Free General Power of Attorney Form for Florida

The Florida General Power of Attorney form is a powerful legal document that grants one person the comprehensive authority to act on another's behalf, handling a wide range of matters including but not limited to financial transactions, real estate operations, and business dealings. This flexibility makes it a crucial tool for individuals looking to ensure their affairs are managed according to their wishes, especially in circumstances where they might not be able to do so themselves due to travel, illness, or any other reason. Importantly, under Florida law, the power granted by this document is vast and can include everything from buying and selling property to managing bank accounts and investments. However, it's also built with safeguards, requiring the person granted this power, known as the agent, to act in the best interests of the person who appointed them, the principal. The form’s validity and the powers it grants are subject to Florida state laws, which outline both the execution requirements to make it legally binding and the duties and limitations of the agent's authority. Understanding these nuances is essential for anyone considering creating a General Power of Attorney, as it ensures that the document accurately reflects their wishes and complies with state regulations.

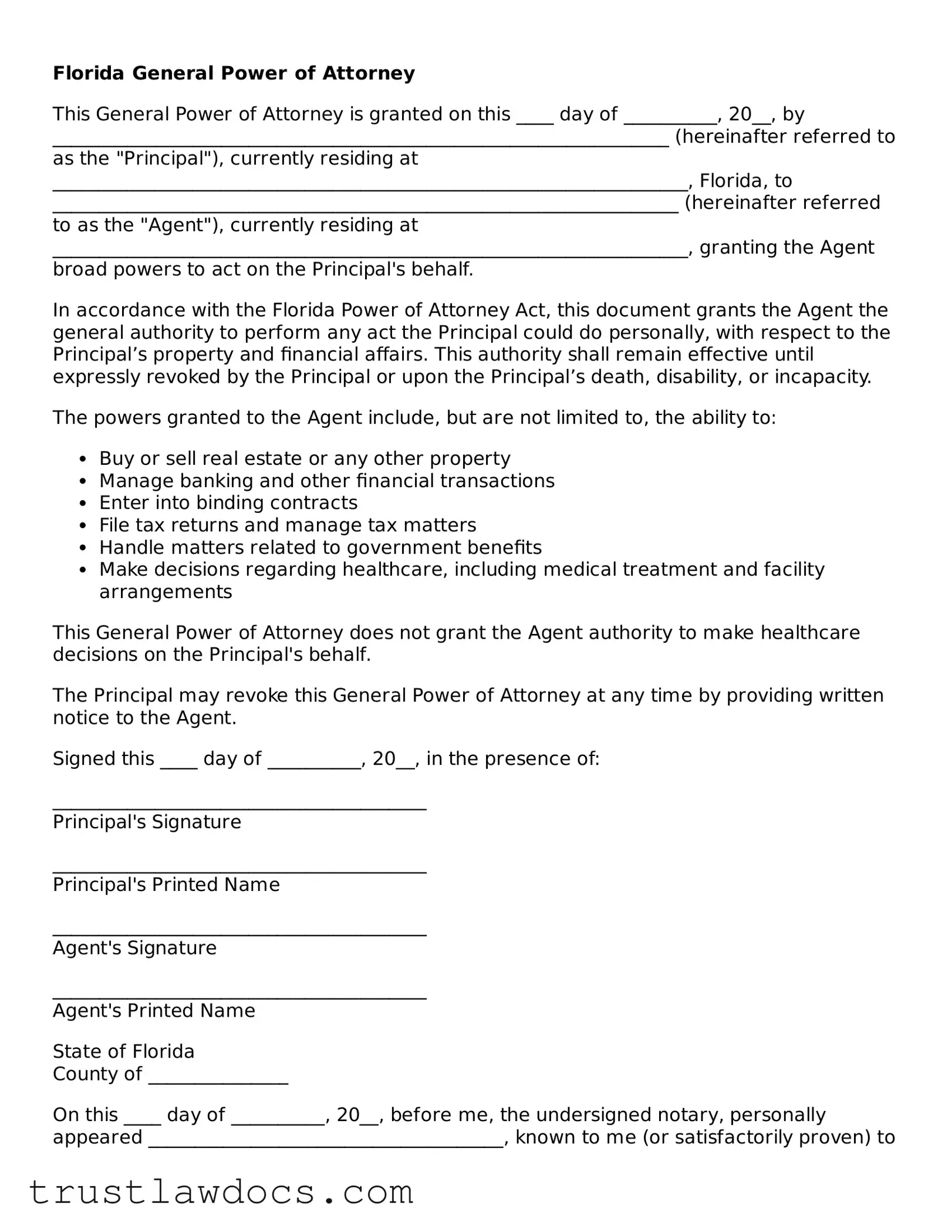

Form Example

Florida General Power of Attorney

This General Power of Attorney is granted on this ____ day of __________, 20__, by __________________________________________________________________ (hereinafter referred to as the "Principal"), currently residing at ____________________________________________________________________, Florida, to ___________________________________________________________________ (hereinafter referred to as the "Agent"), currently residing at ____________________________________________________________________, granting the Agent broad powers to act on the Principal's behalf.

In accordance with the Florida Power of Attorney Act, this document grants the Agent the general authority to perform any act the Principal could do personally, with respect to the Principal’s property and financial affairs. This authority shall remain effective until expressly revoked by the Principal or upon the Principal’s death, disability, or incapacity.

The powers granted to the Agent include, but are not limited to, the ability to:

- Buy or sell real estate or any other property

- Manage banking and other financial transactions

- Enter into binding contracts

- File tax returns and manage tax matters

- Handle matters related to government benefits

- Make decisions regarding healthcare, including medical treatment and facility arrangements

This General Power of Attorney does not grant the Agent authority to make healthcare decisions on the Principal's behalf.

The Principal may revoke this General Power of Attorney at any time by providing written notice to the Agent.

Signed this ____ day of __________, 20__, in the presence of:

________________________________________

Principal's Signature

________________________________________

Principal's Printed Name

________________________________________

Agent's Signature

________________________________________

Agent's Printed Name

State of Florida

County of _______________

On this ____ day of __________, 20__, before me, the undersigned notary, personally appeared ______________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

________________________________________

Notary Public

My commission expires: _______________

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A Florida General Power of Attorney form allows an individual, known as the principal, to delegate financial decisions and actions to another person, called the agent. |

| Revocation | The principal can revoke the power of attorney at any time as long as they are mentally competent. |

| Duration | Unless stated otherwise, the power of attorney remains effective until the principal dies or becomes incapacitated. |

| Governing Laws | This form is governed by the Florida Statutes, Section 709, which covers Power of Attorney and similar instruments. |

How to Write Florida General Power of Attorney

Completing a General Power of Attorney form in Florida is an important step in ensuring one’s affairs can be managed by someone they trust in the event they are unable to do so themselves. This document grants broad powers to an agent, authorizing them to act on the principal's behalf in various matters including financial, legal, and personal. To ensure this document reflects the principal's wishes accurately and is legally binding, it must be filled out meticulously and in accordance with Florida law. Below are the steps needed to accurately complete the Florida General Power of Attorney form.

- Gather necessary information, including the full legal names and addresses of both the principal (the person granting power) and the agent (the person receiving power).

- Locate the official Florida General Power of Attorney form. This can typically be found on legal websites, through an attorney, or from state government offices.

- In the designated section, fill in the principal's full legal name and address.

- Insert the agent's full legal name and address in the corresponding section.

- Review the powers being granted to the agent. These will be listed in the form. If any modifications are needed—either adding or limiting powers—ensure these changes are clearly noted and legible.

- Specify any special instructions or limitations to the agent’s powers directly on the form. If additional space is needed, attach a separate document and reference it accordingly.

- If the form requires the appointment of a successor agent (someone who will take over if the initial agent is unable to fulfill their duties), fill in the successor agent’s full legal name and address.

- Check the requirements for witness signatures and notarization specific to Florida. Generally, Florida law requires that your General Power of Attorney be signed in the presence of two witnesses and be notarized.

- Sign and date the form in the presence of two adult witnesses who are not the agent. Ensure the witnesses sign the form as well.

- Visit a notary public to have the form officially notarized. The notary will confirm your identity, witness your signature, and affix their seal or stamp to the document, making it legally binding.

- Keep the original document in a safe place and provide copies to the agent, successor agent (if applicable), and perhaps a trusted family member or attorney for safekeeping.

Once the Florida General Power of Attorney form is fully executed, the agent has the authority to act on the principal's behalf as specified in the document. It's crucial for both the principal and the agent to fully understand the extent of the powers being granted and their respective responsibilities. Filling out the form correctly is the first step in establishing a clear and effective legal document. Regularly reviewing and updating the document as needed can help ensure that it continues to reflect the principal's wishes and adapts to changing circumstances.

Get Answers on Florida General Power of Attorney

What is a Florida General Power of Attorney form?

A Florida General Power of Attorney form is a legal document that allows an individual, known as the principal, to delegate their legal authority to another person, called the agent or attorney-in-fact. This authority enables the agent to make decisions and take actions on behalf of the principal in various matters, excluding healthcare decisions, until the document is revoked or the principal becomes incapacitated.

Who can serve as an agent under a Florida General Power of Attorney?

Any competent adult can serve as an agent under a Florida General Power of Attorney. It’s crucial that the principal trusts this individual, as they will have broad authority to act on the principal's behalf. The selected agent should be reliable, trustworthy, and capable of handling the responsibilities assigned to them.

How can I revoke a Florida General Power of Attorney?

To revoke a Florida General Power of Attorney, the principal must provide a written notice of revocation to the agent and to any institutions or parties that were relying on the original power of attorney. Additionally, destroying the original document and any copies can help ensure it is no longer in use.

Does a Florida General Power of Attorney need to be notarized?

Yes, for a Florida General Power of Attorney to be legally valid, it must be signed by the principal in the presence of two witnesses and notarized. This process helps confirm the identity of the principal and ensures that the document is legally recognized.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, a General Power of Attorney in Florida automatically becomes void. In such cases, it cannot be used for managing the principal's affairs. Instead, a Durable Power of Attorney, which remains in effect upon the principal's incapacitation, would be required.

Can a General Power of Attorney in Florida be used to sell real estate?

Yes, a General Power of Attorney in Florida can grant the agent the authority to sell real estate on behalf of the principal. However, the document must explicitly grant this power, and certain transactions may require additional legal steps or documentation.

Is there a difference between a General Power of Attorney and a Durable Power of Attorney in Florida?

Yes, the key difference between a General Power of Attorney and a Durable Power of Attorney in Florida lies in their validity after the principal’s incapacitation. A General Power of Attorney becomes invalid if the principal becomes incapacitated, while a Durable Power of Attorney remains effective.

How can I ensure my Florida General Power of Attorney is legally valid?

To ensure your Florida General Power of Attorney is legally valid, follow Florida’s requirements closely: have the document signed by the principal in the presence of two witnesses and a notary. Additionally, be clear and specific about the powers granted to the agent within the document.

Can changes be made to a Florida General Power of Attorney after it's signed?

Yes, changes can be made to a Florida General Power of Attorney after it's signed, but it requires creating and executing a new document that outlines these changes or revokes the previous agreement. The new document must also be signed in the presence of two witnesses and notarized to be legally valid.

Common mistakes

One common mistake individuals make when filling out the Florida General Power of Attorney form is neglecting to specify the powers they are granting. It’s crucial to be clear and precise about what decisions the agent can make on the principal's behalf. Without this specificity, it becomes difficult for third parties to recognize the extent of the agent’s authority, potentially leading to legal complications.

Another frequent error is not properly identifying the parties involved. The principal and the agent must be identified with their full legal names and addresses. Misidentification or the omission of this information can invalidate the document or cause significant delays in its execution.

Many people also mistakenly believe that a General Power of Attorney form does not need to be witnessed or notarized. In Florida, however, for the document to be legally binding, it must be signed in the presence of two witnesses and notarized. This step is crucial for the document’s legal validity.

Forgetting to include a termination date can lead to long-term complications. Unless the principal desires for the Power of Attorney to remain in effect indefinitely, a specific date or event triggering its expiration should be included. Without it, the document could potentially remain active longer than intended.

Individuals often fail to consider the need for a durable Power of Attorney. A standard General Power of Attorney becomes ineffective if the principal becomes incapacitated. If the intention is for the Power of Attorney to remain effective in such situations, it must be explicitly stated, making the document durable.

A significant oversight is not providing specific instructions for managing real estate transactions, as these require particular details for the agent to act effectively. Without these instructions, the agent may be unable to manage, sell, or otherwise deal with real estate on the principal's behalf.

Some people overlook the importance of informing financial institutions and other relevant entities of the Power of Attorney. Failure to do so can result in delays or refusals when the agent attempts to act on the principal's behalf. It is beneficial for the principal to notify these institutions and provide them with a copy of the document.

Not reviewing and updating the document regularly is another common mistake. Life changes, such as a change in marital status, relocation, or altered relationships, can affect the relevance and functionality of the Power of Attorney. Regular review ensures the document reflects the principal’s current wishes and circumstances.

A lack of specificity in granting powers can also be problematic. The document should clearly outline what the agent can and cannot do. Broad or vague authorizations can lead to misinterpretations of the principal’s intentions and potentially unauthorized actions by the agent.

Finally, neglecting to seek professional legal advice when drafting a General Power of Attorney can result in errors and omissions that compromise the document’s validity. Professional guidance ensures that the form complies with Florida law and accurately reflects the principal’s intentions.

Documents used along the form

When handling affairs related to a General Power of Attorney (POA) in Florida, individuals often find themselves needing additional forms and documents to ensure comprehensive coverage of their legal and financial matters. These documents supplement the POA, serving various purposes from specifying healthcare wishes to designating end-of-life care instructions. Below is an overview of other important forms and documents that are commonly used alongside the Florida General Power of Attorney form.

- Medical Power of Attorney - This document allows the principal to appoint an agent to make healthcare decisions on their behalf should they become unable to do so themselves. It's critical for specifying the type of medical care and treatment preferences the principal desires.

- Living Will - Also known as an advance healthcare directive, it outlines the principal's wishes regarding life-prolonging medical treatments if they are in a persistent vegetative state or terminally ill and unable to communicate their healthcare preferences.

- Durable Power of Attorney for Finances - This form permits the appointed agent to manage the principal's financial affairs. Durable means it remains in effect even if the principal becomes mentally incapacitated.

- Last Will and Testament - Documents how the principal's assets will be distributed upon their death. It names an executor who will manage the estate distribution according to the principal's wishes.

- Designation of Health Care Surrogate - Similar to a Medical Power of Attorney, this document appoints a surrogate to make healthcare decisions, emphasizing on following the principal's treatment preferences when they cannot make decisions themselves.

- Declaration of Preneed Guardian - This document specifies the principal's choice for a guardian in the event of their incapacitation, covering decisions beyond health care that might not be specified in a POA.

- HIPAA Release Form - Grants permission for healthcare providers to disclose the principal's health information to specified individuals, usually the ones holding POA or healthcare directives, ensuring they have access to necessary medical records.

- Revocation of Power of Attorney - This form is used to cancel a previously granted power of attorney. It is essential for situations where the principal can manage their own affairs again or wishes to appoint a different agent.

- Trust Agreement - Establishes a trust with assets for specific purposes, managed by a trustee. Trusts can outline specific conditions for asset distribution which can work alongside a POA for comprehensive estate planning.

Combining the General Power of Attorney with these additional forms and documents provides a more robust legal framework for managing one's health and financial matters. Each document serves a critical function, ensuring that the principal's wishes are known and can be executed according to their directives. This strategic approach not only safeguards the principal's interests but also aids in a smoother legal and financial transition when necessary.

Similar forms

The Florida Durable Power of Attorney document shares similarities with a General Power of Attorney but includes a critical distinction: it remains in effect even if the principal becomes incapacitated. This ability ensures that the designated agent can continue managing financial, legal, and health decisions on behalf of the principal, regardless of their health status, providing a layer of protection and continuity that the standard General Power of Attorney does not offer.

A Health Care Power of Attorney form, akin to the General Power of Attorney, allows an individual to appoint someone to make decisions on their behalf. However, it specifically focuses on medical and health care decisions rather than the broad financial and legal authority granted in the general form. This ensures that a trusted agent can advocate for the principal's medical wishes if they cannot speak for themselves, fostering a directed approach to health and well-being.

The Limited Power of Attorney form is another variant, giving an agent authority to act on the principal's behalf but restricts this power to a specific area or task. It contrasts with the broad, sweeping powers granted by a General Power of Attorney, offering a tailored approach that is preferred for one-time transactions or specified acts, diminishing the risk associated with granting wide-ranging authority.

Similar to the General Power of Attorney, the Revocable Power of Attorney permits the principal to revoke the powers granted to the agent at any time, provided the principal is competent. This flexibility allows the principal to adjust their arrangements as circumstances change, embodying a dynamic and responsive legal tool that respects the principal's evolving needs and circumstances.

The Financial Power of Attorney form, while bearing resemblance to the General Power of Attorney by allowing an individual to appoint an agent to handle financial matters, often comes with a more narrowly defined scope of financial responsibilities. This precision ensures that the agent has clear directives on managing the principal's financial affairs, catering to specific needs and minimizing the likelihood of broad, undefined authority that could lead to complexities and challenges.

An Advance Directive is a document that combines elements from the Health Care Power of Attorney and a Living Will, guiding medical treatment preferences in the event of incapacity. While it aligns with the General Power of Attorney in permitting an individual to outline their wishes regarding medical decisions, it exclusively focuses on end-of-life care, making it a critical tool for those seeking to control their medical fate.

A Trust is an estate planning tool that allows an individual (the Trustor) to designate a third party (the Trustee) to manage their assets for the benefit of a beneficiary, which can somewhat resemble the functions of a General Power of Attorney in terms of asset management. However, a Trust offers a more structured framework for managing and distributing assets and often includes specific instructions for these processes, transcending the lifetime of the Trustor and bypassing the probate process.

The Springing Power of Attorney is a unique variant that activates only upon the occurrence of a specific event, typically the principal's incapacitation, distinguishing itself from the always-active nature of a General Power of Attorney. This conditional activation provides an additional layer of security and peace of mind, ensuring that the agent's power to act is triggered by clearly defined circumstances.

Last, a Guardianship or Conservatorship arrangement, while instituted by a court rather than established through a form like the General Power of Attorney, designates an individual to manage the personal and/or financial affairs of another. Unlike a voluntary appointment through a power of attorney document, a Guardianship or Conservatorship is a legal mechanism typically used when an individual cannot make safe or sound decisions about their person or assets, emphasizing protection and oversight for those unable to protect themselves.

Dos and Don'ts

When filling out the Florida General Power of Attorney form, it's important to be thorough and precise. Below are essential dos and don'ts to guide you through the process:

- Do read the entire form carefully before beginning to fill it out. Understanding every section ensures that all information is accurately provided.

- Do use black ink or type directly onto the form for clarity. This makes the document legible and formally presentable.

- Do verify that the person receiving the power, known as the agent, is someone you trust completely. Their decisions on your behalf hold significant legal weight.

- Do specify the powers you are granting clearly. Ambiguities could lead to unintended consequences.

- Do have the document notarized. In Florida, notarization is a critical step for the form to be legally binding.

- Don't leave any sections blank. If a section does not apply, write "N/A" to indicate this clearly.

- Don't sign the form without two witnesses present. Florida law requires your signature to be witnessed by two individuals, adding a layer of legal protection.

- Don't forget to provide copies to your agent and any institutions that might need it, such as banks or medical facilities. Keeping all relevant parties informed prevents confusion and delays.

- Don't hesitate to consult with a legal professional if you have questions or concerns. Getting expert advice ensures that your interests are fully protected.

Misconceptions

When dealing with the Florida General Power of Attorney (POA) form, people often hold misconceptions about its function, scope, and legal implications. Recognizing and correcting these misunderstandings is crucial for anyone considering creating a POA in Florida. The following are common misconceptions:

- A General Power of Attorney grants unlimited power. Despite the term "general," this power of attorney does not provide the agent with unlimited power. It allows the agent to perform a wide range of actions on behalf of the principal, such as handling financial transactions and making decisions about personal property. However, it has its limitations; notably, the agent cannot make healthcare decisions for the principal under a general POA. This type of decision-making power requires a separate document known as a Healthcare Power of Attorney.

- It remains effective after the principal's death. A common misconception is that a General Power of Attorney continues to be effective after the principal’s death. In reality, the authority granted through a POA automatically ends when the principal dies. After death, the executor of the estate, named in the will, takes over the responsibility of managing the deceased’s affairs, not the agent mentioned in the POA.

- Only family members can be named as agents. Actually, the principal has complete discretion over whom they choose to appoint as their agent. The agent can indeed be a family member, but they can also be a trusted friend or professional advisor. The key requirement is that the chosen agent must be someone the principal trusts to manage their affairs responsibly.

- A General Power of Attorney does not need to be witnessed or notarized. In Florida, like in many states, for a General Power of Attorney to be legally valid, specific formalities must be adhered to. This includes signing the document in the presence of two witnesses and having it notarized. This process ensures that the principal's decision to grant power of attorney is made freely and without coercion, and it also verifies the authenticity of the document.

Key takeaways

Filling out and using the Florida General Power of Attorney form is an important legal process that allows one person to grant another person the authority to make decisions on their behalf. Understanding the key components and considerations of this process can ensure that it is carried out effectively and in accordance with state laws. Here are eight key takeaways:

- Understand the scope of authority granted. The Florida General Power of Attorney form enables you to grant broad powers to an agent, including handling financial transactions, real estate matters, and other legal decisions. It is crucial to clearly understand and define the scope of powers being granted.

- Select an agent carefully. The person you appoint as your agent will have significant control over your affairs, so it's vital to choose someone who is trustworthy, responsible, and capable of handling the tasks required.

- Be aware of the form's durability. Unless specified otherwise, a General Power of Attorney in Florida is not durable, meaning it will not remain in effect if you become incapacitated. If you wish for the power of attorney to continue during incapacitation, you must use a Durable Power of Attorney form.

- Follow Florida state laws for execution. For the General Power of Attorney to be valid, it must be signed by the principal (the person granting the authority) in the presence of two witnesses and notarized. This process ensures the document's legality and enforceability.

- Consider a notary public. Having the document notarized, while a requirement, also adds a layer of authentication, making it less likely to be challenged on the grounds of authenticity.

- Review and update regularly. Life circumstances change, and so might your choice of agent or the scope of powers you wish to grant. Regularly reviewing and updating your General Power of Attorney ensures that it always reflects your current wishes.

- Know the termination conditions. The General Power of Attorney automatically terminates upon the principal's death, revocation, or, if specified, incapacitation. Understanding these conditions helps in planning for all outcomes.

- Consult with a legal professional. Given the legal intricacies and implications of granting someone else authority over your affairs, consulting with an attorney to tailor the power of attorney to your specific needs and to ensure compliance with Florida law is advisable.

Popular General Power of Attorney State Forms

Nys Power of Attorney Form - It assures that the principal's financial and business matters are conducted uninterrupted, even during times of incapacity.

Indiana Power of Attorney Form - While the form grants broad powers, the agent is prohibited from acting in their own self-interest or outside the scope of authority granted by the principal.

Power of Attorney California - Acts as a safety net, ensuring your affairs are in order if unexpected events occur.