Free Power of Attorney Form for Texas

In the realm of legal documents, the Texas Power of Attorney (POA) form stands as a crucial instrument, enabling individuals to grant another person the authority to make decisions on their behalf. This delegation of power can cover a wide range of domains, from financial matters and real estate transactions to medical decisions and everyday personal affairs, depending on the specific type of POA form utilized. The state of Texas recognizes several kinds of POA forms, each tailored to distinct needs and circumstances, including Durable, Medical, or Limited POA, among others. Importantly, for a POA to be considered valid in Texas, it must comply with the state's legal requirements, which typically include being signed in the presence of a notary public or certain other qualified witnesses. Understanding the nuances of these forms, the conditions under which they become effective, and how they can be revoked or amended is essential for both the individual granting the authority and the designated agent, ensuring that the power granted is exercised in accordance with the granter’s wishes and Texas law.

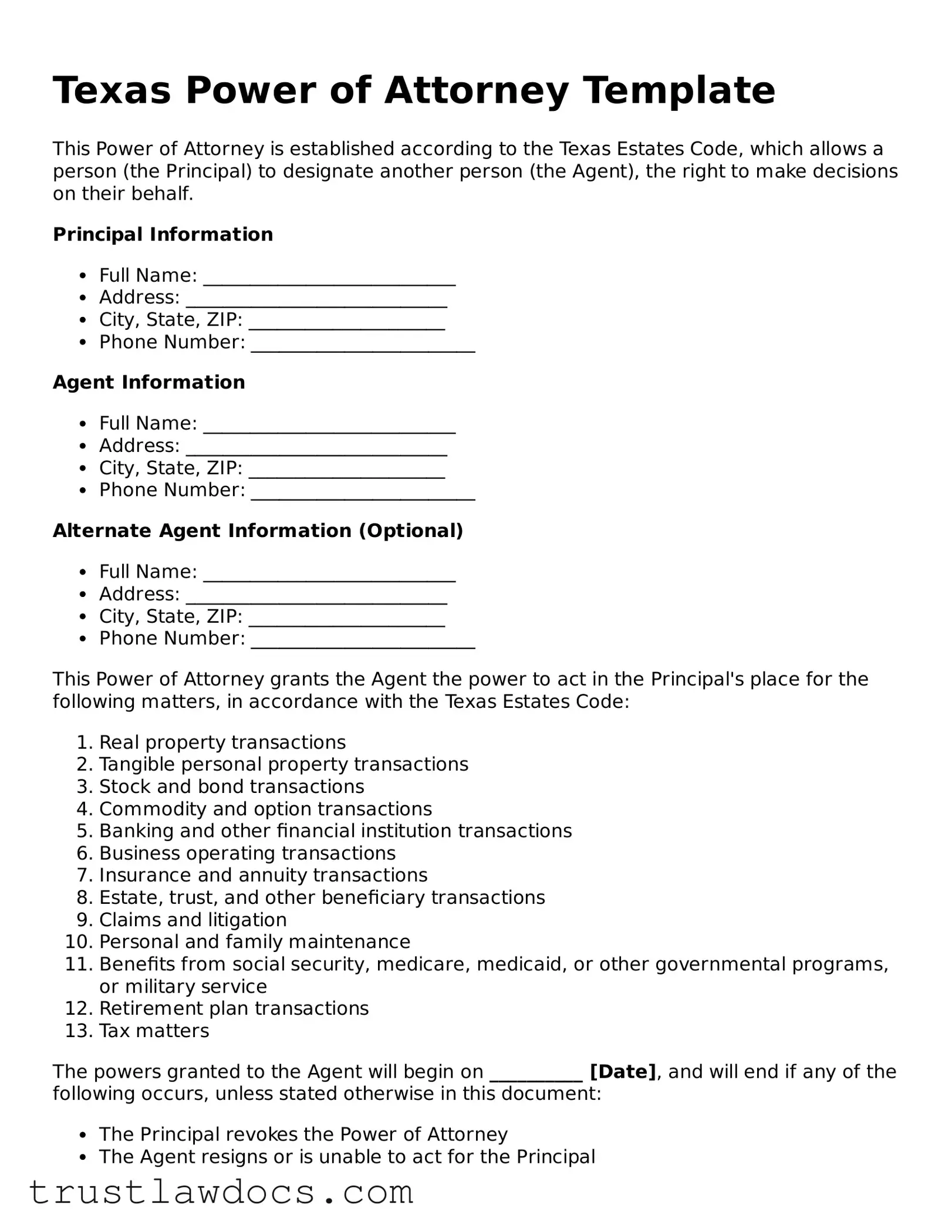

Form Example

Texas Power of Attorney Template

This Power of Attorney is established according to the Texas Estates Code, which allows a person (the Principal) to designate another person (the Agent), the right to make decisions on their behalf.

Principal Information

- Full Name: ___________________________

- Address: ____________________________

- City, State, ZIP: _____________________

- Phone Number: ________________________

Agent Information

- Full Name: ___________________________

- Address: ____________________________

- City, State, ZIP: _____________________

- Phone Number: ________________________

Alternate Agent Information (Optional)

- Full Name: ___________________________

- Address: ____________________________

- City, State, ZIP: _____________________

- Phone Number: ________________________

This Power of Attorney grants the Agent the power to act in the Principal's place for the following matters, in accordance with the Texas Estates Code:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, medicare, medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

The powers granted to the Agent will begin on __________ [Date], and will end if any of the following occurs, unless stated otherwise in this document:

- The Principal revokes the Power of Attorney

- The Agent resigns or is unable to act for the Principal

- The Principal passes away

- A court invalidates the Power of Attorney or appoints a guardian for the Principal

This document is executed this ______ day of _______________, 20__.

Principal's Signature: ___________________________

Agent's Signature: _____________________________

Alternate Agent's Signature (Optional): _____________

State of Texas

County of _______________

This document was acknowledged before me on ______ [Date] by _________________ [Principal's Name].

Notary Public's Signature: _________________________

My Commission Expires: ___________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Power of Attorney form is governed by the Texas Estates Code, specifically Title 2, Chapter 751. |

| Types of Power of Attorney | In Texas, there are several types of Power of Attorney forms, including durable, medical, general, and limited. |

| Durable Power of Attorney | A Durable Power of Attorney remains in effect if the principal becomes incapacitated. |

| Medical Power of Attorney | This allows an agent to make health care decisions on behalf of the principal if they become unable to do so. |

| Requirement for Notarization | Most Power of Attorney forms in Texas need to be notarized to be considered valid. |

| Springing Power of Attorney | This Power of Attorney becomes effective upon the occurrence of a specified event, typically the principal's incapacitation. |

| Revocation | The principal may revoke a Power of Attorney at any time, as long as they are mentally competent. |

| Statutory Form | Texas provides a statutory form for a Durable Power of Attorney in its Estates Code, which may be used to ensure legality. |

| Agent's Authority | An agent can handle financial, real estate, and medical decisions, depending on the powers granted in the form. |

How to Write Texas Power of Attorney

Filling out a Texas Power of Attorney form is a crucial step in authorizing someone to legally act on your behalf in various matters, including financial, legal, or health-related decisions. This process can seem daunting at first, but with clear instructions, it can be completed effectively. It's important to choose someone trustworthy as your agent, as they will have significant responsibilities and control over certain aspects of your life.

Here are the steps needed to fill out the Texas Power of Attorney form:

- Review the Form: Start by reading through the entire form carefully to understand the scope and implications of the document.

- Select the Type of Power of Attorney: Determine which type of Power of Attorney you need, such as General, Durable, or Medical. Each type serves different purposes.

- Identify the Parties: Clearly write your full legal name as the 'Principal' and the full legal name of the person you are appointing as your 'Agent' or 'Attorney-in-fact.'

- Define the Powers: Specify the exact powers you are granting to your Agent. Be as clear and precise as possible to avoid any ambiguity.

- Set the Duration: If you are choosing a Durable Power of Attorney, you need to state that the document remains in effect even if you become incapacitated. Otherwise, mention the specific start and end dates.

- Signatures: Both the Principal and the Agent must sign the document in the presence of a notary public. Ensure that the date of signing is recorded accurately.

- Notarization: The final step is getting the document notarized. This official process involves a notary public verifying the identities of the signatories and witnessing the signing of the document.

Once these steps are completed, make sure to keep the original document in a safe place and provide a copy to your agent. It might also be advisable to inform close family members or trusted friends about the arrangement and where the document is stored. Remember, this is a powerful legal tool, and it should be used with caution and responsibility.

Get Answers on Texas Power of Attorney

What is a Texas Power of Attorney form?

A Texas Power of Attorney (POA) form is a legal document that allows an individual, known as the principal, to delegate authority to another person, called the agent or attorney-in-fact, to make decisions and act on their behalf. These powers can relate to financial, real estate, medical, or other personal affairs.

Who can serve as an agent under a Texas Power of Attorney?

Any competent individual 18 years or older can serve as an agent. The chosen person should be trustworthy, as they will have substantial control over the principal's affairs and decisions. Though often a family member or close friend, the agent can also be a professional such as an attorney or financial advisor.

How can I revoke a Power of Attorney in Texas?

A Power of Attorney in Texas can be revoked at any time by the principal, as long as they are mentally competent. To revoke it, the principal should notify the agent in writing and destroy all copies of the POA document. It is also recommended to inform any institutions or third parties that may have been relying on the POA of its revocation.

Is a Texas Power of Attorney form required to be notarized?

Yes, for most types of Power of Attorney documents in Texas, notarization is required to ensure the document is legally binding. Some forms may also require witnesses. The notarization process involves a notary public, who will verify the identity of the signing party and their understanding and willingness to enter into the agreement.

How long does a Texas Power of Attorney last?

The duration of a Power of Attorney in Texas depends on what is specified in the document. It may be set up to expire on a specific date, upon the completion of a specific task, or upon the principal's incapacitation or death unless it is a durable Power of Attorney, which remains in effect even if the principal becomes incapacitated.

What is the difference between a general and a durable Power of Attorney?

A general Power of Attorney in Texas grants broad powers to the agent to handle a wide range of the principal's affairs and ends if the principal becomes incapacitated. A durable Power of Attorney, on the other hand, is specifically designed to remain in effect even after the principal's incapacitation, ensuring that the agent can continue to act on the principal's behalf.

Can a Power of Attorney be used to make healthcare decisions in Texas?

Yes, but a specific type of POA, known as a Medical Power of Attorney, must be used. This document grants the agent the authority to make healthcare decisions on behalf of the principal if they become unable to make those decisions themselves. It is important to discuss your wishes and instructions with the chosen agent to ensure they make decisions in your best interest.

Common mistakes

One common mistake when filling out the Texas Power of Attorney form is not specifying the powers granted clearly. People often use broad terms without detailing the exact scope of authority they are transferring. This vagueness can lead to confusion and legal challenges, especially when the agent tries to act on the principal's behalf. Being precise about the responsibilities and rights being assigned is crucial.

Another error is failing to choose the right type of Power of Attorney. Texas law recognizes several kinds, including General, Durable, and Medical Powers of Attorney. Each serves different purposes and comes into effect under different circumstances. By not selecting the form that aligns with their needs, individuals inadvertently put themselves and their assets at risk.

Not properly identifying the principal and agent is a simple yet frequent mistake. The form requires full legal names and contact information for both parties. Incorrect or incomplete information can invalidate the document or cause significant delays when the agent needs to act on the principal's behalf.

Overlooking the need for witnesses or a notary's signature is another oversight. Texas law mandates that certain Power of Attorney forms must be signed in the presence of either witnesses or a notary public, or sometimes both, to be legally binding. This step verifies the principal's identity and ensures they are signing the document willingly and without duress. Neglecting this requirement can lead to the document being challenged or disregarded.

Many individuals forget to specify a termination date or condition for the Power of Attorney. Without a clear end point, the document remains in effect until it is formally revoked, the principal dies, or, in some cases, if the principal becomes incapacitated—unless the document is a Durable Power of Attorney, which remains in effect even upon the incapacity of the principal. Deciding on and indicating a termination date or condition is essential for maintaining control over the arrangement.

A crucial mistake is not discussing the Power of Attorney with the chosen agent before completing the form. This conversation ensures the agent understands their responsibilities and is willing and able to take on the role. Surprising someone with this duty can lead to issues, especially if they're unwilling or unable to fulfill the obligations required.

Last but certainly not least, failing to keep the document accessible is a significant error. After going through the effort of completing a Power of Attorney, it should be stored in a secure yet accessible location, and the agent should know how to access it if needed. Without access to the document, the agent's ability to act quickly in the principal's best interest could be severely hindered.

Documents used along the form

When preparing a Texas Power of Attorney (POA), several other documents may often be used alongside it to ensure comprehensive legal and financial planning. These documents complement the POA, offering a more robust and secure way to manage affairs under various circumstances. The list below outlines key documents typically utilized in conjunction with a Texas POA to provide clarity, legal compliance, and peace of mind for all parties involved.

- Advance Healthcare Directive – This allows individuals to outline their preferences for medical care in case they become unable to make decisions for themselves. It covers decisions regarding life support, resuscitation, and organ donation.

- Living Will – Often used alongside an Advance Healthcare Directive, a Living Will specifies an individual’s wishes regarding end-of-life medical treatments, including measures that should or should not be taken to extend life.

- Last Will and Testament – Details how an individual’s assets and estate will be distributed after their death. It can also appoint a guardian for minor children.

- Medical Power of Attorney – A specific type of POA that grants someone authority to make healthcare decisions on behalf of the grantor, should they become incapacitated.

- Declaration of Guardian in Advance of Need – Allows individuals to designate a guardian for themselves and their minor children in the event of incapacity or disability, preemptively deciding who will make decisions if they are unable to do so.

- HIPAA Release Form – Authorizes healthcare providers to disclose personal health information to designated individuals, ensuring loved ones can access necessary medical information under critical circumstances.

- Revocation of Power of Attorney – A document that formally terminates the authority granted in a Power of Attorney, allowing individuals to revoke the powers previously delegated.

- Financial Statement – Although not strictly a legal document like the others, a comprehensive financial statement may be necessary to accompany a POA, providing a detailed overview of assets, liabilities, income, and expenses for financial management or planning purposes.

Each of these documents plays a distinct role in legal and financial affairs, offering a way to manage complexities that might arise due to illness, incapacity, or death. Creating a Texas Power of Attorney, along with these associated documents, enables individuals and their families to face the future with confidence, knowing that their wishes will be respected and their affairs handled according to their directives.

Similar forms

The Advance Healthcare Directive, also known as a living will, bears a striking resemblance to the Texas Power of Attorney form, primarily because it allows individuals to dictate their medical wishes in case they become incapacitated. This document ensures that a person’s healthcare preferences are respected and followed when they're unable to communicate their wishes themselves. Similar to a Power of Attorney, which grants another individual the authority to act on one’s behalf, an Advance Healthcare Directive appoints someone to make healthcare decisions according to the declarant's outlined preferences.

The Last Will and Testament is another document similar to the Texas Power of Attorney form, as it enables individuals to direct how their affairs should be handled after their passing. While a Power of Attorney is effective during a person’s lifetime and ceases upon their death, a Last Will takes effect only after death, directing the distribution of assets, guardianship of minor children, and various personal matters. Both documents are foundational in estate planning, ensuring a person's wishes are honored in life and in death.

A Guardianship Agreement shares similarities with the Texas Power of Attorney by appointing someone to make decisions on behalf of another, often focusing on minors or adults unable to make decisions for themselves. This agreement can cover a wide range of responsibilities, from financial decisions to everyday life care. Meanwhile, a Power of Attorney is typically used for adults, authorizing another person to act in a variety of legal or financial matters. Both documents serve to protect the interests and well-being of someone unable to manage their own affairs.

Finally, a Trust Agreement shares a common purpose with the Texas Power of Attorney, as both are designed to manage an individual's assets. A Trust Agreement creates a legal entity to hold assets for beneficiaries, which can be controlled by trustees. This arrangement provides a mechanism for asset management both during an individual's lifetime and after death. Much like a Power of Attorney, it offers a structured way to handle financial affairs, yet with a Trust, the focus is more on long-term management and distribution of assets according to the grantor's wishes.

Dos and Don'ts

When filling out the Texas Power of Attorney form, it's crucial to navigate the process with precision and care. This document grants another person the authority to act on your behalf in legal, financial, or health-related matters, making accuracy and clarity paramount. Here are essential dos and don’ts to consider.

Do:

- Read instructions carefully before filling out the form, to ensure you understand the scope and implications of granting power of attorney.

- Clearly identify the powers you are granting, specifying any limitations or conditions to tailor the agreement to your needs.

- Choose a trustworthy agent. This person will have significant control over your affairs, so it's vital to select someone who is both competent and reliable.

- Sign the form in the presence of a notary public. This step is essential for the document to be legally valid in Texas.

Don't:

- Rush through the paperwork without fully understanding the terms and conditions you are agreeing to. This could lead to unwanted consequences.

- Leave any sections incomplete. An incomplete form may lead to misunderstandings or disputes, potentially rendering the document invalid.

- Forget to specify an expiration date if you only want the power of attorney to be in effect for a certain period. Without this, the arrangement could continue indefinitely or until you revoke it.

- Fail to keep a copy of the signed document for your records and to give copies to relevant parties, such as financial institutions or healthcare providers, as needed.

Misconceptions

When it comes to the Texas Power of Attorney form, there are several misconceptions that can lead to confusion. Understanding what these are can help in making informed decisions when managing your legal affairs. Here are eight common misconceptions:

It grants control over all aspects of your life immediately. In reality, a Power of Attorney can be designed to only become effective under certain conditions, such as if you're unable to make decisions for yourself.

Once signed, it's permanent. This is not true. You can revoke a Power of Attorney at any time as long as you are mentally competent.

Creating a Power of Attorney means you don’t trust your family. Actually, it's a proactive measure to ensure your affairs are managed according to your wishes by someone you trust, minimizing family disputes.

Any Power of Attorney form works in Texas. Texas has specific requirements for these forms. It’s essential to use one that complies with Texas laws to ensure it's valid.

You don’t need an attorney to create one. While it’s possible to create a Power of Attorney without a lawyer, consulting with one can ensure it accurately reflects your wishes and meets all legal requirements.

All Powers of Attorney grant financial control. There are different types of Power of Attorney forms. Some may only grant medical decision-making powers, while others might specify financial powers or a combination of responsibilities.

The agent can make decisions against your wishes. In reality, an agent under a Power of Attorney is obligated to act in your best interests and according to your directives as stated in the document.

It's only for the elderly or terminally ill. Anyone can benefit from having a Power of Attorney. It’s a useful legal tool for unexpected situations where you might be unable to make decisions for yourself.

Understanding these misconceptions and the actual facts can help ensure that your Power of Attorney serves its intended purpose effectively and according to Texas laws.

Key takeaways

When it comes to filling out a Texas Power of Attorney (POA) form, understanding the process and requirements is key to ensuring that the document serves its intended purpose. Here are eight key takeaways to consider:

- Choose the right type of POA. Texas law recognizes different types of Power of Attorney forms, such as those for financial matters, medical decisions, or the care of a child. Select the form that matches your needs.

- Clearly identify the parties involved. The person granting authority is known as the "principal," and the one receiving it is the "agent" or "attorney-in-fact." Make sure names and contact information are accurate and complete.

- Specify powers granted. Clearly outline what decisions the agent can make on the principal's behalf. You can grant broad authority or limit powers to specific actions.

- Consider durability. A "durable" Power of Attorney remains in effect even if the principal becomes incapacitated. If you want the POA to continue during incapacity, specify this in the document.

- Notarization may be required. Texas law often requires a POA document to be notarized to be valid. Check the requirements for your specific type of POA.

- Witnesses can add validity. Although not always required, having witnesses sign the POA can increase its legitimacy and reduce potential challenges.

- Keep the document accessible. Once the POA is signed and notarized, keep it in a secure yet accessible place. Make sure the agent and relevant third parties know where to find it.

- Review and update as necessary. Circumstances change, which might necessitate updates to your POA. Regularly review the document and make adjustments as needed to reflect current wishes and situations.

Having a well-prepared Power of Attorney in place can provide peace of mind by ensuring that your affairs can be managed according to your wishes, even if you are unable to make decisions yourself. Consider consulting with a legal professional to ensure that your Power of Attorney effectively reflects your intentions and complies with Texas law.

Popular Power of Attorney State Forms

Types of Power of Attorney Indiana - Without a Power of Attorney in place, a court may need to appoint a guardian or conservator to take decisions on behalf of the incapacitated person, a process that can be lengthy and expensive.

Poa Form California - Specific or limited Power of Attorney grants the agent authority to conduct only certain acts, like selling a property, instead of handling all of the principal's affairs.

Does a Power of Attorney Need to Be Notarized in Florida - A power of attorney form allows someone to make decisions for you if you're unable to do it yourself.

Printable Power of Attorney Form Michigan - A Power of Attorney takes effect as soon as it's signed and notarized, or upon a triggering event you specify in the document.