Free Power of Attorney Form for California

Navigating the complexities of legal documentation can be daunting, especially when it concerns the management of one’s personal affairs during unforeseen circumstances. A California Power of Attorney (POA) form is a critical tool that enables individuals to designate another person, known as an agent or attorney-in-fact, to make decisions on their behalf. This arrangement can cover a wide range of responsibilities, from financial matters to healthcare decisions. The form itself must comply with California state laws to ensure its validity and has specific requirements regarding its execution, such as the need for notarization or witness signatures. Different types of POA cater to various needs; for instance, a Durable Power of Attorney remains in effect even if the individual becomes incapacitated. Selecting the correct form, understanding the scope of authority granted, and knowing when and how it can be revoked are paramount considerations for anyone looking to establish a POA in California. This framework empowers individuals, providing peace of mind and security in knowing that their affairs can be appropriately managed according to their wishes.

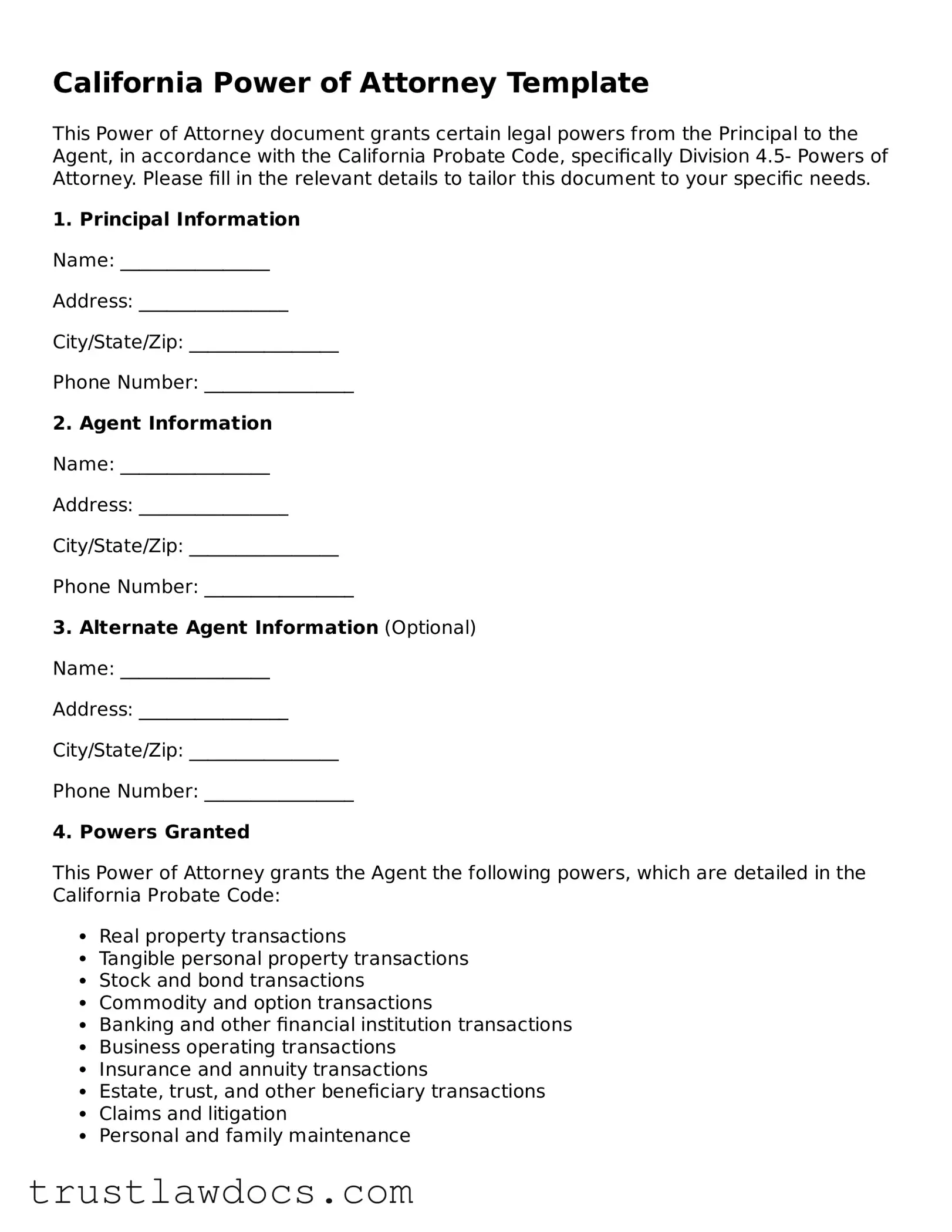

Form Example

California Power of Attorney Template

This Power of Attorney document grants certain legal powers from the Principal to the Agent, in accordance with the California Probate Code, specifically Division 4.5- Powers of Attorney. Please fill in the relevant details to tailor this document to your specific needs.

1. Principal Information

Name: ________________

Address: ________________

City/State/Zip: ________________

Phone Number: ________________

2. Agent Information

Name: ________________

Address: ________________

City/State/Zip: ________________

Phone Number: ________________

3. Alternate Agent Information (Optional)

Name: ________________

Address: ________________

City/State/Zip: ________________

Phone Number: ________________

4. Powers Granted

This Power of Attorney grants the Agent the following powers, which are detailed in the California Probate Code:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

5. Special Instructions

Provide any specific limitations or special instructions for the Agent:

______________________________________________________

______________________________________________________

6. Duration

This Power of Attorney is (check one):

- ____ Durable, remaining in effect in the event of the Principal's incapacity.

- ____ Non-Durable, terminating if the Principal becomes incapacitated.

7. Signature of Principal

By signing below, the Principal agrees to the terms of this Power of Attorney.

Date: ________________

Signature: ________________

8. Acknowledgment

This document was acknowledged before me on (date) ________________ by (name of Principal) ________________, who is personally known to me or has provided ________________ as identification.

Date: ________________

Notary Public: ________________

My Commission Expires: ________________

PDF Form Details

| Fact | Description |

|---|---|

| Governing Law | The California Power of Attorney (POA) forms are governed by the California Probate Code, Sections 4000-4545. |

| Types of POA | California recognizes several types of POA, including General, Limited, Durable, and Health Care POA. |

| Durability | A POA is considered durable if it remains in effect even if the principal becomes incapacitated, as specified in California Probate Code Sections 4000-4545. |

| Execution Requirements | To be legally valid, most California POAs must be signed by the principal and two witnesses or acknowledged before a notary public. |

| Revocation | The principal can revoke a POA at any time, provided they are mentally competent, through a written revocation notice. |

| Agent's Authority | The agent, also known as an attorney-in-fact, is granted the authority to act on behalf of the principal, but cannot make decisions after the principal's death unless specifically allowed. |

| Health Care POA | A Health Care POA allows the agent to make medical decisions for the principal, in accordance with California's Advance Health Care Directive form. |

| Capacity Requirements | The principal must be of sound mind and at least 18 years old to execute a POA in California. |

| Power to Sell Real Estate | To grant an agent authority to sell real estate, the POA must be specific and comply with additional recording requirements in some cases. |

| Agent's Liability | An agent acting under a POA in California is expected to act in the principal's best interest and can be held liable for acting outside the scope of their authority. |

How to Write California Power of Attorney

Preparing for the unexpected by setting up a Power of Attorney (POA) in California is a proactive step to ensure your affairs are managed according to your wishes, even when you're not able to do so yourself. This document enables you to appoint someone you trust to handle your financial, legal, or health-related decisions if you're incapacitated or unable to do so for any reason. The process might seem daunting at first, but by following a few clear steps, you can complete the form effectively and secure peace of mind.

- Start by obtaining the most current California Power of Attorney form. Ensure it meets the state's legal requirements and is the correct type for your specific needs (e.g., financial, medical).

- Read through the entire form first to familiarize yourself with its sections and the type of information required.

- Fill in your full legal name and address where indicated to identify yourself as the principal—the person granting the power.

- Select your agent (also known as an attorney-in-fact), the individual you trust to act on your behalf. Write their full legal name and contact information in the designated space.

- If desired, appoint a successor agent. This is someone who will take over if your first choice is unable or unwilling to serve. Provide their full legal name and contact details as well.

- Specify the powers you are granting. California POA forms may include various options, such as handling financial matters, making healthcare decisions, or dealing with real estate. Be clear and specific about what your agent can and cannot do.

- Discuss the POA with your chosen agent(s) to ensure they understand their responsibilities and agree to take on the role.

- Have the form notarized, if required by California law. This step typically involves signing the document in front of a notary public who then also signs, verifying the identities of the signer(s).

- In some cases, witness signatures might also be necessary, depending on the type of POA and California's current legal requirements. If so, ensure to have the appropriate number of witnesses present during the signing, and have them sign the form as well.

- Finally, store the completed form in a safe but accessible place. Inform your agent(s) where it is kept, and consider giving copies to other trusted individuals, such as a family lawyer or a close relative.

By carefully following these steps, you'll have a valid California Power of Attorney in place. It's a straightforward process that grants you and your loved ones an extra layer of security. Remember, life can be unpredictable, but with a POA, you're prepared to face the uncertainties with confidence.

Get Answers on California Power of Attorney

What is a Power of Attorney form in California?

A Power of Attorney (POA) form in California is a legal document that allows one person, termed the principal, to designate another person, called the agent or attorney-in-fact, to make decisions and take actions on their behalf. This can include managing finances, real estate transactions, and other legal matters. The specifics of what the agent can do depend on the type of POA form and the powers granted within it.

How do I create a Power of Attorney form in California?

To create a Power of Attorney form in California, you need to complete a POA form that specifies who your agent will be and what powers they will have. It's crucial to use a form that complies with California law. Once filled out, the form must be signed in the presence of a notary public or two adult witnesses, depending on the type of power being granted. It's wise to consult with a lawyer to ensure the form meets all legal requirements and accurately reflects your wishes.

Who can serve as an agent under a Power of Attorney?

Almost any competent adult can serve as an agent under a Power of Attorney in California. However, it's important to choose someone you trust implicitly, as they will have significant control over your affairs. The agent has a legal duty to act in your best interest, known as a fiduciary duty, but choosing a responsible and trustworthy person can help prevent misuse of power.

Is a California Power of Attorney form effective immediately?

Whether a Power of Attorney becomes effective immediately or at a future time depends on how the document is drafted. You can choose to have it take effect as soon as it is signed (immediate effect) or upon the occurrence of a future event, like the principal’s incapacitation (springing effect). Be clear in the document about when you want the powers to start.

Can a Power of Attorney be revoked?

Yes, as long as the principal is mentally competent, they can revoke a Power of Attorney at any time. To do so, the principal should notify the agent in writing and, if the POA has been registered or shared with any institutions (like banks or the local land records office), these institutions should be notified as well. Destroying the original document and any copies can also prevent its future use.

Does a Power of Attorney need to be notarized in California?

For certain financial and real estate transactions, California law requires a Power of Attorney to be notarized to be considered valid. Notarization helps to verify the identity of the principal and protects against fraud. When in doubt, notarizing your Power of Attorney is a good practice and can help ensure it is accepted by institutions that require a notarized document.

What is the difference between a General and a Durable Power of Attorney?

A General Power of Attorney authorizes an agent to handle all aspects of the principal’s affairs until the principal becomes incapacitated, at which point the powers granted cease. A Durable Power of Attorney, on the other hand, remains in effect even if the principal becomes incapacitated, making it a more robust tool for planning for future incapacity.

How long does a Power of Attorney last in California?

The duration of a Power of Attorney in California can vary based on the type of POA and what is specified in the document. A Durable Power of Attorney can last until the principal's death or revocation by the principal, while a nondurable or general POA may end at incapacitation or a specified date. Always state the intended duration in the POA form to avoid ambiguity.

Can a Power of Attorney be used to make healthcare decisions?

For the agent to make healthcare decisions on behalf of the principal, a specific type of POA known as a Medical Power of Attorney or an Advance Health Care Directive is required in California. This document is tailored to healthcare decisions, allowing the agent to make choices about medical treatment according to the principal’s wishes.

Where should I keep my Power of Attorney document?

Keep your Power of Attorney document in a safe but accessible place. Inform your agent about where the document is stored. It’s also advisable to keep copies in locations where they may be needed, like with your lawyer, in a safe deposit box, or registered with financial institutions. Accessibility is key in emergencies or when the document needs to be produced quickly.

Common mistakes

When filling out the California Power of Attorney form, many people rush through the paperwork without fully understanding its significance. A common mistake is not specifying the powers granted clearly. This document gives someone else authority over your affairs, and vague language can lead to confusion or misuse. It's crucial to be explicit about what the agent can and cannot do.

Another frequent oversight is forgetting to specify a start and end date. Without clear dates, it can be challenging to determine when the agent's power begins and ends. This could lead to situations where the agent is acting on your behalf either before you intended or after you intended to revoke their authority.

Choosing the wrong agent is also a significant misstep. The person you appoint will have considerable power over your affairs, so it's essential to choose someone who is not only trustworthy but also capable of handling the responsibilities. Failure to choose the right person can lead to mismanagement of your affairs or even misuse of your assets.

Many people fail to have the form witnessed or notarized, as required under California law. This oversight can render the document legally invalid. Recognizing the legal formalities involved in the process ensures that the document holds up under scrutiny.

Not reviewing and updating the document regularly is another common error. Life changes, such as marriage, divorce, or the death of the named agent, can affect the relevance and effectiveness of the power of attorney. Regular review and necessary updates ensure that the document reflects your current wishes and circumstances.

Some individuals make the mistake of not discussing their wishes with the agent before appointing them. It's essential that the agent understands your expectations and is willing to act according to your instructions. Without this discussion, the agent may be unaware of your preferences or, worse, feel overwhelmed by the responsibilities thrust upon them.

There's also the issue of not considering a durable power of attorney for situations that involve long-term incapacity. A standard power of attorney may not suffice if you become unable to make decisions for yourself, as it typically ceases to be effective once you are incapacitated. A durable power of attorney remains in effect, providing continuous management of your affairs without court intervention.

Lastly, a notable mistake is using a generic form without customization. While standard forms provide a basis, every individual's situation is unique. Failing to tailor the document to fit specific needs and preferences can lead to inadequate representation of your interests. Customization ensures that the power of attorney aligns closely with your personal circumstances and goals.

Documents used along the form

When managing affairs through a California Power of Attorney form, several other documents are frequently required to ensure comprehensive authority and legal protection. These documents often complement the power of attorney by providing detailed instructions, specifying wishes regarding healthcare, and offering documentation that supports the agent’s authority in various situations. Understanding each document's purpose helps in creating a robust legal framework that fully supports an individual's needs.

- Advance Health Care Directive: This document allows a person (the principal) to delineate their healthcare preferences, including end-of-life care, in case they become unable to make decisions themselves. It can appoint a healthcare agent to make decisions on the principal’s behalf, complementing a Power of Attorney for healthcare decisions.

- Living Will: While often part of the Advance Health Care Directive in California, a living will specifically addresses end-of-life decisions, such as life support and pain management. It provides clear instructions to healthcare providers and family members about the principal’s wishes, ensuring they are honored.

- HIPAA Authorization Form: This form grants the agent access to the principal’s protected health information, crucial for making informed medical decisions. It ensures healthcare providers can legally share medical records with the appointed agent, aligning with federal privacy regulations.

- Revocation of Power of Attorney: This document is used to cancel a previously granted Power of Attorney. It is essential for situations where the principal decides to revoke the powers granted to an agent, whether due to a change in trust, relationship, or the appointed agent's ability to serve.

Together, these documents form a comprehensive legal toolkit that empowers individuals to plan for the future with confidence. By clearly specifying wishes and delegating authority, they work in conjunction with the Power of Attorney to ensure that personal, financial, and healthcare decisions are managed according to the principal’s directives. It is crucial for anyone considering these documents to understand their purpose and ensure they align with their legal and personal needs.

Similar forms

The California Power of Attorney form shares similarities with the Advanced Health Care Directive. This document, akin to the Power of Attorney, allows individuals to appoint someone to make decisions on their behalf. However, the scope is specifically for health care. It enables the appointed person, often referred to as an agent, to make medical decisions should the individual become incapacitated. Both documents are predicated on trust and the principle of acting in the best interest of the individual who is granting the authority.

Comparable to the California Power of Attorney is the Financial Power of Attorney document. This financial counterpart specifically authorizes an agent to handle financial matters for another person. It can include a broad range of activities, from paying bills and managing investments to buying or selling real estate. Like the general Power of Attorney, it can be designed to take effect immediately or upon the occurrence of a future event, usually the incapacity of the principal.

The Living Trust document also bears resemblance to the California Power of Attorney. It allows an individual, known as the trustor, to transfer property into a trust during their lifetime. A trustee is then responsible for managing the property for the benefit of the designated beneficiaries. While a Living Trust mainly focuses on asset management and avoidance of probate, similar to a Power of Attorney, it involves designating someone else to manage your affairs. However, a key difference lies in the Living Trust's focus on asset distribution after the trustor's death.

Similarly, the Durable Power of Attorney is related to the standard Power of Attorney but with a crucial distinction. The Durable Power of Attorney remains in effect even if the grantor becomes mentally incapacitated. This aspect makes it significantly powerful and ensures continuous management of the grantor's affairs without court intervention, paralleling the general aim of the ordinary Power of Attorney to allow someone else to act in your stead.

The Guardianship Agreement shares objectives with the California Power of Attorney, despite its distinct application. It is a legal mechanism used to appoint someone responsible for the care and wellbeing of another person, often a minor or an adult with disabilities. This document permits the guardian to make decisions affecting the ward's personal, healthcare, and sometimes financial matters, mirroring the Power of Attorney's purpose of delegating decision-making authority.

Lastly, the Limited Power of Attorney document is a more specific version of the general Power of Attorney. It restricts the agent's power to a particular task or for a set duration. Similar to the broader Power of Attorney forms, it grants someone else the legal authority to act on your behalf, but it does so with explicit limitations. This tailored approach allows for a precise delegation of authority, which can be vital in situations requiring specialized handling or transactions.

Dos and Don'ts

When filling out a California Power of Attorney (POA) form, it is essential to approach the process with care and attention to detail. To ensure the form is completed correctly and your intentions are clearly communicated, follow these guidelines:

- Do read the entire form before starting to fill it out to understand all the sections and requirements.

- Don't rush through the process. Take your time to consider your choices, especially when it comes to selecting your agent.

- Do choose an agent who is trustworthy and capable of handling the responsibilities you are delegating.

- Don't neglect to specify the powers you are granting. Be clear about what your agent can and cannot do on your behalf.

- Do consider adding a successor agent. If your first choice is unable or unwilling to serve, having a backup ensures your affairs are still managed.

- Don't leave any sections incomplete. If a section does not apply, indicate this by writing “N/A” (not applicable).

- Do review the form with your agent to ensure they understand their duties and are willing to take on the role.

- Don't forget to sign and date the form in the presence of a notary public or the required witnesses, according to California law.

By adhering to these dos and don'ts, you can help secure your interests and ensure that your California Power of Attorney form accurately reflects your desires and legal requirements.

Misconceptions

When it comes to setting up a Power of Attorney (POA) in California, there are a lot of myths that can confuse people. Understanding these misconceptions can help you make informed decisions. Here are eight common misunderstandings:

- All POAs are the same. In reality, California offers several types of POAs, such as financial, healthcare, or limited ones, each serving different purposes.

- Creating a POA means losing all control. Many believe that once you grant someone else authority through a POA, you lose your rights. That's not true. You can set limits on the agent's power and revoke the POA at any time as long as you're competent.

- A POA grants absolute power. Although it can grant broad authority, California law allows you to specify what your agent can and cannot do, providing a way to tailor the POA to your needs.

- A POA is complicated and expensive to set up. While it's wise to consult with a lawyer to ensure your POA meets your specific needs and legal requirements, the process can be straightforward and relatively low-cost, especially compared to the potential costs of not having one when needed.

- You only need a POA if you're elderly. Accidents or illnesses can happen at any age, making a POA a good idea for adults of all ages to ensure their affairs can be handled if they're unable to do so themselves.

- A POA survives death. A common misconception is that a POA remains in effect after the principal's death. In reality, it terminates upon the principal's death, and the executor of the will then takes over.

- Marriage automatically grants a spouse POA rights. Being married does provide some legal rights, but it does not automatically grant a spouse the authority to act as a POA. Formal documentation is still required to establish this legal relationship.

- Only family members can be named as agents. While many choose a family member to serve as their POA, you can select anyone you trust, including friends or professionals such as attorneys or accountants.

Key takeaways

Navigating the process of establishing a Power of Attorney (POA) in California is an essential task that grants someone else the authority to act on your behalf in legal or financial matters. This document, a cornerstone of proactive planning, ensures your affairs can be managed according to your wishes, even if you're unable to make decisions yourself. To assist you in this process, here are ten key takeaways that you should consider:

- Understanding the Types: California recognizes several types of Power of Attorney documents, including General, Limited, and Durable POAs. Each serves a unique purpose, from broad, all-encompassing authority to specific, one-time permissions.

- Choosing Your Agent Wisely: The person you designate as your agent (or attorney-in-fact) holds significant responsibility. It's crucial to select someone who is not only trustworthy but also capable of handling the tasks required with your best interests in mind.

- Specify Powers with Precision: Clearly outlining the powers your agent can exercise is essential. Whether it's managing your financial portfolio, making healthcare decisions, or handling real estate transactions, specificity prevents confusion and abuse of power.

- Durability Is Key for Longevity: A standard POA ceases to be effective if you become incapacitated. To ensure your agent can still act on your behalf if you're unable to make decisions, opt for a Durable Power of Attorney. This type remains in effect even if you become mentally incompetent.

- Signing Requirements: California law mandates that your Power of Attorney form be signed in the presence of a notary public or two adult witnesses to be legally valid. Each option has specific requirements regarding who can serve as a witness or notary, so it's important to understand these rules fully.

- Revocation Process: If you change your mind, a Power of Attorney can be revoked at any time, as long as you're mentally competent. This revocation must be done in writing, and all parties that were given the original POA should be notified.

- Annual Review: Life changes such as marriage, divorce, relocation, or changes in your financial situation warrant a review of your Power of Attorney. An annual review ensures that your document reflects your current wishes and circumstances.

- Springing Powers: Consider if you want your POA to be "springing," which means it only takes effect under certain conditions, such as if you become incapacitated, as certified by one or more physicians.

- Limitations and Protections: While a POA grants considerable powers, California law also provides protections against abuse. Familiarizing yourself with these can help you craft a document that protects your interests.

- Seek Professional Advice: The intricacies of Power of Attorney documents and California law highlight the importance of consulting with a legal professional. They can provide valuable insight, ensuring your POA fulfills your needs and adheres to all legal standards.

In conclusion, the preparation and use of a Power of Attorney in California are not just about delegating authority; it's a strategic step in managing your personal and financial affairs responsibly. By paying close attention to these ten key takeaways, you can embark on this process with confidence, knowing your rights and interests are well-protected.

Popular Power of Attorney State Forms

How to Get a Power of Attorney in Texas - The form requires witnesses in some states for additional verification.

Financial and Medical Power of Attorney Forms - It’s a cornerstone of managing your personal and financial well-being proactively.

Does a Power of Attorney Need to Be Notarized in Florida - You can choose a family member, friend, or professional to manage your tasks when you can't.