Official General Power of Attorney Document

In the realm of legal documentation, few forms carry as much weight and versatility as the General Power of Attorney (POA). This document grants one individual, known as the agent or attorney-in-fact, the broad authority to act on another person’s, the principal's, behalf in various matters. These can range from financial decisions, such as managing bank accounts and buying or selling property, to more personal concerns like making healthcare choices. The strength of this form lies in its capacity to ensure that the principal's affairs are managed according to their interests, especially in times when they are unable to do so themselves due to illness or absence. However, given its significant implications, the creation of a General Power of Attorney form demands careful consideration. The document’s scope, the selection of a trusted agent, and the understanding that it may be revoked at any time by the principal, are essential aspects that underscore its importance and signify the trust placed in the relationship between the principal and the agent.

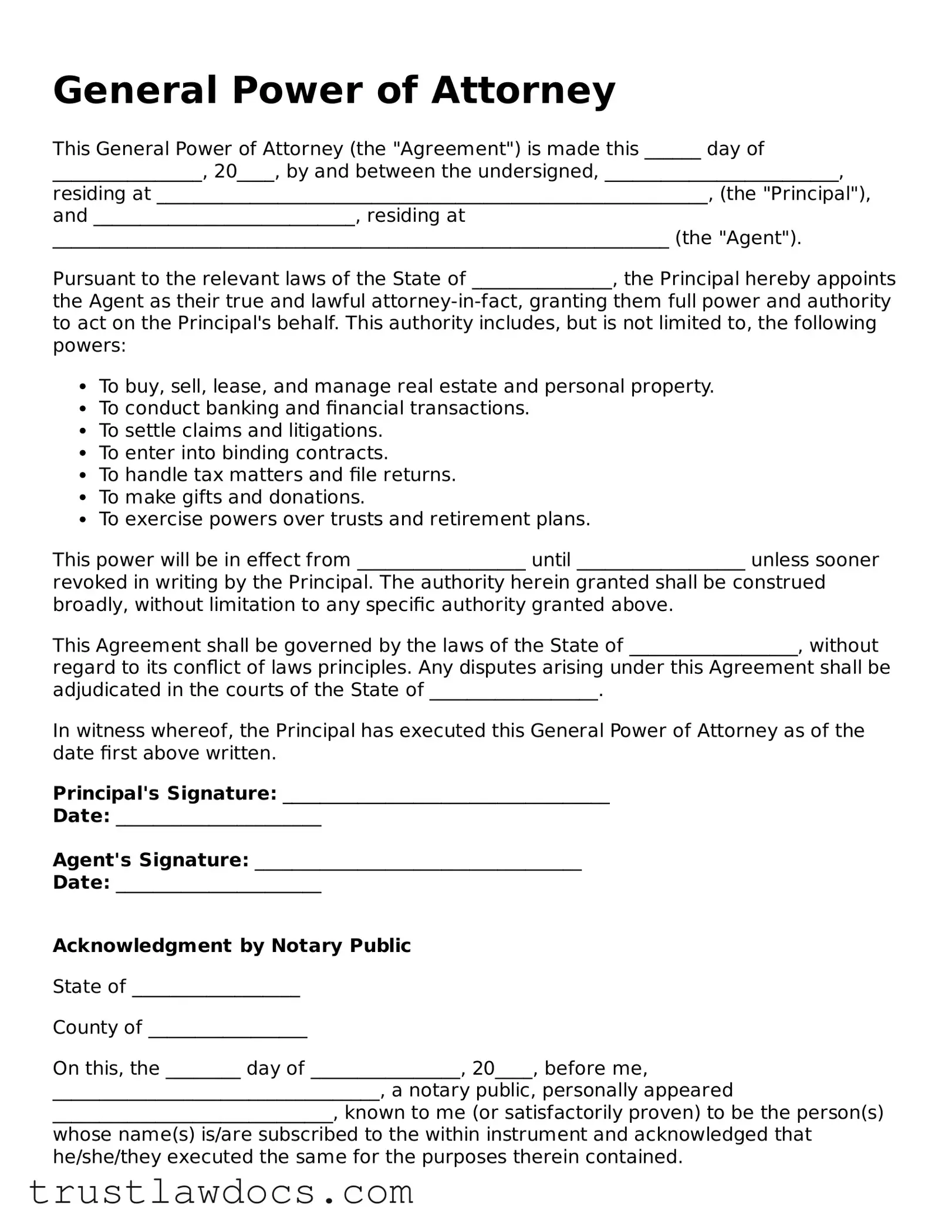

Form Example

General Power of Attorney

This General Power of Attorney (the "Agreement") is made this ______ day of ________________, 20____, by and between the undersigned, _________________________, residing at ___________________________________________________________, (the "Principal"), and ____________________________, residing at __________________________________________________________________ (the "Agent").

Pursuant to the relevant laws of the State of _______________, the Principal hereby appoints the Agent as their true and lawful attorney-in-fact, granting them full power and authority to act on the Principal's behalf. This authority includes, but is not limited to, the following powers:

- To buy, sell, lease, and manage real estate and personal property.

- To conduct banking and financial transactions.

- To settle claims and litigations.

- To enter into binding contracts.

- To handle tax matters and file returns.

- To make gifts and donations.

- To exercise powers over trusts and retirement plans.

This power will be in effect from __________________ until __________________ unless sooner revoked in writing by the Principal. The authority herein granted shall be construed broadly, without limitation to any specific authority granted above.

This Agreement shall be governed by the laws of the State of __________________, without regard to its conflict of laws principles. Any disputes arising under this Agreement shall be adjudicated in the courts of the State of __________________.

In witness whereof, the Principal has executed this General Power of Attorney as of the date first above written.

Principal's Signature: ___________________________________Date: ______________________

Agent's Signature: ___________________________________

Date: ______________________

Acknowledgment by Notary Public

State of __________________

County of _________________

On this, the ________ day of ________________, 20____, before me, ___________________________________, a notary public, personally appeared ______________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public's Signature: ___________________________________Commission Expires: _______________

PDF Form Details

| Fact | Description |

|---|---|

| Definition | A General Power of Attorney (GPA) form is a legal document that allows a person to appoint someone else to manage their financial affairs and other non-medical decisions on their behalf. |

| Duration | Unless specified otherwise, a GPA typically remains in effect until it is revoked, the principal becomes incapacitated, or the principal dies. |

| Revocation | The principal can revoke a GPA at any time as long as they are mentally competent. This requires notifying the appointed attorney-in-fact in writing and, in some cases, notifying third parties who were relying on the GPA. |

| Capacity | The principal must be of sound mind, meaning they understand the significance of the document they are signing, at the time the GPA is executed. |

| Attorney-in-fact | The appointed person, also known as the attorney-in-fact, does not need to be a lawyer but should be a trustworthy individual capable of managing the principal's affairs effectively. |

| State-Specific Laws | The applicability and specific requirements of a GPA, such as witnessing and notarization, can vary significantly between different states within the U.S. |

| Scope of Authority | A General Power of Attorney grants broad powers to handle affairs relating to personal and business finances but does not include making health care decisions for the principal. |

How to Write General Power of Attorney

Handling your financial matters can sometimes require the assistance of someone you trust, especially if you're unable to manage them yourself due to various reasons such as travel, illness, or other personal circumstances. A General Power of Attorney (GPA) form is a legal document that allows you to appoint an agent or a representative to manage your financial affairs on your behalf. Filling out this form correctly is crucial to ensure that your financial matters are handled according to your wishes. The steps to complete the form are quite straightforward, provided you pay close attention to detail and ensure all information is accurate and current.

Here are the necessary steps to fill out the General Power of Attorney form:

- Identify the Principal: Begin by clearly identifying yourself as the principal. Your full name, date of birth, and full address should be accurately provided. This establishes who is granting the power of attorney.

- Select an Agent: Choose a trusted individual who will act as your agent, sometimes also referred to as the attorney-in-fact. Their full name, address, and contact information should be included. Make sure this person agrees and understands their responsibilities before you name them in the document.

- Granting Powers: Specify the exact powers you are granting to your agent. This could include handling bank transactions, signing checks, managing real estate, and more. It's important to be as clear as possible about what your agent can and cannot do.

- Durability Clause: Decide whether the power of attorney will be durable. This means it remains in effect even if you become mentally incompetent. If you wish for the GPA to include this feature, it must be clearly stated in the document.

- Signatures: For the document to be legally binding, it must be signed by you (the principal), the agent you have chosen, and a notary public. The signatures must be done in the presence of a notary to ensure that the document is legally recognized.

- Witnesses: Some states require the presence of one or more witnesses who are not parties to the document. They must watch you sign the document and then add their own signatures and addresses. Check your state’s specific requirements regarding witnesses.

- Date the Document: The date the document is signed is also essential. This indicates when the powers granted to the agent become effective.

- Keep Copies: After the document is fully executed, make sure to keep the original in a safe place and provide copies to your agent and any institutions that may need it, such as your bank.

Lastly, remember that the nature of a General Power of Attorney means it can grant broad powers to your agent, so it's important to choose someone you trust implicitly. Reviewing the completed form with a legal professional can also ensure that your interests are adequately protected and that the document meets all legal requirements in your jurisdiction.

Get Answers on General Power of Attorney

What is a General Power of Attorney?

A General Power of Attorney is a legal document that allows an individual, often referred to as the principal, to designate another person, known as the agent or attorney-in-fact, to act on their behalf in various matters. These matters can include financial, business, and personal affairs. Unlike a specific power of attorney that limits the agent’s powers to a particular task, a general power of attorney grants broad powers to manage a wide range of actions until it is revoked or the principal becomes incapacitated, unless it is made durable.

When should I use a General Power of Attorney?

One might use a General Power of Attorney in several situations. For example, if you will be out of the country and need someone to handle your financial transactions, such as managing bank accounts or paying bills. It is also useful in planning for future incapacity or when you prefer someone else to handle your affairs due to illness or a busy schedule. However, it's important to note that this document will become ineffective if you become incapacitated, unless it specifies otherwise by being durable.

How can I revoke a General Power of Attorney?

To revoke a General Power of Attorney, you must provide a written notice of revocation to the agent you previously designated and to any institutions or parties that were dealing with the agent under the authority of the power of attorney. It is also recommended to get a formal revocation form, sign it in front of a notary, and distribute it similarly to the original power of attorney to ensure that all parties are aware of the revocation.

Does a General Power of Attorney need to be notarized or witnessed to be valid?

Yes, in most states, a General Power of Attorney needs to be either notarized or signed in front of witnesses to be legally valid. The specific requirements vary by state, including the number of witnesses needed or whether notarization can suffice or is necessary. It's crucial to consult the laws of your state or an attorney to make sure your document complies with local regulations, ensuring it is legally enforceable.

Can a General Power of Attorney be used to make healthcare decisions?

No, a General Power of Attorney is typically limited to financial and property matters and does not include the authority to make healthcare decisions for the principal. To grant someone the power to make healthcare decisions on your behalf, you would need to complete a separate document known as a Healthcare Power of Attorney or a Medical Proxy, depending on your state's laws.

Common mistakes

Filling out a General Power of Attorney form can be tricky, leading to common mistakes that can render the document less effective or even invalid. One frequent error is not specifying the powers granted. When individuals grant broad authority without detailing the exact responsibilities, it can lead to confusion and misuse of the power given. It's crucial to list out specific powers to ensure the agent knows their limits and responsibilities.

Another common mistake is neglecting to define the duration of the power of attorney. Without a clear end date or condition for termination, a General Power of Attorney may continue indefinitely or might not meet the principal's intentions. Clearly stating when the document should expire or under what conditions it should be revoked can prevent potential complications in the future.

Many people forget to consider state laws when filling out their General Power of Attorney form. Since legal requirements can vary significantly from one state to another, it's essential to ensure that the form complies with local laws where the principal resides. This oversight can lead to the document being challenged or not recognized by financial institutions or other entities.

Choosing the wrong agent is another mistake that can lead to issues down the line. The designated agent should be someone trustworthy and capable of managing the responsibilities granted by the power of attorney. Failing to consider the agent's willingness, ability, and geographical location can result in ineffective management of the principal's affairs.

A lack of witnesses or notarization, depending on state requirements, is a critical oversight. Some jurisdictions require a General Power of Attorney to be either witnessed, notarized, or both to be considered valid. By overlooking this requirement, individuals risk their document being considered invalid when it's most needed.

Finally, not providing copies of the completed document to relevant parties is a common mistake. Banks, financial advisors, and other institutions should have a copy on file to act according to the principal's wishes. Failing to distribute the document can cause delays and complications in executing the powers granted by the principal.

Documents used along the form

When managing affairs through a General Power of Attorney, various other forms and documents are often necessary to fully empower individuals to act on one another's behalf. These documents can range from those granting specific financial powers to those authorizing someone to make healthcare decisions. Understanding these additional forms ensures that all aspects of one’s personal and financial matters can be appropriately managed.

- Special or Limited Power of Attorney - This document grants someone authority to act on your behalf in specific situations only, such as selling a property, managing certain financial transactions, or handling specific legal matters. It's more narrowly focused than a General Power of Attorney.

- Durable Power of Attorney - A Durable Power of Attorney remains in effect even if the person who has made it becomes incapacitated. This is critical for ensuring that the appointed agent can continue to manage affairs without the need for court intervention.

- Medical Power of Attorney - This document allows an individual to appoint someone to make healthcare decisions on their behalf, should they become unable to do so. It’s an essential part of planning for potential medical issues.

- Living Will - Often used alongside a Medical Power of Attorney, a Living Will specifies a person’s wishes regarding medical treatment and life-sustaining measures in cases of terminal illness or incapacitation.

- Revocation of Power of Attorney - This document is used to cancel a previously granted Power of Attorney. It is essential when the scope of the original document changes, or the appointed agent’s services are no longer needed.

These documents complement the General Power of Attorney by addressing specific needs and scenarios that the broader document does not cover. Each plays a vital role in comprehensive planning, ensuring that individuals can manage their affairs or have them managed by trusted agents under various conditions. Keeping these documents updated and consulting with a legal professional when creating or altering them can provide peace of mind and protect one’s interests.

Similar forms

A Special or Limited Power of Attorney bears resemblance to the General Power of Attorney but is more narrowly focused. While a General Power of Attorney grants broad powers to an agent to act on the principal’s behalf in various matters, a Special Power of Attorney limits the agent’s authority to specific tasks or situations. This could be handling a real estate transaction, managing certain financial affairs, or making healthcare decisions. The specificity of a Special Power of Attorney ensures that the agent has only the powers that the principal is willing to delegate for particular purposes.

A Durable Power of Attorney shares similarities with a General Power of Attorney by allowing an individual to act on another's behalf. However, it includes a critical distinction: it remains in effect or becomes effective when the principal becomes incapacitated. This type of document is crucial for ensuring that someone can manage your affairs if you're unable to do so yourself due to injury, illness, or disability. Thus, while a General Power of Attorney may automatically terminate upon the principal's incapacity, a Durable Power of Attorney is designed specifically for this possibility.

A Health Care Proxy is akin to a General Power of Attorney in the sense that it grants someone else the authority to make decisions on another's behalf. However, a Health Care Proxy is specifically concentrated on health care decisions. This includes choices about medical treatment, surgical interventions, and end-of-life care. While a General Power of Attorney might encompass the authority to make health care decisions among other powers, a Health Care Proxy is exclusively for health-related decisions, especially when the principal cannot make these choices themselves.

The Trust Agreement or Declaration of Trust presents another example of delegated authority, aligning in concept with a General Power of Attorney. In this agreement, an individual (the trustor) transfers assets into a trust, managed by trustees, for the benefit of specified beneficiaries. Like a General Power of Attorney, this document embodies the idea of managing or administering someone’s property or financial affairs. However, the trust agreement creates a fiduciary relationship with duties that last beyond the trustor's incapacity or death, often for the purpose of estate planning.

A Financial Power of Attorney is closely related to a General Power of Attorney, with a specialized focus on financial matters. This document empowers an agent to handle financial transactions on behalf of the principal. These transactions can include paying bills, managing investments, and buying or selling property. Like a General Power of Attorney, it can grant broad powers but is specifically tailored to financial activities, ensuring the principal’s financial obligations and goals are met when they are unable to manage these tasks themselves.

An Advance Health Care Directive, sometimes known as a Living Will, parallels the General Power of Attorney by preparing for a time when the principal might be unable to communicate their wishes concerning medical treatment. It spells out the types of medical interventions the individual prefers or seeks to avoid, particularly in end-of-life situations. Although it does not appoint an agent like a General Power of Attorney, it serves a similar purpose in guiding decisions when the principal is incapacitated, thereby easing the decision-making burden on loved ones and healthcare providers.

The Guardianship or Conservatorship Arrangement, while established through court proceedings, shares objectives with a General Power of Attorney. It involves appointing an individual (the guardian or conservator) to manage the personal and/or financial affairs of another person deemed unable to do so themselves, often due to incapacity or disability. Unlike a General Power of Attorney, which is arranged privately and can be more easily revoked, guardianship or conservatorship is subject to ongoing court oversight and is tailored to provide protection for those who cannot protect themselves.

A Business Power of Attorney is a specialized form that enables a designated agent to conduct business-related transactions on behalf of the principal. This can involve signing documents, entering into contracts, or managing business operations. While it shares the delegation of authority seen in a General Power of Attorney, its scope is specifically tailored to meet the needs of businesses and their operations. It ensures continuity of business activities in the principal’s absence or incapacity.

An Estate Plan often incorporates elements of a General Power of Attorney as part of a comprehensive approach to managing and distributing an individual’s assets upon death or incapacitation. While it may include a General Power of Attorney for managing affairs during the principal's life, an estate plan extends beyond to include wills, trusts, and health care directives to ensure that an individual’s wishes are respected and efficiently executed without unnecessary legal intervention or confusion among heirs and beneficiaries.

A Non-Durable Power of Attorney is similar to a General Power of Attorney in its function of authorizing an agent to act on the principal’s behalf. The key difference lies in its duration; a Non-Durable Power of Attorney is specifically designed to terminate upon the principal’s incapacitation or under certain conditions defined in the document. This makes it suitable for short-term arrangements or specific transactions, such as selling a property or managing affairs when the principal is unavailable or unable to do so for a limited period.

Dos and Don'ts

Filling out a General Power of Attorney form is a significant step that grants another person the authority to act on your behalf in various legal and financial matters. To ensure the process is done correctly and your intentions are clear, consider the following dos and don'ts.

Do:

- Read the form thoroughly before beginning to fill it out. Understanding every section ensures that the document reflects your wishes accurately.

- Be specific about the powers you are granting. The General Power of Attorney can cover a wide range of actions, so clearly define what the designated person can and cannot do on your behalf.

- Choose a trusted individual as your agent. This person will have considerable authority over your affairs, so it's crucial to select someone who is reliable and understands your preferences.

- Sign the document in the presence of a notary public or as per the legal requirements of your state. This step is crucial for the document's validity and helps prevent any challenges to its authenticity.

Don't:

- Rush through the process. Take your time to fill out each section carefully to avoid errors that could make the document invalid or unclear.

- Leave any sections blank. If a section does not apply to your situation, write 'N/A' (not applicable) instead of leaving it empty to avoid any ambiguity.

- Forget to review the document with a legal professional. While not mandatory, getting legal advice can ensure that the form meets all legal requirements and is in your best interest.

- Overlook state laws. Since legal requirements can vary significantly from one state to another, ensure the form complies with the specific laws of the state where it will be used.

Misconceptions

When it comes to managing one's financial or legal affairs, a General Power of Attorney (GPOA) is often utilized as a tool for delegating authority. However, numerous misconceptions surround its application and scope. These misunderstandings can lead to misuse or a reluctance to use this legal document altogether.

It grants unlimited power. One common misconception is that a General Power of Attorney provides the agent with unlimited powers to act on behalf of the principal. In reality, the scope of authority is defined by the terms stipulated in the document itself. The principal can tailor these powers to include or exclude specific actions, ensuring that the agent's authority aligns with the principal's wishes and needs.

It remains effective after the principal’s incapacitation. Many believe that a General Power of Attorney continues to hold validity even after the principal becomes incapacitated. This is not the case, as a standard GPOA becomes null and void if the principal loses the ability to make informed decisions. For a power of attorney to remain effective under such circumstances, it must be specifically designated as "durable".

Only family members can be appointed. There's a widespread belief that only a family member can be named as an agent under a GPOA. However, the principal has the freedom to appoint any trusted individual, whether they are related or not. The key factor is trust, not blood relation. The selected agent should be someone reliable who understands the principal's values and wishes.

It's too complex for personal use. Another misconception is that the General Power of Attorney is too complicated for everyday use, believed to be only necessary for those with extensive assets or business dealings. This document, however, can be an effective tool for anyone. It simplifies the management of one’s affairs, making it easier for someone else to handle tasks ranging from banking transactions to the signing of legal documents, especially when the principal is unavailable or incapacitated.

It overrides the principal’s ability to make decisions. Some people hesitate to create a GPOA under the mistaken belief that it will limit or override their capacity to make their own decisions. In truth, the principal retains the ability to make decisions and can revoke or alter the GPOA at any time, as long as they are competent. The agent's role is to act in the principal's best interest and according to their instructions, not to replace their decision-making authority.

By clarifying these misconceptions, individuals can better understand the purpose and proper use of a General Power of Attorney, ensuring that it serves as a beneficial tool in the management of their legal and financial affairs.

Key takeaways

When it comes to filling out and using the General Power of Attorney form, understanding its purpose and the implications of its use is crucial. This document grants broad powers to an individual, known as the agent or attorney-in-fact, to make decisions and act on behalf of the principal, who is the person creating the power of attorney. Here are key takeaways to consider:

- Choose Your Agent Wisely: The person you select as your agent will have extensive authority to manage your affairs. Ensure this individual is trustworthy, reliable, and capable of handling the responsibilities effectively.

- Be Specific About Powers Granted: Although the form is designed to confer general powers, it’s essential to clearly outline the scope of authority you’re granting. This helps in preventing any abuse of power and ensures your agent acts within the bounds of their designated role.

- Understand the Duration: Generally, a Power of Attorney remains in effect until it is revoked or the principal dies. If you wish for it to end at a specific time or event, make sure this is explicitly stated in the document.

- Sign in the Presence of Witnesses or a Notary: For a General Power of Attorney to be legally binding, it must be signed in the presence of witnesses or notarized, depending on the laws of your state. This step verifies the identity of the principal and helps protect against fraud.

- Keep the Original Document Safe: Once the Power of Attorney is executed, keep the original in a secure location. Provide your agent with a copy, and consider giving copies to relevant financial institutions or medical providers who may need it.

Properly completing and using a General Power of Attorney form can ensure that your affairs are managed according to your wishes, should you become unable to do so yourself. However, it's important to review and possibly update the document as circumstances change. As laws vary by state, consulting with a legal professional can provide guidance tailored to your specific situation.

Consider More Types of General Power of Attorney Forms

How to Write a Notarized Letter for a Vehicle - For long-term stays abroad, this document is invaluable for expats needing someone to oversee their vehicle affairs in the home country.

Durable Power of Attorney California - Including a successor agent in the document is a wise precaution in case the original agent is unable to serve.

Power of Attorney Document - Reduces the complexity of managing real estate by delegating tasks to a trusted individual, equipped with legal authority.