Official Durable Power of Attorney Document

Imagine a scenario where, for any reason, an individual finds themselves unable to manage their personal affairs, whether it be due to health issues, absence, or any unforeseen circumstances. In such events, having a plan in place to ensure that their matters are in capable hands is not just wise but essential. This is where a Durable Power of Attorney (DPOA) form plays a pivotal role. It serves as a legal document that allows a person to appoint someone they trust, often called an agent or attorney-in-fact, to make decisions on their behalf. Unlike other power of attorney forms, its 'durable' nature means it remains in effect even if the individual becomes incapacitated. The range of decisions covered can be broad or specific, including financial, legal, and health-related issues. Preparing a DPOA is a proactive measure that requires thoughtful consideration, ensuring that one's welfare and affairs are managed according to their wishes even when they can't oversee them personally.

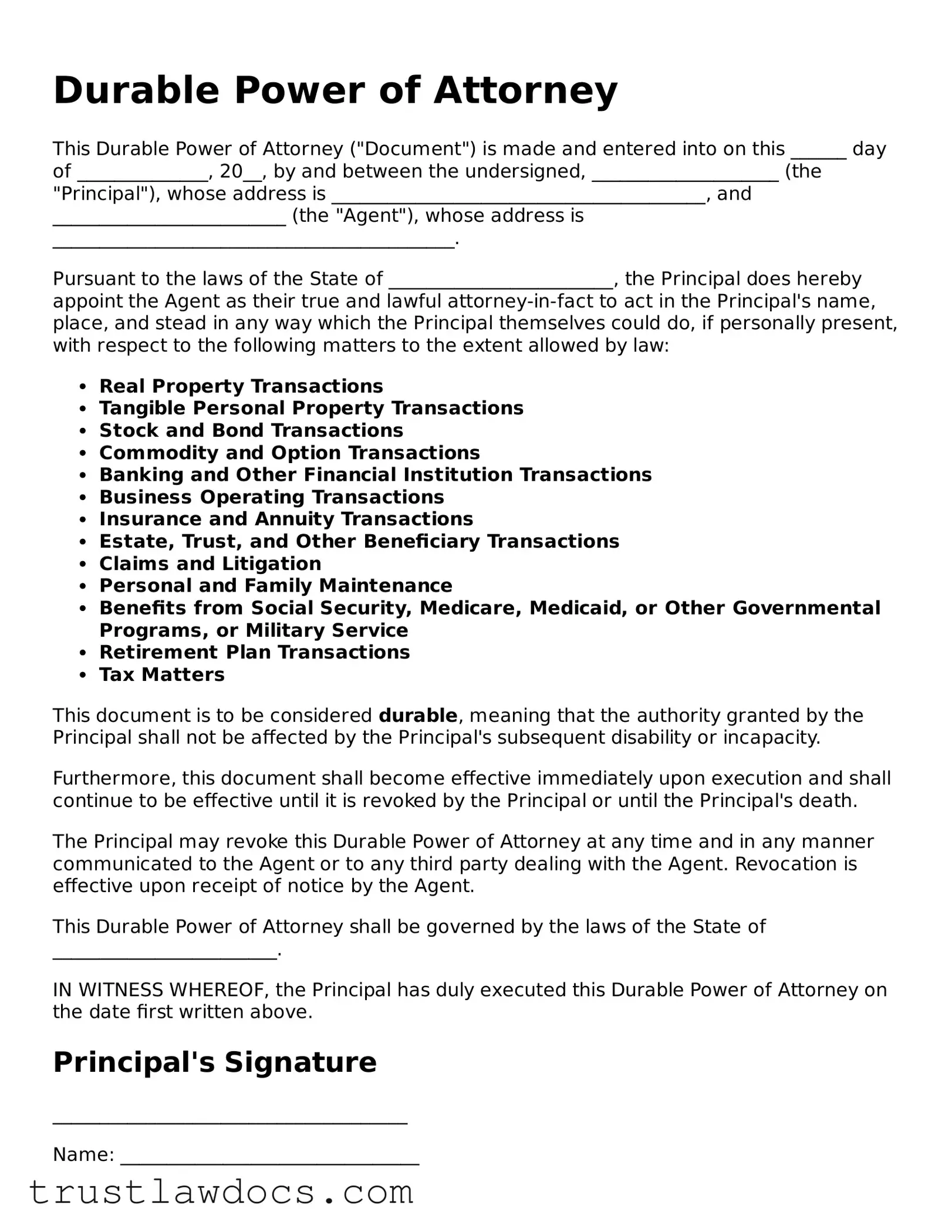

Form Example

Durable Power of Attorney

This Durable Power of Attorney ("Document") is made and entered into on this ______ day of ______________, 20__, by and between the undersigned, ____________________ (the "Principal"), whose address is ________________________________________, and _________________________ (the "Agent"), whose address is ___________________________________________.

Pursuant to the laws of the State of ________________________, the Principal does hereby appoint the Agent as their true and lawful attorney-in-fact to act in the Principal's name, place, and stead in any way which the Principal themselves could do, if personally present, with respect to the following matters to the extent allowed by law:

- Real Property Transactions

- Tangible Personal Property Transactions

- Stock and Bond Transactions

- Commodity and Option Transactions

- Banking and Other Financial Institution Transactions

- Business Operating Transactions

- Insurance and Annuity Transactions

- Estate, Trust, and Other Beneficiary Transactions

- Claims and Litigation

- Personal and Family Maintenance

- Benefits from Social Security, Medicare, Medicaid, or Other Governmental Programs, or Military Service

- Retirement Plan Transactions

- Tax Matters

This document is to be considered durable, meaning that the authority granted by the Principal shall not be affected by the Principal's subsequent disability or incapacity.

Furthermore, this document shall become effective immediately upon execution and shall continue to be effective until it is revoked by the Principal or until the Principal's death.

The Principal may revoke this Durable Power of Attorney at any time and in any manner communicated to the Agent or to any third party dealing with the Agent. Revocation is effective upon receipt of notice by the Agent.

This Durable Power of Attorney shall be governed by the laws of the State of ________________________.

IN WITNESS WHEREOF, the Principal has duly executed this Durable Power of Attorney on the date first written above.

Principal's Signature

______________________________________

Name: ________________________________

Date: __________________________________

Agent's Signature

______________________________________

Name: ________________________________

Date: __________________________________

State of ________________________

County of ______________________

ACKNOWLEDGMENT

This document was acknowledged before me on ____________(date) by _________________________(name of Principal).

______________________________________

(Seal) Signature of Notary Public

My commission expires: ________________

PDF Form Details

| Fact Name | Detail |

|---|---|

| Purpose | Allows an individual to grant another person the authority to make decisions regarding finance and property on their behalf. |

| Duration | Remains in effect even if the principal becomes incapacitated, unless stated otherwise. |

| Revocation | Can be revoked by the principal at any time as long as they are mentally competent. |

| State Specific | Each state has its own form and requirements; it's imperative to use the correct state-specific form. |

| Governing Laws | Varies by state, but generally governed by the state’s power of attorney statutes. |

| Capacity to Sign | The principal must be mentally competent at the time of signing to understand the effects of the document. |

How to Write Durable Power of Attorney

Upon deciding to establish a Durable Power of Attorney, you're taking a proactive step to ensure your affairs are handled by someone you trust, even if you become unable to make decisions for yourself. This form grants a person of your choice the legal authority to act on your behalf concerning financial, legal, and health decisions, among others. Filling out this document accurately is crucial for it to be valid and to reflect your wishes properly. Here are the steps you need to follow:

- Choose a trusted individual to serve as your Agent (sometimes referred to as an Attorney-in-Fact). This person will make decisions on your behalf, so select someone reliable and with good judgment.

- Gather all necessary information, including your full legal name and address, the Agent's full legal name and address, and specifics about the powers you wish to grant.

- Specify the powers being granted in the form. You can choose to grant broad authority or limit the powers to specific actions or time frames, depending on your needs.

- Determine whether the power of attorney is immediate or springs into effect upon a certain event, such as the principal’s incapacity. Make your intentions clear in the document.

- Check your state's requirements for witnesses or notarization. Many states require the Durable Power of Attorney to be notarized or signed in front of witnesses to be legally binding.

- Sign and date the form in the presence of a notary and/or the required witnesses, depending on your state's laws.

- Provide a copy to your Agent and any institutions or individuals that may deal with the Agent under the authority of your Durable Power of Attorney, such as banks or doctors.

Once your Durable Power of Attorney is properly filled out and signed, your Agent will have the permission needed to act on your behalf according to the terms you've set. It's a powerful document that can ensure your affairs are handled as you wish, even if you're not able to manage them yourself. Remember, laws regarding Durable Power of Attorney vary by state, so consulting with a legal professional can provide valuable guidance and peace of mind.

Get Answers on Durable Power of Attorney

What is a Durable Power of Attorney?

A Durable Power of Attorney is a legal document that grants someone you choose the authority to make decisions on your behalf in the event you're unable to do so due to incapacity or disability. Unlike a standard Power of Attorney, it remains in effect even if you become mentally incapacitated and unable to make decisions for yourself.

How does a Durable Power of Attorney differ from a General Power of Attorney?

The main difference lies in the effect of the document after the principal (the person making the Power of Attorney) becomes incapacitated. A General Power of Attorney automatically terminates if the principal becomes incapacitated. In contrast, a Durable Power of Attorney is specifically designed to survive the incapacity or disability of the principal, allowing the agent to continue making decisions on the principal's behalf.

Who should I choose as my agent in a Durable Power of Attorney?

Choosing an agent is a significant decision. This person will have the authority to make important decisions on your behalf, so it's crucial to select someone you trust implicitly. Consider their ability to handle financial and medical decisions wisely and in your best interest. Family members are commonly chosen, but friends or professional advisors can also serve as agents.

Can I revoke or change my Durable Power of Attorney?

Yes, as long as you are still mentally competent, you can revoke or change your Durable Power of Attorney at any time. To do so, you should provide written notice to your current agent and any institutions or parties they have interacted with on your behalf. It's also advised to execute a new document if making changes to ensure all your wishes are up-to-date and clearly laid out.

Is a Durable Power of Attorney effective immediately upon signing?

This depends on how the document is drafted. Some Durable Powers of Attorney are designed to take effect immediately upon signing, while others include "springing" provisions, meaning they only become effective upon the occurrence of a specified event, typically the incapacity of the principal. It's essential to clearly specify your preference in the document.

Common mistakes

One common mistake made when filling out the Durable Power of Attorney (DPOA) form is not specifying the powers granted clearly enough. Individuals often use broad language, thinking it will cover any situation, but this can lead to ambiguity and legal challenges. It is crucial to detail the specific tasks or decisions the agent is authorized to undertake, whether they involve managing investments, selling property, or handling day-to-day finances. By being precise, the individual ensures that their wishes are accurately reflected and can be acted upon without delay or confusion.

Another error frequently encountered is not choosing the right agent. The role of an agent under a DPOA is pivotal, and selecting someone who is both trustworthy and capable of handling financial matters is essential. Sometimes, people opt for family members out of obligation or sentiment, without considering if they have the requisite skills or the time to dedicate to these responsibilities. It's important to assess the potential agent's competence, willingness, and ability to perform the duties required, ensuring they align with the individual's best interests.

A further mistake is neglecting to include a successor agent in the DPOA. Life is unpredictable, and the initially appointed agent may become unable or unwilling to serve due to various reasons such as illness, death, or a change in relationship with the principal. Without naming a successor, the document could become ineffective, leaving the principal's affairs in limbo. Designating an alternative ensures continuity in the management of the principal's affairs without the need for court intervention.

Additionally, not discussing the contents of the DPOA with the appointed agent ahead of time is a misstep that can lead to complications. The agent needs to have a clear understanding of their duties and the principal’s expectations. Surprising someone with the responsibilities of acting as an agent after the document goes into effect can result in refusal or mismanagement. Transparently discussing the roles and expectations can facilitate a smoother transition and implementation of the DPOA when it becomes necessary.

Last but not least, failing to review and update the DPOA periodically is a significant oversight. Changes in relationships, the financial landscape, and the law can render an older DPOA ineffective or less suitable. Regularly reassessing the document ensures that it reflects the current wishes of the individual and is in compliance with the latest legal requirements. Amendments might be necessary to address new assets, replace an agent, or adjust the scope of authority granted.

Documents used along the form

When preparing for future legal and financial decisions, a Durable Power of Attorney is a crucial document that allows someone to act on your behalf. However, to ensure comprehensive planning, several other documents are often used in conjunction with it. Each serves a unique purpose, complementing the Durable Power of Attorney and providing a well-rounded approach to estate and healthcare planning. Here’s a look at some of these key documents.

- Living Will: This document outlines your wishes regarding medical treatment if you become unable to communicate them yourself. It's essential for end-of-life care decisions.

- Medical Power of Attorney: Similar to the Durable Power of Attorney but specifically for health care decisions. It appoints someone to make medical decisions on your behalf if you're incapacitated.

- Last Will and Testament: Specifies how you want your assets distributed after your death. It also names an executor to manage the estate process.

- Revocable Living Trust: Allows you to maintain control over your assets while you're alive but have them transferred to designated beneficiaries without going through probate upon your death.

- Health Insurance Portability and Accountability Act (HIPAA) Authorization: Permits designated individuals to access your medical records, which is crucial for making informed health care decisions on your behalf.

- Declaration of Guardian: Lets you choose who will become your guardian if you become incapacitated before you die and a court decides one is needed.

- Advance Health Care Directive: Combines a Living Will and a Medical Power of Attorney, detailing your healthcare preferences and appointing someone to make decisions for you.

- Letter of Intent: A non-binding document that provides guidance and personal instructions to your executor or a trusted individual. It can cover anything from your funeral wishes to how you'd like certain personal belongings to be handled.

- Financial Information Sheet: While not a legal document, it's incredibly useful. It lists all your financial accounts, insurance policies, and contact information for advisors, making it easier for your Power of Attorney to act on your behalf.

- Trust Certification: For those with a trust, this document proves the existence of your trust and outlines the trustees' powers without revealing specific assets or beneficiaries' information.

Estate planning involves more than just preparing for the end of life; it's about making sure your wishes are respected and your loved ones are cared for, even when you can't make those decisions yourself. Each document plays a vital role in this comprehensive approach, working hand-in-hand with a Durable Power of Attorney to create a strong legal safety net for the future.

Similar forms

The Living Will shares similarities with the Durable Power of Attorney, particularly in the way both documents allow individuals to make decisions about their future care. A Living Will specifically outlines one’s preferences regarding medical treatment if they become unable to communicate their wishes due to a severe health condition. Similar to a Durable Power of Attorney for health care decisions, this document ensures that the individual's preferences are known and respected, even if they cannot vocalize them.

A Health Care Proxy is another document akin to the Durable Power of Attorney; it allows an individual to appoint someone else to make health care decisions on their behalf if they are unable to do so. The primary similarity lies in the delegation of decision-making power. However, a Health Care Proxy is exclusively focused on health care decisions, whereas a Durable Power of Attorney can also encompass financial and other personal matters.

The General Power of Attorney form bears resemblance to the Durable Power of Attorney in that it grants someone else the authority to make decisions or take actions on one’s behalf. The key difference is in the "durable" aspect; a General Power of Attorney typically becomes invalid if the person becomes incapacitated. The Durable Power of Attorney, on the other hand, remains in effect even if the individual can no longer make decisions for themselves, providing a continuous mechanism for managing one’s affairs.

Trust documents, often used in estate planning, share a common purpose with the Durable Power of Attorney by allowing individuals to control how their assets are managed and distributed. A living trust, for example, can appoint a trustee to manage the grantor's assets, a role somewhat similar to how an agent in a Durable Power of Attorney might manage someone’s finances. Both tools are crafted to ensure that personal matters and assets are handled according to the individual’s wishes.

The Advance Directive is another document closely related to the Durable Power of Attorney, particularly a version that covers health care decisions. This document combines elements of a Living Will and a Health Care Proxy, outlining both a person’s general wishes about life-sustaining treatment and appointing someone to make medical decisions on their behalf. The connection lies in their shared goal: to ensure that one’s personal directives are followed in situations where they might not be able to express their wishes due to incapacity or severe illness.

Dos and Don'ts

Filling out a Durable Power of Attorney (DPOA) form is an important step in planning for future financial and health decisions. It allows you to appoint someone to act on your behalf if you become unable to manage your affairs. To ensure the process goes smoothly and your intentions are clearly communicated, there are several best practices to follow, as well as common pitfalls to avoid.

Things You Should Do

- Fully understand the powers being granted. Before you fill out the form, make sure you comprehend the extent of authority you are giving to your agent. This may include making financial decisions, managing real estate, or addressing medical concerns.

- Choose an agent you trust implicitly. This person will have significant control over your affairs, so it’s crucial to select someone who is not only trustworthy but also capable of making decisions that align with your values and wishes.

- Be specific about the powers granted. If there are certain decisions or actions you do not want your agent to make on your behalf, clearly detail these in the document. It’s better to be too specific than too vague.

- Sign in the presence of a notary. To ensure your DPOA is legally binding, sign the document in front of a notary public. This step verifies your identity and confirms that you are signing the document of your own free will.

Things You Shouldn't Do

- Don’t leave any sections blank. If a section does not apply to your situation, mark it as N/A (not applicable) rather than leaving it blank. This helps to confirm you didn’t overlook anything by mistake.

- Avoid choosing an agent based solely on relationship. Just because someone is a close family member or friend does not necessarily mean they are the best choice for managing your affairs. Objectivity, reliability, and trustworthiness are key traits your agent should possess.

- Don’t forget to discuss your wishes with your agent. It's essential that the person you appoint understands your preferences and desires. This conversation can guide them in making decisions that reflect your wishes.

- Never use a generic form without reviewing state requirements. Durable Power of Attorney laws can vary by state. Using a form that does not meet your state’s specific requirements could render the document invalid.

Misconceptions

When it comes to planning for the future, understanding the ins and outs of legal documents is crucial. The Durable Power of Attorney (DPOA) is a powerful tool that authorizes someone to act on your behalf in financial matters if you're unable to do so. However, there are common misconceptions that can lead to confusion and missteps. Let's clarify some of these misunderstandings.

- It gives complete control over all aspects of your life. Many believe that a DPOA grants the agent complete control over the principal's affairs. In reality, its scope is limited to financial matters and does not extend to personal decisions like healthcare, which would require a separate healthcare proxy or power of attorney.

- It is effective immediately upon signing. While this can be true, a DPOA can also be structured to come into effect only when the principal becomes incapacitated, known as a "springing" DPOA. The conditions under which it becomes active should be clearly defined in the document itself.

- It remains valid after death. A common misconception is that a DPOA continues to be effective after the principal's death. In fact, its authority ends at the moment of the principal's death, at which point the executor of the estate, as specified in the will, takes over.

- Only a family member can be appointed as an agent. Some believe the agent must be a family member. However, the principal has the freedom to choose anyone they trust, whether they are related or not. This could be a close friend or a trusted advisor.

- It cannot be revoked or changed. People often think once a DPOA is created, it is set in stone. The truth is, as long as the principal has the capacity, they can revoke or amend their DPOA at any time to reflect changes in their preferences or circumstances.

- There is a universal form that covers all situations. Another common belief is that there is a single, standardized DPOA form that is universally accepted. However, legal requirements vary by state, and it is important to use a form that complies with local laws and suits the principal's specific needs.

Understanding these misconceptions can alleviate concerns and prevent potential legal pitfalls. It's crucial to approach the creation and use of a Durable Power of Attorney with clear knowledge and accurate information. For personalized advice, consulting with a legal professional familiar with local laws and personal circumstances can provide valuable guidance.

Key takeaways

Filling out and using a Durable Power of Attorney form is an essential step in planning for future financial management and decision-making, especially in unexpected situations where you might be unable to make decisions yourself. Understanding the key aspects of this legal document can empower individuals to make informed choices regarding their financial and legal affairs. Here are five key takeaways regarding the Durable Power of Attorney form:

- Choose an Agent Wisely: The decision of whom to appoint as your agent, the individual granted the authority to make decisions on your behalf, should not be taken lightly. Ideally, this person should be someone you trust implicitly, such as a close family member or a trusted friend, who will act in your best interest. This individual should be reliable, have good judgment, and ideally, be financially savvy.

- The Scope of Authority is Customizable: The Durable Power of Attorney can be tailored to meet your specific needs. You can grant broad authority, allowing your agent to make all financial decisions for you, or you can limit their authority to certain types of decisions. It’s crucial to carefully consider what powers you wish to grant to ensure they align with your preferences and circumstances.

- Durability is Key for Long-term Planning: A distinctive feature of the Durable Power of Attorney is its resilience in the face of the principal's incapacity. Unlike a general Power of Attorney, which becomes ineffective if the principal becomes incapacitated, a Durable Power of Attorney remains in effect, ensuring that your agent can still act on your behalf, which is particularly valuable in long-term planning and unforeseen situations like illness or accidents.

- It Requires Proper Execution: For a Durable Power of Attorney to be legally valid, it must meet specific state requirements regarding its execution. These typically include being signed by the principal in the presence of a notary and possibly witnesses, depending on the state’s laws. Proper execution is crucial to ensure that the document is recognized by financial institutions, courts, and other entities.

- Revocation Is Possible: Circumstances change, and it may become necessary to revoke a Durable Power of Attorney. If you decide to revoke the document, it is essential to do so in writing and to inform any financial institutions and individuals that were aware of the initial Power of Attorney. Additionally, destroying all copies of the revoked document is a prudent step to prevent confusion or unauthorized use in the future.

By understanding these key takeaways, individuals can approach the creation and use of a Durable Power of Attorney with greater confidence and clarity, ensuring that their affairs are managed according to their wishes, even in unexpected circumstances.

Consider More Types of Durable Power of Attorney Forms

How to Write a Notarized Letter for a Vehicle - It's an essential form for those unable to personally deal with their vehicle transactions, delegating authority to a trusted agent.

Power of Attorney Document - Empowers your chosen representative to negotiate, sign, and execute documents related to real estate, ensuring your best interests are maintained.

Revocation of Power of Attorney California - It's a key step in the process of changing one’s legal representatives or adjusting the scope of their authority.