Official Motor Vehicle Power of Attorney Document

Dealing with motor vehicle transactions can sometimes require the involvement of a third party, especially when circumstances prevent personal attendance. This is where a Motor Vehicle Power of Attorney (POA) form becomes an invaluable tool. Essentially, it grants a trusted individual the authority to make decisions regarding the buying, selling, and overall handling of a vehicle on someone else's behalf. This form, specific to motor vehicle affairs, is recognized and can be used across different jurisdictions, although requirements may vary by state. The importance of carefully selecting who is given this power cannot be overstated, as it involves significant trust in the agent's decisions about one's vehicle. Additionally, understanding the specific functions and limitations that can be assigned through this document is crucial for ensuring that it accurately reflects the principal's wishes and complies with state regulations. By filling out a Motor Vehicle Power of Attorney form, vehicle owners ensure that their needs are met efficiently, even in their absence, and provide the appointed agent with a clear directive of their responsibilities and boundaries.

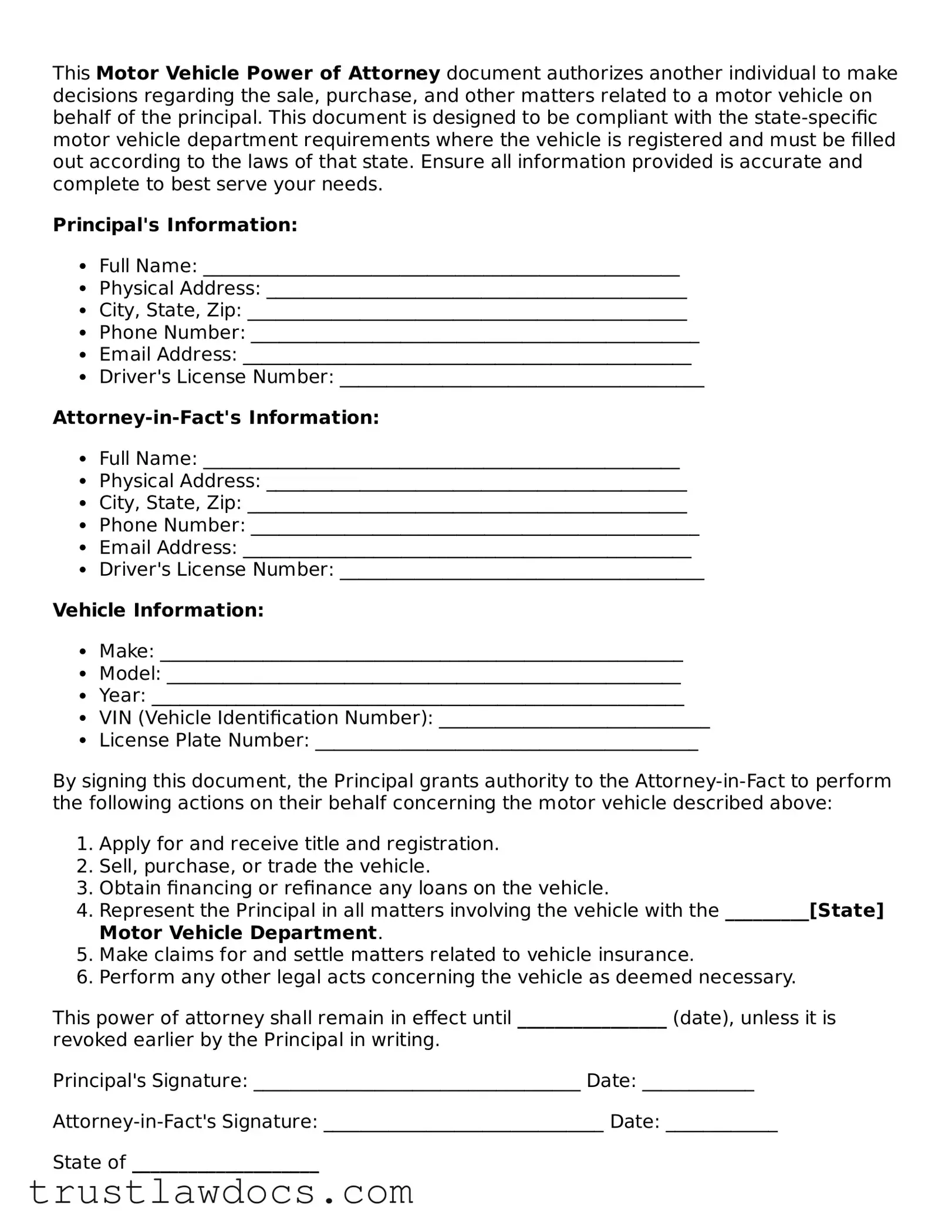

Form Example

This Motor Vehicle Power of Attorney document authorizes another individual to make decisions regarding the sale, purchase, and other matters related to a motor vehicle on behalf of the principal. This document is designed to be compliant with the state-specific motor vehicle department requirements where the vehicle is registered and must be filled out according to the laws of that state. Ensure all information provided is accurate and complete to best serve your needs.

Principal's Information:

- Full Name: ___________________________________________________

- Physical Address: _____________________________________________

- City, State, Zip: _______________________________________________

- Phone Number: ________________________________________________

- Email Address: ________________________________________________

- Driver's License Number: _______________________________________

Attorney-in-Fact's Information:

- Full Name: ___________________________________________________

- Physical Address: _____________________________________________

- City, State, Zip: _______________________________________________

- Phone Number: ________________________________________________

- Email Address: ________________________________________________

- Driver's License Number: _______________________________________

Vehicle Information:

- Make: ________________________________________________________

- Model: _______________________________________________________

- Year: _________________________________________________________

- VIN (Vehicle Identification Number): _____________________________

- License Plate Number: _________________________________________

By signing this document, the Principal grants authority to the Attorney-in-Fact to perform the following actions on their behalf concerning the motor vehicle described above:

- Apply for and receive title and registration.

- Sell, purchase, or trade the vehicle.

- Obtain financing or refinance any loans on the vehicle.

- Represent the Principal in all matters involving the vehicle with the _________[State] Motor Vehicle Department.

- Make claims for and settle matters related to vehicle insurance.

- Perform any other legal acts concerning the vehicle as deemed necessary.

This power of attorney shall remain in effect until ________________ (date), unless it is revoked earlier by the Principal in writing.

Principal's Signature: ___________________________________ Date: ____________

Attorney-in-Fact's Signature: ______________________________ Date: ____________

State of ____________________

County of ___________________

This document was acknowledged before me on __________(date) by ______________________(name of principal) and ______________________(name of attorney-in-fact).

Notary Public's Signature: ____________________________________

My commission expires: _______________________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | Authorizes someone to make decisions and take actions regarding the titling and registration of a vehicle on behalf of the principal. |

| Validity | May be specific to a certain transaction or period, as defined in the form itself. |

| Governing Laws | Vary by state, specifying how the form must be executed and any particular requirements for it to be considered valid. |

| Common Uses | Buying, selling, titling, and registering a vehicle, including handling license plates and dealing with loans or liens. |

| State-specific Forms | Most states have their own forms, which must be used to ensure compliance with local laws. |

| Signature Requirements | Typically requires the principal’s signature to be notarized, subject to state laws. |

| Accessibility | Usually available through state Department of Motor Vehicles (DMV) websites or in-person at local DMV offices. |

How to Write Motor Vehicle Power of Attorney

Filling out a Motor Vehicle Power of Attorney form is a straightforward process, yet it's crucial for delegating authority responsibly over your vehicle. This document grants another person the legal right to make decisions about your vehicle on your behalf. It could be for something as routine as renewing a registration or as significant as selling the vehicle. It’s vital to approach this task with attention to detail to ensure that your vehicle is managed according to your wishes.

To start, gather all the necessary information, including the vehicle identification number (VIN), make, model, and year of your vehicle, as well as your personal identification details and those of the person you are granting power to. Follow these steps to ensure the form is filled out correctly:

- Begin by entering the date at the top of the form. This marks when the power of attorney will become effective.

- Write your full legal name and address in the section designated for the principal. This identifies you as the legal owner of the vehicle.

- In the agent's section, fill in the full legal name and address of the person you are granting power to. Ensure the information is accurate to avoid any legal complications.

- Detail the vehicle's information, including its make, model, VIN, and year. Be precise, as this information is crucial for legal identification of the asset in question.

- Specify the powers you are granting. This might include buying or selling the vehicle, applying for a title, or handling registration tasks. Be clear about what the agent can and cannot do.

- If the form requires, specify any limitations to the powers granted. This might involve financial limits or time constraints on the agent’s authority.

- Review the completed form to ensure all the information is correct. Errors could delay or invalidate the document, so take your time.

- Sign and date the form in the presence of a notary public. Your signature grants the powers listed, so do not sign until you are sure everything is in order.

- Have the form notarized. The notary public will verify your identity and your signature, giving the document legal standing.

- Distribute copies of the notarized form. Provide one to the agent, keep one for yourself, and consider giving one to your legal advisor for safekeeping.

After completing these steps, the designated person will have the authority to act on your behalf concerning your vehicle within the scope you’ve outlined. This document does not transfer vehicle ownership; it simply grants another individual the ability to make decisions about the vehicle under certain conditions. Remember, the Motor Vehicle Power of Attorney can be revoked by you at any time, provided you complete the necessary legal steps to do so. Ensure to keep a copy of this document in a safe place, as it's an important legal instrument regarding your vehicle-related affairs.

Get Answers on Motor Vehicle Power of Attorney

What is a Motor Vehicle Power of Attorney?

A Motor Vehicle Power of Attorney is a legal document that allows you to appoint another person to handle affairs related to your motor vehicle on your behalf. This could include registering, buying, or selling a vehicle, as well as other transactions with the department of motor vehicles (DMV).

Who can be appointed as an agent in a Motor Vehicle Power of Attorney?

Any competent adult whom you trust can be appointed as your agent. This includes a family member, friend, or even a professional advisor. It's crucial that the chosen individual is trustworthy, as they will be making decisions about your motor vehicle in your absence.

How do I create a Motor Vehicle Power of Attorney?

To create a Motor Vehicle Power of Attorney, you’ll need to fill out a specific form provided by your state's DMV or a similar authoritative body. The form must be completed accurately, including the details of the agent and the specifics of the powers granted. Once filled, it usually requires a notary’s signature to be valid.

Is the Motor Vehicle Power of Attorney effective in all states?

The effectiveness of a Motor Vehicle Power of Attorney can vary from one state to another due to differing state laws. Most states have their forms and specific requirements. It's essential to check the regulations in your state and ensure the document meets all legal requirements to be valid.

Can I revoke a Motor Vehicle Power of Attorney?

Yes, you can revoke a Motor Vehicle Power of Attorney at any time as long as you are mentally competent. To do so, you should notify your agent in writing and destroy all copies of the document. Additionally, you may need to inform the DMV or any related institutions where the document was presented.

Does a Motor Vehicle Power of Attorney need to be notarized?

Yes, in most cases, a Motor Vehicle Power of Attorney needs to be notarized to be considered legal and valid. The requirement for notarization helps prevent fraud and ensures that the principal (the person granting the power) truly signed the document of their own free will.

Common mistakes

Filling out a Motor Vehicle Power of Attorney (MVPoA) form is an important task that allows someone to make decisions about your vehicle on your behalf. It's essential to understand that even a small mistake can lead to the form being invalidated or not accepted. One common error is not providing complete information about the vehicle. It's crucial to include all pertinent details such as make, model, year, and VIN (Vehicle Identification Number) to avoid any confusion or misrepresentation of the vehicle in question.

Another frequent oversight is failing to specify the powers granted clearly. The form should explicitly state what the appointed person is authorized to do on your behalf, whether it's selling the vehicle, registering it, or handling specific transactions. A broad or vague authorization could lead to legal complications and misunderstandings about the extent of the powers conferred.

Incorrect or missing signatures also pose a significant problem. The MVPoA form requires the signatures of both the principal (the person granting the power) and the agent (the person receiving the power). Sometimes, individuals forget to sign the document, or the signatures may not match those on file, especially if the form needs to be notarized. Ensuring that all signatures are correct and present is crucial for the form to be legally binding.

Failing to recognize the need for a notary or witness signatures where required is another common mistake. Depending on the state, notarization may be necessary for the form to be considered valid. Without the official stamp or seal from a notary, or the required witnesses, the document might not hold up if its authenticity is questioned.

Some individuals overlook the importance of checking whether their state has a specific MVPoA form. While generic forms are available, certain states have their own versions that must be used. Using the wrong form could result in it being rejected, causing delays and potentially impacting the ability to carry out intended transactions with the vehicle.

Lastly, not keeping a record or copy of the signed MVPoA form is a mistake that can lead to complications. Should the original document be lost, having a copy is essential for verifying that the power of attorney has been granted. It’s advisable to keep both a digital and a physical copy in safe places for reference when needed.

Documents used along the form

The Motor Vehicle Power of Attorney form grants someone else the authority to make decisions regarding your vehicle on your behalf. This could include buying, selling, or registering a vehicle. When handling matters related to a Motor Vehicle Power of Attorney, several other forms and documents are frequently required to ensure everything is legally in place and the process proceeds smoothly. Here is a list of documents often used alongside the Motor Vehicle Power of Attorney form:

- Bill of Sale: This document records the transaction between the buyer and seller of the vehicle, providing proof that the ownership has been transferred.

- Title Application: Used to apply for a vehicle title, this form is essential when a vehicle changes ownership, ensuring the new owner is recognized legally by state authorities.

- Odometer Disclosure Statement: This form reports the vehicle's mileage at the time of sale and is required by federal law to prevent odometer fraud.

- Release of Liability: When selling or transferring a vehicle, this document releases the previous owner from responsibility for what happens with the vehicle after the sale.

- Sales Tax Form: This document is necessary for reporting and paying the sales tax associated with the purchase of a vehicle.

- Vehicle Registration Forms: Used to register the vehicle with state authorities, ensuring it is legally allowed to operate on public roads.

- VIN Verification Form: A document that verifies the vehicle's VIN (Vehicle Identification Number) for registration and titling purposes, often required for out-of-state or imported vehicles.

- Insurance Forms: Proof of insurance is frequently needed when registering or titling a vehicle, indicating that the vehicle meets state insurance requirements.

- Lien Release: If the vehicle was previously financed, this document is needed to prove that the vehicle is free from liens and that the title can be transferred to the new owner.

- Inspection Documents: Certain states require a vehicle inspection for safety and emissions before registration. These documents prove that the vehicle has passed the necessary inspections.

Utilizing these documents in conjunction with the Motor Vehicle Power of Attorney can significantly streamline any transactions or legal processes involving your vehicle. Each serves a unique purpose, ensuring that all aspects of the vehicle's sale, purchase, and registration are properly documented and meet legal standards. It's crucial to understand the requirements and ensure that all necessary paperwork is completed accurately to avoid any potential legal issues.

Similar forms

The General Power of Attorney form, like the Motor Vehicle Power of Attorney, grants sweeping authority to an agent to make decisions on someone else’s behalf. However, its scope extends beyond vehicles, covering legal and financial affairs. This similarity lies in the delegation of authority, but the General Power of Attorney encompasses a broader range of actions, from banking to property management.

Similarly, the Durable Power of Attorney document echoes the Motor Vehicle Power of Attorney, establishing an agent's authority. The key difference is its durability; it remains effective even if the principal becomes incapacitated. This feature sets it apart, emphasizing preparedness for unexpected life events, while still allowing for the management of specific assets like vehicles.

The Health Care Power of Attorney shares the concept of authorizing an agent, too. Instead of handling vehicle-related matters, the agent makes health care decisions on the principal’s behalf when they cannot. This demonstrates the versatility of power of attorney documents in covering different aspects of one’s life, revealing their critical role in personal planning.

A Limited Power of Attorney provides another parallel, offering a tailored version of delegation. It restricts the agent's power to specific tasks, events, or periods, such as selling a particular car. This customization characterizes both the Limited and the Motor Vehicle Power of Attorney, making them pivotal for targeted legal actions.

The Real Estate Power of Attorney, by contrast, focuses solely on property transactions. Like its motor vehicle counterpart, it empowers an agent to act in real estate dealings, from buying to selling. Although it diverges in the type of assets managed, the fundamental principle of appointing a representative connects them.

A Financial Power of Attorney form, centering on financial affairs, similarly grants an agent authority to manage the principal's monetary matters. It can encompass various financial tasks, including those related to vehicles, hence overlapping with the Motor Vehicle Power of Attorney. The common ground here is their role in safeguarding an individual's financial interests through designated agents.

The Child Care Power of Attorney offers a unique take by focusing on minor children rather than assets. It authorizes an agent to make decisions regarding the child's welfare, education, and health. Despite the distinct focus, it shares the basic framework of delegating authority, mirroring how different facets of one's life can be managed through power of attorney documents.

The Springing Power of Attorney is triggered by specific events, often the principal’s incapacity. This conditional activation is a notable feature, distinguishing it from the more immediate authority granted in a Motor Vehicle Power of Attorney. Both documents, however, highlight the importance of planning for varied circumstances.

An Advanced Directive, or Living Will, guides medical treatment preferences in scenarios where someone can't make decisions. While not a power of attorney, it shares the forward-thinking aspect of the Motor Vehicle Power of Attorney. It ensures decisions align with the principal’s values and wishes, covering different grounds of personal preparation.

Lastly, the Business Power of Attorney focuses on commercial and business-related decisions. Like the Motor Vehicle Power of Attorney, it allows an individual to appoint someone to handle specific business affairs, such as transactions or operations involving company vehicles. This reflects the concept of trust and delegation in professional contexts, further illustrating the wide-reaching applications of power of attorney documents.

Dos and Don'ts

When filling out the Motor Vehicle Power of Attorney form, individuals grant another person the authority to make decisions and take actions on their behalf concerning their vehicle. This can include tasks such as registration, purchasing or selling, and other transactions related to the motor vehicle. It's crucial to approach this document with care to ensure that one's intentions are clearly communicated and legally documented. Here are five things you should do and five things you shouldn't do when completing the Motor Vehicle Power of Attorney form:

What You Should Do:

- Verify the form's requirements: Different states may have varying requirements for a Motor Vehicle Power of Attorney. Ensure the form complies with local laws and regulations.

- Clearly identify the parties involved: Provide accurate and complete information for both the principal (the person granting the power) and the agent (the person receiving the power).

- Specify the powers granted: Be explicit about what the agent can and cannot do with the vehicle. This clarity helps prevent misunderstandings and unauthorized actions.

- Include a validity period: If the form does not specify, consider adding a duration for the power of attorney to remain effective. This can be a specific date range or upon the occurrence of a certain event.

- Sign and notarize the form (if required): To ensure the document's legality, sign it in the presence of a notary public or in accordance with state laws regarding witnesses.

What You Shouldn't Do:

- Leave sections blank: Incomplete information can lead to legal challenges or the document being deemed invalid. Fill out all required sections.

- Use vague language: Ambiguities in the document can result in misinterpretation of the intended powers granted to the agent. Be precise in your wording.

- Forget to update it: Circumstances change, and so might the need for the Power of Attorney. Revisit and revise the document as necessary to reflect current needs.

- Fail to discuss with the agent: Before appointing someone, have a thorough discussion about your expectations and their responsibilities. This ensures they are willing and prepared to act on your behalf.

- Overlook state laws: Neglecting to adhere to state-specific requirements can render the document ineffective. Always consult local statutes or a legal professional to ensure compliance.

Misconceptions

When it comes to delegating authority through a Motor Vehicle Power of Attorney (MVPOA), various misconceptions often take the wheel, leading to confusion and legal roadblocks. Understanding what an MVPOA can and cannot do is crucial for anyone looking to navigate their motor vehicle-related transactions smoothly. Let's address and steer clear of ten common misunderstandings.

- Misconception 1: An MVPOA allows the agent to take ownership of the vehicle.

Reality: An MVPOA authorizes the agent to act on your behalf in matters relating to your vehicle, such as registration or sale, but it does not grant the agent ownership rights.

- Misconception 2: It's valid in any state once it's signed.

Reality: While many states honor an MVPOA from another state, it's essential to check local laws, as requirements can vary significantly from one state to another.

- Misconception 3: It's a complicated process to get an MVPOA.

Reality: Actually, obtaining and completing an MVPOA form is relatively straightforward. The key is to ensure the form complies with your state's specific requirements.

- Misconception 4: Any MVPOA form will work.

Reality: Not all MVPOA forms are created equal. It's vital to use a state-specific form or a form that meets your state's legal criteria to avoid issues.

- Misconception 5: You don't need to notify your insurance company when granting an MVPOA.

Reality: It's advisable to inform your insurance provider when you authorize someone else to handle your vehicle affairs, especially if they'll be driving the car.

- Misconception 6: An MVPOA grants unlimited powers.

Reality: An MVPOA typically specifies what actions the agent can take, such as registering a vehicle, transferring a title, or obtaining a duplicate title. It does not provide unlimited power over all vehicle-related matters.

- Misconception 7: You can't revoke an MVPOA once it's given.

Reality: You have the right to revoke an MVPOA at any time, assuming you are mentally competent. However, revocation must be done in writing and, in some cases, issued to the same entities where the original POA was filed or recorded.

- Misconception 8: A digital signature is always acceptable on an MVPOA.

Reality: Depending on your state's laws, a digital or electronic signature may or may not be accepted. Many states require a wet ink signature, especially for documents related to vehicle ownership and transactions.

- Misconception 9: An MVPOA automatically expires when the vehicle is sold.

Reality: The termination of an MVPOA depends on the terms set within it or on state laws. Some may expire upon the vehicle's sale, while others require the principal to revoke it explicitly.

- Misconception 10: Only family members can be named as agents.

Reality: You can designate anyone you trust as your agent, not just family members. The critical factor is trust, as this person will have legal authority over your motor vehicle transactions.

Understanding these misconceptions and the realities behind a Motor Vehicle Power of Attorney can empower vehicle owners to make informed decisions. Always consult with a legal professional or the appropriate state department if you're unsure about the steps to take. Knowledge is key to navigating the legalities of vehicle ownership and representation.

Key takeaways

When dealing with the Motor Vehicle Power of Attorney (MVPOA) form, understanding its purpose and correct usage is paramount. Below are key takeaways to ensure the form is filled out and used properly:

- Ensure accuracy by verifying all the information provided on the MVPOA form, including the vehicle's description and the identities of both the principal and the agent.

- Understand the scope of authority granted to the agent, which allows them to perform tasks related to the vehicle such as titling, registration, and selling on behalf of the principal.

- Be aware of the form's expiration date, if applicable, as some states require a MVPOA to be valid only for a specific period.

- Both the principal and the agent should have copies of the completed MVPOA for their records and to present as necessary when dealing with motor vehicle authorities.

- Before filling out the form, check for any state-specific requirements or versions of the MVPOA, since laws and regulations can vary significantly.

- Notarization might be required for the MVPOA to be considered valid. This requirement is dependent on the state in which the vehicle is registered.

- Signing the MVPOA may need to be witnessed, in addition to notarization, in some states to ensure compliance with local laws.

- The principal should carefully consider whom they appoint as their agent, as this individual will have significant legal authority over their vehicle.

- Revocation of a MVPOA should be done in writing, and all relevant parties, including the agent and the state motor vehicle department, should be notified.

- If the vehicle is sold or the ownership is otherwise transferred, the MVPOA typically becomes void, but it's crucial to confirm this by checking the relevant state regulations.

Adhering to these guidelines can streamline the process of granting and exercising power of attorney for motor vehicle matters, ensuring that both the principal's and the agent's rights are protected while complying with state laws.

Consider More Types of Motor Vehicle Power of Attorney Forms

Durable Power of Attorney California - It often complements a medical power of attorney, which covers health care decisions, rather than financial matters.

Power of Attorney Document - Equips your designated agent with the legal authority needed to effectively handle real estate transactions, protecting your interests.