California Family Code sections 1600-1617. |

| 2 | Both parties must enter into the agreement voluntarily and without any duress or undue influence. |

| 3 | Full financial disclosure by both parties is required for the agreement to be enforceable. |

| 4 | California law allows prenuptial agreements to address property rights, management of household expenses, and division of property upon separation, divorce, or death, but it cannot adversely affect child support rights. |

| 5 | Parties are encouraged to have independent legal counsel when entering into a prenuptial agreement to ensure their rights are protected, though it's not mandatory unless specific conditions arise, such as short notice. |

| 6 | The agreement must be in writing and signed by both parties to be enforceable. |

| 7 | A prenuptial agreement in California cannot include terms that violate public policy or laws, such as clauses mandating illegal actions or decisions about child custody. |

How to Write California Prenuptial Agreement

Before embarking on the journey of marriage, couples often decide to lay down the financial groundwork to secure their future together. A Prenuptial Agreement in California serves as a blueprint for this purpose, detailing how assets and responsibilities will be managed both during the marriage and in the event of a divorce. Filling out this form demands attention to detail and an understanding of your personal financial landscape. Below is a guide designed to help you navigate through the process smoothly and efficiently.

- Start by gathering all necessary financial documents for both parties, such as bank statements, property deeds, and stock certificates. This will provide a clear understanding of your assets and liabilities.

- Download the latest version of the California Prenuptial Agreement form from a reputable source to ensure it's up-to-date with current laws.

- Read through the entire form first to familiarize yourself with the sections and the information required.

- Enter the full legal names and current addresses of both parties entering the agreement at the top of the form.

- Specify the date of the marriage to clearly define when the agreement will take effect.

- Detail the financial assets, liabilities, and property both parties are bringing into the marriage. This includes separate and joint accounts, real estate, stocks, and personal property. Be as detailed as possible to avoid any ambiguity.

- In the sections provided, clearly state how assets and liabilities will be managed during the marriage. This could include who will manage the household finances, how expenses will be shared, and whether income will be combined or kept separate.

- Outline the terms for division of property and assets in the event of a divorce, ensuring that both parties understand and agree to the conditions laid out. This includes specifying what will be considered marital property versus personal property.

- Include provisions for spousal support, if any, detailing the circumstances under which it would be payable, the amount, and the duration.

- Discuss and document any special agreements, such as inheritances or gifts that will remain separate from marital assets.

- Both parties should carefully review the completed document, ensuring that all information is accurate and reflects their understanding and agreement.

- Sign the form in the presence of a notary public to validate its authenticity. Both parties must provide their signatures, along with the date of signing.

- Keep at least two copies of the signed agreement in a safe place—one with each party—alongside the original document, ensuring it's accessible when needed.

Successfully filling out a Prenuptial Agreement in California paves the way for clear financial communication in marriage. It's a proactive step toward mutual understanding and respect for each other's assets and wishes. Should you find the process overwhelming or complex, don't hesitate to seek legal counsel to guide you through. This ensures that the agreement not only meets legal standards but also aligns perfectly with both parties' expectations.

Get Answers on California Prenuptial Agreement

What is a California Prenuptial Agreement form?

A California Prenuptial Agreement form is a legal document signed by a couple before they get married. This document outlines how assets and finances will be handled during the marriage and in the event of a divorce. It aims to ensure a fair distribution according to the couple's wishes, rather than by state law alone.

Who should consider signing a Prenuptial Agreement in California?

Anyone entering marriage with assets, debts, or children from previous relationships may consider signing a Prenuptial Agreement. This includes individuals with significant disparities in wealth, those who own a business, and anyone who wants to protect their financial future. This agreement is a practical tool for planning and can help reduce conflicts if the marriage ends.

How can one create a valid Prenuptial Agreement in California?

To create a valid Prenuptial Agreement in California, both parties should fully disclose their financial information, including assets, liabilities, and income. The agreement must be in writing and signed voluntarily by both parties without any pressure or duress. It is also advisable to have independent legal counsel review the agreement for each party to ensure that it is fair and in compliance with California law.

Can a Prenuptial Agreement be modified or revoked after marriage?

Yes, a Prenuptial Agreement can be modified or revoked after the marriage, but this must be done with the consent of both parties. Any changes or the revocation must be in writing and signed by both spouses. It's important for the couple to discuss and review their agreement periodically, adjusting it as their situation changes.

Common mistakes

When couples decide to tie the knot, many opt for a prenuptial agreement in California. This legal document can help protect individual assets, clarify financial rights, and avoid potential conflicts if the marriage doesn't work out. However, errors can creep in during its preparation. One common mistake is not providing a full disclosure of assets and debts. Being transparent about finances is crucial. If one party hides or understates their financial situation, it could lead to the agreement being invalidated in court.

Another issue arises with the inclusion of invalid provisions. Some individuals might attempt to include terms about child support, custody, or visitation, not realizing these matters cannot be predetermined in a prenup and are decided by the court based on the child's best interest at the time of separation or divorce. This oversight can cause parts of the agreement to be disregarded by a judge.

A third point of contention is the lack of independent legal advice. It's essential for each party to have their own attorney review the agreement. This ensures that both individuals fully understand their rights and the implications of the agreement. When couples overlook this, one party may later claim they didn't understand the agreement, potentially leading to disputes.

Additionally, many couples rush the prenuptial agreement process, not allowing enough time for consideration and negotiation. This haste can result in one party feeling pressured to sign, which could be grounds for the agreement being challenged and possibly voided. It's generally advised to finalize the agreement well before the wedding date.

An error often encountered is failing to follow state-specific legal requirements. California has particular rules about how a prenup must be executed to be considered valid. For example, the agreement must be in writing and signed by both parties. Ignoring these specifics can render the agreement unenforceable.

Moreover, some believe that once the prenup is signed, it cannot be changed or revoked. However, modifications are possible if both parties agree. Not keeping the prenup updated to reflect changes in financial situations or personal wishes can lead to issues down the line.

Another area where errors occur is in setting unrealistic or unfair terms. If the agreement heavily favors one party, it might be seen as unconscionable and could be invalidated by a court. Ensuring fairness and reasonableness in the terms is key to upholding the agreement's validity.

Overlooking the need for precision and clarity in drafting the document is yet another mistake. Ambiguities or vague language can lead to interpretations that were not intended by either party. It's crucial to be precise and clear about each term within the agreement to avoid future disputes.

Some couples also mistakenly believe a prenup is only for the wealthy. This misconception can lead to not considering the future implications of shared debts or the distribution of assets acquired during the marriage, regardless of one's financial status at the time of marriage.

Last but not least, neglecting to update or revisit the agreement as circumstances change is a common oversight. Life events such as the birth of children, significant career changes, or acquiring substantial assets or debts mean the agreement should be reviewed and possibly amended to reflect these changes.

In conclusion, careful consideration, full transparency, precise drafting, and legal guidance are essential when creating a prenuptial agreement in California. Avoiding these common mistakes can help ensure the agreement serves its intended purpose and is enforceable in the eyes of the law.

Documents used along the form

In California, when couples decide to marry, they often consider creating a prenuptial agreement to outline how assets and responsibilities will be managed both during the marriage and in the event of a divorce. Alongside a prenuptial agreement, several other forms and documents can be important for protecting individual rights and clarifying intentions. These documents can supplement the prenuptial agreement or address areas not covered by it.

- Financial Statement: A comprehensive snapshot of each party’s finances, including income, debts, and assets. This document serves as a foundation for the prenuptial agreement, ensuring that both parties are making informed decisions based on current financial realities.

- Will and Testament: This is a legal document that outlines an individual's wishes regarding the distribution of their estate and the care of any minor children upon their death. While a prenup addresses assets during marriage and divorce, a will covers the distribution of assets upon death.

- Living Trust: A living trust is established by an individual during their lifetime. It allows them to control the distribution of their estate, and it can provide a smoother transition of assets to beneficiaries without going through probate. This can work in concert with a prenuptial agreement to ensure assets are managed according to the individuals’ wishes both during and after their lifetime.

- Postnuptial Agreement: Similar to a prenuptial agreement but executed after the couple marries. It can be useful if the couple did not sign a prenuptial agreement or if their financial situations change significantly. This document can modify or completely replace the terms of an existing prenuptial agreement.

- Power of Attorney: This legal document allows one person to make decisions on another's behalf, typically covering legal, financial, or health-related decisions. While not directly related to the division of assets, it can be an essential part of a couple’s legal and financial planning, particularly in situations where one party becomes incapacitated.

When preparing for marriage, it's crucial to consider not just the emotional and physical union but also the legal and financial implications. The documents listed offer a way to manage those implications, safeguarding both parties' interests. By combining a prenuptial agreement with these other forms, couples can create a comprehensive plan that addresses their current realities and future possibilities, encouraging transparency and trust in their relationship.

Similar forms

A postnuptial agreement, like a prenuptial agreement, is a legal document agreed upon by a couple after they have gotten married or entered into a civil union. This document outlines how assets and financial matters will be handled in the event of a divorce or the death of one partner, similarly to prenuptial agreements, but they are created after the marriage has already taken place. Both documents serve the function of protecting individual assets and establishing financial expectations, but they differ in their timing relative to the marriage ceremony.

A cohabitation agreement is another legal document that closely resembles a prenuptial agreement, but it is designed for couples who live together without being married. It covers many of the same issues as a prenuptial agreement, such as the division of assets and responsibilities for debts should the relationship end. While the essence of protecting individual rights and assets is shared, the key difference lies in the legal recognition of the relationship by the state or federal government, which isn't required for a cohabitation agreement.

A property settlement agreement is typically used in the context of a divorce and outlines how the divorcing couple's assets and liabilities will be divided between them. Like a prenuptial agreement, it serves to clarify financial arrangements and asset distribution, but it is created at the end of a marriage rather than the beginning. The emphasis on fair division of property post-separation mirrors the preventative intention behind prenuptial agreements, which aim to establish these parameters before marriage.

A will or testament is a legal document that allows a person to express their wishes regarding the distribution of their assets and the care of any minor children after their death. While a will differs in purpose from a prenuptial agreement, which focuses on the event of separation or divorce while both spouses are alive, both types of documents are similar in that they plan for the distribution of assets. A prenuptial agreement, however, can also influence the terms of a will by specifying what happens to certain assets before the will takes effect.

A business partnership agreement shares fundamental similarities with a prenuptial agreement in the sense that both are preemptive legal agreements designed to outline the management and control of assets, albeit in different contexts. A business partnership agreement details the operations of a partnership, the distribution of profits and losses, and procedures for resolving disputes or dissolving the partnership. Like a prenuptial agreement, it aims to protect the parties' investments and set expectations for how matters will be handled should the partnership end, reflecting the same foresight into managing assets and responsibilities.

Dos and Don'ts

When you're getting ready to fill out a California Prenuptial Agreement form, it's important to approach it carefully and thoughtfully. This document is more than just paperwork; it's a way to protect both parties and ensure that you're both on the same page about your financial future. Here are some guidelines to help you through the process:

Do:

- Read the entire form carefully before you start filling it out. Understanding every part is crucial.

- Discuss the contents of the prenuptial agreement with your partner openly and honestly. Communication is key.

- Make sure that all financial information is disclosed fully and accurately. Transparency builds trust.

- Consider hiring a lawyer to review the agreement. A legal professional can offer valuable advice and make sure your rights are protected.

- Use clear and precise language to avoid any misunderstandings or ambiguity.

- Ensure that both you and your partner sign the agreement and have your signatures witnessed as required by law.

- Keep a copy of the signed agreement in a safe place.

- Review the agreement periodically with your partner, especially when there are significant changes in your financial situation.

- Ensure that the agreement is fair to both parties. An overly one-sided agreement may not be enforceable.

- Remember that you can revise the agreement if both parties agree to the changes. Life changes, and so can your agreement.

Don't:

- Rush through the process. Taking the time to consider all aspects of the agreement is important.

- Hide assets or debts. Full disclosure is a legal requirement and is crucial for a fair agreement.

- Use complicated legal language unless you fully understand it. Simplicity is often best.

- Sign the agreement without fully understanding every component. If you're unsure, seek clarification.

- Forget to consider the laws specific to California, as they will dictate how your agreement is interpreted and enforced.

- Assume that a prenuptial agreement is only for the wealthy. It can be beneficial for anyone entering a marriage.

- Let pressure or emotions guide your decision to sign. This agreement should be the result of careful consideration and mutual agreement.

- Ignore the option to have independent legal advice. It's often in your best interest to have your own lawyer.

- Fail to update the agreement as your financial situation changes. It should reflect your current circumstances.

- Believe that a prenuptial agreement is setting your marriage up for failure. It's a practical step for protecting both parties.

Misconceptions

California Prenuptial Agreement Form Misconceptions

Prenuptial agreements in California are often surrounded by misunderstandings that can cloud the judgment of engaged couples. It is critical to dispel these misconceptions to ensure both parties make well-informed decisions before entering into such an agreement.

Only for the Wealthy: A common misconception is that prenuptial agreements are only for the wealthy. In reality, they can benefit couples of any financial standing by providing clarity and protection for both parties' assets and debts.

They Indicate Distrust: Many believe that suggesting a prenuptial agreement signals a lack of trust between partners. However, discussing and drafting a prenuptial agreement can actually strengthen a relationship by ensuring open communication and setting clear expectations for the future.

Prenups Cover Child Support and Custody: It's a misunderstanding that prenuptial agreements can include terms for child support and custody. California law mandates that these issues are decided based on the child's best interest at the time of separation or divorce, not in advance through a prenup.

No Need if Planning to Stay Married: Some couples believe there's no need for a prenuptial agreement if they plan to stay married. However, a prenup can still serve as an essential part of financial planning, ensuring that both parties have a clear understanding of their financial rights and responsibilities.

Cannot Waive Spousal Support: Another misconception is that one cannot waive their right to spousal support in a prenuptial agreement. In California, adults can waive their future right to spousal support, provided the agreement is executed correctly and deemed not unconscionable at the time of enforcement.

Prenups are Ironclad: Many assume once a prenuptial agreement is signed, it is ironclad and cannot be challenged. However, prenups can be contested and invalidated in court under certain conditions, such as evidence of duress, fraud, or if the agreement is found to be fundamentally unfair at the time of divorce.

All Assets are Separated: There's a belief that a prenuptial agreement separates all assets of the individuals. While it can designate certain assets as separate property, California law allows for the creation of community property during the marriage, which can be subject to division upon divorce.

Understanding these misconceptions is crucial for couples considering a prenuptial agreement in California. It enables them to approach the subject with a clear and informed perspective, ensuring that the agreement serves their mutual interests and is in compliance with state laws.

Key takeaways

When approaching the task of filling out and using the California Prenuptial Agreement form, it's essential to grasp the basics to ensure everything is legally sound and aligned with your intentions. Here are key takeaways to consider:

- Understand what can and cannot be included: California law permits couples to include provisions on property division, financial support, and debt allocation in a prenuptial agreement. However, terms that govern child custody or support are not allowed.

- Ensure full disclosure: Both parties must fully disclose their financial assets and liabilities. This transparency is critical for the enforceability of the agreement.

- Seek independent legal advice: Each partner should obtain independent legal advice. This step is crucial to ensure that both individuals understand the agreement's terms and that it is fair to both parties.

- Observe the waiting period: After a prenuptial agreement is presented, California law requires a seven-day waiting period before it can be signed. This period allows both parties ample time to consider the agreement thoroughly.

- Follow proper signing procedures: For a prenuptial agreement in California to be valid, it must be in writing and signed by both parties. Witnesses or a notary might also be required to legitimize the document, depending on the specific circumstances.

By keeping these key points in mind, you can navigate the process of creating and executing a California Prenuptial Agreement with greater confidence and legal awareness.

Popular Prenuptial Agreement State Forms

Indiana Prenup - Empowers couples to make informed decisions about their property, debts, and financial obligations.

New York Prenup - It helps in safeguarding personal and business assets from marital claims, thus protecting one's financial legacy and future growth.