Free Power of Attorney Form for New York

In today’s complex legal and financial environment, ensuring that your affairs are managed according to your wishes is more important than ever. The New York Power of Attorney form stands as a critical document for anyone looking to secure their financial interests and decision-making capabilities, should they become unable to do so themselves. This legally binding document grants a trusted individual or entity the authority to act on your behalf in various capacities, ranging from handling banking transactions to making real estate decisions. With its comprehensive nature, the form embodies specific stipulations that cater to the unique legal standards of New York State, thereby necessitating a clear understanding of its application and implications. Drafted with precision, it requires thorough contemplation of the powers being granted, ensuring that your rights and intentions are adequately protected. As such, it serves not only as a testament to your foresight but also as a safeguard for your financial and personal autonomy.

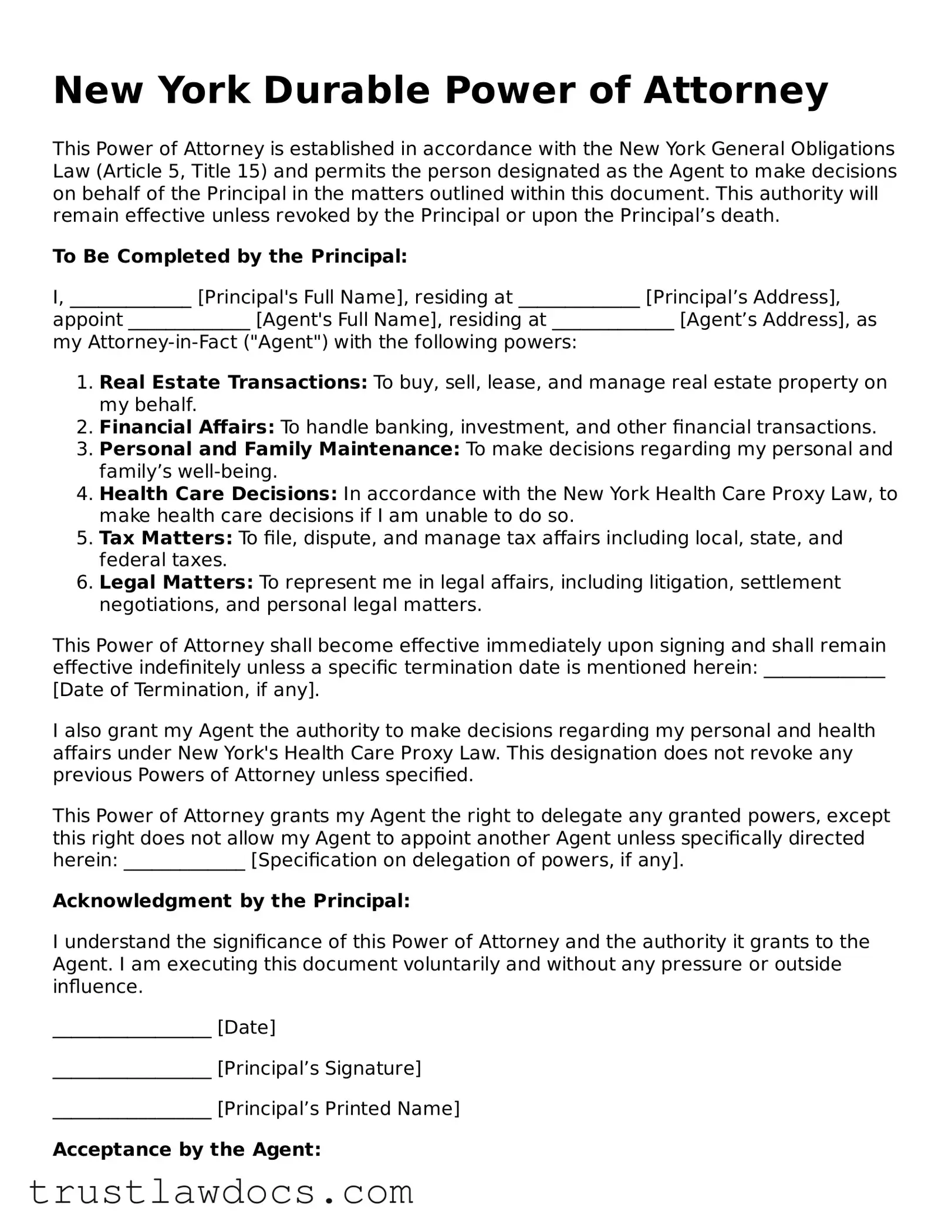

Form Example

New York Durable Power of Attorney

This Power of Attorney is established in accordance with the New York General Obligations Law (Article 5, Title 15) and permits the person designated as the Agent to make decisions on behalf of the Principal in the matters outlined within this document. This authority will remain effective unless revoked by the Principal or upon the Principal’s death.

To Be Completed by the Principal:

I, _____________ [Principal's Full Name], residing at _____________ [Principal’s Address], appoint _____________ [Agent's Full Name], residing at _____________ [Agent’s Address], as my Attorney-in-Fact ("Agent") with the following powers:

- Real Estate Transactions: To buy, sell, lease, and manage real estate property on my behalf.

- Financial Affairs: To handle banking, investment, and other financial transactions.

- Personal and Family Maintenance: To make decisions regarding my personal and family’s well-being.

- Health Care Decisions: In accordance with the New York Health Care Proxy Law, to make health care decisions if I am unable to do so.

- Tax Matters: To file, dispute, and manage tax affairs including local, state, and federal taxes.

- Legal Matters: To represent me in legal affairs, including litigation, settlement negotiations, and personal legal matters.

This Power of Attorney shall become effective immediately upon signing and shall remain effective indefinitely unless a specific termination date is mentioned herein: _____________ [Date of Termination, if any].

I also grant my Agent the authority to make decisions regarding my personal and health affairs under New York's Health Care Proxy Law. This designation does not revoke any previous Powers of Attorney unless specified.

This Power of Attorney grants my Agent the right to delegate any granted powers, except this right does not allow my Agent to appoint another Agent unless specifically directed herein: _____________ [Specification on delegation of powers, if any].

Acknowledgment by the Principal:

I understand the significance of this Power of Attorney and the authority it grants to the Agent. I am executing this document voluntarily and without any pressure or outside influence.

_________________ [Date]

_________________ [Principal’s Signature]

_________________ [Principal’s Printed Name]

Acceptance by the Agent:

I, _____________ [Agent's Full Name], accept the designation as Attorney-in-Fact for _____________ [Principal's Full Name] and swear to act in the Principal’s best interest to the best of my abilities. I acknowledge that I may be held liable for any willful misconduct that occurs during my tenure as Agent.

_________________ [Date]

_________________ [Agent’s Signature]

_________________ [Agent’s Printed Name]

Witness Acknowledgement (if applicable):

This document was signed by the Principal and Agent in the presence of undersigned witnesses, who also sign below to verify the Principal's mental capacity and voluntary execution of this Power of Attorney.

Witness 1 Signature: _____________

Witness 1 Printed Name: _____________

Witness 2 Signature: _____________

Witness 2 Printed Name: _____________

Notarization (if applicable):

This document was acknowledged before me on this date: _____________ [Date]

by _____________ [Name of Principal].

______________________________________

Notary Public Signature

Notary Public Printed Name: _____________

My Commission Expires: _____________

PDF Form Details

| Fact | Detail |

|---|---|

| Governing Law | New York General Obligations Law, Article 5, Title 15 |

| Form Type | Statutory Short Form Power of Attorney and New York Statutory Gifts Rider (optional) |

| Mandatory Signing Requirements | The principal and agent must sign the form in the presence of a notary public or two witnesses not related to the principal. |

| Effective Date Options | Immediately upon signing or upon the principal's incapacitation, if stated. |

| Durability | Remains effective even if the principal becomes incapacitated, unless stated otherwise. |

| Revocation | The principal may revoke the power of attorney at any time as long as they are mentally competent or by creating a new power of attorney document. |

How to Write New York Power of Attorney

Filling out a Power of Attorney (POA) form in New York is a critical step in authorizing someone to legally act on your behalf in various matters. This document can encompass a wide range of responsibilities, from handling your financial affairs to making healthcare decisions. It's important to approach this task with attention to detail to ensure that your interests are protected and your instructions are clear. Below are the steps needed to complete the New York Power of Attorney form accurately.

- Start by reading the instructions provided at the beginning of the form carefully. Understanding these guidelines is crucial for accurately completing the document.

- Enter your full legal name and address in the designated section at the top of the form to identify yourself as the principal.

- Appoint your agent by filling in their full legal name and contact details. If you wish to appoint a successor agent (optional), provide their information in the corresponding section.

- Specify the powers you are granting to your agent. Be clear and precise in identifying what your agent is authorized to do on your behalf. Check the appropriate boxes next to the powers you are granting.

- Indicate any special instructions or restrictions regarding the powers granted to your agent. This section is critical for tailoring the POA to your specific needs and circumstances.

- Fill in the section on when the POA is effective and its duration. Specify if the POA is effective immediately, upon a specific date, or upon the occurrence of a certain event. Also, indicate if it is durable or terminates upon a specific date or event.

- Review the form to ensure all provided information is accurate and complete. Any mistakes can affect the validity or the execution of the POA.

- Sign and date the form in front of a notary public. The notarization process is mandatory for the POA to be legally valid in New York.

- Have your agent sign the form as well, acknowledging their acceptance of the responsibilities assigned to them. This step may also need to be completed in the presence of a notary.

- Keep the original signed document in a safe but accessible place, and provide your agent with a copy. It's also advisable to give a copy to your attorney, if you have one, and any financial institutions or healthcare providers that may require it.

With these steps completed, you have successfully filled out the New York Power of Attorney form. This document is now a legal record authorizing your agent to act on your behalf in the defined capacities. It's recommended to review and, if necessary, update your POA periodically to ensure it continues to reflect your wishes and circumstances.

Get Answers on New York Power of Attorney

What is a New York Power of Attorney form?

A New York Power of Attorney (POA) form is a legal document that grants one person, known as the agent or attorney-in-fact, the authority to act on behalf of another person, known as the principal, in financial matters. This can include managing bank accounts, signing documents, and handling real estate transactions.

Why might someone need a Power of Attorney in New York?

Individuals often need a Power of Attorney when they are unable to handle their financial affairs personally. This can be due to being out of the country, physical incapacity, or other reasons where delegation of financial decision-making is necessary or prudent.

How can one obtain a Power of Attorney form in New York?

Power of Attorney forms for New York can be obtained from several sources, including legal document websites, attorneys who specialize in estate planning or elder law, and sometimes from banks or financial institutions. It's important to ensure that the form complies with New York State law to be valid.

Who can be designated as an agent in a Power of Attorney?

Any competent adult can be designated as an agent in a Power of Attorney. It is vital to choose someone who is trustworthy and capable of handling financial matters responsibly, as they will have significant authority over the principal's affairs.

Are there different types of Power of Attorney forms in New York?

Yes, New York recognizes several types of Power of Attorney forms, including General, Durable, and Limited POA. Each serves different purposes and offers different levels of authority and duration.

What makes a Power of Attorney legally binding in New York?

To be legally binding in New York, a Power of Attorney must be signed by the principal, properly witnessed, and comply with New York State laws. Additionally, the form must be notarized to be valid.

Can a New York Power of Attorney be revoked?

Yes, a principal can revoke a Power of Attorney at any time, as long as they are mentally competent. To revoke the POA, the principal should provide written notice to the agent and any institutions or parties that were relying on the POA.

Does a Power of Attorney need to be filed with any government office in New York?

No, a Power of Attorney does not need to be filed with any government office in New York to be effective. However, for real estate transactions, the POA may need to be filed with the county clerk's office where the property is located.

What happens if the principal becomes incapacitated?

If the Power of Attorney is "durable," it remains in effect even if the principal becomes incapacitated. If it's not specified as durable, the POA would automatically terminate upon the principal's incapacitation.

Are there any limitations on what an agent can do with a Power of Attorney?

Yes, the scope of the agent's authority is limited to what is specifically granted in the Power of Attorney document. New York law also prohibits certain actions, like making health care decisions or executing a will on behalf of the principal.

Common mistakes

Filling out a New York Power of Attorney (POA) form marks a significant step towards ensuring one's affairs will be handled according to their wishes, should they become unable to manage them independently. However, this task is fraught with complexities that can lead to critical errors if not approached with care. One common mistake is neglecting to select a specific type of POA, leading to ambiguities about what powers the agent actually holds. A general POA might be too broad for someone's comfort, while a limited POA might not offer the comprehensive authority needed in certain situations. Understanding the differences and implications is essential.

Another frequent oversight is failing to designate an alternate agent. Life's unpredictability means that the initially chosen agent might not always be available or capable of acting when needed. Without specifying a successor, the document risks becoming ineffective precisely when it's needed most, leaving one's affairs in limbo. It's about preparing for every contingency.

A third pitfall involves inadequate specificity in defining the agent's powers. While it might seem easier to grant broad authority, this lack of specificity can lead to problems down the road. It's crucial to granularly detail the powers being granted, ensuring they align precisely with one’s wishes and cover all necessary aspects of one’s affairs, from financial management to healthcare decisions.

Improper execution of the POA form is yet another common error. New York law requires adherence to specific signing and witnessing protocols for a POA to be legally valid. Skipping any of these steps, such as not having the form notarized or forgetting to have the necessary witnesses, can render the document non-binding. Furthermore, overlooking the requirement to provide explicit instructions for gifting powers limits the agent's ability to manage the principal’s estate effectively or undertake estate planning measures, which could have significant tax implications.

A lack of regular updates constitutes a mistake with potential long-term consequences. As life evolves, so too do relationships and one's wishes regarding how affairs should be managed. By not periodically reviewing and updating the POA, one risks having an outdated document that does not accurately reflect current wishes or account for changed relationships.

Some individuals mistakenly believe that a POA includes medical decision-making by default. However, in New York, a separate Health Care Proxy form is required to grant an agent the authority to make medical decisions on someone’s behalf. Confusing these distinct legal documents can leave critical healthcare decisions unaddressed within the scope of a standard POA.

Underestimating the importance of discussing the POA’s contents with the named agent(s) is another blunder. This conversation ensures that the agent understands their responsibilities, the extent of the powers granted to them, and the principal's expectations. Without this understanding, agents may act in ways that are inconsistent with the principal's wishes, potentially leading to conflicts.

Finally, assuming that a POA form filled out in another state will be valid in New York can lead to unpleasant surprises. Each state has its own laws governing the execution and validity of POA documents. A POA executed in accordance with another state's laws might not be recognized in New York, undermining its intended purpose.

In conclusion, carefully navigating these common pitfalls when filling out a New York Power of Attorney form is crucial. By paying meticulous attention to the type of POA, designating alternate agents, specifying powers, ensuring the document's proper execution, updating it regularly, understanding its limitations, discussing it with the chosen agent, and ensuring it complies with New York laws, individuals can provide for the management of their affairs with confidence, knowing their wishes will be respected and carried out.

Documents used along the form

In New York, the Power of Attorney (POA) form is an essential document enabling individuals to authorize others to make decisions on their behalf, concerning finances, legal matters, and certain personal life aspects. While the POA is pivotal, it often works in conjunction with other legal forms and documents to ensure thorough planning and execution of one's wishes. This set of documents can protect an individual's interests in various situations and provide clarity to the appointed agents about their roles and boundaries.

- Health Care Proxy: This document allows individuals to appoint someone to make health care decisions for them if they become incapacitated. This is separate from the POA, focusing solely on health care issues.

- Living Will: A living will makes known an individual's wishes regarding medical treatment if they become unable to communicate those wishes themselves, especially concerning life-sustaining measures.

- Will (Last Will and Testament): Specifies how an individual's assets and estate should be distributed upon their death. It identifies beneficiaries, guardians for minor children, and an executor to manage the estate settlement process.

- Standby Guardianship Form: This form designates a guardian for minor children or dependent adults in the event the primary caretaker becomes unable to care for them, temporarily or permanently.

- Revocation of Power of Attorney Form: This document legally cancels a previously granted Power of Attorney, ensuring that the powers granted can be formally taken back when desired.

- Durable Power of Attorney for Finances: A specific form of POA that remains in effect even if the principal becomes incapacitated, focusing specifically on financial decisions and transactions.

- Advance Directive: Combines a living will and a health care proxy, outlining an individual's wishes for medical treatments and appointing an agent to make health care decisions on their behalf.

- Trust Agreement: Not necessarily used alongside a POA but often part of estate planning. This document sets up a trust to manage an individual’s assets, sometimes offering tax benefits or helping skip the probate process.

Together, these documents form a comprehensive legal framework that addresses a wide range of personal, financial, and medical decisions. Having a complete set of these forms prepared and in place can offer peace of mind to individuals and their families, ensuring that their wishes are respected and followed, even in their absence or incapacity. As each document serves a specific purpose, it’s critical to understand the role it plays within the broader scope of personal and estate planning to ensure the best protection and control over personal matters.

Similar forms

The New York Power of Attorney form shares similarities with the Medical Power of Attorney, as both grant authority to another individual to make decisions on one's behalf. The Medical Power of Attorney, specifically, allows the appointed person to make healthcare decisions if the principal becomes incapacitated or unable to communicate their wishes. This is similar to the broad authority that can be given in the Power of Attorney document, although it's specifically tailored to medical-related decisions.

Comparable to the New York Power of Attorney form is the Durable Power of Attorney. Durable Powers of Attorney are designed to remain in effect even if the principal becomes mentally incapacitated. This enduring aspect sets the Durable Power of Attorney apart from a standard Power of Attorney, which typically ceases to be effective if the principal loses mental capacity, unless stated otherwise in the document itself.

The Limited Power of Attorney form is another document that bears resemblance to the New York Power of Attorney form. However, its scope is more confined. A Limited Power of Attorney awards specific powers to the agent for a limited time or for specific tasks, such as selling a property or handling financial transactions, in contrast to the broader powers that may be assigned in a general Power of Attorney.

Similarly, the General Power of Attorney form and the New York Power of Attorney form provide extensive powers to the agent to act on the principal's behalf. The key difference lies in their geographical applicability and any state-specific nuances; otherwise, both documents function to broadly delegate authority across various matters without the narrow focus seen in more specific forms of Power of Attorney.

The Financial Power of Attorney is akin to the New York Power of Attorney form in that it permits an agent to handle financial affairs on behalf of the principal. This can include managing bank accounts, paying bills, and making investment decisions. The similarity revolves around the financial authority granted, though the New York Power of Attorney could encompass a wider range of powers beyond just financial matters.

The Trust is another legal document that, while structurally and functionally different from a Power of Attorney, has overlapping objectives regarding managing and protecting assets for the benefit of designated beneficiaries. Unlike a Power of Attorney that appoints an agent to manage the principal's affairs, a Trust establishes a fiduciary relationship where the Trustee manages the Trust's assets for the beneficiaries.

The Will, much like the New York Power of Attorney form, is a document that specifies directives for personal matters. While a Power of Attorney is operative during the lifetime of the principal and focuses on decision-making authority, a Will comes into effect upon the principal's death, detailing how their assets should be distributed among heirs.

The Guardianship form shares objectives with the New York Power of Attorney by ensuring someone can make decisions for another. Guardianship is often used when an individual is unable to make decisions for themselves due to youth or incapacity. Unlike a Power of Attorney, which is arranged before incapacity and can be chosen by the individual, a court usually appoints guardianship in a legal proceeding.

The Advance Directive, parallel to the Power of Attorney, enables individuals to outline their wishes regarding medical treatment and care in advance. Though an Advance Directive specifically addresses healthcare decisions and end-of-life care, reflecting the focused scope of a Medical Power of Attorney, both documents serve to guide decisions when the individuals themselves are unable to communicate their preferences.

Dos and Don'ts

When filling out the New York Power of Attorney form, accuracy and attention to detail are paramount. This document grants someone else the authority to make decisions on your behalf, so it's critical to get it right. Here are some guidelines to ensure you complete the form correctly and avoid common pitfalls.

Do's:

- Read all instructions carefully before beginning to fill out the form. Understanding the scope and implications of the document is crucial.

- Use the full legal names and accurate addresses for both the principal and the agent to avoid any confusion or legal challenges down the line.

- Be specific about the powers you are granting. The form allows you to delineate exactly what your agent can and cannot do on your behalf.

- Have the document notarized. This step is essential for the power of attorney to be recognized as valid in the State of New York.

- Keep a copy of the document for your records. It's also wise to provide a copy to your agent and any other relevant parties, such as your attorney.

- Review and update the document as necessary. Life changes might necessitate adjustments to the powers granted.

- Consult with a legal professional if you have any doubts or questions about how to fill out the form or the implications of the powers you are granting.

Don'ts:

- Don't rush through the process without understanding every part of the document. Making an error can lead to unintended consequences.

- Don't use vague language when defining the scope of authority. Ambiguities could lead to power disputes or legal challenges.

- Don't forget to sign and date the form. An unsigned Power of Attorney is invalid.

- Don't withhold discussing your decision with the person you're appointing as your agent. It's imperative they understand their responsibilities and agree to take on the role.

- Don't neglect to inform your financial institutions and other relevant entities about the Power of Attorney. They need to be aware of the change to recognize your agent's authority.

- Don't appoint someone you do not fully trust. The power of attorney grants significant authority and control over aspects of your life and assets.

- Don't fail to consider state-specific requirements. Ensure the form complies with New York laws to avoid any legal issues.

Misconceptions

When it comes to legal documents, the Power of Attorney (POA) form in New York is often surrounded by misunderstandings. These documents are crucial in granting someone else the power to act on your behalf for financial or legal matters. Let’s debunk five common misconceptions about the New York POA form.

It grants unlimited power. A common misconception is that a Power of Attorney gives the designated person (agent) complete control over all personal affairs. In reality, the New York POA form allows the principal (the person who creates the POA) to specify exactly what powers the agent can exercise, making it possible to limit their authority to specific actions or transactions.

It remains valid after death. Another myth is that a POA continues to be effective after the principal’s death. However, all POA forms in New York, and indeed in most jurisdictions, become void upon the death of the principal. At that point, the executor of the estate, as stated in the will, takes over.

Only seniors need a POA. Many people think that POAs are only for the elderly. While it's true that aging individuals may have a more pressing need for a POA, due to the increased likelihood of incapacity, adults of all ages can benefit from having a POA in place. It's about preparedness and ensuring that someone you trust can legally act on your behalf if you become unable to do so yourself.

Creating a POA is a complex and expensive process. Some believe that establishing a POA involves an intricate and costly legal process. However, in New York, while it's important that the POA form meets all legal requirements, the process itself is not necessarily complicated or expensive. Forms are readily available and can be completed without a lawyer, though consulting one can ensure it is done correctly.

A lawyer must be the agent. There’s a notion that the person you appoint as your agent under a POA must be a lawyer. This is not the case. While it's essential that the appointed agent is someone trustworthy, there are no legal requirements for them to be a professional or to have any specific qualifications other than being a competent adult.

Understanding what a Power of Attorney form in New York encompasses and what it does not is crucial. A correctly executed POA can serve as a powerful tool in managing your affairs, ensuring that your financial matters and legal decisions are handled as per your wishes, should you become unable to do so yourself.

Key takeaways

Understanding and using the New York Power of Attorney (POA) form is crucial for ensuring your wishes are carried out effectively when you're unable to act on your own behalf. Here are key takeaways to remember when filling out and using this form:

- Choose Your Agent Wisely: Your agent (or "attorney-in-fact") will have significant power over your affairs. Select someone you trust completely and who understands your wishes.

- Be Specific About Powers Granted: Clearly outline what your agent can and cannot do on your behalf. The POA form allows you to grant broad or limited authority.

- Durability is Key: A "Durable" POA remains in effect even if you become incapacitated. Without this specification, the POA would end if you were no longer mentally competent.

- Multiple Agents: You can appoint more than one agent. If you do, decide whether they can act separately or if they must make decisions together.

- Monitor Your Agent: Even with complete trust in your agent, it’s wise to have a system in place to monitor their actions. This can prevent abuse of power and ensure your wishes are being followed.

- Signing Requirements: For a POA to be valid in New York, it must be signed by you (the principal) and notarized. In some cases, witnesses may also be required.

- Revocation Process: You have the right to revoke your POA at any time, provided you are mentally competent. This revocation should be in writing and properly communicated to your agent and any institutions that were relying on the original POA.

- Seek Legal Advice: Filling out a POA form can involve complex decisions. Consulting with a legal professional can help ensure that the form accurately reflects your wishes and is executed properly.

Popular Power of Attorney State Forms

Does a Power of Attorney Need to Be Notarized in Florida - Creating a power of attorney form is a critical step in estate planning and managing future uncertainties.

Poa Form California - This legal instrument is often part of estate planning, alongside wills, trusts, and advanced healthcare directives.

Printable Power of Attorney Form Michigan - Without a Power of Attorney, your family may face lengthy and complicated court processes to manage your affairs should you become incapacitated.

How to Get a Power of Attorney in Texas - It typically becomes active immediately upon signing, unless stated otherwise.