Free Durable Power of Attorney Form for California

In California, the significance of planning for the unexpected cannot be overstated, particularly when it comes to managing one's financial and legal affairs. This preparation is greatly facilitated by the California Durable Power of Attorney form, which stands as a crucial legal document. Its primary function is to authorize a trusted individual, known as the agent, to make financial decisions on behalf of the person filling out the form, referred to as the principal. This authority can encompass a wide range of activities, from managing bank accounts to real estate transactions, and remains effective even if the principal becomes incapacitated. Given its enduring nature, this form plays a pivotal role not just in estate planning, but also in providing peace of mind to individuals who want to ensure their affairs are handled according to their wishes, no matter the circumstances. Therefore, understanding the major aspects of this form, including its preparation, execution, and the specific powers it grants, is essential for residents of California who wish to take a proactive approach to their financial well-being and legal protection.

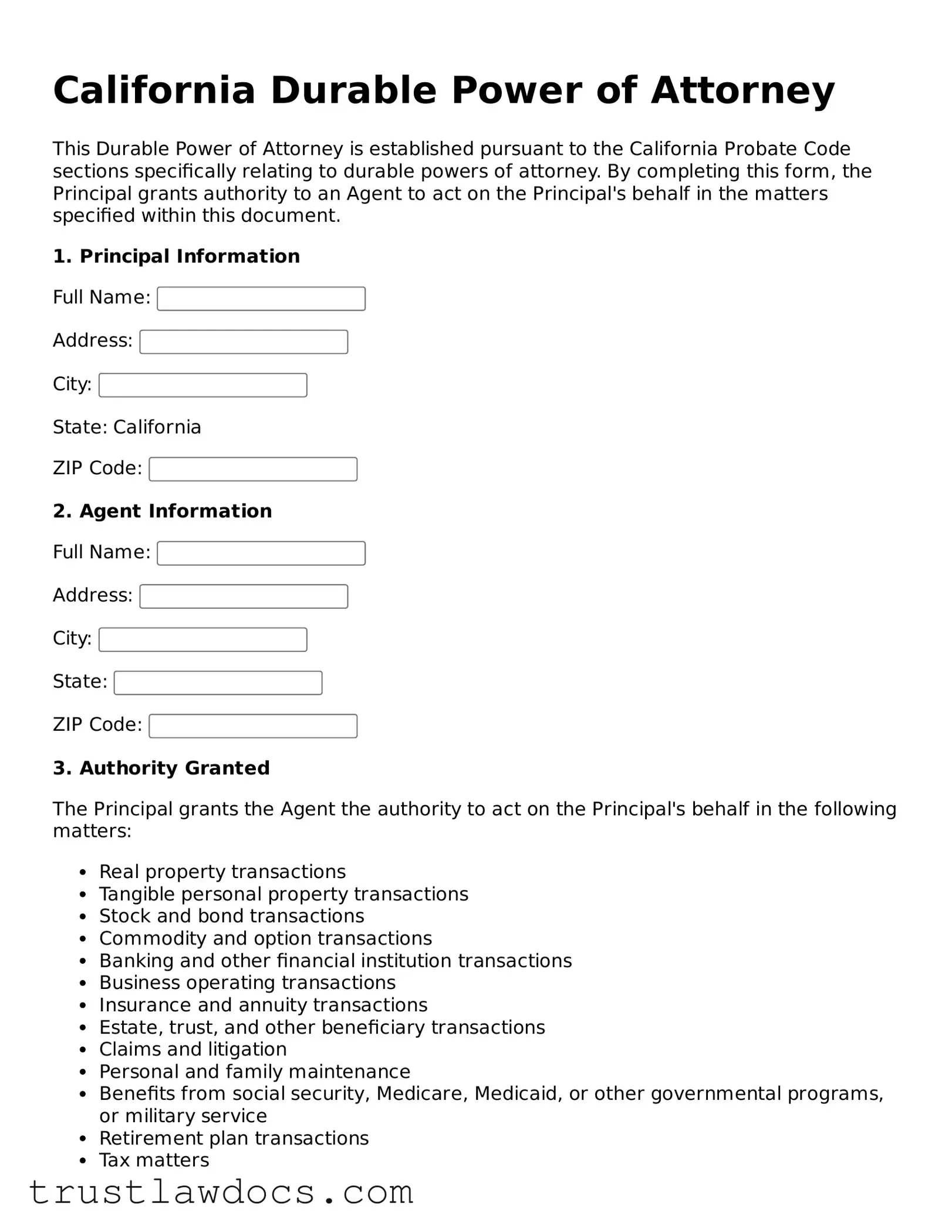

Form Example

California Durable Power of Attorney

This Durable Power of Attorney is established pursuant to the California Probate Code sections specifically relating to durable powers of attorney. By completing this form, the Principal grants authority to an Agent to act on the Principal's behalf in the matters specified within this document.

1. Principal Information

Full Name:

Address:

City:

State: California

ZIP Code:

2. Agent Information

Full Name:

Address:

City:

State:

ZIP Code:

3. Authority Granted

The Principal grants the Agent the authority to act on the Principal's behalf in the following matters:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

4. Durable Clause

This Power of Attorney shall remain in effect in the event that the Principal becomes disabled, incapacitated, or incompetent.

5. Signature and Date

Principal's Signature: __________________________________ Date:

Agent's Signature: __________________________________ Date:

6. Acknowledgement by Notary Public

This section needs to be completed by a Notary Public to confirm the identities of the Principal and the Agent and to verify the signatures on this document.

Notary Public

State of California

County of _____________

On , before me, _________________ (insert the name of the notary), personally appeared (names of the individuals involved), who proved to me on the basis of satisfactory evidence to be the persons whose names are subscribed to this instrument and acknowledged to me that they executed it.

Witness my hand and official seal.

Signature of Notary: ____________________________

Seal:

PDF Form Details

| Fact Number | Description |

|---|---|

| 1 | The California Durable Power of Attorney form allows an individual to grant another person the authority to make financial decisions on their behalf. |

| 2 | This form remains effective even if the principal becomes incapacitated, ensuring continuous management of their affairs. |

| 3 | The authority granted can be broad or limited, depending on the preferences specified within the document. |

| 4 | For the Durable Power of Attorney to be valid in California, it must be signed by the principal and either notarized or signed by two witnesses. |

| 5 | Witnesses to the document cannot be the agent appointed, related to the principal by blood, marriage, or adoption, and must not be entitled to any portion of the principal’s estate upon death. |

| 6 | The California Probate Code sections 4000 to 4465 govern the Durable Power of Attorney, ensuring protections for both the principal and the agent. |

| 7 | Choosing someone trustworthy and capable of handling financial affairs is crucial, as the agent will have significant control over the principal's assets. |

| 8 | The principal has the right to revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| 9 | The use of a Durable Power of Attorney can help avoid the need for a court-appointed conservatorship if the principal becomes incapable of managing their financial matters. |

How to Write California Durable Power of Attorney

A Durable Power of Attorney is a legal document that allows an individual to appoint someone else to manage their affairs if they become unable to do so. This could include making financial decisions or handling property transactions on their behalf. It's important to complete this form carefully and accurately to ensure that the appointed individual, often referred to as the "agent," has the correct authority needed. The steps for filling out a California Durable Power of Attorney form are straightforward but require attention to detail.

- Gather all necessary information, including the full legal names and addresses of both the person filling out the form (the "principal") and the appointed agent(s).

- Read the form thoroughly to understand the types of powers you are granting to your agent. This can include financial matters, real estate transactions, and more.

- In the designated section, write the full legal name and address of the appointed agent.

- If you wish to appoint an alternate agent in case the first agent is unable or unwilling to serve, fill in the information for an alternate agent in the provided section.

- Specify the powers you are granting to your agent by initialing next to corresponding statements on the form. If you wish to grant all listed powers, you may be able to initial a single statement indicating this, depending on the form's layout.

- Read the special instructions section carefully. Here, you can include any specific limitations or extensions to the powers granted to your agent. Write these instructions clearly.

- Check whether the form requires witness signatures, notarization, or both. California law has specific requirements for these steps to ensure the document's validity.

- Sign and date the form in the presence of the required witnesses and/or notary public, as stipulated by California law. Make sure the agent does the same if required by the form.

- Store the completed, signed, and notarized (if necessary) form in a safe but accessible place. It is also advisable to provide copies to your appointed agent, any alternate agents, and possibly your attorney.

- Inform your agent of their appointment and discuss the responsibilities and powers you have granted to them. This ensures they understand their role and your expectations.

After you have completed the form, it is important to keep it in a secure location where your agent can access it if needed. Additionally, you may want to share copies with your financial institutions, family members, or your attorney to ensure that your wishes are followed. Remember, you can revoke or change the Durable Power of Attorney at any time as long as you are competent. Regularly review and update the document to reflect any changes in your situation or wishes.

Get Answers on California Durable Power of Attorney

What is a Durable Power of Attorney in California?

A Durable Power of Attorney in California is a legal document that allows one person, known as the principal, to appoint another person, the agent or attorney-in-fact, to make decisions on their behalf. This authority can cover a wide range of activities, including managing financial affairs or property, and continues to be effective even if the principal becomes incapacitated.

How do I choose an agent for my Durable Power of Attorney?

Choosing an agent requires thoughtful consideration. The appointed agent should be someone you trust deeply, as they will have significant control over your affairs should you become unable to manage them yourself. It’s advised to select someone who is not only trustworthy but also capable of handling the responsibilities that come with the role, such as managing finances or making important decisions. Family members, close friends, or even trusted professionals can serve as agents.

Can a Durable Power of Attorney be revoked?

Yes, a Durable Power of Attorney can be revoked at any time by the principal as long as they are mentally competent. This revocation must be done in writing and communicated effectively to the current agent as well as any institutions or parties that were relying on the Durable Power of Attorney. It's important to also issue a new Durable Power of Attorney if you wish to appoint a different agent.

What happens if I don’t have a Durable Power of Attorney in California?

Without a Durable Power of Attorney, if you become incapacitated and unable to handle your own affairs, your loved ones might have to go through a lengthy and potentially stressful court process to be appointed as your legal guardian or conservator. This process can be time-consuming and costly, and it might not result in the person you would have chosen being appointed to manage your affairs.

Common mistakes

Filling out a California Durable Power of Attorney (POA) form is a serious step in managing one’s personal affairs, entrusting someone else with the power to make decisions on one’s behalf. However, even with the significance of this document well understood, mistakes can be made that may undermine its effectiveness or even render it invalid. Recognizing and avoiding these common errors can help ensure that the POA serves its intended purpose.

One common mistake is not specifying powers clearly. The strength of a Durable Power of Attorney lies in its clarity concerning the agent’s powers. Ambiguities might lead to the agent having either too much leeway, putting the principal's assets at risk, or too little, hindering the agent's ability to act effectively when needed. It’s crucial to thoroughly detail the specific powers granted to the attorney-in-fact, ensuring they align with the principal's wishes and circumstances.

Another area where errors frequently occur is in the selection of the agent or attorney-in-fact. This decision is often made without adequate consideration of the person's ability to act in the principal's best interest. Emotional choices can lead to appointing a friend or relative who, despite good intentions, may lack the necessary judgment, financial acumen, or impartiality to act effectively. Sometimes, it's wise to select a professional or someone with legal or financial expertise, especially for complex estates.

Not properly executing the document according to California law is a critical mistake that can invalidate the entire POA. This error includes skipping required signatures, not having the document notarized if necessary, or failing to adhere to any specific state stipulations regarding witnesses. California has specific legal requirements for executing a durable POA to ensure its validity and enforceability; overlooking these formalities can lead to significant legal headaches down the line.

Finally, overlooking the need for a successor agent is a mistake that can render the power of attorney ineffective just when it is most needed. Life is unpredictable; the originally chosen agent might become unwilling or unable to act due to unforeseen circumstances such as illness, relocation, or even death. Without a designated successor to step in, the POA would fail to function, possibly necessitating court intervention to appoint a new agent, which can be a time-consuming and emotionally taxing process.

Documents used along the form

When considering the setup of a Durable Power of Attorney in California, it's important to understand that this document does not stand alone. It's part of a suite of legal documents often prepared to ensure comprehensive coverage of one's wishes regarding financial matters, health care decisions, and end-of-life care. Here are four additional forms and documents frequently used in conjunction with the California Durable Power of Attorney form, each serving its unique purpose in the broader context of estate planning and personal care.

- Advanced Health Care Directive: This document allows an individual to outline their preferences for medical treatment and care in situations where they are unable to communicate their wishes themselves. It also includes the appointment of a health care agent, similar to the power of attorney, but specifically for health care decisions.

- Living Will: Closely related to the Advanced Health Care Directive, the Living Will enables individuals to specify their wishes regarding life-prolonging medical treatments. It comes into play when the situation is terminal or there is no expectation of recovery. While the Advanced Health Care Directive can include broader health care preferences and appoint an agent, the Living Will focuses specifically on end-of-life care.

- Last Will and Testament: This vital document outlines how an individual’s assets and estate will be distributed upon their death. It appoints an executor to manage the estate and ensures that the individual's final wishes regarding their possessions, and sometimes guardianship of minor children, are legally recognized.

- HIPAA Authorization Form: While not always immediately thought of, this form is crucial as it grants the person or persons named in the Power of Attorney and the Advanced Health Care Directive access to the individual's healthcare information. This access is necessary for making informed decisions about health care when the individual is unable to communicate their wishes directly due to incapacity.

Together, these documents form a protective network that ensures an individual's preferences and rights are respected across different scenarios, from managing financial affairs to making critical health care decisions. They embody the principle of safeguarding one’s personal and financial autonomy and ensuring that, in times of incapacity, there is a clear, legally recognized path that honors the individual's values and wishes.

Similar forms

The California Durable Power of Attorney form shares similarities with the Advance Health Care Directive. Both documents grant authority to another person to make important decisions on one's behalf. However, while the Durable Power of Attorney often focuses on financial and property matters, the Advance Health Care Directive is specifically designed to address health care decisions, including end-of-life care and the refusal or acceptance of medical treatment. This ensures that an individual's health care wishes are followed when they cannot communicate their desires due to illness or incapacity.

Another document that bears resemblance is the General Power of Attorney. Like the Durable Power of Attorney, it gives someone else the authority to act on your behalf in various matters. The key difference lies in their effectiveness upon the principal's incapacitation. A General Power of Attorney typically becomes invalid if the person who made it becomes mentally incapacitated. In contrast, a Durable Power of Attorney is specifically intended to remain in effect even after the principal can no longer make decisions for themselves, providing a continuous means of managing one's affairs without court intervention.

The Living Trust is also similar to the California Durable Power of Attorney form. Both allow individuals to manage their assets and make preparations for when they are either unwilling or unable to handle their affairs. A Living Trust, however, is used primarily for estate planning, allowing assets to bypass the probate process upon death. It can also include provisions for the grantor's care and the management of their assets if they become incapacitated. In this way, it complements the financial management aspects of a Durable Power of Attorney by providing a broader estate planning strategy.

Lastly, the Limited Power of Attorney is akin to the Durable Power of Attorney form, with both permitting someone to act on your behalf. The distinction lies in the scope of authority granted; a Limited Power of Attorney is typically used for specific transactions or limited periods. This could include selling property, handling certain financial transactions, or managing specific legal matters. Unlike a Durable Power of Attorney, which is broad and intended to stay effective through the principal’s incapacity, a Limited Power of Attorney has a narrower focus, providing targeted assistance rather than comprehensive authority.

Dos and Don'ts

Filling out a California Durable Power of Attorney form is a significant step in managing your affairs. To ensure that your document fully represents your wishes and remains legally valid, consider these guidelines carefully.

Do:

- Read the entire form before filling it out. Understanding each section will help you make informed decisions.

- Choose a trustworthy individual as your attorney-in-fact. This person will have considerable control over your affairs.

- Be specific about the powers you are granting. Detailing each power helps prevent misuse and confusion.

- Sign the document in the presence of a notary public or witnesses as required by California law. This step is crucial for the document’s legal validity.

- Inform your attorney-in-fact and family members about the document. Knowing its existence and location will ease its use when necessary.

- Keep the document in a safe, easily accessible place. Consider giving a copy to your attorney-in-fact as well.

- Review and update the document as your situation changes. This ensures that the document remains up-to-date with your wishes.

Don't:

- Use ambiguous language that could lead to interpretation issues. Clear and direct wording is essential.

- Forget to date the document. The absence of a date can question the document’s validity and your intentions.

- Appoint an attorney-in-fact without discussing it with them first. They should be aware and willing to take on the responsibility.

- Neglect state-specific requirements. California may have particular rules about witnessing and notarization that must be followed.

- Fail to consider a successor attorney-in-fact in case your first choice is unable or unwilling to serve.

- Overlook the importance of reviewing the form periodically. Laws and personal circumstances change, and your document should reflect these changes.

- Assume the form is self-explanatory to the attorney-in-fact. Discuss your intentions and specific instructions to ensure they understand their role and your expectations.

Misconceptions

When it comes to making important decisions about legal documents, it's crucial to have the correct information. In California, the Durable Power of Attorney is a powerful tool, but it's often misunderstood. Let's clear up some common misconceptions:

It grants unlimited power: Many believe that a Durable Power of Attorney allows the agent to do anything they want. However, it only grants the power specified in the document. Limits can be set by the person who creates the power of attorney.

It's effective immediately after signing: While this can be true, a Durable Power of Attorney can also be drafted to become effective upon a certain event, like the incapacity of the principal.

It remains valid after death: A common misunderstanding is that a Durable Power of Attorney remains in effect after the principal's death. In truth, it becomes invalid once the principal passes away.

It replaces a will: Some think that a Durable Power of Attorney can serve the same purpose as a will. This isn't true. A will is used to distribute assets after death, something a Durable Power of Attorney cannot do.

It's only for the elderly: People of all ages can benefit from having a Durable Power of Attorney. Accidents or sudden illness can make it a necessary tool for anyone.

It is difficult to revoke: As long as the principal is mentally competent, they can revoke the Durable Power of Attorney at any time.

All Durable Powers of Attorney are the same: There are different types, including those for healthcare decisions and financial matters. Each serves a specific purpose.

It allows the agent to make decisions against the principal's wishes: The agent is legally obliged to act in the principal's best interest and according to their instructions as laid out in the document.

A lawyer must create it: While legal advice is highly recommended, especially to understand all implications, a Durable Power of Attorney form doesn't require a lawyer to be legal.

It's only for those with complex estates: Regardless of the size of your estate, a Durable Power of Attorney can be crucial in managing your assets and decisions if you're unable to do so yourself.

Understanding the facts about the Durable Power of Attorney in California can help you make informed decisions about your future and protect your interests and those of your loved ones. If you're considering this essential legal document, ensure you're guided by accurate information and, if possible, consult with a legal professional to tailor it to your specific needs.

Key takeaways

When preparing to fill out a California Durable Power of Attorney (DPOA) form, it's essential to understand its purpose and the implications of the decisions made within this document. Here are five key takeaways to consider:

- Choose your agent carefully. The person you appoint as your agent will have significant control over your financial matters. This person should be trustworthy, competent, and willing to act in your best interests.

- Be specific about the powers granted. The DPOA allows you to specify exactly what financial powers your agent can exercise. These can range from paying bills to managing real estate and investments. Clearly outlining these powers can prevent confusion and misuse of authority.

- Understand the durability aspect. A "durable" power of attorney remains in effect even if you become incapacitated. This feature is crucial for ensuring that your financial matters are taken care of when you cannot manage them yourself.

- Keep records accessible. After the DPOA form is filled out, it should be kept in a safe yet accessible place. Both your agent and a trusted individual should know its location. In some cases, it may also be advisable to register the document with relevant financial institutions.

- Consult with a professional. While filling out a DPOA form may seem straightforward, consulting with a legal professional can help ensure that the document accurately reflects your wishes and is valid under California law. This step can prevent potential legal challenges in the future.

Popular Durable Power of Attorney State Forms

Durable Power of Attorney Michigan - Maintain control over your financial matters even if you can't make decisions yourself by appointing a trusted agent.

Texas Statutory Durable Power of Attorney - This legal document can also include provisions for managing digital assets, a growing concern in today’s digital world.

General Durable Poa - This document ensures that your financial and personal dignity are maintained, by enabling decisions that align with your values and preferences, without undue influence from outside parties.

How to Get a Power of Attorney in Florida - By appointing a durable power of attorney, you can rest assured that your financial legacy is protected.