Free General Power of Attorney Form for Indiana

In Indiana, managing one's affairs in times of uncertainty or incapacity is a matter taken seriously, and the General Power of Attorney (GPA) form serves as a key tool in this endeavor. This form, when properly completed, permits an individual, known as the principal, to delegate broad financial powers to another person, labeled the agent or attorney-in-fact. These powers can range from managing real estate transactions, handling bank accounts, to dealing with personal property issues. Importantly, unlike its counterpart, the Durable Power of Attorney, the GPA ceases to be effective if the principal becomes incapacitated or mentally incompetent, thereby protecting the principal's interests in scenarios where they cannot make decisions themselves. Given its potential impact on financial and personal affairs, understanding the nuances, limitations, and the proper way to execute the Indiana General Power of Attorney form is crucial for individuals looking to ensure their matters are in trusted hands, should they ever be unable to manage them personally.

Form Example

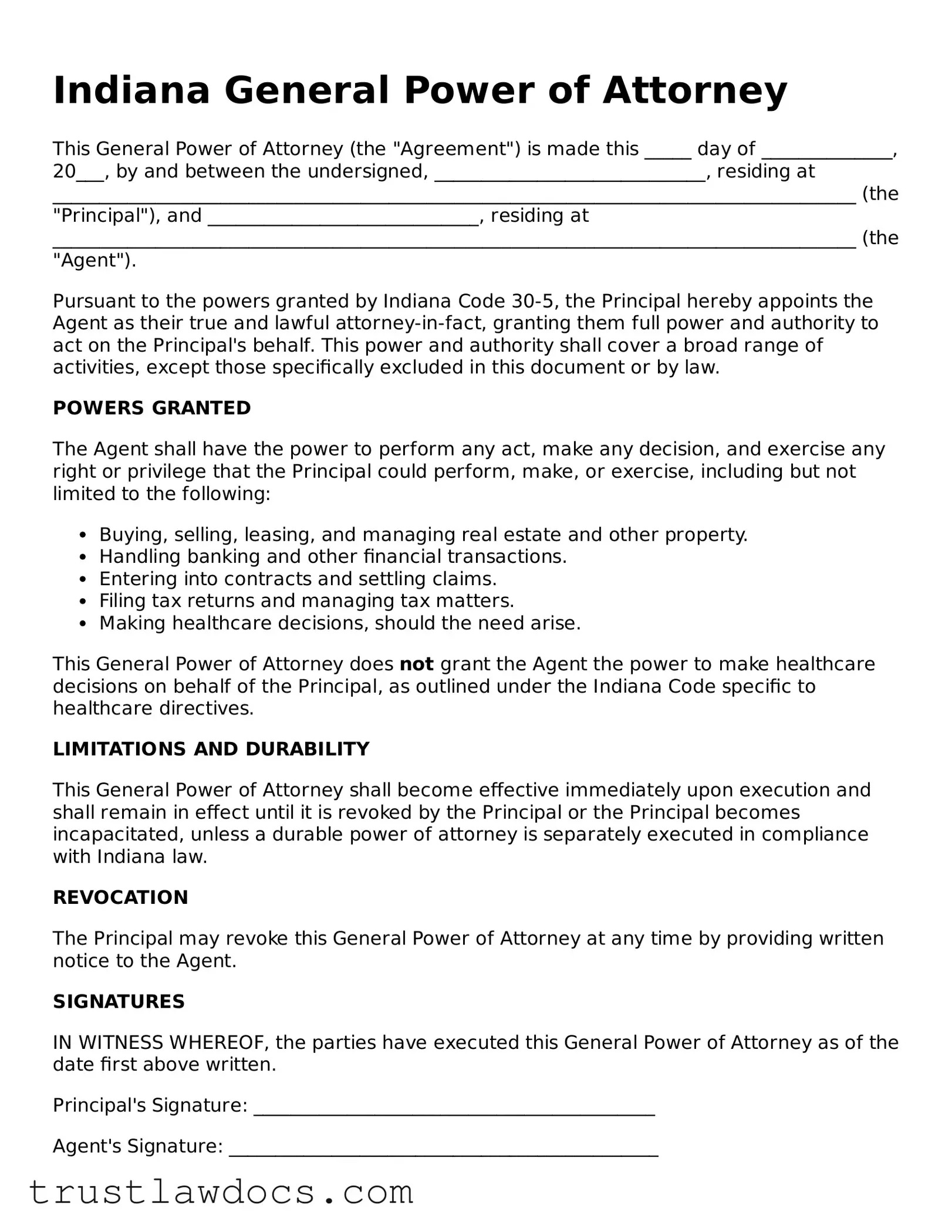

Indiana General Power of Attorney

This General Power of Attorney (the "Agreement") is made this _____ day of ______________, 20___, by and between the undersigned, _____________________________, residing at ______________________________________________________________________________________ (the "Principal"), and _____________________________, residing at ______________________________________________________________________________________ (the "Agent").

Pursuant to the powers granted by Indiana Code 30-5, the Principal hereby appoints the Agent as their true and lawful attorney-in-fact, granting them full power and authority to act on the Principal's behalf. This power and authority shall cover a broad range of activities, except those specifically excluded in this document or by law.

POWERS GRANTEDThe Agent shall have the power to perform any act, make any decision, and exercise any right or privilege that the Principal could perform, make, or exercise, including but not limited to the following:

- Buying, selling, leasing, and managing real estate and other property.

- Handling banking and other financial transactions.

- Entering into contracts and settling claims.

- Filing tax returns and managing tax matters.

- Making healthcare decisions, should the need arise.

This General Power of Attorney does not grant the Agent the power to make healthcare decisions on behalf of the Principal, as outlined under the Indiana Code specific to healthcare directives.

LIMITATIONS AND DURABILITYThis General Power of Attorney shall become effective immediately upon execution and shall remain in effect until it is revoked by the Principal or the Principal becomes incapacitated, unless a durable power of attorney is separately executed in compliance with Indiana law.

REVOCATIONThe Principal may revoke this General Power of Attorney at any time by providing written notice to the Agent.

SIGNATURESIN WITNESS WHEREOF, the parties have executed this General Power of Attorney as of the date first above written.

Principal's Signature: ___________________________________________

Agent's Signature: ______________________________________________

State of Indiana

County of ________________

Subscribed and sworn before me this _____ day of _______________, 20___.

Notary Public: __________________________________________________

My Commission Expires: ________________________

PDF Form Details

| Fact | Description |

|---|---|

| 1. Definition | A General Power of Attorney in Indiana allows one person (the principal) to grant another person (the agent) broad powers to handle their financial affairs. |

| 2. Governing Law | This form is governed by the Indiana Code, specifically IC 30-5, the Powers of Attorney Act. |

| 3. Durability | Unless specified otherwise, a General Power of Attorney in Indiana is not durable, meaning it does not remain in effect if the principal becomes incapacitated. |

| 4. Signing Requirements | The form must be signed by the principal and either notarized or witnessed by two adults, according to IC 30-5-4-1. |

| 5. Scope of Authority | The agent can be authorized to handle a wide range of actions, including but not limited to financial matters, real estate transactions, and personal property dealings. |

| 6. Revocation | The principal has the right to revoke the General Power of Attorney at any time, as long as they are mentally competent. |

| 7. Agent’s Responsibilities | The agent is obligated to act in the principal's best interest, preserve the principal's estate plan, and avoid conflicts of interest. |

| 8. Limitations | Under Indiana law, there are certain acts a General Power of Attorney cannot authorize, such as creating a will on behalf of the principal. |

| 9. Co-Agents | The principal may appoint more than one agent to act jointly or separately, depending on the principal’s preference and the specifications within the document. |

| 10. Termination | The General Power of Attorney automatically terminates upon the principal's death, revocation, or if the principal becomes incapacitated, unless it is made durable. |

How to Write Indiana General Power of Attorney

When preparing to fill out the Indiana General Power of Attorney form, it is important to approach the process with clarity and precision. This legal document grants another person, known as the agent, broad powers to handle your affairs if you are unable to do so yourself. It's a powerful tool that requires careful consideration of whom you trust to make significant decisions on your behalf. The steps provided below outline the necessary information and actions to properly complete the form, ensuring your intentions are clearly communicated and legally documented.

- Begin by entering your full legal name and address at the top of the form, confirming your identity as the principal granting the power.

- Designate your chosen agent by writing their full legal name and address in the specified section. This selection should be made with trust and confidence in the individual’s understanding of your wishes.

- If you wish to appoint a successor agent, provide their full legal name and address in the designated area. This step ensures an alternate is available should your primary agent be unable or unwilling to serve.

- Specify the powers you are granting to your agent. While the form may have pre-listed powers, you have the option to add additional responsibilities or limit the scope as you see fit.

- Consider adding any special instructions for your agent that can guide their actions or impose restrictions. This customization makes your intentions clear and can provide additional peace of mind.

- Select how you wish the power of attorney to become effective. Some choose to have it take effect immediately, while others may prefer it become active only upon the occurrence of a specific event, like incapacitation.

- Determine the duration of the power of attorney. You can opt for it to remain valid until explicitly revoked, for a specified period, or to automatically terminate under certain conditions, such as your death or incapacitation.

- Sign and date the form in the presence of a notary public. Your agent may also be required to sign, acknowledging their acceptance of the responsibilities you’re entrusting to them.

- Ensure the document is notarized. A notarized document confirms your identity and protects the integrity of the power of attorney.

- Finally, distribute copies of the notarized document to relevant parties. Your agent, successor agent, and any institutions or individuals who may need to recognize the authority granted should receive a copy.

Completing the Indiana General Power of Attorney form is a decisive step toward securing your financial and personal affairs. It allows you to designate a trusted individual to act on your behalf, ensuring that your matters are handled according to your wishes. By following the steps outlined, you can achieve peace of mind knowing that your interests are protected even when you are not able to advocate for yourself.

Get Answers on Indiana General Power of Attorney

What is a General Power of Attorney form in Indiana?

A General Power of Attorney form in Indiana is a legal document that allows you to appoint someone, often referred to as your "agent" or "attorney-in-fact," to manage your financial affairs. This can include paying bills, managing bank accounts, buying or selling property, and other financial activities. The authority you give to your agent is broad, but it ends if you become incapacitated or pass away.

How do I choose an agent for my Power of Attorney?

Choosing an agent is a significant decision. You should select someone you trust deeply, as they will have control over your financial matters. Most people choose a close family member or a long-time friend. It's important that the person you choose is reliable, financially savvy, and willing to take on the responsibilities. Before making your decision, discuss the role with them to ensure they are comfortable with it.

Do I need a lawyer to create a General Power of Attorney in Indiana?

While it's not legally required to have a lawyer to create a General Power of Attorney, consulting with one can be beneficial. A lawyer can ensure that the document meets all legal requirements and accurately reflects your wishes. They can also advise you on the powers you're granting and any potential risks. If your financial situation is complex, seeking legal advice is particularly recommended.

How can I revoke a General Power of Attorney?

You have the right to revoke your General Power of Attorney at any time, as long as you are mentally competent. To revoke it, you should send a written notice to your agent and to any institutions or parties that might be dealing with your agent under the authority of the document. Additionally, it might be wise to destroy all copies of the original document and to file a formal revocation form if your state provides one.

Common mistakes

Filling out a General Power of Attorney (GPA) form in Indiana is a significant step in managing your affairs, ensuring that someone can legally act on your behalf when you're unable to do so. However, errors in completing this form can lead to complications down the line, possibly rendering the document invalid or not reflecting your true wishes. Understanding these common pitfalls can help you avoid them.

Firstly, a frequent mistake is not specifying the powers granted clearly. Individuals often assume that a general power of attorney grants an agent the ability to perform any act on their behalf. However, for clarity and to prevent any misuse of power, it's vital to outline the specific areas your agent can act in, such as financial matters, real estate transactions, or personal decisions. If the powers aren't detailed properly, it could lead to significant misunderstandings or legal challenges in the future.

Another error is neglecting to choose the right agent. This decision cannot be taken lightly, as the selected individual will have considerable control over important aspects of your life. It's crucial to select someone who is not only trustworthy but also capable of handling the responsibilities you're entrusting to them. Failing to properly consider your agent's qualifications or their relationship to you might result in your affairs not being managed as you would have wished.

Many also overlook the importance of setting a duration for the power of attorney. Without specifying when the GPA takes effect and when it ends, you might inadvertently leave your affairs in a state of uncertainty. In Indiana, if the document does not state an expiration date, the GPA remains in effect indefinitely until it is revoked or the principal becomes incapacitated, in which case, without specifying otherwise, the GPA would typically end. Clearly defining the document's term is essential for ensuring that it only applies during the timeframe you desire.

Lastly, a common oversight is failing to follow Indiana's legal requirements for executing a GPA, such as not having it properly witnessed or notarized. This misstep can lead to the document being considered invalid. Indiana law requires these formalities to protect against fraud and ensure that the principal genuinely wishes to grant the powers specified in the GPA. Without following these procedural requirements, the entire document could be rendered useless.

Documents used along the form

The Indiana General Power of Attorney form allows individuals to grant broad legal authority to another person, enabling them to take various actions on their behalf. This significant legal document is often used in conjunction with other forms and documents to ensure comprehensive management of a person's affairs. The following list includes commonly used documents that accompany the Indiana General Power of Attorney form, each serving a specific purpose in the legal landscape.

- Medical Power of Attorney: This document grants a designated agent the authority to make healthcare decisions on behalf of the granter, should they become incapable of making such decisions themselves.

- Durable Power of Attorney: Durable Powers of Attorney are designed to remain in effect even if the grantor becomes mentally incapacitated, unlike the general type which typically does not include such stipulations.

- Living Will: A Living Will outlines a person's wishes regarding end-of-life medical care, working in tandem with a Medical Power of Attorney to ensure those preferences are respected.

- Limited Power of Attorney: This is a more specific form of power of attorney that restricts the agent's powers to a defined purpose or timeframe, unlike the broad scope of a General Power of Attorney.

- Real Estate Power of Attorney: Specifically designed for real estate transactions, this document allows the agent to buy, sell, manage, or conduct other activities related to the grantor's real property.

- Financial Power of Attorney: Focuses exclusively on financial decisions and transactions, such as managing bank accounts, paying bills, and investing on behalf of the grantor.

- Vehicle Power of Attorney: Grants an agent authority to handle tasks related to the ownership or sale of a vehicle, such as registration or title transfer.

- Advance Directive: Combines a Living Will and Medical Power of Attorney, providing comprehensive instructions for healthcare and naming an agent to carry out those instructions.

- Revocation of Power of Attorney: A document used to legally cancel a previously granted power of attorney, effective upon its execution or a specified date.

- Guardianship Form: In cases where an individual is incapable of making decisions for themselves, a guardianship form can appoint a legal guardian to take responsibility for the individual's personal and financial matters.

Utilizing the Indiana General Power of Attorney form in conjunction with these specific documents can provide a robust legal framework for managing one's affairs. Properly executed, these documents work together to ensure that an individual's health, financial, and personal preferences are respected and followed, even in their absence or incapacity. It's advisable for individuals to consult with legal professionals to understand the implications of each document and ensure they align with their personal circumstances and legal requirements.

Similar forms

The Indiana General Power of Attorney form shares similarities with the Indiana Durable Power of Attorney. Both documents empower someone to act on another's behalf, but the key difference lies in their operational lifespan. A General Power of Attorney typically ceases to be effective if the principal becomes incapacitated. In contrast, a Durable Power of Attorney is designed to remain in effect even if the principal loses their ability to make decisions, ensuring continuous management of their affairs.

Another similar document is the Indiana Healthcare Power of Attorney. This document, like the General Power of Attorney, allows an individual to designate someone to make decisions on their behalf. However, the scope is specifically limited to healthcare decisions. While the General Power of Attorney might encompass a broad array of financial and legal decisions, the Healthcare Power of Attorney is focused exclusively on matters related to the individual’s health and medical treatment, particularly when they cannot make those decisions themselves.

The Indiana Limited (Special) Power of Attorney is also analogous to the General Power of Attorney, but with a narrower focus. The Limited Power of Attorney gives someone the authority to act on the principal's behalf for a specific task or for a limited time. For example, it might be used to grant someone the power to sell a property or manage a particular financial transaction, expiring once the specified task is completed. Unlike the broad and comprehensive authority granted by the General Power of Attorney, the Limited Power of Attorney confines the agent’s power to a defined set of actions or time period.

Lastly, the Indiana Springing Power of Attorney bears resemblance to the General Power of Attorney in that it allows an individual to appoint someone to manage their affairs. The distinctive feature of a Springing Power of Attorney is that it only becomes effective upon the occurrence of a specified event, usually the principal's incapacity. This contrasts with the General Power of Attorney, which typically takes effect immediately upon execution and does not rely on a future event for its activation.

Dos and Don'ts

When it comes time to fill out the Indiana General Power of Attorney form, it's important to approach the task with care and attention. Whether you're managing your affairs or helping someone else with theirs, the following tips can help ensure the process goes smoothly. Let's look into what you should and shouldn't do:

What You Should Do:

Read the form thoroughly before you start filling it out. Ensure you understand each part, so you accurately reflect your wishes.

Use black ink or type your responses to make sure everything is legible and stands up to legal standards.

Include specific details about the powers you're granting, to whom, and under what circumstances. Clearly defined terms can help prevent misunderstandings later on.

Have the form notarized, if required. This step often adds a layer of legal validation to the document.

What You Shouldn't Do:

Don't rush through filling out the form. Taking your time can prevent mistakes that could have legal implications.

Avoid using generic language that could be open to interpretation. Be as clear and specific as possible.

Don't forget to review and update the document as needed. Life changes may necessitate adjustments to your Power of Attorney.

Never sign the document without fully understanding its contents and implications. If you're unsure, consult a professional.

Misconceptions

When it comes to the Indiana General Power of Attorney (POA) form, several misconceptions commonly arise. Understanding these can help individuals make informed decisions about granting someone else the authority to handle their financial matters.

It gives unlimited power: Many believe a General POA allows the agent to do anything with the principal's assets or make personal decisions for them. However, it specifically covers financial and business transactions, not personal decision-making like health care choices.

It survives the principal's incapacity: A common misconception is that a General POA remains effective if the principal becomes incapacitated. This is not true in Indiana unless the POA is specifically designated as "durable."

It's irrevocable: People often think that once a General POA is created, it cannot be changed or canceled. Actually, the principal can revoke it at any time, as long as they are mentally competent.

It goes into effect immediately: While this can be true, it's also possible to make the POA "springing," meaning it only goes into effect upon the occurrence of a specific event, like the principal’s incapacity.

It requires a lawyer: There's a belief that you must have a lawyer to create a valid POA in Indiana. While legal advice can be beneficial, it's possible to create a POA without one, as long as the form meets state requirements.

It allows the agent to change the principal’s will: Some think that giving someone general power of attorney allows that person to alter the principal's last will. This is not correct; a POA does not grant the agent authority to change a will.

There's only one standard form: People often assume there's only one "official" form for a General POA in Indiana. In reality, the content can vary as long as it complies with Indiana laws and effectively communicates the principal's intent.

It's effective after the principal's death: A significant misconception is that the POA continues to be effective after the principal's death. The authority granted under a POA ends when the principal dies.

It grants access to medical records: It's mistakenly believed that a General POA includes the authority to access the principal's medical records or make health care decisions, which requires a separate medical POA.

It's only for the elderly: Many assume that POAs are only for senior citizens. However, adults of any age can benefit from having a POA as part of their broader estate planning.

Key takeaways

When approaching the task of filling out and utilizing the Indiana General Power of Attorney form, it's important to proceed with both knowledge and caution. This document grants broad powers to an individual, allowing them to act on your behalf in various financial and legal matters. Understanding the implications and correct usage of this form is imperative for protecting oneself and ensuring one's wishes are accurately represented. Here are key takeaways to keep in mind:

- Ensure the form complies with Indiana law. It's crucial that the General Power of Attorney form adheres to the specific legal requirements of Indiana to guarantee its validity and prevent any future disputes or denial of powers granted within the document.

- Choose your attorney-in-fact wisely. The person you appoint to act on your behalf, known as the attorney-in-fact, should be someone you trust implicitly. Their actions in your name will affect your financial and possibly personal affairs significantly.

- Be specific about the powers you are granting. Although it's a "general" power of attorney, you have the option to limit the scope of powers given to your attorney-in-fact if desired. Clearly specifying these limits in the document is advisable.

- Consider a durability clause. Determining whether the power of attorney should be durable—that is, remain in effect even if you become incapacitated—is a critical decision. This ensures that your appointed attorney-in-fact can continue to act on your behalf without interruption.

- Sign in the presence of a notary. For the document to be legally binding in Indiana, it must be signed in the presence of a notary public who can certify its authenticity. This step is essential for the document's enforceability.

- Keep records accessible. Once the power of attorney form is completed and notarized, keeping copies in a secure yet accessible place is important. Inform your attorney-in-fact where these documents are stored in case they need to act on your behalf.

- Inform relevant parties. Banks, financial institutions, and others who may be affected by the power of attorney should be informed of its existence and provided with a copy if required. This can prevent any confusion or delays when your attorney-in-fact needs to act on your behalf.

- Review and update regularly. As your situation changes, your General Power of Attorney may need updates. Regularly reviewing and amending the document ensures it continues to reflect your wishes and situation accurately.

- Understand revocation procedures. If at any time you wish to revoke the power of attorney, it's important to understand the correct process for doing so under Indiana law, including notifying your attorney-in-fact and any institutions or individuals that were informed of its existence.

In summary, the Indiana General Power of Attorney is a powerful and flexible tool for managing your financial and legal affairs through another individual. However, with great power comes the need for careful consideration and precision in its execution. Adhering to these guidelines will help ensure that the form serves your interests well and that your appointed attorney-in-fact can act effectively and responsibly on your behalf.

Popular General Power of Attorney State Forms

General Power of Attorney Texas Form - Regular review and updating of a General Power of Attorney are recommended to reflect current wishes and circumstances.

Power of Attorney California - Provides legal backing for your designated agent to act in your best interests.

How to Get Power of Attorney in Florida - It simplifies the process of authorizing a trusted individual to make broad legal decisions on someone's behalf.