Free Durable Power of Attorney Form for Indiana

In the labyrinth of legal documents that guard our decisions when we're unable to do so ourselves, the Indiana Durable Power of Attorney stands as a beacon of autonomy and foresight. Anchored in the principle of self-determination, this form empowers individuals to appoint a trusted agent or attorney-in-fact to manage their financial affairs, potentially traversing a broad spectrum from everyday transactions to more complex financial maneuvers. Its durability is its hallmark, with the document retaining its validity even in the face of the principal's incapacitation, ensuring continuity and stability. Yet, its power demands a high degree of trust and responsibility in the chosen agent, coupled with a clear understanding of its scope and limitations. While navigating state-specific requirements, the Indiana Durable Power of Attorney underscores the importance of proactive legal planning, providing not just peace of mind to the principal, but also clear directives to those stepping into roles of substantial fiduciary duty.

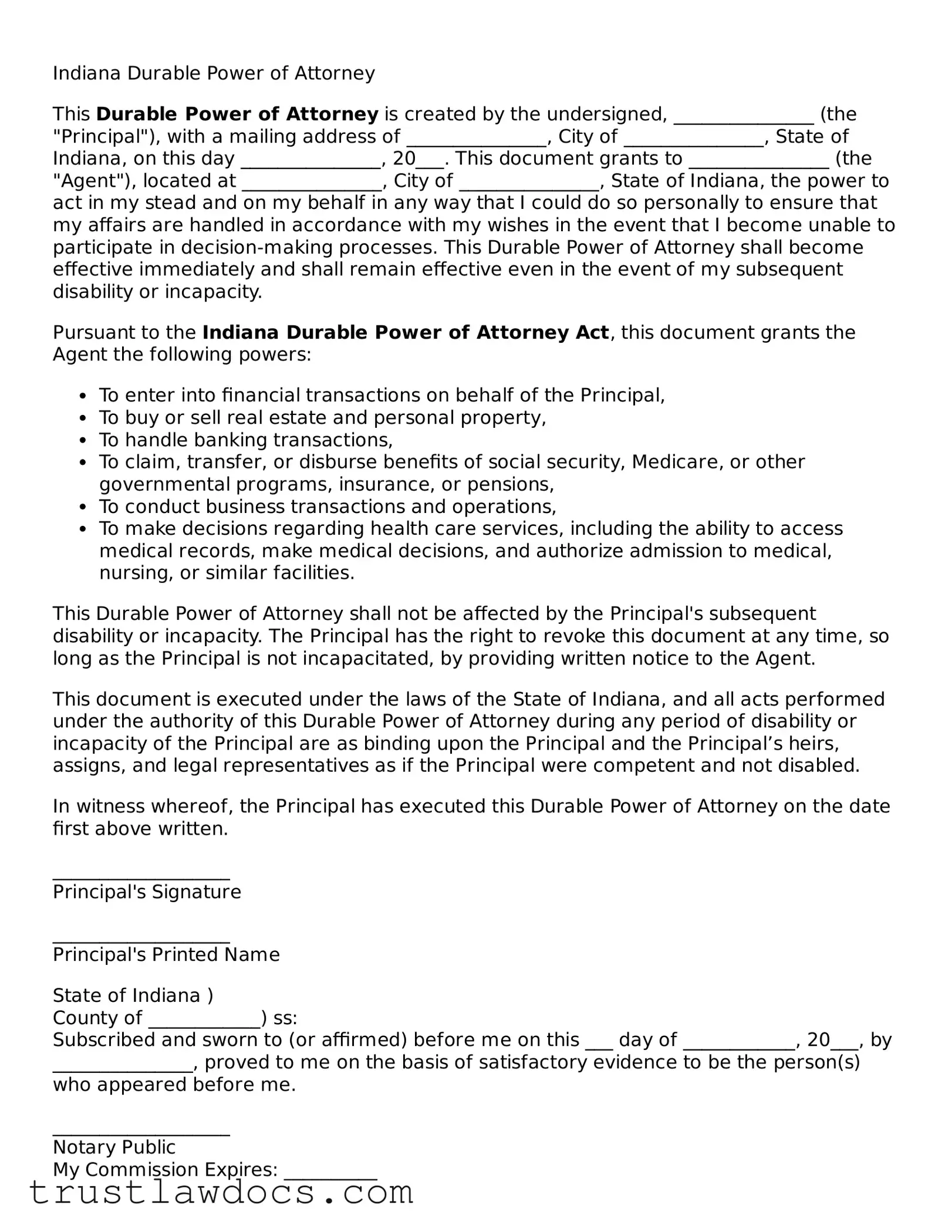

Form Example

Indiana Durable Power of Attorney

This Durable Power of Attorney is created by the undersigned, _______________ (the "Principal"), with a mailing address of _______________, City of _______________, State of Indiana, on this day _______________, 20___. This document grants to _______________ (the "Agent"), located at _______________, City of _______________, State of Indiana, the power to act in my stead and on my behalf in any way that I could do so personally to ensure that my affairs are handled in accordance with my wishes in the event that I become unable to participate in decision-making processes. This Durable Power of Attorney shall become effective immediately and shall remain effective even in the event of my subsequent disability or incapacity.

Pursuant to the Indiana Durable Power of Attorney Act, this document grants the Agent the following powers:

- To enter into financial transactions on behalf of the Principal,

- To buy or sell real estate and personal property,

- To handle banking transactions,

- To claim, transfer, or disburse benefits of social security, Medicare, or other governmental programs, insurance, or pensions,

- To conduct business transactions and operations,

- To make decisions regarding health care services, including the ability to access medical records, make medical decisions, and authorize admission to medical, nursing, or similar facilities.

This Durable Power of Attorney shall not be affected by the Principal's subsequent disability or incapacity. The Principal has the right to revoke this document at any time, so long as the Principal is not incapacitated, by providing written notice to the Agent.

This document is executed under the laws of the State of Indiana, and all acts performed under the authority of this Durable Power of Attorney during any period of disability or incapacity of the Principal are as binding upon the Principal and the Principal’s heirs, assigns, and legal representatives as if the Principal were competent and not disabled.

In witness whereof, the Principal has executed this Durable Power of Attorney on the date first above written.

___________________

Principal's Signature

___________________

Principal's Printed Name

State of Indiana )

County of ____________) ss:

Subscribed and sworn to (or affirmed) before me on this ___ day of ____________, 20___, by _______________, proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

___________________

Notary Public

My Commission Expires: __________

This document is prepared as a general template. It is advisable to consult with a legal professional to ensure that all specific needs and legal requirements are met.

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | The Indiana Durable Power of Attorney form allows an individual to appoint someone else to manage their financial affairs. |

| 2 | This form remains effective even if the principal becomes incapacitated. |

| 3 | To be valid, the form must be signed by the principal and notarized in Indiana. |

| 4 | Under Indiana law, specifically IC 30-5-3-4, the chosen agent must act in the principal's best interest. |

| 5 | The form can include special instructions for the agent, limiting or specifying the powers granted. |

| 6 | An executed Indiana Durable Power of Attorney form does not expire unless it explicitly states a termination date. |

| 7 | The principal has the right to revoke the power of attorney at any time as long as they are competent. |

How to Write Indiana Durable Power of Attorney

Approaching the task of assigning someone the authority to act on your behalf with a Durable Power of Attorney in Indiana can seem daunting at first. However, breaking down the process into clear, manageable steps makes it easier to understand and complete. A Durable Power of Attorney (DPOA) is a powerful legal document. It allows you to designate an individual, known as an agent, to manage your financial affairs and make decisions on your behalf should you become unable to do so. The "durable" aspect of this power of attorney means that the document remains in effect even if you become incapacitated. Here are the steps needed to fill out an Indiana Durable Power of Attorney form.

- Start by downloading the most current version of the Indiana Durable Power of Attorney form. This ensures that you are using the correct paperwork that complies with the latest state laws.

- Fill in your full legal name and address at the top of the form to establish your identity as the principal—the person granting the power.

- Enter the full name and address of the person you are choosing as your agent. This individual will have the authority to act on your behalf under the guidelines you set within the document.

- Read through the powers listed on the form carefully. These include, but are not limited to, handling financial and business transactions, buying or selling real estate, and managing personal and family maintenance. For each power, you can indicate whether you wish your agent to have this authority by initialing next to the corresponding statement.

- There may be a section to specify any special instructions for your agent. This could involve limitations on their powers or additional responsibilities you wish them to carry out. Write down any such instructions clearly.

- If you want the Durable Power of Attorney to take effect immediately and continue in the event you become incapacitated, ensure this section of the form is completed accordingly. If preferential timing for these powers to commence is desired, specify this clearly.

- Choose a successor agent. This step is optional but recommended. A successor agent would act in your best interest if the initially selected agent is unable or unwilling to perform their duties.

- Sign and date the form in the presence of a notary public. Indiana law requires a Durable Power of Attorney to be notarized to have legal effect. The agent and successor agent, if applicable, also need to sign the document, acknowledging their acceptance of the responsibilities designated to them.

- Store the signed document in a safe, accessible place. Inform your agent, successor agent (if any), and close family members or advisors where the document is kept.

Completing the Indiana Durable Power of Attorney form marks a significant step in managing your financial and personal affairs responsibly. It provides peace of mind, knowing that someone you trust is authorized to make decisions on your behalf if necessary. Remember, legal advice can be invaluable in ensuring all aspects of your Durable Power of Attorney align with your wishes and comply with state laws. Don't hesitate to seek guidance from a legal professional if you have any queries during this process.

Get Answers on Indiana Durable Power of Attorney

What is an Indiana Durable Power of Attorney?

An Indiana Durable Power of Attorney is a legal document that allows an individual, often called the principal, to appoint another person, known as the agent or attorney-in-fact, to make decisions and take actions on their behalf. What makes it "durable" is that it remains in effect even if the principal becomes incapacitated or unable to make decisions themselves.

Why do I need an Indiana Durable Power of Attorney?

Having an Indiana Durable Power of Attorney in place is crucial because it ensures that someone you trust can make financial, legal, and sometimes health-related decisions for you if you're unable to do so yourself. Without it, your loved ones might have to go through a lengthy and costly court process to obtain the authority to manage your affairs.

How do I choose an agent for my Indiana Durable Power of Attorney?

Choosing an agent requires careful consideration. The person you select should be trustworthy, understand your wishes, and be capable of making decisions under pressure. It's also advisable to choose someone who is geographically close or able to travel if necessary to handle your affairs. Discussing your expectations with your chosen agent before finalizing the document is essential.

Can I revoke or change my Indiana Durable Power of Attorney?

Yes, you can revoke or change your Indiana Durable Power of Attorney at any time as long as you are mentally competent. To revoke, you should provide written notice to your current agent and inform any institutions or individuals that might be affected. To make changes, you need to create a new document and ensure it is legally executed according to Indiana law.

Is a lawyer required to set up an Indiana Durable Power of Attorney?

While a lawyer is not strictly required to set up an Indiana Durable Power of Attorney, consulting one can be beneficial. A lawyer can help ensure the document is correctly drafted to reflect your wishes, addresses all necessary elements, and meets all legal requirements in Indiana. This can help prevent issues and misunderstandings in the future.

Common mistakes

Filling out the Indiana Durable Power of Attorney form often involves nuanced details that can be overlooked. One common mistake is not specifying the powers granted clearly. Individuals frequently assume broad terms cover all necessary authority, but this can lead to confusion and limitations on the agent’s ability to act. It's crucial to detail the permissions granted to ensure the agent can fully represent the principal’s interests.

Another error involves omitting to specify the form's durability. The whole point of a Durable Power of Attorney is that it remains in effect even if the principal becomes incapacitated. If this characteristic is not explicitly stated, the document’s power might not extend as needed during crucial times, potentially requiring a court appointment of a guardian or conservator.

Choosing the wrong agent is a mistake with significant repercussions. Sometimes individuals select an agent based on personal relationships rather than the person’s ability to manage affairs effectively. The agent should be someone trustworthy, financially savvy, and ideally, geographically close enough to manage affairs without undue hardship.

Not considering the appointment of a successor agent is another oversight. If the initial agent is unable or unwilling to serve, having a successor agent named prevents delays or the need for court intervention to assign a new agent.

Failure to properly execute the form as per Indiana law can render the document invalid. This often includes neglecting the requirement for notarization or missing witness signatures. Each state has specific requirements for legal execution, and Indiana's mandates must be followed for the document to be legally binding.

Lack of specificity in granting authority for health care decisions is a common mistake. A Durable Power of Attorney for health care needs clear language regarding medical decisions, which is distinct from financial or general affairs management. Without this specificity, the agent may be powerless in medical contexts.

Some individuals mistakenly believe that a Durable Power of Attorney grants the agent the right to override the principal’s wishes. It's essential to understand that the agent is bound to act in the principal’s best interest and according to their directives as long as the principal is capable of making decisions.

Forgetting to provide copies to relevant parties, such as financial institutions, health care providers, or family members, is another error. These entities often require time to process such documents and failing to distribute copies can cause unnecessary delays when the agent needs to act.

Ignoring state-specific provisions can also lead to problems. Each state, including Indiana, may have unique requirements or restrictions that need to be addressed in the document. For example, some states have particular stipulations about real estate transactions that must be explicitly granted in the document.

Last, not reviewing and updating the document regularly is a significant oversight. Life changes, such as marriage, divorce, the death of an agent, or relocation to another state, can impact the efficacy of the existing document. Periodic reviews ensure that the Durable Power of Attorney remains relevant and effective according to the principal’s current situation and wishes.

Documents used along the form

When preparing a Durable Power of Attorney (DPOA) in Indiana, it's essential to consider other legal documents that may complement or enhance the directives and protections the DPOA provides. These documents can help in managing a comprehensive estate plan, ensuring medical preferences are honored, or safeguarding financial interests. Here's a list of ten forms and documents often used alongside the Indiana Durable Power of Attorney form.

- Living Will Declaration – Specifies an individual’s preferences regarding end-of-life medical treatments, such as life support and resuscitation efforts, in case they become unable to communicate their wishes.

- Health Care Representative Appointment – Designates a person to make healthcare decisions on behalf of the individual, complementing the DPOA by covering more specific health-related decisions.

- Last Will and Testament – Outlines how an individual's property and assets should be distributed after their death, ensuring that their wishes are followed and potentially reducing conflicts among heirs.

- Revocable Living Trust – Allows an individual to manage their assets during their lifetime and specifies how these assets are distributed after death, often used to avoid probate.

- Financial Information Release Form – Authorizes financial institutions to disclose personal financial records to a designated agent, useful for managing or overseeing financial transactions and investments.

- HIPAA Release Form – Grants permission for healthcare providers to share an individual’s private health information with specified parties, essential for healthcare agents to make informed decisions.

- Mental Health Care Power of Attorney – Specializes in mental health decisions, allowing an agent to make choices about mental health treatment when the individual is unable to do so.

- Declaration for Funeral Arrangements – Enables an individual to specify their preferences for funeral arrangements, including burial or cremation, relieving family members from making these decisions during a difficult time.

- General Power of Attorney – Grants broad or limited financial powers to an agent, but unlike the DPOA, it becomes ineffective if the individual becomes incapacitated. It’s often used for specific transactions or periods.

- Do Not Resuscitate (DNR) Order – A medical order indicating that an individual does not want CPR or other life-sustaining treatments if their heart stops or they stop breathing.

Together, these documents form a robust legal framework that can address a wide range of situations from financial management and healthcare decisions to end-of-life preferences. It's crucial to consult with legal professionals when drafting these documents to ensure they meet all legal requirements in Indiana and accurately reflect your wishes.

Similar forms

The Indiana Durable Power of Attorney form is akin to a Medical Power of Attorney, which also grants an individual the authority to make decisions on someone’s behalf. While the Durable Power grants broad powers including financial decisions, the Medical Power of Attorney is specifically designed to allow someone to make healthcare decisions only, when the principal cannot do so due to incapacity. Both documents ensure that the principal's preferences are respected by allowing them to appoint a trusted individual to act in their best interest.

Similarly, the Living Will bears resemblance to the Durable Power of Attorney, as both documents pertain to preparations for incapacity. A Living Will provides instructions regarding end-of-life care, dictating the treatments the individual wishes or does not wish to receive. Unlike the Durable Power of Attorney, which delegates decision-making power to another person, a Living Will directly communicates the principal's decisions regarding their health care, acting as a guide for the appointed agent and healthcare providers.

The General Power of Attorney document closely mirrors the Durable Power of Attorney in its function of allowing an individual to grant someone else the authority to handle their affairs. However, the General Power of Attorney typically ceases to be effective if the principal becomes incapacitated. The “durable” aspect of the Durable Power of Attorney ensures that the agent’s power remains intact even if the principal loses the ability to make decisions for themselves.

Another related document is the Limited (or Special) Power of Attorney. This document allows the principal to grant limited powers to an agent for specific tasks or situations, such as selling property or managing a particular financial account. Unlike the broad authority granted in a Durable Power of Attorney, the scope of a Limited Power of Attorney is narrowly tailored to specific acts, giving the agent authority to act in the principal's stead only in certain, clearly defined situations.

The Trust Agreement shares some common ground with the Durable Power of Attorney, especially in estate planning contexts. Both arrangements can manage and protect assets. However, a Trust Agreement creates a fiduciary relationship where the Trustee holds title to assets for the benefit of the beneficiaries, which may include the trust creator while they are alive. The Durable Power of Attorney, conversely, permits an agent to manage the principal’s broad financial affairs directly on their behalf without transferring title of those assets.

Revocable Living Trusts are similar in purpose to Durable Powers of Attorney, as both are tools for managing an individual's assets during their lifetime and ensuring proper distribution upon their death. A key difference is that a Revocable Living Trust can include detailed instructions for the management and distribution of assets after the individual’s death, a function beyond the scope of a Durable Power of Attorney, which ceases to be effective upon the principal's death.

The Advance Healthcare Directive, also known as an Advance Directive, consolidates elements of a Living Will and Medical Power of Attorney into a single document. It allows individuals not only to set forth their wishes regarding medical treatment but also to appoint a healthcare representative to make decisions on their behalf. While it deals specifically with health care decisions, similar to how a Durable Power of Attorney enables someone to make financial decisions, both documents safeguard the principal's wishes during periods of incapacitation.

Lastly, the Guardianship Appointment shares similarities with the Durable Power of Attorney by allowing an individual to choose someone to make decisions for them. However, a guardianship typically involves court intervention and is often used when no durable power of attorney is in place, or when the court determines that the appointed agent is not acting in the best interest of the individual. Unlike the more preemptive measure of a Durable Power of Attorney, a Guardianship Appointment is a legal recognition granted or approved by a court, often after the individual is already incapacitated.

Dos and Don'ts

Filling out the Indiana Durable Power of Attorney form is a crucial step in planning for the future. It allows you to designate someone you trust to manage your affairs if you're unable to do so yourself. To ensure this process is smooth and effective, here are several dos and don'ts to keep in mind.

Do:- Read the instructions carefully before filling out the form to understand the specific requirements and ensure you comply with Indiana laws.

- Choose a trusted individual as your agent. This person should be reliable, able to handle responsibility, and above all, trustworthy.

- Be specific about the powers you grant. Clarify what your agent can and cannot do on your behalf to avoid any confusion or misuse of power.

- Consider naming a successor agent. If your first choice is unable or unwilling to serve, having an alternate can ensure your affairs are still managed as you wish.

- Sign and date the form in the presence of a notary public. This step is essential for the document to be legally recognized in Indiana.

- Rush through the process. Take your time to fill out the form accurately and thoughtfully to reflect your wishes clearly.

- Forget to review and update the document regularly. Life changes, such as marriage, divorce, or the death of your chosen agent, can impact the relevance and effectiveness of your durable power of attorney.

By following these guidelines, you can ensure that your Indiana Durable Power of Attorney form is filled out correctly and effectively, providing peace of mind for both you and your loved ones.

Misconceptions

When it comes to understanding the Indiana Durable Power of Attorney form, there are several common misconceptions that need to be clarified. These misconceptions can lead to confusion and misapplication of the form's intended use, potentially compromising the principal's wishes regarding their financial and legal matters. Here's a closer look at some of these misunderstandings.

- It grants unlimited power. One widespread misconception is that the Indiana Durable Power of Attorney form provides the agent with unlimited control over the principal's affairs. In reality, the powers can be as broad or as specific as the principal wishes, confined to what is explicitly stated in the document.

- It becomes effective immediately. Another misunderstanding is that the form takes effect as soon as it is signed. However, the principal has the flexibility to specify whether the powers granted become effective immediately or upon the occurrence of a future event, usually the principal’s incapacity.

- It supersedes a will. Some people mistakenly believe that a Durable Power of Attorney can override a will. In truth, this form pertains only to the management of the principal's affairs during their lifetime. It has no impact on the distribution of assets after the principal's death; that is the role of a will.

- It's irrevocable. Many assume once an Indiana Durable Power of Attorney form is executed, it cannot be changed or revoked. This is incorrect, as the principal can revoke or alter the document at any time, as long as they are mentally competent.

- It avoids the need for a guardian or conservator. While it's true that having a Durable Power of Attorney can obviate the need for a court-appointed guardian or conservator, this is not absolute. In certain circumstances, a court might still find it necessary to appoint someone, especially if there are concerns about the agent’s actions.

- Only the elderly need it. Another common misconception is that Durable Power of Attorney forms are only for the elderly. People of all ages can benefit from having this document, as it ensures that their affairs can be handled according to their wishes should they become incapacitated.

- It permits medical decisions on the principal’s behalf. Many believe that the Indiana Durable Power of Attorney form allows the agent to make healthcare decisions for the principal. This is a misunderstanding; a separate document, known as a Healthcare Proxy or Medical Power of Attorney, is needed for medical decisions.

Clearing up these misconceptions is crucial for ensuring that individuals are fully informed about how the Indiana Durable Power of Attorney works and how it can be leveraged to safeguard their financial and legal interests during times of incapacity. Proper understanding and application of this form are key to effective estate planning and personal asset management.

Key takeaways

Filling out and using the Indiana Durable Power of Attorney form is an important step in planning for future financial management and personal care. Here are seven key takeaways to guide you through the process:

- Understand its purpose: The Indiana Durable Power of Attorney allows you to appoint someone you trust, known as an "agent" or "attorney-in-fact," to manage your financial affairs if you are unable to do so yourself.

- Choose your agent wisely: Your agent will have broad powers to handle your affairs, so it’s crucial to choose someone who is trustworthy, financially savvy, and has your best interests at heart.

- Be specific about powers granted: The form allows you to specify exactly what powers your agent will have. Consider carefully which powers you want to grant, including managing real estate, handling banking transactions, and making healthcare decisions.

- Consider naming a successor agent: It's wise to name a successor agent in case your first choice is unable or unwilling to serve. This ensures continuity in managing your affairs without interruption.

- Sign in the presence of a notary: For your Durable Power of Attorney to be legally valid in Indiana, you must sign it in the presence of a notary public. This step provides an additional layer of validation and protection.

- Keep it accessible: Once signed and notarized, keep the document in a safe but accessible place. Inform your agent and successor agent of its location, and consider providing copies to key family members or your attorney.

- Review and update regularly: Life changes such as marriage, divorce, the birth of a child, or a change in your financial situation may require updating your Durable Power of Attorney. Review it regularly and update it as needed to reflect your current wishes and circumstances.

Popular Durable Power of Attorney State Forms

Texas Statutory Durable Power of Attorney - It serves as an essential safeguard, ensuring that financial matters are handled appropriately and in accordance with the individual’s wishes, no matter the circumstances.

How to Get a Power of Attorney in Florida - This legal document remains effective even if you become mentally incapacitated, providing peace of mind for you and your loved ones.

General Durable Poa - This document empowers your agent to act in your best interests, subject to the terms you set forth, granting them authority only as you see fit.

California Power of Attorney Form - It’s often recommended to consult with legal and financial advisors when setting up a Durable Power of Attorney.