Free General Power of Attorney Form for New York

When individuals consider managing their affairs, whether due to travel, health concerns, or preparing for the unforeseen, the New York General Power of Attorney form emerges as a crucial document. This legal instrument allows one person, known as the principal, to grant another person, the agent or attorney-in-fact, the authority to handle their financial matters. The breadth of powers encompassed can range from everyday transactions to handling complex business dealings, making it a versatile tool for planning and management. However, it's important to note that this power ceases if the principal becomes incapacitated, distinguishing it from a Durable Power of Attorney. Due to the significance and potential implications of this document, understanding its structure, the specific powers granted, and the process for its creation and revocation is indispensable for anyone considering its use. The state of New York has specific requirements and legal criteria that must be met for the document to be valid, including the need for witnesses and certain declarations to be made by the principal, emphasizing the necessity for careful consideration and often, legal guidance when drafting and executing the form.

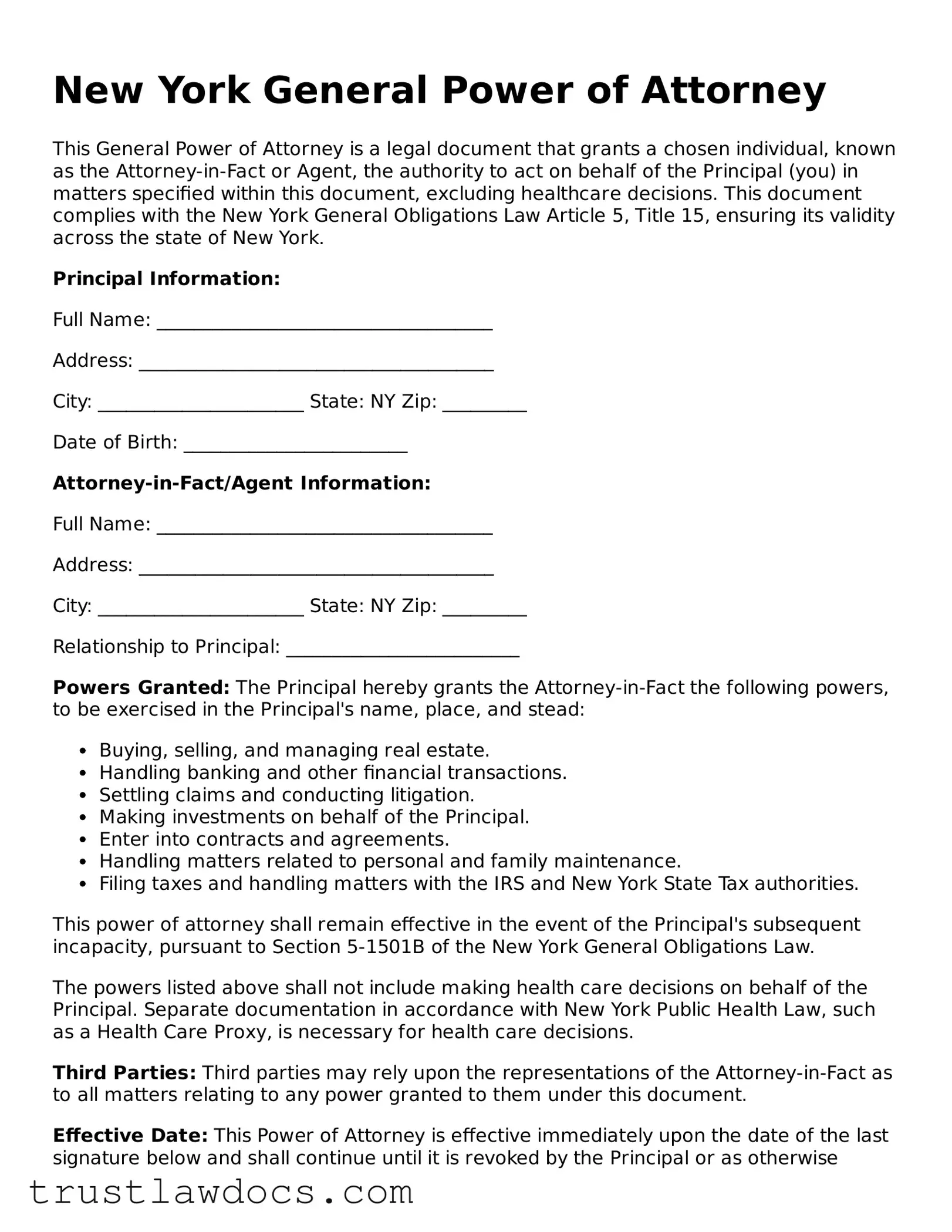

Form Example

New York General Power of Attorney

This General Power of Attorney is a legal document that grants a chosen individual, known as the Attorney-in-Fact or Agent, the authority to act on behalf of the Principal (you) in matters specified within this document, excluding healthcare decisions. This document complies with the New York General Obligations Law Article 5, Title 15, ensuring its validity across the state of New York.

Principal Information:

Full Name: ____________________________________

Address: ______________________________________

City: ______________________ State: NY Zip: _________

Date of Birth: ________________________

Attorney-in-Fact/Agent Information:

Full Name: ____________________________________

Address: ______________________________________

City: ______________________ State: NY Zip: _________

Relationship to Principal: _________________________

Powers Granted: The Principal hereby grants the Attorney-in-Fact the following powers, to be exercised in the Principal's name, place, and stead:

- Buying, selling, and managing real estate.

- Handling banking and other financial transactions.

- Settling claims and conducting litigation.

- Making investments on behalf of the Principal.

- Enter into contracts and agreements.

- Handling matters related to personal and family maintenance.

- Filing taxes and handling matters with the IRS and New York State Tax authorities.

This power of attorney shall remain effective in the event of the Principal's subsequent incapacity, pursuant to Section 5-1501B of the New York General Obligations Law.

The powers listed above shall not include making health care decisions on behalf of the Principal. Separate documentation in accordance with New York Public Health Law, such as a Health Care Proxy, is necessary for health care decisions.

Third Parties: Third parties may rely upon the representations of the Attorney-in-Fact as to all matters relating to any power granted to them under this document.

Effective Date: This Power of Attorney is effective immediately upon the date of the last signature below and shall continue until it is revoked by the Principal or as otherwise provided by law.

Signature of Principal:

___________________________________ Date: _______________

Signature of Attorney-in-Fact:

___________________________________ Date: _______________

Acknowledgement by Notary Public:

This document was acknowledged before me on (date) __________ by (name of Principal) ________________________, who is personally known to me or who has produced identification _______________.

Notary Public's Name: __________________________________

Signature: ______________________________ Commission expires: __________

PDF Form Details

| Fact Name | Description |

|---|---|

| Purpose | A General Power of Attorney form in New York allows one person to grant another person the authority to make decisions on their behalf regarding financial affairs. |

| Governing Law | New York General Obligations Law, specifically Article 5, Title 15, governs General Power of Attorney forms in New York. |

| Revocation | The document can be revoked at any time by the principal, provided they are of sound mind, through a written notice of revocation. |

| Witness Requirement | The signing of the document must be witnessed by a notary public or at least two adults who are not named as agents in the document. |

| Durability | A General Power of Attorney in New York can be made durable, meaning it remains in effect even if the principal becomes incapacitated, if this intention is clearly stated in the document. |

| Limitations | While it grants broad powers, certain actions, such as making health care decisions, require a separate form of power of attorney or health care directive in New York. |

| Filing Requirements | There's no legal requirement to file a General Power of Attorney with any government body in New York, but it may be necessary to present it to financial institutions or other entities. |

How to Write New York General Power of Attorney

Filling out a General Power of Attorney form in New York is a critical step for anyone wishing to grant someone else the authority to make decisions on their behalf. This legal document allows the appointed person, known as the agent, to handle a wide range of matters, including financial transactions, real estate affairs, and other personal or business dealings. It's vital to approach this task with care to ensure your wishes are clearly documented and legally valid. Below are the steps one should follow to complete the form accurately.

- Begin by obtaining the most current version of the New York General Power of Attorney form. This can often be found online through legal services or at a local law library.

- Read the entire form carefully before you start filling it out. Understanding each section in advance will help prevent mistakes.

- In the designated section, enter your full legal name and address, establishing you as the principal who is granting the power of attorney.

- Identify the agent by writing their full legal name and address in the specified field. Ensure this information is accurate to avoid any confusion regarding the identity of the appointed agent.

- Detail the specific powers you are granting to the agent. This section requires precise language, so consider consulting with a legal professional to ensure your intentions are clearly articulated.

- Some powers may require special authorization within the form. Read instructions carefully to see if any of your granted powers fall under this category and provide the necessary signatures or initials.

- If you wish to impose any conditions or limitations on the agent's powers, use the section provided to outline these restrictions.

- Select an expiration date for the power of attorney if you wish it to be time-limited. Otherwise, it may remain in effect indefinitely or until specifically revoked.

- Review the form with the designated agent present, ensuring both parties agree with the terms outlined.

- Sign and date the form in the presence of a notary public to validate its authenticity. The agent may also be required to sign, depending on the form's specific instructions.

- Store the completed form in a safe place and provide copies to relevant parties, such as financial institutions or legal professionals, as necessary.

Once the form is fully completed and properly executed, the responsibilities and powers granted to the agent become effective immediately, unless otherwise specified. It is crucial to communicate with the appointed agent, ensuring they understand their obligations and the trust bestowed upon them. Remember, a Power of Attorney can be a powerful tool in managing one's affairs but demands thoughtful consideration and precise execution.

Get Answers on New York General Power of Attorney

What is a New York General Power of Attorney form?

A General Power of Attorney form in New York is a legal document that allows one person, known as the principal, to grant another person, the agent or attorney-in-fact, the power to make decisions and conduct transactions on their behalf. These powers can cover a broad range of activities, from financial decisions to business transactions, but they do not include healthcare decisions.

How can someone create a General Power of Attorney in New York?

To create a General Power of Attorney in New York, the principal must complete and sign the form, often in the presence of a notary public or witnesses, depending on state requirements. The form must clearly state the powers being granted to the agent. It is recommended to use a state-specific form to ensure compliance with local laws.

What powers can be given with a General Power of Attorney?

With a General Power of Attorney, an agent can be granted a wide range of powers, including handling financial matters, buying or selling real estate, managing business transactions, and dealing with government benefits. However, making healthcare decisions on behalf of the principal is not permitted under a General Power of Attorney.

When does a General Power of Attorney take effect?

A General Power of Attorney can be designed to take effect immediately upon signing or upon the occurrence of a specific event, such as the principal's incapacity. The principal's preferences should be clearly indicated in the document.

Can a General Power of Attorney in New York be revoked?

Yes, a General Power of Attorney can be revoked at any time by the principal as long as they are mentally competent. To revoke the power, the principal should provide a written notice to the agent and to any institutions or individuals that were aware of the existence of the power of attorney.

Does a General Power of Attorney grant the ability to make healthcare decisions?

No, a General Power of Attorney in New York does not allow the agent to make healthcare decisions on behalf of the principal. For healthcare decisions, a separate document known as a Healthcare Proxy or Medical Power of Attorney is required.

Is a lawyer required to create a General Power of Attorney in New York?

While it is not strictly necessary to have a lawyer to create a General Power of Attorney, consulting with an attorney can ensure that the document meets all legal requirements and accurately reflects the principal's wishes. This can be especially important for complex estates or financial situations.

How long is a General Power of Attorney valid in New York?

A General Power of Attorney remains valid until it is revoked by the principal, the principal dies, or, if specified, a fixed end date arrives. Note that if the principal becomes incapacitated and the power of attorney is not durable, it may not remain in effect.

What is the difference between a General Power of Attorney and a Durable Power of Attorney?

The key difference is that a Durable Power of Attorney remains in effect if the principal becomes mentally incapacitated. In contrast, a General Power of Attorney may not. The durability of the power must be clearly stated in the document for it to be considered durable.

Can a Power of Attorney be used to vote in elections on behalf of the principal?

No, an agent cannot use a General Power of Attorney to vote in federal, state, or local elections on behalf of the principal. Voting rights are personal and cannot be delegated to another individual.

Common mistakes

Filling out a General Power of Attorney (POA) form in New York is a critical process that grants an individual, known as the agent or attorney-in-fact, the authority to make decisions on behalf of another, the principal. Despite its importance, several common mistakes can significantly impact the effectiveness of this legal document and the principal's wishes. Being aware of these errors can help individuals navigate this process with greater assurance and achieve the desired outcomes.

One frequent oversight is not specifying the powers granted clearly. A POA can range widely in scope, from broad authority across various aspects of the principal's life to very specific powers. Without clear delineation, an agent may be uncertain about their authority, potentially leading to inaction or unauthorized decisions that can be harmful or contrary to the principal's interests.

Another pitfall lies in choosing the wrong agent. The importance of selecting an agent who is not only trustworthy but also has the requisite skills and availability to perform the necessary duties cannot be overstated. Unfortunately, some people prioritize emotional bonds over practical considerations, leading to the appointment of agents ill-equipped for the responsibilities entrusted to them.

Additionally, many fail to consider the durability of the POA. A durable POA remains in effect even if the principal becomes incapacitated, while a non-durable POA does not. Neglecting to specify the POA's durability can result in a lack of legal authority precisely when it's most needed, complicating financial and personal matters at critical times.

Ignoring the need for a successor agent is another common error. Life is unpredictable, and the initially chosen agent may become unable or unwilling to serve. Without a successor agent named in the POA, the document might become ineffective, necessitating legal intervention to appoint a new agent.

Not adhering to New York's signing requirements can also invalidate the document. This oversight includes not having the POA notarized or failing to obtain the requisite number of witness signatures. Such technical mistakes can render the POA legally ineffective, leaving the principal without the necessary representation.

A misconception that a POA grants absolute power often leads to problems. The agent's powers are limited to those expressly granted in the document and subject to state law. Misunderstandings here can result in overreach by the agent or challenges from third parties concerning the agent's actions.

Lastly, failing to consult with a legal professional can result in POA documents that do not align with the principal's needs or comply with state laws. Professional legal advice can tailor a POA to the specific circumstances of the principal, ensuring its effectiveness and legality.

Avoiding these mistakes when completing a New York General Power of Attorney form is crucial. By giving attention to detail and seeking professional guidance, individuals can ensure their affairs will be managed according to their wishes, safeguarding their interests and those of their loved ones.

Documents used along the form

When preparing a General Power of Attorney (GPOA) form in New York, individuals often find that several other documents are crucial to complement or support the GPOA. These documents can vary based on the specific needs and situations of the person granting the power of attorney (the principal). Below is a list of forms and documents commonly associated with the New York GPOA, each serving its unique purpose in ensuring thorough legal and financial planning.

- Living Will: This document outlines an individual's preferences regarding medical treatments and life-sustaining measures if they become incapable of making decisions due to illness or incapacitation.

- Health Care Proxy: Similar to a GPOA, but specifically focuses on health care decisions, allowing a designated agent to make medical decisions on the principal's behalf if they are unable to do so.

- Last Will and Testament: Specifies how an individual’s assets and property should be distributed after their death. It is essential for estate planning and complements the GPOA's powers that cease upon the principal's death.

- Durable Power of Attorney for Finances: A specific form of power of attorney that remains in effect even if the principal becomes mentally incapacitated, allowing the agent to manage financial affairs.

- Revocation of Power of Attorney: A document used to cancel a previously granted power of attorney, it is important to have when the principal wishes to terminate the powers given to an agent.

- Advance Directive: Combines a living will and a health care proxy into one document, providing comprehensive instructions for health care preferences and agent designation.

- Trust Agreement: This document establishes a trust, appointing a trustee to manage assets placed within the trust either during the principal’s life or after their death, potentially bypassing probate.

- Business Power of Attorney: Grants an agent authority to make business-related decisions, vital for business owners who wish to ensure their operations continue smoothly in their absence.

- Bank Forms: Many banks have their own specific forms to grant someone else access to or control over one’s bank accounts, often used in conjunction with a GPOA.

- Real Estate Deeds: Legal documents that transfer property ownership. If a GPOA includes real estate transactions, accompanying deeds may be required to formalize the transfer.

Each of these documents plays a significant role in comprehensive legal and estate planning, ensuring that an individual's wishes are honored in both life and death. While the GPOA is a powerful tool, it is often just one piece of the puzzle. A thorough understanding and careful preparation of these additional forms can provide peace of mind and legal protection for both the principal and their loved ones.

Similar forms

The New York Durable Power of Attorney form shares similarity with the General Power of Attorney but with a crucial distinction; it remains in effect even if the principal becomes incapacitated. This feature is vital for those planning long-term for situations where they might not be able to make decisions themselves due to health issues. It ensures that the agent can continue to handle the principal’s financial affairs seamlessly, without the need for court intervention, thus offering peace of mind and continuity.

The Health Care Proxy is another document akin to the General Power of Attorney, focusing more narrowly on health care decisions. While a General Power of Attorney typically covers financial and administrative matters, a Health Care Proxy designates an agent to make medical decisions on the principal’s behalf if they are unable to do so. This specificity in scope underscores the importance of having both documents in place for comprehensive planning across different aspects of one’s life.

Similarly, a Living Will is related to the General Power of Attorney, despite primarily addressing end-of-life care preferences rather than delegating decision-making power. It outlines the principal's wishes regarding medical treatments and life-sustaining measures if they become terminally ill or incapacitated. This document complements a Health Care Proxy by providing detailed guidance to the health care agent, ensuring the principal’s medical preferences are honored, hence its importance alongside a General Power of Attorney.

The Springing Power of Attorney also bears resemblance to the General Power of Attorney but with a unique trigger mechanism. Unlike the general form, which takes effect immediately upon execution, a Springing Power of Attorney becomes active only under specific conditions, typically the principal’s incapacitation. This feature offers an extra layer of control and security, as the agent's power is dormant until necessary, reflecting a preference for retaining autonomy over one’s affairs for as long as possible.

Dos and Don'ts

When dealing with the New York General Power of Attorney form, it's crucial to approach the task with attention and diligence. Proper completion of this form ensures that your affairs are managed as you wish in your absence. Here are some guidelines to help navigate the process effectively.

What You Should Do

- Read the form thoroughly before you start filling it out. Understanding every section ensures that you don't miss any critical instructions or details.

- Use black ink or type your responses to ensure that all information is legible and that there are no misunderstandings about your intentions.

- Be precise when specifying the powers you are granting. If certain powers or conditions are meant to be included or excluded, make sure this is clearly indicated.

- Include a detailed specification of any limitations to the powers granted. This is crucial to prevent any misuse of the authority you are giving.

- Ensure that the form is signed in the presence of a notary public or other authorized official to comply with New York state law requirements for it to be legally binding.

What You Shouldn't Do

- Do not leave any sections blank. If any part does not apply, mark it with “N/A” (not applicable) to indicate that you did not overlook the section.

- Do not forget to date the document. The absence of a date can lead to questions regarding the validity and effectiveness of the Power of Attorney.

- Avoid using vague language when describing the authority you are granting. Ambiguities can lead to misinterpretation and unauthorized actions.

- Do not neglect to review and update the document as needed. Your circumstances and relationships can change, requiring adjustments to the document.

- Do not sign the form without a witness or notary present, as failure to follow the witnessing requirement can invalidate the entire document.

Misconceptions

Understanding the General Power of Attorney (PoA) form in New York is crucial for making informed decisions about legal representation and authority delegation. However, several misconceptions surround this legal document, which can lead to confusion and mismanagement. Below are six common misunderstandings clarified for better comprehension.

It grants complete control over all personal affairs: A common misconception is that a General Power of Attorney provides the agent with unlimited power over the principal's affairs. In reality, the document can be tailored to specify which powers are delegated, allowing the principal to retain control over certain decisions.

The form is the same in every state: While many believe that a General Power of Attorney form is standardized across the United States, this isn't true. Each state, including New York, has specific requirements and provisions that must be reflected in the form for it to be valid.

It remains in effect after the principal's death: Another common misunderstanding is that a General Power of Attorney continues to hold after the principal passes away. However, all powers granted through this document automatically terminate upon the death of the principal.

Creating a PoA requires a lawyer: While legal advice can be invaluable in ensuring that a Power of Attorney form meets all legal requirements, it's a misconception that you must hire a lawyer to create one. Individuals can prepare their own document, although it may be wise to consult with a lawyer to ensure its effectiveness and legality.

A General Power of Attorney allows the agent to make health care decisions: Often, people mistakenly believe that a General Power of Attorney grants the agent authority to make health care decisions on the principal's behalf. However, making health care decisions requires a different type of document, known as a Health Care Proxy or Power of Attorney in New York.

It is irrevocable: Some think that once a General Power of Attorney is created, it cannot be revoked. This is not correct. The principal has the right to revoke or amend the Power of Attorney at any time as long as they are competent to do so.

Key takeaways

When it comes to navigating legal documents, the General Power of Attorney (POA) form in New York bears significant importance. This document grants someone else the authority to act on your behalf in various financial and legal matters. Here are key takeaways that one should keep in mind while filling out and using this document:

- Understanding the Form: The New York General Power of Attorney form is a powerful document that must be filled out with a clear understanding of its scope. It gives the appointed person, known as the agent, broad powers to manage your financial affairs.

- Choosing an Agent Wisely: Select an agent who is trustworthy and reliable. This individual will have a significant amount of control over your financial and legal matters, so choosing someone who has your best interests at heart is crucial.

- Specificity Matters: Be specific about the powers you are granting. The form allows you to delineate exactly what decisions your agent is authorized to make on your behalf. Clear instructions will help prevent any misunderstandings.

- Notarization is a Requirement: In New York, your General Power of Attorney form must be notarized to be legally effective. This step verifies your identity as the principal and confirms that you are signing the document voluntarily.

- Witnesses Add Validity: While New York law does not always require witnesses for a General POA to be valid, having your POA signed in front of witnesses can add an extra layer of legal protection and validity to the document.

- Revocation Process: Understand that you have the right to revoke your General Power of Attorney at any time, as long as you are mentally competent. It’s advisable to notify your agent in writing and retrieve all copies of the POA.

- Storage and Accessibility: Once executed, store your General Power of Attorney form in a secure yet accessible place. Inform your agent and other important parties of its location, ensuring that it can be easily found when needed.

By closely following these guidelines when filling out and using a New York General Power of Attorney form, you can ensure your financial affairs will be handled according to your wishes, provide peace of mind, and protect your interests in times when you are unable to make decisions yourself.

Popular General Power of Attorney State Forms

Indiana Power of Attorney Form - The authority granted through a General Power of Attorney can be customized but typically does not cover healthcare decisions.

General Power of Attorney Texas Form - The form is used to appoint a trusted person to manage financial affairs if the principal cannot do so.

Power of Attorney California - Allows a trusted friend or family member to legally manage your responsibilities.