Free Power of Attorney Form for Florida

In the sunny state of Florida, where the balmy breezes meet the rigors of life's unforeseen circumstances, the Power of Attorney (POA) form stands out as a vital legal instrument. This document, steeped in the ethos of preparation and foresight, allows individuals to designate another person to act on their behalf in various matters - be it financial, health-related, or otherwise. The essence of the POA, a blend of trust and legal forethought, cannot be understated, as it encompasses the authority to make broad or limited decisions depending on the granter's wishes. Its significance is further underscored by the need to adhere to Florida's specific legal requirements to ensure its validity. Through this lens, the Florida Power of Attorney form represents not just a piece of paper, but a beacon of autonomy and readiness, ensuring that one's affairs are in capable hands, come what may. Each clause and stipulation within the document carries the weight of intent, safeguarding the interests and wishes of the individual it serves, thereby illuminating the path towards a secure and prepared future.

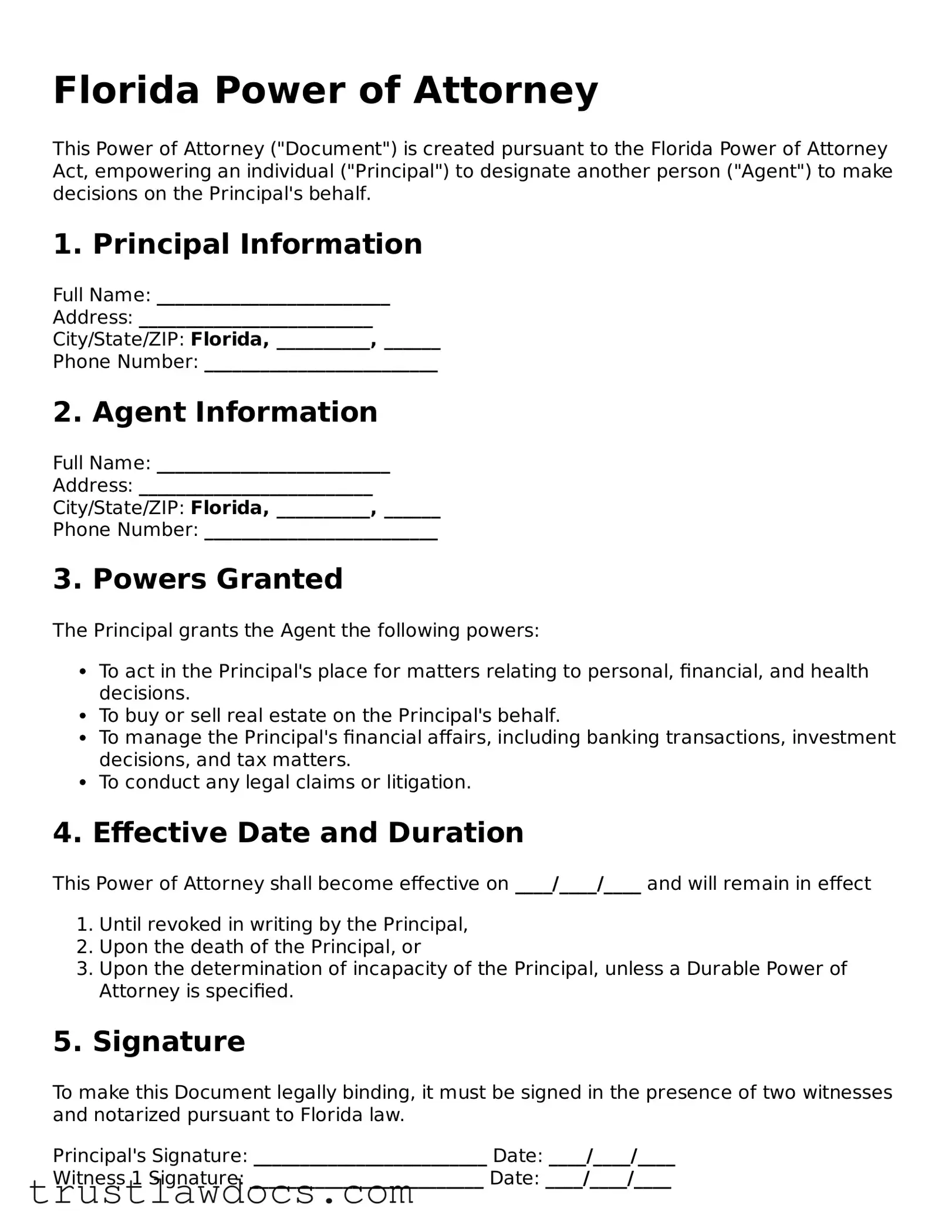

Form Example

Florida Power of Attorney

This Power of Attorney ("Document") is created pursuant to the Florida Power of Attorney Act, empowering an individual ("Principal") to designate another person ("Agent") to make decisions on the Principal's behalf.

1. Principal Information

Full Name: _________________________

Address: _________________________

City/State/ZIP: Florida, __________, ______

Phone Number: _________________________

2. Agent Information

Full Name: _________________________

Address: _________________________

City/State/ZIP: Florida, __________, ______

Phone Number: _________________________

3. Powers Granted

The Principal grants the Agent the following powers:

- To act in the Principal's place for matters relating to personal, financial, and health decisions.

- To buy or sell real estate on the Principal's behalf.

- To manage the Principal's financial affairs, including banking transactions, investment decisions, and tax matters.

- To conduct any legal claims or litigation.

4. Effective Date and Duration

This Power of Attorney shall become effective on ____/____/____ and will remain in effect

- Until revoked in writing by the Principal,

- Upon the death of the Principal, or

- Upon the determination of incapacity of the Principal, unless a Durable Power of Attorney is specified.

5. Signature

To make this Document legally binding, it must be signed in the presence of two witnesses and notarized pursuant to Florida law.

Principal's Signature: _________________________ Date: ____/____/____

Witness 1 Signature: _________________________ Date: ____/____/____

Witness 2 Signature: _________________________ Date: ____/____/____

Notary Public: _________________________ Date: ____/____/____

6. Acknowledgment by Agent

I, _________________________, acknowledge that as the Agent, I will act in the best interest of the Principal and abide by all laws and regulations governing this Power of Attorney.

Agent's Signature: _________________________ Date: ____/____/____

PDF Form Details

| Fact Name | Description |

|---|---|

| Governing Laws | The Florida Power of Attorney form is governed by the Florida Statutes, Chapter 709 - Powers of Attorney and Similar Instruments. |

| Durability Provision | In Florida, a Power of Attorney is considered durable if it includes language that specifies that the agent's authority continues despite the principal's incapacity. |

| Springing Powers | Florida law allows for springing powers of attorney, which become effective upon the occurrence of a specified event, typically the incapacity of the principal. |

| Signing Requirements | To be valid, a Florida Power of Attorney must be signed by the principal and two witnesses, and it must also be notarized. This ensures the document is legally recognized. |

How to Write Florida Power of Attorney

Filling out a Power of Attorney (POA) form in Florida grants another person the legal authority to make decisions on your behalf. This process needs meticulous attention to detail to ensure that your rights and interests are fully protected. The following steps are designed to guide you through completing a Florida Power of Attorney form properly. It's crucial to accurately fill in the form to avoid any potential legal issues or misunderstandings in the future.

- Start by downloading the official Florida Power of Attorney form from a reliable source. Ensure it meets the current legal requirements.

- Read the entire form carefully before you begin to fill it out. This helps you understand the scope and limitations of the powers you're granting.

- Enter your full legal name and address in the designated space at the top of the form to identify yourself as the Principal.

- Specify the full legal name and address of the person you're appointing as your Agent (or Attorney-in-Fact). This person will make decisions on your behalf.

- Define the powers you are granting to your Agent. Be as precise as possible to avoid any ambiguity. These powers can range from handling financial matters to making healthcare decisions.

- Include any specific instructions or limitations you wish to impose on your Agent’s authority. This step is crucial for tailoring the POA to your individual needs.

- If you want the POA to be durable (remain in effect even if you become mentally incapacitated), clearly state this in the document. Without specifying, the POA could be voided if you lose mental capacity.

- Indicate the effective date and any conditions that will terminate the POA. Some choose to have it become effective immediately, while others may specify a triggering event, such as incapacity.

- Review the form with your Agent present to ensure there is a mutual understanding of its contents and the expectations it sets forth.

- Sign and date the form in the presence of a Notary Public and, depending on Florida's current requirements, possibly one or two witnesses. The witnesses cannot be the Agent appointed in the POA.

- The Notary Public will then notarize the form, confirming your identity and your signature. This step is essential for the document's legal validity.

- Keep the original signed and notarized POA in a safe but accessible place. Provide your Agent with a copy, and consider giving copies to relevant financial institutions, doctors, or family members as necessary.

After completing the Power of Attorney form, it's a good practice to review it regularly and update it as your circumstances or wishes change. Changes in law or personal situations, like a change in your Agent, may necessitate completing a new POA form. Always consult with a legal professional if you have questions about the process or how to ensure your POA is legally sound and reflects your current wishes.

Get Answers on Florida Power of Attorney

What is a Power of Attorney (POA) form in Florida?

A Power of Attorney (POA) form in Florida is a legal document that grants one person, known as the agent or attorney-in-fact, the authority to act on behalf of another person, known as the principal, in matters specified within the document. These matters may include financial, legal, medical, or real estate affairs. The form must comply with Florida law to be valid.

Who can be named as an agent in a Florida POA?

Any competent adult, such as a family member, friend, or professional, can be named as an agent in a Florida POA. The chosen individual should be someone the principal trusts deeply, as they will have significant power and responsibility. It is essential that the agent understands the duties and obligations involved.

Are there different types of POA forms available in Florida?

Yes, Florida recognizes several types of POA forms, including General Power of Attorney, Durable Power of Attorney, Limited Power of Attorney, Medical Power of Attorney, and Springing Power of Attorney. Each type serves different purposes and becomes effective under specific conditions. Choosing the right form depends on the principal's needs and the powers they wish to grant.

What makes a POA legally binding in Florida?

To make a POA legally binding in Florida, it must meet certain requirements. The principal must be competent and understand the significance of the document when signing. The POA must be signed by the principal in the presence of two witnesses and notarized. Certain types of POA, such as the Durable Power of Attorney, must contain specific wording to ensure they remain valid even if the principal becomes incapacitated.

Can a Florida POA be revoked?

Yes, a Florida POA can be revoked at any time by the principal as long as they are mentally competent. The revocation must be in writing and follow specific procedures to be effective, including notifying the agent and any third parties who might have acted under the authority of the POA. Destroying the original document and any copies can also help signal revocation.

What happens if the agent under a Florida POA abuses their authority?

If the agent under a Florida POA abuses their power, it could lead to legal consequences including litigation. The principal, or their loved ones if the principal is incapacitated, can petition the court to remove the agent and possibly seek damages. It's crucial to choose an agent wisely and consider granting POA powers to more than one person to provide checks and balances.

Does a Florida POA need to be filed with any government body?

Typically, a Florida POA does not need to be filed with a government body to be effective. However, if the POA grants authority over real estate transactions, the document might need to be recorded with the county recording office where the property is located. It's important to keep the original document safe and accessible to the agent when needed.

How can someone terminate a Florida POA?

To terminate a POA in Florida, the principal needs to execute a written document stating the revocation of the power granted to the agent. This document should be notarized and, ideally, witnessed in the same manner as the original POA was executed. Notifying the agent and any institutions or third parties that had been relying on the POA is also a critical step in effectively terminating the power.

Common mistakes

Filling out a Florida Power of Attorney (POA) form can seem straightforward, but mistakes can easily occur if one is not careful. These errors can significantly impact the effectiveness of the document, leading to delays or even the inability to act on behalf of another when necessary. A common mistake is not specifying the powers granted. Many assume that a POA grants universal rights, but in reality, the document must clearly outline the specific actions the designated person can undertake. Without clear instructions, financial institutions and healthcare providers might refuse to honor the POA, questioning its validity in certain situations.

Another critical error is neglecting to choose the right agent. The role of an agent under a POA is filled with responsibilities and requires a high degree of trust. Sometimes, individuals select an agent based on convenience or familial relationships rather than the person's ability to act responsibly and in the principal's best interest. This oversight can lead to mismanagement of assets or failure to make decisions that align with the principal's wishes, especially in critical situations.

Failure to consider the need for a durable power of attorney is yet another mistake. A standard POA often becomes invalid if the principal becomes incapacitated. In Florida, if the document does not explicitly state that the powers granted should remain in effect upon the incapacity of the principal, the agent could lose their authority exactly when it is most needed. Ensuring that a POA is durable is crucial for it to serve its primary purpose of allowing another to act on the principal’s behalf during times of incapacity.

Lastly, not regularly updating the POA can lead to issues down the line. Life changes, such as marriages, divorces, relocation, or changes in financial situations, can all render the existing POA ineffective or unsuitable. By not periodically reviewing and updating the POA to reflect current wishes and circumstances, one risks having an outdated document that doesn’t accurately represent their current situation or preferences, potentially leading to confusion or conflict among those involved.

Documents used along the form

In the state of Florida, executing a Power of Attorney (POA) is an important step for an individual—also known as the principal—to grant another person—the agent—the authority to make decisions on their behalf. However, a POA is often just one component of a comprehensive legal strategy to manage one's affairs. Several other forms and documents commonly accompany a POA to ensure thorough planning and legal protection. Understanding these documents can provide individuals with a stronger foundation to safeguard their interests.

- Advance Directive for Health Care: This document allows individuals to outline their preferences for medical care if they become unable to make these decisions themselves. It typically includes a Living Will and a Health Care Surrogate Designation, where the former states one's wishes regarding life-prolonging treatments, and the latter appoints someone to make healthcare decisions on their behalf.

- Will: A legal document that specifies how an individual's property and assets should be distributed after their death. It also allows them to name an executor, who will manage the estate until its final distribution.

- Revocable Living Trust: This form enables an individual to manage their assets during their lifetime and dictate how these assets are distributed upon their death, all while potentially avoiding probate. The person creating the trust can amend or revoke it at any time during their lifetime.

- Declaration of Preneed Guardian: By filling out this document, an individual can declare their preference for a guardian in the event that they become legally incapacitated. This can be particularly important for individuals concerned about who would have the legal authority to make decisions on their behalf if they're unable to do so themselves.

- HIPAA Release Form: This document grants the agent named in a Health Care Surrogate Designation the right to access the principal's protected health information. This access can be crucial for making informed decisions about the principal's healthcare needs.

Together, these documents enhance the effectiveness of a Florida Power of Attorney by providing a comprehensive framework for decision-making in the event of incapacity or death. Crafting these documents with the help of legal professionals can ensure that an individual's wishes are honored and their interests are protected in a variety of scenarios. Making informed decisions about these complementary documents can offer peace of mind to individuals and their families, providing clarity and guidance during challenging times.

Similar forms

The Florida Power of Attorney form shares similarities with the Advance Directive, as both documents enable individuals to make crucial decisions regarding their health care and financial matters ahead of potential incapacity. While the Power of Attorney focuses primarily on financial affairs and can designate an agent to make a broad range of decisions, the Advance Directive specifically addresses health care decisions and may include a living will or health care proxy, ensuring one's medical treatment preferences are honored.

Similar to the Durable Power of Attorney, the Will holds an essential role in estate planning, facilitating the distribution of an individual's assets upon their death. Though the Power of Attorney becomes invalid when the principal dies, the Will becomes active, guiding the executor in managing and distributing the estate according to the deceased's wishes. This highlights both documents' central role in a comprehensive estate plan, albeit serving different functions regarding timing and control over personal and financial matters.

Revocable Living Trusts stand in line with the power and purpose of a Power of Attorney, with a focus on managing and protecting assets during the trustor's lifetime and upon their death. Like a Power of Attorney, a Revocable Living Trust allows for the designation of someone to manage one's affairs without court intervention. However, a trust typically deals with specific assets and provides detailed instructions for their use and distribution, operating both before and after the trustor’s death.

Health Care Surrogate Designations are crafted to specifically handle medical decisions, akin to how a Power of Attorney may be designated for health care purposes. This document appoints a surrogate to make health-related decisions if one is unable to do so. Although they both can serve health care decision-making roles, the Power of Attorney can be broader, encompassing financial decisions as well, unless specifically stated to be a Health Care Power of Attorney.

The Financial Information Release Form, while narrower in scope, parallels the Power of Attorney in its authorization capacities. This form explicitly allows designated parties to access an individual’s financial records, aiding in situations ranging from tax preparation to estate planning. Unlike the broader Power of Attorney, which grants general or specific financial management powers, this document serves as a targeted tool for financial transparency.

Lastly, the Guardianship Designation is somewhat akin to a Power of Attorney in that it involves assigning another party to make decisions on behalf of someone else, especially in terms of minor children or adults who are incapacitated. While a Power of Attorney can be revoked or might expire, a guardianship, especially for minors, usually remains in force until the child reaches adulthood or under specific conditions outlined by the court, providing a long-term solution for care and decision-making.

Dos and Don'ts

When filling out the Florida Power of Attorney form, it's crucial to approach the task with care and attention to detail. This document grants another person the authority to make decisions on your behalf, making accuracy and clarity paramount. Here are four practices to adopt, as well as four pitfalls to avoid, to ensure the process serves your best interests.

Do:

- Review Florida statutes. Before getting started, familiarize yourself with the state-specific laws and requirements for a Power of Attorney in Florida. This ensures your document complies with local regulations and is legally valid.

- Choose your agent wisely. The person you appoint as your agent will have significant control over your affairs. Consider their trustworthiness, reliability, and ability to handle the responsibilities you’re assigning to them.

- Be specific about powers granted. Clearly detail the decisions your agent is authorized to make on your behalf. Specifying their powers can prevent abuse of the position and confusion about their role.

- Sign in the presence of a notary public. Florida law requires that your Power of Attorney be notarized to be valid. Ensure this step is completed to formalize the document’s legal standing.

Don't:

- Leave blanks in the document. Unfilled sections can lead to misunderstandings or exploitation. If a section does not apply, indicate this appropriately to maintain clarity.

- Use vague language. Ambiguity can render your Power of Attorney challenging to enforce or act upon. Use clear, concise language to express your wishes and the extent of your agent’s authority.

- Forget to specify a duration. If you intend for the Power of Attorney to be temporary or to have limitations on the duration, make this clear. Without such specifications, the document may remain in effect longer than you intend.

- Fail to review and update regularly. Circumstances change, and so might the relevance of your Power of Attorney. Regularly reviewing and updating the document ensures it always reflects your current wishes and situation.

Misconceptions

When it comes to managing your affairs, the Florida Power of Attorney (POA) form is a pivotal document that grants someone else the power to act on your behalf. However, around this crucial document, numerous misconceptions swirl. Clearing up these misconceptions can ensure that when the time comes, you're prepared and protected.

- One Document Fits All. Many believe a single POA document can cover every aspect of their financial, health, and legal needs. In reality, Florida law requires different forms for different purposes, such as separate documents for financial matters and healthcare decisions.

- It Grants Unlimited Power. The assumption that granting a POA means giving up all control is false. In Florida, you can specify what powers your agent has, including limits and conditions, thus maintaining a level of control over your affairs.

- It’s Valid In All States. Just because a POA form is valid in Florida doesn't mean it will be recognized in other states. While many states honor out-of-state POA documents, it’s essential to check the local laws wherever the POA will be used.

- It Remains Effective After Death. A common misconception is that a POA continues to be effective after the principal's death. However, in Florida, the power ceases upon the principal's death, at which point the executor of the estate takes over.

- It’s Irrevocable. People often think once a POA is signed, it’s set in stone. In fact, a Florida POA can be revoked or changed as long as the principal is mentally competent.

- A Spouse Automatically Has It. There's a widespread belief that spouses inherently have POA for each other. While spouses do have certain rights, a formal POA document is required in Florida for one spouse to act legally on the other's behalf in many situations.

- Only For The Elderly. The misconception that POAs are only for seniors can prevent younger individuals from taking steps that protect their interests. In truth, adults of all ages can benefit from having a POA in place.

- DIY Is As Good As Legal Help. With templates readily available, many believe they don’t need professional advice to create a POA. However, Florida has specific legal requirements that might not be met by a generic form, potentially making the document invalid.

Understanding the true nature of the Power of Attorney in Florida empowers you to make informed decisions about your future and ensure your interests are protected. Always consider consulting with a legal professional to navigate the complexity of these documents. Clearing up misconceptions is the first step toward utilizing this powerful legal tool effectively.

Key takeaways

Filling out and using the Florida Power of Attorney form is an important step in managing your affairs or those of a loved one. It allows an individual, known as the principal, to grant legal authority to another person, referred to as the agent or attorney-in-fact, to make decisions on their behalf. Understanding the key considerations can ensure that the process is done correctly and effectively. Here are six key takeaways to remember:

- Choose Your Agent Carefully: The agent you appoint will have significant control over your financial or health-related decisions, depending on the type of power of attorney you grant. It's crucial to choose someone trustworthy, reliable, and capable of handling the responsibilities.

- Understand the Different Types: Florida law recognizes several types of powers of attorney, including durable, nondurable, specific, and health care. Each serves different purposes, from broad financial control to making specific health care decisions. Understanding each type will help you choose the one that best fits your needs.

- Follow Florida Legal Requirements: For a power of attorney to be valid in Florida, it must comply with state laws, including being signed by the principal, witnessed by two adults, and notarized. Ensure that all legal requirements are met to avoid any issues with validity.

- Be Specific in Powers Granted: The form allows you to specify exactly what powers the agent can exercise. Be as clear and specific as possible to ensure your intentions are followed and to prevent any abuse of authority.

- Consider a Durable Power of Attorney: A durable power of attorney remains in effect if you become incapacitated, ensuring your agent can continue to make decisions on your behalf. This is particularly important for long-term planning and peace of mind.

- Keep Records and Copies: After completing the form, keep the original in a safe but accessible place and provide copies to your agent and any relevant institutions, such as your bank or healthcare provider. Regularly review and update it as necessary to reflect any changes in your wishes or situation.

Popular Power of Attorney State Forms

Financial and Medical Power of Attorney Forms - A Power of Attorney can cover financial decisions, real estate transactions, and more.

Types of Power of Attorney Indiana - A Power of Attorney can alleviate the burden on family members during challenging times by pre-determining who will take charge of critical decisions.