Official Real Estate Power of Attorney Document

In the complex world of real estate transactions, individuals often find themselves in need of delegating authority to another party to manage, sell, purchase, or resolve issues related to property on their behalf. This delegation is formalized through a Real Estate Power of Attorney (POA) form, an essential legal document that grants a trusted person—the agent—the power to act in the property owner's stead. The significance of this document lies not only in its ability to facilitate seamless transactions but also in the protection it offers to all involved parties. The form covers extensive grounds, specifying the type of real estate transactions the agent is authorized to handle, the duration of the power granted, and the specific powers bestowed upon the agent. It serves as a safeguard, ensuring that the agent's actions align with the property owner's interests and legal requirements, thus preventing potential disputes or misunderstandings. Crafting a POA for real estate purposes requires careful consideration and a clear understanding of the legal implications to ensure that the property owner's rights and interests are adequately represented and protected.

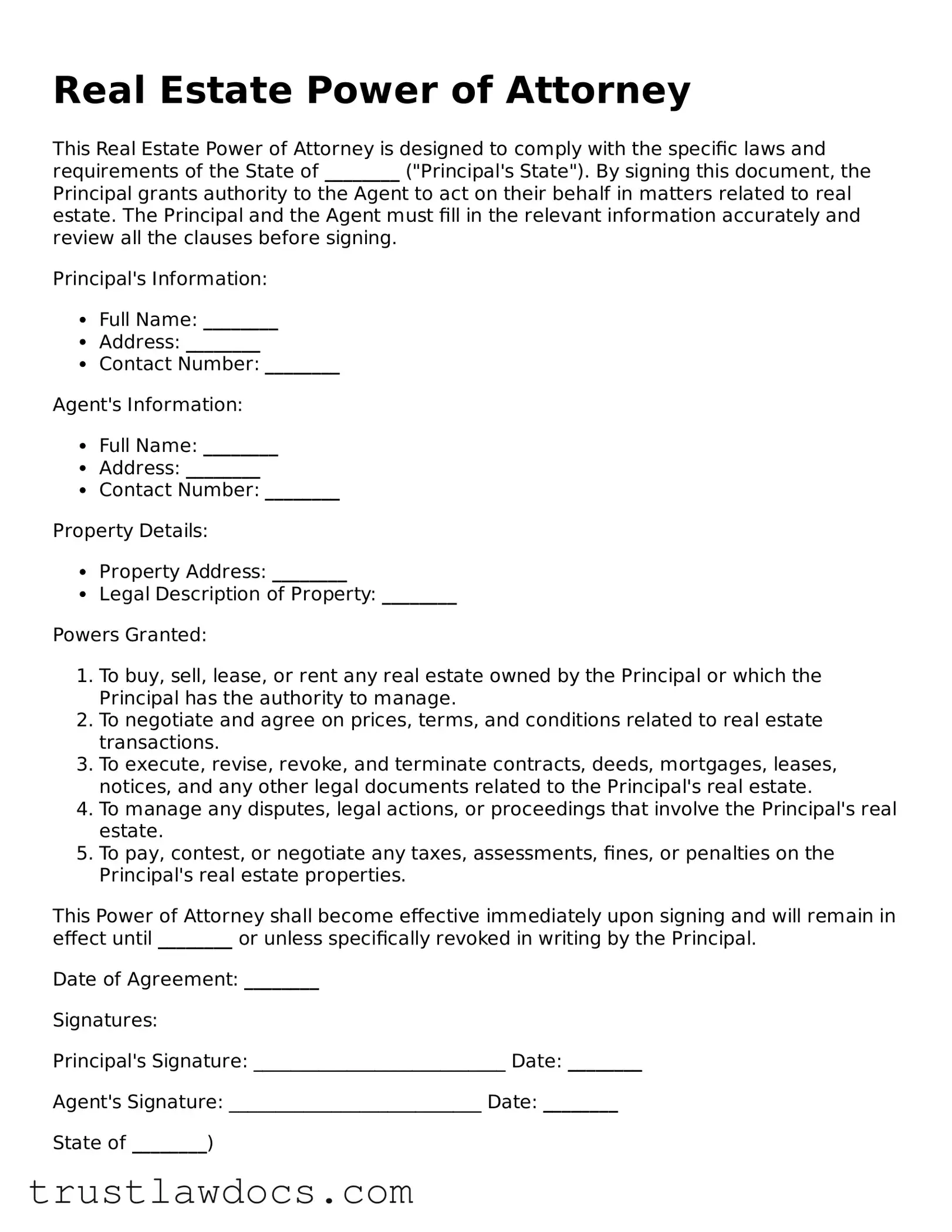

Form Example

Real Estate Power of Attorney

This Real Estate Power of Attorney is designed to comply with the specific laws and requirements of the State of ________ ("Principal's State"). By signing this document, the Principal grants authority to the Agent to act on their behalf in matters related to real estate. The Principal and the Agent must fill in the relevant information accurately and review all the clauses before signing.

Principal's Information:

- Full Name: ________

- Address: ________

- Contact Number: ________

Agent's Information:

- Full Name: ________

- Address: ________

- Contact Number: ________

Property Details:

- Property Address: ________

- Legal Description of Property: ________

Powers Granted:

- To buy, sell, lease, or rent any real estate owned by the Principal or which the Principal has the authority to manage.

- To negotiate and agree on prices, terms, and conditions related to real estate transactions.

- To execute, revise, revoke, and terminate contracts, deeds, mortgages, leases, notices, and any other legal documents related to the Principal's real estate.

- To manage any disputes, legal actions, or proceedings that involve the Principal's real estate.

- To pay, contest, or negotiate any taxes, assessments, fines, or penalties on the Principal's real estate properties.

This Power of Attorney shall become effective immediately upon signing and will remain in effect until ________ or unless specifically revoked in writing by the Principal.

Date of Agreement: ________

Signatures:

Principal's Signature: ___________________________ Date: ________

Agent's Signature: ___________________________ Date: ________

State of ________)

County of ________)

This document was acknowledged before me on ________ by ________ (Principal) and ________ (Agent).

Notary Signature: ___________________________

Notary Printed Name: ________

Commission Number: ________

My Commission Expires: ________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | A Real Estate Power of Attorney form allows an individual to designate someone else to manage real estate affairs on their behalf. |

| Functions | It can authorize the agent to buy, sell, manage, or conduct other real estate transactions. |

| Duration | This power of attorney can be set up to be either durable, meaning it stays in effect if the principal becomes incapacitated, or non-durable, which means it is voided if the principal is unable to make decisions. |

| Governing Laws | Each state has its own laws governing the creation and use of Real Estate Power of Attorney forms. Generally, they must comply with state real estate and power of attorney laws. |

| Signatory Requirements | The form typically requires the signature of the principal, the designated agent, and sometimes a notary or witnesses depending on the state’s requirements. |

| Revocation | The principal can revoke a Real Estate Power of Attorney at any time, as long as they are mentally competent, by notifying the agent in writing. |

How to Write Real Estate Power of Attorney

Filling out a Real Estate Power of Attorney form is a significant step in managing property transactions when you cannot be physically present or prefer someone else to act on your behalf. This legal document grants another person the authority to make decisions about your real estate, which can include buying, selling, and managing properties. The process requires attention to detail and accuracy to ensure that your interests are protected and all actions taken on your behalf are in accordance with your wishes. Below are the steps to guide you through accurately completing the Real Estate Power of Attorney form.

- Start by entering your full name and address at the top of the form, establishing you as the principal.

- Specify the full name and address of the person you are granting power to, known as the agent. Make sure to check the spelling and details for accuracy.

- Read through the powers section carefully, and mark the specific real estate transactions you are authorizing your agent to conduct. These can range from buying and selling to managing any of your real estate properties.

- If the form includes a section for limitations, specify any actions or decisions you do not want your agent to make concerning your property.

- Look for a section about the term or duration of the power of attorney. Fill in the dates specifying when the document will become effective and when it will expire, if applicable.

- Review the form to ensure that all information provided is accurate and reflects your desires regarding how your real estate affairs should be handled.

- Sign the document in the presence of a notary public. Most states require real estate power of attorney forms to be notarized to have legal effect.

- Have the agent sign the document, if required by your state or preferred for added validity.

- Store the original signed document in a secure place, and provide your agent with a copy so they can prove their authority when needed.

- Finally, inform relevant parties, such as your real estate agent or property manager, about the power of attorney and provide them with the necessary contact information for your authorized agent.

By following these steps meticulously, you can ensure that the Real Estate Power of Attorney form is completed correctly, granting the necessary powers to your chosen agent to manage your real estate affairs effectively. Remember, the accuracy of the information and adherence to legal requirements are crucial for the form's acceptance and efficacy in legal and real estate transactions.

Get Answers on Real Estate Power of Attorney

What is a Real Estate Power of Attorney?

A Real Estate Power of Attorney is a legal document that grants an individual (the agent) the authority to make decisions about buying, selling, managing, or leasing real estate on behalf of another person (the principal). This form is used to allow the principal to designate someone else to handle specific real estate transactions, especially in cases where the principal cannot be present to do so themselves.

Who can be designated as an agent in a Real Estate Power of Attorney?

Any competent adult, such as a trusted family member, friend, or professional advisor, can be designated as an agent. It's crucial that the principal chooses someone who is trustworthy and capable of handling the responsibilities that come with managing or making decisions about real estate, as the agent will have significant power over the principal's property.

How can a Real Estate Power of Attorney be revoked?

A Real Estate Power of Attorney can be revoked at any time by the principal, as long as the principal is mentally competent. To revoke the power of attorney, the principal should provide a written notice of revocation to the agent and to any institutions or parties that were aware of the original power of attorney. It is also advisable to record the revocation in the same places where the original power of attorney was recorded, especially if it involved real estate transactions.

Is a Real Estate Power of Attorney effective in case the principal becomes incapacitated?

Whether a Real Estate Power of Attorney remains effective after the principal's incapacitation depends on whether the document is designated as "durable." A durable power of attorney remains in effect if the principal becomes incapacitated, allowing the agent to continue making decisions about the principal’s real estate. If it is not specified as durable, it will generally cease to be effective upon the principal’s incapacitation.

Do I need a lawyer to create a Real Estate Power of Attorney?

While it is not strictly necessary to have a lawyer create a Real Estate Power of Attorney, consulting with a legal professional can be very beneficial. A lawyer can help ensure that the document clearly states the principal's intentions, complies with state laws, and addresses all necessary aspects of the real estate transactions it is intended to cover. They can also provide advice on selecting an agent and making the power of attorney durable, if desired.

Common mistakes

Filling out a Real Estate Power of Attorney (POA) form is a significant step in managing property transactions on behalf of another person. However, it's common for individuals to make errors during this process, potentially leading to legal complications. One prevalent mistake is not specifying the powers granted clearly. This document allows an agent to act on the principal's behalf, but its effectiveness is compromised if it doesn't detail the exact transactions the agent is authorized to perform, such as buying, selling, or managing real estate.

Another common oversight is failing to choose the right agent. This decision should not be taken lightly. The designated agent should be someone who is trustworthy, understands real estate transactions, and, ideally, has relevant experience. By choosing an agent based purely on personal relationships without considering their capability or reliability, principals risk their interests being poorly managed or, worse, exploited.

The lack of a durational limit is also a frequent mistake. A POA can grant immense control over one’s financial and legal affairs, therefore, it's crucial to stipulate when this authority begins and ends. Some prefer their POA to be effective immediately and for a defined period, while others might opt for a "springing" power, which comes into effect under specific conditions, such as the principal's incapacitation. Without clear timing, the document’s applicability could be too broad or too limited.

People often miss the necessity for proper witnesses and notarization. The requirements vary by state, but generally, a Real Estate POA must be signed in the presence of a notary, and sometimes, witnesses. Skipping this step can render the document legally invalid, leading to disputes or refusal by institutions to recognize the agent's authority.

Forgetting to consider state-specific laws is another pitfall. Real estate laws and requirements for a POA can differ significantly from one jurisdiction to another. A form that is valid in one state might not be in another. Ignorance of these nuances can invalidate the document or certain provisions within it, causing unforeseen hurdles in property management or transactions.

A significant error is not updating the POA when circumstances change. Life events such as divorce, the death of the designated agent, or a shift in the principal's intentions can affect the relevancy and functionality of the POA. Regular review and necessary updates ensure that the document reflects the current wishes of the principal and adheres to any changes in law.

Last but not least, a subtle yet impactful mistake is neglecting to provide copies of the POA to relevant parties. Banks, real estate agents, and others involved in property transactions require access to this document to verify the agent’s authority. Failure to distribute copies as needed can lead to delays and complications in executing the principal’s directives.

Documents used along the form

In the process of managing real estate transactions, the Real Estate Power of Attorney (POA) form plays a critical role. It grants someone the legal authority to act on your behalf in matters related to your property, including buying, selling, and managing. However, when dealing with real estate transactions, several other key documents often accompany the POA to ensure the process is thorough and legally sound. These complementary documents vary based on the transaction's specifics, but each serves an important function in safeguarding the interests of all parties involved.

- Deed: This critical document officially transfers property ownership from the seller to the buyer. Depending on the transaction, different types of deeds (general warranty, special warranty, quitclaim) offer varying levels of protection against future claims on the property.

- Title Search Report: This report reveals the property's legal status, including ownership, liens, encumbrances, and any issues that might affect the title. It's essential for ensuring the property can be legally transferred.

- Title Insurance Policy: To protect against potential defects in the title not discovered during the title search, buyers often obtain title insurance. This policy provides financial protection against losses arising from title issues.

- Home Inspection Report: Before finalizing a real estate transaction, a professional home inspector is usually hired to assess the property's condition. This report identifies any problems or repairs that might be needed.

- Appraisal Report: An appraisal provides an independent estimate of the property's value. Lenders require appraisals to ensure the property's value matches the loan amount.

- Loan Documents: If the purchase involves a mortgage, various loan documents will be part of the transaction. These include the mortgage agreement, disclosure statements, and the promissory note indicating the loan's repayment conditions.

- Closing Disclosure: This document outlines the final terms of the loan and the closing costs. Buyers and sellers receive it before completing the transaction, providing transparency and allowing for review before finalizing the deal.

- Home Warranty Policy: This optional policy covers the cost of repairing or replacing certain systems and appliances in the home that might fail after the purchase is completed.

- HOA Documents: If the property is part of a homeowners’ association (HOA), the buyer should review the HOA's covenants, conditions, and restrictions (CC&Rs), bylaws, and financial statements to understand the rules and fees associated with the property.

While the Real Estate Power of Attorney form grants authority to act on the principal's behalf, the documents listed above play their own roles in ensuring the legality, financial prudence, and physical condition of the property in question are fully considered. Understanding each document's purpose and requirement can significantly enhance the efficiency and security of any real estate transaction.

Similar forms

The General Power of Attorney form is similar to the Real Estate Power of Attorney form, as both empower someone else to act on your behalf. The main distinction is that while the Real Estate Power of Attorney specifically allows the agent to manage your real estate transactions, the General Power of Attorney grants them broader powers. These can include handling financial and business transactions, making healthcare decisions, and more, depending on how it's drafted.

The Durable Power of Attorney is another document closely related to the Real Estate Power of Attorney. The key similarity is the authority both documents grant to an agent. However, the difference lies in their operational timelines. A Durable Power of Attorney remains in effect if you become incapacitated, whereas a non-durable Real Estate Power of Attorney may not. This ensures that your agent can continue managing your real estate affairs even if you're unable to make decisions yourself.

A Health Care Proxy shares a foundational concept with the Real Estate Power of Attorney in that it appoints someone to make specific decisions on your behalf. However, its focus is entirely on healthcare decisions, unlike the real estate focus of the latter. This document activates when you are unable to make medical decisions for yourself, ensuring that your health care wishes are respected and followed.

A Financial Power of Attorney, much like the Real Estate Power of Attorney, designates someone to manage certain affairs for you. This document pertains specifically to your financial matters, such as banking transactions, investments, and managing your financial assets. While it can include real estate transactions, its scope is broader, covering any financial decision-making authority you choose to grant.

The Limited Power of Attorney is closely aligned with the Real Estate Power of Attorney by offering a way to grant specific powers to an agent. The difference lies in the scope and duration of the authority granted. A Limited Power of Attorney could be drafted to include not just real estate matters but any task, and it usually has a set term or is for a single transaction, making it more restrictive than a more open-ended Real Estate Power of Attorney.

An Advance Directive is conceptually similar to the Real Estate Power of Attorney, providing instructions for future scenarios. While an Advance Directive specifically outlines your wishes regarding medical treatment and end-of-life care, a Real Estate Power of Attorney focuses on property management. Both documents ensure your personal matters are handled according to your wishes when you're not in a position to communicate them.

The Springing Power of Attorney has a unique trigger mechanism which relates to its similarity with the Real Estate Power of Attorney. It is designed to become effective only under certain circumstances, such as the principal's incapacitation, similar to how some Real Estate Power of Attorney documents may be structured. This setup aims to maintain control over when the agent's authority begins, offering a safeguard for the principal's assets and interests until it's necessary to hand over control.

Dos and Don'ts

Filling out a Real Estate Power of Attorney form is a significant step in managing your property-related matters effectively, especially if you won’t be able to handle them personally. This document allows someone else to act in your stead for real estate transactions. To ensure the process goes smoothly and your interests are securely represented, here are vital dos and don'ts to keep in mind:

Do:

- Review the form carefully to understand all the sections and what is being asked. It’s important to know exactly what powers you are granting.

- Choose a trusted person as your agent who has your best interests at heart and understands the responsibilities involved.

- Be specific about the powers you are granting. You can limit the authority to certain acts or transactions to safeguard your property.

- Include a termination date for the Power of Attorney to ensure it is not open-ended. This limits the time frame during which your agent can act on your behalf.

- Have the document notarized to confirm its validity. Notarization is a legal requirement in many states for Real Estate Power of Attorney forms.

Don't:

- Leave any sections incomplete. An incomplete form may lead to misunderstandings or legal challenges in the future.

- Forget to review and update the document as your situation or relationships change. It’s important to keep the document current to reflect your present wishes.

- Ignore local laws and requirements. Real estate laws can vary significantly from one jurisdiction to another, so it’s crucial to ensure your document complies with local regulations.

- Sign the document without witnesses present, if required by law. Witnesses can provide an additional layer of legal protection and authenticity.

- Rush through the process without understanding every aspect of the document. Take your time, consider consulting a legal professional, and make informed decisions.

Misconceptions

There are several misconceptions surrounding the Real Estate Power of Attorney (POA) form that can lead to confusion and misunderstandings. Addressing these misconceptions is crucial for anyone considering or dealing with real estate transactions through a POA.

A Real Estate Power of Attorney grants unlimited power. This is a common misconception. In reality, the scope of authority granted by a Real Estate POA can be highly specific and limited to certain acts, such as selling or managing a property on behalf of the principal. The granular details of the powers can be tailored to fit the principal's precise needs and intentions.

Only the elderly or incapacitated need a Real Estate Power of Attorney. While it's true that Real Estate POA forms are often used in situations where someone is unable to manage their affairs due to age or incapacity, they are also utilized by individuals who are physically unable to be present for transactions or who find it more convenient to have someone else handle certain affairs. For example, someone living abroad might use a Real Estate POA to manage or sell property in their home country.

Creating a Real Estate Power of Attorney is a complicated process. The process can be straightforward with proper guidance. While it's essential to ensure that the document clearly outlines the powers granted and complies with state laws, many templates and professional services can help simplify this process. It's always recommended to consult with a legal professional to ensure the POA meets all legal requirements and accurately reflects the principal’s wishes.

A Power of Attorney for real estate is irrevocable. Many believe that once a Real Estate Power of Attorney is created, it cannot be changed or revoked. This is not the case. The principal can revoke or amend the POA as long as they are mentally competent. It's important to follow the proper legal procedures for revocation to ensure it is effective and to inform any relevant parties of the change.

Key takeaways

Navigating real estate transactions can be complex, but leveraging a Real Estate Power of Attorney (POA) can greatly simplify the process for individuals who cannot be physically present or prefer to delegate these tasks. Understanding the nuances of this powerful document can ensure its effectiveness and protect all parties involved. Below are key takeaways every individual should know when filling out and using a Real Estate Power of Attorney form:

- Clarity is key: When completing a Real Estate POA, it's critical to be as clear and precise as possible regarding the powers you're granting. This means specifying which property or properties the POA covers, the exact duties you're delegating (e.g., buying, selling, managing), and any limitations to these powers. Vague language can lead to misunderstandings or misuse of the POA.

- Choose your agent wisely: The person you designate as your agent (also known as an attorney-in-fact) will have significant authority over your real estate matters. It's essential to select someone trustworthy, reliable, and ideally with some knowledge of real estate. Remember, this individual will act on your behalf, so their honesty and competency are paramount.

- Understand the types of POAs: Real Estate POAs come in different forms, such as durable and springing. A durable POA remains in effect if you become incapacitated, while a springing POA takes effect only under conditions you specify, such as if you are not physically able to sign documents yourself. Deciding on the type that best suits your needs is a crucial step in the process.

- State laws vary: Real estate laws and regulations differ significantly from state to state, including the requirements for executing a POA. Some states might require the POA to be notarized, witnessed, or both. It's important to consult local laws or a legal professional in your area to ensure your Real Estate Power of Attorney complies with local requirements, thereby ensuring its validity and enforceability.

By keeping these points in mind, you can confidently use a Real Estate Power of Attorney to your advantage, ensuring your real estate matters are handled according to your wishes, even in your absence.

Consider More Types of Real Estate Power of Attorney Forms

How to Write a Notarized Letter for a Vehicle - Essential for those who frequent auctions, enabling agents to bid and purchase on their behalf without constant direct communication.

Florida Minor Power of Attorney - It's a way for parents to ensure their child's continuity of lifestyle and care in their absence.