Free Operating Agreement Form for Texas

When diving into the business landscape, especially in the vibrant economy of Texas, understanding and crafting a solid Operating Agreement becomes crucial for any Limited Liability Company (LLC). This document, not mandated but highly recommended in Texas, sets the foundation for your business's internal operations and structures, detailing how decisions are made, profits shared, and disputes resolved, among other critical aspects. It offers a customized roadmap, ensuring that all members are on the same page and providing a level of protection for the personal assets of the company's members. Beyond delineating the financial and managerial organization of the LLC, it also solidifies your business's credibility and seriousness in the eyes of banks, creditors, and potential investors. Taking the time to create an Operating Agreement shows a commitment to the business's longevity and professionalism, making it a key step for Texas LLCs aiming for success in a competitive environment.

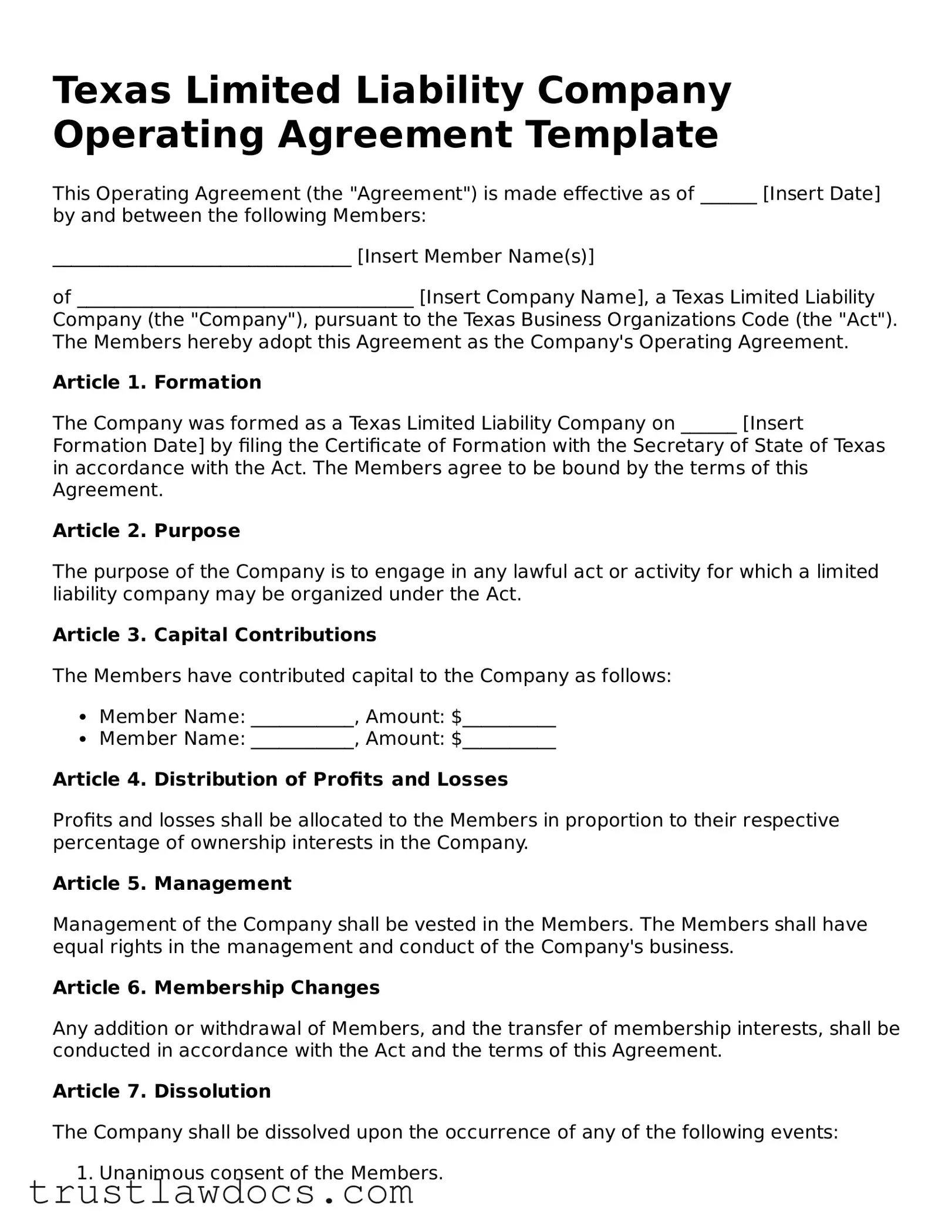

Form Example

Texas Limited Liability Company Operating Agreement Template

This Operating Agreement (the "Agreement") is made effective as of ______ [Insert Date] by and between the following Members:

________________________________ [Insert Member Name(s)]

of ____________________________________ [Insert Company Name], a Texas Limited Liability Company (the "Company"), pursuant to the Texas Business Organizations Code (the "Act"). The Members hereby adopt this Agreement as the Company's Operating Agreement.

Article 1. Formation

The Company was formed as a Texas Limited Liability Company on ______ [Insert Formation Date] by filing the Certificate of Formation with the Secretary of State of Texas in accordance with the Act. The Members agree to be bound by the terms of this Agreement.

Article 2. Purpose

The purpose of the Company is to engage in any lawful act or activity for which a limited liability company may be organized under the Act.

Article 3. Capital Contributions

The Members have contributed capital to the Company as follows:

- Member Name: ___________, Amount: $__________

- Member Name: ___________, Amount: $__________

Article 4. Distribution of Profits and Losses

Profits and losses shall be allocated to the Members in proportion to their respective percentage of ownership interests in the Company.

Article 5. Management

Management of the Company shall be vested in the Members. The Members shall have equal rights in the management and conduct of the Company's business.

Article 6. Membership Changes

Any addition or withdrawal of Members, and the transfer of membership interests, shall be conducted in accordance with the Act and the terms of this Agreement.

Article 7. Dissolution

The Company shall be dissolved upon the occurrence of any of the following events:

- Unanimous consent of the Members.

- Events as defined under the Act leading to the dissolution of a Limited Liability Company.

Article 8. Governing Law

This Agreement and the rights of the Members hereunder shall be governed by and construed in accordance with the laws of the State of Texas, without regard to conflicts of law principles.

Article 9. Amendments

This Agreement may only be amended or modified by a written document signed by all Members.

Article 10. Signatures

In witness whereof, the undersigned Members have executed this Operating Agreement as of the effective date first above written.

__________________________ [Insert signature]

Member Name: _______________ [Print Name]

__________________________ [Insert signature]

Member Name: _______________ [Print Name]

PDF Form Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The Texas Operating Agreement is a document used by LLCs in Texas to outline the business structure and member roles. |

| 2 | It is not mandatory to file this document with the Texas Secretary of State, but it's highly recommended for internal use. |

| 3 | The agreement can be tailored to fit the specific needs of the LLC, including provisions for management, profit distribution, and disputes. |

| 4 | Governing law for the Texas Operating Agreement form is the Texas Business Organizations Code (BOC). |

| 5 | Having an Operating Agreement in place can help ensure clarity and reduce misunderstandings among members. |

| 6 | This document can also help protect members' personal assets from the LLC's debts and obligations. |

| 7 | The agreement should be updated periodically to reflect any significant changes in the business or its members. |

| 8 | Executing a well-drafted Operating Agreement can strengthen the credibility of the LLC with banks, investors, and other parties. |

How to Write Texas Operating Agreement

Filling out the Texas Operating Agreement form is an important step in formalizing the structure and operating procedures of a limited liability company (LLC) in Texas. This document outlines the rights and responsibilities of members, the allocation of profits and losses, and other crucial operational details. Though the state of Texas does not legally require LLCs to have an Operating Agreement, creating one is highly advisable as it helps to ensure that all members are on the same page and can provide legal protection in the event of disputes. The process is straightforward but requires careful attention to detail to ensure that all information is accurately captured.

- Start by gathering all necessary information about the LLC, including the official name of the LLC as registered with the Texas Secretary of State, the principal place of business, and the names and addresses of all members.

- Designate a name for the Operating Agreement document. This could simply be "Operating Agreement of [LLC Name]."

- Specify the duration of the LLC if it is not intended to be perpetual. This detail should be included in the first section of the agreement.

- Detail the contributions of each member to the LLC. This includes not only initial monetary contributions but also any property or services contributed now or promised for the future.

- Describe how profits and losses will be allocated among members. This is typically done according to the percentage of ownership, but the agreement can specify a different arrangement.

- Outline the management structure of the LLC. This involves deciding whether the LLC will be managed by its members or by appointed managers. Include the names and roles of initial managers if applicable.

- Specify the voting rights of members. This section should detail how decisions are made, such as by majority vote or unanimous consent, and how each member's vote is weighted.

- Include provisions for admitting new members and outline the process for transferring membership interests, should a member wish to sell their stake or in the event of a member's death.

- Describe the process for dissolving the LLC, including how assets will be distributed after all debts have been paid.

- Conclude the agreement with a section for each member to sign and date, indicating their agreement to the terms outlined.

After completing all steps, it’s important to keep the Operating Agreement in a safe place where all members can access it if needed. While the State of Texas does not require the document to be filed, having it on hand is crucial for resolving any potential disputes and ensuring the smooth operation of the LLC.

Get Answers on Texas Operating Agreement

What is an Operating Agreement?

An Operating Agreement is a key document used by LLCs that outlines the business's financial and functional decisions, including rules, regulations, and provisions. The purpose of this document is to govern the internal operations of the business in a way that suits the specific needs of its owners. It is meant to ensure that all business owners are on the same page regarding the company's operational procedures and dispute resolution, providing a clear guide for running the business.

Is an Operating Agreement required in Texas?

In Texas, an Operating Agreement is not legally required to form an LLC. However, having an Operating Agreement is highly recommended, even for single-member LLCs. This document plays a crucial role in protecting your business's limited liability status, helps to ensure that courts respect your personal liability protection, and adds credibility to your operation as a serious business entity.

What are the key elements to include in a Texas Operating Agreement?

A comprehensive Texas Operating Agreement should include the following elements: the percentage of members' ownership, the share of profits and losses, the members' rights and responsibilities, the company's management structure, and the procedures for bringing in new members and handling the departure of existing ones. Additionally, it should define how decisions are made, how meetings are held, and how to handle the dissolution of the business. These elements help prevent conflicts among members by providing clear guidelines and procedures.

Can I write my own Operating Agreement in Texas?

Yes, you can draft your own Operating Agreement in Texas. While it's possible to create this document without the assistance of a legal professional, it's important to ensure that your Operating Agreement complies with state law and covers all necessary aspects of your business operations. Many business owners opt to consult with a lawyer or use customizable templates to ensure that the document is comprehensive and tailored to their specific needs.

How does an Operating Agreement protect my LLC in Texas?

An Operating Agreement protects your LLC by delineating the rights, powers, duties, liabilities, and obligations of each member. It functions as a contractual agreement amongst members to operate the LLC in a certain way. By establishing clear rules and procedures for the business operations, the agreement helps prevent misunderstandings that can arise from oral agreements. Moreover, it reinforces the limited liability status of your LLC, helping to ensure that members’ personal assets are protected from the business's debts and obligations.

Do I need to file my Operating Agreement with the state of Texas?

No, you do not need to file your Operating Agreement with any state agency in Texas. This document is an internal agreement among the members of the LLC. However, it's important to keep a copy of the Operating Agreement with your business records. Financial institutions, potential investors, and others may request to see this document for verification purposes. While it's not filed with the state, it's a critical document for the smooth operation and management of your LLC.

Common mistakes

When entrepreneurs in Texas set out to fill their Operating Agreement for an LLC (Limited Liability Company), they often overlook certain details that can significantly impact their business's future. One common mistake is not tailoring the agreement to the specific needs of their LLC. A generic approach can leave gaps in addressing unique operational aspects of the business, failing to provide clear guidance on how to handle unforeseen circumstances.

Another area often mishandled is not clearly defining the roles and responsibilities of each member. Without a clear delineation, misunderstandings may arise, leading to internal conflicts and operational inefficiencies. This is especially crucial in multi-member LLCs, where roles can overlap or responsibilities may not be evenly distributed.

A significant mistake is the failure to outline the process for adding or removing members. The Operating Agreement should explicitly state the conditions under which new members can join, existing members can exit, and the financial and procedural steps required. Neglecting to address this can lead to complications and disputes in the future.

Similarly, not specifying dispute resolution mechanisms within the agreement is a critical oversight. Without a predetermined path to resolving disagreements, members are left without guidance during conflicts, potentially leading to costly legal battles that could have been avoided with proper foresight.

Details regarding financial contributions and profit distributions are often inadequately addressed. It’s essential that the Operating Agreement specifies each member's capital contribution and the formula for distributing profits and losses. Failure to do so can lead to disagreements and dissatisfaction among members.

A common mistake is not updating the Operating Agreement to reflect changes in the business structure or membership. As an LLC grows and evolves, its Operating Agreement should be revised to remain relevant and accurate, ensuring it continues to meet the needs of the business and its members.

Many people inaccurately believe that once filed, they do not need to refer back to their Operating Agreement. This document should be a living reference that guides operational decisions and conflict resolutions, not just a formality completed at the inception of the LLC.

Another error is not having a clear succession plan within the Operating Agreement. Planning for the future, including scenarios of retirement, incapacitation, or death of a member, ensures the business can continue smoothly without interruption.

Underestimating the importance of the Operating Agreement is common. Some see it as mere paperwork, not recognizing its role as a legal document that governs the operations of the LLC and protects the members’ interests.

Lastly, attempting to create an Operating Agreement without seeking legal advice can lead to oversights and errors. Professional guidance ensures that the document complies with Texas law and fully covers all aspects necessary for the LLC's successful operation.

Documents used along the form

When forming a business in Texas, particularly a Limited Liability Company (LLC), an Operating Agreement is a critical document that outlines the operational and financial decisions of the business. It's a foundational tool that helps ensure all members are on the same page regarding the company's management and processes. However, to fully establish and protect your business, several other forms and documents are often required in conjunction with an Operating Agreement. These documents are essential for various purposes, including legal protection, compliance, and financial management.

- Articles of Organization: This is the primary document needed to officially form your LLC in Texas. It must be filed with the Texas Secretary of State and includes basic information about your LLC, such as its name, purpose, registered agent, and management structure.

- Employer Identification Number (EIN): Issued by the Internal Revenue Service (IRS), an EIN is essentially a social security number for your business. It's necessary for opening a business bank account, filing federal taxes, and hiring employees.

- Operating Agreement Amendment: Should the initial terms of the Operating Agreement change, this document allows members to officially record any modifications or updates to the original agreement.

- Membership Certificates: These certificates serve as physical evidence of ownership in the LLC. They specify the percentage of the company that each member owns.

- Annual Report: Many states require LLCs to file an Annual Report. This document updates or confirms the company's information on file with the state, such as addresses, management structure, and member information.

- Business Licenses and Permits: Depending on the type of business and where it's located, various local, state, and federal licenses and permits could be required to legally operate your business.

- Buy-Sell Agreement: A crucial agreement that outlines what happens if a member wishes to sell their interest, dies, or becomes disabled. It helps prevent potential conflicts among remaining members or with heirs and successors.

- Minutes of Meeting: Maintaining a record of the LLC's meetings is important for legal compliance and decision-making. While not required in all states, it's a good practice to document the discussions and resolutions made during meetings.

Accompanying the Operating Agreement with these documents not only ensures compliance with state laws and regulations but also protects the members' interests and facilitates smoother operation and management of the business. Proper preparation and maintenance of these documents help establish a strong legal foundation for your LLC in Texas, enabling it to grow and thrive in a competitive environment.

Similar forms

The Texas Operating Agreement shares similarities with a Partnership Agreement, primarily in its function to outline the operations of a business and define the roles and responsibilities of the parties involved. Both documents are essential in clarifying how decisions are made, profits are shared, and disputes are resolved. While the Operating Agreement is used for Limited Liability Companies (LLCs), the Partnership Agreement is geared towards partnerships, yet both serve the crucial role of establishing the legal framework within which the entities operate, protect individual interests, and detail financial arrangements.

Similarly, a Shareholders’ Agreement found in corporations echoes the Texas Operating Agreement in its intent to regulate the interactions among the owners and the management layers of the company. It delineates the rights and obligations of shareholders, sets up the company's management policies, and includes provisions for the protection of minority shareholders. Both documents are instrumental in preventing conflicts and ensuring that all parties are on the same page regarding the company’s governance and operational strategy, thus providing a roadmap for corporate conduct and decision-making processes.

A Buy-Sell Agreement is another document that mirrors aspects of the Texas Operating Agreement, particularly around the provisions for the transfer of ownership interest. This agreement comes into play when a member of a business decides to sell their stake, retire, or in the event of death. It outlines how the interest will be valued and transferred, ensuring the business continues smoothly without disruptions. The Operating Agreement often contains similar clauses that govern the process of ownership changes, aimed at protecting the business and its owners' interests during significant transitions.

The Bylaws of a corporation are akin to the Operating Agreement in that they provide a comprehensive framework for the company's operations. Bylaws detail the rules around meetings, elections of officers and directors, and other essential corporate governance matters. Though Bylaws are used by corporations whereas the Operating Agreement is for LLCs, both documents fulfill the fundamental need for an internal structure that guides the entity’s operations and decision-making procedures. This ensures smooth, organized, and legally compliant management across different types of business entities.

Last, an Employment Agreement shares the characteristic of specifying roles and responsibilities, much like the Operating Agreement does for LLC members. However, the Employment Agreement is specifically between an employer and its employee, detailing the terms of employment, salary, benefits, and conditions under which employment can be terminated. Although targeting different relationships, both documents are key to setting expectations and obligations clearly from the outset, safeguarding the interests of all parties involved and reducing the likelihood of future disputes.

Dos and Don'ts

When filling out the Texas Operating Agreement form for your LLC, it's crucial to tread carefully. This document outlines the ownership structure and operating procedures for your business, ensuring smooth operation and compliance with Texas law. Below are key dos and don’ts to keep in mind.

- Do review the Texas LLC act prior to drafting your Operating Agreement to ensure compliance with state-specific requirements.

- Do make sure all members of the LLC agree on the terms before the Operating Agreement is finalized. This reduces potential conflicts.

- Do include detailed descriptions of each member's contributions, ownership percentages, and rights to distributions. Clear definitions prevent misunderstandings.

- Do outline the process for adding or removing members to ensure a clear path is set for future changes in membership.

- Don't use generic templates without customization. Every business is unique, and your Operating Agreement should reflect the specific needs and agreements of your LLC members.

- Don't skip defining the roles and responsibilities of members and managers. Clarifying these roles within the document can help in decision-making processes.

- Don't forget to update the Operating Agreement as your business evolves. Regular reviews and updates will ensure the document remains relevant and effective.

- Don't neglect to have all members sign the Operating Agreement. Unsigned agreements might not be enforceable, putting your business at risk.

Following these guidelines will help you create a solid foundation for your business, ensuring you’re prepared for future growth and protected against potential issues. Remember, the Operating Agreement is not just a formality; it's a critical tool for defining your business operations and resolving disputes, should they arise.

Misconceptions

When it comes to establishing a Limited Liability Company (LLC) in Texas, the Operating Agreement is often misunderstood. To set the record straight, let's dispel some of the most common misconceptions surrounding this crucial document.

- It's mandatory by law to have one: Unlike some states, Texas does not legally require LLCs to have an Operating Agreement. However, having one is highly advisable as it provides a clear framework for the operation of the LLC and can help protect the members' personal assets.

- One size fits all: Many believe that Operating Agreements are a one-size-fits-all document. This is not the case; each LLC should tailor its Operating Agreement to suit its specific needs, operations, and member agreements. A template or generic agreement may not cover the unique aspects of your business.

- Only for multi-member LLCs: While it's true that Operating Agreements are crucial for multi-member LLCs to outline the rights and responsibilities of each member, single-member LLCs can also benefit from having one. It adds credibility to your operation, can help in legal situations, and clarifies the business structure for financial institutions or partners.

- Doesn't impact taxes: There's a misconception that Operating Agreements have no impact on taxes. Though it's true the agreement itself doesn't change your tax obligations, it does specify how the LLC's profits are distributed among members. These distributions can have significant tax implications for each member.

- Unchangeable once signed: Some think that once an Operating Agreement is signed, it's set in stone. However, it's actually a living document that can—and should—be updated as the business evolves, membership changes, or the LLC grows. Changes to the agreement just need to be documented and approved by members according to the procedures set out in the original agreement.

- Legal expertise not required: While it's possible to create an Operating Agreement without a lawyer, not consulting legal expertise can be risky. There might be crucial aspects of Texas LLC law that a generic agreement doesn't cover, or you might miss opportunities to better protect the members' personal assets. A legal professional can help ensure the agreement meets all of your business needs and complies with state law.

Key takeaways

When managing a Texas Operating Agreement form, it is essential to approach the process with a comprehensive understanding to ensure the document accurately represents the agreement between members of a limited liability company (LLC). Below are ten key takeaways that individuals should consider:

- Customization Is Key: The Operating Agreement should be tailored to fit the specific needs and structure of the LLC, taking into account the unique aspects of the business and the agreement between its members.

- Detail Ownership Percentages: Clearly outline each member's ownership percentage, which is typically based on the amount they have invested in the company. This clarity is crucial to prevent disputes.

- Define Member Roles and Responsibilities: Provide a detailed description of each member's roles, responsibilities, and duties to avoid ambiguity and facilitate smoother operations within the LLC.

- Voting Rights and Procedures: Establish clear rules regarding voting rights and the processes for making various business decisions, which will help in managing disagreements and making crucial decisions efficiently.

- Profit and Loss Distribution: Clearly state how profits and losses will be distributed among members, typically in proportion to their ownership percentages, to ensure fairness and transparency.

- Process for Adding or Removing Members: Include a process for the addition or removal of members, detailing any necessary approvals and the impact on ownership percentages, to manage transitions smoothly.

- Guidelines for Meetings and Communication: Set forth guidelines for how and when meetings will be held, including how members will be notified, to ensure effective communication within the LLC.

- Dispute Resolution Mechanisms: Establish a procedure for resolving disputes between members to minimize conflicts and their impact on the business.

- Dissolution Procedures: Outline the steps for dissolving the LLC, including the distribution of assets and liabilities among members, to ensure a clear understanding of the process should the business need to be wound down.

- Signature Requirement: Ensure that all members sign the Operating Agreement to validate the document and signify their agreement to its terms, strengthening the enforceability of the agreement.

By carefully considering these key takeaways when filling out and using the Texas Operating Agreement form, members of an LLC can create a solid foundation for their business operations and mitigate potential future issues. It's also advisable to consult with a legal professional to ensure that the agreement comprehensively covers all legal aspects relevant to the LLC's operation.

Popular Operating Agreement State Forms

Florida Operating Agreement - Creating an Operating Agreement helps ensure that all business owners are on the same page regarding the company's governance.

Does California Require an Operating Agreement for an Llc - It offers an organized framework for operational procedures, business decisions, and member interactions within an LLC.