Free Motor Vehicle Power of Attorney Form for New York

Imagine having someone you trust handle all the matters related to your motor vehicle in New York, from registration and titling to dealing with the Department of Motor Vehicles (DMV) on your behalf. With the New York Motor Vehicle Power of Attorney form, this doesn't have to be just in your imagination. It's a legal document that allows vehicle owners to appoint an agent to act in their stead for transactions concerning their motor vehicle. This could range from buying or selling the vehicle, registering it, transferring titles, to obtaining plates, making this form an indispensable tool for those unable to attend these matters personally. Whether you're out of the state, incapacitated, or simply too busy, having this form in place ensures that your vehicle-related tasks are managed without a hitch. The importance of accurately completing this form cannot be overstated, as it grants significant legal powers concerning one of your most valuable assets. Thus, understanding its provisions and the correct way to fill it out is the first step towards safeguarding your interests while entrusting someone with your vehicle's legal matters.

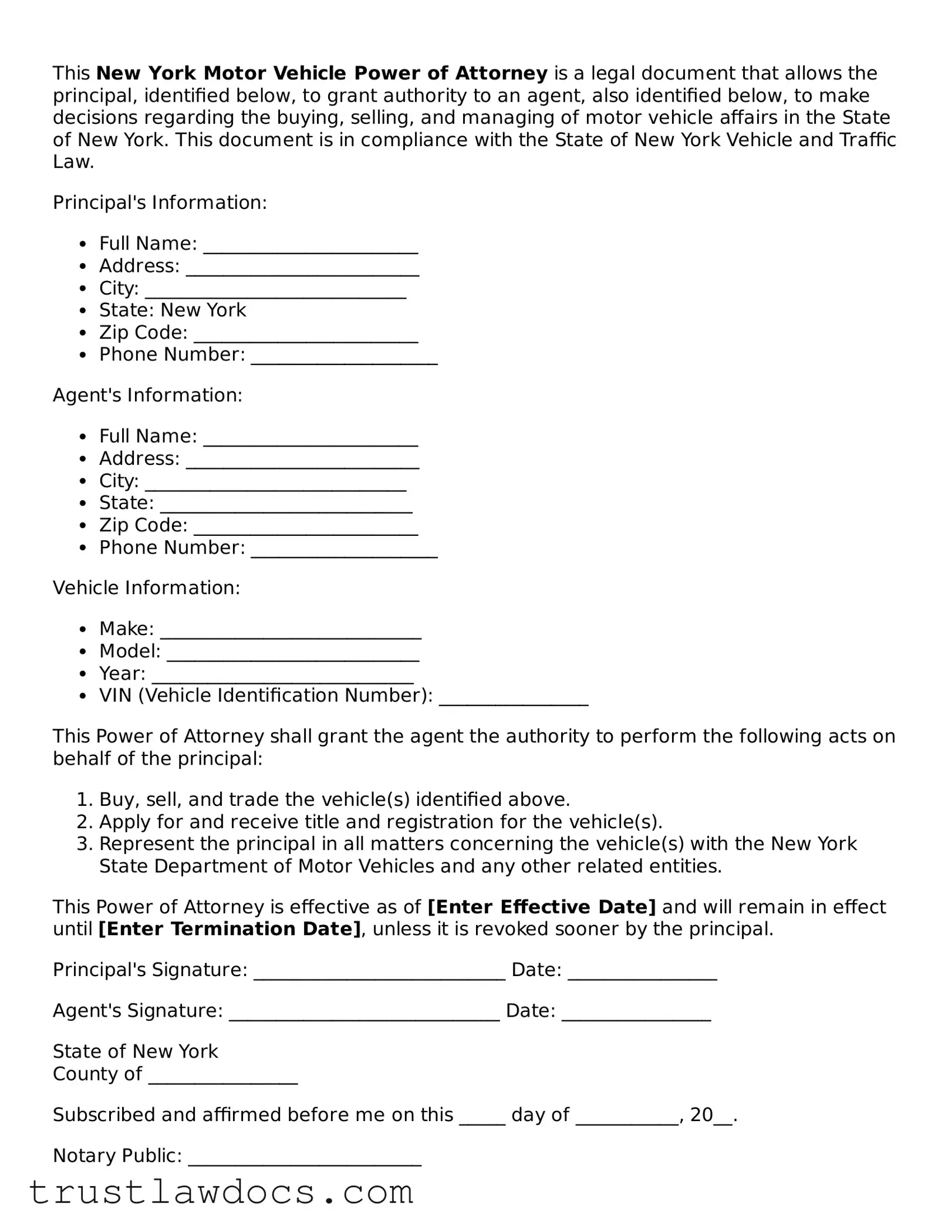

Form Example

This New York Motor Vehicle Power of Attorney is a legal document that allows the principal, identified below, to grant authority to an agent, also identified below, to make decisions regarding the buying, selling, and managing of motor vehicle affairs in the State of New York. This document is in compliance with the State of New York Vehicle and Traffic Law.

Principal's Information:

- Full Name: _______________________

- Address: _________________________

- City: ____________________________

- State: New York

- Zip Code: ________________________

- Phone Number: ____________________

Agent's Information:

- Full Name: _______________________

- Address: _________________________

- City: ____________________________

- State: ___________________________

- Zip Code: ________________________

- Phone Number: ____________________

Vehicle Information:

- Make: ____________________________

- Model: ___________________________

- Year: ____________________________

- VIN (Vehicle Identification Number): ________________

This Power of Attorney shall grant the agent the authority to perform the following acts on behalf of the principal:

- Buy, sell, and trade the vehicle(s) identified above.

- Apply for and receive title and registration for the vehicle(s).

- Represent the principal in all matters concerning the vehicle(s) with the New York State Department of Motor Vehicles and any other related entities.

This Power of Attorney is effective as of [Enter Effective Date] and will remain in effect until [Enter Termination Date], unless it is revoked sooner by the principal.

Principal's Signature: ___________________________ Date: ________________

Agent's Signature: _____________________________ Date: ________________

State of New York

County of ________________

Subscribed and affirmed before me on this _____ day of ___________, 20__.

Notary Public: _________________________

Commission Number: ____________________

Expiration Date: _______________________

PDF Form Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The New York Motor Vehicle Power of Attorney form allows a vehicle owner to delegate authority to another person to handle matters related to their vehicle with the New York Department of Motor Vehicles (DMV). |

| 2 | This form is specific to the state of New York and must be used for transactions involving vehicles registered in New York. |

| 3 | The document grants the agent the power to sign documents, make decisions, and handle transactions regarding the sale, purchase, and registration of the vehicle. |

| 4 | To be valid, the form must be completed accurately, including the vehicle identification number (VIN), descriptions of the vehicle, and the specific powers granted. |

| 5 | The power of attorney must be signed by the vehicle owner in the presence of a notary public for it to be recognized legally. |

| 6 | Once signed, the document does not expire unless a specific expiration date is mentioned; otherwise, it remains in effect until revoked. |

| 7 | The vehicle owner may revoke the power of attorney at any time by writing a letter of revocation and ensuring the agent and the New York DMV are aware of the revocation. |

| 8 | Using the New York Motor Vehicle Power of Attorney form simplifies the process of delegating vehicle-related responsibilities and ensures that transactions can proceed smoothly without the direct presence of the vehicle's owner. |

| 9 | Governing Law: The form and its use are governed by the laws of the State of New York. |

How to Write New York Motor Vehicle Power of Attorney

When an individual seeks to delegate authority concerning the management, sale, or registration of a motor vehicle in New York, utilizing a Motor Vehicle Power of Attorney (POA) form becomes essential. This legal document allows the vehicle owner to appoint another person to act on their behalf. Filling out this form correctly is crucial to ensure its validity and effectiveness in granting the required powers. It's important to proceed with care and attention to detail to avoid common mistakes. The process involves providing personal information, designating an agent, and understanding the specific powers being granted. Following a step-by-step guide can simplify this process, ensuring that all necessary sections are completed accurately.

- Begin by collecting the necessary information, including the full legal names and addresses of both the principal (the vehicle owner granting the power) and the agent (the individual who is being granted the power).

- Identify the vehicle in question by accurately providing its make, model, year, and Vehicle Identification Number (VIN). This step is critical for specifying which vehicle the POA will apply to.

- Specify the exact powers being granted to the agent. This could include the authority to sell the vehicle, register it, or perform other transactions on behalf of the principal. Be as clear and precise as possible to avoid any ambiguity.

- Review the instructions regarding the signing and notarization of the form. In New York, notarization may be required to validate the POA. Ensure that both the principal and the agent understand when and how the document must be signed.

- Complete the signature process according to New York State requirements. This typically involves signing the document in the presence of a notary public. Ensure that both the principal and the agent have valid identification at the time of signing.

- After the form is fully executed, keep copies in a safe but accessible place. Provide a copy to the agent, and consider informing relevant family members or attorneys about the POA's existence and location.

Completing the New York Motor Vehicle Power of Attorney form is a straightforward process that plays a vital role in managing vehicle-related tasks. By carefully following the outlined steps, individuals can ensure that their wishes are respected and that their chosen agent can act on their behalf without undue hindrance. Whether the need is for selling, registering, or otherwise handling vehicle transactions, this form provides a secure and recognized way to authorize another person to take these actions.

Get Answers on New York Motor Vehicle Power of Attorney

What is a New York Motor Vehicle Power of Attorney (POA) form?

A New York Motor Vehicle Power of Attorney form is a legal document that allows someone to appoint another person, known as an agent or attorney-in-fact, to take care of tasks related to their vehicle. This could include registering the vehicle, selling it, or handling other matters with the New York State Department of Motor Vehicles (DMV) on the vehicle owner's behalf.

Who should use a New York Motor Vehicle Power of Attorney form?

Anyone who needs another person to handle their motor vehicle affairs in New York should use this form. This may be useful for individuals who are out of state, physically unable to visit the DMV, or those who need assistance due to their schedule or other commitments.

How do I appoint someone as my attorney-in-fact?

To appoint someone as your attorney-in-fact, you must complete the New York Motor Vehicle Power of Attorney form. This includes providing detailed information about yourself, your vehicle, and the person you are appointing. You must also sign the form in front of a notary public, who verifies your identity and your voluntary signing of the document.

Is the New York Motor Vehicle POA form valid indefinitely?

No, the New York Motor Vehicle POA is not valid indefinitely. Its expiration depends on the terms specified within the document. If no expiration date is given, it could be subject to the default laws in New York concerning the duration of power of attorney documents, which may vary.

Can I revoke my New York Motor Vehicle Power of Attorney?

Yes, you have the right to revoke your New York Motor Vehicle Power of Attorney at any time. To do this, you should provide a written notice of revocation to your attorney-in-fact and inform the New York DMV of this change. It is also advised to destroy any physical copies of the POA document to prevent future use.

Does the attorney-in-fact need to sign the Motor Vehicle POA form?

No, the attorney-in-fact does not need to sign the New York Motor Vehicle Power of Attorney form. However, the principal (the person granting the power) must sign it in the presence of a notary. It's important that the attorney-in-fact is fully aware of their appointment and agrees to undertake the responsibilities designated to them.

What happens if my Motor Vehicle POA form is not notarized?

If your New York Motor Vehicle POA form is not notarized, it will not be considered valid. Notarization is a legal requirement that confirms the signature on the form is genuine and that the document was signed voluntarily. The DMV will reject any POA documents that are not properly notarized.

Where should I submit my completed New York Motor Vehicle POA form?

Once notarized, your New York Motor Vehicle POA form should be submitted to the NY DMV office where your attorney-in-fact will be conducting business on your behalf. It can also sometimes be presented directly at the time of transaction. Be sure to check with your local DMV office for any specific submission guidelines or requirements.

Common mistakes

One common mistake made when filling out the New York Motor Vehicle Power of Attorney (POA) form is not providing all the required information. The form asks for specific details about the vehicle and the parties involved. Omitting information such as the Vehicle Identification Number (VIN), make and model of the vehicle, or the legal names and addresses of the principal and the agent can invalidate the POA.

Another error includes using incorrect or outdated forms. The State of New York periodically updates its legal documents to comply with current laws. If an individual uses a version of the POA form that is no longer accepted, the document may be considered invalid, hindering their ability to conduct transactions on behalf of the vehicle's owner.

People often misunderstand the scope of the POA form, granting either too much or too little authority to the agent. It's crucial to be clear and precise about what the agent can and cannot do. Overly broad powers could inadvertently give the agent more control than intended, while too narrow a scope might not cover all necessary transactions.

Failure to properly sign and date the document is another common mistake. The New York Motor Vehicle POA form requires the signature of the vehicle owner (the principal) to be notarized. Skipping the notarization process or incorrectly filling out the dates can lead to the rejection of the form when submitted for any vehicle-related transactions.

Not specifying a durable or non-durable POA can also cause confusion. A durable POA remains in effect if the principal becomes incapacitated, whereas a non-durable POA does not. If the document doesn't clearly state the choice, it may not function as intended during critical times.

Forgetting to revoke a previous Motor Vehicle POA when creating a new one is a mistake that can lead to legal complications. Without the revocation of any prior POAs, there could be multiple agents with the potential authority to make decisions, which could conflict or lead to disputes down the line.

Many individuals fail to share a copy of the POA with the agent or neglect to keep a record for themselves. It's important for all parties involved to have access to the document to understand the extent of the powers granted and for record-keeping purposes.

Some people mistakenly believe that a Motor Vehicle POA form filled out in New York will automatically be valid in other states. However, legal requirements differ from state to state, and while a New York POA may be acknowledged elsewhere, it's not guaranteed. It’s advisable to check the validity in the state where the vehicle transactions will occur.

Lastly, not seeking legal advice when filling out the New York Motor Vehicle POA form is a common oversight. While the form may seem straightforward, the implications of what is being signed can be complex. Consulting with a legal expert can help ensure that the POA meets the individual's needs and complies with state laws.

Documents used along the form

When managing vehicle-related transactions in New York, the Motor Vehicle Power of Attorney (POA) form serves as a pivotal document, empowering an individual to act on another's behalf concerning their motor vehicle affairs. This form is typically not used in isolation. Several other forms and documents are often utilized in conjunction with the Motor Vehicle POA to ensure comprehensive coverage of legal requirements and facilitate smooth transactions.

- Odometer Disclosure Statement: This document is essential during the sale or purchase of a vehicle. It records the vehicle's mileage at the time of sale and is a requirement under federal law to prevent odometer fraud.

- Vehicle Title Application: When a vehicle changes ownership, this application is necessary to update or issue a new title reflecting the current owner's details. It is an official request to the New York State Department of Motor Vehicles.

- Bill of Sale: This document provides a record of the transaction between the seller and the buyer, detailing the sale's terms, including the sale date, purchase price, and vehicle information. It often serves as a proof of purchase and may be required for tax purposes.

- Vehicle Registration Application: To legally operate a vehicle on New York roads, the vehicle must be registered with the state. This form initiates or renews the registration process, tying the vehicle officially to its owner.

- Insurance Identification Card: Proof of insurance is mandatory in New York, and this card verifies that the vehicle is insured under a policy meeting the state's minimum requirements. This documentation might be needed when the vehicle is being operated or during various transactions at the DMV.

These documents complement the Motor Vehicle POA, creating a framework that addresses legal, regulatory, and procedural necessities for vehicle transactions in New York. When used together, they streamline the process for all parties involved, providing clear and official records of each transaction step.

Similar forms

The New York Motor Vehicle Power of Attorney form is similar to the General Power of Attorney form in its foundational purpose of delegating authority. In a General Power of Attorney, an individual, known as the principal, grants comprehensive authority to another, known as the agent, to make decisions on their behalf. This scope might cover financial, legal, and personal decision-making. While the Motor Vehicle Power of Attorney focuses specifically on decisions and actions related to a vehicle, such as registration or sale, the General Power of Attorney encompasses a broader range of powers, often including the ability to handle matters related to various types of personal property.

Comparable to the New York Motor Vehicle Power of Attorney form is the Limited Power of Attorney form. The Limited Power of Attorney allows for the appointment of an agent to perform specific acts or duties on behalf of the principal for a limited period or under specific circumstances. Similar to how the Motor Vehicle Power of Attorney enables someone else to manage affairs specifically related to a motor vehicle, a Limited Power of Attorney might be tailored to a single transaction or a narrowly defined purpose, excluding other functions or powers not expressly mentioned.

The Durable Power of Attorney form shares similarities with the New York Motor Vehicle Power of Attorney form in terms of the delegation of authority. The Durable Power of Attorney remains in effect even if the principal becomes incapacitated or unable to make decisions themselves. While the Motor Vehicle Power of Attorney is focused on vehicle-related matters, the durability aspect of a Durable Power of Attorney ensures that the agent's power to make decisions on the principal's behalf extends across various scenarios, including health crises or cognitive decline, covering a wider range of decisions beyond just those related to a vehicle.

Springing Power of Attorney forms bear resemblance to the New York Motor Vehicle Power of Attorney, as both activate under specific conditions. A Springing Power of Attorney becomes effective only when a predetermined condition is met, typically the principal's incapacitation. This conditionality parallels the specific focus of the Motor Vehicle Power of Attorney on vehicle-related matters, though the scope of a Springing Power of Attorney can be broader or differently focused, depending on the conditions set forth in the document.

The Health Care Proxy is another document similar to the New York Motor Vehicle Power of Attorney, focussing on a specific domain: health care decisions. Like the Motor Vehicle Power of Attorney delegates authority related to someone's vehicle, a Health Care Proxy assigns someone to make medical decisions on the principal's behalf if they are unable to do so. Although the Health Care Proxy is concerned exclusively with health care, both documents share the core concept of entrusting decision-making authority to another individual for a particular set of decisions.

Comparable in nature to the New York Motor Vehicle Power of Attorney is the Real Estate Power of Attorney. This document authorizes an agent to manage real estate transactions on behalf of the principal. It involves tasks such as buying, selling, or managing real estate properties, akin to how the Motor Vehicle Power of Attorney allows for handling vehicle transactions. The specificity to a type of property or transaction highlights the focused authority given to an agent, differing mainly in the nature of the property involved.

Financial Power of Attorney documents also share similarities with the New York Motor Vehicle Power of Attorney. They grant an agent the authority to handle financial affairs and transactions on behalf of the principal. This might include managing bank accounts, investments, and other financial matters. While the Motor Vehicle Power of Attorney is strictly limited to vehicle-related affairs, both forms of power of attorney enable the principal to delegate critical financial or transactional responsibilities to another party, ensuring continuity in the management of their affairs.

The Tax Power of Attorney form, much like the New York Motor Vehicle Power of Attorney, is designed for a specific purpose. It allows an individual to designate another person, often a tax professional, to handle tax matters and communicate with the tax authorities on their behalf. Although it’s centered on tax issues, the fundamental similarity lies in the delegation of authority for a specific area of the principal's affairs, demonstrating how power of attorney forms can be tailored to diverse needs and situations.

Finally, the Child Care Power of Attorney form resonates with the concept of the New York Motor Vehicle Power of Attorney by empowering an individual to make decisions regarding a child's welfare, including education, healthcare, and general upbringing, on behalf of the child's parents or guardians. This form is specific to child care, contrasting with the Motor Vehicle Power of Attorney's focus on vehicle affairs, but both documents facilitate the delegation of responsibility in areas critically important to the principal.

Dos and Don'ts

Filling out a Motor Vehicle Power of Attorney form in New York equips another person with the authority to make decisions regarding your vehicle, including registration, title transfer, and other related tasks. To ensure the process is smooth and legally binding, some do's and don'ts need to be followed:

- Do ensure you use the correct form. New York State has specific forms for these purposes, so using the state-provided Motor Vehicle Power of Attorney form is crucial.

- Do fill out the form completely. Every section should be filled out with accurate information to avoid delays or legal complications.

- Do clearly identify the person you're appointing as your agent. Provide full legal names and contact details to prevent any confusion.

- Do specify the powers you are granting. Being clear about what your agent can and cannot do with your vehicle is key.

- Do sign and date the form in the presence of a notary public. This step is vital for the document's validity.

- Don't leave any sections blank. Incomplete forms may be rejected or cause legal uncertainty.

- Don't sign without a notary present. A notarized signature is required to authenticate the document.

- Don't forget to provide a copy to the appointed agent. They will need this document to prove their authority when handling vehicle matters on your behalf.

- Don't neglect to keep a copy for your records. Having a copy will help you reference the powers granted and can be important if the document needs to be revoked or amended.

Misconceptions

Many people have misconceptions about the New York Motor Vehicle Power of Attorney (POA) form. Understanding what the form is and isn't can help clarify its uses and limitations. Here are some common misunderstandings:

It allows someone to take full ownership of your vehicle. The form does not transfer ownership; it merely grants someone else the authority to make specific decisions or carry out transactions related to your vehicle, such as registration or sale, on your behalf.

It’s a complicated document that requires a lawyer to complete. While legal advice can be beneficial, especially in complex situations, the form is designed to be straightforward and can be completed by individuals without legal assistance.

It is valid in all states once signed. The form is specific to New York State. Each state has its own requirements and forms for motor vehicle affairs. If you need to use a Power of Attorney for vehicle matters in another state, you should obtain the specific form for that state.

There's no way to revoke it once it's given. You can revoke a Power of Attorney at any time, provided you are mentally competent. It's recommended to do so in writing, informing any relevant parties, such as the New York State Department of Motor Vehicles (DMV) and the agent you had appointed.

Any Power of Attorney will work for motor vehicle transactions. This is not the case. The New York Motor Vehicle Power of Attorney form is tailored for transactions involving motor vehicles. A general Power of Attorney form may not be accepted for specific transactions at the DMV.

It grants the agent the ability to make any and all decisions for you. The scope of the form is limited to the authority expressly granted within it. This typically includes registering, buying, or selling a vehicle, and dealing with licensing issues. It does not extend to other personal or financial decisions.

Clearing up these misconceptions can help you better understand the purpose and limitations of the New York Motor Vehicle Power of Attorney form, ensuring that it is used effectively and as intended.

Key takeaways

In New York, a Motor Vehicle Power of Attorney (MVPOA) form enables an individual (the principal) to grant another person (the agent) the authority to make decisions and take actions relating to the titling and registration of a motor vehicle on their behalf. Understanding how to properly fill out and use this form is vital for anyone looking to facilitate motor vehicle transactions without their direct involvement. Below are key takeaways for individuals considering the use of an MVPOA form in New York.

- Identify the parties accurately: When filling out the MVPOA form, ensure that the full legal names of both the principal and the agent are correctly spelled and match the identification documents that will be presented to the New York State Department of Motor Vehicles (DMV).

- Specify the vehicle clearly: The form requires specific details about the vehicle, including its make, model, year, and Vehicle Identification Number (VIN). These details must be exact to ensure the MVPOA is applied to the correct vehicle.

- Understand the powers granted: The MVPOA grants the agent the authority to sign documents and make decisions related to the titling, registration, and certain transactions involving the vehicle. Before signing, the principal should fully understand which powers they are transferring.

- Notarization may be required: For the MVPOA to be valid, it often needs to be notarized. This process involves signing the document in front of a Notary Public, who then certifies it. Always check the current requirements with the New York DMV or a legal advisor.

- Keep records of the MVPOA: Both the principal and the agent should keep copies of the notarized MVPOA for their records. Having access to the document can help resolve any disputes or questions about its validity.

- Duration of the POA: Understand that the MVPOA may have an expiration date or may be revoked by the principal at any time. Clarifying the duration of the power granted is essential for both parties.

- Revocation process: If the principal decides to revoke the MVPOA, they should do so in writing and notify any involved parties, including the DMV and any other institutions that may have received the MVPOA.

- Legal implications: Executing an MVPOA has significant legal implications. The agent's actions within the scope of the authority granted by the document are legally binding on the principal.

- Seek legal advice if necessary: If there are any questions or uncertainties about filling out the MVPOA form or its implications, it is advisable to consult with a legal professional. This ensures that both the principal and the agent fully understand their rights and responsibilities.

Using a Motor Vehicle Power of Attorney can streamline the process of managing a vehicle's administrative matters. However, it is a powerful legal instrument that should be used with a clear understanding of its effects and limitations.

Popular Motor Vehicle Power of Attorney State Forms

Texas Dmv Forms - Empowers your chosen agent to act swiftly and in your best interest, whether it’s maintaining registration or transferring the title under your directives.

Indiana Car Title - Ensures your vehicle dealings are handled properly in your stead.

Michigan Appointment of Agent - For the document to be effective, it needs to clearly identify the vehicle(s) in question, usually by VIN (Vehicle Identification Number).

Reg 260 Pdf - A Motor Vehicle Power of Attorney form allows someone to handle car-related matters on another person's behalf.