Free Durable Power of Attorney Form for Michigan

The Michigan Durable Power of Attorney form serves as a powerful tool in estate planning, empowering individuals to appoint a trusted person to manage their financial affairs if they become unable to do so themselves. This legal document takes on critical significance, especially during times of unexpected health crises or diminished mental capacity, ensuring that personal financial matters are handled according to the individual's wishes. It covers a wide range of financial decisions, from everyday tasks like banking and bill payments to more complex transactions involving real estate, investments, and tax matters. Its durability ensures that the appointed agent's authority remains in effect during the principal's incapacitation, a feature that sets it apart from other forms of power of attorney. Understanding its scope, the conditions under which it can be activated, and the powers it grants is essential for anyone looking to secure their financial legacy and provide clarity and direction for their loved ones during potentially challenging times.

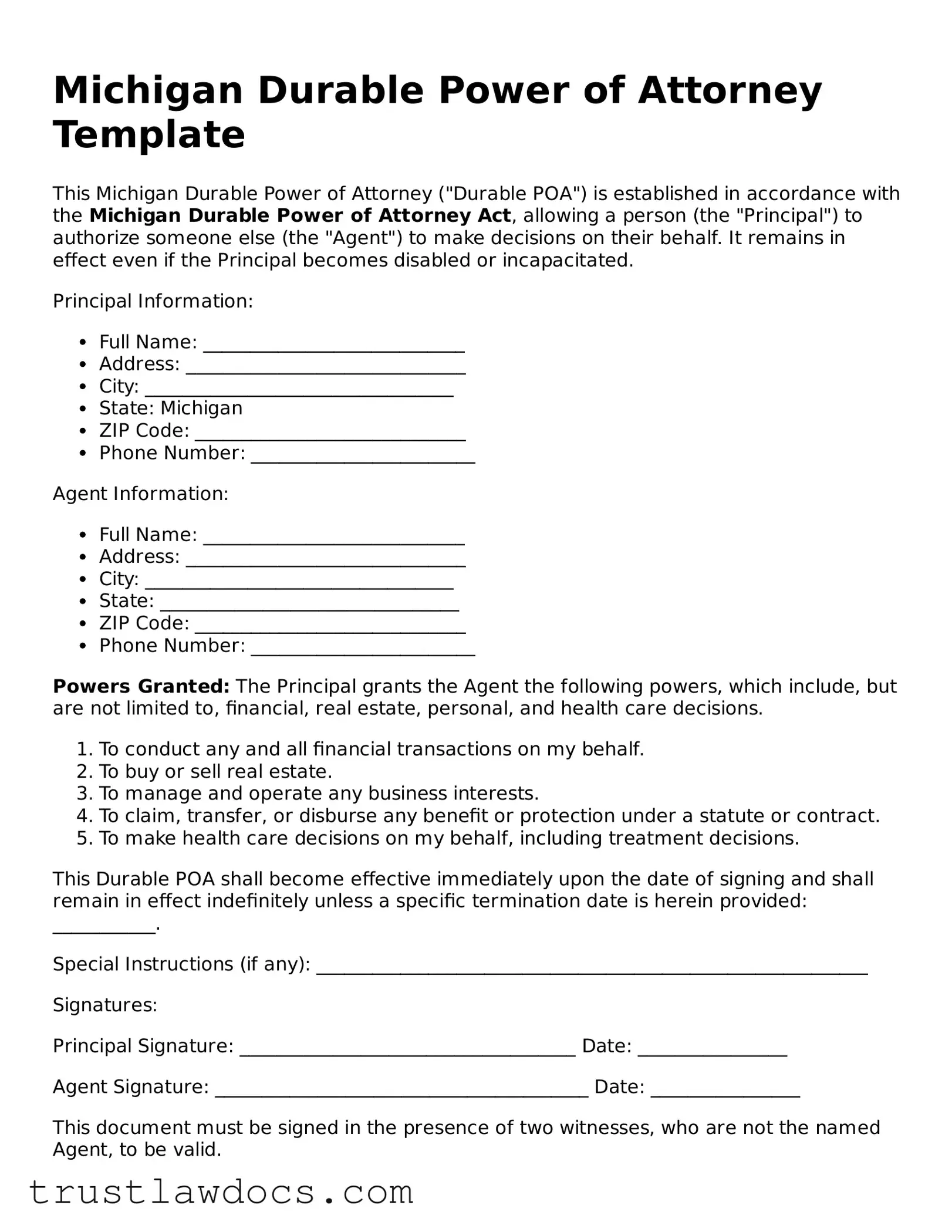

Form Example

Michigan Durable Power of Attorney Template

This Michigan Durable Power of Attorney ("Durable POA") is established in accordance with the Michigan Durable Power of Attorney Act, allowing a person (the "Principal") to authorize someone else (the "Agent") to make decisions on their behalf. It remains in effect even if the Principal becomes disabled or incapacitated.

Principal Information:

- Full Name: ____________________________

- Address: ______________________________

- City: _________________________________

- State: Michigan

- ZIP Code: _____________________________

- Phone Number: ________________________

Agent Information:

- Full Name: ____________________________

- Address: ______________________________

- City: _________________________________

- State: ________________________________

- ZIP Code: _____________________________

- Phone Number: ________________________

Powers Granted: The Principal grants the Agent the following powers, which include, but are not limited to, financial, real estate, personal, and health care decisions.

- To conduct any and all financial transactions on my behalf.

- To buy or sell real estate.

- To manage and operate any business interests.

- To claim, transfer, or disburse any benefit or protection under a statute or contract.

- To make health care decisions on my behalf, including treatment decisions.

This Durable POA shall become effective immediately upon the date of signing and shall remain in effect indefinitely unless a specific termination date is herein provided: ___________.

Special Instructions (if any): ___________________________________________________________

Signatures:

Principal Signature: ____________________________________ Date: ________________

Agent Signature: ________________________________________ Date: ________________

This document must be signed in the presence of two witnesses, who are not the named Agent, to be valid.

Witness 1: _____________________________________________ Date: ________________

Witness 2: _____________________________________________ Date: ________________

Acknowledgment by a Notary Public is recommended to provide additional validation.

State of Michigan )

County of ______________ )

Sworn to and subscribed in my presence this ___ day of ____________, 20__.

Notary Public: _________________________________________

My Commission Expires: ________________________________

PDF Form Details

| Fact Name | Description |

|---|---|

| Governing Law | Michigan's Durable Power of Attorney forms are governed by the Michigan Compiled Laws, specifically within sections 700.5501 to 700.5520. |

| Purpose | This form allows an individual (the principal) to appoint someone else (the agent) to make decisions on their behalf concerning financial, real estate, and other matters should the principal become unable to do so themselves. |

| Durability | "Durable" means that the Power of Attorney remains effective even if the principal becomes mentally incapacitated, ensuring continuous management of their affairs without court intervention. |

| Revocation | The principal may revoke a Durable Power of Attorney at any time, as long as they are mentally competent, by providing written notice to the agent or by executing a new Power of Attorney form. |

How to Write Michigan Durable Power of Attorney

Filling out a Durable Power of Attorney (DPOA) form in Michigan is an important step in managing your affairs and ensuring that your decisions are honored, especially in situations where you might be unable to make those decisions yourself. This legal document allows you to appoint a trusted individual to act on your behalf regarding financial matters. The process, though straightforward, requires attention to detail to ensure the document's validity and effectiveness.

- Start by reviewing the entire form to understand the information and decisions you need to make.

- Enter your full legal name and address at the top of the document to identify yourself as the principal.

- Select and write down the name and contact information of the person you wish to appoint as your attorney-in-fact or agent. This individual will have the power to manage your financial affairs on your behalf.

- Specify the powers you are granting to your attorney-in-fact. You can choose to grant broad authority or limit their powers to specific actions or transactions. It’s important to clearly define these powers to avoid any confusion or misuse of the authority granted.

- Decide if your Durable Power of Attorney will become effective immediately or upon a certain event, such as an incapacitation. Clearly indicate this choice on the form.

- If you want your DPOA to have an expiration date or event, specify this in the designated section. If not, it will remain effective until you revoke it or pass away.

- Your Durable Power of Attorney must be signed in the presence of two witnesses who are not named as the attorney-in-fact. These witnesses cannot be your relatives or beneficiaries of your estate. Each witness must sign the document, verifying that they witnessed your signature.

- Michigan law requires notarization for the Durable Power of Attorney to be legally binding. Thus, after signing, take the document to a notary public. The notary will verify your identity and your witnesses' identities (if present) and will affix a seal, making the document legally valid.

- Finally, provide a copy of the completed and notarized Durable Power of Attorney to your attorney-in-fact. You might also want to provide copies to financial institutions, doctors, or anyone else who might need to recognize the authority of your appointed agent.

Completing a Durable Power of Attorney is a crucial step in estate planning. By carefully selecting an agent and specifying the powers granted to them, you can ensure that your financial matters are handled according to your wishes, even if you are not able to manage them yourself. Remember to review the document periodically and update it as necessary, especially after major life events or changes in your relationships or financial situation.

Get Answers on Michigan Durable Power of Attorney

What is a Michigan Durable Power of Attorney?

A Michigan Durable Power of Attorney is a legal document that lets you appoint someone to manage your financial and legal affairs if you become unable to do so yourself. Unlike other power of attorney forms, this one remains in effect even if you become mentally incapacitated.

How do I choose someone to act as my Agent?

Choosing someone to act as your Agent requires careful consideration. You should select a person you trust completely, as they will have access to your financial and legal affairs. Often, people choose a close family member or a trusted friend. It's important that the person you choose is both willing and able to take on the responsibilities.

What powers can I grant with a Michigan Durable Power of Attorney?

With a Michigan Durable Power of Attorney, you can grant a wide range of powers, including but not limited to handling financial and business transactions, managing real estate, settling claims, and handling matters related to government benefits. You can choose to grant broad authority or limit powers to specific actions and decisions.

When does the Michigan Durable Power of Attorney come into effect?

This form comes into effect as soon as it is signed and notarized, unless the document states otherwise. You have the option to specify that the powers granted only become effective under certain conditions, such as if a doctor determines that you are unable to make decisions for yourself.

Is a lawyer required to create a Michigan Durable Power of Attorney?

No, you do not need a lawyer to create a Durable Power of Attorney in Michigan. However, consulting with a legal professional can help ensure that the document meets all legal requirements and accurately reflects your wishes, especially for more complex estates or specific desires.

Can I revoke my Michigan Durable Power of Attorney?

Yes, you can revoke your Durable Power of Attorney at any time as long as you are mentally competent. To do so, you should provide a written notice to your Agent and to any institutions or individuals that were relying on the document. It's also wise to destroy any physical copies of the document.

What happens if I don't have a Michigan Durable Power of Attorney?

If you become incapacitated without a Durable Power of Attorney in place, your family might have to go through court proceedings to gain the authority to handle your affairs. This process can be time-consuming, expensive, and stressful. Having a Durable Power of Attorney ensures that someone you trust can immediately take over your affairs without court involvement.

Common mistakes

One common mistake made when filling out the Michigan Durable Power of Attorney (DPOA) form is not specifying the powers granted with enough precision. People often assume that broad terms cover all necessary aspects, but this can lead to confusion and legal challenges down the line. It is crucial to detail the specific powers the agent will have, such as managing financial accounts, real estate transactions, or medical decisions, to ensure clarity and prevent issues.

Another error is neglecting to choose an alternate agent. Life is unpredictable, and the initially selected agent might become unavailable due to illness, relocation, or a change in relationship status. Without naming an alternate, the DPOA could become ineffective just when it is needed most. Including a successor agent ensures continuity in managing affairs, even if the first choice can no longer serve.

Failing to discuss the responsibilities with the chosen agent before completing the DPOA form is a significant oversight. This conversation is vital to ensure the agent is willing and able to take on the duties. Surprising someone with this responsibility after the fact can lead to reluctance or refusal to act, potentially leaving affairs in limbo during critical times.

Many people mistakenly believe that once the DPOA form is filled out, it doesn't need another look. However, life changes such as marriage, divorce, the birth of children, or the death of the named agent can affect the relevance and effectiveness of the document. Regularly reviewing and updating the DPOA ensures it reflects current wishes and circumstances.

Not properly witnessing or notarizing the form according to Michigan laws is another error that can render the DPOA invalid. Michigan law requires specific witnessing and/or notarization protocols to be followed for the document to be legally binding. Ignoring these requirements can lead to significant hurdles when the time comes to use the DPOA.

Some people fill out the DPOA form but then fail to share its existence or location with anyone. If the appointed agent or family members do not know about the document or cannot access it, its purpose is defeated. It’s important to keep the DPOA in a known, secure, yet accessible place and inform key individuals of its location.

A critical mistake is not consulting with a legal professional. While templates and generic forms are available, every person’s situation is unique, and state laws vary. A legal advisor can offer personalized guidance to ensure the DPOA meets all legal requirements and truly reflects the individual's wishes.

Lastly, a frequently overlooked aspect is the durability clause. Without clearly stating that the power of attorney is to remain effective even in the event of the principal's incapacitation, the document might not serve its intended purpose at a crucial time. Understanding and explicitly including a durability clause will ensure the agent can act when needed most.

Documents used along the form

When you're preparing a Michigan Durable Power of Attorney (DPOA), it's crucial to consider other forms and documents that may complement or enhance the directives you've established. These additional forms can provide a more comprehensive approach to managing your personal, healthcare, and financial affairs, especially if you become unable to make decisions yourself. Below is a list of seven important documents that are often used alongside a Michigan DPOA to ensure thorough planning.

- Advance Healthcare Directive/Living Will: This document allows you to outline your preferences for medical treatment and end-of-life care, should you become incapable of communicating your wishes.

- Medical Power of Attorney: Similar to the DPOA but specifically focused on healthcare decisions, this grants a trusted individual the authority to make medical decisions on your behalf if you're unable to do so.

- HIPAA Authorization Form: This form permits healthcare providers to share your health information with designated individuals, such as family members or the person you've named in your Medical Power of Attorney.

- Last Will and Testament: While a DPOA deals with decisions during your lifetime, a Last Will and Testament outlines how you wish your assets to be distributed after your death.

- Revocable Living Trust: This helps manage your assets during your lifetime and beyond, allowing for smoother transitions without the need for probate court proceedings. It can be altered or revoked as your circumstances change.

- Guardianship Designation: This document is crucial if you have minor children or dependents. It designates who will care for them in the event of your incapacity or death.

- Financial Inventory: Though not a formal legal document, a detailed list of your assets, liabilities, account numbers, and other financial information can be invaluable for the individuals managing your affairs under a DPOA.

Each of these documents plays a vital role in comprehensive estate and personal planning. Together with a Michigan Durable Power of Attorney, they ensure that your healthcare preferences, financial resources, and the care of your dependents are managed according to your wishes. Planning ahead with these documents can provide peace of mind to you and clarity to those who may need to act on your behalf.

Similar forms

Similar to the Michigan Durable Power of Attorney form, the Healthcare Power of Attorney is a document designed to grant someone else the authority to make medical decisions on your behalf if you're incapable of doing so. The main difference lies in the scope—while the durable variant typically covers financial matters, the healthcare version focuses exclusively on medical decisions. This strategic planning tool ensures your health care preferences are respected even when you can't voice them yourself.

The Living Will, also known as an advance directive, shares a common goal with the Michigan Durable Power of Attorney for healthcare choices: ensuring decisions about your health align with your wishes if you cannot communicate them. Unlike a Power of Attorney that appoints someone to make decisions, a Living Will specifically outlines what medical treatments you do or do not want, such as life support or resuscitative measures, providing clear instructions to healthcare providers.

A General Power of Attorney allows you to appoint someone to manage a wide range of your financial and legal affairs, not just the durable aspects covered in a Durable Power of Attorney. This document is effective immediately upon signing and typically expires if you become incapacitated, contrasting with its durable counterpart designed to remain in effect even after the principal's incapacitation.

The Limited Power of Attorney is tailored to give someone the right to act on your behalf, but only in specific situations. It's much more narrow in scope compared to the Michigan Durable Power of Attorney, which grants broad authority. For example, you might use a Limited Power of Attorney to allow someone to sell a car or house when you cannot do it yourself. Its effectiveness is limited to particular tasks, events, or time periods, making it a versatile tool for focused purposes.

Trust Agreements create a fiduciary relationship, allowing a trustee to hold assets on behalf of a beneficiary, which can include situations outlined in a Durable Power of Attorney, like incapacitation. While both documents deal with managing and protecting the principal's assets, trust agreements can offer more complex instructions and conditions for managing those assets, potentially providing benefits like estate tax advantages and avoiding probate.

The Springing Power of Attorney is similar to a Durable Power of Attorney in that it can allow an agent to handle your affairs if you are unable to do so. However, it "springs" into effect based on specific conditions outlined in the document, usually the principal's incapacitation. This differs from the durable variant that is typically effective immediately upon signing. The springing option adds a level of control, only transferring power at a time of genuine need.

Dos and Don'ts

Creating a Durable Power of Attorney (DPOA) in Michigan is an important step in planning for the future. This legal document allows you to appoint someone you trust to manage your affairs if you're unable to do so. However, the process requires careful attention to detail to ensure that the document is valid and reflects your wishes accurately. Below are essential dos and don'ts to consider when filling out the Michigan Durable Power of Attorney form.

Things You Should Do:

- Choose your agent carefully. Select someone you trust implicitly to act in your best interest, considering their ability to handle financial or medical decisions prudently.

- Be specific about the powers you are granting. Clearly outline what your agent can and cannot do on your behalf to avoid any confusion or misuse of authority.

- Discuss your wishes with your chosen agent. Having a conversation about your values and expectations ensures they are willing and prepared to act on your behalf when necessary.

- Sign and date the form in the presence of a notary public. Michigan law requires notarization for the document to be legally binding, underscoring the significance of this step.

- Keep the document in a safe but accessible place. Inform your agent and loved ones where the DPOA is stored so that it can be easily found when needed.

Things You Shouldn't Do:

- Don't choose an agent based on obligation or expectation. Your decision should be based on trust and the ability to manage important duties, not on familial expectations or social pressures.

- Don't leave any sections blank. If a section does not apply, indicate this clearly to avoid any ambiguity about your intentions.

- Don't fail to specify limits or conditions on your agent's power. Without clear guidance, your agent may make decisions that are contrary to your wishes or interests.

- Don't forget to review and update your DPOA as necessary. Life changes, such as a change in your relationship with your agent or in your own health, may necessitate adjustments to your document.

- Don't ignore state-specific requirements. Each state has its own laws regarding DPOAs. Ensure you're complying with Michigan's specific stipulations to avoid any legal issues.

By following these guidelines, you can create a DPOA that effectively safeguards your interests and ensures your appointed agent can act in your stead, respecting your wishes to the fullest. Remember, while the process might seem daunting, the peace of mind it brings is invaluable.

Misconceptions

A common misconception is that creating a Durable Power of Attorney (DPOA) in Michigan requires an attorney. Although having legal guidance is beneficial, individuals can draft this document themselves or with the help of online resources, as long as it meets Michigan's legal requirements.

Many believe that a DPOA grants unlimited power to the appointed agent. In reality, the document's powers are as broad or limited as specified by the principal (the person who creates the DPOA), including decisions about property, financial affairs, and other matters.

There's a misconception that a DPOA can be executed at any time, regardless of the principal's mental state. However, the principal must be mentally competent at the time of signing for the document to be valid in Michigan.

Another myth is that a DPOA is only for the elderly. People of any age can benefit from creating a DPOA, as unexpected situations, like accidents or sudden illness, can occur at any time, necessitating someone to handle their affairs.

Some believe that a DPOA goes into effect immediately upon signing. While this can be the case, Michigan allows for "springing" powers, meaning the DPOA only becomes effective upon the occurrence of a specified event, typically the principal's incapacity.

It's wrongly assumed that once a DPOA is created, it can't be changed or revoked. As long as the principal is competent, they can modify or revoke their DPOA at any time to reflect their current wishes.

There's a false belief that a DPOA covers healthcare decisions. In Michigan, a separate document, called a Designation of Patient Advocate or Durable Power of Attorney for Healthcare, is needed for healthcare decisions.

Some think that a DPOA automatically terminates upon the principal's death. This is correct; a DPOA is no longer effective once the principal dies, and the estate will then be managed according to the will or state law if no will exists.

Finally, there's a misconception that a DPOA can be created verbally. In Michigan, a DPOA must be in writing, signed by the principal, and properly witnessed and/or notarized to be legally valid.

Key takeaways

Understanding how to properly fill out and use the Michigan Durable Power of Attorney (DPOA) form is essential for ensuring that your financial affairs can be handled according to your wishes, should you become unable to manage them yourself. Here are four key takeaways to keep in mind:

- Choose carefully: The person you appoint as your agent (sometimes called the "attorney-in-fact") holds significant authority to manage your financial matters. It’s crucial to select someone you trust implicitly, as they will be acting on your behalf.

- Be specific: The Michigan DPOA form allows you to define the extent of the powers you grant to your agent. You can make it as broad or as specific as you like. Be clear about what your agent can and cannot do with your assets to avoid any confusion or misuse of authority.

- Notarization is necessary: For your DPOA to be legally valid in Michigan, it needs to be notarized. This means you and your witnesses will sign the document in front of a notary public, who will verify the identity of everyone signing and ensure all signatures are authentic.

- Keep it accessible: After your DPOA is duly filled out, signed, and notarized, make sure to store it in a safe yet accessible place. Inform your agent where the document is kept and consider giving copies to trusted family members or advisors. In case the time comes when it needs to be used, locating the document quickly will be vital.

Popular Durable Power of Attorney State Forms

General Durable Poa - The Durable Power of Attorney is an essential element in estate planning, complementing wills and trusts, by ensuring smooth management of your affairs during your lifetime.

California Power of Attorney Form - A Durable Power of Attorney form allows someone to act on your behalf in legal matters if you're unable to do so yourself.

Indiana General Power of Attorney Form - Allows you to appoint a trusted individual to handle your personal, financial, and business matters.

How to Get a Power of Attorney in Florida - A Durable Power of Attorney is revocable, meaning you have the flexibility to change your agent or revoke the power altogether as your circumstances or preferences change.