Free Durable Power of Attorney Form for Florida

When it comes to managing affairs in the face of uncertainty, few documents carry as much weight as the Florida Durable Power of Attorney. This critical legal instrument allows individuals to appoint someone they trust to handle their financial matters, should they become unable to do so due to illness or incapacity. Unlike a standard Power of Attorney, this version remains in effect even if the person who made it loses their mental faculties, offering a layer of protection and continuity that is invaluable during difficult times. The form encompasses a broad range of powers, from buying or selling real estate on behalf of the principal to managing bank accounts and investment portfolios. It's designed with flexibility in mind, allowing for customization according to the specific needs and wishes of the person it represents. Given its potential to impact financial dealings significantly, getting it right – understanding its provisions, limitations, and the responsibilities it bestows – is of paramount importance. Failing to properly comprehend its contents or not adhering to Florida’s specific legal requirements can result in unnecessary complications and legal battles, precisely at a time when stability is most needed.

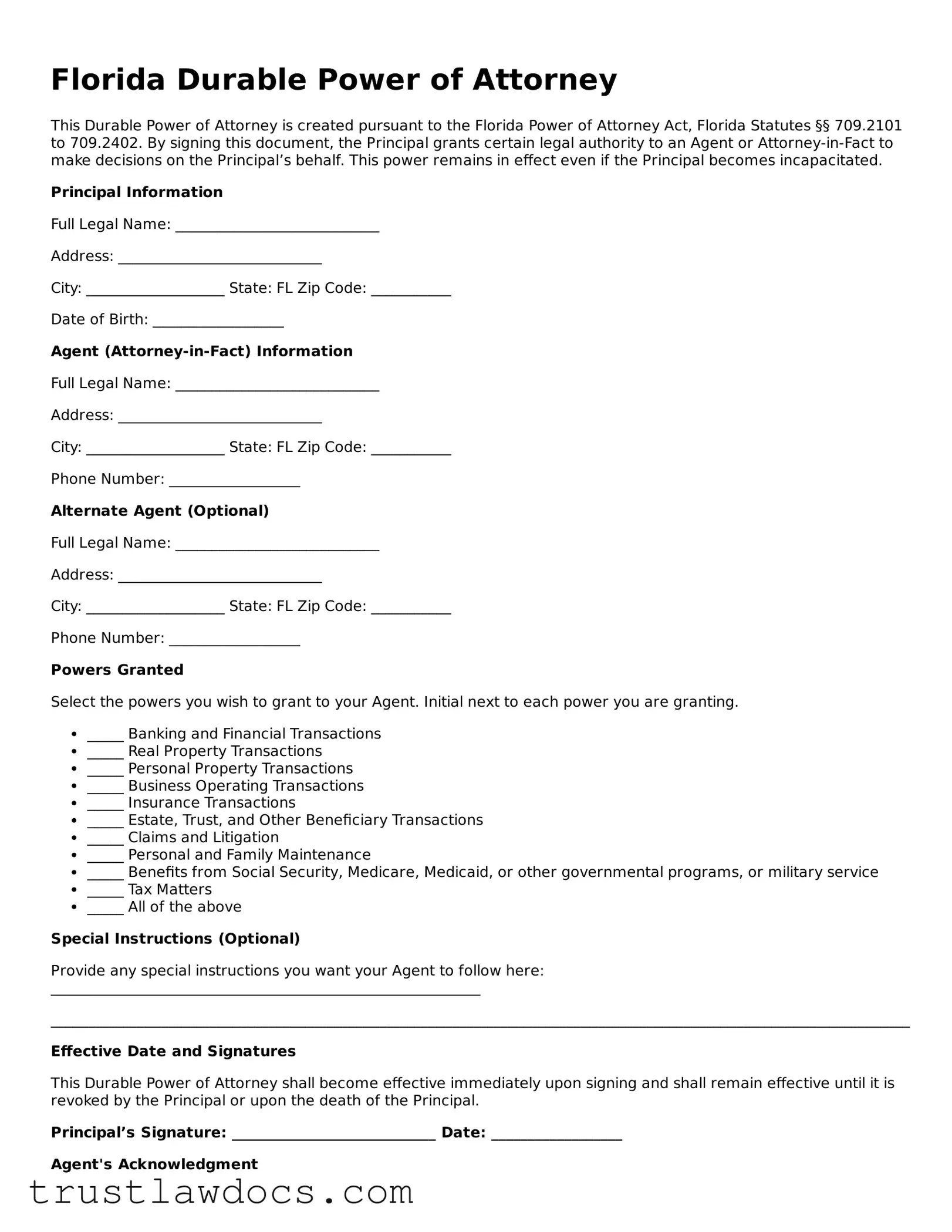

Form Example

Florida Durable Power of Attorney

This Durable Power of Attorney is created pursuant to the Florida Power of Attorney Act, Florida Statutes §§ 709.2101 to 709.2402. By signing this document, the Principal grants certain legal authority to an Agent or Attorney-in-Fact to make decisions on the Principal’s behalf. This power remains in effect even if the Principal becomes incapacitated.

Principal Information

Full Legal Name: ____________________________

Address: ____________________________

City: ___________________ State: FL Zip Code: ___________

Date of Birth: __________________

Agent (Attorney-in-Fact) Information

Full Legal Name: ____________________________

Address: ____________________________

City: ___________________ State: FL Zip Code: ___________

Phone Number: __________________

Alternate Agent (Optional)

Full Legal Name: ____________________________

Address: ____________________________

City: ___________________ State: FL Zip Code: ___________

Phone Number: __________________

Powers Granted

Select the powers you wish to grant to your Agent. Initial next to each power you are granting.

- _____ Banking and Financial Transactions

- _____ Real Property Transactions

- _____ Personal Property Transactions

- _____ Business Operating Transactions

- _____ Insurance Transactions

- _____ Estate, Trust, and Other Beneficiary Transactions

- _____ Claims and Litigation

- _____ Personal and Family Maintenance

- _____ Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service

- _____ Tax Matters

- _____ All of the above

Special Instructions (Optional)

Provide any special instructions you want your Agent to follow here: ___________________________________________________________

______________________________________________________________________________________________________________________

Effective Date and Signatures

This Durable Power of Attorney shall become effective immediately upon signing and shall remain effective until it is revoked by the Principal or upon the death of the Principal.

Principal’s Signature: ____________________________ Date: __________________

Agent's Acknowledgment

I, ____________________________ (Agent's name), hereby accept this appointment as Attorney-in-Fact and swear or affirm that I will act in the Principal’s best interest according to the powers granted to me in this Durable Power of Attorney and under the laws of the State of Florida.

Agent’s Signature: ____________________________ Date: __________________

Alternate Agent's Acknowledgment (if applicable)

I, ____________________________ (Alternate Agent's name), hereby accept this appointment as an Alternate Attorney-in-Fact and swear or affirm that I will act in the Principal’s best interest, only in the absence or inability of the primary Agent, according to the powers granted to me in this Durable Power of Attorney and under the laws of the State of Florida.

Alternate Agent’s Signature: ____________________________ Date: __________________

Witnesses

The law requires that this Durable Power of Attorney must be signed in the presence of two witnesses, who also need to sign below.

1st Witness Name: ____________________________

Signature: ____________________________ Date: __________________

2nd Witness Name: ____________________________

Signature: ____________________________ Date: __________________

Notarization (if required or desired)

This section should be completed by a Notary Public if notarization is required or desired for additional legal standing.

PDF Form Details

| Fact | Detail |

|---|---|

| 1. Definition | A Florida Durable Power of Attorney is a legal document that allows someone to act on your behalf in legal and financial matters, even if you become incapacitated. |

| 2. Governing Law | This form is governed by Florida Statutes, Chapter 709 - Powers of Attorney and Similar Instruments. |

| 3. Durability | The term "durable" means that the Power of Attorney remains effective even if the principal becomes mentally incapacitated. |

| 4. Activation | It becomes effective immediately upon signing unless the document specifies a different starting time or triggering event. |

| 5. Agent’s Powers | The agent can handle financial affairs, real estate transactions, business operations, and more, as specified in the document. |

| 6. Choosing an Agent | The principal should choose someone they trust completely as their agent since this person will have considerable control over their affairs. |

| 7. Legal Requirements | For it to be valid, the Power of Attorney must be signed by the principal in the presence of two witnesses and notarized. |

| 8. Termination | It can be revoked by the principal at any time, as long as they are mentally competent, or it terminates automatically upon the principal’s death. |

| 9. Springing Power of Attorney | Florida law permits the creation of a "springing" Power of Attorney, which only becomes effective upon the happening of a specified event, such as the incapacity of the principal. |

| 10. Filing Requirements | While not required, it may be filed with the Clerk of the Court in the county where the principal resides for safekeeping and ease of access. |

How to Write Florida Durable Power of Attorney

Filling out a Florida Durable Power of Attorney form marks a significant step towards ensuring your affairs can be managed according to your wishes, even if you're unable to do so yourself. This document will authorize a person you trust, referred to as an "agent," to make decisions on your behalf. It’s crucial to complete this form with clarity and precision to ensure your agent has the proper authority they need without any undue delay. Here are the steps to accurately fill out the form.

- Begin by downloading the latest version of the Florida Durable Power of Attorney form from a reliable source, ensuring it aligns with current state laws.

- Enter your full legal name and address at the beginning of the form to identify yourself as the "principal."

- Select and clearly identify the person you wish to act as your "agent" or "attorney-in-fact." Include their full name, address, and contact information to avoid any ambiguity.

- Specify the powers you are granting your agent. This section requires careful consideration as it outlines the extent of authority you're transferring. It’s advisable to consult with a legal professional if you're unsure about any powers you wish to include.

- If desired, appoint a successor agent. This step is optional but recommended. Should your primary agent be unable or unwilling to serve, having a successor agent ensures there is no interruption in the management of your affairs.

- The specifics regarding when the power of attorney will take effect and under what circumstances it will remain in effect should be filled in. Most choose it to be effective immediately and to remain so even if the principal becomes incapacitated, reflecting the “durable” nature of the document.

- It is critical to read through the entire form carefully to ensure all sections are completed accurately and reflect your true intentions.

- Your signature is required to validate the document. The signing must be done in the presence of a notary public to ensure its legality. Some states may require witness signatures as well; check Florida's current requirements to comply.

- After completing and signing the form, distribute copies to relevant parties. Your agent, successor agent (if applicable), and any institutions or individuals who may need to recognize the authority of your agent should receive a copy.

Once these steps have been carefully followed, your Durable Power of Attorney will be in full effect, conferring the necessary authority to your chosen agent. Remember, this is a powerful document that can grant significant control over your affairs. It’s highly recommended to store the original document in a safe but accessible location and to review it periodically, especially in the event of changed relationships or other significant life events.

Get Answers on Florida Durable Power of Attorney

What is a Florida Durable Power of Attorney?

A Durable Power of Attorney (DPOA) in Florida is a legal document that allows an individual, known as the principal, to appoint someone they trust, called the agent, to manage their financial affairs. Unlike other power of attorney forms, it remains effective even if the principal becomes incapacitated.

Who can serve as an Agent in a Florida DPOA?

Any competent adult, such as a close family member, friend, or even a professional like an attorney, can be chosen as an agent. The chosen individual should be someone the principal trusts deeply, as they will have extensive power over the principal's finances.

What powers can be granted in a Florida Durable Power of Attorney?

The powers granted can be broad or specific, depending on the principal's wishes. They often include managing bank accounts, real estate, personal property, investments, and handling transactions with government bodies. The principal can tailor the powers to include or exclude certain acts.

When does a Florida DPOA become effective?

Typically, a DPOA becomes effective immediately upon signing unless the document specifies otherwise. Some may choose a "springing" power, meaning it only becomes effective upon the occurrence of a specific event, usually the principal's incapacitation, as determined by a medical professional.

How can a Durable Power of Attorney be terminated in Florida?

A DPOA can be terminated if the principal revokes it while competent, if the appointed agent resigns or is unable to serve, upon the principal's death, or if a court invalidates the document. If the principal designated a successor agent, that person may then assume the role.

Does a Florida Durable Power of Attorney need to be notarized?

Yes, for a Durable Power of Attorney to be legally binding in Florida, it must be signed by the principal in the presence of two witnesses and be notarized. The notary public cannot serve as a witness.

Is a Florida Durable Power of Attorney valid in other states?

While Florida's DPOA is generally recognized across the United States due to the Full Faith and Credit Clause of the U.S. Constitution, it's advisable to check with an attorney or the relevant authorities in the other state to ensure it meets local requirements.

Common mistakes

When it comes to filling out the Florida Durable Power of Attorney form, some individuals may encounter pitfalls. To ensure the document serves its intended purpose without any hitches, it's imperative to avoid common mistakes. Here are ten errors to steer clear of:

One significant mistake is not specifying the powers granted clearly. The document should precisely outline what decisions the agent can make on behalf of the principal. Vague descriptions can lead to confusion or misuse of authority, potentially complicating financial and legal situations.

Another error involves choosing the wrong agent. The role demands someone trustworthy, reliable, and capable of handling financial matters with prudence. Sometimes, people hastily nominate a close family member without assessing their ability to manage such responsibilities, which could lead to mismanagement or, worse, financial abuse.

Often, people forget to include a successor agent in the document. Should the primary agent be unable or unwilling to serve, having a successor named ensures that there's no gap in representation. The absence of this foresight can leave affairs in limbo during critical times.

A common oversight is not specifying the effective date. The Florida Durable Power of Attorney can be made to take effect immediately or upon the occurrence of a specific event, usually the principal's incapacity. A clear declaration of this aspect prevents any ambiguity regarding when the agent's power begins.

Failing to tailor the document to individual needs is another mistake. While using a standard form may seem convenient, it might not encompass all the necessary powers or restrictions specific to the principal's situation. Legal advice can help customize the document to fit unique circumstances.

Not addressing the termination of the power of attorney is a flaw in some cases. Under certain conditions, such as a divorce, when the agent is the principal's spouse, the principal might want the document to end. Without specifying this, the power of attorney could remain in effect despite changed personal relationships.

Some individuals mistakenly believe that a durable power of attorney covers medical decisions. However, in Florida, a separate designation, known as a healthcare surrogate, is needed for medical decisions. Mixing up these documents can leave critical healthcare choices unaddressed.

A technical but crucial mistake is not having the document witnessed and notarized correctly. Florida law requires specific witnessing and notarization for the document to be valid. Failure to comply with these formalities can render the entire document ineffective.

Overlooking the importance of discussing the contents with the chosen agent is also a common error. It's essential that the agent understands the responsibilities conferred upon them and agrees to take on these duties. An uninformed or unwilling agent can complicate matters, should they need to act on the principal's behalf.

Finally, neglecting to review and update the durable power of attorney periodically is a mistake. As life situations and laws change, the document may need adjustments to remain relevant and effective. Regular reviews ensure that it accurately reflects the principal's current wishes and legal standards.

By avoiding these common errors, individuals can ensure that their Florida Durable Power of Attorney forms are properly executed, providing peace of mind and securing their financial and legal matters effectively.

Documents used along the form

When setting up a Florida Durable Power of Attorney, it's important to prepare thoroughly. This document allows someone you trust to manage your affairs if you're unable to do so. Accompanying it with other documents can help ensure that all aspects of your care and estate are covered comprehensively. Below is a list of documents often used alongside a Florida Durable Power of Attorney, each serving its unique purpose in your planning.

- Living Will: Specifies your wishes regarding medical treatment if you become unable to communicate them yourself, particularly about life-sustaining measures.

- Health Care Surrogate Designation: Appoints someone to make medical decisions on your behalf if you're unable to do so, complementing the Living Will by covering decisions outside of its scope.

- Declaration of Preneed Guardian: Designates your choice of guardian in the event a court decides you need one, offering you the opportunity to make this choice in advance.

- Last Will and Testament: Dictates how your assets should be distributed after your death, an essential document for estate planning.

- Revocable Living Trust: Allows you to manage your assets during your lifetime and specify how they should be handled after your death, often used to avoid probate.

- HIPAA Release Form: Gives designated persons the right to access your medical records, facilitating the management of your health care by those you trust.

- Designation of Preneed Guardian for Minor: If you have minor children, this designates a guardian for them, should something happen to you and the other parent.

- Personal Property Memorandum: Often attached to a will, this details who receives personal items that may not require formal probate procedures.

- Declaration Naming Preneed Guardian of the Person and Property: Expands upon the Declaration of Preneed Guardian to specifically cover financial decisions and personal care.

- Do Not Resuscitate Order (DNRO): A doctor's order that prevents emergency medical personnel from performing CPR, should you stop breathing or your heart stops beating.

Each of these documents plays an essential role in comprehensive planning, working together with a Florida Durable Power of Attorney to cover a broad range of decisions: financial, medical, and personal. It's advisable to consult with professionals who can provide guidance specific to your situation, ensuring that your documents are correctly prepared and reflective of your wishes.

Similar forms

The Florida Durable Power of Attorney form bears similarities to the Health Care Proxy, as both documents allow individuals to designate another person to make decisions on their behalf. In the case of the Durable Power of Attorney, the focus is on financial affairs, while the Health Care Proxy is specific to medical decisions. This distinction is clear, but the underlying principle of entrusting someone to act in one's best interest is a common thread.

Comparable to the Living Will, the Durable Power of Attorney enables individuals to prepare for situations where they might not be able to communicate their wishes directly. While the Living Will specifies an individual’s preferences regarding end-of-life care, the Durable Power of Attorney appoints an agent to handle financial matters, showing how both serve to protect personal autonomy in different domains.

Similar to a General Power of Attorney, the Durable Power of Attorney permits an individual to appoint someone to manage their financial affairs. The critical difference is that the "durable" aspect means the power of attorney remains effective even if the principal becomes incapacitated, emphasizing the document’s role in long-term planning.

The Springing Power of Attorney and the Durable Power of Attorney share the characteristic of activation based on specific conditions; however, a Springing Power of Attorney becomes effective only when certain predefined conditions are met, often including the incapacity of the principal. This contrasts with the immediate effectiveness of the Durable Power of Attorney, albeit both prioritize the principal's inability to manage their affairs.

The Financial Power of Attorney is closely related to the Durable Power of Attorney, as it too involves the delegation of authority over personal financial decisions. The distinction often lies in the scope and duration of authority granted, where the Durable Power of Attorney is expressly designed to remain in effect upon the principal's incapacitation, underscoring its importance for uninterrupted asset management.

Trust Documents, while serving a broader estate planning function, share the Durable Power of Attorney’s objective of assigning management responsibilities to a trusted individual. Trusts often focus on the distribution and management of assets according to the grantor's wishes, including when they are unable to make decisions themselves, paralleling the durable power’s foresight in financial management.

The Guardianship Appointment is akin to the Durable Power of Attorney in that it involves assigning someone the authority to make decisions on another's behalf. However, a Guardianship Appointment typically covers a broader range of personal decisions beyond finances, including daily living and healthcare, and usually requires court involvement, highlighting its more comprehensive and supervised nature.

A Conservatorship, similarly, grants an individual or organization the power to handle another's financial and sometimes personal affairs, often due to incapacity or disability. The process is court-managed, offering a layer of oversight absent in the more privately arranged Durable Power of Attorney, though both address the need to manage affairs during incapacity.

The Limited Power of Attorney shares the functional aspect of delegating authority to another person, as seen with the Durable Power of Attorney, but is restricted to specific tasks or for a limited time. Unlike its durable counterpart, the limited version provides a narrowly defined scope, showcasing the versatility of power of attorney documents in catering to differing needs and circumstances.

The Advance Directive, much like the Durable Power of Attorney, prepares an individual for future health and personal care incapacity. While it primarily focuses on healthcare decisions, including the designation of a healthcare surrogate, the essence of designating another to act in one's stead, as embodied in the Durable Power of Attorney, illustrates a commonality in planning for unforeseen incapacitation.

Dos and Don'ts

The Florida Durable Power of Attorney (DPOA) is a legal document that grants one person the authority to act on behalf of another in various financial and legal matters. When filling out this form, it's essential to pay close attention to detail and follow best practices. Here are six do's and don'ts to keep in mind:

Do's:- Choose a trusted agent: Select someone who is reliable, trustworthy, and capable of handling your financial matters responsibly.

- Be specific about granted powers: Clearly outline the extent of the powers you are granting, including any limitations you wish to apply.

- Consult with a legal professional: Seek advice from a lawyer to ensure the form is filled out correctly and addresses your specific needs.

- Sign in the presence of witnesses or a notary: Florida law requires your DPOA to be either witnessed by two individuals or notarized to be valid.

- Inform your agent: Discuss the responsibilities and expectations with the person you've chosen as your agent before finalizing the document.

- Keep the original document safe: Store the DPOA in a secure location and provide copies to your agent and any relevant institutions.

- Don't rush the process: Take your time to fill out the form accurately, avoiding any potential errors or misunderstandings.

- Don't choose an agent based on convenience alone: Just because someone is readily available doesn't mean they're the best choice for managing your affairs.

- Don't forget to specify expiration: If you wish the DPOA to have an expiration date, make sure it's clearly stated in the document.

- Don't neglect to review and update: Circumstances change, and so might your choice of agent or the scope of authority given. Review and update the DPOA as needed.

- Don't use overly broad or vague language: Ambiguities in the document can lead to disputes or misuse of the granted powers.

- Don't fail to notify important parties: Family members, financial institutions, and anyone else who might be affected should be informed about the DPOA and its contents.

Misconceptions

Understanding the Florida Durable Power of Attorney (DPOA) is crucial for making informed decisions about your future and financial affairs. However, several misconceptions exist that can lead to confusion. Here, we address some common misunderstandings:

All powers of attorney are the same. One prevalent misconception is that all powers of attorney documents are identical. In reality, the Florida Durable Power of Attorney is specifically designed to remain in effect even if the principal, the person granting the authority, becomes incapacitated. This is distinct from a general power of attorney, which typically becomes void under such circumstances.

The durable power of attorney grants unlimited power. While it may seem that the agent or attorney-in-fact has unlimited power, the Florida DPOA actually allows the principal to specify the extent of powers granted. This means that the principal can limit what the agent can do on their behalf.

A durable power of attorney and a living will are the same. Another common error is conflating a durable power of attorney with a living will. A living will expresses your wishes regarding medical treatment in case you become unable to communicate them yourself, whereas a DPOA pertains to financial and administrative decisions.

It's only for the elderly. Many believe that a durable power of attorney is something only the elderly should consider. However, unexpected circumstances can arise at any age, making a DPOA a wise precaution for adults of all ages.

It goes into effect immediately after signing. This isn't always the case. The principal has the option to stipulate that the DPOA only kicks in under certain conditions, such as upon the principal's incapacitation, making it a "springing" durable power of attorney.

Only family members can be designated agents. In reality, the principal can choose anyone they trust to serve as their agent. There is no requirement that the agent be a family member, although choosing someone trustworthy and capable is extremely important.

You don’t need a lawyer to create a DPOA. While it’s technically true that you can create a DPOA without an attorney, consulting with a legal professional experienced in Florida’s laws regarding durable powers of attorney ensures that the document clearly expresses your wishes and adheres to all legal requirements.

Once executed, it can't be changed or revoked. A durable power of attorney can indeed be modified or revoked by the principal as long as they are competent to do so. This flexibility allows the principal to make adjustments as their circumstances or wishes change.

Clearing up these misconceptions can empower individuals to make decisions that best suit their needs and wishes, with a proper understanding of the Florida Durable Power of Attorney.

Key takeaways

The Florida Durable Power of Attorney form is a vital legal document that allows a person (the principal) to designate another person (the agent or attorney-in-fact) to make decisions on their behalf should they become unable to do so. Understanding its implications, requirements, and scope is crucial for both the principal and the agent. Below are key takeaways about filling out and using this form:

- Comprehensive Authority: The form grants broad powers to the agent, covering financial, legal, and sometimes health decisions. Principals should carefully consider which powers to grant, ensuring they align with their needs and wishes.

- Choosing an Agent: It's crucial to select an agent who is both trustworthy and capable of handling significant responsibilities. This person will have a considerable amount of control over the principal's affairs, so trust and reliability cannot be overstated.

- Durability Aspect: The "durability" aspect means that the power of attorney remains effective even if the principal becomes mentally incapacitated. This feature is particularly important for long-term planning.

- Legal Requirements: Florida law has specific requirements for a power of attorney to be considered valid, including the need for it to be signed by the principal, witnessed by two adults, and notarized. Ensuring these steps are properly followed is critical for the document's validity.

- Revocation: The principal retains the right to revoke the power of attorney at any time, as long as they are mentally competent. This revocation must be done in writing and properly communicated to the agent and any relevant institutions.

- Specificity: While the form can grant general powers, it's also possible (and sometimes advisable) to be specific about the powers granted. Specifying can help align the document more closely with the principal's intentions and needs.

- Third-Party Acceptance: Although a durable power of attorney is legally binding, some institutions may have their own forms or requirements. It's wise to check with relevant institutions (banks, healthcare providers, etc.) to ensure the power of attorney will be accepted without issue.

- Professional Advice: Given the complexities and legal implications of a durable power of attorney, consulting with a legal professional can provide valuable insights and ensure that the document meets all legal requirements and the principal's needs.

Properly executing a Florida Durable Power of Attorney form is a critical step in planning for the future. It empowers individuals to make proactive decisions about who will manage their affairs if they are unable to do so themselves. Following the above guidelines can help ensure that the process is done correctly and effectively.

Popular Durable Power of Attorney State Forms

Indiana General Power of Attorney Form - Designate a trusted person to handle your financial matters with this form.

General Durable Poa - Once signed, it requires careful storage and communication with the appointed agent and relevant financial institutions, ensuring its effectiveness when needed.

Durable Power of Attorney Michigan - Establish a plan for your assets and healthcare wishes by selecting a durable power of attorney now.

California Power of Attorney Form - The earlier you set up a Durable Power of Attorney, the better prepared you'll be for any situation that might render you unable to act on your own behalf.