Official Prenuptial Agreement Document

The excitement and romance of an upcoming marriage often overshadow the practicalities of preparing for the future, but engaging with a Prenuptial Agreement form is one of those essential steps that can safeguard the financial stability and clarify the personal assets of both parties before they say “I do.” This critical document, far from undermining the trust and confidence in a blossoming partnership, supports a clear understanding and sets a solid foundation for the future. It details the rights, responsibilities, and the property division of each person in the event of a separation or divorce, ensuring that matters such as debts, inheritance, and assets are thoroughly addressed. While the mention of a prenuptial agreement can evoke a sense of discomfort, its role in promoting transparency and preventing potential conflicts cannot be understated. Drawing up this agreement encourages couples to communicate openly about their finances, aligning their expectations and planning strategically for their marriage’s legal and financial aspects.

Form Example

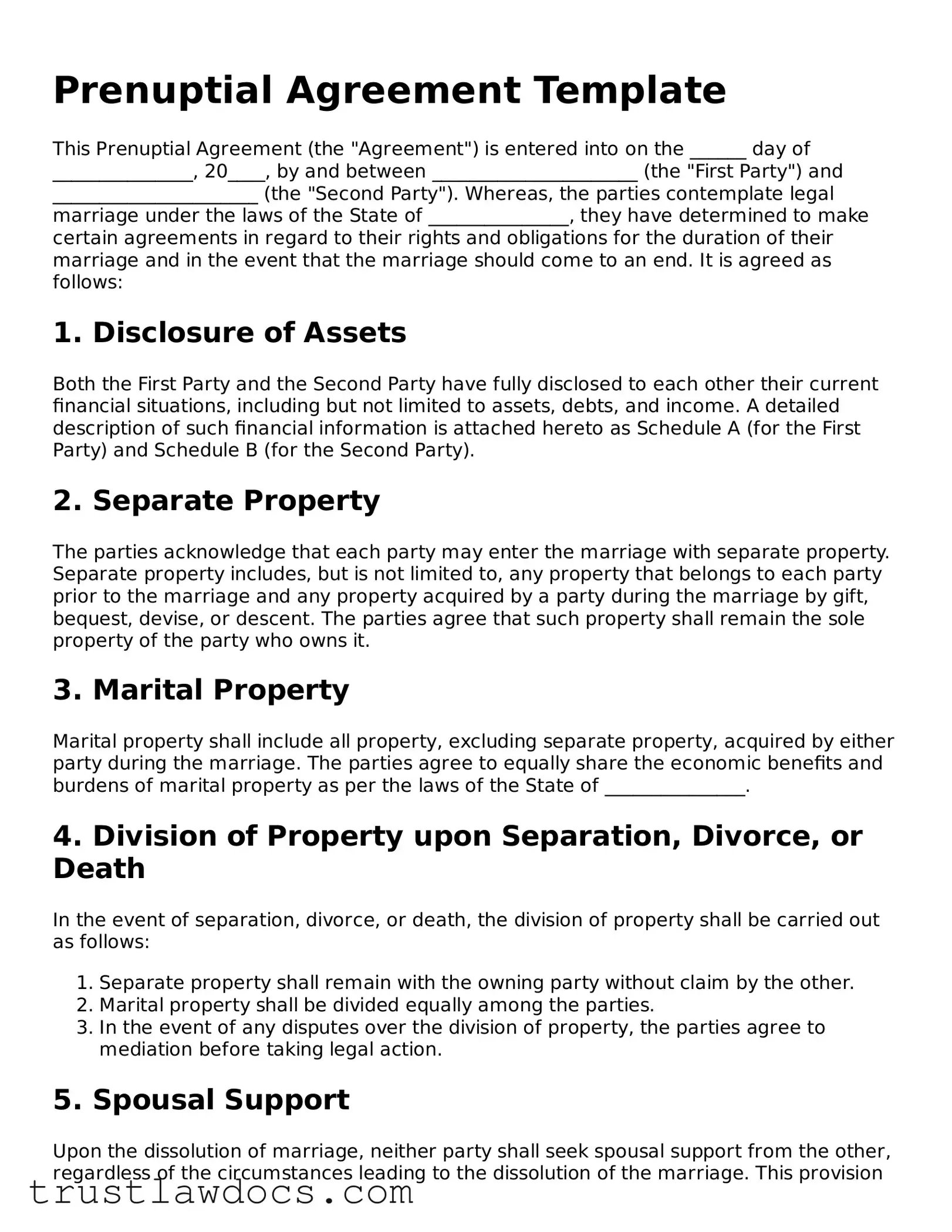

Prenuptial Agreement Template

This Prenuptial Agreement (the "Agreement") is entered into on the ______ day of _______________, 20____, by and between ______________________ (the "First Party") and ______________________ (the "Second Party"). Whereas, the parties contemplate legal marriage under the laws of the State of _______________, they have determined to make certain agreements in regard to their rights and obligations for the duration of their marriage and in the event that the marriage should come to an end. It is agreed as follows:

1. Disclosure of Assets

Both the First Party and the Second Party have fully disclosed to each other their current financial situations, including but not limited to assets, debts, and income. A detailed description of such financial information is attached hereto as Schedule A (for the First Party) and Schedule B (for the Second Party).

2. Separate Property

The parties acknowledge that each party may enter the marriage with separate property. Separate property includes, but is not limited to, any property that belongs to each party prior to the marriage and any property acquired by a party during the marriage by gift, bequest, devise, or descent. The parties agree that such property shall remain the sole property of the party who owns it.

3. Marital Property

Marital property shall include all property, excluding separate property, acquired by either party during the marriage. The parties agree to equally share the economic benefits and burdens of marital property as per the laws of the State of _______________.

4. Division of Property upon Separation, Divorce, or Death

In the event of separation, divorce, or death, the division of property shall be carried out as follows:

- Separate property shall remain with the owning party without claim by the other.

- Marital property shall be divided equally among the parties.

- In the event of any disputes over the division of property, the parties agree to mediation before taking legal action.

5. Spousal Support

Upon the dissolution of marriage, neither party shall seek spousal support from the other, regardless of the circumstances leading to the dissolution of the marriage. This provision can be modified only by a written agreement signed by both parties.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of _______________, without giving effect to any choice or conflict of law provision or rule.

7. Amendment and Revocation

This Agreement may only be amended or revoked by a written document signed by both parties and notarized. Any oral agreement to the contrary shall have no effect.

8. Acknowledgment

Each party acknowledges that he or she has had sufficient time to review the Agreement and consult with legal counsel and financial advisors of their choice. Each party further acknowledges that he or she enters into this Agreement voluntarily and without any coercion or duress.

Signatures

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the first date above written.

First Party Signature: ________________________________________

First Party Printed Name: _____________________________________

Second Party Signature: ______________________________________

Second Party Printed Name: ___________________________________

Notary Public: ______________________________________________

My Commission Expires: ______________________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose of Prenuptial Agreement | It is designed to outline how assets and financial matters are to be handled during the marriage and in the event of divorce or death. |

| Applicability | Prenuptial agreements are recognized in all 50 states, but the requirements and enforcement can vary significantly from state to state. |

| Governing Laws | The laws governing prenuptial agreements are primarily state-specific family laws and statutes, which dictate how these agreements must be drafted, executed, and enforced. |

| Requirements for Validity | To be considered valid, most states require that prenuptial agreements be in writing, signed voluntarily by both parties, and notarized. Full disclosure of assets is often required, and the agreement must not be unconscionable. |

How to Write Prenuptial Agreement

Before embarking on the journey of marriage, some couples decide to establish a prenuptial agreement. This legal document, commonly known as a prenup, outlines how assets and financial matters will be handled during the marriage and in the event of a divorce. While the topic might seem daunting at first, filling out a prenuptial agreement form is a straightforward process that provides a layer of financial security and clarity for the future. Let's walk through the steps needed to complete this form efficiently and accurately.

- Start by gathering all necessary financial documents. This includes bank statements, property deeds, stock certificates, and any other assets or debts. Both parties should have a clear understanding of their financial situation.

- Discuss openly with your partner about your goals and concerns. This conversation should cover what you both want to include in the agreement, such as which assets will remain individual property and how any future earnings or debts will be handled.

- Once you have all the information and have agreed on the terms, fill out the names and addresses of both parties at the top of the prenuptial agreement form.

- Detail the financial assets and liabilities each party brings into the marriage. This section should include the total value of these assets and liabilities.

- Specify the terms regarding how property will be managed during the marriage. This can include who will own, use, or manage certain assets.

- Explain the division of property in the event of divorce, dissolution, or death. Outline who will retain ownership of specific assets and how any shared property will be divided.

- Include any agreements on spousal support or alimony. State whether one party will receive financial support, the conditions under which they would receive it, and for how long.

- Decide if the agreement will have a sunset clause—a provision where the agreement becomes void after a certain period of marriage.

- Review the agreement together, ensuring both parties fully understand and agree to the terms.

- Both parties should seek independent legal advice. Having separate attorneys review the agreement can help ensure that it is fair, legally binding, and that both parties' interests are protected.

- Sign the document in the presence of a notary public. Depending on your state, you may also need witnesses to sign the agreement.

Filling out a prenuptial agreement form is a significant step towards a transparent and secure marital foundation. Although the process involves critical financial disclosures and some complex decisions, it ultimately fosters open communication and mutual understanding between partners. By following these steps, couples can confidently navigate the preparation of their prenuptial agreement, ensuring it reflects their shared values and objectives.

Get Answers on Prenuptial Agreement

What is a Prenuptial Agreement?

A Prenuptial Agreement, often referred to as a "prenup," is a legal document that a couple signs before they get married to outline how assets and finances will be divided in the event of a divorce or separation. It can also address issues like alimony and debt. This agreement can be customized to meet the specific needs and circumstances of the couple.

Who should consider getting a Prenuptial Agreement?

Anyone who wishes to protect their personal assets, reduce conflicts in case of a divorce, and have clear agreements regarding their financial matters should consider getting a Prenuptial Agreement. This includes individuals with significant assets, business owners, those with children from previous relationships, or individuals who anticipate receiving inheritances.

Does a Prenuptial Agreement only protect assets acquired before marriage?

No, a Prenuptial Agreement can be designed to address both assets acquired before and during the marriage. The couple can agree on how future earnings, assets acquired after marriage, and potential inheritances will be handled. The specifics of what is covered should be clearly outlined in the agreement.

Can a Prenuptial Agreement decide child custody and support issues?

No, a Prenuptial Agreement cannot determine child custody and child support issues. These matters are decided by the court based on the best interests of the child at the time of the divorce or separation, and a prenup agreement cannot bind these decisions.

Is a lawyer needed to create a Prenuptial Agreement?

While it is possible to draft a Prenuptial Agreement without a lawyer, it is highly recommended that each party consult with their own attorney. This helps ensure that the agreement is legally sound, fair, and enforceable. Also, an attorney can provide advice tailored to an individual's situation and help protect their rights.

Can a Prenuptial Agreement be modified or revoked after marriage?

Yes, a Prenuptial Agreement can be modified or revoked after marriage, but this must be done with the consent of both parties. Any changes or the decision to revoke the agreement should be made in writing and follow the legal requirements, similar to those when initially drafting the agreement.

What happens if a Prenuptial Agreement is challenged in court?

If a Prenuptial Agreement is challenged in court, the judge will evaluate its validity and enforcement. This includes whether both parties entered into the agreement voluntarily, had a full disclosure of assets, and whether the terms are fair and not against public policy. If the court finds any sections of the agreement to be invalid or unfair, it may choose not to enforce those sections or, in some cases, the entire agreement.

Common mistakes

Filling out a prenuptial agreement is a significant step for couples as they plan to tie the knot, aiming to safeguard their financial future. However, in the rush of excitement or the overwhelming nature of wedding planning, people often make mistakes that can render these agreements less effective or even invalid. Understanding these pitfalls can help couples ensure their prenuptial agreements stand strong.

One common error is not allowing adequate time for both parties to ponder the agreement and seek independent legal advice. Prenuptial agreements should never be a last-minute decision. Rushing can lead to pressure or duress claims that may invalidate the agreement. Both individuals need ample time to review the agreement's terms, understand their rights, and consult with their own lawyers.

Another mistake is overlooking full disclosure of all assets and liabilities. A prenuptial agreement is grounded in transparency. Failing to reveal the full extent of one’s financial situation can not only breach trust but can also lead to the agreement being challenged or invalidated. It's crucial that both parties openly and honestly declare their financial standing.

Underestimating the importance of legal representation is also a significant oversight. Some couples opt to save on costs by drafting the agreement themselves or using generic online templates. However, this can be a perilous approach. Each person should have their own lawyer who can advise them on their rights and ensure the agreement is fair and complies with state laws. Personalized legal counsel can prevent unforeseen issues down the road.

Ignoring or misunderstanding state laws can also lead to problems. Prenuptial agreements are subject to state laws, and what may be enforceable in one state might not be in another. This is particularly important for couples who might move to different states or have assets in various jurisdictions. Knowledge of how state laws affect your agreement is critical for its durability.

Setting unrealistic or unfair terms is another pitfall. While prenuptial agreements can cover a variety of financial aspects, including property division and alimony, terms that are excessively one-sided or seem to penalize one partner unfairly often face scrutiny and may be invalidated by a court. Fairness and reasonability are key factors in crafting a lasting agreement.

Some couples make the mistake of including non-financial provisions related to personal behavior, chores, or lifestyle choices. Courts generally do not enforce such terms, viewing them as outside the scope of the agreement’s financial intent. Keeping the content focused on financial matters and legal concerns ensures the agreement's enforceability.

Overlooking changes in circumstances is a common error as well. Life brings changes such as births, deaths, and significant alterations in financial status. An effective prenuptial agreement should account for these potential changes, incorporating clauses that allow for adjustments under certain conditions. Without such foresight, the agreement may become outdated or irrelevant.

Failing to update the agreement is another oversight. As mentioned, life changes, and so should your prenuptial agreement. It’s wise to review and potentially revise the agreement periodically to reflect new assets, liabilities, or changes in the law. This proactive approach helps keep the agreement aligned with current circumstances and legal standards.

Last but not least, neglecting the emotional aspect of prenuptial agreements can strain relationships. Approaching the topic with sensitivity and respect for each other’s feelings is essential. It’s not just a legal document but a part of your relationship's foundation. Open communication and mutual understanding can transform a potentially divisive topic into a strengthening bond for the future.

By avoiding these common mistakes, couples can ensure their prenuptial agreement is a solid foundation for their financial future together. It’s about protection and clarity, not distrust or pessimism. With careful planning, transparent communication, and legal guidance, a prenuptial agreement can be an invaluable part of a couple’s journey together.

Documents used along the form

Engaging in the process of creating a prenuptial agreement offers couples a unique opportunity to openly discuss financial expectations and responsibilities before marriage. However, this document does not stand alone. There are several other key forms and documents that often accompany a prenuptial agreement, each serving its specific purpose to further solidify and detail a couple's financial and legal understanding and intentions. Here is a succinct overview of some of these important documents that frequently accompany prenuptial agreements.

- Will/Last Testament: This document outlines how one's assets and estate will be distributed upon their death. It's pivotal for ensuring that the wishes of each spouse are honored, particularly in scenarios that may not be covered or considered within the prenuptial agreement itself.

- Power of Attorney: This grants one party the authority to act on the other's behalf under specific circumstances, such as financial decisions or health care directives. It's crucial during unforeseen events where one spouse cannot make decisions due to incapacitation or absence.

- Postnuptial Agreement: Similar to a prenuptial agreement, but established after the couple is married. This can be useful if circumstances change drastically after the wedding, or if the couple failed to make a prenuptial agreement and later decides it would be beneficial.

- Financial Statements: Detailed declarations of each partner's current financial situation. These documents can include bank statements, investment accounts, debts, and asset valuations. They provide a clear financial picture at the beginning of the marriage and can serve as a benchmark for discussions about financial growth and responsibilities.

- Life Insurance Policies: These policies can be structured to provide for either spouse in the event of the other's death, also offering a degree of financial security and peace of mind. They might also be adapted over time to reflect changes in the couple’s financial situation or family structure, such as the birth of children.

Together, these documents complement a prenuptial agreement, providing a comprehensive approach to marital planning. By meticulously considering and drafting each document, couples can ensure their legal and financial affairs are in order, thus laying a strong foundation for their future together. It's always recommended to consult with legal and financial professionals when preparing these documents to ensure they align with current laws and best serve the couple's interests.

Similar forms

A Postnuptial Agreement is akin to a Prenuptial Agreement, but it's executed after a couple marries or enters a civil union. While a Prenuptial Agreement outlines the distribution of assets and responsibilities before marriage, a Postnuptial Agreement performs this function after marriage. Both documents serve to clarify financial arrangements between spouses, but their timing distinguishes them.

A Living Will bears similarity to a Prenuptial Agreement in that it anticipates future circumstances and outlines specific preferences in advance. A Living Will details medical treatments one wishes to receive or avoid in the event they become unable to express their preferences, while a Prenuptial Agreement addresses financial and property arrangements before marriage. Both serve as preemptive measures to manage personal affairs.

A Last Will and Testament, much like a Prenuptial Agreement, is a tool for estate planning. It specifies how one's assets and responsibilities are to be distributed after death. While a Prenuptial Agreement deals with these issues in anticipation of marriage, a Last Will and Testament addresses them in anticipation of death. Each document provides a structured approach to managing personal and financial matters.

Separation Agreements share similarities with Prenuptial Agreements in their focus on the division of assets and responsibilities between partners. However, a Separation Agreement is utilized when a couple decides to live apart without formally ending their marriage. Like a Prenuptial Agreement, it outlines financial arrangements and custodial arrangements, but it does so within the context of separation rather than marriage preparation.

A Co-habitation Agreement is similar to a Prenuptial Agreement but for couples who live together without getting married. It outlines how assets, liabilities, and responsibilities will be shared or divided if the relationship ends. Both types of agreements aim to clarify financial arrangements and rights, providing a level of security and understanding for the parties involved.

Trust Agreements, like Prenuptial Agreements, are concerned with managing and protecting assets. A Trust Agreement allows an individual to specify how their assets should be handled and distributed during their lifetime or after death. While a Prenuptial Agreement focuses on assets in the context of marriage, a Trust Agreement has a broader application, potentially benefiting various beneficiaries as determined by the grantor.

Partnership Agreements in business bear resemblance to Prenuptial Agreements in personal relationships. They outline the terms of a business partnership, including the distribution of profits, losses, and the responsibilities of each partner. Though one pertains to marriage and the other to business, both agreements aim to prevent disputes by clarifying roles and expectations from the outset.

A Buy-Sell Agreement among business owners shares objectives with a Prenuptial Agreement by preparing for future changes. This type of agreement determines what happens to a partner's share of the business should they decide to leave, die, or become incapacitated. Similar to a Prenuptial Agreement, it aims to protect the interests of the parties involved and prevent conflicts by setting clear expectations.

Employee Non-Disclosure Agreements (NDAs) and Prenuptial Agreements both involve the protection of sensitive information. An NDA is a legal contract between an employer and an employee that outlines confidential material, knowledge, or information that the employee is prohibited from sharing. While the context is different, both types of agreements are preventative measures designed to protect assets or information considered valuable.

Dos and Don'ts

When filling out the Prenuptial Agreement form, it's important to approach the task with attention and care. This contract can impact your financial and personal future. Here are the dos and don'ts you should consider:

Do:

- Discuss the agreement openly with your partner to ensure mutual understanding and expectations.

- Include a complete disclosure of all assets, liabilities, income, and expectations of gifts and inheritances.

- Seek independent legal advice to ensure that the agreement is fair and valid.

- Consider future changes in circumstances and include provisions for these changes.

- Make sure the agreement is signed well in advance of the wedding to avoid any claims of pressure or duress.

- Review the agreement every few years or after significant life events, such as the birth of a child.

Don't:

- Use generic forms without customizing to your specific situation.

- Hide or fail to disclose any assets or liabilities as this can render the agreement void.

- Pressure or coerce your partner into signing the agreement.

- Forget to update the agreement as your financial situation changes.

- Rush through the process—take your time to consider all aspects and implications of the agreement.

- Ignore state laws and requirements that can affect the enforceability of the agreement.

Misconceptions

Prenuptial agreements, often known as "prenups," are surrounded by numerous misconceptions. These legal documents are designed to protect both parties in the event of a divorce, but misunderstandings about their purpose, enforceability, and fairness prevail. Here, we will dispel some of the most common misconceptions.

- Prenups are only for the wealthy. One common misconception is that prenuptial agreements are exclusively for the rich. This is not true. While high net worth individuals may have more assets to protect, prenups can benefit anyone with personal or business assets, debts, or children from previous relationships. They create a clear agreement on financial matters, which can simplify proceedings in the event of a divorce.

- Prenups are planning for divorce. Many people mistakenly believe that getting a prenuptial agreement is akin to planning for a marriage to fail. However, prenups are more about preparation and protection. They encourage couples to have open discussions about finances, which is a leading cause of discord in marriages. By setting expectations and agreements upfront, prenups can actually strengthen a relationship.

- Prenups strip away rights. There's a widespread misconception that prenuptial agreements strip one party of all their rights. The truth is, prenups must be fair and not promote divorce to be enforceable. Both parties must have adequate legal representation, or the chance to seek it, and enter into the agreement voluntarily. This ensures that the agreement is balanced and both parties’ interests are protected.

- Child support and custody can be included in prenups. Contrary to what some may believe, prenuptial agreements cannot dictate child support or custody arrangements. These decisions are always made based on the best interests of the child at the time of the divorce. Courts have the final say in these matters to ensure the child's welfare is prioritized over parental agreements made previously.

- You can waive your right to alimony in a prenup. While it is true that prenups can include provisions about alimony, these provisions are subject to review by a judge at the time of the divorce. If the waiver of alimony would leave one spouse in a significantly unjust situation, a court may decide not to enforce that part of the agreement. Each party’s financial situation at the time of the divorce is taken into consideration.

- Prenups are set in stone. Finally, the belief that prenups are unchangeable is incorrect. Couples can modify or revoke a prenuptial agreement after marriage if both parties agree to the changes. Life circumstances change, and agreements made before the marriage can be adjusted to reflect new realities, always with the aim of being fair and equitable to both parties.

Key takeaways

A Prenuptial Agreement is an important document for couples planning to marry, allowing them to outline the ownership of their personal and financial assets before the marriage. This agreement can protect both parties in the event of a divorce, separation, or even the death of a spouse. Here are six key takeaways about filling out and using a Prenuptial Agreement form:

- Start Early: Begin the conversation and drafting process well before the wedding date. This ensures both parties have ample time to consider their positions, seek legal advice, and make any necessary adjustments without pressure.

- Seek Independent Legal Advice: Each party should have their own attorney who can explain the rights and obligations that come with the agreement. This step is crucial for the agreement to be enforceable, as it demonstrates that both parties fully understood the agreement and willingly entered into it.

- Full Disclosure is Mandatory: For a Prenuptial Agreement to hold up, both parties must fully disclose their assets, liabilities, income, and expectations of gains or inheritances. Concealment of any financial information can render the agreement invalid.

- Understand What Can and Cannot Be Included: While prenuptial agreements can specify asset division and financial arrangements upon a separation, divorce, or death, they cannot dictate personal matters such as child custody, visitation rights, or child support obligations. Legal requirements vary by state, so it's essential to understand what's permitted in your jurisdiction.

- Consider Future Changes: Circumstances change, so it's wise to consider and possibly include provisions for future adjustments. Some couples opt to include "sunset clauses" that render the agreement void after a certain period or under specific conditions, reflecting the evolving nature of relationships and finances.

- Ensure It's Properly Executed: For a Prenuptial Agreement to be legally binding, it must be executed properly according to the laws of the state. This often requires the agreement to be in writing, signed by both parties, and, in some cases, witnessed or notarized.

Ultimately, a well-crafted Prenuptial Agreement can provide certainty and protect both individuals, enhancing the mutual trust and partnership required for a successful marriage. Addressing financial matters upfront, with clarity and fairness, lays a solid foundation for a couple's future together.

Other Templates:

Tattoo Waiver Form - This contractual document is a testament to the tattoo industry's commitment to safety, professionalism, and ethical standards.

Commercial Real Estate Letter of Intent Template - The form acts as a non-binding agreement capturing the essential aspects of a real estate transaction, such as the purchase price and due diligence period.