Free Durable Power of Attorney Form for Texas

Many people find themselves in situations where they need someone they trust to manage their affairs, especially as they age or face health challenges. The Texas Durable Power of Attorney form enables individuals to appoint a trusted person to handle their financial matters. This form remains effective even if the person who created it becomes incapacitated, providing peace of mind that their affairs will be managed according to their wishes. It covers a range of financial duties, from managing bank accounts to buying or selling property, making it a crucial document for planning for the future. Understanding its importance, completing this form accurately, and choosing a reliable agent are significant steps in ensuring that one's financial matters are in safe hands, regardless of what the future may hold.

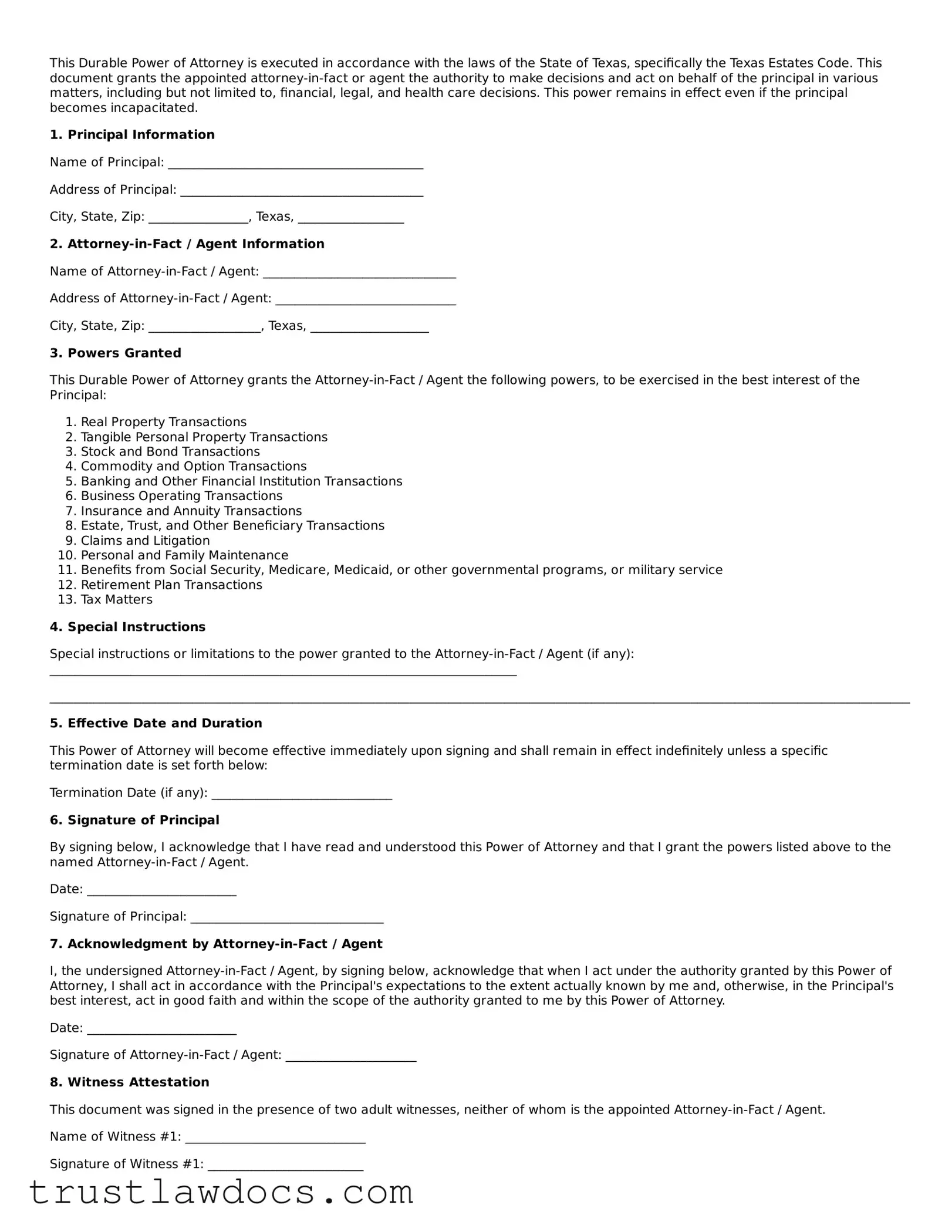

Form Example

This Durable Power of Attorney is executed in accordance with the laws of the State of Texas, specifically the Texas Estates Code. This document grants the appointed attorney-in-fact or agent the authority to make decisions and act on behalf of the principal in various matters, including but not limited to, financial, legal, and health care decisions. This power remains in effect even if the principal becomes incapacitated.

1. Principal Information

Name of Principal: _________________________________________

Address of Principal: _______________________________________

City, State, Zip: ________________, Texas, _________________

2. Attorney-in-Fact / Agent Information

Name of Attorney-in-Fact / Agent: _______________________________

Address of Attorney-in-Fact / Agent: _____________________________

City, State, Zip: __________________, Texas, ___________________

3. Powers Granted

This Durable Power of Attorney grants the Attorney-in-Fact / Agent the following powers, to be exercised in the best interest of the Principal:

- Real Property Transactions

- Tangible Personal Property Transactions

- Stock and Bond Transactions

- Commodity and Option Transactions

- Banking and Other Financial Institution Transactions

- Business Operating Transactions

- Insurance and Annuity Transactions

- Estate, Trust, and Other Beneficiary Transactions

- Claims and Litigation

- Personal and Family Maintenance

- Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement Plan Transactions

- Tax Matters

4. Special Instructions

Special instructions or limitations to the power granted to the Attorney-in-Fact / Agent (if any): ___________________________________________________________________________

_______________________________________________________________________________________________________________________________________________________________________________________

5. Effective Date and Duration

This Power of Attorney will become effective immediately upon signing and shall remain in effect indefinitely unless a specific termination date is set forth below:

Termination Date (if any): _____________________________

6. Signature of Principal

By signing below, I acknowledge that I have read and understood this Power of Attorney and that I grant the powers listed above to the named Attorney-in-Fact / Agent.

Date: ________________________

Signature of Principal: _______________________________

7. Acknowledgment by Attorney-in-Fact / Agent

I, the undersigned Attorney-in-Fact / Agent, by signing below, acknowledge that when I act under the authority granted by this Power of Attorney, I shall act in accordance with the Principal's expectations to the extent actually known by me and, otherwise, in the Principal's best interest, act in good faith and within the scope of the authority granted to me by this Power of Attorney.

Date: ________________________

Signature of Attorney-in-Fact / Agent: _____________________

8. Witness Attestation

This document was signed in the presence of two adult witnesses, neither of whom is the appointed Attorney-in-Fact / Agent.

Name of Witness #1: _____________________________

Signature of Witness #1: _________________________

Date: __________________

Name of Witness #2: _____________________________

Signature of Witness #2: _________________________

Date: __________________

9. Notarization

This Durable Power of Attorney was acknowledged before me on this ___ day of ____________, ______, by the above-named Principal.

Name of Notary: __________________________________

Signature of Notary: ______________________________

My Commission Expires: ___________________________

PDF Form Details

| Fact Number | Detail |

|---|---|

| 1 | The Texas Durable Power of Attorney form is governed by the Texas Estates Code, Title 2, Chapter 751. |

| 2 | This form allows an individual, known as the principal, to appoint someone else, known as an agent, to manage their financial affairs. |

| 3 | It remains effective even if the principal becomes mentally incapacitated, making it "durable" in nature. |

| 4 | The principal can specify the powers granted to the agent, which can include buying or selling property, managing bank accounts, and handling tax matters. |

| 5 | For it to be valid, the form must be signed by the principal in the presence of a notary public. |

| 6 | Principals have the right to revoke the power of attorney at any time, as long as they are mentally competent. |

| 7 | If the form does not specify an expiration date, it remains in effect until the principal dies or revokes the power of attorney. |

How to Write Texas Durable Power of Attorney

When filling out the Texas Durable Power of Attorney form, it's crucial to approach the task with precision and clarity. This document grants another person the legal authority to make decisions on your behalf, should you become unable to do so. The specifics of the form require careful consideration to ensure that your intentions are accurately represented and legally sound. The following steps are designed to guide you through the process, making it as straightforward and error-free as possible.

- Start by reading the form thoroughly before writing anything. Ensure you understand every section to avoid common mistakes.

- Enter your full legal name and address at the top of the form where indicated. This identifies you as the principal, the person granting the power.

- Specify the full name and address of the person you are granting power to, known as the 'agent' or 'attorney-in-fact.' Ensure the details are accurate to prevent any confusion about their identity.

- Read through the powers listed in the form carefully. These may include making financial decisions, selling property, or managing bank accounts. Initial next to each power you wish to grant to your agent. If you prefer not to grant a specific power, leave the space beside it blank.

- If the form provides a section to grant special instructions, use this area to detail any specific limitations or powers that are not already listed. Be as clear and detailed as possible to avoid ambiguity.

- Review the section regarding when the power of attorney will become effective and when it will terminate. Some forms allow you to have it take effect immediately, while others may specify that it only does so upon your incapacitation. Select the option that best suits your wishes.

- Sign and date the form in the presence of a Notary Public. The form is not legally binding without your signature and the Notary’s seal and signature.

- Have your agent sign the form, if required by state law or if specified by the form. This acknowledges their acceptance of the responsibilities the role entails.

- Store the completed document in a safe but accessible place. Inform your agent and a trusted family member or friend of its location, so it can be found when needed.

- Consider providing a copy to your attorney, if you have one, and possibly your financial institution, to ensure they recognize your agent’s authority.

Completing the Texas Durable Power of Attorney form is a significant step in planning for the future. By carefully selecting an agent and specifying their powers, you can ensure that your affairs will be managed according to your wishes, even if you are unable to oversee them yourself. Remember, laws can vary by state, so consider consulting with a legal professional to ensure your document is in compliance with Texas law and fully addresses your needs.

Get Answers on Texas Durable Power of Attorney

What is a Texas Durable Power of Attorney?

A Texas Durable Power of Attorney (DPOA) is a legal document that allows an individual (the "principal") to appoint someone else (the "agent" or "attorney-in-fact") to make financial decisions on their behalf, even if the principal becomes incapacitated. This form is "durable" because it remains effective even if the principal loses the ability to make decisions for themselves.

Who can be appointed as an agent in a Texas Durable Power of Attorney?

In Texas, virtually any competent adult can be appointed as an agent under a Durable Power of Attorney. This might be a spouse, adult child, friend, attorney, or anyone else the principal trusts to manage their financial affairs. It's important to choose someone who is trustworthy, understands the principal's wishes, and is willing to take on this responsibility.

What kind of powers can be granted with a Texas Durable Power of Attorney?

The powers granted can be broad or specific, depending on the principal's preferences. These may include managing real estate, handling banking transactions, investing money, taking out loans, handling tax matters, and more. The principal can customize the DPOA to fit their specific needs and preferences.

When does a Texas Durable Power of Attorney take effect?

A Texas DPOA can take effect immediately upon signing or can become effective upon the occurrence of a specified event, such as the principal's incapacitation. This must be clearly stated in the document.

Is a Texas Durable Power of Attorney revocable?

Yes, as long as the principal is competent, they can revoke or change their Durable Power of Attorney at any time. This is typically done by notifying the agent in writing and destroying the original power of attorney document, as well as any copies.

Do I need a lawyer to create a Texas Durable Power of Attorney?

While it's not legally required to have a lawyer create a DPOA, consulting with one can ensure that the document accurately reflects the principal's wishes and complies with Texas law. A lawyer can also advise on the best way to structure the DPOA based on the principal's unique situation.

How does one terminate a Texas Durable Power of Attorney?

To terminate a DPOA, the principal must draft a written revocation statement declaring the DPOA null and void and notify the agent and any institutions or parties that were relying on the DPOA. If the principal is incapacitated, a court proceeding may be necessary to terminate the DPOA.

What happens if the agent under a Texas Durable Power of Attorney misuses their powers?

If an agent misuses their powers, they can be held legally accountable. The principal, or their legal representative if the principal is incapacitated, may need to take legal action to recover any lost funds or property. It's crucial to choose an agent who is trustworthy and to monitor their actions if possible.

Does a Texas Durable Power of Attorney need to be notarized?

Yes, for a Texas Durable Power of Attorney to be legally effective, it must be signed by the principal in the presence of a notary public. This step ensures the document's validity and that the principal is signing it willingly and without duress.

Common mistakes

In the realm of preparing for future uncertainties, filling out a Texas Durable Power of Attorney (DPOA) form is a pivotal step many take to ensure their affairs are managed in accordance with their wishes, should they become incapacitated. Yet, the complexity and gravity of this legal document often lead to mistakes. One common error is the failure to specify the scope of powers granted. Individuals may unintentionally give their appointed agent either too much or too little authority, which can lead to complications in managing financial or health affairs effectively.

Another significant oversight is not updating the DPOA. Life events such as marriage, divorce, the birth of a child, or the death of the designated agent can render the document outdated or irrelevant. Without regular reviews and updates, the DPOA may not reflect the current wishes of the principal or the current legal landscape, thereby causing it to be ineffective when needed most.

Choosing the wrong agent is a mistake with potentially grave consequences. The role of an agent requires absolute trust and confidence, as they will be making critical decisions on the principal's behalf. An agent lacking in financial acumen or not possessing the principal's complete trust can lead to mismanagement or abuse of the powers granted in the DPOA.

Many individuals neglect to discuss their wishes and the responsibilities involved with their chosen agent beforehand. This lack of communication can result in the agent being unaware of their duties or the principal's preferences, leading to decisions that might not align with the principal’s intentions.

Not having the DPOA legally recognized through proper witnessing or notarization is another critical error. Texas law requires specific formalities to be observed for a DPOA to be valid. Failure to adhere to these requirements can invalidate the document entirely, rendering it useless in times of need.

Some people mistakenly believe that a DPOA is a "one-size-fits-all" document, failing to customize it to their specific situation. This misconception can lead to significant omissions or the inclusion of unnecessary powers, which may not serve the principal's best interests.

The assumption that a DPOA can only be established with the help of an attorney can deter individuals from creating one. While legal advice is invaluable in ensuring the DPOA meets all legal requirements and personal needs, resources are available for those who wish to proceed on their own. However, caution should be exercised to avoid errors that could invalidate the document.

Finally, the failure to distribute copies of the DPOA to relevant parties, such as financial institutions, healthcare providers, and family members, can prevent the agent from acting when necessary. Without access to or knowledge of the DPOA, institutions may refuse to recognize the agent’s authority, complicating matters at critical moments.

Documents used along the form

When preparing for the future, particularly for health or financial decisions, many people consider a Durable Power of Attorney in Texas. This document allows you to appoint someone to make decisions on your behalf should you become unable to. However, to ensure a comprehensive approach to planning, several additional forms and documents are also commonly used alongside the Durable Power of Attorney. Each serves its unique purpose, contributing to a well-rounded legal and personal care strategy.

- Medical Power of Attorney: This document enables you to designate a trusted individual to make health care decisions on your behalf if you're unable to make them yourself. It's specific to medical decisions, differing from a Durable Power of Attorney, which often focuses on financial matters.

- Directives to Physicians (Living Will): Also known as an advance healthcare directive, this document outlines your wishes regarding medical treatment if you become terminally ill or permanently unconscious and cannot communicate your health care preferences.

- HIPAA Authorization Form: The Health Insurance Portability and Accountability Act (HIPAA) privacy rule requires this form. It allows specified individuals access to your medical records, facilitating informed decisions about your health care under a Medical Power of Attorney or in other necessary situations.

- Declaration of Guardian: This form lets you choose who will be your guardian of the person and/or estate should you become incapacitated and a court determines that a guardian is required. It’s a proactive step in selecting someone you trust, rather than leaving the choice up to the courts.

- Last Will and Testament: Though not directly related to your incapacity, your Last Will and Testament is vital for specifying how your assets should be distributed upon your death. It ensures your wishes are known and can greatly ease the transition for your loved ones.

- Revocable Living Trust: This document allows you to maintain control over your assets while you're alive but makes provisions for their distribution upon your death, potentially avoiding the lengthy and costly probate process. A Revocable Living Trust can work in tandem with a Durable Power of Attorney for managing your assets.

Together, these documents form a robust legal framework to protect your interests both during your lifetime and after. It's essential to consult with a legal professional when preparing these documents to ensure they meet all legal requirements and accurately reflect your wishes. Each plays a crucial role in providing peace of mind for you and your loved ones, making it worth the effort to understand and complete them as part of your planning process.

Similar forms

The Texas Durable Power of Attorney form shares similarities with the Medical Power of Attorney, primarily in the way both empower someone else to make decisions on a person's behalf. While the Durable Power of Attorney allows a designated agent to manage financial and property matters, the Medical Power of Attorney grants an agent authority over healthcare decisions. This ensures that an individual's preferences in both health and fiscal matters are respected even if they become incapacitated.

Comparable to a Living Will, the Durable Power of Attorney plays a crucial role in planning for future incapacitation. However, a Living Will specifies one's wishes regarding medical treatments and end-of-life care, rather than appointing someone to make decisions. It reflects on the individual's specific desires about life support and other critical medical interventions, acting as a guide for healthcare providers and loved ones in serious medical situations.

Similar to the General Power of Attorney, the Durable version authorizes an agent to act on the principal's behalf. The key difference lies in the durability aspect; a Durable Power of Attorney remains in effect even after the principal becomes incapacitated, whereas a General Power of Attorney typically does not. This feature makes the Durable Power of Attorney an essential tool for long-term planning and protection of personal interests.

The Springing Power of Attorney is closely related to the Durable Power of Attorney with a distinctive trigger mechanism. It only becomes active upon the occurrence of a specific event, often the incapacity of the principal. In contrast, a Durable Power of Attorney can be effective immediately upon execution or specify a condition for activation. This makes the Springing Power of Attorney a choice for those seeking to maintain control over their affairs until a certain condition is met.

Lastly, the Limited Power of Attorney and the Durable Power of Attorney share the common feature of designating an agent for the principal’s affairs. The Limited Power of Attorney, however, restricts the agent’s authority to a specific activity or period, unlike the broader, more enduring powers granted in a Durable Power of Attorney. This specificity makes Limited Power of Attorney suitable for focused tasks without granting comprehensive control over all aspects of the principal's life.

Dos and Don'ts

When it comes to filling out the Texas Durable Power of Attorney form, it's essential to approach this task with diligence and precision. Doing it right ensures that your wishes regarding your finances and legal matters are respected and executed according to your directives, especially if you become unable to manage them yourself. Here are some recommended dos and don'ts to consider:

Do:

- Choose the right agent. This person will have significant control over your financial and possibly personal affairs. Ensure they are trustworthy, financially savvy, and capable of handling the responsibilities you're entrusting to them.

- Be specific about powers granted. Clearly outline what your agent can and cannot do. This precision prevents any abuse of power and ensures your agent acts within the boundaries you've set.

- Consult a professional. It's wise to speak with a lawyer or legal expert when filling out this form. They can offer invaluable advice and ensure the document complies with Texas law, making it less likely to be challenged.

- Sign in the presence of a notary or witnesses. Depending on Texas law requirements, ensure your document is signed according to legal standards to avoid it being questioned for its validity.

Don't:

- Rush the process. Take your time to consider all aspects of the power you're granting. This decision has profound implications, and rushing could lead to overlooking important details.

- Use vague language. Clarity is crucial in legal documents. Ambiguities can lead to interpretations that might go against your original intentions.

- Forget to specify a durability clause. For the power of attorney to remain effective even if you become incapacitated, it needs to be clearly stated as "durable."

- Neglect to keep it updated. Life changes, and so might your choice of agent or your wishes regarding the powers you grant. Regularly review and update your document to reflect your current wishes.

Misconceptions

Many individuals have misunderstandings about the Texas Durable Power of Attorney form. It's essential to address these misconceptions to ensure people are fully informed about the importance and implications of this legal document.

All powers of attorney are the same. A common misconception is that all powers of attorney documents serve the same purpose. However, the Texas Durable Power of Attorney is specifically designed to remain in effect even if the principal becomes incapacitated, unlike some other forms which may terminate under such circumstances.

It grants immediate control over all aspects of one’s life. Many believe that by signing a Durable Power of Attorney, they are giving away control over all aspects of their lives immediately. In truth, the scope of authority granted to the agent can be as broad or as specific as the principal desires and does not necessarily strip the principal of their autonomy.

The same form works in every state. People often think that a power of attorney document is universally recognized in every state once executed. However, each state has its own laws concerning the creation and use of these documents. The Texas Durable Power of Attorney form is tailored to comply with Texas laws and may not be recognized or might require additional steps to be effective in other states.

It’s only for the elderly. Another misconception is that Durable Powers of Attorney are only for the elderly. In reality, adults of all ages can benefit from having this document. It ensures that someone they trust can manage their affairs if they become unable to do so, regardless of their age.

Creating a Durable Power of Attorney is a complex and expensive process. Some people are deterred by the mistaken belief that creating a Durable Power of Attorney involves a complex and costly legal process. While it's advisable to seek legal advice, the process can be straightforward and relatively inexpensive, especially compared to the potential legal complications and costs that can arise without it.

It takes away your right to make decisions. A significant misunderstanding is that once a Durable Power of Attorney is in place, the principal can no longer make decisions for themselves. In reality, the principal retains the right to make personal decisions as long as they are capable. The agent’s authority comes into play under the conditions specified by the principal, typically when they are deemed incapable of managing their own affairs.

Clearing up these misconceptions helps individuals understand the significance and practicality of a Durable Power of Attorney. It's a tool for managing one’s affairs with foresight, not a surrender of control.

Key takeaways

Understanding the Texas Durable Power of Attorney form is critical for anyone looking to ensure their financial matters are handled according to their wishes, should they become unable to do so themselves. Below are four key takeaways to guide you through filling out and using this important document.

- Choice of Agent is Crucial: The person you choose to act as your agent holds significant power over your financial assets and decisions. It's imperative to select someone you trust implicitly. This individual should be reliable, financially savvy, and fully understand your wishes and how to act in your best interest.

- Specify Powers with Precision: The form allows you to grant broad or limited powers to your agent. These can include managing your bank accounts, buying or selling real estate, and handling your tax matters, among others. Clearly outlining the powers granted helps prevent any confusion or misuse of authority.

- Understand the Durability Aspect: What makes the Durable Power of Attorney in Texas stand out is its continuation, even if you become incapacitated. This is essential for uninterrupted management of your affairs, but it also means you need to have complete trust in your chosen agent.

- Legal and Proper Execution: For the document to be valid, it must meet specific requirements, such as being signed in the presence of a notary public. Texas law may also require witness signatures, so it's wise to consult with legal counsel to ensure all necessary steps are taken for your document to be legally binding.

By keeping these key points in mind, you can confidently take steps to protect your financial well-being with a Texas Durable Power of Attorney. Should you have any questions or require further clarification, consulting with a legal professional can provide peace of mind and ensure your document is correctly filled out and executed.

Popular Durable Power of Attorney State Forms

General Durable Poa - It's beneficial for business owners, providing an avenue for continued operation of their businesses without interruption, should they become incapacitated.

Durable Power of Attorney Michigan - By completing this form, you can have peace of mind, knowing your affairs will be cared for if you're unable to act.