Free General Power of Attorney Form for Texas

When individuals in Texas wish to authorize someone else to act on their behalf for various matters, ranging from financial to personal transactions, they often turn to a legal instrument known as the General Power of Attorney (POA). This form empowers the designated representative, also referred to as the agent, to perform actions and make decisions just as the principal, the person granting the power, might do themselves. Essential for its broad applicability, the Texas General Power of Attorney form requires meticulous attention to detail to ensure that it accurately reflects the principal’s wishes and complies with state legal standards. From real estate transactions to handling business operations and engaging in litigation, the scope of authority granted can be as broad or as limited as the principal sees fit. However, it's critical to be aware that this powerful document remains in effect unless specifically revoked or if the principal becomes incapacitated, at which point, unless otherwise stated, a Durable Power of Attorney would be needed to maintain the agent's authority. Understanding the significance and the legalities of the Texas General Power of Attorney is vital for anyone looking to establish such an arrangement, ensuring that their affairs are managed according to their preferences.

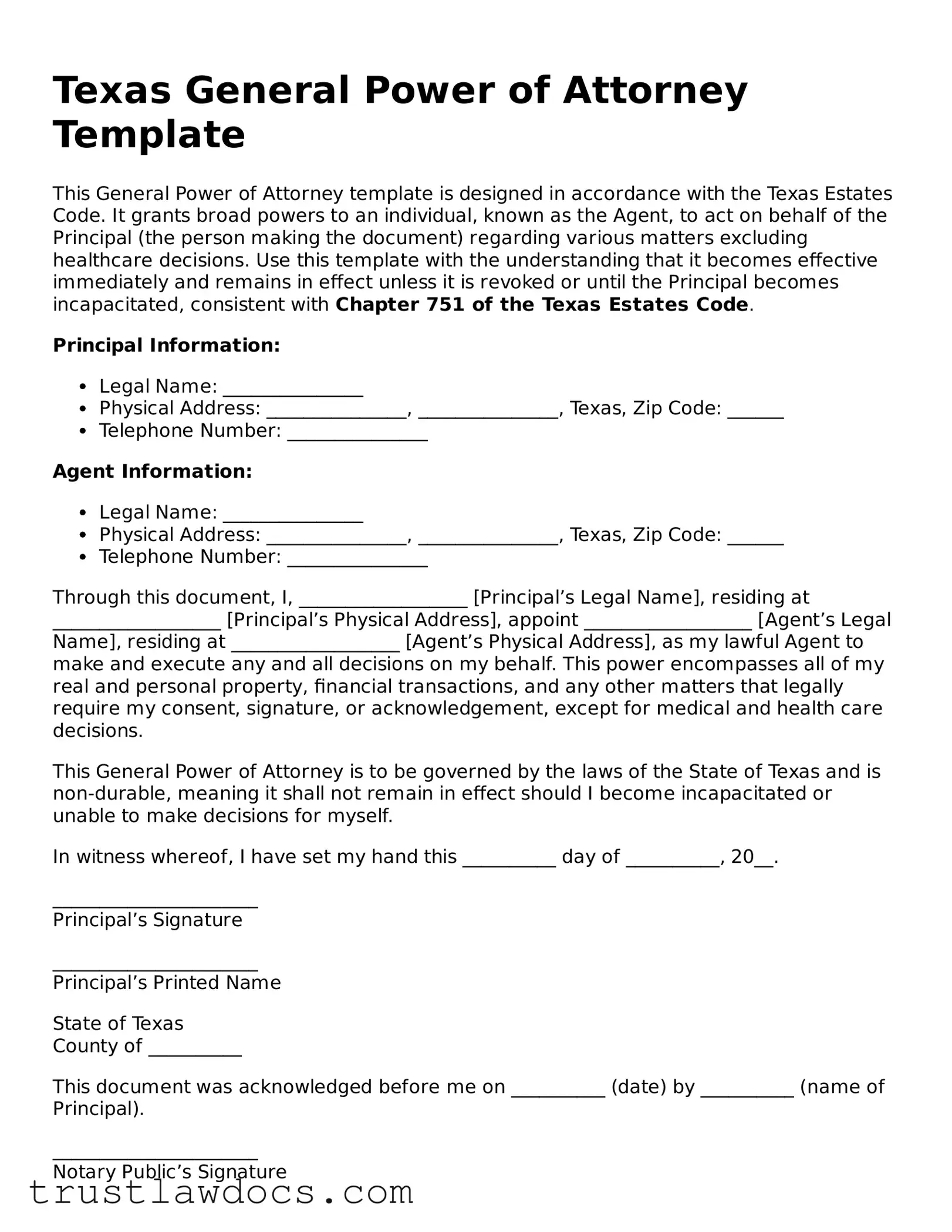

Form Example

Texas General Power of Attorney Template

This General Power of Attorney template is designed in accordance with the Texas Estates Code. It grants broad powers to an individual, known as the Agent, to act on behalf of the Principal (the person making the document) regarding various matters excluding healthcare decisions. Use this template with the understanding that it becomes effective immediately and remains in effect unless it is revoked or until the Principal becomes incapacitated, consistent with Chapter 751 of the Texas Estates Code.

Principal Information:

- Legal Name: _______________

- Physical Address: _______________, _______________, Texas, Zip Code: ______

- Telephone Number: _______________

Agent Information:

- Legal Name: _______________

- Physical Address: _______________, _______________, Texas, Zip Code: ______

- Telephone Number: _______________

Through this document, I, __________________ [Principal’s Legal Name], residing at __________________ [Principal’s Physical Address], appoint __________________ [Agent’s Legal Name], residing at __________________ [Agent’s Physical Address], as my lawful Agent to make and execute any and all decisions on my behalf. This power encompasses all of my real and personal property, financial transactions, and any other matters that legally require my consent, signature, or acknowledgement, except for medical and health care decisions.

This General Power of Attorney is to be governed by the laws of the State of Texas and is non-durable, meaning it shall not remain in effect should I become incapacitated or unable to make decisions for myself.

In witness whereof, I have set my hand this __________ day of __________, 20__.

______________________

Principal’s Signature

______________________

Principal’s Printed Name

State of Texas

County of __________

This document was acknowledged before me on __________ (date) by __________ (name of Principal).

______________________

Notary Public’s Signature

______________________

Notary Public’s Printed Name

My commission expires: __________

Note: It is recommended to consult with a legal professional when completing this template to ensure it meets all necessary legal requirements and adequately reflects the Principal's wishes.

PDF Form Details

| Fact | Detail |

|---|---|

| Governing Law | The Texas General Power of Attorney form is governed by the Texas Estates Code, specifically Chapter 751. |

| Purpose | It allows an individual (the principal) to grant broad financial powers to another person (the agent). |

| Revocation | The form can be revoked by the principal at any time, as long as they are mentally competent, by writing a revocation statement or creating a new Power of Attorney document. |

| Witness Requirement | In Texas, the General Power of Attorney form does not have to be notarized, but two adult witnesses are required for it to be considered legally valid. |

How to Write Texas General Power of Attorney

In Texas, the General Power of Attorney form is a legal document that allows a person (the principal) to designate someone else (the agent) to make decisions on their behalf. It’s a responsibility that requires trust and mutual understanding. Filling out this form might seem tricky, but with a step-by-step guide, the process can be straightforward. This guide helps ensure that all necessary information is provided accurately to avoid any potential legal issues or misunderstandings between the parties involved.

- Begin by entering the full legal name of the person granting the power, referred to as the principal, at the top of the form.

- Next, fill in the complete legal name of the person who will be given the authority, known as the agent.

- Specify the powers being granted by the principal to the agent. This section should include a detailed list of the tasks the agent is authorized to perform on behalf of the principal.

- Include any special instructions or limitations to the powers granted. This might involve specifying dates, restrictions on specific types of transactions, or any other conditions the principal desires to impose.

- It's important to clearly state the duration of the power of attorney. Specify if it’s effective immediately and remains in effect indefinitely, or until a specific date, or upon the occurrence of a specified event.

- Have the principal sign and date the form in the presence of a notary public. This step legalizes the document, making it a binding legal agreement between the principal and the agent.

- In some cases, the agent may also need to sign the document, acknowledging their acceptance of the responsibilities. Check the specific requirements for your situation to see if this step is necessary.

- Finally, the document must be notarized. This involves the principal and, if required, the agent, signing the form in front of a notary. The notary will then add their seal or stamp to officially notarize the document.

Filling out the Texas General Power of Attorney form accurately is crucial for ensuring that the agent has the correct authority to act on the principal's behalf. This legal procedure not only provides peace of mind but also strengthens the trust between the principal and the agent. By following these steps, individuals can ensure that their affairs will be handled according to their wishes should they become unable to manage them directly.

Get Answers on Texas General Power of Attorney

What is a Texas General Power of Attorney form?

A Texas General Power of Attorney form allows you to appoint someone, known as an agent, to manage your financial affairs. This form can cover a wide range of tasks like handling bank transactions, buying or selling property, and managing personal business. The authority you grant is broad and typically remains in effect unless you become incapacitated or decide to revoke it.

Who can be my agent?

Almost anyone you trust can be designated as your agent. This includes family members, friends, or trusted professionals. The key here is trust, as this individual will have significant control over your financial matters. Choose someone who is responsible and has the capability to handle the tasks you'll assign.

Does my agent need to live in Texas?

No, your agent does not need to reside in Texas. However, choosing someone local can be beneficial for practical reasons, especially if the management of real property or local transactions are involved. The most crucial factor is that your agent is willing and able to carry out the duties assigned, regardless of their location.

What happens if I become incapacitated?

Under a General Power of Attorney in Texas, should you become incapacitated, the power you've granted typically ceases to be effective. If you anticipate the need for your agent to act on your behalf if you're incapacitated, consider a Durable Power of Attorney, which remains in effect even if you lose capacity.

Can I revoke my General Power of Attorney?

Yes, you can revoke your General Power of Attorney at any time, as long as you are competent. To do this effectively, notify your agent in writing and retrieve all copies of the document. For thoroughness, you might also inform any institutions or individuals that interacted with your agent under this power.

Do I need a lawyer to create a General Power of Attorney?

While you are not required to have a lawyer to create a General Power of Attorney in Texas, consulting with one can be very helpful. A lawyer can ensure the form meets all legal requirements and properly reflects your wishes. If your financial affairs are complicated, seeking professional advice is strongly recommended to ensure everything is in order.

Common mistakes

Many individuals encounter errors when filling out the Texas General Power of Attorney form. One common mistake is not specifying the powers granted clearly. Without detailed descriptions of the authority given, the document may not serve its intended purpose effectively, leading to confusion or legal challenges.

Another oversight is failing to designate an alternate agent. Should the primary agent become unable to serve, an alternate agent can step in without the need for court intervention. This critical detail often goes overlooked, potentially leaving affairs in limbo if the initial agent can no longer act.

Notarization is also frequently missed. In Texas, for a Power of Attorney to be legally binding, it must be notarized. Skipping this step renders the document invalid, which can lead to significant legal impediments when the document is needed the most.

People often neglect to include an expiration date for the Power of Attorney. While some may prefer an indefinite duration, others might benefit from setting a specific term. Without this, the document could either expire too soon or remain active longer than desired.

Incorrectly identifying the parties involved is another common error. The form requires precise information about the principal and the agent. Any inaccuracies in names, addresses, or other identifying details can void the document or delay its acceptance by institutions.

Some fail to discuss the responsibilities with their chosen agent before completion. It is crucial that the agent understands their role and agrees to take on the responsibilities. If the agent is unaware or unwilling, the Power of Attorney might not be executed as planned.

A lack of specificity in granted powers can also pose problems. The form allows the principal to limit or extend the powers granted to the agent. Without clear definitions, the agent may make decisions that the principal would not approve of.

Forgetting to sign and date the form is a surprisingly common mistake. A signature and date are critical for the document's validity. An unsigned or undated Power of Attorney will not be recognized legally, causing unnecessary delays and complications.

Lastly, not providing copies to relevant parties is an oversight many make. Banks, healthcare providers, and others need to be aware of the Power of Attorney to honor it. Failure to distribute copies can prevent the agent from acting effectively on the principal's behalf.

Documents used along the form

Understanding the landscape of legal documentation that often accompanies or is related to the Texas General Power of Attorney (GPA) form is essential for individuals looking to ensure their affairs are in order. The GPA form is a valuable tool for authorizing an individual, the “agent,” to manage a wide array of financial and legal matters on behalf of the “principal.” However, depending on one’s specific needs and circumstances, other forms and documents might also be necessary. Below, we highlight some of these additional documents, providing a clearer picture of the comprehensive approach required for thorough legal preparedness.

- Medical Power of Attorney: This document permits an individual to designate an agent to make healthcare decisions on their behalf if they become unable to do so. Its coverage is strictly limited to medical decisions, contrasting the broader financial focus of the General Power of Attorney.

- Directive to Physicians (Living Will): A document expressing an individual's preferences regarding medical treatments and life-sustaining measures if they become critically ill or incapacitated. It acts independently of the Medical Power of Attorney.

- Durable Power of Attorney: Similar to the General Power of Attorney, this document allows an individual to appoint an agent for financial decisions. The key difference is its durability; it remains effective even if the principal becomes mentally incapacitated.

- Declaration of Guardian in Advance: This document specifies an individual’s preference for a guardian of their person and their estate should they become incapacitated and a guardianship become necessary.

- Revocation of Power of Attorney: Used to cancel a previously granted power of attorney, this form is crucial when the principal decides to terminate an agent's authority or wishes to appoint a new agent.

- HIPAA Release Form: This form allows an individual’s health information to be shared with designated persons, complementing a Medical Power of Attorney by ensuring chosen agents have access to necessary medical records.

- Special or Limited Power of Attorney: This form grants an agent authority to conduct a specific transaction or handle a particular matter on behalf of the principal, unlike the more broad-based General Power of Attorney.

- Real Estate Power of Attorney: This allows an individual to designate an agent to manage real estate matters on their behalf, including buying, selling, or managing property.

- Banking Power of Attorney: It authorizes an agent to handle banking transactions, including withdrawals, transfers, and account management, offering an efficient way to manage one’s financial affairs.

Each of these documents serves a unique and critical role in comprehensive estate and personal planning. While the General Power of Attorney offers broad management powers, combining it with the appropriate selection from the above list can ensure all aspects of one’s affairs are accurately addressed. It’s advisable for individuals to consult with legal professionals to understand how these documents interplay with their specific situations and to craft a holistic plan that reflects their needs and wishes.

Similar forms

The Texas General Power of Attorney (POA) form shares similarities with several other legal documents, each designed with specific purposes and stipulations that distinguish them from one another, yet interconnected through the notion of delegated authority or decision-making. One such document is the Limited Power of Attorney. Unlike the broad, sweeping authority granted in a general POA, which typically covers a wide range of acts the principal can perform, a Limited Power of Attorney narrows this scope to specific tasks or actions, like selling a property or managing certain financial transactions. This specificity allows the principal to retain greater control over the delegated powers.

Another related document is the Durable Power of Attorney. The central feature that aligns it with the general POA is its function of empowering an agent to act on the principal's behalf. However, its unique characteristic is its durability—it remains in effect even if the principal becomes incapacitated. This aspect is crucial for planning long-term affairs and ensuring that one's financial and health-related decisions can be managed regardless of one's health condition, making it a critical document for comprehensive estate planning.

The Medical Power of Attorney is structured with a similar foundational concept to a general POA but is exclusively focused on healthcare decisions. This specificity means that while a general POA might authorize financial and business transactions, a Medical Power of Attorney grants the agent the power to make medical decisions on the principal's behalf if they become unable to do so themselves. It is a critical document for personal health care management and end-of-life planning, underscoring the significance of specifying the type of decisions the agent is authorized to make.

Similarly, a Springing Power of Attorney is akin to the General Power of Attorney with the distinguishing feature of a triggering event. Unlike a general POA, which becomes effective immediately upon signing, a Springing Power of Attorney takes effect only when a specific, defined condition is met, usually the principal's incapacity. This document offers a balance between maintaining personal control over affairs and ensuring assistance when needed, reflecting careful planning for unexpected circumstances.

The Revocable Living Trust, while not a POA, is related in its approach to managing one's affairs, either during their lifetime or after death. Like a general POA, it involves designating another individual to manage the principal's assets. However, it does so within the framework of a trust, providing added layers of specificity and durability that a POA does not. This structure is particularly advantageous for estate planning, asset protection, and avoiding probate.

Similarly, a Financial Power of Attorney, akin to a General Power of Attorney, grants someone the authority to handle financial matters on the principal's behalf. It can be as broad or as narrow in scope as the principal desires, although typically, it's focused exclusively on financial affairs. This focus makes it an essential tool for financial planning, ensuring that one's financial obligations and investments are managed effectively, especially during periods of absence or incapacity.

An Advance Directive, often in the form of a living will, is a document that conveys a person's wishes regarding end-of-life medical care, in case they become unable to communicate those wishes themselves. While it differs in content and purpose from a general POA, which might also include decisions about property or finances, it shares the foundational principle of appointing another to act in the principal's place. It's an essential part of health care planning, emphasizing the principal's autonomy and wishes concerning their medical treatment and life-sustaining measures.

Lastly, a Guardianship Appointment is a court-ordered arrangement where an individual is given the legal authority to care for another person and/or their property, usually in cases where the latter cannot do so themselves due to minor status or incapacity. While a General Power of Attorney allows individuals to voluntarily delegate authority, a guardianship may be imposed by a court, offering a different route to manage someone's personal and financial affairs when they are not in a position to do so. This highlights the legal system's role in protective oversight and care for the vulnerable.

Dos and Don'ts

When filling out the Texas General Power of Attorney form, it's essential to be precise and informed to ensure that the document accurately reflects your intentions. Below are key dos and don'ts to guide you through the process.

Things You Should Do

- Read the form thoroughly before you start filling it out to ensure you understand all the sections and terms.

- Print or type your information clearly to prevent misunderstandings or processing delays.

- Specify the powers you are granting in detail to avoid any ambiguity about the authority given.

- Consult with a legal expert if you have any doubts or questions about how to fill out the form or what implications it might have.

- Choose a trusted person as your agent who will act in your best interest.

- Sign and date the form in the presence of a notary public to make it legally binding.

Things You Shouldn't Do

- Don't leave any sections incomplete, as missing information could lead to misunderstandings or legal complications.

- Don't grant more powers than necessary. Consider the scope of authority you're comfortable giving.

- Don't use vague language that could be interpreted in multiple ways.

- Don't forget to notify your agent and any relevant institutions of the power of attorney to ensure it can be exercised smoothly.

- Don't neglect to keep a copy of the signed and notarized document for your records.

- Don't fail to review and update the document as your situation or laws change.

Misconceptions

Understanding the General Power of Attorney (POA) in Texas is crucial for effectively managing one's affairs or assisting someone in doing so. However, misconceptions about its use and implications are common. Clarifying these misunderstandings ensures that individuals can make informed decisions when engaging in legal and financial planning. Here are ten common misconceptions about the Texas General Power of Attorney form:

It grants unlimited power: A common misconception is that the Texas General Power of Attorney grants unlimited power to the agent. Although it's a broad mandate, the scope is defined by the specific powers enumerated in the document.

It remains effective after death: A General Power of Attorney in Texas is valid only during the lifetime of the principal. Upon the principal's death, the authority granted through the POA ceases, and the estate is then managed according to the will or state laws if there's no will.

It supersedes a will: Some believe that a Power of Attorney can override the terms of a will. This is incorrect; a POA is only operational during the principal's lifetime and does not affect the distribution of assets as outlined in a will.

It can be verbally granted: For a Power of Attorney to be legally valid in Texas, it must be in writing. Verbal agreements are not recognized as binding under Texas law regarding POA grants.

It is irrevocable: The principal has the right to revoke or amend the General Power of Attorney at any time, as long as they have the mental capacity to do so. This flexibility is crucial for adapting to changing circumstances or relationships.

Only relatives can be appointed: There's a misconception that only family members can serve as agents under a Power of Attorney. In Texas, any trusted individual or even an organization that the principal chooses can act in this role, provided they accept the responsibility.

It's the same as a Medical Power of Attorney: People often confuse the General Power of Attorney with a Medical Power of Attorney. The former deals with financial and property matters, while the latter specifically addresses health care decisions.

No one can contest it: While a properly executed Power of Attorney is legally binding, its use or the agent's decisions can be challenged in court if they are alleged to be abusive or not in the principal's best interests.

It requires a lawyer to set up: While legal advice is beneficial, especially for complex situations, Texas does not mandate that a lawyer must draft or be involved in the creation of a General Power of Attorney. Pre-formatted legal documents can be used, but understanding the implications and ensuring the form meets all legal requirements is crucial.

It automatically includes power to sell real estate: Unless specifically stated, a General Power of Attorney does not necessarily grant the agent power to sell the principal's real estate. Specific powers need to be clearly outlined within the document to authorize such transactions.

Key takeaways

When approaching the process of filling out and utilizing a Texas General Power of Attorney form, individuals should understand its significance and the responsibilities it entails. This legal document enables a person, known as the principal, to designate another person, termed the agent or attorney-in-fact, to make decisions and act on their behalf in various matters. Here are six key takeaways to consider during this process:

- Complete Accuracy is Essential: The information provided in the Texas General Power of Attorney form must be accurate and include complete details. This includes the full legal names, addresses, and contact details of both the principal and the agent. Mistakes or inaccuracies can lead to delays or the invalidation of the document.

- Scope of Authority: The form allows the principal to define the scope of powers granted to the agent. This can range from broad authority, covering almost all actions the principal could take themselves, to more limited and specific authorities. Clearly detailing these powers prevents confusion and unauthorized actions.

- Durability Considerations: A crucial decision is whether the power of attorney will be durable. This means it remains in effect even if the principal becomes incapacitated. Non-durable powers of attorney terminate if the principal loses the ability to make decisions for themselves.

- Selection of Agent: The choice of an agent is a significant decision. The agent should be someone the principal trusts implicitly, as they will have the authority to manage financial, legal, and sometimes personal decisions on the principal’s behalf.

- Witnesses and Notarization: For a Texas General Power of Attorney to be valid, it typically needs to be signed in the presence of witnesses and/or be notarized, depending on the specific requirements of the jurisdiction. This process adds a layer of legal verification and protection.

- Revocation Process: The principal has the right to revoke the power of attorney at any time, as long as they are mentally competent. The revocation should be in writing, and notification should be provided to the agent and any institutions or individuals that were relying on the authority of the power of attorney.

Understanding these key takeaways ensures that the principal and agent can navigate the complexities of the Texas General Power of Attorney with confidence and clarity. It's crucial to consider seeking legal advice to ensure that all legal requirements are met and that the form is correctly filled out and filed.

Popular General Power of Attorney State Forms

Financial Power of Attorney Michigan - Properly executing the form helps in avoiding potential legal disputes among family members about who should manage the principal’s affairs.

Nys Power of Attorney Form - It must be signed in the presence of a notary public to ensure its legality and validity.

Power of Attorney California - This document gives another person broad legal powers to act on your behalf.