Free Power of Attorney Form for Indiana

In Indiana, as in many other states, individuals have the ability to make critical decisions regarding their financial, medical, and personal affairs through the use of a Power of Attorney (POA) form. This vital legal document grants a designated person or entity, known as the agent or attorney-in-fact, the authority to act on behalf of the principal—the person making the designation—under specific circumstances. The scope of the authority, which can be broad or limited, along with the duration of the power, varies depending on the type of Power of Attorney form selected and the preferences of the principal. From healthcare decisions and real estate transactions to everyday financial management, the Indiana POA form ensures that the principal's affairs can be managed according to their wishes, even if they become incapacitated or unable to communicate their desires. It is a powerful tool for estate planning and managing one's affairs, making it crucial for residents of Indiana to understand the implications, requirements, and processes involved in creating a valid POA.

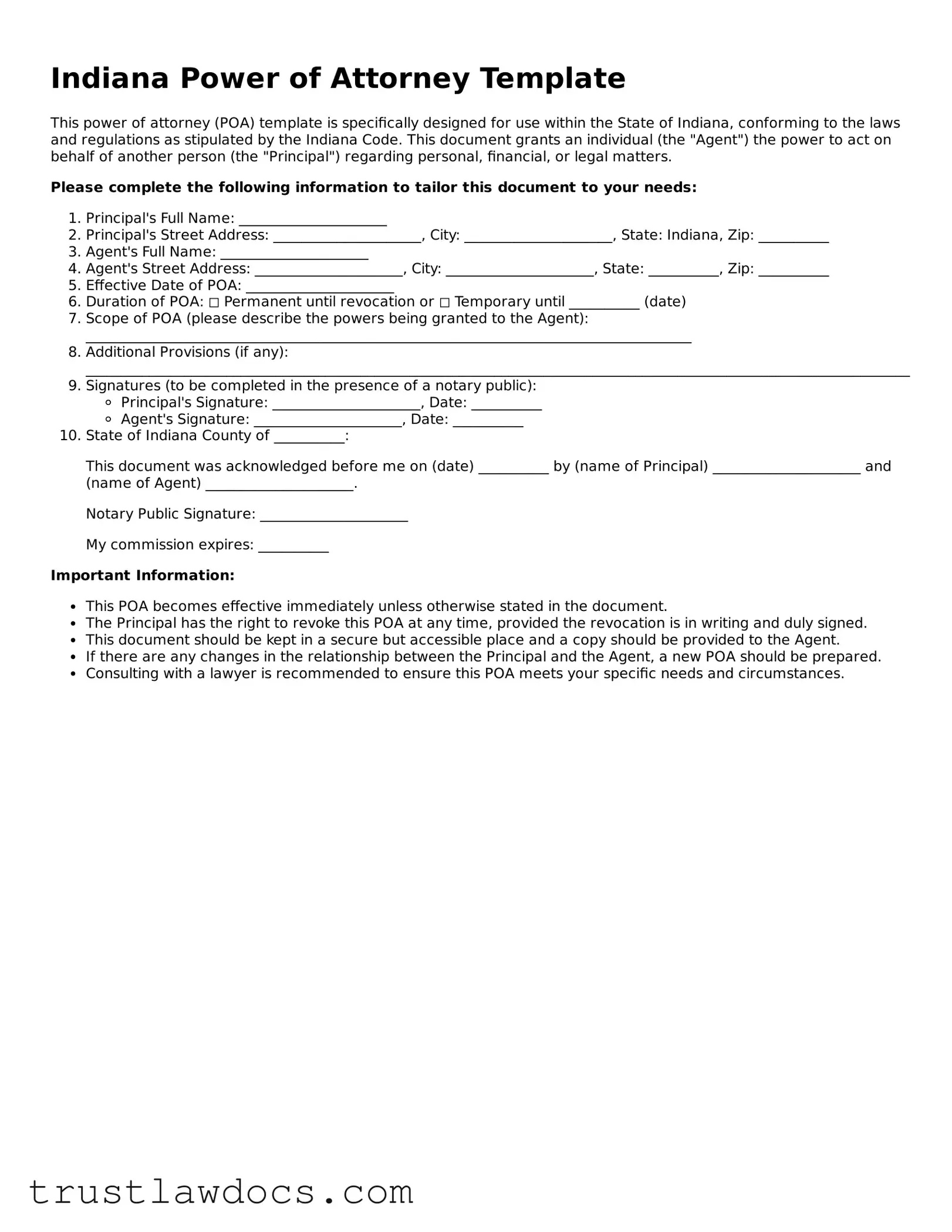

Form Example

Indiana Power of Attorney Template

This power of attorney (POA) template is specifically designed for use within the State of Indiana, conforming to the laws and regulations as stipulated by the Indiana Code. This document grants an individual (the "Agent") the power to act on behalf of another person (the "Principal") regarding personal, financial, or legal matters.

Please complete the following information to tailor this document to your needs:

- Principal's Full Name: _____________________

- Principal's Street Address: _____________________, City: _____________________, State: Indiana, Zip: __________

- Agent's Full Name: _____________________

- Agent's Street Address: _____________________, City: _____________________, State: __________, Zip: __________

- Effective Date of POA: _____________________

- Duration of POA: ◻ Permanent until revocation or ◻ Temporary until __________ (date)

- Scope of POA (please describe the powers being granted to the Agent): ______________________________________________________________________________________

- Additional Provisions (if any): _____________________________________________________________________________________________________________________

- Signatures (to be completed in the presence of a notary public):

- Principal's Signature: _____________________, Date: __________

- Agent's Signature: _____________________, Date: __________

- State of Indiana County of __________:

This document was acknowledged before me on (date) __________ by (name of Principal) _____________________ and (name of Agent) _____________________.

Notary Public Signature: _____________________

My commission expires: __________

Important Information:

- This POA becomes effective immediately unless otherwise stated in the document.

- The Principal has the right to revoke this POA at any time, provided the revocation is in writing and duly signed.

- This document should be kept in a secure but accessible place and a copy should be provided to the Agent.

- If there are any changes in the relationship between the Principal and the Agent, a new POA should be prepared.

- Consulting with a lawyer is recommended to ensure this POA meets your specific needs and circumstances.

PDF Form Details

| Fact Number | Detail |

|---|---|

| 1 | The Indiana Power of Attorney (POA) form allows an individual (the "principal") to authorize someone else (the "agent") to make decisions on their behalf. |

| 2 | There are different types of POA forms in Indiana, including General, Limited, Durable, and Health Care POA. |

| 3 | A Durable Power of Attorney in Indiana remains in effect even if the principal becomes incapacitated, unlike a General POA which becomes invalid in such circumstances. |

| 4 | Under Indiana law, specifically the Indiana Code (IC 30-5), a POA must be signed by the principal and either notarized or witnessed by a disinterested party. |

| 5 | The Indiana Health Care Representative Act allows individuals to appoint someone to make healthcare decisions for them, including the decision to withhold or withdraw life-prolonging treatments. |

| 6 | To be valid, an Indiana POA must clearly identify the principal and agent, specify the powers granted, and be executed according to legal requirements. |

| 7 | In Indiana, unless the POA document states otherwise, an agent's authority commences immediately upon execution of the document. |

| 8 | An Indiana POA can be revoked by the principal at any time as long as the principal is mentally competent, through a written document that is signed, dated, and ideally notarized. |

| 9 | If a POA is durable and the principal becomes incapacitated, Indiana law requires the agent to act in the principal's best interest, keep records of transactions, and avoid conflicts of interest. |

| 10 | The Indiana Secretary of State does not require POA forms to be registered. However, documents related to real estate transactions must be recorded with the county recorder's office where the property is located. |

How to Write Indiana Power of Attorney

Filling out a Power of Attorney (POA) form in Indiana is a significant step in planning for future financial, legal, and medical decisions. This document allows you to appoint someone you trust to make decisions on your behalf should you become unable to do so yourself. Although the process can seem daunting, by following these steps, you can complete it with confidence. Ensure that all information you provide is accurate and reflects your wishes clearly.

- Download the official Indiana Power of Attorney form. This form is available on various legal websites or can be obtained from an attorney.

- Read the form carefully before filling it out. This ensures you understand the scope and implications of the document.

- Enter your full legal name and address in the designated sections to identify yourself as the principal.

- Specify the full legal name and address of the person you are appointing as your attorney-in-fact. This individual will make decisions on your behalf.

- Clearly describe the powers you are granting to your attorney-in-fact. Indiana law allows you to give general powers or specify particular powers related to financial, legal, or medical decisions.

- Include any specific instructions or limitations on the powers granted. For example, you may wish to limit your attorney-in-fact's ability to make gifts of your property or designate how they should make health care decisions.

- Specify the duration of the POA. You can choose to have it become effective immediately and remain in effect indefinitely, or you can set it to become effective upon a certain date or event, such as your incapacitation.

- Have the form notarized. Indiana law requires your signature on the Power of Attorney form to be notarized to be valid.

- Provide copies of the completed and notarized form to your attorney-in-fact, family members, or anyone else who may need to be aware of the arrangement.

After completing these steps, your Power of Attorney form will be legally binding in Indiana. It's wise to review and possibly update your POA periodically to ensure it continues to reflect your current wishes and circumstances.

Get Answers on Indiana Power of Attorney

What is a Power of Attorney form in Indiana?

A Power of Attorney form in Indiana is a legal document that allows one person, known as the principal, to delegate their decision-making powers to another person, known as the agent. This form can cover a wide range of decisions including financial, real estate, and healthcare matters.

Who can be designated as an agent in Indiana?

In Indiana, any competent adult can be designated as an agent. This means the person must be at least 18 years old and have the mental capacity to make decisions. Many people choose a trusted family member or friend to serve as their agent, but a professional, such as an attorney or financial advisor, can also be selected.

Do I need a lawyer to create a Power of Attorney in Indiana?

Although it's not legally required to have a lawyer create a Power of Attorney in Indiana, consulting with one is highly recommended. A lawyer can ensure the document is properly drafted to reflect your wishes accurately and complies with Indiana law.

How can I revoke a Power of Attorney in Indiana?

To revoke a Power of Attorney in Indiana, you must provide a written notice of revocation to your agent and any institutions or entities that were relying on the original Power of Attorney. It's also a good practice to destroy the original document and any copies to prevent confusion.

Is a Power of Attorney form in Indiana only used for financial matters?

No, a Power of Attorney in Indiana can be used for a variety of matters, not just financial ones. These can include healthcare decisions, buying or selling property, and managing business transactions. The specific powers granted are listed in the document itself.

How does a Power of Attorney in Indiana become effective?

A Power of Attorney in Indiana becomes effective as specified in the document. Some are effective immediately upon signing, while others may come into effect upon the incapacity of the principal. The terms should be clearly stated in the Power of Attorney form.

What happens if my Power of Attorney is not followed in Indiana?

If your Power of Attorney is not being followed in Indiana, you may need to take legal action to enforce the document. This could involve filing a petition in court to have the agent adhere to the terms specified in the Power of Attorney or seeking damages for any losses incurred.

Can a Power of Attorney in Indiana make healthcare decisions?

Yes, a Power of Attorney in Indiana can include the authority to make healthcare decisions. This is often done through a separate document known as a Healthcare Power of Attorney, which specifically grants the agent the power to make medical decisions on behalf of the principal.

What should I do with my completed Power of Attorney form in Indiana?

After completing your Power of Attorney form in Indiana, you should provide a copy to your agent and inform close family members or friends about the arrangement. It’s advisable to keep the original document in a safe but accessible place, and consider giving copies to relevant financial institutions or healthcare providers.

Common mistakes

One common mistake when filling out the Indiana Power of Attorney (POA) form is not specifying the powers granted in clear, precise language. Individuals often assume that broad statements cover all necessary authority, but this vagueness can lead to disputes or challenges from third parties. It's crucial to detail the specific actions the agent can undertake, ensuring they align with the principal's needs and intentions.

Another error is overlooking the selection of a durable power of attorney when it's needed. A durable POA remains in effect even if the principal becomes incapacitated, which is essential for ongoing financial management or healthcare decisions. Without specifying durability, the POA might automatically end if the principal becomes unable to make decisions, contrary to their actual intent.

A further oversight involves neglecting to name a successor agent. Situations may arise where the original agent can no longer serve, due to relocation, illness, or unwillingness. Failing to appoint an alternate can render the document ineffective just when it's needed most, requiring a potentially costly and time-consuming court process to appoint a new agent.

Not utilizing a witness or notary public as required by Indiana law is another significant misstep. This formalization process lends credence to the document, making it harder to challenge. It verifies that the principal signed the document willingly and without coercion. Skipping this step can lead to questions about the document's legitimacy.

Misunderstanding the scope of the POA is also problematic. For instance, some might draft a financial POA thinking it covers healthcare decisions, or vice versa. Indiana requires separate documents for healthcare and financial matters, so misconceptions here can leave critical areas without proper legal authorization.

Incorrectly assuming that a POA allows the agent to make decisions after the principal's death is a common misconception. In Indiana, a POA's authority ends upon the principal's death. At that point, the executor of the estate, as named in a will, takes over. Any actions needed after death, like distributing assets, cannot be done under the authority of a POA.

Another frequent mistake is not keeping the POA document accessible. If the document is locked away or not readily available to the agent when needed, it defeats its purpose. Both the agent and relevant financial or medical institutions should have easy access to it, or at least know where to find it quickly.

Some people erroneously believe that a one-size-fits-all POA form from the internet will suit their situation perfectly. However, everyone's circumstances and needs are unique. A generic form may not address specific state laws or personal preferences. Tailoring the POA to fit individual requirements, ideally with legal guidance, ensures it will effectively serve its intended purpose.

Finally, not updating the POA document to reflect current laws or life changes is a critical oversight. Laws governing POA can and do change, and personal situations such as marriage, divorce, or the birth of a child can alter one's choices for an agent or the powers they wish to grant. Regularly reviewing and updating the POA ensures it will perform as expected when needed.

Documents used along the form

The Indiana Power of Attorney form is a crucial document for authorizing someone to act on your behalf in financial or health-related decisions. However, preparing for life's unexpected turns doesn't stop there. Alongside this pivotal form, there are several other documents you might consider to ensure comprehensive coverage of your affairs. Each serves a unique function, complementing the Power of Attorney to fortify your legal and personal preparedness.

- Living Will Declaration: This document, also known as an advance directive, lays out your wishes regarding end-of-life care. Should you become unable to communicate, this declaration guides healthcare providers and loved ones in making critical decisions that align with your preferences.

- Healthcare Representative Appointment: Similar to a Power of Attorney for healthcare, this form nominates a person to make healthcare decisions on your behalf. The key distinction lies in its activation: it comes into effect only when you're unable to make decisions for yourself.

- Last Will and Testament: This essential document outlines how you wish your property and assets to be distributed after your death. A Last Will and Testament also allows you to appoint an executor—the person responsible for overseeing the distribution of your estate.

- HIPAA Authorization Form: The Health Insurance Portability and Accountability Act (HIPAA) privacy rule can restrict the sharing of your health information. A HIPAA Authorization Form gives healthcare providers permission to disclose your health information to specified individuals, usually the ones you've nominated in your Power of Attorney or Healthcare Representative Appointment.

- Revocation of Power of Attorney: Circumstances change, and there may come a time when you need to cancel a previously granted Power of Attorney. This legal document officially terminates the authority you had given to another person, ensuring there's no confusion about their ability to act on your behalf.

Together, these documents provide a network of legal protections, ensuring that your health, financial, and personal preferences are respected, no matter what. By understanding and utilizing these forms in conjunction with an Indiana Power of Attorney, you can achieve peace of mind, knowing that you are well-prepared for the future.

Similar forms

The Indiana Power of Attorney (POA) form is similar to a Medical Power of Attorney. Both documents allow an individual, known as the principal, to designate another individual to make decisions on their behalf. Where the Indiana POA can cover a broad scope of powers, including financial and legal decisions, a Medical Power of Attorney specifically grants the agent the authority to make healthcare decisions when the principal is incapacitated or unable to do so themselves.

Similar to a Durable Power of Attorney, the Indiana POA can continue its effectiveness even after the principal becomes incapacitated, depending on how it is set up. A Durable Power of Attorney remains in effect or becomes effective upon the incapacitation of the principal. This ensures that the agent can manage the principal’s affairs without interruption.

A Living Will is another document that shares similarities with an Indiana Power of Attorney. While a Living Will outlines a person’s wishes regarding medical treatment and life-sustaining measures in the event they become incapacitated, a Power of Attorney appoints someone to make decisions on their behalf. Both are advance directives that provide instructions for a person’s care if they’re unable to communicate their wishes.

The Indiana Power of Attorney is also akin to a Springing Power of Attorney. A Springing Power of Attorney becomes effective upon the occurrence of a specified event, usually the incapacitation of the principal. This contrasts with a standard POA, which typically takes effect immediately upon signing, unless otherwise specified.

Similarities can also be found between the Indiana Power of Attorney and a General Power of Attorney. Both grant an agent the authority to perform a wide range of actions on behalf of the principal. However, a General Power of Attorney usually ceases to be effective if the principal becomes incapacitated, unless it’s specified as durable.

A Financial Power of Attorney is a document specifically focused on allowing an agent to make financial decisions for the principal, such as handling bank accounts, paying bills, and managing investments. This is similar to the financial powers that can be included in an Indiana Power of Attorney, showing how both documents play a crucial role in financial planning and management.

Similar to the Indiana Power of Attorney, a Limited or Special Power of Attorney allows the principal to grant specific powers to an agent for specific purposes or transactions, such as selling a property. The main difference lies in the scope of authority granted; a Limited Power of Attorney is far more narrow and specific than the broad powers that might be granted in a general POA.

The Guardianship Agreement is another document that bears similarity to a Power of Attorney. While a Guardianship Agreement usually involves a court-appointed guardian to make decisions for a minor or incapacitated adult, a Power of Attorney allows an individual to voluntarily appoint someone to make decisions on their behalf without the need for court intervention.

An Advance Directive is a broader term that encompasses several types of healthcare directives, including a Power of Attorney for health care and a Living Will. It is designed to outline a person’s wishes regarding medical treatment and appoints an agent to make healthcare decisions, showing how it shares the forward-looking aspect of ensuring an individual’s wishes are respected, much like the principles behind creating a Power of Attorney.

Lastly, the Trust Agreement shares similarities with a Power of Attorney. Both can provide for the management of an individual’s assets, but a Trust Agreement typically involves holding property by one party for the benefit of another and can continue to operate beyond the grantor's incapacitation or death. Unlike a POA, which grants someone the authority to act on the principal's behalf, a trust is a legal entity that holds assets, highlighting their roles in estate planning.

Dos and Don'ts

When filling out the Indiana Power of Attorney (POA) form, it's important to approach the task with care and attention. A Power of Attorney is a powerful legal document that grants someone else the authority to act on your behalf. To ensure the process goes smoothly and your interests are adequately protected, here are some guidelines to follow.

Do:

- Read the document thoroughly before starting. Ensure you understand the scope of authority you’re granting.

- Use precise language to define the powers granted. Ambiguities can lead to issues down the line.

- Choose a trusted individual as your agent. This person will have significant control over your affairs, so trust is paramount.

- Include specifics about when the POA will take effect and under what circumstances it will terminate.

- Have the document notarized if required. This adds a layer of authenticity and is a legal requirement in some contexts.

- Consult with a legal professional if you have any doubts or questions. A little guidance can prevent big mistakes.

- Inform relevant parties, such as financial institutions or healthcare providers, about the POA.

- Keep a copy of the signed document in a safe but accessible location, and provide copies to your agent and any relevant institutions.

Don't:

- Rush through the process. Filling out a POA form without proper consideration can have unintended consequences.

- Be vague about the powers you’re granting. Specificity can help prevent misuse of the POA.

- Choose an agent based solely on personal relationships without considering their ability and willingness to act responsibly on your behalf.

- Forget to specify a termination date or criteria, leaving open the possibility of a perpetual POA that might not align with your future intentions.

- Skip the step of having it notarized if it’s required for your situation, as failure to do so could invalidate the document.

- Attempt to use the POA form to cover items that it’s not legally designed to address, such as making changes to a will.

- Keep the signing of the document a secret from family or others who may be directly affected.

- Assume one copy is enough. Having multiple copies ensures that the document can be accessed when needed and by those who need it.

Following these dos and don'ts can help ensure that your Indiana Power of Attorney form accurately reflects your wishes and protects your interests. Always remember, when in doubt, seek legal advice to navigate any complexities you might encounter.

Misconceptions

Misunderstandings about the Indiana Power of Attorney (POA) form are common. This document, crucial in planning for future financial and health care decisions, often comes with a set of misconceptions. Here, we clarify eight frequent misconceptions:

All POAs are the same. In reality, Indiana has various types of POA forms for different purposes, such as financial matters, healthcare decisions, or the care of minor children. Each type has its specific uses and limitations.

A POA grants unlimited power. Contrary to this belief, the powers granted by a POA can be broad or limited, depending on how the document is drafted. The person creating the POA, known as the principal, dictates the extent of authority given to the agent.

A POA is effective after the principal's death. Actually, all powers granted through a POA terminate upon the principal’s death. At that point, the executor of the estate, as specified in a will, takes over.

Creating a POA means losing control. This is not true; a POA can be structured to become active only under certain conditions, such as incapacitation, allowing the principal to retain control over their affairs until the specified conditions are met.

A POA can be executed after the principal is incapacitated. In reality, for a POA to be valid, it must be executed while the principal is of sound mind, understanding the implications of the document they are signing.

A verbal agreement is enough to appoint a POA. Indiana law requires a POA to be in writing, signed by the principal, and notarized to be legally binding.

Only seniors need a POA. People of all ages can benefit from having a POA. Unexpected situations, such as accidents or sudden illness, can occur at any age, making it essential to have arrangements in place for someone to handle financial and health decisions.

A POA is difficult to revoke. As long as the principal is competent, they can revoke a POA at any time. This revocation must be in writing and communicated to any relevant parties, especially the previously appointed agent.

Key takeaways

Filling out and using the Indiana Power of Attorney (POA) form is an important process that allows one person to grant another person the authority to make decisions on their behalf. This process involves several key steps and considerations:

- Understanding the Types: Know the different types of POA, including General, Limited, Health Care, and Durable, to choose one that best fits your needs.

- Choosing an Agent: Select someone you trust completely as your agent. This individual will be making decisions in your name.

- Specifying Powers: Clearly outline the powers you are granting. You can allow your agent to handle financial matters, make health care decisions, or both, depending on the type of POA.

- Meeting State Requirements: Ensure your POA form complies with Indiana state law. This might include witness signatures, notarization, or specific language that needs to be included in the document.

- Signing Formally: The POA must be signed and dated by you (the principal) in the presence of a notary public or, in some cases, additional witnesses to make it legally binding.

- Informing Others: Share the completed POA with relevant parties, such as your financial institutions, doctors, or family members, so they know whom to contact.

- Revocation Ability: Understand that you can revoke your POA at any time as long as you are competent. This requires a formal revocation process.

- Keeping Records: Maintain copies of the POA document in a safe place, and make sure your agent and any alternates have access or copies as needed.

- Reviewing Periodically: Reassess your POA periodically to ensure it still reflects your wishes, especially after major life events like marriage or the birth of a child.

- Seeking Legal Advice: Consider consulting with a legal professional to ensure your POA meets all legal requirements and accurately reflects your intentions.

Popular Power of Attorney State Forms

Financial and Medical Power of Attorney Forms - It’s particularly important if you're traveling abroad and need someone to act on your behalf domestically.

Poa Form California - In the event of the principal's death, the authority granted through a Power of Attorney typically ends and the executor of the estate takes over.