Free General Power of Attorney Form for California

In the bustling state of California, a practical tool exists for individuals seeking to entrust another person with the management of their financial matters—this is known as the General Power of Attorney (POA) form. This document serves as an authorization that allows a designated person, often referred to as the agent, to make decisions and take actions concerning the signatory's property, finances, and other non-health-related matters. Tailored specifically for residents of California, this legally binding form is especially significant due to the state's rigorous legal standards and specificity in statutory requirements. Understanding its major aspects—such as the scope of authority granted, the duration of the power, and the process for choosing an agent—is crucial. The form not only grants comprehensive control over financial transactions but also prompts the principal to consider deeply whom they trust to manage their affairs. This document helps in preparing for a time when the principal might be unable to make decisions due to travel, illness, or incapacity, ensuring that their financial responsibilities are handled as per their wishes. Recognizing the ins and outs of the General Power of Attorney form in California is a step forward in planning for financial well-being and peace of mind.

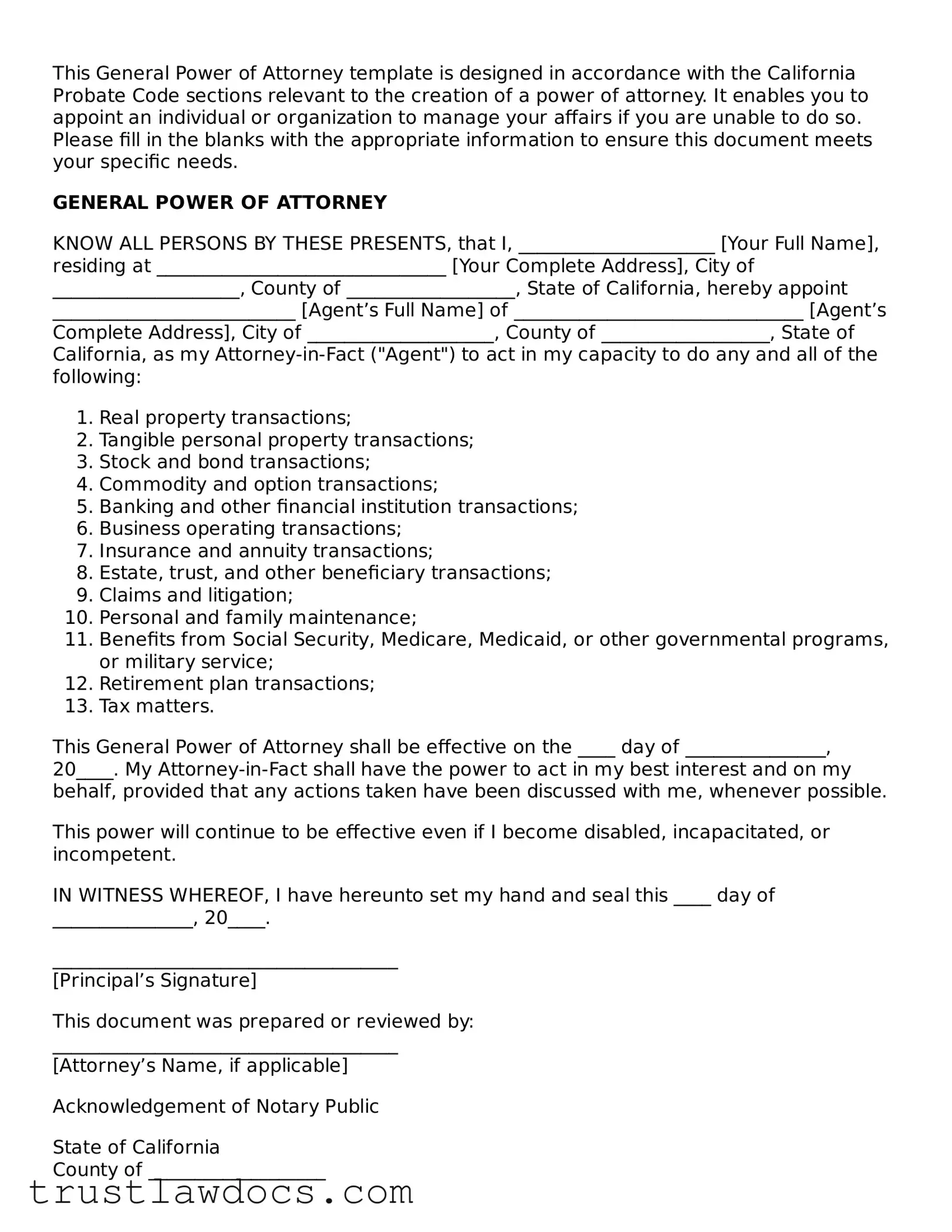

Form Example

This General Power of Attorney template is designed in accordance with the California Probate Code sections relevant to the creation of a power of attorney. It enables you to appoint an individual or organization to manage your affairs if you are unable to do so. Please fill in the blanks with the appropriate information to ensure this document meets your specific needs.

GENERAL POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that I, _____________________ [Your Full Name], residing at _______________________________ [Your Complete Address], City of ____________________, County of __________________, State of California, hereby appoint __________________________ [Agent’s Full Name] of _______________________________ [Agent’s Complete Address], City of ____________________, County of __________________, State of California, as my Attorney-in-Fact ("Agent") to act in my capacity to do any and all of the following:

- Real property transactions;

- Tangible personal property transactions;

- Stock and bond transactions;

- Commodity and option transactions;

- Banking and other financial institution transactions;

- Business operating transactions;

- Insurance and annuity transactions;

- Estate, trust, and other beneficiary transactions;

- Claims and litigation;

- Personal and family maintenance;

- Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service;

- Retirement plan transactions;

- Tax matters.

This General Power of Attorney shall be effective on the ____ day of _______________, 20____. My Attorney-in-Fact shall have the power to act in my best interest and on my behalf, provided that any actions taken have been discussed with me, whenever possible.

This power will continue to be effective even if I become disabled, incapacitated, or incompetent.

IN WITNESS WHEREOF, I have hereunto set my hand and seal this ____ day of _______________, 20____.

_____________________________________

[Principal’s Signature]

This document was prepared or reviewed by:

_____________________________________

[Attorney’s Name, if applicable]

Acknowledgement of Notary Public

State of California

County of ___________________

On the ____ day of _______________, 20____, before me, ___________________________________ [Name of Notary], a Notary Public in and for said State, personally appeared ___________________________________ [Name(s) of the Signer(s)], known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_____________________________________

[Notary Public’s Signature]

My Commission Expires: ___________________

PDF Form Details

| Fact | Detail |

|---|---|

| Purpose | Allows an individual to grant another person the authority to make legal decisions on their behalf. |

| Scope | Covers a wide range of actions including financial, real estate, and personal matters. |

| Validity requirements | Must be signed by the principal, notarized, and sometimes witnessed to be legally valid. |

| Durability | Can be made durable to remain in effect even if the principal becomes incapacitated. |

| Governing laws | Governed by the California Probate Code, particularly sections dealing with powers of attorney. |

| Revocation | The principal can revoke it at any time as long as they are mentally competent. |

| Agent's authority | The agent can perform almost any act the principal could, within the bounds specified in the form. |

| Limitations | The agent cannot make decisions about the principal’s health care or other acts beyond the scope granted. |

How to Write California General Power of Attorney

When a person wants to allow another individual to make legal decisions on their behalf, a General Power of Attorney (POA) in California offers a formal avenue to grant these permissions. This document is a valuable tool for individuals planning for future uncertainties regarding their finances, health, and other aspects of legal authority. It's critical to approach filling out this form with attention to detail and clear understanding of the implications. Each section of the form serves a distinct purpose in establishing the scope and limits of the legal powers being transferred. Here are the steps to fill out the California General Power of Attorney form accurately and thoroughly.

- Identify the Principal and the Agent. Begin by clearly listing the full legal names and addresses of the principal — the person granting the power — and the agent (or attorney-in-fact) — the person receiving the authority to act on the principal's behalf.

- Specify the Powers Granted. Detail the specific powers that the principal is transferring to the agent. This section might include powers related to financial matters, property transactions, and other legal decisions. It's important to be precise about what powers are being granted to ensure both parties understand the scope of authority.

- Delineate Any Limitations. If the principal wishes to set any limits on the powers granted, such as restricting the agent from selling certain properties or making gifts, these limitations should be explicitly stated in the document.

- Select the Duration. The principal needs to decide whether the POA will be durable or springing. A durable POA remains in effect even if the principal becomes incapacitated, while a springing POA takes effect only if a specified condition, usually the incapacity of the principal, is met. The choice must be clearly indicated on the form.

- Signatures. Both the principal and the agent must sign the document in the presence of a notary public or other authorized official. The signing process must adhere to California state laws for the POA to be legally valid. This might include requirements for witnesses.

- Date the Document. The principal should enter the date that the document is signed. This date is important for legal reasons and may also affect the duration of the POA.

- Notarization. The final step is for the notary public to fill out their section, confirming that the principal signed the document willingly and under no duress. This step is crucial for the document's legal validity.

Filling out the General Power of Attorney form in California is a significant step in legal planning. It's a process that requires careful consideration and precision to ensure that the document accurately reflects the principal's wishes and that it provides the agent with the correct level of authority. Following these steps and understanding each component of the form can assist in creating a clear and effective document. Once completed, this POA will serve as an essential legal instrument, guiding actions and decisions should the principal be unable to make them personally.

Get Answers on California General Power of Attorney

What is a General Power of Attorney form in California?

A General Power of Attorney form in California is a legal document that allows an individual (the principal) to grant another person (the agent) the authority to make a wide range of decisions on their behalf. This could include managing financial transactions, buying or selling property, and making legal choices. It is a powerful tool that remains effective until the principal either revokes it or becomes incapacitated, unless it is specified as durable.

How does one create a General Power of Attorney in California?

To create a General Power of Attorney in California, the principal must fill out the form, clearly identifying themselves and the agent, along with the specific powers granted. It's essential that the document adheres to California laws, requiring either two adult witnesses or a notary public's acknowledgment. Once completed, it's critical for both the principal and the agent to keep copies of the document for their records.

Can a General Power of Attorney be revoked?

Yes, a General Power of Attorney can be revoked at any time by the principal as long as they are mentally capable. To revoke it, the principal should provide a written notice to the agent and to any other parties who were relying on the document. Destroying the original document and any copies as well as notifying financial institutions and others affected can also help ensure it is fully revoked.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, a General Power of Attorney not specified as durable will automatically terminate. This means the agent would no longer have the authority to make decisions on behalf of the principal. For continuous authority despite incapacity, the form used must be a Durable Power of Attorney, which specifically allows the document to remain in effect even if the principal loses the ability to make decisions for themselves.

Common mistakes

Completing the California General Power of Attorney form can often be a straightforward process, but mistakes do happen. These errors can sometimes negate the very purpose of having a Power of Attorney (POA) in place. One common mistake is not specifying the powers granted clearly enough. Without clear definitions, an agent might not be able to act effectively on behalf of the principal, or they might overstep their authority, creating confusion and potentially legal issues.

Another stumbling block is failing to acknowledge the form's state-specific requirements. California has its own set of rules and statutes governing POAs, and overlooking these can render the document void. This extends to not having the proper witnesses or notary acknowledgments, which are critical to ensuring the document's legality and enforceability in California.

People often incorrectly assume that a General POA grants an agent the power to make healthcare decisions. However, for healthcare decisions, California requires a separate form known as an Advance Healthcare Directive. Mixing up these documents can leave important decisions unaddressed.

Not choosing the right agent is another frequent error. The role requires someone trustworthy, reliable, and ideally, with some knowledge or capability to handle the tasks at hand. Assigning this responsibility to someone without considering their capacity or willingness can result in mismanagement of the principal's affairs or outright neglect.

Date-related oversights also occur. Someone might forget to specify when the power starts and ends, which can lead to ambiguity about its validity. Some believe once signed, these documents last indefinitely, but that's not the case if an expiration date is set or if the POA is durable and meant to cease upon the principal's incapacitation.

Moreover, a crucial mistake is not updating the POA document to reflect life changes. Marriages, divorces, relocation, or changes in financial status can all necessitate a review and possibly a revision of the POA to keep it relevant and accurate.

Simple but impactful are errors related to the document's physical handling. For instance, failing to keep the original in a secure, accessible place or not distributing copies to relevant parties, such as financial institutions or agents, can stall its use when needed.

Additionally, there's a common misconception that a POA covers actions after the principal's death. This belief leads to misunderstandings about the document's scope. In reality, a POA's authority ends upon the principal's death, at which point the executor of the estate takes over.

Lastly, the do-it-yourself approach, without seeking professional advice, can lead to oversights. Legal documents can be complex, and what seems like a small mistake could invalidate the entire POA. Consulting with a professional can ensure that the form meets all legal requirements and truly serves the principal's needs.

Documents used along the form

When handling legal and financial matters, it's essential to have the right documents in place to ensure your affairs are managed according to your wishes. While the California General Power of Attorney (POA) form is a crucial document that allows you to appoint someone to manage your financial matters, there are other forms that are often used in conjunction with it to provide a comprehensive legal strategy. Each document serves a unique purpose and adds an extra layer of security and clarity for your plans.

- Advance Health Care Directive – This document complements a General POA by addressing health care decisions rather than financial matters. It allows you to name a health care agent to make medical decisions on your behalf if you become unable to do so yourself. It also enables you to specify your wishes regarding treatment preferences, organ donation, and end-of-life care.

- Durable Power of Attorney for Finance – Although similar to the General POA, the Durable POA for Finance remains in effect even if you become incapacitated. This is crucial for continuous financial management without court intervention. This form specifies which financial powers your agent can exercise on your behalf, including handling business operations, accessing safety deposit boxes, and managing retirement accounts.

- Living Will – Often used alongside an Advance Health Care Directive, a Living Will provides specific directives about your health care preferences, particularly concerning life-sustaining treatment if you are in a terminal condition. This document helps to ensure that your health care wishes are honored, even when you can't communicate them yourself.

- Last Will and Testament – This document is essential for estate planning. It outlines how you want your property and assets distributed after your death. While not directly related to the General POA, which ceases to be effective upon your death, it is a critical component of a well-rounded legal plan to manage your affairs and wishes comprehensively.

Incorporating these documents alongside the California General Power of Attorney form creates a robust legal framework that covers a wide range of decisions, from financial management to health care and end-of-life wishes. With these documents, you can ensure that your preferences are clearly communicated and legally enforceable, providing peace of mind for both you and your loved ones.

Similar forms

The California General Power of Attorney (GPA) form shares similarities with the Durable Power of Attorney (DPOA) document, particularly in their basic functionality of designating an agent to make decisions on behalf of the principal. Both documents empower someone else to act in the principal's stead, encompassing a range of transactions or decisions. However, while a GPA typically ceases to be effective if the principal becomes incapacitated, a DPOA is specifically crafted to remain in effect even if the principal loses the capacity to make decisions, providing a continuous avenue for financial management without court intervention.

Another document resembling the California GPA is the Limited Power of Attorney (LPOA). An LPOA grants specific powers to an agent for limited purposes, such as selling a particular asset or managing a specific financial transaction. Unlike the broader provisions of a GPA, which can authorize an agent to handle nearly all of the principal's affairs, the LPOA narrows the agent's authority to pre-specified acts, offering the principal more control over the extent of the delegated powers and often for a limited time.

The Medical Power of Attorney (or Healthcare Proxy) document also parallels the GPA in its function of appointing an agent. However, the scope of authority in a Medical Power of Attorney is distinct, focusing solely on making healthcare-related decisions when the principal is unable to do so themselves. This specificity contrasts with the GPA's broader application, which usually encompasses financial and business transactions instead of healthcare decisions, highlighting the importance of specifying the type of authority given to ensure it aligns with the principal's needs.

Living Trusts share a common goal with the California GPA: managing assets. A Living Trust appoints a trustee to manage the trust's assets for the benefit of the beneficiaries, a role similar to that of the agent in a GPA. Nonetheless, Living Trusts offer a unique advantage in estate planning, such as avoiding probate, which is not a direct concern of the GPA. The formation of a Living Trust is often more complex and tailored to an individual's estate planning goals, aiming to protect assets and ensure a smooth transfer to beneficiaries, a consideration beyond the purview of a GPA.

Lastly, the Springing Power of Attorney is akin to the California GPA, with the key difference being the conditionality of the former's activation. A Springing Power of Attorney becomes effective only upon the occurrence of a specific event, usually the principal’s incapacity. This delayed activation feature is intended to provide peace of mind and preserve the principal's control over their affairs until it's absolutely necessary to relinquish it, contrasting with the GPA's immediate effectiveness upon execution. This distinction allows principals to tailor the timing of an agent's authority in accordance with their personal preferences and circumstances.

Dos and Don'ts

When completing the California General Power of Attorney form, certain practices ensure the process is smooth and legally sound. Here’s a comprehensive guide:

What you should do:

- Thoroughly read and understand the powers being granted before you sign the document.

- Choose an agent who is trustworthy and capable of handling your financial affairs responsibly.

- Be specific about the powers you are granting to avoid any ambiguity.

- Have the document notarized to add a layer of authenticity and legal validity.

- Keep a copy of the document in a safe but accessible place.

What you shouldn't do:

- Don't leave any section incomplete; this could lead to confusion or misuse of the document.

- Don't choose an agent based solely on personal relations without considering their capability or reliability.

- Don't forget to specify the duration of the power of attorney, especially if it's meant for a specific period.

- Don't neglect to review and possibly update the document regularly to reflect any changes in your preferences or situation.

Misconceptions

When dealing with the California General Power of Attorney (POA) form, many individuals hold misconceptions that can lead to confusion or mismanagement of their affairs. It's crucial to understand what this form does and does not entail to ensure one's interests are adequately protected. Here are seven common misconceptions explained:

It remains valid after the principal's death: A widespread misconception is that the California General POA remains in effect even after the principal’s death. However, all powers granted through this document cease upon the death of the principal. Arrangements for handling the principal’s estate should be directed through a will or trust, not a POA.

The agent has unrestricted power: While it might seem that granting someone a General POA gives them unlimited authority, the reality is the powers of an agent are limited to those expressly written in the document. California law also imposes duties on the agent, including acting in the principal’s best interest, which inherently limits the agent’s powers.

It grants authority over healthcare decisions: Another common misconception is that a General POA allows the agent to make healthcare decisions for the principal. In California, healthcare decisions require a separate document known as an Advance Healthcare Directive. A General POA only covers financial decisions and other non-healthcare related affairs.

A lawyer must draft it: While it's advisable to consult with a legal professional when creating any legal document, California law does not require a lawyer to draft a General POA. However, ensuring that the form complies with Californian law and that it accurately reflects the principal’s wishes might necessitate legal expertise.

It's only for the elderly: Many assume that POA documents are only necessary for older adults. In reality, unforeseen circumstances such as accidents or sudden illnesses can make a POA essential for anyone, regardless of age, to ensure that their affairs can be managed properly in their absence or incapacity.

One size fits all: A common error is the belief that a standard form works for everyone. Although California provides statutory forms for a General POA, the specific circumstances and needs of the principal might require customization. Tailoring the document ensures that it accurately reflects the principal's intentions and meets their unique needs.

It's irrevocable: Some believe once a General POA is created, it cannot be revoked. This is not true. The principal can revoke a General POA at any time as long as they are mentally competent. This revocation must be communicated to the agent and, preferably, documented formally to avoid confusion.

Understanding these nuances of the California General Power of Attorney can help individuals make informed decisions when managing their or a loved one's affairs, ensuring that their rights and interests are adequately protected.

Key takeaways

When handling the California General Power of Attorney (POA) form, it is crucial to bear in mind several key points to ensure the document is completed accurately and serves its intended purpose. This power of attorney allows you to appoint someone to make broad financial decisions on your behalf, making it an essential tool for estate planning and managing affairs during times when you are unable to do so yourself.

- Understand the scope of authority you are granting: The California General Power of Attorney form gives the person you choose, often called your agent, the power to handle your financial affairs. This includes but is not limited to managing bank accounts, buying and selling property, and handling tax matters. Ensure you trust this person completely, as they will have significant control over your assets.

- Choose your agent wisely: The agent you appoint should be a trusted family member, friend, or advisor who is willing and able to take on the responsibilities. Consider their ability to manage financial matters prudently and their availability to act on your behalf when needed.

- Be specific about the powers granted: While the form allows for broad authority, you can tailor the powers given to your agent. Specify any limitations or additional powers you wish to grant to ensure the POA aligns with your financial management needs and goals.

- Understand the durability of the POA: In California, a General Power of Attorney is not durable by default. This means it will automatically become invalid if you become incapacitated unless you specify otherwise in the document. If you require a durable power of attorney, you must clearly state this on the form.

- Legal requirements must be met: For the POA to be valid in California, it must be signed by you and two witnesses or be notarized. The witnesses must be adults and cannot be the agent you have appointed.

- Keep the original document safe: Once the POA is completed and signed, keep the original in a safe but accessible place. Inform your agent and any other relevant parties, such as family members or your attorney, where the document is stored.

- Review and update as necessary: Your financial situation and relationships can change, so it's important to periodically review your General Power of Attorney. Make updates as necessary to reflect your current wishes and to replace an agent if needed.

Making informed decisions about your California General Power of Attorney form can protect your interests and ensure your financial matters are handled according to your wishes. Taking the time to fill out the form accurately and thoughtfully is an important step in effective financial planning.

Popular General Power of Attorney State Forms

Nys Power of Attorney Form - This legal document is a key element in comprehensive life planning, alongside wills and health care directives.

Indiana Power of Attorney Form - Upon the principal's death, the General Power of Attorney becomes null and void, and the executor of the estate then takes over management of the principal’s affairs.

Financial Power of Attorney Michigan - Regular review and updating of the document are recommended to reflect changes in the principal’s situation or wishes.

General Power of Attorney Texas Form - This document grants a chosen agent broad authority to handle financial decisions for the principal.