Official Power of Attorney Document

Empowering someone to act on your behalf in legal, financial, or health matters is a significant step that requires trust and understanding. The Power of Attorney form serves as the legal document that facilitates this process, laying the foundation for another to make crucial decisions if you are unable to do so yourself. It covers various scenarios, from managing day-to-day finances to making critical healthcare decisions, ensuring that your affairs are handled according to your wishes. The form's versatility allows it to be customized for different needs, whether for a temporary period or under more permanent circumstances. Understanding the implications, requirements, and different types of Power of Attorney forms is essential for anyone considering this legal tool. By doing so, individuals can safeguard their interests and enjoy peace of mind, knowing their affairs are in capable hands.

Power of Attorney Document Types

Form Example

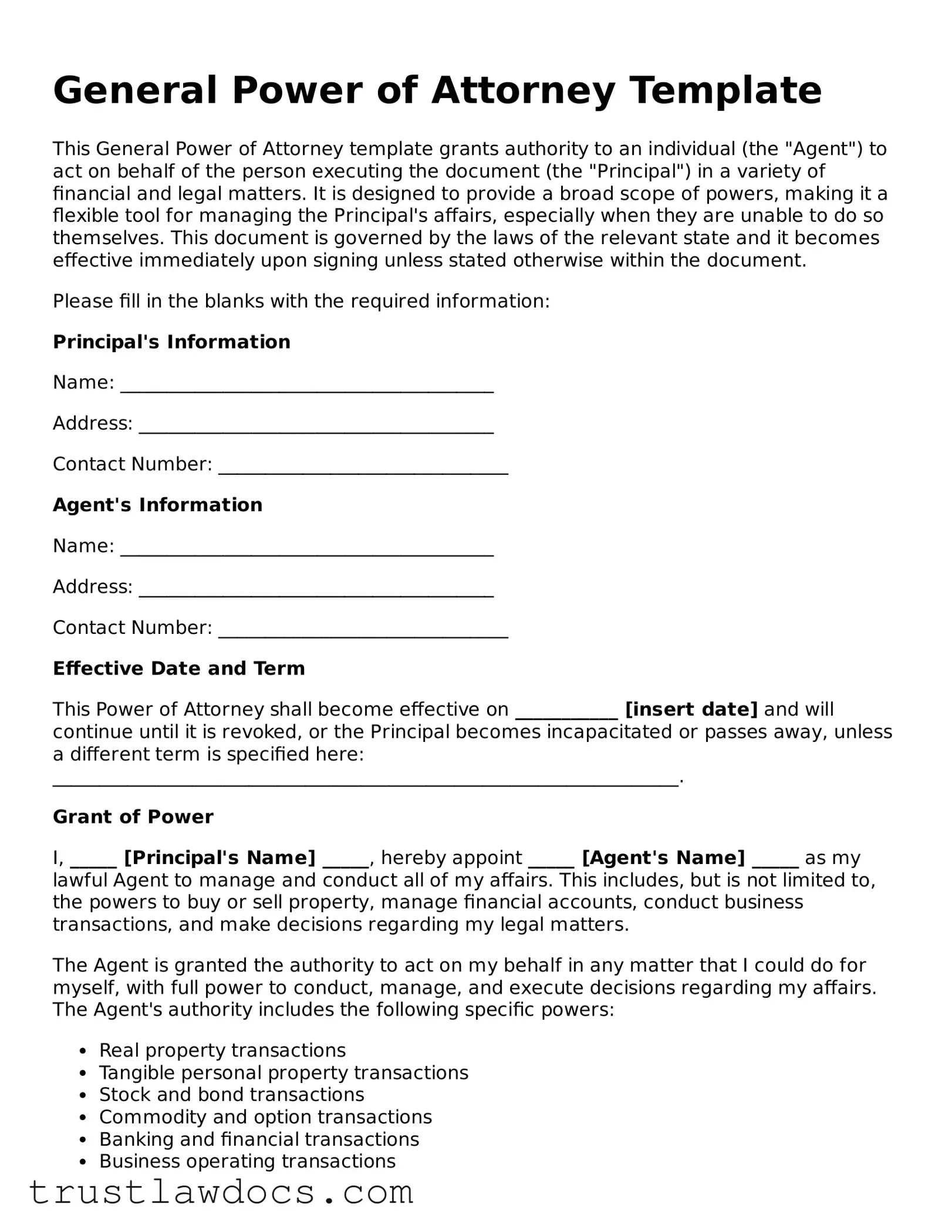

General Power of Attorney Template

This General Power of Attorney template grants authority to an individual (the "Agent") to act on behalf of the person executing the document (the "Principal") in a variety of financial and legal matters. It is designed to provide a broad scope of powers, making it a flexible tool for managing the Principal's affairs, especially when they are unable to do so themselves. This document is governed by the laws of the relevant state and it becomes effective immediately upon signing unless stated otherwise within the document.

Please fill in the blanks with the required information:

Principal's Information

Name: ________________________________________

Address: ______________________________________

Contact Number: _______________________________

Agent's Information

Name: ________________________________________

Address: ______________________________________

Contact Number: _______________________________

Effective Date and Term

This Power of Attorney shall become effective on ___________ [insert date] and will continue until it is revoked, or the Principal becomes incapacitated or passes away, unless a different term is specified here: ___________________________________________________________________.

Grant of Power

I, _____ [Principal's Name] _____, hereby appoint _____ [Agent's Name] _____ as my lawful Agent to manage and conduct all of my affairs. This includes, but is not limited to, the powers to buy or sell property, manage financial accounts, conduct business transactions, and make decisions regarding my legal matters.

The Agent is granted the authority to act on my behalf in any matter that I could do for myself, with full power to conduct, manage, and execute decisions regarding my affairs. The Agent's authority includes the following specific powers:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and financial transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or civil or military service

- Retirement plan transactions

- Tax matters

Limitations

This Power of Attorney does not grant the Agent the power to make health care decisions for the Principal. Separate legal documentation is required to authorize medical decisions on behalf of the Principal.

Principal's Signature

_________________________________________

Date: _____________________________________

Agent's Signature

_________________________________________

Date: _____________________________________

Witnesses' Signatures (if required by state law)

Witness 1 Name: ___________________________

Witness 1 Signature: ________________________

Date: _____________________________________

Witness 2 Name: ___________________________

Witness 2 Signature: ________________________

Date: _____________________________________

This document is intended to comply with the relevant state laws; however, it may not serve as a substitute for legal advice or address specific legal issues that arise. Always consult with a qualified attorney to ensure your Power of Attorney meets all legal requirements of your state and is tailored to your specific needs.

PDF Form Details

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that grants one person (the agent) the authority to act on behalf of another person (the principal). |

| Types of POA | There are various types, including General, Durable, Special or Limited, Health Care, and Springing Powers of Attorney, each serving different purposes. |

| Durable vs. Non-Durable | A Durable POA remains effective even if the principal becomes incapacitated, whereas a Non-Durable POA becomes void in case of the principal's incapacity. |

| State-Specific Laws | Each state has its own laws governing the creation and use of POAs. It's vital to use a state-specific form to ensure compliance and effectiveness. |

| Creation Process | To create a valid POA, the principal must be of sound mind, the document must be signed and notarized, and may also need to be witnessed, depending on state laws. |

| Revocation | The principal can revoke a POA at any time, as long as they are mentally competent, through a written notice to the agent and any third parties involved. |

How to Write Power of Attorney

Filling out a Power of Attorney (POA) form is a significant step in managing your affairs, making sure someone you trust is legally permitted to make decisions on your behalf, should you become unable to do so yourself. Finding the right form, understanding its components, and completing it accurately can seem daunting, but it’s a manageable process when broken down into clear steps. Next, we'll guide you through these steps, aiming to make the procedure as straightforward as possible.

- Gather Required Information: Start by collecting all necessary information, including your full legal name, address, and the details of the person (agent) you are appointing. You'll also need specific details about the powers you are granting, such as financial, legal, or health-related decisions.

- Select the Right Form: Ensure you have the correct POA form that matches your needs - financial, healthcare, or general. Different states have different requirements, so be sure the form is specifically valid in your state.

- Read Instructions Carefully: Before filling out the form, read any provided instructions thoroughly to familiarize yourself with the process and the specific requirements of the form, such as signing in the presence of witnesses or a notary public.

- Fill in Your Details: Clearly write or type your personal information in the designated sections, including your full name, date of birth, and full address.

- Detail the Agent’s Powers: Clearly specify the powers you are delegating. Be as detailed as necessary to ensure your wishes are accurately reflected. For instance, if you grant financial powers, specify whether your agent can open new accounts or only manage existing ones.

- Appoint a Successor Agent (Optional): You may wish to appoint a successor agent who can take over if your primary agent is unable or unwilling to serve. This step is optional but recommended for additional security.

- Sign the Form: Your signature makes the document legally binding. Depending on your state’s law, you may need to sign the POA form in front of a notary or witnesses. Ensure you follow these requirements to the letter.

- Store Your POA Safely: Once signed, store your POA form in a safe, easily accessible place. Inform your agent where the document is kept and consider providing copies to trusted family members or advisors.

Completing a Power of Attorney form is a practical step towards safeguarding your future. By delegating decision-making power to a trusted individual, you can have peace of mind knowing that your affairs are in good hands, even in circumstances where you might not be able to manage them yourself. Remember, the effectiveness of a POA depends on the quality of the form and the accuracy of the information provided, so take care to ensure everything is in order.

Get Answers on Power of Attorney

What is a Power of Attorney (POA)?

A Power of Attorney is a legal document that grants one person, known as the agent or attorney-in-fact, the authority to make decisions and act on behalf of another person, known as the principal. This authority can cover a range of actions, including financial transactions, legal matters, and medical decisions, depending on the type of POA established.

Are there different types of POA? If so, what are they?

Yes, there are several types of Power of Attorney documents, each designed for specific purposes. The most common types include:

- General Power of Attorney: Grants broad powers to the agent over various affairs of the principal.

- Durable Power of Attorney: Remains in effect if the principal becomes incapacitated or unable to make decisions for themselves.

- Limited or Special Power of Attorney: Grants the agent authority to act on the principal's behalf in specific situations only.

- Medical Power of Attorney: Allows the agent to make medical decisions for the principal if they are unable to do so.

- Financial Power of Attorney: Gives the agent authority to handle financial matters for the principal.

How does one create a Power of Attorney?

Creating a Power of Attorney involves drafting a document that specifies who the agent will be, what powers they will have, and under what circumstances these powers will be executed. It is highly recommended to consult with a legal professional to ensure that the document clearly reflects the principal's wishes and complies with state laws. Once the document is drafted, it usually needs to be signed in front of a notary public and, in some cases, witnesses.

When does a POA become effective?

The effectiveness of a Power of Attorney can vary depending on the preferences of the principal and the laws of the state. Some POAs become effective immediately upon being signed, while others, known as "springing" powers, become effective only once a specific event occurs, such as the incapacity of the principal.

Can a Power of Attorney be revoked or changed?

Yes, a Power of Attorney can be revoked or altered at any time by the principal, as long as they are mentally competent. To revoke or change a POA, the principal must communicate their intentions in writing and, preferably, notify any institutions or individuals that were relying on the original POA. It is also advisable to destroy all copies of the old POA document.

Is a Power of Attorney valid in all states?

A Power of Attorney created in one state is generally recognized in other states. However, since laws can vary significantly from one state to another, it might be necessary to create a new POA document that complies with the laws of the state where the principal resides or where the document will be used.

What happens if there is no POA when someone becomes incapacitated?

If someone becomes incapacitated without having a valid Power of Attorney in place, it may become necessary for a court to appoint a guardian or conservator. This legal process can be lengthy, expensive, and stressful. It involves the court making decisions about who will handle the incapacitated person's affairs, often without direct knowledge of the person's wishes.

Does a Power of Attorney allow the agent to make decisions after the principal's death?

No, a Power of Attorney automatically expires upon the death of the principal. After death, the management of the principal's estate is handled according to their will or, if there is no will, through the state's probate process. The agent under a POA does not have any authority to make decisions or act on behalf of the deceased's estate unless they have been named as the executor or personal representative in the will.

Should a lawyer be consulted when creating a POA?

While it is possible to create a Power of Attorney on your own using templates or forms, consulting with a lawyer ensures that the document is legally sound, reflects your wishes accurately, and meets all state legal requirements. A lawyer can also provide valuable advice on choosing an agent and the specific types of powers to grant.

Common mistakes

Completing a Power of Attorney (POA) form is a significant step for anyone who wants to ensure their affairs are handled according to their wishes if they're unable to do so themselves. However, mistakes in filling out this form can lead to unintended consequences. It is essential to approach this task with care to avoid common errors.

One frequent mistake is not clearly identifying the parties involved. The form should accurately name the person granting authority (the principal) and the individual receiving it (the agent or attorney-in-fact). Ambiguities or errors in this section can create confusion and potentially render the document invalid or disputable in the eyes of the law.

Another common error is failing to specify the powers granted. A POA can range from very broad, allowing the agent to handle almost all affairs, to very specific, limiting actions to particular tasks. Not clearly defining these powers can lead to misunderstandings between all parties involved, including financial institutions and healthcare providers who might rely on the document.

Many individuals also overlook the importance of selecting a durable POA when it is needed. A durable Power of Attorney remains in effect if the principal becomes incapacitated, which is often the primary reason for creating a POA. If the document is not specified as durable, it may not serve its intended purpose at a critical time.

Not properly witnessing and notarizing the document is another mistake that can greatly affect the legality of a POA. Many states have specific requirements for the number of witnesses and notarization to ensure the document’s validity. Skipping these steps can lead to a POA being considered invalid.

Some people mistakenly delay the process of creating a POA until it is nearly too late. This delay can cause significant issues if the individual becomes incapacitated before the document is executed, leaving no legal authority for someone to manage their affairs.

Furthermore, not reviewing and updating the POA regularly can lead to challenges. Life changes such as divorce, relocation, or a change in the relationship with the named agent can make updates to the POA necessary. A document that reflects outdated wishes or relationships may not be effective.

Last but not least, using a generic form without consulting a legal professional can be a grave mistake. While standard forms can be a good starting point, the intricacies of state laws and individual circumstances are best navigated with the advice of an attorney. This ensures the POA meets all legal requirements and accurately reflects the principal’s intentions.

Awareness and avoidance of these common mistakes when filling out a Power of Attorney form can save individuals and their families from potential legal and emotional hardship. It is always advisable to approach this sensitive task with due diligence and seek professional guidance when necessary.

Documents used along the form

When preparing for future uncertainties or planning your affairs, creating a Power of Attorney (POA) is a crucial step. However, this important document often works hand in hand with several others to ensure comprehensive coverage of one’s needs and preferences. Each of these documents serves a specific purpose, complementing the POA by covering aspects it does not or by providing further detailed instructions tailored to specific situations. Here's a list of seven other forms and documents that are frequently used alongside a POA.

- Living Will: This document spells out your wishes regarding medical treatment if you're unable to communicate them yourself. It guides healthcare providers and loved ones through your preferences for end-of-life care, including life support and resuscitation efforts.

- Advance Healthcare Directive: Similar to a living will, this directive outlines your healthcare preferences but also allows you to appoint someone to make healthcare decisions on your behalf if you're unable. It's more comprehensive than a living will, often including the living will's contents within it.

- Last Will and Testament: A will lays out how you want your property and assets to be distributed after your death. While a POA grants someone authority over your affairs while you're alive, a will covers the distribution of your estate after you pass away.

- Revocable Living Trust: This document helps manage your assets during your lifetime and distribute them after your death. You can change or revoke it at any time. A living trust can help avoid probate, simplify the transfer of assets, and provide privacy regarding the details of your estate.

- Durable Financial Power of Attorney: While a general POA might automatically end if you become incapacitated, a durable POA remains in effect. It's specifically designed to ensure that your appointed agent can manage your financial affairs even if you're unable to make decisions yourself.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPAA) protects your medical records and other health information. A HIPAA release form allows designated individuals to access your medical information, which can be important for those making healthcare decisions on your behalf.

- Declaration of Guardian: This document lets you select someone to be your guardian in the event that you become incapacitated and unable to make decisions for yourself. It can cover both personal and financial decisions, depending on your state's laws.

Including these documents alongside a Power of Attorney can offer a well-rounded approach to planning for the future. Each plays a unique role in ensuring that your wishes are respected and that your affairs are managed smoothly, both during your lifetime and after. Consulting with legal professionals to understand which documents best suit your situation can provide peace of mind and security for both you and your loved ones.

Similar forms

A Living Will, akin to a Power of Attorney, facilitates decisions about medical care, though it activates only when the individual is incapacitated and unable to communicate their wishes directly. Both documents serve as preemptive measures to ensure that an individual's choices are respected, especially in situations where they cannot express themselves. The Power of Attorney can encompass decisions beyond health care, specifying an agent for various decisions, whereas a Living Will focuses strictly on health-related directives.

A Health Care Proxy, much like a Power of Attorney for health care decisions, designates someone to make medical decisions on an individual's behalf when they're unable to do so. Both forms empower an appointed agent with the authority to act in the best interest of the person, considering their medical preferences and overall well-being. The principal difference lies in the scope, with the Power of Attorney potentially covering a broader range of authorities beyond health care.

A Durable Power of Attorney is specifically designed to remain effective even after the principal becomes mentally incapacitated. This feature aligns closely with the general concept of a Power of Attorney, which allows someone else to make decisions on one’s behalf. The key distinction is the durability clause, ensuring that the document's powers endure through the principal's incapacitation, a critical aspect not inherently present in all Power of Attorney forms.

A Revocable Living Trust shares similarities with a Power of Attorney as it grants authority to an individual, known as a trustee, to manage the principal's assets. Both aim to facilitate the handling of affairs without court intervention. However, a Revocable Living Trust is particularly focused on asset management and can continue to operate after the principal's death, a permanence and scope not shared by all Power of Attorney forms, which are generally inoperative upon the principal's demise.

A Guardianship or Conservatorship arrangement, similar to a Power of Attorney, involves the appointment of an individual to oversee the personal and financial affairs of someone unable to do so themselves. While both grant significant authority over another's matters, obtaining a Guardianship or Conservatorship usually requires court involvement and is often considered when the individual hasn’t designated an agent through a Power of Attorney or when the scope of authority needed exceeds that which a Power of Attorney can provide.

An Advance Healthcare Directive closely resembles a healthcare-specific Power of Attorney by allowing individuals to outline their medical care preferences in advance and, in many cases, appoint an agent to make decisions on their behalf. Both serve the vital role of guiding healthcare providers when the patient is incapacitated. The distinction often lies in the Advance Healthcare Directive's dual focus on specific treatment preferences and the appointment of a healthcare agent.

A Financial Power of Attorney is a variant that specifically authorizes someone to handle one's financial matters, closely related to the general Power of Attorney in its function. This tailored document underscores an individual's trust in the appointed agent to manage financial transactions and decisions, from paying bills to handling investments. Like its broader counterpart, it can be structured to become effective immediately or upon a certain condition, such as the principal's incapacitation.

Dos and Don'ts

Completing a Power of Attorney (POA) form is a pivotal step in managing personal, financial, or health affairs in the event you're unable to do so yourself. It's essential to approach this process thoughtfully to ensure the document fully reflects your wishes and legal requirements. Here are several dos and don'ts to consider:

Do:- Understand the Different Types of POA: Research and understand the various forms of Power of Attorney available, such as Durable, Non-Durable, Medical, or Limited, to ensure you select the type that best fits your needs.

- Select a Trustworthy Agent: Choose someone who is not only trustworthy but also capable of making decisions that align with your wishes and best interests.

- Be Specific About Powers Granted: Clearly detail the powers you are granting to your agent. This clarity will help prevent any misinterpretations in the future.

- Consult an Attorney: Seek advice from a legal professional to ensure the POA meets all state-specific legal requirements and accurately represents your intentions.

- Inform Your Agent: Discuss your decision with the person you've chosen as your agent. Make sure they understand their responsibilities and are willing to take them on.

- Witnesses and Notarization: Follow your state's requirements regarding witnesses and notarization to ensure your POA is legally binding.

- Keep Copies in a Safe Place: Distribute copies of the completed form to your agent and relevant institutions, such as your bank or medical provider, and store the original in a secure location.

- Ignore State-Specific Forms: Each state has its own requirements for POA forms. Do not use a generic form without ensuring it complies with your state's laws.

- Procrastinate: The best time to prepare a POA is now, before it's urgently needed. Delaying this task could lead to complications if you become unable to express your wishes.

- Forget to Specify Limits: If you want to set limits on the authority you're granting, make sure these are clearly outlined in the document.

- Overlook Alternate Agents: Failing to name an alternate agent can create problems if your primary agent is unable or unwilling to serve.

- Assume One POA Fits All Situations: Understand that one POA may not cover all aspects of your affairs. You might need more than one to address different areas, such as healthcare and finances separately.

- Avoid Updating Your POA: Life changes, such as marriage, divorce, or the death of an agent, can affect your POA. Regularly review and update your POA to reflect your current wishes.

- Underestimate the Importance of Legal Advice: Don't assume you know all the legal implications. Professional guidance can prevent issues and ensure your POA is effective and valid.

Misconceptions

Understanding the Power of Attorney (POA) is crucial for effectively managing legal and financial decisions on behalf of another person. However, misconceptions abound regarding its scope and utility. Below are nine common misunderstandings about the POA form:

A POA grants unlimited power. Contrary to popular belief, a Power of Attorney can be specifically tailored to fit particular needs and does not necessarily give the agent the ability to make all decisions. The person creating the POA can limit what the agent can and cannot do.

It remains effective after death. Many assume a POA continues to hold sway after the principal's death. However, all powers granted through a POA cease when the principal passes away, at which point the executor of the estate takes over.

Only family members can be appointed. While it's common to appoint a family member as an agent, there is no requirement that an agent must be related to the principal. The chosen agent can be a trusted friend or even a professional advisor.

A POA is difficult to revoke. This is not the case; as long as the principal is mentally competent, they can revoke a POA at any time for any reason. The process usually involves notifying the current agent in writing and destroying the original documents.

Creating a POA means losing control. Many fear that signing a POA is akin to giving away all their rights. However, a POA is a strategic tool for managing one’s affairs during times when they are unable to do so themselves. It does not strip the principal of their ability to make decisions.

All POAs are the same. There are different types of POAs, including financial, medical, or specific ones limited to certain tasks. Each type serves a distinct purpose and grants different levels of authority.

POAs are only for the elderly. While it's true that POAs are often used as part of elder care planning, people of any age can benefit from having a POA in place, as unexpected illness or accidents can happen to anyone at any time.

A POA can make healthcare decisions. Unless explicitly stated and prepared as a Healthcare Power of Attorney, standard POAs do not typically grant the agent the right to make healthcare decisions. These are two distinct legal documents with different purposes.

You don’t need a lawyer to create a POA. While it's possible to draft a POA without legal assistance, using an experienced attorney ensures that the document meets all legal requirements and accurately reflects the principal's wishes. This is especially important given each state’s unique laws regarding POAs.

Key takeaways

Filling out a Power of Attorney (POA) form is a significant action, allowing someone else to make decisions on your behalf. Whether it's due to travel, illness, or preparing for future uncertainties, understanding the key points of this legal document is crucial. Here are five takeaways to consider:

- Choose the right type of POA: Not all POA forms are the same. Some grant broad powers, while others limit decision-making to specific areas, such as healthcare or financial affairs. Ensure you select the one that best suits your needs and circumstances.

- Designate a trustworthy agent: The person you choose to act on your behalf, often called an agent or attorney-in-fact, should be someone you trust implicitly. This individual will have significant power over your affairs, so their integrity and reliability are paramount.

- Understand the powers granted: Carefully review the powers you are granting to your agent. It's essential to be clear on what they can and cannot do. If there are areas you wish to restrict, these should be explicitly outlined in the document.

- Consider the document's duration: A POA can be set up to start immediately, upon a certain date, or when a specific event occurs (such as becoming incapacitated). Deciding when the POA takes effect and whether it expires or is durable (remains in effect if you become incapacitated) is an important part of the planning process.

- Legal requirements vary by state: The legal requirements for a POA vary significantly from one state to another. This includes the need for witnesses, notarization, or specific phrases. Ensuring your POA meets your state’s legal requirements is crucial for its validity.

Engaging with a legal professional to guide you through the process of selecting, filling out, and executing a Power of Attorney form can provide peace of mind, knowing that the document accurately reflects your wishes and will stand up to legal scrutiny. It's a step that shouldn't be taken lightly, but with proper care and consideration, it can be an empowering action for you and your loved ones.

Other Templates:

Letter of Satisfaction Mortgage - Key in finalizing the sale of a property, demonstrating no ongoing financial obligations exist.

Free Printable Salon Booth Rental Agreement - It ensures both parties adhere to industry standards and regulatory requirements, protecting the salon's operations and client services.